Markets

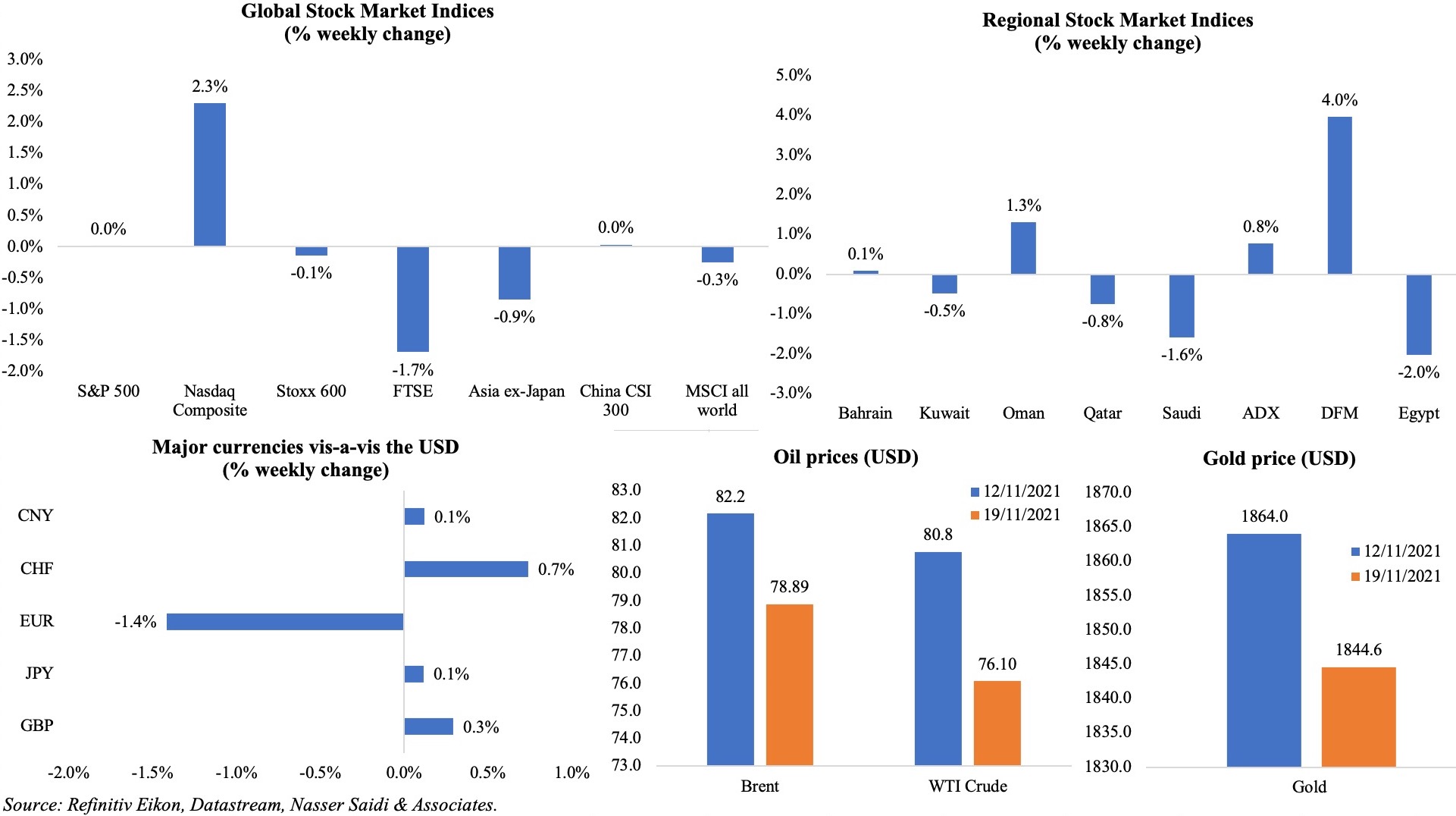

In the US, Nasdaq recorded a weekly gain while Dow Jones posted a 2nd successive weekly loss; fresh Covid19 lockdowns in Europe caused markets to give up gains by end of the week after posting record highs (Germany’s DAX, Switzerland’s SMI, France CAC 40, Stoxx 600, UK’s FTSE,); the MSCI world equity index fell by 0.3%. Regional markets were mixed: both Saudi and Egypt were down, while DFM gained given the buzz around potential IPOs and announcements of incentives. The euro fell to more than six-year lows versus the Swiss franc and touched a 16-month low against the dollar. Furthermore, the rise in UK inflation pushed the GBP to its highest rate against the euro since Feb 2020 on higher rate expectations. Oil prices dipped after Austria reimposed a full lockdown to tackle Covid19 infections and fears of similar moves across other nations in Europe amid news of potential release of oil reserves from China and the US. Despite its safe haven status, gold price slipped by 1% on talks about accelerated tapering moves from the Fed.

Weekly % changes for last week (18 – 19 Nov) from 11 Nov (regional) and 12 Nov (international).

Global Developments

US/Americas:

- Industrial production in the US rebounded by 1.6% mom in Oct (Sep: -1.3%). Capacity utilization climbed to 76.4% (Sep: 75.2%). The Fed disclosed that about half of the rebound in industrial production reflected a recovery from the effects of Hurricane Ida.

- Retail sales in the US inched up by 1.7% mom in Nov (Oct: 0.8%), the largest gain since Mar, as holiday shopping started earlier given potential shortage of goods. Sales soared 16.3% yoy in Oct and are 21.4% above their pre-pandemic level.

