Markets

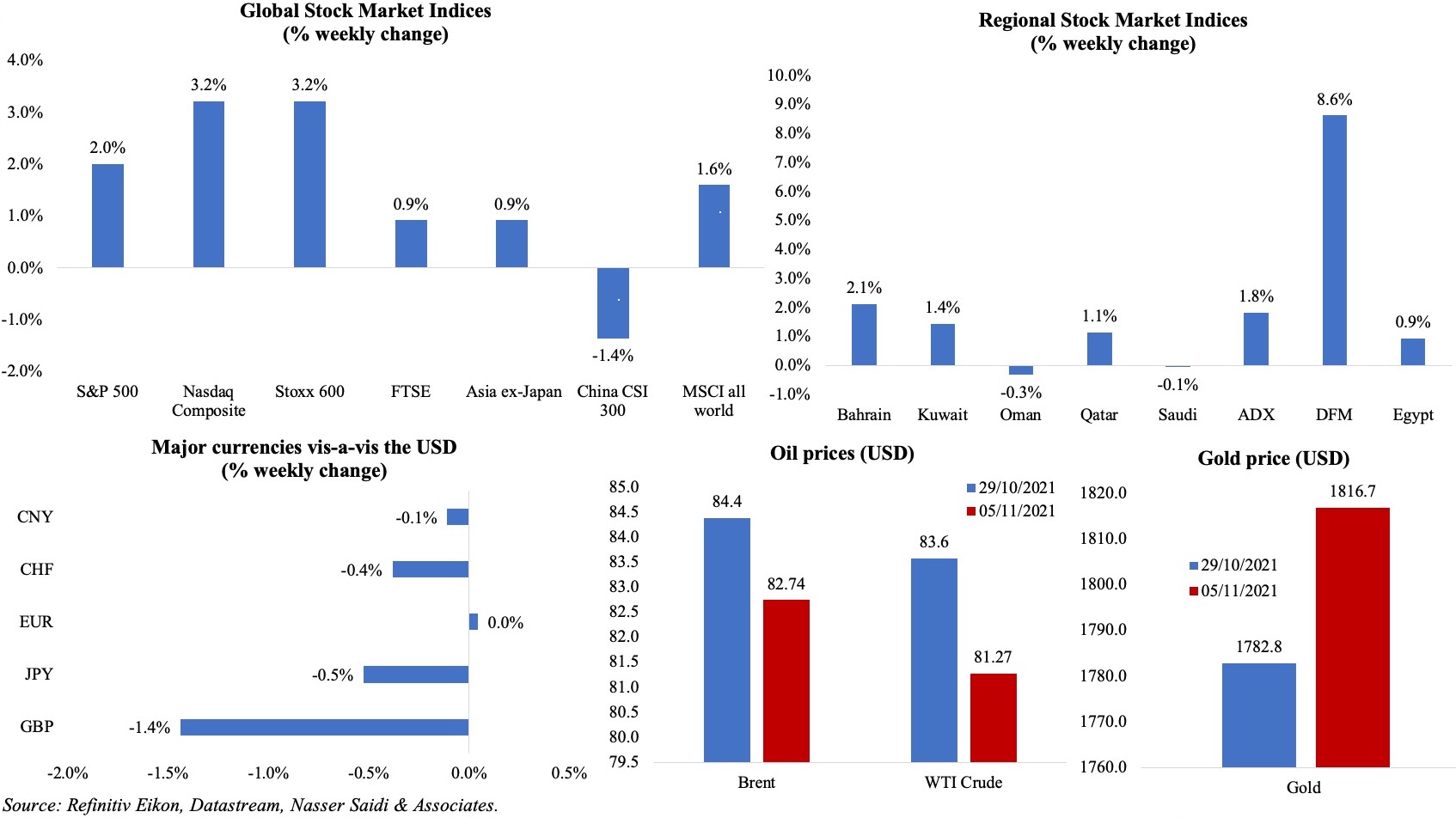

US markets jumped to a record high, boosted by strong jobs growth and falling unemployment while Pfizer’s Covid19 pill update supported sentiment; the latter supported Europe’s gains, led by travel stocks, while dovish moves by the Fed, BoE and ECB’s comments supported overall sentiment; MSCI’s all world index gained 1.6%. In the region, Abu Dhabi and Dubai indices gained on the launch of market-boosting initiatives; Dubai posted its biggest weekly rise in about 6 years. The dollar index increased to its highest level in more than a year on Fri before retreating, while the pound had the worst week since Aug (falling by more than 1%) given the Bank of England’s surprise decision not to hike rates. Though crude prices increased on Fri given supply concerns (after OPEC+ stuck to their earlier plan raise output by 400k barrels per day from Dec), prices fell for the second straight week. Gold price ticked up by close to 2% from a week ago given the dovish rhetoric from major central banks.

Weekly % changes for last week (4 – 5 Nov) from 28 Oct (regional) and 29 Oct (international).

Global Developments

US/Americas:

- US Fed stated that it would scale back its USD 120bn a month bond-buying programme later this month; it will reduce its purchases of Treasury securities by USD 10bn a month and of agency mortgage-backed securities by USD 5bn a month.

- The US House of Representatives passed the USD 1.2trn infrastructure bill: this will deliver USD 550bn of new federal investments in US infrastructure over five years and includes USD 110bn for roads, bridges and major infrastructure projects and USD 40bn for bridge repair, replacement and rehabilitation among others.

- Non-farm payrolls increased by 531k in Oct (Sep: 312k) – this was the biggest jump in a single month since Jul. Unemployment rate inched down to 4.6% from 4.7% the month before. Labour force participation rate remained unchanged at 61.6%. The economy is still 4mn+ jobs short of the pre-pandemic levels.

- Non-farm productivity fell by 5% in Q3 (Q2: 2.1%) – the biggest quarterly drop since Q2 1981. Unit labour costs jumped by 3%, a combination of the productivity drop plus a 2.9% increase in hourly compensation, while output grew by 1.7% and hours worked rose by 7%.

