Weekly Insights 14 Oct 2021: Global divergence in growth predicted – can MENA cope?

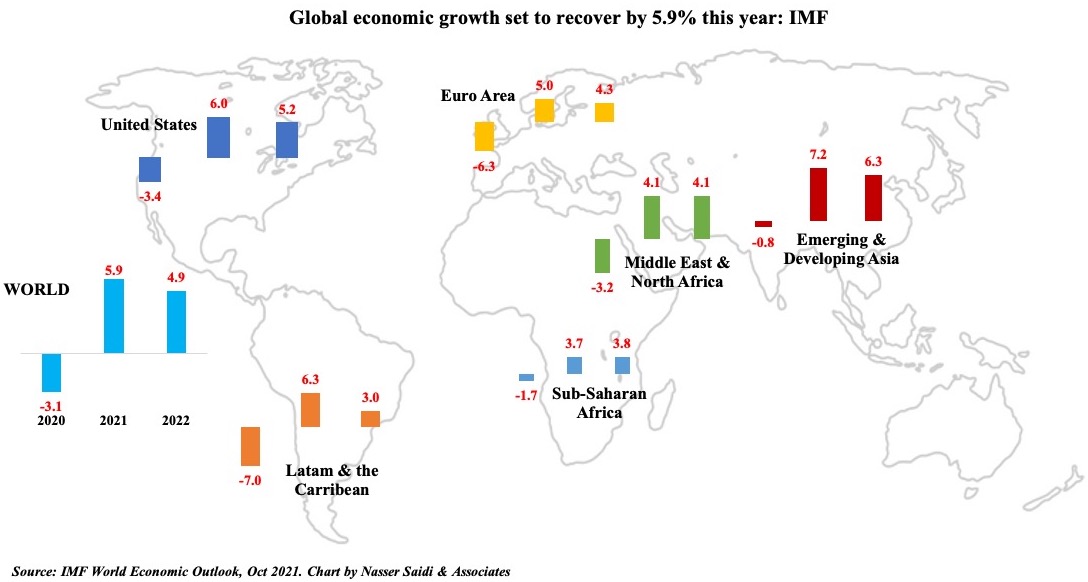

1. The IMF expects global growth to recover by 6% in 2021, but at divergent paces

The main message from the IMF remains a sombre one: for full global recovery, vaccine deployment has to be increased; as supply chain constraints continue amid high demand, and even as employment is below pre-pandemic levels inflation is a worry (expected to decline in 2022, but highly uncertain); as economies rollback stimulus measures, economies need to be prepared for liquidity challenges as well as capital outflows.

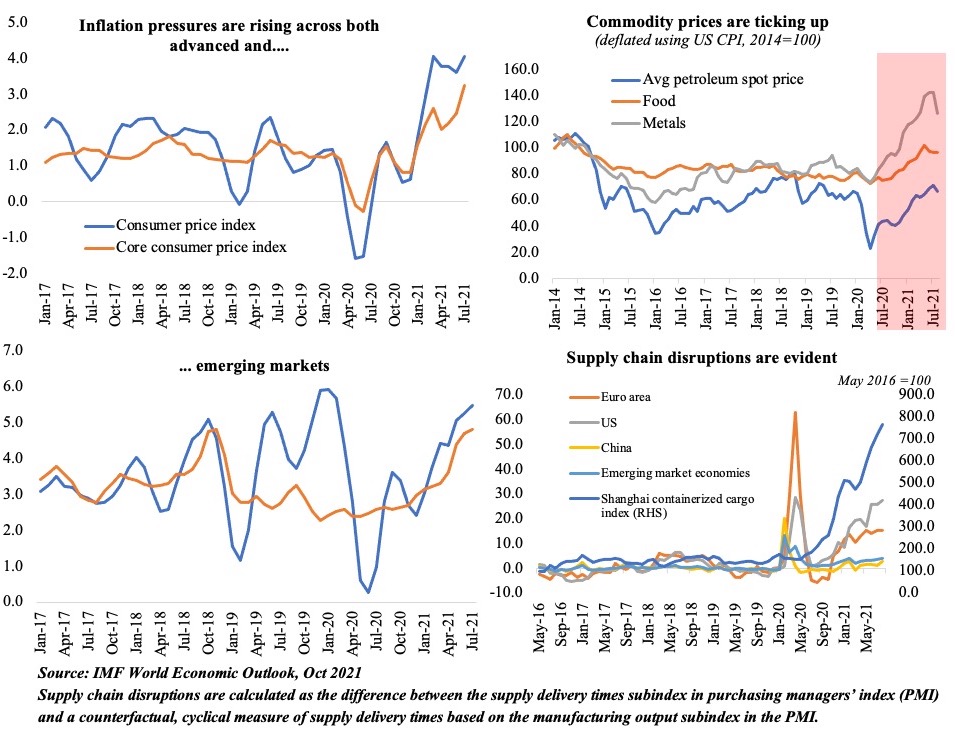

2. Inflation is a major risk factor: more so, if pandemic-induced supply-demand mismatches persist for longer

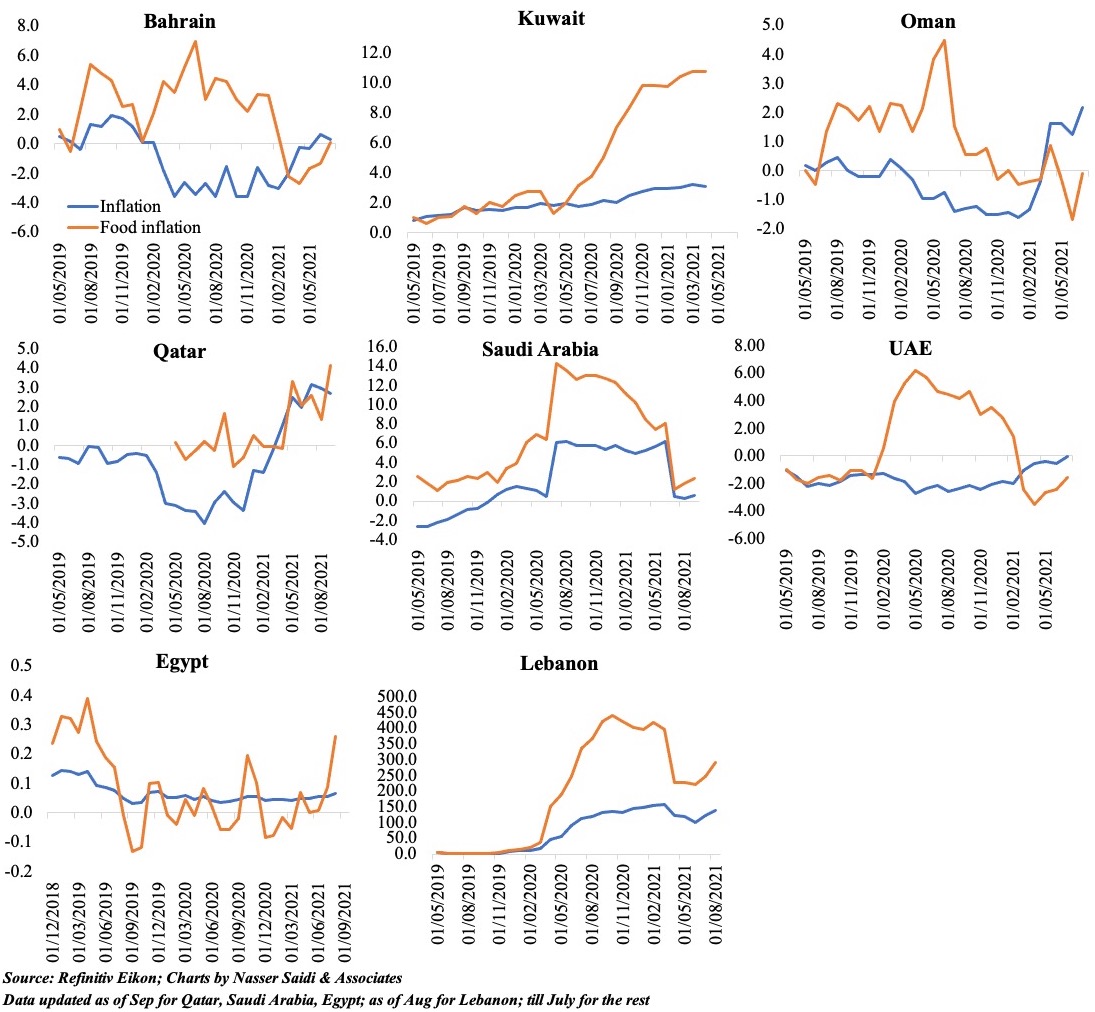

- A confluence of (a) supply chain disruptions; (b) cyclical recovery of demand post-Covid (fueled by fiscal & monetary stimulus); and (c) weather shocks is leading to the current uptick in prices

- Disruptions are likely to continue into early next year but any prolonged supply shortages will lead to more uncertainty; wages are another question mark (depending on demand vs supply)

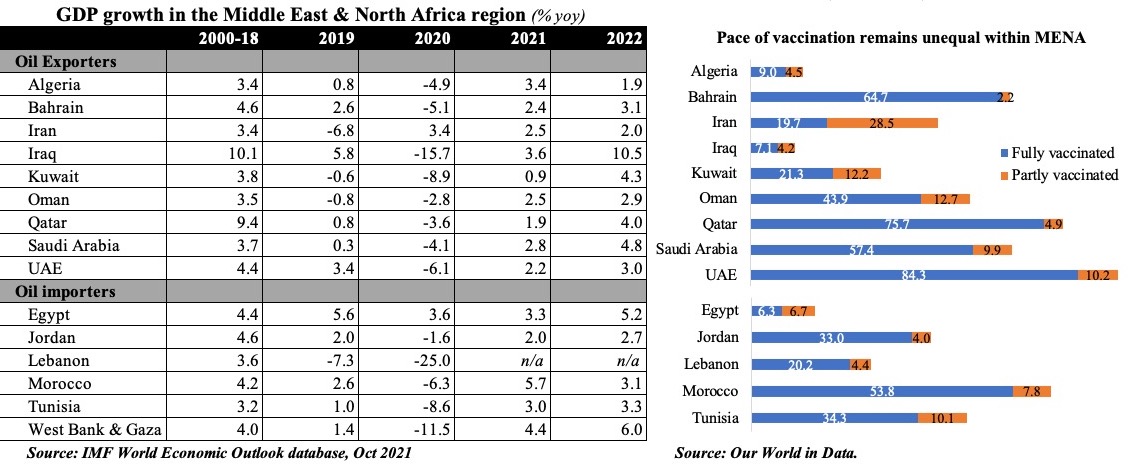

3. The Middle East & North Africa region is estimated to grow by 4.1% this year and next

- The oil exporters will benefit from the recent uptick in prices, and along with a relatively higher pace of vaccination, witness a return to pre-pandemic growth levels by next year

- Oil importers will be hit by the rising oil prices and food prices (exerting greater pressure on poorer families), but a faster vaccination pace could support a return to “normal” sooner in tourism dependent nations (like Egypt & Jordan)

- Covid19 and its aftermath will likely result in a further widening of inequality: be it health (pace of vaccination), jobs (nearly one third of the employed population in the region is facing high risks of layoff or reduction of wages and/or hours of work: ILO/ESCWA), poverty (18mn people have been pushed into poverty in MENA: World Bank)

- What needs to be done? Highlights the need for social safety nets / cash transfers; support for women and youth to return to the labour force; ensure that children return to school & resume studies after the pandemic-gap. In the absence of support, the region might be looking at a phase of greater social unrest

4. Inflation in the MENA region is ticking up, as food prices increase sharply

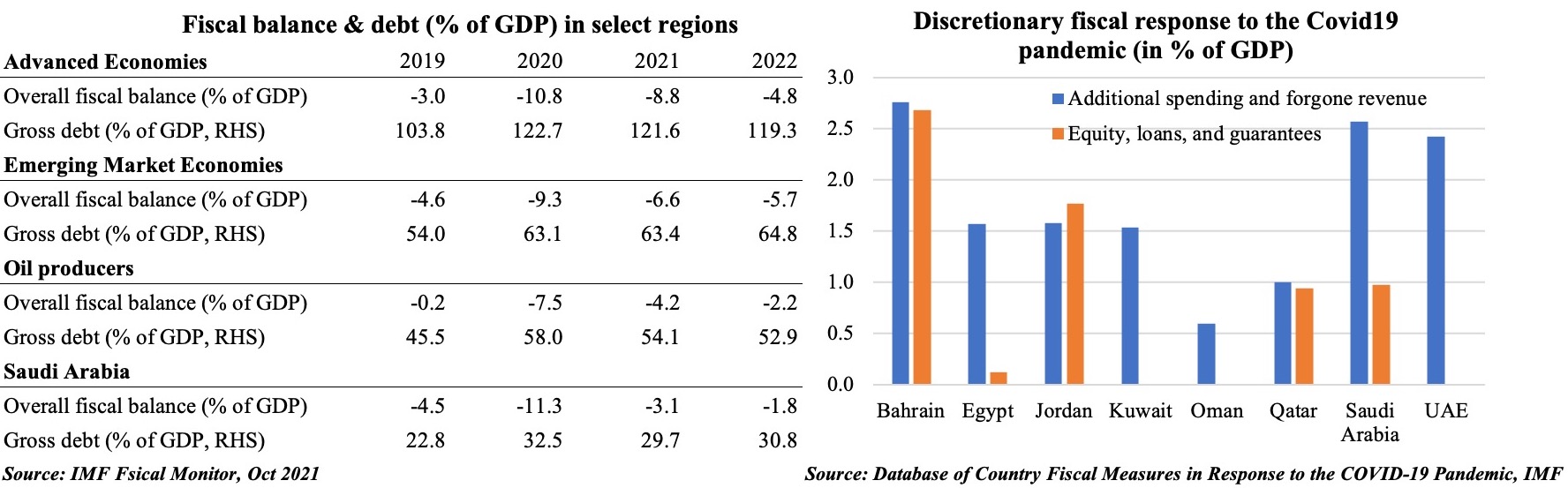

5. A Bird’s Eye View of the Fiscal Outlook: Global govt debt at just below 100% of GDP; higher vs. pre-pandemic

- Fiscal balance remains in deficit in 2021 across all regional groupings, with the global reading at 7.9% vs MENA’s 4.3% and Saudi’s 3.1%. A summary of fiscal measures since Jan 2020 are charted for select MENA countries (below)

- Governments have scaled back spending in 2021, but government revenues are still low compared to pre-pandemic levels. Furthermore, when stimulus measures (~ $16.9trn in pandemic-related fiscal measures) are rolled back, businesses could be struggle to meet financing requirements, resulting in lower revenues/ insolvencies/ bankruptcies

- Government debts have increased in 2020 & 2021, and is unlikely to fall back to pre-pandemic levels soon => greater risk to global interest rate hikes & refinancing risks (esp those nations with limited fiscal space)

- What can be done to ease MENA’s fiscal pain? 1. Reduce spending on subsidies, wages; 2. Improve mobilization of revenues + introduction of new taxes (e.g. carbon tax) and/or increase in existing taxes (VAT, excise) to be supported by cash transfers to the poor (where needed); 3. introduction of fiscal rules (only 1/3-rd have such rules in place currently); 4. support businesses (after stimulus measures are removed) by providing deferred tax payment options

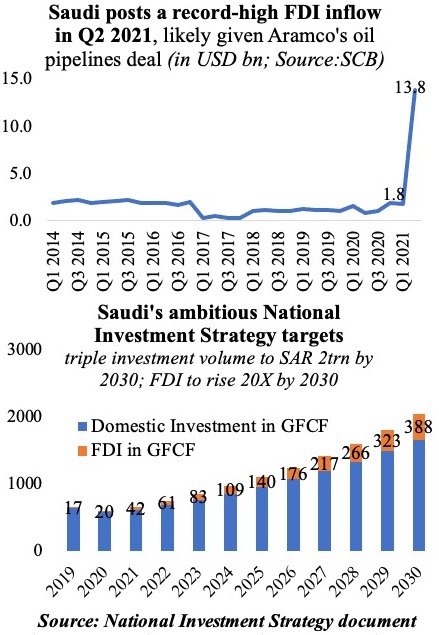

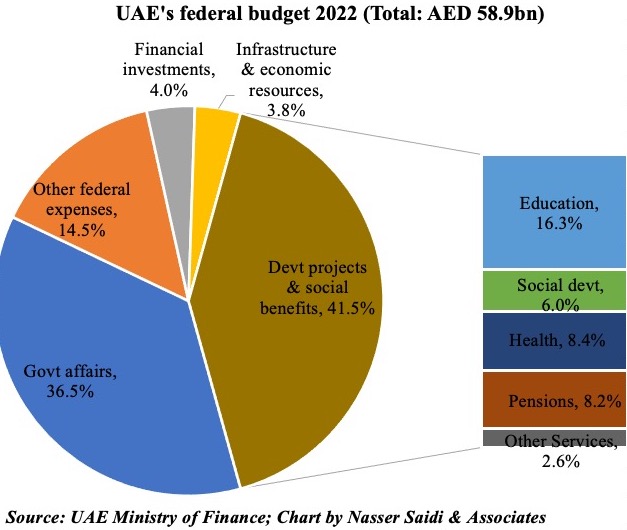

6. UAE’s record-high federal budget for 2022 & Saudi Arabia’s ambitious FDI targets hogged headlines this week

- UAE’s federal budget for the 5 years 2022-26 stands at a record high total of AED 290bn

- Budget expenditure for 2022 is set at AED 58.931bn, with bulk of it allocated to development projects & social benefits

- Given the oversubscribed orders for UAE’s debut federal bonds, more federal issuances can be expected in the future (eventually in local currency) & used towards infrastructure spending

- Saudi Arabia’s highly ambitious National Investment Strategy expects to raise net FDI to SAR 388bn annually & raise local investments to SAR 1.7trn by 2030

- FDI inflows have been low in recent quarters compared to historical averages of between USD 8-10bn a quarter during 2008-10. Net FDI touched USD 5.5bn last year.