- Building permits in the US grew 4% mom to 1.65mn in Oct while the number of houses authorized for construction but not yet started rose by 4.8% to a 15-year high of 152k. Housing starts meanwhile continued to fall, down by 0.7% in Oct to a seasonally adjusted annual rate of 1.52mn units, following Sep’s 2.7% dip. Materials shortages due to supply chain bottlenecks and high prices of raw materials have been weighing on homebuilding.

- The NY Empire State manufacturing index rose to 30.9 in Nov (Oct: 19.8), supported by new orders (28.8 from 24.3) and shipments (28.2 from 8.9); optimism for the next 6 months dropped to 36.9 from 52 the month before. The Philadelphia Fed manufacturing survey accelerated to 39 in Nov (Oct: 23.8), thanks to increases in employment and prices paid and received.

- Initial jobless claims declined by 1k of 268k in the week ended Nov 12th, staying below the 300k mark for the 5th consecutive week while the 4-week average slipped to 272.75k. Continuing fell by 129k to 2.08mn in the week ended Nov 5th.

Europe:

- GDP in the eurozone increased by 2.2% qoq and 3.7% yoy in Q3, confirming the previous estimate. The number of employed persons increased by 0.9% qoq in Q3 (Q2: 0.7%).

- Inflation in the EU grew to a 13-year high of 4.1% yoy in Oct (Sep: 3.4%), with energy prices rising by 23.7%, followed by services (2.1% from 1.7% in Sep). Core inflation inched up to 2% yoy (and up 0.3% on the month).

- German producer price index accelerated to 18.4% yoy in Oct, largely due to soaring gas and electricity prices.

- Inflation in the UK jumped to 4.2% yoy in Oct (Sep: 3.1%), rising at the fastest pace in a decade, driven by the hospitality sector as well as a rise in costs of fuel and second-hand cars. Core inflation accelerated to 3.4% from 2.9% the month before. Producer price index also inched up in Oct, rising to 8% yoy (Sep: 7%) – the highest output producer inflation since Oct 2008; core output was up by 0.7% mom (Sep: 0.6%).

