Markets

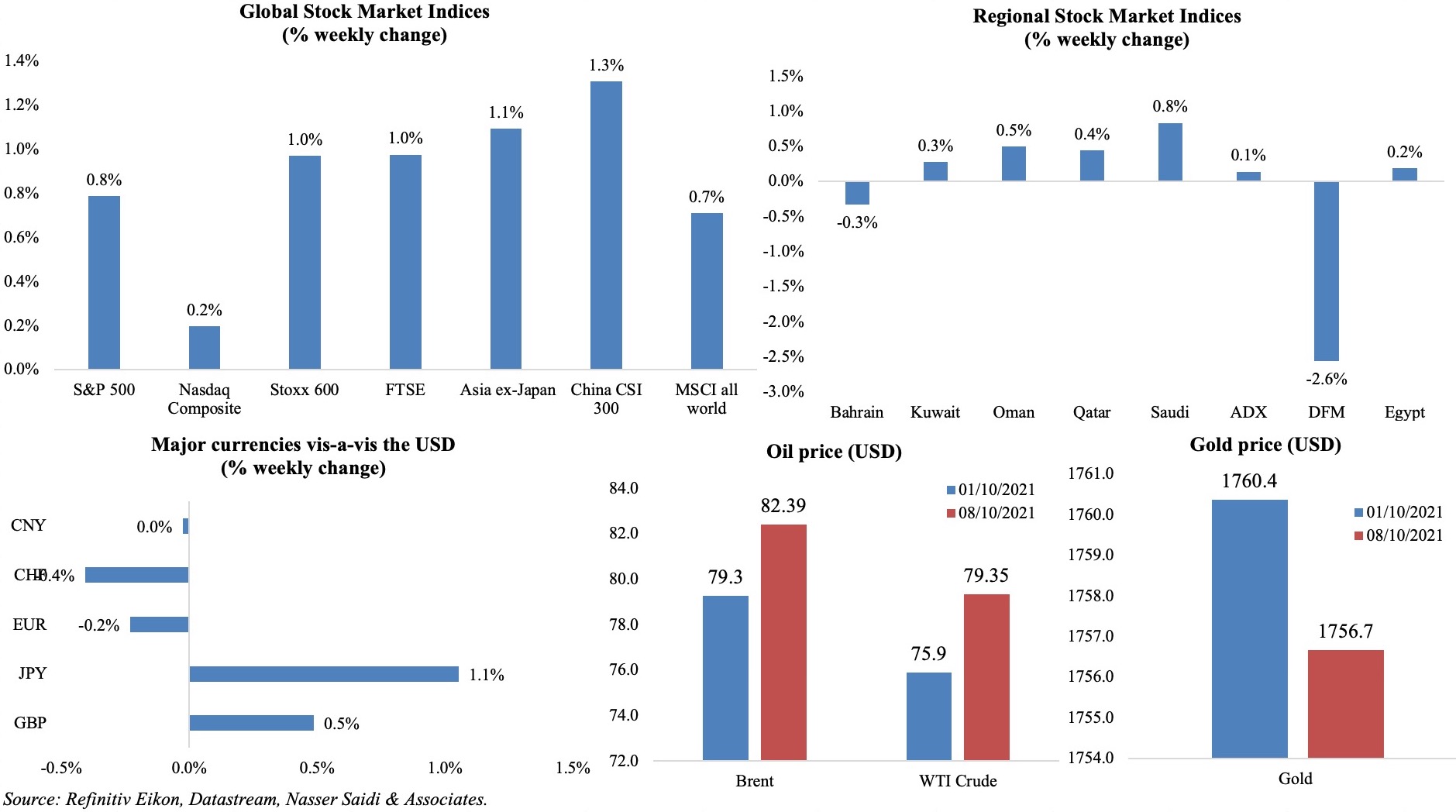

Most markets ended the week on a positive note even though the weak payrolls number released on Friday flustered US equity markets slightly; in Europe, the Stoxx 600 ticked up by 1% last week, recording the best week in 2 months; in Asia, markets were all up including China which opened after a week-long break, taking solace from a strong services PMI reading. In the region, most markets mirrored their global counterparts, with the Saudi Tadawul rising above 11,550 points for the first time since Jan 2008 though Dubai was dragged down by banking stocks. The yen gained vis-à-vis the greenback and the pound closed with a 0.5% rise. Oil price rose by 4%+ last week, also touching their highest level since 2014, while gold prices closed 0.2% lower.

