Markets

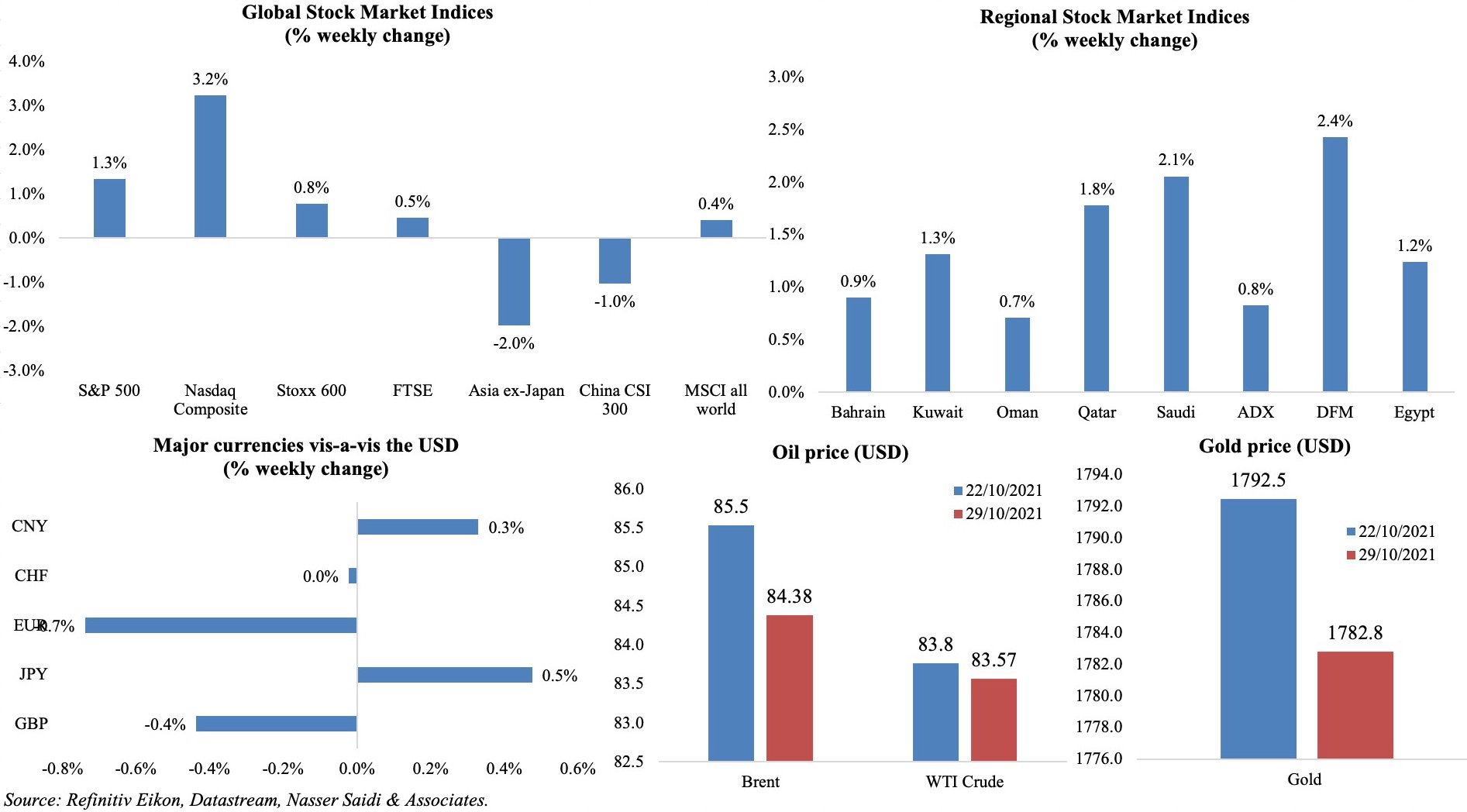

A few weaker than expected corporate earnings reports (Apple, Amazon) saw some losses in US equity markets, though both S&P 500 and Nasdaq ended the week higher. European equity markets had to deal with an uptick in economic recovery alongside inflation rate at a 13-year high, with the ECB stressing that an interest rate hike will not immediately follow exit from the pandemic emergency purchase programme (PEEP). Regional markets were mostly up, supported by strong corporate earnings and high oil prices. The dollar had a good week while the euro fell against the dollar, the pound and the Swiss franc. Oil prices ended the week slightly down compared to the week before, after touching multi-year highs on Monday. Gold prices fell last week, given the stronger dollar and rising inflation numbers.

Weekly % changes for last week (28 – 29 Oct) from 21 Oct (regional) and 22 Oct (international).

Global Developments

US/Americas:

- US GDP grew at an annualized 2% pace in Q3 (Q2: 6.7%), the slowest gain since the 31.2% plunge in Q2 2020, as consumer spending eased (+1.6% in Q3 vs Q2’s 12%) and federal government spending dropped by 4.7%. Personal disposable income dropped by 0.7% in Q3 (Q2: -25.7%, given the end of government stimulus payments); personal spending also declined to 8.9% from 10.5% in Q2.

- Durable goods orders in the US fell by 0.4% mom in Sep (Aug: 1.3%), dragged down by a 2.3% drop in orders for transportation equipment. Non-defense capital goods orders (excluding aircraft) inched up by 0.8% in Sep (Aug: 0.5%) to an all-time high.

- Goods trade deficit in the US widened to a record high USD 96.3bn in Sep (Aug: USD 89.4bn). Exports fell by 4.7% in Sep, with declines in sales of industrial supplies (-9.9%), capital goods (-3.6%) and automotive vehicles (-2%) among others. Imports rose by 0.5% though imports of vehicles and consumer goods were down by 7.7% and 0.7% respectively.

- Chicago Fed National Activity Index tumbled to -0.13 in Sep (Aug: 0.05), posting the lowest reading since Apr, with production related indicators down by -0.37 (Aug: -0.08). The index’s 3-month moving average moved down to +0.25 in Sep (Aug: +0.38).

- The Dallas Fed Manufacturing Business Index increased to 14.6 in Oct, up 10 points from the month before, even though the production index fell by 5.9 points to 18.3 and demand indices improved. The Richmond Fed manufacturing index also jumped to a 3-month high of 12 in Oct (Sep: -3), thanks to gains in shipments (1 vs Sep’s -1), new orders (10, up from -19) and employment (27 from 20).

- S&P Case Shiller home price index surged by 19.7% yoy in Aug, following an increase of 20% the month before. While all cities reported price gains, it was at a slower rate than the previous month in most.

- Pending home sales unexpectedly slipped by 2.3% mom and 8% yoy in Sep, potentially due to a combination of rising home prices and mortgage rates.

- Initial jobless claims fell to a new pandemic-low of 281k in the week ended Oct 22nd from an upwardly revised 291k the previous week; the 4-week average slipped to 299.25k. Continuing claims slipped by 237k to 2.243mn in the week ended Oct 15th, the lowest level since the pandemic began.

Europe:

- The ECB left interest rates unchanged and monetary policy stance unchanged at the latest meeting. Lagarde stated that though inflation will take longer to decline than previously expected, the factors pushing up prices now will “ease in the course of next year”.

- Preliminary estimates showed an acceleration in eurozone GDP by 2.2% qoq and 3.7% yoy in Q3, with the rebound largely due to France and Italy (growing at 3% and 2.6% respectively). Growth in the region is still 0.5% smaller than in Q4 2019.

- Inflation in the eurozone rose to a 13-year high of 4.1% yoy in Oct (Sep: 3.4%), driven by rising energy costs (23.5%), food, beverages and tobacco prices (+2.2%) and price hikes due to supply constraints. Core inflation increased to 2.1% in Oct from Sep’s 1.9%. Meanwhile, though the ECB estimates inflation to touch2% in 2021, it is estimated at 1.7% in 2022 and 1.5% in 2023 i.e. below its 2% target.

- Preliminary estimates for GDP growth in Germany stood at 1.8% qoq and 2.5% yoy for Q3 (Q2: 1.9% qoq & 9.8% yoy), thanks to “higher household final consumption expenditure”; GDP is still 1.1% below Q4 2019 numbers. The government has lowered its GDP forecast for the year to 2.6% (from 3.5% before).

- Harmonised index of consumer prices in Germany rose to 4.6% yoy in Oct (Sep: 4.1%), the highest recorded since Jan 1997, given higher energy and raw material costs. In mom terms, prices increased by 0.5% (Sep: 0.3%).

- Germany’s Ifo business climate index slipped to 97.7 in Oct, the lowest level since Apr, with supply problems driving down capacity utilization in manufacturing (by 2.1 ppts to 84.7%). The current assessments slipped to 100.1 from 100.4 the month before, and expectations were also pessimistic, falling to 95.4 (Sep: 97.4).

- The GfK consumer confidence index in Germany unexpectedly inched up to 0.9 in Nov (Oct: 0.4), posting the highest since Apr 2020. While the propensity to buy improved, both economic and income expectations fell.

- Unemployment rate in Germany moved down to 5.4% in Oct (Sep: 5.5%; Mar 2019: 4.9%) with the number of people out of work dropping by 39k to 2.466mn.

- Eurozone’s economic sentiment indicator increased to 118.6 in Oct (Sep: 117.8) – close to the all-time high of 119 touched in Jul this year; however, the inflation expectations index surged to 40.0 in Oct, the highest value since 1993. Consumer confidence in the euro area fell to -4.8 in Oct (Sep: -4) while the business climate improved to 1.76 in Oct (Sep: 1.71).

Asia Pacific:

- The Bank of Japan left policy rates unchanged at the latest policy meeting while lowering its real GDP growth and inflation outlook for the fiscal year 2021. The BOJ lowered its consumer inflation forecast for the year ending Mar 2022 to 0% from 0.6%; its forecasts also show inflation falling short of the 2% target for at least 2 more years.

- Japan’s leading economic index fell to 101.3 in Aug (Jul: 104.1), the lowest level since Feb. Coincident index also slipped in Aug, to 91.3 from 94.4 the month before.

- Inflation in Tokyo eased to 0.1% yoy in Oct (Sep: 0.3%). Excluding food, prices remained unchanged at 0.1% while excluding food and energy costs, prices fell by 0.4% (Sep: -0.1%).

- Industrial production in Japan slipped by 5.4% mom in Sep, according to flash estimates – the third straight month of contraction in IP. Motor vehicles production continues to record the sharpest declines (-28.2% in Sep following Aug’s -15.2%). In yoy terms, IP fell by 2.3% – the first yearly drop in 7 months.

- Retail trade in Japan rebounded by 2.7% mom in Sep (Aug: -4%) though in yoy terms, sales declined for a second consecutive month (-0.6% after the 3.2% drop in Aug).

- South Korea’s GDP grew by 0.3% qoq and 4% yoy in Q3, as per the central bank’s preliminary estimates, and lower than Q2’s 0.8% qoq and 6% yoy growth. Private consumption was the main drag on growth, contracting by 0.3% in Q3 (Q2: +3.6%), alongside drops of 3.0% and 2.3% in construction and facility investments. Exports meanwhile rebounded by 1.5% (Q2: -2%).

- Inflation in Singapore ticked up to 2.5% yoy in Sep (Aug: 2.4%), with rising food, housing, and transportation costs (+1.6%, 2.3% and 8.3% respectively). The central bank, in its biannual review, stated that core inflation will continue to rise in the upcoming quarters as business costs rise and given continued import price pressures.

- Industrial production in Singapore shrank by 2.8% mom and 3.4% yoy in Sep (Aug: +5.6% mom and 11% yoy), posting the first drop since Oct 2020. The volatile biomedical manufacturing plunged by 35.9%, dragged down by pharmaceuticals.

Bottomline: With inflation on the rise, it is no surprise that central banks are turning more hawkish: the Bank of Canada last week ended its bond buying, surprising markets. This week sees central bank meetings of (a) the Reserve Bank of Australia last week made no offer to buy the 2024 yield target bond, causing markets to price in a rake hike as early as Apr 2022); (b) the Fed is expected to begin tapering its pandemic-era bond purchases; and (c) the Bank of England’s recent hawkish comments indicate a likely rate hike this week. The OPEC+ also meets this week, but though other nations are pressuring for a boost in output, it seems likely that the OPEC+ will hold its previously decided course. Lastly, it is increasingly likely that the G20 will endorse OECD’s plan to impose a global minimum corporate tax of 15%, with the rules coming into effect from 2023.

Regional Developments

- Bahrain announced its plans to achieve net zero emissions in 2060, a day after Saudi Arabia declared its intention to achieve the same.

- Egypt’s central bank left interest rates on hold for the 8th consecutive time.

- Egypt’s investment minister disclosed that the country plans to make 30% of all the government projects green by 2024 and then raise it to 100% by 2030. In the current fiscal year, about EGP 447bn had been spent on 691 green projects in various sectors.

- Hotels in Egypt, which had been operating at 70% capacity, have been permitted to run at full capacity for the first time since the pandemic (while observing Covid safety measures). Tourism revenues reached USD 4bn in 2020, down from USD 03bn in 2019. In H1 2021, the country received 3.5mn tourists – the same number as reported in all of 2020.

- Egypt will receive USD 200mn in loan to fund infrastructure projects: this will include a USD 150mn loan from Asian Infrastructure Investment Bank and USD 50mn from the OPEC Fund for International Development. Separately, the World Bank approved a USD 360mn development policy financing loan to support the nation’s post-pandemic recovery.

- The state of emergency in Egypt has been lifted after four years. The President, announcing this in a Facebook post, also stated that “Egypt has become an oasis of security and stability in the region”.

- Iraq will stop flaring associated gas by 2025, according to the deputy PM; he also stated that the country plans to produce 12 GW of power from solar over the next decade.

- In the KPMG 2021 Kuwait CEO Outlook, around 88% of respondents revealed plans to make acquisitions in the next 3 years to grow and transform their businesses, with 92% also stating that headcount would also be increased during this time. Tech remains a top priority, with 80% of CEOs saying technology investments would be made while targeting growth.

- Saudi Arabia ordered the Lebanese ambassador to leave within 48 hours on Friday, as well as banned Lebanese imports – a diplomatic crisis after a Lebanese minister aired comments calling the Yemeni war futile. Shortly after Saudi, Bahrain and Kuwait asked the Lebanese ambassadors to leave while the latter in addition also recalled its ambassador from Beirut. Lebanon’s foreign minister stated that international contacts had asked the PM not to resign over the ongoing rift.

- An Apr 2016 confidential report, prepared by the IMF for Lebanon’s financial authorities, states that while the gross reserves of the Banque Du Liban (BdL) were high at USD 36.5bn, “reserves net of the commercial banks’ claims on BdL and gold were negative USD 4.7bn in Dec 2015”. Sources revealed to Reuters that the central bank governor had insisted that the figures not be published by the IMF citing potential to destabilize the financial market. The IMF declined to address the omission of this figure in the report.

- The IMF is likely to start negotiations with Lebanon in Nov, reported Al Jadeed TV, citing the foreign minister. He also disclosed optimism about reaching an agreement regarding the maritime border dispute with Israel.

- Islamic banking sector assets in Oman touched OMR 5.7bn as of H1 2021, with a market share of 15.13%. The Central Bank is looking at three key issues to support the growth of the Islamic banking sector – this includes a legal framework for Islamic banking, a shariah governance framework, and implementation of international standards.

- Qatar announced its aim to reduce GHG emissions and reduce carbon intensity of its LNG facilitate by 25% by 2030.