- The ILO unemployment rate in the UK fell to 4.3% in the 3 months to Sep from 4.5% in Jun-Aug. The Claimant Count Rate edged lower to 5.1% (Sep: 5.2%) while average earnings grew by 4.9% (excluding bonus), slowing from 6% previously.

- Retail sales in the UK rebounded strongly, rising by 0.8% mom in Oct – this follows five months of almost no growth; even excluding fuel, sales were up by 1.6% mom. This is 5.8% higher than their pre-pandemic levels in Feb 2020. ONS revealed that non-food stores were the only main retail sector to see a rise in sales volumes (+4.2%).

- UK consumer confidence index improved in Nov, up by 3 points to -14 in Nov.

Asia Pacific:

- Fixed asset investment in China increased by 6.1% yoy in the period Jan-Oct (Jan-Sep: 7.3%), with investments by the private sector rising by 8.5%. FDI into China grew by 17.8% in the first 10 months to CNY 943.2bn (vs 19.6% in Jan-Sep). Foreign investment into the service sector was up by 20.3%, while high-tech industries saw FDI inflows jumped 23.7%.

- China’s industrial production increased by 3.5% yoy in Oct (Sep: 3.1%), rising by 10.9% in Jan-Oct. Retail sales grew by 4.9% yoy in Oct (Sep: 4.4%). Urban jobless rate remained unchanged at 4.9% in Oct – the lowest level since Dec 2018 – while among the 16-24 age group, unemployment rate dipped to 14.2% (Sep: 14.6%).

- The value of government land sales in China fell for the 4th month in Oct, down by 13.14% yoy to CNY 573.7bn (USD 89.9bn), versus Sep’s 11.15% slump in a policy clampdown.

- Japan’s preliminary estimates for GDP shrank by 0.8% qoq (Q2: 0.4%), with household consumption, private non-residential investment and public investments declining by 1.2%, 3.8% and 1.5% respectively. In annual terms, GDP fell by 3% in Q3 (Q2: 1.5%).

- Japan unveiled a record USD 490bn spending package at a time when other major developed nations are planning to withdraw stimulus measures. This includes spending for items ranging from cash payouts to households, subsidies to COVID-hit firms and reserves set aside for emergency pandemic spending.

- Inflation in Japan increased by 0.1% yoy in Oct (Sep: 0.2%), with a slump in mobile phone fees (-54%) amid a surge in gas prices by 21%. Prices excluding food increased by 0.1% (advancing for the 2nd consecutive month) while prices excluding both food and energy fell by 0.7% (Sep: -0.3%).

- Exports from Japan increased by 9.4% yoy in Oct (Sep: 13%), the smallest rise in 8 months, dragged down by 36.7% drop in the shipment of cars. Imports grew by 26.7% (Sep: 38.2%), hence posting a trade deficit of JPY 67.4bn (USD 586.6mn).

- Core machinery orders remained flat in month-on-month terms in Sep; orders were up by 12.5% yoy.

- Retail inflation in India rose marginally to 4.48% in Oct on the back of higher prices of edible oil and vegetables as well as the price of services. Wholesale price inflation in India increased to 12.54% yoy in Oct (Sep: 10.66%) – the 7th consecutive month of double-digits WPI – with the ministry citing “rise in prices of mineral oils, basic metals, food products, crude petroleum & natural gas, chemicals and chemical products”.

- Trade deficit in India more than doubled to USD 19.73bn in Oct 2021, compared to a year ago. Exports jumped by 43.1% to USD 35.65bn and imports rose at a faster pace of 62.5% (oil imports surged by 140.5% to USD 14.4bn).

Bottomline: Global economic recovery is currently facing two major concerns – inflationary pressures and new lockdowns in Europe where cases are skyrocketing (Austria announced the first nationwide vaccine mandate in Europe). The Fed minutes (out this week) should provide some indication as to their take on inflation and tapering timelines. For now, in spite of higher prices, retail sales have held up well as people started holiday shopping early. Emerging markets are facing additional concerns of tighter financing conditions: in Turkey, central bank cut interest rates by 1 ppt to 15% last week and the lira touched its weakest level on record; China’s real estate woes and liquidity issues are worsening; Paytm shares plunged by more than 27% after India’s biggest IPO debuted on the market (with worries about profitability, high valuation and competition in the payments segment).

