Markets

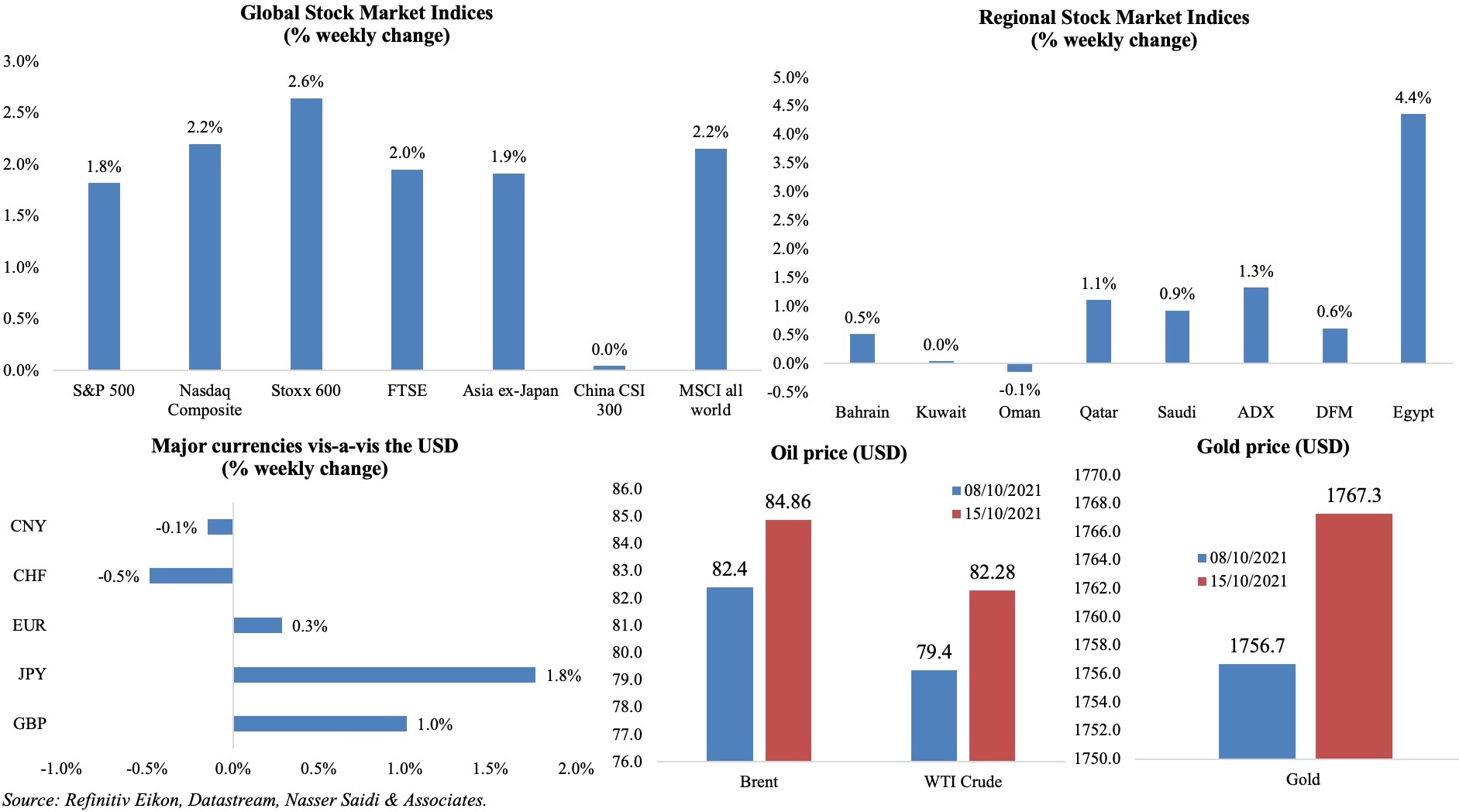

Strong corporate earnings brought cheer to global markets, even as inflation pressures remain unabated. In the US, S&P 500’s gains (best week in almost 3 months) were driven by industrial and financial groups, while in Europe’s Stoxx600, banking, energy, and tech stocks supported the jump (recording the best week in nearly 7 months, and banks began to trade at pre-pandemic levels). The MSCI Asia Pacific ex-Japan posted the best weekly gain since late Jun while Japan’s Nikkei gained thanks to tech stocks performance. On Friday, the MSCI all-world index posted the biggest daily rise since May 14th. Regionally, most markets were up compared to a week ago, thanks to rising oil prices, with Egypt recording a 4.5% jump. The yen touched its lowest levels since Oct 2018 while sterling’s gain was supported by a weaker dollar and expectations of BoE rate hikes this year. Oil prices rose to a 3-year high of more than USD 85 a barrel given an expected oil supply deficit in the backdrop of easing travel restrictions and ahead of the winter months. Gold price increased to the most in 7 months last week, before dropping slightly lower to end the week at USD 1766.82 (+0.6% from a week ago).

Weekly % changes for last week (14 Oct – 15 Oct) from 7 Oct (regional) and 8 Oct (international).

Global Developments

US/Americas:

- The FOMC minutes indicated that a “gradual tapering process” could begin in mid-Nov or Dec while staff continued to expect that this year’s rise in inflation would prove to be transitory.

- Inflation in the US surged to a 13-year high of 5.4% yoy in Sep (Aug: 5.3%) while it rose by 0.4% compared to the previous month – with food prices (+0.9% mom, the largest gain since Apr 2020) and rents accounting for more than half the rise. Core inflation rose 0.2% mom, rising from Aug’s 0.1%, on rents as well as a 1.3% rise in cost of new motor vehicles.

