Weekly Insights 4 Nov 2021: Economic & Financial Updates from the GCC

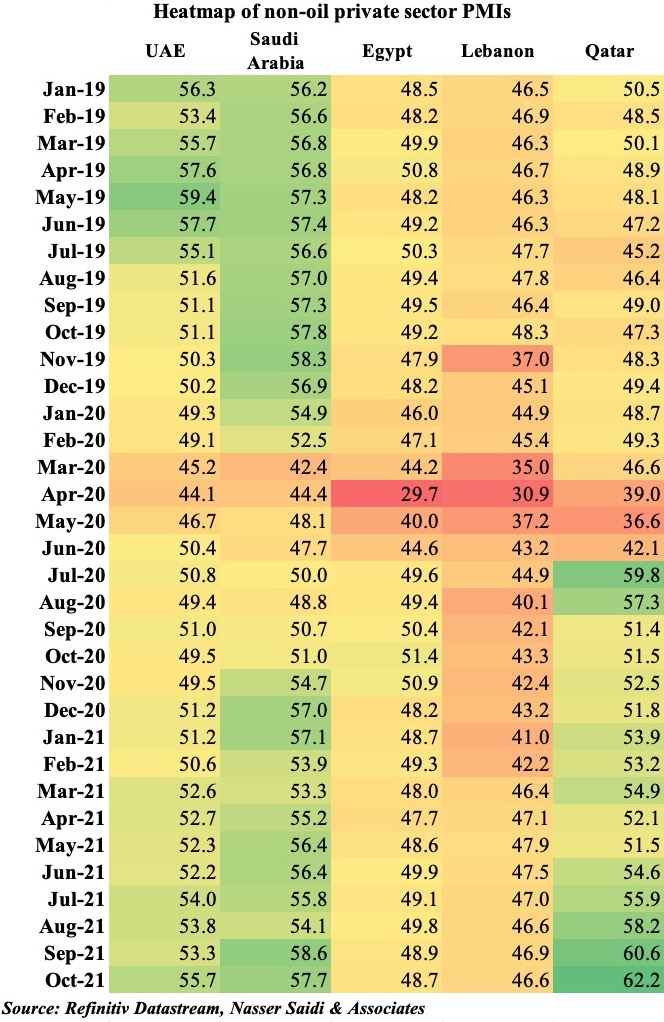

1. Diverging PMIs in the Middle East

- Diverging PMI readings: GCC PMIs remained in expansionary territory this year; in contrast, Egypt and Lebanon PMIs remain below-50

- Recovery in domestic demand drives PMI up in the GCC: Qatar touched a new peak in Oct; Saudi non-oil sector output expanded at the strongest pace since Dec 2017; UAE posted the fastest increases in activity & new orders since Jul 2019, as Expo got underway

- Lebanon remains bogged down by deteriorating economic conditions despite the new government and negotiations with the IMF

- Inflationary pressures weighs on Egypt: input prices & output charges rose at fastest rates since Aug 2018; business confidence weakened on concerns that supply constraints could worsen further, for longer

- GCC firms had been holding back on passing higher prices to customers: however, Saudi & Qatar are breaking the pattern. Saudi posted quickest rise in output prices since Aug 2020 while in Qatar, firms raised their own prices by the most since Mar