Regional Developments

- The oil and gas sector in Bahrain contributes to only about 20% of GDP, but forms the largest part of revenues, according to the finance minister. He disclosed that the country is still running a deficit and hence borrowings would continue.

- Bahrain-origin exports surged by 85% yoy to BHD 366mn in Oct, with top 10 trading partners accounting for 67% of total. Saudi Arabia, UAE and the US were the top nations receiving exports (BHD 53mn, BHD 37mn and BHD 33mn respectively). Imports grew by 24% to BHD 452mn, with Brazil, China and Australia the top exporters to Bahrain (BHD 61mn, BHD 56mn and BHD 54mn respectively).

- Unemployment rate in Egypt inched up to 7.5% in Q3 2021 (Q2: 7.3%), with the total number of unemployed citizens reaching 2.2mn during the quarter. Male unemployment rate climbed to 5.9% in Q3 (Q2: 5.7%) while the female rate stood at 15.3% (Q2: 15%).

- Egypt’s budget deficit widened to EGP 219.8bn in Jul-Oct 2021, rising to 3.1% of GDP compared to 2.6% of GDP in the same period a year ago. Total revenues touched EGP 311bn (+8.3% yoy), of which tax revenues contributed about 78.8%. Expenditures also ticked up, rising by 16.6% to EGP 530.7bn.

- The Financial Regulatory Authority in Egypt announced a reduction in fees – the 3rd time in 2 years – for trading operations on the exchange by 20%. The current payable fee is 10%.

- Egypt’s petroleum sector has witnessed 99 petroleum agreements in the past 7 years, with investments totaling USD 17bn in addition to the implementation of 45 projects to develop oil fields with investments of EGP 565bn.

- Remittances into Egypt increased by 11.6% yoy to USD 2.7bn in Aug 2021, according to the central bank. Year-to-date, remittances were up by 10.4% to USD 21.4bn.

- Egypt’s central bank has instructed banks to increase financing for roughly around 126k companies and factories, especially SMEs. This is to support employment and production rates amid rising international prices, thereby avoiding financial problems.

- The Suez Canal saw a record 80 ships passing through last Monday, with a total of 5.4mn tons of shipments.

- Iraq received a shipment of 1.2mn doses of the Pfizer Covid vaccine through the Covax sharing scheme. According to official data, nearly 7mn Iraqis have received at least one dose of the vaccine, accounting for 17.5% of the total population.

- Iraqi wheat production is in a crisis given water scarcity, according to the Ministry of Agriculture. It is estimated that production deficit will reach 2mn tons this year.

- Real estate sales in Kuwait increased by 16% qoq and 63% yoy to KWD 1.1bn in Q3 2021, thanks to strong activity in the residential sector (+87% yoy) and a significant rise in home and land prices (+27% and 14% respectively as of Sep).

- Domestic credit disbursed in Kuwait grew by 2.1% qoq in Q3; business credit was flat in 3Q2021 with the yoy increase at 0.3% through Sep. Credit to the real estate sector accounted for 43% of the total, and credit growth to the sector inched up by 2.3% yoy at end-Sep.

- Egypt will export gas to Lebanon via Syria and the Arab Gas pipeline by early next year: the nation plans to export up to 65mn cubic feet of gas per day to Lebanon. The nation will pay Egypt using a World Bank loan, though the amount has yet to be determined.

- Credit to the private sector in Oman inched up by 2.6% yoy to OMR 23.4bn at end-Sep 2021. Nominal GDP during H1 2021 increased by 10.1%, driven by an increase in output of the hydrocarbon sector by 8.7% and the non-hydrocarbon sector by 11.1%.

- The IMF disclosed that it had received a request for aid from Tunisia’s new government. This would be the country’s 4th aid program in 10 years from the IMF, and it hopes to receive a USD 4bn loan before end of the year.

Saudi Arabia Focus

- Saudi Arabia’s oil exports increased by 1% mom and 8% yoy to 6.52mn barrels per day (bpd) in Sep, rising for the 5th straight month. Between Apr-Sep, oil exports have risen by nearly 15%. Crude oil output rose by 100k bpd to 9.622mn bpd in Sep – the highest since Apr 2020.

- Inflation in Saudi Arabia ticked up to 0.8% in Oct (Sep: 0.6%), given the uptick in food and beverages (1.4%) and transport (6.4%). SAMA expects inflation to rise slightly in Q4, given global inflation levels and strengthening domestic demand.

- Saudi Arabia launched NEOM’s industrial city OXAGON last week – the largest floating industrial complex. Powered 100% by clean energy, the port, logistics and rail delivery facility will be unified, providing world-class productivity levels with net-zero carbon emissions. The facility is estimated to reduce ship to factory time to a day at most.

- In a bid to drive the logistics sector, the Saudi Transport General Authority issued 32 logistic licenses to local and international SMEs in the private sector.

- Saudi Global Ports Company, in coordination with the Saudi Ports Authority (Mawani), plans to reduce handling fees of importing empty containers at King Abdulaziz Port Dammam by 50%, for the duration of a year. This will support competitiveness of the ports, and reduce costs for businesses.

- The licensing process to set up a business from outside Saudi Arabia has been simplified: first, investors need to request an attestation for a contract from the Ministry of Foreign Affairs, following which they can apply for a business license from the Ministry of Investment. Finally, they need to authenticate the establishment contract of the business and issue the commercial register with the Ministry of Commerce.

- Saudi Arabia launched the largest factory for solar panels production in the MENA region in Tabuk Industrial City: strategically located near NEOM and the Red Sea projects, the project is estimated to have a production capacity of 1.2 gigawatts and accounts for SAR 700mn (USD 186.6mn) of investments.

- Bloomberg reported that the Saudi government and sovereign wealth fund are planning to launch green bonds in a few months to raise funds to finance projects powered entirely by renewable energy.

- More than 175k families have benefited from the Saudi Housing Ministry’s Sakani program from Jan-Oct this year.

- Saudi Arabia’s holdings of US Treasury bills declined by 5.3% yoy to USD 124.3bn in Sep. During Jan-Sep, Saudi reduced its investments in US T-bills by 8.87% from end-Dec.

- The Ministry of Justice in Saudi Arabia initiated a real estate exchange trial: this will process direct transactions, real estate offers, new transactions, mortgages, inquiries about title deeds and update of title deeds. Buy orders are expected to be added shortly.

- Saudi PIF roughly tripled its stakes in US-listed holdings to USD 43.45bn in Q3, from USD 16bn in Q2, boosted by Lucid Motors’ IPO in Jul. The PIF has an estimated USD 430bn worth of assets under management. In addition to stakes in Lucid Motors (a majority 62.72%), Alibaba, Walmart, Pinterest, the wealth fund also purchased stakes in Just Eat Takeaway.com and Ballard Power Systems.

UAE Focus![]()

- UAE’s new labour law for the private sector will come into force from Feb 2nd, 2022: it allows for temporary and flexible work, freelance jobs as well as condensed working hours (40 hours per week can be completed in 3 days) and shared jobs (2 persons can do the same job and split the pay, after agreeing with the employer). Another provision bans employers from holding employees’ passports or charging them for recruitment fees. Any indefinite contracts will be changed to fixed-term contracts that can be renewed.