- Private sector hired 571k workers in in Oct (Sep: 523k) – reporting the fastest pace of job creation since June – with services sector hiring 458k, led by leisure and hospitality (185k).

- ISM manufacturing PMI for Oct slowed to 60.8 in Oct (Sep: 61.1), after new orders fell to 59.8 (the lowest since Jun 2020) from 66.7 the month before while employment picked up to 52 (Sep: 50.2). Prices paid increased to 85.7, from 81.2 the month before.

- Markit manufacturing PMI in the US slipped to 58.4 in Oct (Sep: 60.7 and lower than the preliminary estimate of 59.2), with half of all companies reporting lower production due to a lack of supplies. Services PMI ticked up to 58.7 in Oct (Sep: 54.9 and the preliminary estimate of 58.2), thanks to to greater client demand and a further rise in new business.

- Factory orders increased by 0.2% mom in Sep (Aug: 1.0%); orders for non-defense capital goods ticked up by 0.8% and core capital goods were up by 1.4%.

- Goods trade deficit in the US widened to a new record-high of USD 80.9bn in Sep (Aug: USD 73.3bn). Goods exports plunged by 4.7% to USD 142.7bn, with petroleum exports plunging by 15.5%, though consumer goods exports were the highest ever. Goods deficit with China increased to USD 36.5bn (+15% mom).

- Initial jobless claims fell to a new pandemic-low of 269k in the week ended Oct 29th, staying below the 300k mark for the 4th consecutive week and from an upwardly revised 283k the prior week; the 4-week average slipped to 284.75k. Continuing claims slipped by 134k to just over 2.1mn in the week ended Oct 22nd, the lowest level since the pandemic began.

Europe:

- German manufacturing PMI declined to a 9-month low of 57.8 in Oct (Sep: 58.4). Higher input price inflation and supply constraints were well-documented, while employment gained for an 8th consecutive month.

- Manufacturing PMI in the Eurozone slipped to an 8-month low of 58.3 in Oct (Sep: 58.6 and preliminary estimate of 58.5), as output and new order growth lost momentum, while supplier lead times lengthened thereby intensifying inflationary pressures. Services activity fell to a 6-month low of 54.6.