Weekly % changes for last week (7 Oct – 8 Oct) from 30 Sep (regional) and 1 Oct (international).

Global Developments

US/Americas:

- Non-farm payrolls in the US increased by just 194k in Sep (Aug: 366k), partly a result of public-sector payrolls dropping by a net 123k. Average hourly earnings increased by 0.6% mom and 4.6% yoy in Sep (Aug: 0.4% mom, 4% yoy) while the labour force participation rate stood at 61.6%. Unemployment rate fell to 4.8% in Sep (Aug: 5.2%), the lowest since Feb 2020 while employment-to-population level increased to 58.7%, its highest since Mar 2020.

- US private sector added 568k jobs in Sep (Aug: 340k), with the leisure and hospitality sector leading the pack with 226k jobs.

- US factory orders rose for the 4th straight month in Aug, posting a gain of 1.2% mom, following an upwardly revised 0.7% gain in Jul. Orders for non-defense capital goods excluding aircraft edged up by a revised 0.6%, from the prior estimate of a 0.5% gain.

- Trade deficit in the US widened to a record high of USD 73.3bn in Aug (Jul: USD 70.3bn); exports gained 0.5% to USD 213.7bn in Aug – the highest since May 2019 – while imports rose by 1.4% to USD 287bn, a record high. Goods trade deficit also increased, widening to USD 89.4bn in Aug (Jul: USD 87.6bn) as goods exports rose by 0.7% to a record USD 149.7bn.

- ISM services PMI improved to 61.9 in Sep (Aug: 61.7), thanks to an uptick in business activity (62.3 from 60.1) and new orders (63.5 from 63.2) while employment index slipped to 53 (Aug: 53.7) and prices paid increased to 77.5 (Aug: 75.4).

- Markit services PMI increased to 54.9 in Sep, from a preliminary reading of 54.4. Though new business rose the least in 13 months and cost pressures intensified, business confidence was the highest since Jun.

- Initial jobless claims declined for the first time in four weeks to 326k in the week ended Oct 1st from an upwardly revised 364k the previous week; the 4-week average inched up to 344k. Continuing claims slipped to 2.714mn in the week ended Sep 24th.

- The US approved a temporary lift of the debt ceiling: the USD 480bn increase will lift the debt limit to USD 28.9trn, and the deadline is now Dec 3rd.

Europe:

- German factory orders collapsed by 7.7% mom in Aug (Jul: 4.9%); domestic orders were down by 5.2% while foreign orders tumbled by 9.5%.

- Industrial production in Germany decreased by 4% mom in Aug (Jul: +1.3%): this is the steepest slump since Apr 2020. Production of cars and car parts were down by 17.5% on the month, given supply disruptions especially microchips and other intermediate products (like semiconductors). In yoy terms, IP was up by 1.7%, much lower than the 6% uptick in Jul.

- Exports from Germany fell by 1.2% mom in Aug, slipping for the first time in 15 months, while imports grew by 3.5%, causing the trade surplus to narrow to EUR 13bn (Jul: EUR 17.7bn). In yoy terms, exports to US and China were up by 22.4% and 4.4% respectively. Current account balance also narrowed, down to EUR 11.8bn (Jul: EUR 17.9bn)

- Retail sales in the eurozone rebounded by 0.3% mom in Aug, after slipping by 2.6% in Jul. Non-food product retail trade increased by 1.8% while automotive fuel (-0.1%) and food, drinks, & tobacco (-1.7%) weighed on overall sales. In yoy terms, sales remained unchanged.

- EU producer price index accelerated by 1.1% mom and 13.4% yoy in Aug.

- Sentix investor confidence in the eurozone declined for the third consecutive month to record 16.9 in Oct (Sep: 19.6), the lowest level since Apr. Expectations index dropped from 9.0 to 8.0, posting the lowest since May 2020.

- Services PMI in Germany increased by 0.2 points from the preliminary estimate to 56.2 in Sep, but was lower than the 60.8 recorded in Aug. In the Eurozone, services PMI stood at 56.2 in Sep, a tad higher than the flash estimate of 56.1, but lower than Aug’s 59. Input costs rose at the fastest rate since mid-2008, while output price inflation was around its highest level in over two decades.

- Markit services PMI in the UK climbed to 55.4 in Sep (from Aug’s 6-month low of 55) in spite of supply chain disruptions and price pressures.

Asia Pacific:

- The Caixin services PMI jumped to 53.4 in Sep (Aug: 46.7), with sub-indices of new business, prices charged and employment rising above-50 amid input prices rising for the 15th consecutive month. Composite index surged to 51.4 (Aug: 47.2) on services strength.

- China’s foreign exchange reserves fell to USD 3.2trn in Sep (Aug: USD 3.232trn) – this is the lowest level since Apr and the largest mom decline since Mar.

- Inflation in Tokyo increased by 0.3% yoy in Sep (Aug: -0.4%); Excluding fresh food, prices grew by 0.1% though excluding fresh food and energy, prices were down by 0.1%.

- Preliminary data for Japan’s leading economic index showed a drop to 101.8 in Aug (Jul: 104.1), the lowest since Feb. Coincident indicator declined to 91.5 from 94.4 a month ago.

- Overall household spending in Japan declined by 3% yoy in Aug (Jul: +0.7%), as the Covid19 related curbs weighed on consumption. The mom figures showed a 3.9% contraction in Aug, the fourth straight month of decline.

- Current account balance in Japan narrowed to JPY 1665.6bn in Aug (Jul: JPY 1910.8bn). Trade balance slipped to JPY 372.4bn in Aug, from a surplus JPY 622.3bn the month before, as imports grew at a faster pace (45.9%) compared to exports (27.1%).

- Calling the policy stance “accommodative”, the Reserve Bank of India left interest rates unchanged at the latest meeting for the 8th consecutive time: repo rate stands at 4% and reverse repo at 3.35%.

- Singapore PMI edged down by 0.1 points to 50.8 in Sep (Aug: 50.9), with slower expansion in new orders, new exports, output, inventory and employment.

- Retail sales in Singapore slipped by 2.8% yoy and 0.6% mom in Aug, after low base effects dissipated amid Covid19 restrictions. This was the first decline following six months of yoy increases. Online retail sales made up an estimated 14.1% of total sales in Aug (Jul: 13.8%).

Bottomline: The IMF expects global economy to recover at a slower pace than the 6% forecast in Jul, citing the “Great Vaccination Divide” as the main obstacle (more detailed forecasts will be published this week). Meanwhile, inflation continues to be a concern, with the FAO’s world food price index rising to a 10-year peak in Sep (+32.8% yoy and 2% mom). The OPEC+ decision to raise output by 400k barrels a day in Nov, and the gas to oil switching (given the shortage) has resulted in an oil price surge that adds on to the inflationary pressure. Last week also saw updated forecasts related to trade and travel (airlines). The WTO expects global trade to recover by 10.8% this year (up from the 8% predicted in Mar) and then by 4.7% next year; though shortages and supply chain constraints exist, the WTO does not expect it to have large impacts at the aggregate level. Travel is expected to see only a gradual recovery, with IATA expecting passenger numbers to rise to 2.3bn and 3.4% in 2021 and 2022 respectively – much lower than the 4.5bn registered in 2019.

Regional Developments

- The World Bank estimates economic losses in the MENA region to touch almost USD 200bn by end-2021 given the pandemic. The region is estimated to grow by 2.8% this year, following a 3.8% drop in 2020. The report finds that 13 of the 16 MENA nations would have lower standard of living in 2021 compared to pre-Covid levels. The report can be accessed at https://openknowledge.worldbank.org/bitstream/handle/10986/36318/9781464817984.pdf

- Egypt’s PMI stayed below-50 for the 10th month in a row, touching a 4-month low of 48.9 in Sep (Aug: 49.8). Both non-oil output and new orders declined while employment sub-index rose for the 3rd consecutive month.

- Fuel prices in Egypt were increased by 3.6% from 8th Oct: all fuel grades were hiked by 25 piasters. This follows similar moves in Jul and Apr this year.

- The IPO for Egypt’s state-controlled payments firm e-finance for Digital and Financial Investments will launch Oct 10 with the subscription window closing on Oct 14th.

- Egypt’s government has launched a 3-year USD 2bn syndicated loan with green and Islamic finance components, disclosed Emirates NBD. The green tranche will be utilized for green projects under the “Green Financing Framework” while the Islamic tranche will go to meet budgetary requirements.

- Egypt’s central bank amended the mortgage finance initiative for middle-income persons to further support the real estate sector: this includes the repayment period being increased to 25 years instead of 20, the abolition of the maximum net area unit requirement and raising the maximum unit price to EGP 2.5mn.

- The government of Egypt plans to invest about USD 45bn into its sustainable rural communities’ program, according to the planning minister.

- Egypt and Saudi Arabia signed contracts for the USD 1.8bn electricity interconnection project: it is expected to begin in 2022 and result in the exchange of 3000 MW of electricity between the two nations.

- Iraq signed separate solar deals with the UAE and a Norwegian-led consortium, as part of the country’s plan to add 7500 MW to its grid by 2023: with UAE’s Masdar, Iraq plans to build 5 solar power plants with a total capacity of 1000 MW. The agreement with the consortium is for the construction of 2 solar plants with a total capacity of 525 MW at a cost of around USD 500mn.

- Jordan aims to supply Lebanon with electricity by the end of the year, disclosed its energy minister. Egyptian gas will be used to generate electricity in Jordan, for transmission to Lebanon via the Syrian power grid.

- Lebanon’s two largest power stations have been shut down due to fuel shortages: there will hence be no centrally generated electricity “for several days”. The army later agreed to provide 6,000 kilolitres of gas oil distributed equally between the two power stations – which will secure power for 3 days.

- PMI in Lebanon inched up marginally to 46.9 in Sep (Aug: 46.6): political stability and reform potential continue to weigh down on sentiment. Output and new orders fell due to weak demand, while fuel shortages affected businesses in addition to supply disruptions. Private sector companies reported a mom drop in overall expenses for the first time since Jan 2019.

- The IMF is expected to start technical discussions with Lebanon in “the coming days”, according to a spokeswoman. The objective is to agree on a recovery program that can harness international support and is committed to “a fair and comprehensive solution for all creditors”, according to a statement from the finance ministry.

- Lebanon’s state assets are subject to privatization, revealed the economy minister: however, the issue of how to organize the assets sell-off remains uncertain for now.

- Britain is launching a 14-week consultation with British businesses (while also meeting representatives of GCC), as the first step towards trade negotiations with the GCC.

- A report from S&P Global finds that GCC banking sector continues to be strong, with core customer deposits the main source of funding. Customer deposits in the GCC grew by an annualized 6.6% in H1 2021 versus the 6.3% recorded in 2019. The UAE not only had a very small (annualized) growth in lending, amounting only to 0.6%, it also experienced the biggest deterioration in asset quality as its NPL ratio (6.6% in H1 2021). The GCC’s NPL ratio rose to 3.8% on average at mid-2021 (end-2019: 3.1%).

Saudi Arabia Focus

- Saudi Arabia PMI increased to a 7-year high of 58.6 in Sep (Aug: 54.1) – the fastest rate in Aug 2015. Output growth accelerated for the first time in 4 months while new orders growth accelerates sharply. Business confidence jumped to the strongest since Jan.

- The World Bank estimates Saudi Arabia’s growth to rebound to 2.4% and 3.3% in 2021 and 2022, from a 4.1% plunge the year before. The baseline projection is still susceptible to pandemic related risks, especially if new variants emerge, according to the officials.

- Sales of 17 cement companies in Saudi Arabia decline dby 11% yoy to 4.1mn tonnes, reported Argaam.

- Tadawul is planning a USD 4bn stake sale in an IPO, reported Bloomberg; the exchange is expected to release information on the IPO later this month.

- Saudi Arabia plans to produce 70% of its needed energy products locally by 2030, disclosed the energy minister. The ministry plans to boost localization of equipment and development of national cadres to achieve the goal.

- Aramco’s share price rose to an all-time high of SAR 38 (USD 10.13) last week, thereby placing the company’s valuation at USD 2trn, thanks to the rising energy demand globally. At an energy conference last week, Aramco’s CEO reiterated the company’s plans to raise oil capacity to 13mn barrels a day, also stating that this would take until 2027 (from 12mn bpd).

- Bloomberg reported that Saudi Aramco is considering an IPO of its retail fuels and lubricants unit, with talks in an early stage. Earlier in the week, it was reported that five North American firms were bidding for a deal to sell a share of Aramco’s gas pipelines.

- Saudi Arabia cut the Nov official selling price to Asia for its flagship Arabian Light crude to USD 1.30 a barrel above the Oman/Dubai average.

- Saudi Arabia’s cabinet extended the “soft mortgage” scheme – which reduces the first payment on a housing loan to 10% from 15% – by 3 years.

- Saudi Arabia confirmed last week that it had held its first round of direct talks with Iran’s new government on Sep 21st. The talks are still “in the exploratory phase”, according to the foreign minister.

UAE Focus![]()

- UAE’s PMI edged down slightly to 53.3 in Sep (Aug: 53.8), even though output and new orders increased (thanks to a “continued recovery in footfall and contracts related to Expo 2020”). Job creation slowed, although from a 43-month high in Aug while higher raw material prices added to price pressures.

- UAE’s Federal government raised USD 4bn in its debut bond sale, after having received orders upwards of USD 22.5bn. This underscores investors confidence in the country’s fundamentals and its recovery story. With USD 2bn raised in 40-year notes, the UAE has successfully secured cheap and long-term funding for the government. The funds are to be used for financing of long-term projects like infrastructure and to also support investments by the Emirates Investment Authority (UAE’s SWF). This will support and accelerate the development of a government debt market, which can be used to finance budget deficits. Read more: https://nassersaidi.com/2021/10/07/weekly-insights-7-oct-2021-moving-towards-gradual-economic-recovery-in-the-gcc/

- The UAE became the first MENA nation to announce a plan for net-zero emissions by 2050: the country will oversee AED 600bn (USD 163bn) in investment in renewable energy vs USD 40bn invested in the past 15 years. No further details of the investments were provided.

- CBRE reported that while the average residential property prices grew by 4.4% yoy in Aug – the highest growth since Feb 2015 – the rents fell by 2.7% during this period. While apartment and villa prices increased by 2.5% and 17.9% respectively in Aug, they were still 30.4% and 20.5% lower than highs touched in 2014.

- Emirates airlines signed a USD 750mn five-year dual-tranche financing facility with Emirates NBD.

- The UAE has granted federal government employees 6 days of special paid leave to visit the Expo 2020, to be used any time during the 6-month period.

Media Review

OECD: International community strikes a ground-breaking tax deal for the digital age

Iraq’s election could be worthless if few turn out to vote

After “Doing Business”

Lebanon’s health system on life support (with Dr. Nasser Saidi’s comments)

https://www.telegraph.co.uk/global-health/terror-and-security/lebanon-on-life-support/

Gulf states are trying to increase private employment

Powered by: