Weekly Insights 11 Nov 2021: a broad-based recovery is underway in the GCC

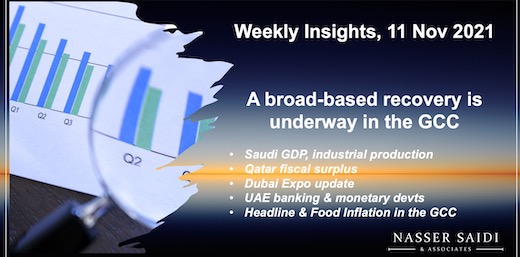

1. Saudi Arabia’s preliminary Q3 GDP surges by 6.8%, supported by oil sector gains

- Saudi Arabia’s preliminary Q3 GDP estimates show that the economy expanded by 6.8% yoy, thanks to a 9% yoy uptick in the oil sector while non-oil sector activity eased (+6.2% vs Q2’s 11.1%). Higher demand for oil globally, rise in oil production (as agreed under OPEC+) and higher oil prices supported the uptick

- The 7-day rolling average of daily confirmed Covid19 cases is low at 44.3 (as of 10th Nov), and with high vaccination rates (69% have had at least 1 dose, 62% fully vaccinated), stringency index shows that rules have been significantly relaxed (57.41 from a peak of 94 at end-Apr 2020)

- High-frequency mobility indicators suggest an improvement in economic activity into Q4 as well, after restrictions are eased, flights and even events resume (Riyadh Season 2021, FII, upcoming F1 race in Jeddah)

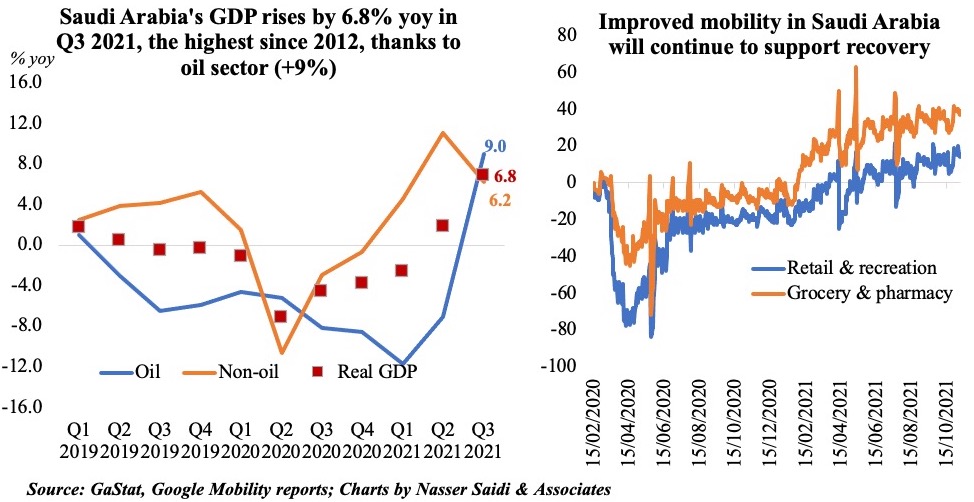

2. Industrial production in Saudi Arabia rises by 6.5% yoy in Sep; manufacturing pace is slower vis-à-vis PMI

- Higher mining and quarrying production (+7.6% yoy) has led to a 6.5% increase in overall industrial production index in Sep. Saudi increased oil production to 9.6mn barrels per day (bpd) from 8.9mn bpd a year ago.

- The manufacturing component within the IPI (22% weight in overall index) eased slightly to 4.6% (Aug: 5%)

- The non-oil sector PMI expanded for a 14th straight month in Oct (57.7), with strong new orders sub-index

- To see if this positive behaviour in PMI was reflected in practice, we tracked it along with manufacturing growth. The chart on the left tracks three-month-on-three-month changes in the official IP data to remove some volatility along with headline PMI data. It shows that improvement in non-oil sector is happening faster than in official manufacturing – pointing to the strength in recovery of the non-oil, non-manufacturing sectors. But after a consecutive period of declines, manufacturing seems to be improving from Jul onwards.

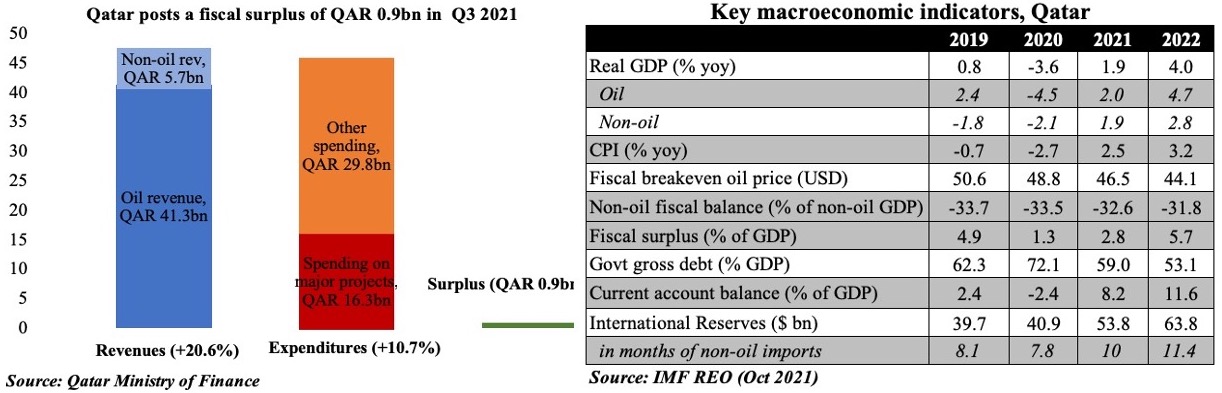

3. Increase in energy prices leads Qatar to post a fiscal surplus in Q3

- Qatar’s Ministry of Finance revealed that a fiscal surplus of QAR 0.9bn was posted in Q3 2021. For the Jan-Sep 2021 period, total budget surplus stands at QAR 4.9bn

- While revenues grew by 20.6% yoy, revenues from the energy sector accounted for 87.7% of total income in the quarter. Oil and gas revenues grew by 34.6% yoy to QAR 41.3bn in Q3. On the expenditure side, more than one-third went towards major projects including 2022 World Cup.