- Eurozone retail sales unexpectedly dropped by 0.3% mom in Sep (Aug: 1%); while car fuel sales rose by 1% and food, drinks and tobacco sales were up by7%, non-food sales fell by 1.5% (dragged down by a 1.4% drop in internet and mail order sales). Retail sales in Germany slipped by 0.9% yoy and 2.5% mom in Sep (Aug: 0.4% yoy and 1.1% mom) with non-food sales tumbling 5.1%. Compared to Feb 2020, retail sales were 3.7% higher.

- German factory orders rebounded by 1.3% mom in Sep, from the upwardly revised 8.8% drop in Aug. Orders for machinery and equipment jumped 12.2%, and orders for capital goods grew by 3.9%. The rise was largely due to orders from outside the euro area (+14.9%) compared to the drops from within the euro area (-7.3%) and domestic orders (-5.9%).

- Industrial production in Germany fell by 1.1% mom and 1% yoy in Sep as supply constraints (raw materials and intermediate products) continued to play havoc. Manufacturing sector production fell by 2.4% qoq in Q3 and is 9.5% lower than in Feb 2020.

- Producer price index in the eurozone increased by 2.7% mom and 16% yoy in Sep.

- The Bank of England meeting left rates unchanged, surprising markets that were expecting rates to rise to 0.25%. Later, the governor told the BBC that “we do think interest rates will need to rise and they will rise”.

- Markit manufacturing PMI in the UK inched up to 57.8 in Oct (from Sep’s 7-month low of 57.1), as production rose marginally and new order intakes increased (in spite of a decline in new export orders) while employment rose for the 10th consecutive month. Services PMI improved to 59.1 from the preliminary estimate of 58 – this is the strongest pace of recovery since Jul.

Asia Pacific:

- China non-manufacturing PMI slipped to 52.4 in Oct (Sep: 53.2), with new orders falling for a 5th consecutive month (49) and with new exports orders and employment below the 50-mark (at 47.5 each). Caixin services PMI moved up to 53.8 in Oct (Sep: 53.4), as new orders expanded the most in 3 months, and employment rose for the second straight month.

- China’s NBS manufacturing PMI unexpectedly declined to 49.2 in Oct (Sep: 49.6): output, new orders and exports sales all declined (at 48.4, 48.8 and 46.6 respectively) while employment fell for the 7th consecutive month (48.8). In contrast, Caixin manufacturing PMI inched up to a 4-month high of 6 in Oct (Sep: 50), with the sub-index for total new orders hitting their highest since Jun despite power shortages and rising costs weighing on output.

- Foreign exchange reserves in China increased for the first time since Jul, rising to USD 3.218trn at end-Oct (+0.53% mom).

- China’s exports growth slowed in Oct (+27.1% yoy from Sep’s 28.1%) while imports grew by 20.6% (faster than Sep’s 17.6%), posting a trade surplus of USD 84.54bn (Sep: USD 66.76bn). Crude oil imports plunged to their lowest since Sep 2018, while coal imports slowed.

- Japan’s manufacturing PMI stood at 53.2 in Oct (Sep: 51.5), the 9th month of expansion: both output and new orders rebounded from the declines in Sep and employment continued to increase. Output cost inflation rose to the quickest pace in just over 13 years.

- Overall household spending in Japan fell by 1.9% yoy in Sep (Aug: -3%); in seasonally adjusted mom terms, spending was up by 5% – the first increase in 5 months. Separately, eased border rules will come into effect from Nov 8 (Monday) – with shorter quarantine periods of 3 days for inbound business travelers (with proof of vaccination) though no mention was made of tourists.

- India’s PM put forward an ambitious aim for the country to achieve net zero by 2070. The country still generates more than 50% of its electricity from coal and is the world’s 4th biggest emitter of CO2.

- India reduced fuel taxes last week: excise duty on petrol by INR 5 (USD 0671) per litre, and that on diesel by INR 10 per litre. The federal government will see a revenue loss of between INR 550-600bn due to this cut in taxes. Prior to the cut, taxes accounted for 52% and 47% of the price of petrol and diesel respectively.