- Producer price index in the US grew 8.6% yoy in Sep (Aug: 8.3%), recording the highest uptick since Nov 2010. In mom terms, PPI was up by 0.5% – the smallest rise this year. Core PPI increased by 0.2% mom and 6.8% yoy in Sep.

- Retail sales in the US increased by 0.7% mom in Sep, slower than Aug’s upwardly revised 0.9% reading. Sales at auto dealerships partially rebounded (+0.5%, after Aug’s 3.3% drop), sales at service stations jumped (+1.8% due to higher prices) while sales at clothing stores and online grew by 1.1% and 0.6% respectively.

- NY Empire state manufacturing index softened to 19.8 in Oct (Sep: 34.3). New orders and shipments rose at slower pace while both prices paid and received indices held near record highs.

- The Michigan Consumer sentiment index slipped to 71.4 in Oct (Sep: 72.8) – the second lowest reading since 2011. In addition to the Delta variant, supply chain shortages and reduced labour participation rates weighing on consumer spending, another significant factor was a decline in confidence in government economic policies over the past 6 months.

- The JOLTS report indicated that a record 4.3mn persons quit jobs in Aug (2.9% of the workforce compared to 2.7% in Jul). Job openings remained quite high at 10.439mn in Aug (though declining from Jul’s 11.098mn).

- Initial jobless claims fell to a new pandemic-low of 293k in the week ended Oct 8th from an upwardly revised 329k the previous week; the 4-week average eased to 334.25k. Continuing claims slipped by 134k to 2.593mn in the week ended Oct 1st.

Europe:

- Industrial production in the eurozone declined by 1.6% mom in Aug (Jul: 1.4%), as supply constraints lowered production: capital and consumer durable goods production dropped by 3.9% and 3.4% respectively. Germany posted the steepest decline among the countries (-4.1%) while industrial output edged up by 1% and 0.1% in France and Spain respectively. In yoy terms, eurozone IP grew by 5.1%, slowing from Aug’s 8.2% reading.