- The Dubai Financial Market’s incentives to boost IPOs and support listings from the private sector includes financial support to the cost of private companies’ IPOs on the Main Market and listing on the Second Market, post-listing support through participation in its international roadshows, and a 3-year waiver on fees (listing, AGM and dividend distribution).

- Dubai launched a AED 1bn (USD 272mn) Dubai Future District Fund to support seed to growth-stage tech startups and encourage them to list on the local stock exchanges. The aim is to establish 1,000 tech firms in the country in 5 years and increase startup investments to AED 4bn from AED 1.5bn.

- Potential IPO announcements are flowing: the Chairman and CEO of Emirates Airlines stated that it could list one of its entities on the DFM. The Al Habtoor Group may list 30 or 35% of shares in Q3 2022, revealed the firm’s Chairman during an interview with Al Arabia.

- India hopes to sign a new trade pact with the UAE in H1 2022, stated the Consul-General of India in Dubai in an interview. This will help achieve over USD 115bn in bilateral trade in the next five years.

- UAE plans to invest USD 10bn in Brazil in the coming decade, disclosed the economy minister, after bilateral talks were held.

- UAE’s financial regulators have issued joint guidelines to support financial institutions safely adopt enabling technologies like application programming interfaces (which allow FinTechs to work with banks’ software), Big Data analytics, artificial intelligence, biometrics, cloud computing and distributed ledger technology. This will help these institutions to manage risk “proactively and appropriately” from the introduction of technology.

- The UAE central bank will publish a new index for actual overnight funding transactions denominated in UAE Dirham from 7th Dec 2021, named “DONIA” (Dirham Overnight Index Average) and will improve transparency in domestic money market activities.

- The Department of Economic Development in Abu Dhabi has added 11 new commercial activities to the list of Freelance Professional License including accounting and auditing, analysing and reviewing accounting and auditing systems, Sharia review consultancy, design of database systems and electronic risk management services among others.

- Dubai announced a five-year multiple entry visa for foreign employees of firms based in the emirate to improve flexibility and efficiency: this allows employees of MNCs to visit and stay in the UAE for 90 days, with an extension of further 90 days.

- UAE signed 23 agreements with local and international companies worth AED 22.5bn (USD 6.1bn) during the first 4 days of the Dubai Airshow, revealed the Ministry of Defence.

- Bloomberg reported that the UAE will award contracts for USD 20bn of natural gas projects (Dalma gas field in Persian Gulf waters) in the coming days, in a bid to boost exports. The Dalma gas field will see gas flowing by about 2025 and help UAE become self-sufficient in gas by 2030, according to ADNOC CEO.

- Passengers at the Dubai International Airport will increase to around 45-50 million in 2022, from 27-30 million this year, stated the Deputy CEO of Dubai Airports Co. Separately, Dubai International Airport disclosed that it had welcomed 20.7mn passengers in Jan-Oct this year, with traffic up almost 20% in the past month. India (2.8mn), Pakistan (1mn), Egypt (753k), US (710k) and Turkey (598k) were the largest source nations.

- The State of the UAE Retail Economy, released by Majid Al Futtaim, revealed that footfall in shopping malls increased by 18% yoy in Q3, while retail performance grew by 7% qoq in Q3 (surpassing 2019). The report, which finds that consumer confidence in Dubai reached its highest level in 10 years in Q3, also states that e-commerce grew by 34% yoy in Q3 and more than a fifth higher than Q2.

Media Review

Inflation: is now the time to get worried?

https://www.ft.com/content/570e9180-45fb-4157-9727-553c2471c309

Governments are not going to stop getting bigger

https://www.economist.com/briefing/2021/11/20/governments-are-not-going-to-stop-getting-bigger

https://www.economist.com/leaders/2021/11/20/the-world-is-entering-a-new-era-of-big-government

Lebanon medicine prices skyrocket as subsidies lifted

https://www.thenationalnews.com/mena/lebanon/2021/11/16/lebanon-lifts-most-medicine-subsidies/