- Services PMI in India grew to 58.4 in Oct (Sep: 55.2), with demand increasing at the strongest pace in 10 years; however, business confidence remains muted and international demand was below-50 for the 20th straight month.

- Singapore retail sales increased by 6% mom and 6.6% yoy in Sep, reversing Aug’s 2.8% drop, supported by the launches of new mobile phones (computer and telecom equipment sales were up by 66.1% yoy). Sales of food and beverage services rose 4.4% yoy, after falling 6.7% in Aug when stricter dine-in restrictions were in place.

Bottomline: Global manufacturing PMI edged up to 54.3 in Oct (Sep: 54.1), thanks to a building of stock holdings and faster jobs growth – which offset slower increases in both output and new orders (given input shortages, supply chain issues and rising cost inflation). Meanwhile, the increase in wheat prices to the highest level in 9 years points towards an uptick in food inflation going forward.

Regional Developments

- Bahrain revealed an updated fiscal balance programme: the plan includes reducing expenditure and project spend while also streamlining cash subsidies to citizens and introducing new government services revenue initiatives. VAT will be raised to 10% (still below the 15% Saudi rate) and the zero-deficit target pushed to 2024 (instead of 2022): it will be the first full-year surplus since 2008. Furthermore, a strategic projects plan would see over USD 30bn in investments, a regulatory reform package would support USD 2.5bn of FDI by 2023, and a new sector strategies plan aims to support annual growth of 5% in the non-oil sector by 2022.

- PMI in Egypt remained in contractionary territory for the 11th consecutive month in Oct, falling 0.2 points to 48.7. Inflationary pressures are a major concern and output levels were reduced due to supply constraints in obtaining raw materials and other components (sub-index fell to 47.5 from 48.9). Input stocks fell by their fastest since Jun 2020, costs jumped by the steepest in over 3 years and the sub-index for future output expectations tumbled to 65.0 from 85.7 on expectations of worsening supply chain disruptions. Employment levels however reached its highest level in 2 years as the effects of the pandemic dissipate.

- Net foreign reserves in Egypt increased by USD 24mn to USD 40.849bn at end-Oct, according to the central bank. Saudi Arabia provided a deposit of USD 3bn recently and extended the term of current deposits amounting to USD 2.3bn. Net foreign assets of the banking system jumped to USD 11bn in Sep (Aug: USD 10bn).

- Egypt’s exports to the G20 nations surged by 39.2% yoy to USD 9bn in H1 2021. Italy, the US and Saudi Arabia were the biggest export destinations, touching values of USD 1.1bn each. Imports from the G20 increased by 14% to USD 27bn, with value of Chinese imports topping the list (USD 6.5bn), followed by the US (USD 3.2bn) and Saudi Arabia (USD 3.1bn).

- The Egyptian Financial Regulatory Authority will allow the establishment of SPACs, with the proceeds of the subscription used to acquire one or more companies or projects after the subscription. If the planned acquisition is not completed within a period of 2 years, the SPAC is required to return the funds to the investors.

- The central bank of Egypt issued treasury bills worth EGP 18bn (USD 1.14bn) to finance the budget deficit.

- Egypt is planning to establish an electronic system to allow VAT refund for tourists on purchases exceeding EGP 1500 (USD 95); the aim is to start operations in Sharm El Sheikh before end of this year.

- Egypt, with gas production at 7.0-7.2bn cubic feet per day and exports of 8bn cubic feet of gas per day, is expected to start exporting liquified gas to Lebanon by end of this year.

- The Suez Canal Authority plans to increase transit fees by 6% next year, according to the chairman. LNG tankers and tourist cruise ships will be excluded from the fee hike.

- According to Egypt’s petroleum minister, the nation plans to use clean fuel hydrogen as part of efforts to generate 42% of its electricity from renewable energy sources by 2030.

- Oil exports from Iraq stood at 3.12mn barrels per day (bpd) in Oct, slightly higher than the average 3.08mn bpd reported in Sep. Crude oil exports generated a revenue of USD 68bn with an average price per barrel of USD 79.4.

- Kuwait is planning to spend USD 8.2bn on 14 projects related to its main airport’s redevelopment. One of the main projects is a new terminal which will accommodate 25mn passengers annually and is estimated to cost USD 5bn.

- Lebanon’s PMI slumped further to 46.6 in Oct (Sep: 46.9), with all sub-indices on the decline except for employment. Output slipped to a 7-month low and new orders fell at the fastest pace in 7 months, with weak demand as well as political and economic instability clouding confidence.

- Saudi Arabia and Oman signed two agreements to enhance cooperation in land and air transport. Separately, Oman’s minister of economy called for speeding up the activation of the maritime link between Saudi Arabia and Oman – which would allow for transfer of oil and gas exports bypassing the Strait of Hormuz.

- Qatar’s PMI touched a record-high 62.2 in Oct (Sep: 60.6), with confidence buoyed by the upcoming FIFA World Cup 2022: both output and new work increased at the fastest rates in the survey’s history, and employment increased for the 13th consecutive month.

- The Qatar Central Bank approved the USD 50bn merger between Masraf Al Rayan and Al Khaligi Bank: this forms the second largest Islamic banking entity in Qatar.

- UK announced USD 68mn in funding to green projects/ infrastructure while supporting energy transition in MENA. Funds will be used to mobilize private sector funds, and support work across the region including Morocco, Algeria, Egypt, Tunisia, Jordan and Lebanon.

Saudi Arabia Focus

- Saudi PMI eased to 57.7 in Oct (Sep: 58.6) but remained above the series average of 56.9. The output sub-index increased to 62.1 – the strongest in nearly 4 years and from 61.2 in the previous month – while employment stayed above 50 for the 7th straight month.

- Higher oil prices supported Saudi Arabia post a small budget surplus of SAR 6.7bn in Q3 2021: the first since Q1 2019. The nation recorded an overall deficit of SAR 5.4bn in the period Q1-Q3 this year (vs a budgeted SAR 140.9bn for full year 2021). Oil revenues accounted for 61% of total revenues in Q3 vs 57% in Q1 2021 while non-oil revenues declined by 22% yoy to SAR 95.4bn in Q3.

- Saudi Arabia is not planning to reduce VAT in the short term, stated the finance minister to Asharq, on the sidelines of the G20 meetings. Furthermore, he disclosed that advisers for a planned green debt issuance have been appointed though the format is yet to be decided.

- Saudi CMA approved the request for the IPO of 30% of Tadawul: approval of the Saudi Tadawul Holding Group to offer 36mn shares for public subscription is valid for 6 months.

- Three businesses are planning to IPO, offering around 9 million shares, according to Tadawul. Of these, the Riyadh-based Advanced International Company and Alwasail Industrial Co will list on Nomu, while Scientific and Medical Equipment House is planning a listing on the main market.

- SAMA’s updated debt crowfunding activities regulations redefine the beneficiary to include all commercial establishments registered in the Kingdom and to add a definition of aggregate accounts to ensure complete segregation between the funds of the participants in the financing process and the funds of the crowdfunding facility.

- The weekly update of point of sales transactions (PoS) in Saudi Arabia showed an increase in value across all sectors in the week ended Oct 30th (+29% wow after 3 consecutive weeks of drops; education was up 83.2%, clothing up 42%, food & beverages up 55.5%). In Sep, the value of PoS transactions fell to SAR 39.9bn (USD 10bn) from Aug’s all-time high SAR 41bn.

- Saudi Arabia issued permits for 745 industrial projects worth around SAR 75bn (USD 20bn) in Q3 2021, according to the National Centre for Industrial and Mining Information. In Sep alone, the volume of investments in new industrial facilities and factories amounted to SAR 999mn (USD 266mn).

- Prices of apartments in Saudi Arabia is growing at the fastest rate in five years, according to a new Knight Frank report. Apartment values increased by 17% and 12% over the past year in Riyadh and Jeddah respectively.

- Saudisation of the workforce increased by 1% in the private sector in Q3 2021, with about 60k more employees joining the sector. The current rate of Saudization is 23.6% of total employees in the private sector.

- The volume of assets managed by licensed financial institutions in Saudi Arabia exceeded SAR 704bn (USD 187.6bn) by end of Q2 2021, reported Al Arabiya, citing the CMA.

- Moody’s revised the outlook for Saudi Arabia to stable from negative previously while also affirming the A1 ratings.

UAE Focus![]()

- UAE PMI increased to 55.7 in Oct (Sep: 53.3), the highest reading since Jun 2019 and above the long-run series average. Both the output sub-index (61.1 from Sep’s 57.1) and new orders touched their highest levels in more than two years.

- Dubai announced plans to sell stakes in as many as 10 state-owned firms in energy, retail and logistics sectors – in a bid to join the IPO boom in other regional exchanges (3 IPOs this year in Abu Dhabi; ACWA Power, STC & others in Saudi Arabia). The privatisation move will likely attract domestic and foreign investments and boost overall liquidity. This, in addition to news of the AED 2bn market maker fund, sent the index higher – recording its biggest intraday gain in about 18 months. DEWA is the first planned listing; Bloomberg reported that the firm could be valued at more than USD 25bn. A Dubai Markets Supervisory Committee and a specialized courts for capital markets were also announced in the emirate.

- The Abu Dhabi Exchange launched a derivatives market, and plans to introduce index futures in Q1 next year. Three market makers including ADQ’s Q Market Makers, BHM Capital, and Al Ramz Capital joined the ADX Derivatives market to provide liquidity.

- Dubai announced the merging of its Economy and Tourism departments to form the Department of Economy and Tourism – to increase the value added of the industrial sector by 150% over the next five years, support the expansion of foreign export markets for local products by 50% and attract 25mn tourists into the emirate by 2025. The new entity is also tasked with attracting 100k companies in three years, 400 global economic events annually by 2025 and encourage private and family-owned businesses to list on the Dubai bourse.

- Dubai Courts announced the formation of a law enforcement committee for the financial markets and two new courts within the Commercial Court for the resolution of disputes related to securities.

- The new amendments to the UAE Commercial Transactions Law regarding decriminalisation of cheques and amendments relating to partial payment of the cheque will come into force from 2nd of Jan 2022, according to the central bank.

- Expo 2020 announced that of the 2.35mn visits in Oct, 28% were persons under 18 years old (thanks to the Expo School Programme) and 17% of visits were from overseas. The top five most popular overseas markets consisted of India, Germany, France, Saudi Arabia and the UK.

- The US and UAE announced a USD 4bn joint agricultural initiative to accelerate innovation for climate-smart agriculture and food systems over the next five years.

- UAE aims to capture 25% of the global hydrogen fuel market by 2030: more than 7 hydrogen projects are already being implemented in the country. ADNOC produces more than 300k tons per year of hydrogen and plans to increase its production to 500k tons per year.

- The Emirates Nuclear Energy Corporation completed Unit 3 of the Barakah nuclear energy plant. It is on track to start up and deliver clean electricity in 2023 and will cut Abu Dhabi Emirate’s carbon emissions by 50% by 2025.

- Abu Dhabi’s Department of Energy announced nine new projects to support UAE’s Net Zero by 2050 initiative: it is expected that these projects (along with existing ones) will reduce CO2 emissions from power generation and water production by 50% over 10 years. Abu Dhabi aims to reduce emissions from power generation to approx. 20mn tonnes in 2025 from 40mn tonnes in 2020.

- DP World and Indonesia’s sovereign wealth fund signed a USD 7.5bn deal to form a consortium for long-term investment in terminals, cargo park, land transport to and from ports and industrial zones in Indonesia.

Media Review

Fed, ECB, and BOE hop aboard the “transitory” inflation express

Cautionary tales from high-inflation emerging economies

Gulf states cut ties with Lebanon as diplomatic row escalates: FT

https://www.ft.com/content/4f37a44a-c3db-476e-b093-8e89e3d67c69

The Great COP-Out?

https://www.project-syndicate.org/bigpicture/the-great-cop-out

UAE Sustainable Finance Working Group’s high level statement on sustainable finance

Dr. Nasser Saidi’s comments on the ban on Lebanese imports by some GCC nations: CNN Arabia

https://arabic.cnn.com/business/article/2021/11/03/lebanon-gulf-economy