- Fitch Ratings placed credit ratings of Qatari banks on “ratings watch negative” citing the sector’s increasing reliance on external funding and a recent rapid growth in assets. Foreign funding was USD 193bn at end-Aug, accounting for 48% of the Qatari banking sector’s liabilities versus USD 121bn and 38% at end-

- Debt capital markets (DCM) activity in the MENA region declined by 8% yoy to USD 90.9bn in Jan-Sep this year, according to Refinitiv. UAE was the top nation in DCM activity, with USD 25.8bn in related proceeds, followed by Qatar (USD 20.1bn), Saudi Arabia, Egypt and Oman. Investment-grade corporate debt recorded a total of USD 62.3bn – the highest year-to-date total since records began in 1980 – while the financial industry remained the top performing industry (USD 37.9bn in proceeds till Sep 2021).

- Kearney’s 2021 Global Cities Report ranked Dubai as the 23rd top city globally out of 156 (up 4 places from last year), and also leading the MENA region. Abu Dhabi and Dubai secured the 4th and 15th spot in the Global Cities Outlook, both rising 3 places from last year. Cairo ranked fourth in the MENA region, followed by Riyadh. Riyadh was ranking first among the GCC cities in terms of Human Capital, as per the report.

Saudi Arabia Focus

- Saudi Arabia launched a Middle East Green Initiative, with an aim to invest SAR 39bn (USD 10.4bn) to reduce carbon emissions in the region and contribute 15% of the funds towards this initiative. The country will support the establishment of a regional carbon capture and storage centre, a regional early storm warning centre, a regional cloud seeding programme, a regional centre for sustainable development of fisheries and create a cooperation platform to implement the concept of a circular carbon economy.

- At the Future Investment Initiative (FII) conference, Saudi energy minister disclosed that a scheme to offset carbon emissions would support the nation’s aim to achieve net zero emissions. Separately, a sustainable tourism global centre was launched in Saudi Arabia as part of its commitment to transition to net-zero emissions; details of the centre will be revealed at the COP26. The travel and tourism sector is responsible for 8% of global greenhouse gas emissions.

- Saudi Arabia’s exports surged by 58.9% yoy to SAR 89.2bn in Aug, thanks to growth in oil export (+74.2%) and the low base year effect; non-oil exports grew by 26.8%. Value of imports increased by 23.6% to SAR 50.3bn; imports from the UAE increased by 31% mom to SAR 4.1bn (this follows the 33% drop in Jul, given the change in import rules). China remained the main export partner, followed by India and Japan.

- The Saudi Central Bank is still examining the use of distributed ledgers and blockchain technologies, reported Al Eqtisadiah. While optimistic that it will be able to boost e-payments to 70% of total transactions before the target year 2030, the apex bank has no intention of phasing out banknotes.

- Saudi Arabia’s net foreign assets grew by 2.5% mom and 3.75% yoy to SAR 1.68trn in Sep. Central bank assets increased by 0.97% mom to SAR 1.891trn (USD 504.1bn) in Sep, with its deposits with banks abroad surging by 16.1% to SAR 306.54bn.

- Claims on the private sector in Saudi Arabia inched up by 1.5% mom (the fastest since Jun 2021) to SAR 1.986trn (USD 529.5bn) in Sep, according to central bank data. Banks’ total assets grew by 1.1%to SAR 3.151trn.

- Saudi Arabia has licensed 44 companies to open regional HQs in Riyadh, covering multiple sectors including technology, food and beverages, consulting and construction: these firms are expected to move to the city within a year. The new HQs are expected to add SAR 67bn (USD 18bn) to the economy and provide 30k jobs by 2030, according to the president of the Royal Commission for Riyadh City. Separately, the investment minister disclosed that talks were ongoing with various carmakers (including Lucid) to set up manufacturing in the country and that the PIF was working on creating a new national airline with Riyadh as the hub.

- Saudi Arabia plans to automate 4000 factories within 5 years and move away from over-reliance on expat workers, according to the minister of industry and mineral resources. He also revealed that the industrial sector received more than USD 23bn in new investments last year, during which some 33k jobs were created.

- The majority of gas from Saudi Arabia’s USD 110bn Jafurah gas field will be used to make blue hydrogen, reported Bloomberg, citing the energy minister. Saudi Arabia plans to export hydrogen as part of its green transition plans.

- Saudi Arabia launched a national infrastructure fund to support up to SAR 200bn (USD 53bn) in water, transportation, energy and health projects over the next decade, enabling it to reduce its dependence on oil revenues. The fund will use structured financing products, including debt, equity and guarantees, “to de-risk infrastructure investment opportunities for local and global investors”, according to the project director.

- The Saudi Exchange has issued ESG disclosure guidelines to help listed companies to report on sustainable investment practices, as well as encourage firms to voluntarily disclose their ESG performance.

- Fintech Saudi’s annual report for 2020/2021 revealed that more than SAR 1.3bn (USD347mn) had been invested in fintech in Saudi Arabia in 12 months, with the number of companies rising by 37%. New fintech companies covered sectors including payments, capital markets, insurance and business tools for SMEs.

- The Olayan family in Saudi Arabia is considering an IPO of a holding company of about 25 units, revealed the company CEO in a Bloomberg interview. The company, which has seen an uptick in its consumables segment, is also weighing an IPO of some of its operating firms.

- The newly created Saudi-Swiss Investment Forum will support investment in both countries as well as back Swiss companies that want to invest in the country and aims to reach SAR 12trn (USD 3.2bn) of financing by 2030.

- Production in Saudi Arabia’s largest gold mine will commence in Q1 2022, revealed Ma’aden’s CEO at the FII. The project is using renewable energy for 13% of its energy requirements, with plans to increase this further.

- Saudi Arabia’s first large industrial-scale wind farm – the 400 MW project in Dumat Al Jandal, with 90 turbines – will be ready to operate within the coming weeks and is expected to produce its first power within months. When fully operational, it is expected to reduce CO2 emissions by nearly 1 million tons annually and supply 72k homes with clean energy.

- Saudi Arabia has submitted a bid to host the Expo 2030 event, revealed the Crown Prince: coinciding with the finale of the Vision 2030 program. The theme of the submission is “The era of change: Leading the planet to a foresighted tomorrow”.

UAE Focus![]()

- UAE banking assets are likely to grow by between 8-10% in 2022, according to the chairman of the UAE Banks Federation, supported by the economic rebound. He stated that overall lending is estimated to reach 8-10% next year, thanks to an increase in demand for loans; furthermore, though NPLs are likely to rise to 8% this year, it will be back to “normal” pre-pandemic rates of about 2% by 2022.

- The DFSA issued a regulatory framework for investment tokens: this will be applied to individuals or entities interested in marketing, issuance, advising on, trading or owning investment tokens in or from the DIFC. Proposals for exchange tokens (aka cryptocurrencies) are still being formulated, with a consultation paper expected in Q4.

- Mortgages are on the increase in Dubai: as of end-Q3, Dubai witnessed a 68% surge in mortgages compared to 2020 and 71% compared to 2019.

- Moody’s affirmed the long-term ratings of 8 banks in the UAE and changed its outlook to stable from negative, citing that “banks’ profitability is expected to recover owing to a reduction in provisioning charges”; net income to tangible banking assets had recovered to around 1% during H1 2021 from 0.8% for 2020.

- Dubai Expo revealed that there were about 1.5 million visits to the event in the first 24 days, with children accounting for about a quarter of visits.

- The UAE has signed a “green corridor” agreement with Israel, allowing vaccinated persons to travel freely between the two nations, as per a tweet from the Israeli consulate.

- Abu Dhabi was ranked 28th and Dubai 29th out of 118 cities in the 2021 Smart City Index issued by the IMD-SUTD, up 14 places. Singapore, Zurich, Oslo, Taipei City and Lausanne topped the list.

- The UAE was ranked 3rd in the Bloomberg Covid Resilience Ranking, behind only Ireland and Spain, thanks to a decrease in the number of cases and deaths alongside very high vaccination rates. Saudi Arabia was ranked 15th in the list, with a Resilience score of 68.5.

Media Review

The G20’s Pandemic Wake-Up Call

Gulf energy giants pledge net zero – but plan to stick with oil

Economics of the climate

https://www.economist.com/special-report/2021/10/27/the-economics-of-the-climate

Cost of breakfast foods hits 10-year high

https://www.ft.com/content/50019155-2ae9-4659-97db-d7aeae116f42