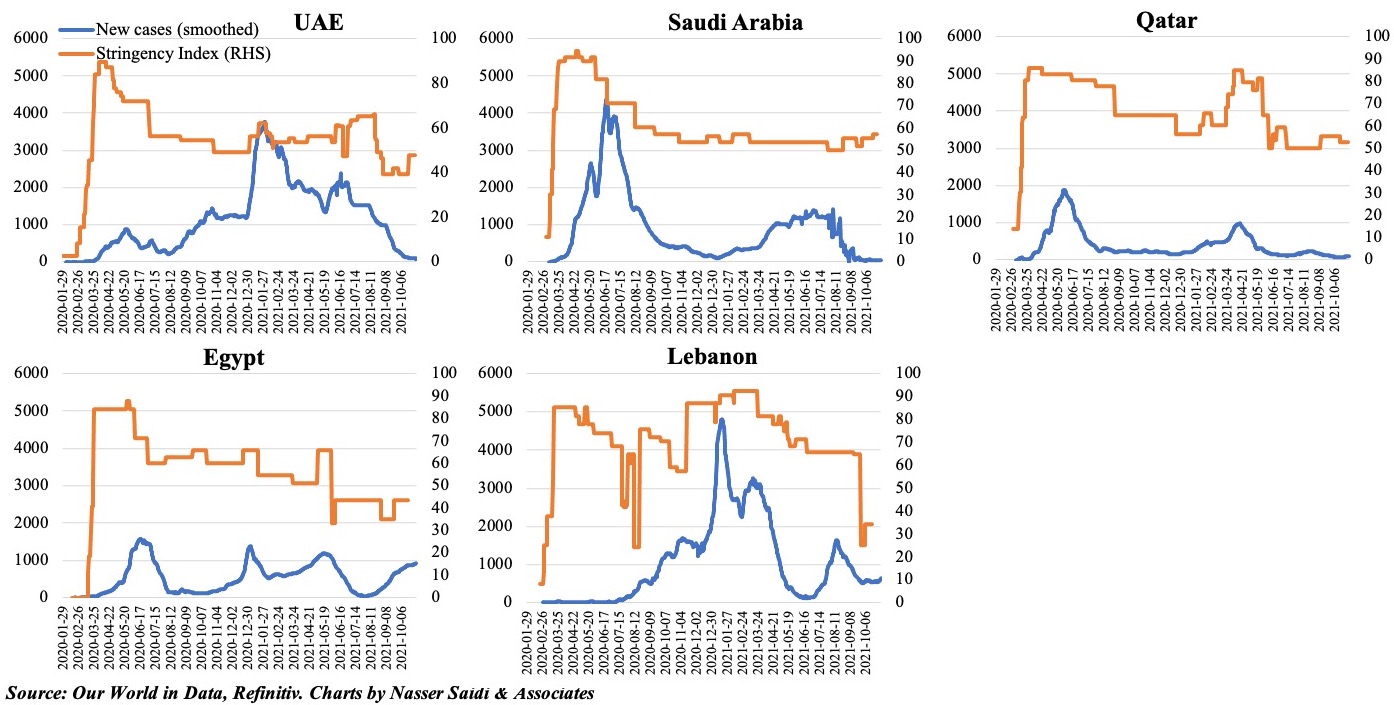

2. Significantly lower Covid19 cases & subsequent ease in restrictions support upticks in GCC PMIs; inflationary & political pressures weigh on PMIs in Egypt & Lebanon respectively alongside a recent rise in cases

- Supply chain constraints are causing a steep increase in prices

- PMI sub-indices in Sep reported a lengthening of average supplier lead times to an extent exceeded only twice in the survey’s 23-year history

- However, both Saudi Arabia & the UAE reported a shortening of supplier lead times in spite of supply chain issues; potentially given linakges to Asia (where the situation is better compared to Europe & the US)

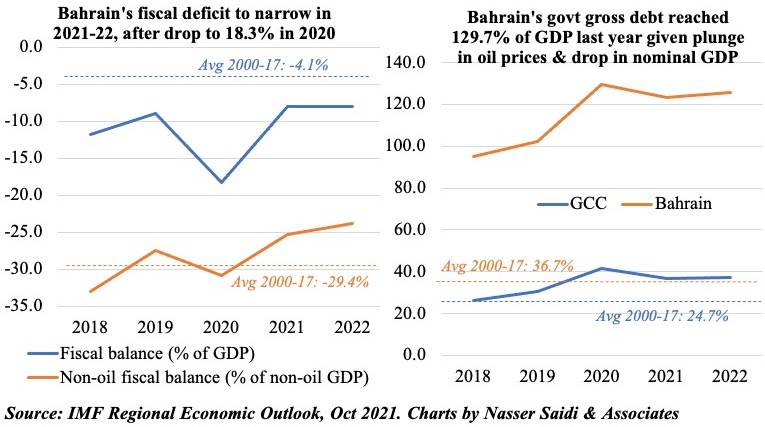

3. Bahrain delays zero-deficit target to 2024

- According to the IMF (Oct REO data), fiscal deficit had widened to 18.3% of GDP in 2020, while public debt jumped to 129.7% of GDP (2019: 102.1%). Deficit is estimated to narrow to 8% in 2021 and ‘22

- Bahrain on Sunday announced an updated fiscal balance programme

- The plan includes reducing expenditure & project spend + streamlining cash subsidies to citizens + new government services revenue initiatives; VAT will be raised to 10%

- The zero-deficit target pushed to 2024 (instead of 2022 before): it will be the first full-year surplus since 2008

- Saudi Arabia, UAE & Kuwait have pledged continued support to the nation: likely to raise investors confidence in the nation; their USD 10bn aid package extended in 2018 was linked to a fiscal balance programme

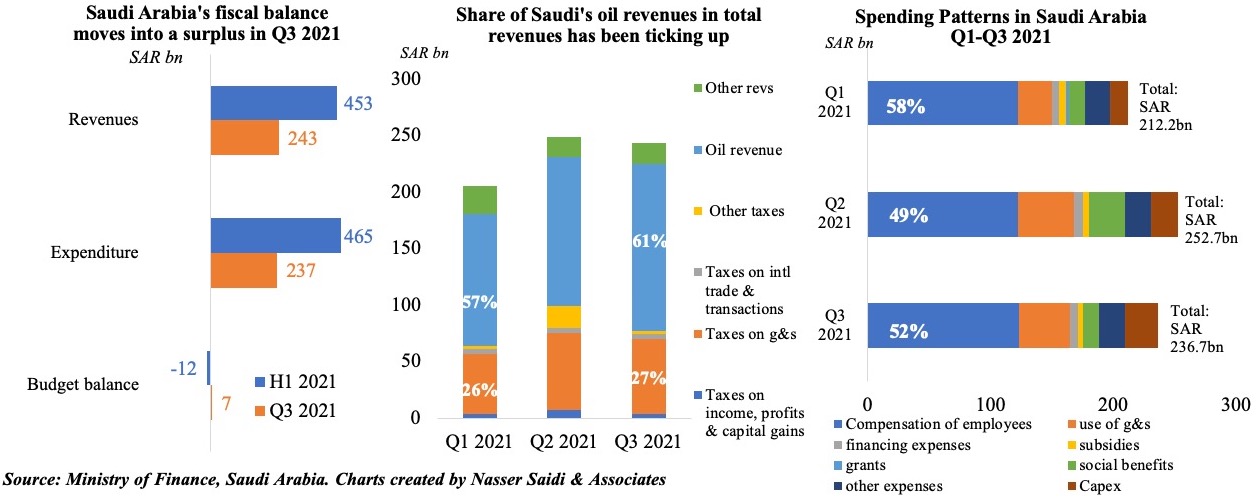

4. Saudi Arabia posts a small fiscal surplus in Q3 2021 – the first since Q1 2019

- Higher oil prices supported Saudi Arabia post a small surplus of SAR 6.7bn in Q3 2021: the first since Q1 2019. The nation recorded an overall deficit of SAR 5.4bn in the period Q1-Q3 this year (vs a budgeted SAR 140.9bn for full year 2021)

- Oil revenues accounted for 61% of total revenues in Q3 vs 57% in Q1 2021 while non-oil revenues declined by 22% yoy to SAR 95.4bn in Q3

- Compensation of employees still account for more than half of total spending; it grew by 3% yoy to SAR 123.5bn in Q3. The sharpest decline was registered in grants (-63% to SAR 175mn)

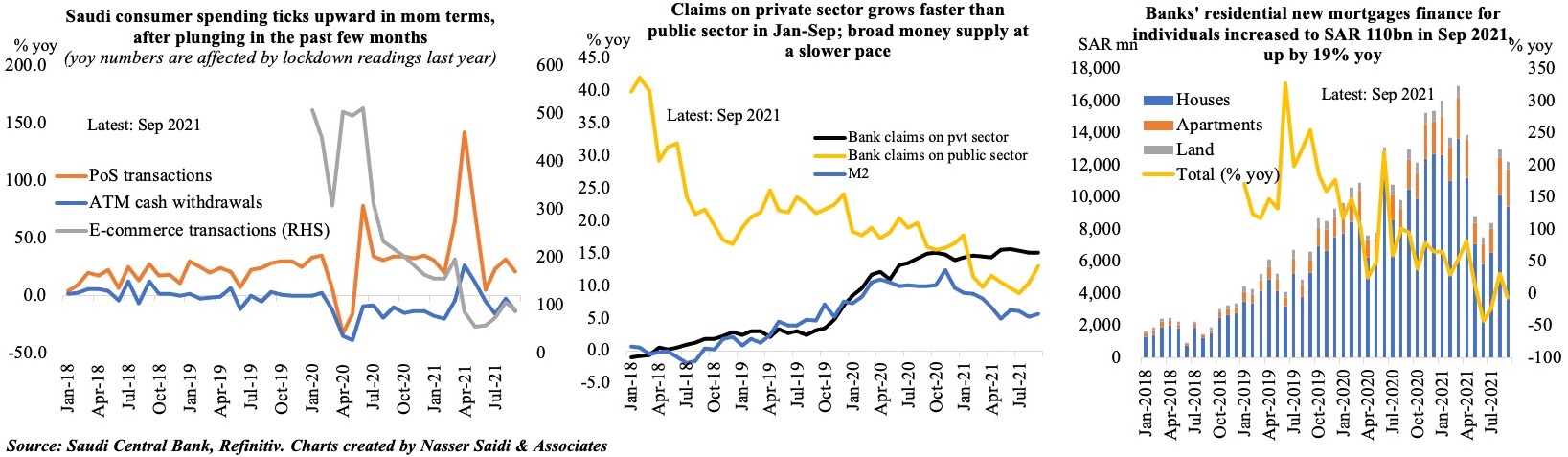

5. Saudi consumer spending slowed in Sep; weekly PoS show a rebound by end-Oct; mortgages spike again after summer lull

- Overall consumer spending in Saudi Arabia declined by in 1.7% mom in Sep, with declines in both ATM and point-of-sales (PoS) transactions.

- The value of PoS transactions fell by 2.4% mom to SAR 39.9bn in Sep from Aug’s record-high; the weekly update of PoS transactions showed an increase in value across all sectors in the week ended Oct 30th (+29% wow after 3 consecutive weeks of drops; education was up 83.2%, clothing up 42%, food & beverages up 55.5%)

- Claims on both private and public sector continued to increase: for the period Jan-Sep 2021, claims on private and public sector were up by 15% and 11.4% yoy respectively. Money supply (M2) grew at a slower pace (6.7%)

- Given the aim to boost home ownership (to 70% in 2030), it is little wonder that new mortgage finance has seen a surge in the past year, supported by availability of cheap loans and affordable housing. After a lull during the summer months, loans have once again picked up in Aug-Sep. This has also resulted in a hike in apartment prices over the past year – at the fastest pace in five years.

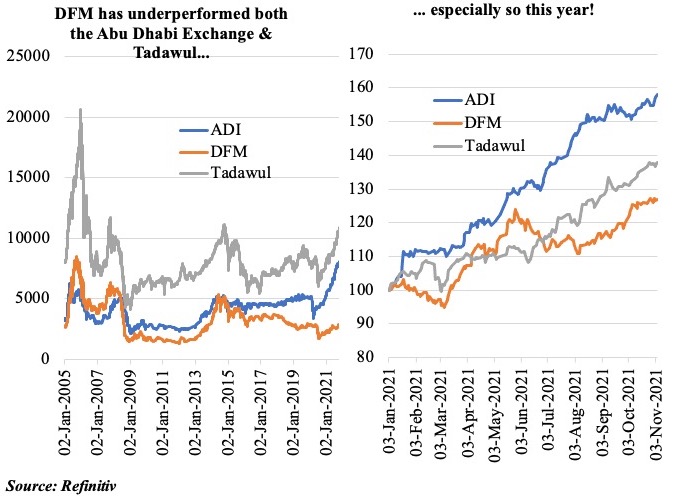

6. Dubai Financial Market Incentives

- This week, Dubai announced plans to sell stakes in as many as 10 state-owned firms in energy, retail and logistics sectors – in a bid to join the IPO boom in other regional exchanges (3 IPOs this year in Abu Dhabi; ACWA Power, Stc & others in Saudi Arabia)

- The privatisation move will likely attract domestic and foreign investments and boost overall liqudity. This, in addition to news of the AED 2bn market maker fund, sent the index higher

- DEWA is the first planned listing; Bloomberg reported that the firm could be valued at more than USD 25bn

- Dubai’s listing track record has not been highly successful. Since start of 2020 DXB Entertainments and DP World delisted from the Exchange, Marka (which IPO-ed in 2014) was declared bakrupt & assets brought into liquidation while Arabtec shares were suspended; Damac is planning to take the company private

- The Abu Dhabi Exchange launched a derivatives market today, and plans to introduce index futures next year

- Overall, the future looks bright so long as transparency and disclosure remains top priority, alongside good corporate governance practice