- Public debt also increased in Q3, up 3.3% to QAR 383bn

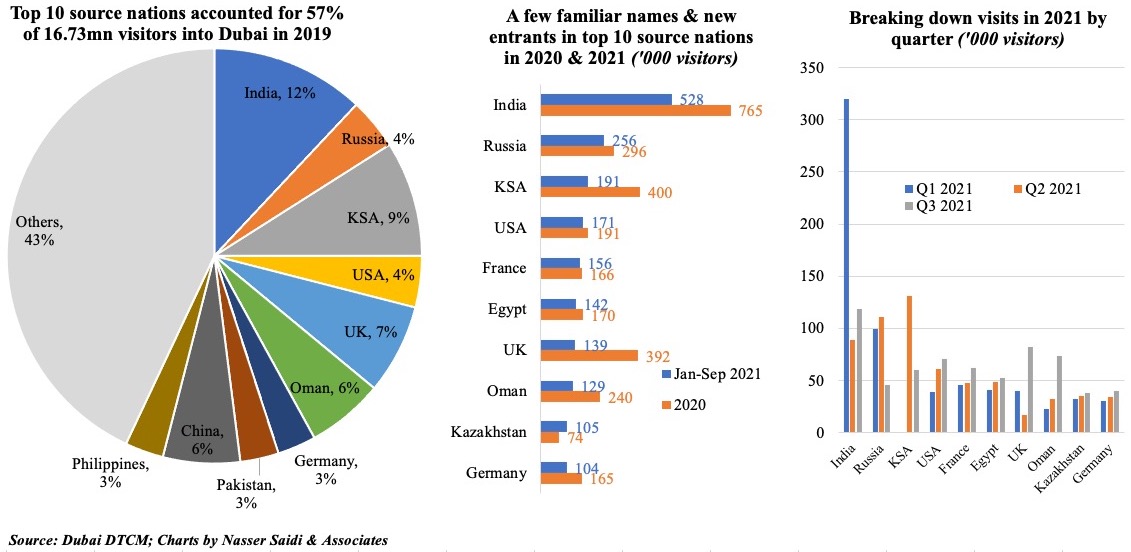

4. Expectations for Dubai Expo to attract more tourists in Q4; a few (pre-Covid) top source nations still missing

- Dubai PMI for Oct surged to 54.5 in Oct (Sep: 51.5) as new orders rebounded; anecdotal evidence, including from hospitality and retail sectors, indicate an increase in tourism activity since the start of the Expo, which bodes well for recovery

- Dubai Expo this week reported nearly 3mn visits since its doors opened on Oct 1 (includes multiple visits). In the one month since the start of the Expo, of the 2.35mn visits, 28% were from schools (given the Expo Schools Programme) while 17% were from overseas. India, Germany, France, Saudi Arabia and the UK were cited as the top nations with most visits (not updated at the latest briefing). This reflects the composition of tourists visiting Dubai : these are 5 of the top 10 source nations in Jan-Sep 2021

- Compared to pre-Covid (when tourist numbers into Dubai stood at 16.73mn), many top source nations are still missing this year given Covid19 and flight restrictions – noticeably China, Philippines & Pakistan. This year saw 3.85mn visitors till Sep, but pace has been determined by flight restrictions (visits from India dropped in Q2, no Saudi visits in Q1 & low in Q3 given border closures).

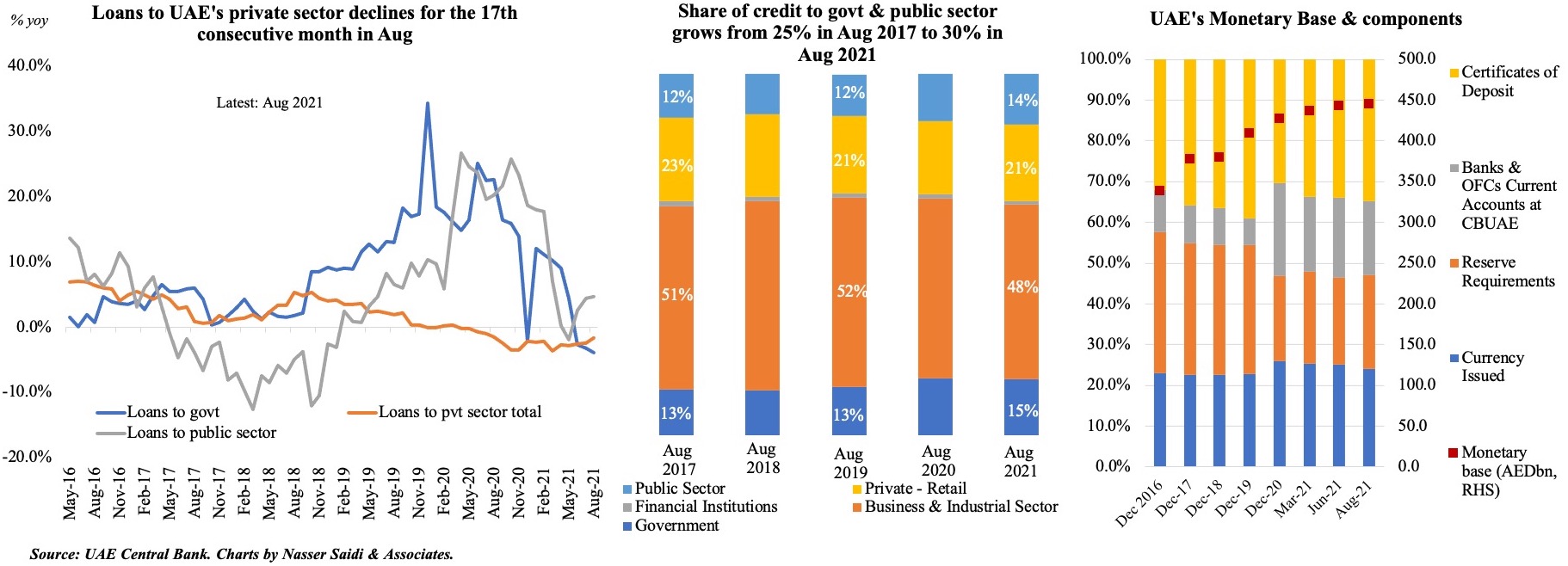

5. Credit disbursement to the UAE’s private sector remains weak in 2021

- Aug marks the 17th consecutive month of yoy decline in credit to the private sector and 14th consecutive month of yoy decline in lending to the business sector

- Overall domestic credit disbursed in UAE fell by 1.2% yoy in Aug 2021; but compared to a month ago, it was up by 0.3%. Together, credit to the government and public sector account for 30% of the total in Aug, while the share of credit to businesses has dropped to 48% of the total from 52% in the same period 2 years ago

- UAE’s monetary base expanded by 1.8% mom in Aug, supported by the 68.5% expansion in Banks & OFC’s Excess Reserves (11% of monetary base) while all other sub-components fell.

- All monetary aggregates – M1, M2 and M3 – inched up: M1 increased by 1.1% mom in spite of the 2.6% drop in currency in circulation; M2 ticked up by 0.7%, supported by the 2.9% rise in foreign currency deposits; M3 was up by 0.3% although government deposits dropped by 1.4%.

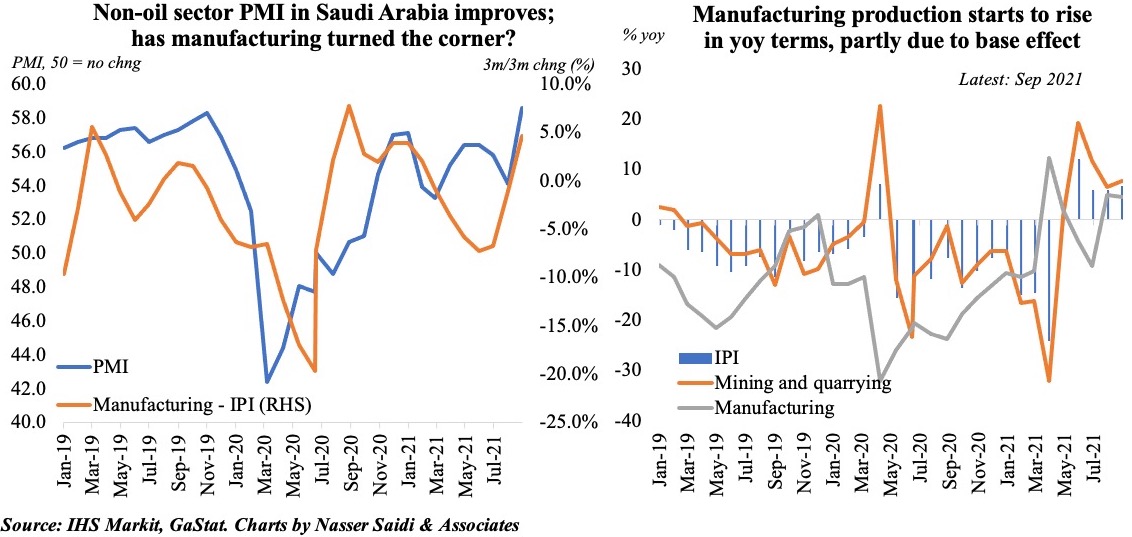

6. Inflation in the GCC is slowly ticking up