- The ZEW survey for Germany showed a decline in both economic sentiment (22.3 in Oct from 26.5) and current situation (21.6 from 31.9). The economic sentiment indicator fell for the 5th consecutive month while the current situation indicator declined after continuously rising for the period Feb-Sep 2021. In the Eurozone, economic sentiment worsened by 10.1 points to 21 in Oct while the indicator for the current economic situation fell 6.6 points to 15.9.

- Wholesale price index in Germany increased by 0.8% mom and 13.2% yoy in Sep (Aug: 12.3% yoy).

- GDP in the UK inched up by 0.4% mom in Aug (Jul: -0.1%) – just 0.8% lower than it was in Feb 2020, according to ONS estimates. Services sector growth bounced back by 0.3% (Jul: -0.1%) while manufacturing expanded by 0.5% (Jul: -0.6%). In the 3 months to Aug, growth stood at 2.9%.

- Industrial production in the UK rose by 0.8% mom in Aug (Jul: 0.3%), with manufacturing up by 0.5% mom. In yoy terms, IP grew by 3.7% – the smallest gain since Mar.

- UK trade deficit widened to GBP 3.716bn in Aug (Jul: GBP 2.948bn), posting the largest deficit since end of the Brexit transition period. Exports declined by 2% to a 6-month low of GBP 49.8bn.

- UK ILO unemployment rate slipped to 4.5% in the 3 months to Aug from the 4.6% reading in Jul. Average earnings including bonus lost momentum during the period, down to 7.2% (from the previous month’s 8.3%).

Asia Pacific:

- Exports from China accelerated by 28.1% yoy in Sep (Aug: 25.6%) while imports growth slowed – rising by 17.6% versus 33.1% in Aug – causing trade surplus to widen to USD 66.76bn (Aug: USD 58.34bn).

- Inflation in China remained flat in mom terms in Sep, and edged lower to 0.7% yoy (Aug: 0.8%): food prices fell by 5.2% while non-food prices stood at 2% (Aug: 1.9%). Producer price index increased to 10.7% – the fastest pace since records began in Oct 1996 – after rising by 9.5% the month before.

- Money supply in China grew by 8.3% yoy in Sep (Aug: 8.2%). New loans increased to CNY 1660bn in Sep (Aug: CNY 1220bn); outstanding yuan loans grew by 11.9% yoy, the slowest pace since May 2002. Outstanding total social financing grew by 10% in Sep, the weakest pace since 2017, and slowing from 10.3% in Aug.

- Producer price index in Japan increased by 0.3% mom and 6.3% yoy in Sep (Aug: 0.1% mom and 5.8% yoy). This was the 7th consecutive month of price hikes and the highest since Sep 2008.

- The final estimates for industrial production in Japan showed an increase of 8.8% yoy in Aug (prelim: 9.3%). In mom terms, IP fell by 3.6% following an estimated 3.2% drop.

- Machinery orders in Japan declined by 2.4% mom in Aug (Jul: 0.9%). In yoy terms, orders were up by 17%. Core machinery orders unexpectedly declined by 2.4% mom in Aug 2021, while manufacturing orders fell by 13.4% – the most since Feb 2016.

- Bank of Korea left interest rates unchanged at 0.75%; the governor also stated that rates could be hiked at its next review in Nov “according to our own projections of where the economy is going”.

- Industrial output in India increased by 11.9% yoy in Aug (Jul: 11.5%) – accelerating for the first time in 4 months – with a slight slowdown in manufacturing output (9.7% from 10.5%). Cumulative output growth in the current fiscal year stands at 28.6%.

- India’s wholesale price inflation eased to 10.66% in Sep (Aug: 11.39%; Sep 2020: 1.32%) as food prices moderated (-4.7%) and in spite of the hike in fuel and power prices (+24.91%). Retail inflation also slowed to a 5-month low of 4.4% in Sep, given lower food prices.

- Advance estimates showed that Singapore GDP rebounded by 0.8% qoq in Q3, following a drop of 1.4% in the previous quarter. In yoy terms, GDP grew by 6.5% (Q2: 15.2%).

- The Monetary Authority of Singapore (MAS) unexpectedly tightened monetary policy, stating it would “raise slightly” the slope of the Singdollar NEER policy band from zero previously.

Bottomline: The IMF expects global growth to recover by 5.9% in 2021 (and by 4.9% in 2022), but at divergent paces. The main messages from the IMF remain sombre: for full global recovery, vaccine deployment must be increased; as supply chain constraints continue amid high demand, and even as employment is below pre-pandemic levels inflation is a worry (expected to decline in 2022, but highly uncertain); as economies rollback stimulus measures, economies need to be prepared for liquidity challenges as well as capital outflows. China will release its Q3 GDP numbers this week: given weak economic readings so far from retail sales to construction and given supply constraints and power cuts affecting production, it is likely to show a slowdown. This easing will likely be mirrored across the globe, given China’s crucial linkages in global value chains. Meanwhile, the UK and EU’s Northern Ireland Brexit negotiations continue (links in the Media Review section) amid already visible fallouts from Brexit especially widespread labour shortages (from truck drivers to the hospitality industry) leading to ongoing food and fuel shortages (and given backlogs, potentially shortage of even turkeys for Christmas!).

Regional Developments

- The IMF expects growth in the MENA region to rebound by 4.1% this year and next. The oil exporters will benefit from the recent uptick in prices, and along with a relatively higher pace of vaccination, witness a return to pre-pandemic growth levels by next year. Oil importers will be hit by the rising oil prices and food prices (exerting greater pressure on poorer families), but a faster vaccination pace could support a return to “normal” sooner in tourism dependent nations (like Egypt & Jordan).

- Annual urban inflation in Egypt increased to 6.6% in Sep (Aug: 5.7%), the highest since Jan 2020 but within the central bank’s 5%-9% target range. Food prices jumped by 3.5% mom. Core inflation inched up to 4.8% in Sep, from Aug’s 4.5%.

- Egypt is targeting a primary surplus of 1.5% of GDP and budget deficit of 6.7% in the current fiscal year, according to a Cabinet statement issued last week.

- Tax revenues in Egypt expanded by 18.8% yoy to EGP 109.8bn in Jul-Aug 2021: VAT revenues grew by 12.8% and revenues from the Suez Canal Authority rose by 10.4% while tax receipts from sovereign and non-sovereign bodies grew by 153% and 2.9% to EGP 24.6bn and EGP 85.3bn respectively.

- Current account deficit in Egypt widened to USD 5.13bn in Apr-Jun from USD 3.83bn a year ago. Imports were up by 41.7% yoy to USD 19.59bn while tourism revenue jumped to USD 1.75bn from a pandemic-hit low of USD 305mn a year ago. For the full fiscal year till end-Jun, tourism revenue dropped by 50.7% to USD 4.9bn.

- Annual revenue of Egypt’s Suez Canal increased by 12.4% to USD 4.9bn till Oct 12th (from start of the year). The number of ships crossing the canal increased by 6.7% to 13.3k ships during the period Jan-Aug, according to the head of the Suez Canal Authority.

- Egypt has signed electricity interconnection deals with Greece and Cyprus; this follows an earlier deal with Saudi on a USD 1.8bn project. The agreement with Greece plans transmission of power generated by renewables from Egypt via an undersea cable.

- Egypt will be listed on JP Morgan’s government bond index for emerging markets (GBI-EM) in Jan 2022. It was estimated that local currency bond markets would benefit up to USD 2.2bn if Egyptian bonds were to join the index

- Jordan’s GDP grew by 3.2% yoy in Q2 2021, according to the central bank, from 0.3% in Q1, benefitting from a low base a year ago. Construction and mining contributed to the rise in GDP, growing by 5.7% and 5.4% during the quarter.

- Turnout in Iraq’s parliamentary elections reached 43%, with more than 9.6mn persons casting their votes on Oct 10th. Winning 73 of the 329 seats in parliament, Shia Muslim cleric Moqtada al-Sadr claimed victory for his nationalist Saeroun movement. Since al-Sadr did not stand as a candidate, weeks of negotiations are in the offing to build a new coalition government.

- Kuwait’s central bank will gradually ease the regulatory mitigation package related to liquidity and the capital adequacy standard in two phases. The maximum allowed funding will be adjusted in relation to the size of deposits to become 95% instead of 100% as of Jan 1 2022, and adjust to 90% from Jan 1, 2023, reported Al Rai daily citing informed sources.

- Lebanon’s energy ministry received central bank approval for USD 100mn in credit to issue fuel import tenders for electricity generation.

- Qatar’s energy minister stated that the country (which is the largest supplier of LNG) had already allocated all its LNG output and have no additional supplies to calm the market.

- The emir of Qatar appointed two females to the Shura Council last week, after no female candidates secured seats in the election. Neither of these women had contested in the election.

- Moody’s downgraded Tunisia’s long-term foreign currency and local currency issuer ratings to Caa1, 7 levels below investment grade, from B3; negative outlook was maintained.

Saudi Arabia Focus

- Inflation in Saudi Arabia inched up to 0.6% yoy in Sep (Aug: 0.3%), rising by 0.2% mom. Food prices increased by 2.6%, thanks to higher vegetable prices (12.5%) as well as meat and poultry costs (2%), while transport costs were up by 5.9%.

- Saudi Arabia wants economic output to rise to SAR 6.4trn (USD 1.71trn), disclosed the investment minister while speaking about the economic development strategy to year 2030.

- Saudi Arabia’s highly ambitious National Investment Strategy expects to raise net FDI to SAR 388bn (USD 103.45bn) annually and raise local investments to SAR 1.7trn by 2030. The strategy will include 40 initiatives including the opening of economic zones, according to the investment minister; no timeframe was provided. According to the latest Saudi central bank data, foreign investment in Saudi Arabia grew by 16% yoy to SAR 2.256trn Q2 this year.

- Non-oil exports from Saudi Arabia increased by 37% yoy to a record USD 33.4bn in H1 2021. Petrochemicals were the biggest source of exports, up 44% to SAR 73.6bn in H1. Top export destinations during the period were UAE (SAR 17bn), China (SAR 16.8bn) and India (SAR 7.1bn).

- Saudi Arabia will require foreign firms in the oil and gas sector to raise local content (which include workers, supplies and operations as well as added value) to at least 70% from 30-35% currently to secure government contracts, reported Reuters. Details of the plan (timeline, targets and mechanism) will be announced by the energy ministry at a later stage.

- Saudi Arabia’s Commerce Ministry issued 31 licenses since the beginning of this year, reported Al-Eqtisadiah. Eleven licenses were issued for cement exports and 20 to export steel.

- The Saudi Industrial Development Fund, at its annual meeting, announced the launch of multiple initiatives to empower the private sector: this includes a land, a logistic loan, a supply chain financing product and an industrial business incubator program. The minister of industry disclosed that over 60 logistic zones would be developed by 2030 to support exports, e-commerce and re-export operations.

- NEOM’s green hydrogen JV plans to secure financing in Q1 2022, revealed ACWA’s CEO – about 20% of the USD 6.5bn project will be funded with equity and the rest will be limited-recourse project finance. The aim is to produce green hydrogen for export, with the first shipment expected from NEOM’s port in Q1 2026.

- The value of contracts awarded in Saudi Arabia surged by 134% yoy and 34% qoq to SAR 25.8bn (USD 6.9bn) in Q2 this year, according to a report by the US-Saudi Business Council. Energy was the largest sector, followed by contracts in the petrochemicals and water sectors.

- Saudi Arabia will ease Covid19 restrictions from Oct 17th: masks will no longer be required at public places while still be imposed indoors; social distancing measures are to be lifted and full-capacity attendance will be allowed at the Holy Mosques for fully vaccinated persons.

UAE Focus![]()

- UAE’s federal budget for the 5 years 2022-26 stands at a record high total of AED 290bn. Budget expenditure for 2022 is set at AED 58.931bn, with bulk of it allocated to development projects & social benefits sector (41.2%) while the infrastructure and financial resources sector’s share was 3.8%.

- UAE will launch more dollar bond issuances next year, and is working on plans to ussue local currency debt, according to the undersecretary of the ministry of finance.

- UAE’s non-oil trade grew by 27% yoy to AED 900bn (USD 245bn) in H1 this year: non-oil exports grew by 44% yoy to AED 170bn (and up 41% compared to H1 2019) while non-oil imports rose by 24% to AED 482bn and re-exports were up 22% to AED 238bn. Top non-oil trading partners during the period were China, Saudi Arabia, Iraq, Turkey and Italy.

- The UAE and South Korea will start negotiations towards a free trade deal within 2 months, aiming to reach a deal within a year. According to South Korea’s trade minister, the Comprehensive Economic Partnership Agreement (CEPA) between the nations will include deals to reduce greenhouse gas emissions and develop green technology.

- Abu Dhabi launched a AED 5bn (USD 1.4bn) IPO fund to strengthen the Abu Dhabi Securities Exchange as a leading stock market. The fund will invest in 5-10 private companies a year, with a target ticket size of 10-40% of the float and focusing on SMEs.

- Dubai announced PPP projects worth more than AED 25bn (USD 6.81bn): this includes 7 urban development projects worth AED 22.58bn, 14 road and transport projects worth AED 2.39bn and eight projects in health and safety at AED 526mn.

- Dubai’s non-oil trade with African nations accelerated by more than 100% to AED 1.2trn (USD 326.6trn) in the last decade, according to the President of the Dubai Chamber.

- UAE’s oil minister, in the sidelines of the energy forum, stated that demand for energy and especially natural gas is peaking while reiterating that it was important to maintain balance in the market. UAE will continue to invest in the energy sector to meet the growing demand and ensure stability, according to the energy ministry.

- Abu Dhabi’s IHC plans to list its subsidiary Multiply – which focuses on investing in tech-focused businesses – on the main exchange in the emirate this year. According to the CEO, IHC plans to offer 30% of Multiply’s shares and is working with local banks on the transaction.

- Expo 2020 reported 411,768 visits in the first 10 days since the launch of the event. The organizer announced that one in three visits was from abroad, with 175 nationalities having visited the event.

- Etihad raised USD 1.2bn with a loan linked to environmental, social and governance (ESG) targets in global aviation – this was the first sustainability-linked loan in global aviation. Etihad has committed to a target of net zero carbon emissions by 2050.

- UAE and Syria agreed on plans to enhance economic cooperation and explore new sectors. Non-oil bilateral trade between the two nations touched AED 1bn (USD 272mn) in H1 2021.

Media Review

The IMF’s World Economic Outlook, Oct 2021

https://www.imf.org/en/Publications/WEO/Issues/2021/10/12/world-economic-outlook-october-2021

https://blogs.imf.org/2021/10/12/a-hobbled-recovery-along-entrenched-fault-lines/

PIF to use oil platforms to attract tourists through ‘THE RIG.’ Project

https://www.arabnews.com/node/1949041/business-economy

Brexit: What now for the Northern Ireland Protocol?

https://www.bbc.com/news/uk-northern-ireland-58925288

https://www.ft.com/content/98bd08ca-faee-4476-947d-2f3817928ee3

The Great Supply-Chain Massacre

https://www.project-syndicate.org/commentary/current-supply-shocks-and-2008-global-financial-crisis-by-diane-coyle-2021-10

How the world learns to live with covid-19: from pandemic to epidemic

https://www.economist.com/briefing/2021/10/16/how-the-world-learns-to-live-with-covid-19

Powered by: