Markets

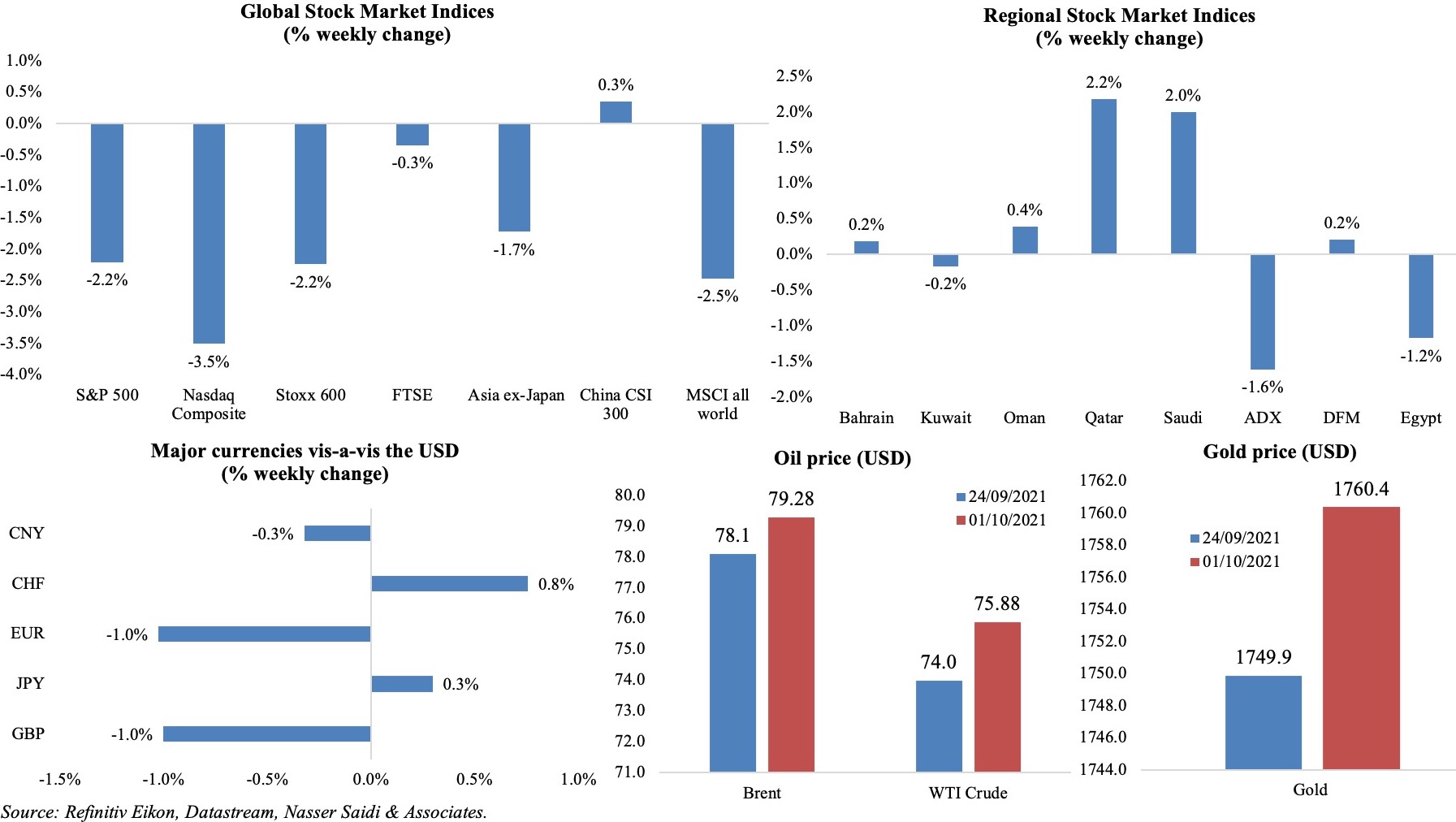

Major global equity markets suffered a setback last week, with S&P and Nasdaq posting the biggest weekly drops since Feb, Stoxx down by 2% after heightened inflation worries (latest EU reading stood at a 13-year high) while the MSCI all world index declined by 2.5%. Regional markets were mixed: higher oil and gas prices supported equity performance (especially in Qatar and Saudi Arabia) though Abu Dhabi bucked the trend, ending 1.6% lower than a week ago. The euro posted its worst fall since mid-Jun, and the pound dragged to a 9-month low (before recovering slightly) while the yen bounced back after posting a 19-month low. Oil prices posted a substantial increase last week, with Brent breaching the USD 80 mark (for the first time in 3 years) before settling at just above USD 79 while gold price inched higher on the weaker dollar and inflation fears.

Weekly % changes for last week (30 Sep-1 Oct) from 23 Sep (regional) and 24 Sep (international).

Global Developments

US/Americas:

- GDP growth in the US increased to 6.7% at an annualized rate in Q2 (according to the third and final estimate), higher than the previous estimate of 6.6% and Q1’s 6.4% reading. The PCE core index jumped by 6.1% yoy in Q2, unchanged from the previous estimate while PCE index remained high at 6.5%.

- Personal income grew by 0.2% (Jul: 1.1%) while spending increased by 0.8% in Aug (Jul: -0.1%). Personal saving as a percentage of disposable income fell to 9.4% (Jul: 10.1%). PCE price index was up 4.3% yoy in Aug: energy prices rose by 24.9% and food prices by 2.8%.

- Durable goods orders inched up by 1.8% mom in Aug (Jul: 0.5%), with orders for non-defense aircraft and parts surging by 77.9% alongside an uptick in orders for capital goods (6.7%), transportation (5.5%) and manufacturing (3.3%). Non-defense capital goods excluding aircraft were up by 0.5% after Jul’s 0.3% gain.

- ISM manufacturing PMI increased to 61.1 in Sep (Aug: 59.9), thanks to an increase in production (59.4, tad lower than Aug’s 60) new orders sub-index (66.7, unchanged from Aug) while factory employment rebounded (50.2 from 49).

- Markit manufacturing PMI dropped to a 5-month low of 60.7 in Sep (Aug: 61.1): though new sales increased, demand was outpacing production capacity which is affected negatively by supply constraints and material shortages. Input costs increased at the second-fastest rate since data collection began in May 2007, easing only slightly from the high recorded in Aug.

- Dallas Fed manufacturing index fell to 4.6 in Sep (Aug: 9), with declines in new orders (down by 6.1 points to 9.5) amid an increase in the production sub-index (by 3.4 points to +24.2). The Richmond Fed manufacturing index fell to -3 in Sep (Aug: 9): this was the lowest level since May 2020. The sub-indices for shipments and new orders declined to -1 and -19 respectively, also the lowest readings in 16 months. Separately, Chicago PMI eased to a 7-month low of 64.7 in Sep (Aug: 66.8).

- Preliminary goods trade balance widened to USD 87.6bn in Aug (Jul: USD 86.8bn): exports inched up by 0.7% mom while imports grew at a relatively faster pace of 0.8% to USD 236.6bn.

- The S&P Case Shiller home price indices rose 19.9% yoy in Jul, following the 19.1% rise in Jun. The average mortgage rate for a 30-year loan declined to 2.8% at end-Jul from 2.98% at the start, also encouraging more buying, while the lack of homes for sale drove up prices further.

- Pending home sales surged by 8.1% mom in Aug, rebounding from the 2% drop in Jul. In yoy terms, signings were down by 8.3%. Sales rose the most in the least-expensive regions – the Midwest and South of the country.

- Initial jobless claims increased by 27k to 362k in the week ended Sep 24th, with the 4-week average falling slightly to 335,750. Continuing claims rose by 131k to 2.84mn in the week ended Sep17th. The four-week moving average for continuing claims fell to 2.8mn – the lowest since Mar 14th 2020.

Europe:

- Inflation in the Eurozone increased to 3.4% in Sep (Aug: 3%), the highest level since Sep 2008, driven up by surging energy prices. Core CPI inched up to 1.9% in Sep (Aug: 1.6%).

- The harmonized index of consumer prices in Germany accelerated at a record pace of 4.1% yoy in Sep (Aug: 3.4%).

- French inflation hit a near 10-year high of 2.7% in Sep. The French PM announced on Thursday that the government would be blocking further natural gas price increases as well as rises in electricity tariffs, in a bid to support consumers combat the price hikes.

- Consumer confidence in the Euro Area eased to -4 in Sep (Aug: -5.3) while the business climate indicator decreased to 1.72 points from 1.74 the month before.

- Unemployment rate in Germany held steady at 5.5% in Sep, thanks to a smaller fall in unemployment (to 2.47mn from 2.58mn in Aug). Separately, unemployment rate in the EU fell to 6.8% in Aug from 6.9% the month before and from 7.7% in Aug 2020. About 2.8mn young people (under 25) were unemployed in the EU, with youth unemployment rate nudging down to 16.2% (Jul: 16.4%).

- Manufacturing PMI in Germany declined to an 8-month low of 58.4 in Sep (Aug: 62.6), with growth in output and new orders dropping to a 15-month low. Manufacturers’ optimism slipped to its lowest since Aug 2020, with supply shortages expected to persist into 2022.

- Eurozone’s manufacturing PMI slowed to 58.6 in Sep (Aug: 61.4) – the largest drop since Apr 2020 at the start of the pandemic – as growth in both new orders and output was the weakest in 8 months. Austria was the only economy to see faster manufacturing growth over the month as expansions slowed elsewhere.

- Retail sales in Germany rebounded by 1.1% mom in Aug (Jul: -4.5% mom), thanks to upticks in non-food products (+4.9%), online trade (+95) while sales of food and beverages declined by 3.4%. Retail sales were 6% higher when compared to Feb 2020.

- UK’s preliminary GDP for Q2 increased by 5.5% qoq and 23.6% yoy, higher than the preliminary estimate of 4.8% qoq growth, driven by services sector performance. Food and accommodation sector posted an 87.6% acceleration in quarterly terms while manufacturing posted a 1.8% rise and construction returned to pre-pandemic levels. Households increased spending by almost 8% in and savings ratio fell to 11.7% (Q1: 18.4%).

- Current account deficit in the UK remained unchanged at GBP 8.6bn in Q2, equivalent to 1.5% of GDP (Q1: 1.6% of GDP).

- UK manufacturing PMI was down to 57.1 in Sep (Aug: 60.3), as growth slowed across all sectors – consumer, intermediate and investment goods. Multiple factors were cited for the rising average vendor lead times including “delays to air, land and sea freight, staff shortages at vendors, COVID-19 and Brexit disruptions, a lack of delivery drivers and port delays”.

Asia Pacific:

- China’s non-manufacturing PMI jumped back to expansionary territory in Sep, moving up to 53.2 (Aug: 47.5). This was supported by improvements in new orders (49.0 from Aug’s 42.2), new export orders (46.4 from 43.9), and employment (47.8 from 47.0). Services index rose to 52.4 from the previous month’s 45.2 while construction dropped to 57.5 (Aug: 60.5).

- China’s NBS manufacturing PMI unexpectedly slipped to below-50 in Sep, clocking in at 49.6 (Aug: 50.1), the lowest point since Feb 2020. Output, new orders and exports sales declined, with readings under-50 with the power crisis adding a new uncertainty element amid supply shortages. Employment dropped for the 6th consecutive month (49.0 vs 49.6).

- Caixin manufacturing PMI moved up to 50 from 49.2 reading in Jul, as new orders returned to above-50 while new export orders slipped to the lowest level since Feb. Furthermore, sentiment strengthened to its highest since June.

- Japan’s leading economic index slipped to 104.1 in Jul (Jun: 104.2 – which was the highest reading since Feb 2014). The coincident indicator slid to 94.4 in Jul (Jun: 94.6).

- Japan’s manufacturing PMI slowed to 51.5 in Sep from Aug’s 52.7. Output contracted for the first time since Jan, given Covid19 cases surge and shortage of raw materials. New orders among Japanese manufacturers also fell for the first time since Dec 2020.

- Japan Tankan large manufacturing index increased to 18 in Q3 (Q2: 14), the highest level since 2018. Large tankan manufacturing outlook also edged up in Q3, rising to 14 from 13 in the previous quarter.

- Industrial production in Japan was down by 3.2% mom in Aug (Jul: -1.5%), declining for the second straight month. Weaker production of cars and electronic machines, a result of components and chip shortages, dragged down production. In yoy terms, IP increased by 9.3% in Aug (Jul: 11.6%). The government downgraded its assessment of IP – to “stalling” – for the first time since Apr 2020.

- Retail trade in Japan fell by 4.1% mom and 3.2% yoy in Jul (Jun: 1.1% mom and 2.4% yoy), posting the first decline since Feb 2021, as households reduced spending amid a surge in Covid19 cases. Large retailer sales fell by 4.7% (Jun: 1.3%).

- Fiscal deficit in India reached INR 4.68trn in Apr-Aug, accounting for 31.1% of the yearly budget target. Net tax receipts stood at INR 6.45trn while expenditure was INR 12.77trn.

- India posted a current account surplus in Apr-Jun quarter, thanks to a narrowing of the trade deficit, according to the Reserve Bank of India. Current account surplus stood at USD 6.5bn or 0.9% of GDP vs a deficit of USD 8.1bn in Jan-Mar 2021 and USD 19.1bn in Apr-Jun 2020, a record high). Private transfer receipts, which comprises remittances by Indians abroad, rose by 14.8% during the quarter. A balance of payments surplus of USD 31.9bn was posted in Apr-Jun compared to USD 19.8bn surplus in the same period a year ago.

Bottomline: Global manufacturing PMI remained unchanged at 54.1 in Sep, but continue to be severely constrained by supply chain disruptions and input shortages. Europe and US readings outperform weaker Asian ones while in the US and UK, labour and skill shortages are oft mentioned as added constraints, though for different reasons with Brexit affecting the UK. Inflation woes are becoming stronger by the month amid rising energy prices (power outages in China have impacted industry and the start of winter season in the West will mean higher bills, adding to the worries), raising uncertainty about growth prospects as central banks discussions start to centre around raising rates and removing Covid-induced stimulus measures. Last but not the least, OPEC ministers are scheduled to meet on Monday to review policy: though expectations are that the existing plan will be followed, there has been increasing chatter that more oil might be added.

Regional Developments

- Bahrain is planning to double its VAT rate to 10% from 5% currently; this would require Parliamentary approval, and to this end a draft law modifying provisions of the VAT law has been submitted. If approved, the amended tax will come into effect from Jan 2022.

- A new “sea-to-air” logistics hub has been launched in Bahrain: the hub will use streamlined clearance procedures, optimized logistics, and full digitization to ensure a 2-hour turnaround time for all containers (50% reduction vs pure sea freight) and at 40% of the cost (vs pure air freight).

- A royal decree has abolished the National Oil and Gas Authority in Bahrain, with “all its rights and obligations transferred to the Ministry of Oil”.

- announced the launch of a global technology hub at its offices in Bahrain, with an aim of employing 1,000 coders over the next 10 years. Tamkeen (a government funded labour fund) is expected to subsidise a portion of the salaries and cover training costs locally and abroad.

- The central bank of Egypt has approved licenses for contactless payments by mobiles to further plans of digital transformation and greater financial inclusion. This will allow businesses to accept payments from mobile phones (i.e. phones can be used as PoS terminals).

- ’s Minister of International Cooperation revealed that the ministry had supported in attracting USD 3.2bn in financing for the private sector through its international development partners (like the EBRD, EIB and IFC among others) in 2020. In H1 this year, about USD 1.9bn was received from the partners.

- The SME Development Agency in Egypt announced that it had provided financing worth EGP 1bn for innovative projects (partly using USD 50mn obtained from a USD 200mn loan agreement with the World Bank).

- Three Egyptian banks – National Bank of Egypt, Banque Misr, and Banque Du Caire – plan to launch in Oct a EGP 1bn (USD 64mn) fund to support fintech firms.

- The Egyptian Tax Authority has announced that all online content creators need to register for income tax. Those creators whose revenues reached EGP 500k per year since their online debut are also required to register for VAT.

- Egypt and Saudi Arabia will sign electricity interconnection contracts on Oct 5th, with implementation likely to start in 2022. The interconnection project aims to exchange 3,000 MW during peak times.

- Egypt has been selected as the nominee to host the COP27 UN climate conference due to take place next year, revealed the US climate envoy.

- ’s foreign minister disclosed that the country had requested release USD 10bn of frozen funds by the US (as a sign of goodwill) ahead of restarting nuclear accord talks.

- Iraq opened the Jamima border-crossing port with Saudi Arabia for the first time since 1991, following the opening of the Ar’ar border crossing in Nov 2020.

- Jordan has re-opened the main border crossing with Syria: the Jaber crossing had been open since 2018 before it was closed given pandemic-related restrictions. The opening will allow for transit cargo from the Gulf into Syria as well as unrestricted passenger traffic.

- Kuwait’s Manpower Authority has been tasked with getting another 100k citizens working in the private sector within 4 years.

- Meetings are underway to agree on the size and distribution of financial losses in Lebanon, revealed the economy minister. Separately, ahead of a meeting with Lazard, the PM hoped that the Lazard’s financial plan could be developed into a “more realistic” vision to help the nation out of the current crisis.

- S&P upgraded Oman’s outlook to positive from stable while affirming ‘B+/B’ long and short-term foreign and local currency sovereign credit ratings. S&P cited Oman’s reform program and higher oil prices leading to narrower fiscal deficits, thereby slowing the net government debt as reasons for the revised outlook.

- GDP growth in Qatar was up by 4% yoy in Q2, supported by the non-oil sector performance (+6.2%). Sectors which saw growth surge include accommodation and food services (+41%), transportation and storage (+26.9%) as well as manufacturing (+13.4%). In qoq terms however, growth slipped by 0.3% in Q2.

- Qatar’s first ever legislative elections for 30 members of the Shura Council was held on 2nd Oct, with a 63.5% voter turnout.

- Qatar Airways reported doubling of annual losses to QAR 14.9bn (USD 4.1bn): passenger revenue plummeted by 80% to QAR 7.9bn while operating loss shrank by 7% to OMR 1.1bn.

- Qatar Petroleum secured a new deal to supply LNG to China for a period of 15 years. This deal will see Qatar deliver 3.5mn tonnes per annum starting from Jan 2022.

- The EU Ambassador disclosed that the EU has tentatively reopened trade talks with the GCC. Initiated in the sidelines of the 76th session of the UN General Assembly, discussions are to continue during the upcoming visit of the EU representative to the Gulf region.

Saudi Arabia Focus

- Saudi Arabia revised down its 2021 budget deficit to SAR 85bn (equivalent to 2.7% of GDP) from a previous SAR 141bn (or 4.9%) estimate, thanks to higher revenues from the rise in oil prices. Revenues are estimated to rise to an estimated SAR 930bn (USD 248bn) versus a budget SAR 849bn for the full year. Total expenditure declined by 0.9% yoy to SAR 465bn in H1 2021 while private investment indicators improved by 12.3%, according to the finance ministry. Deficit is estimated to narrow to 1.6% of GDP next year, and surpluses are forecast from 2023 onwards.

- Saudi Arabia’s national debt is expected to touch SAR 989bn (USD 264bn), or 31.3% of its GDP, in the next fiscal year. Principal repayments on debt will reach SAR 76bn next year, according to the finance ministry.

- Point of sale transactions in Saudi Arabia increased by 6% mom to SAR 40.9bn in Aug. Cards and mobile technology accounted for 95% of transactions and 91% in terms of value.

- The Saudi Central Bank extended the deferred loan payment program for MSMEs – which was set to expire on Oct 1st – until end-2021.

- Unemployment rate among Saudi citizens fell to a decade-low of 11.3% in Q2 this year (Q1: 11.7%). Male unemployment among Saudi citizens fell to 6.1% (Q1: 7.2%) while female unemployment inched up to 22.3% (Q1: 21.2%). Though labour force participation rate fell slightly to 49.4%, it remained above pre-pandemic levels.

- Saudi Arabia launched a SAR 50bn (USD 13bn) strategy to develop the Aseer region (on the Red Sea coast) into a tourism hub, with an aim of attracting 10mn visitors by 2030.

- The Saudi Capital Market Authority approved share sale applications of 4 companies in the Nomu market – Jahez International Company for Information and Technology, Nayifat Finance Co., Group Five Pipe Saudi Co. and East Pipes Integrated Company for Industry. This approval will be valid for 6 months.

- PIF is exploring a stake sale in Saudi telco STC while maintaining a majority stake of more than 50% in the company.

- S&P affirmed Saudi Arabia’s “A-” credit rating with a stable outlook: deficit is expected to drop to 4.3% this year, and average 5.7% between this year and 2024. Words of caution were attached to Neom projects, stating that “funding pressures may impede their pace”.

- Saudi Arabia is considering the issuance of more green bonds to expand its investor base in addition to financing backed by export credit agencies as well as conventional and Islamic bonds. The Kingdom has secured financing of SAR 100bn till end-Aug out of plans to raise a total SAR 124bn for 2021, according to the head of the Saudi national debt office. Separately, he also stated that transitioning to renewable energy would save businesses about USD 13bn.

- Saudi Arabia plans to find “suitable” jobs for graduates within a year of graduation: the aim is to increase Saudization in high-skilled positions to 40% by 2030. The minister of human resources also disclosed that should the candidates not be matched with available jobs, the program would upgrade their skills.

- ACWA Power, which set the final price of its IPO at SAR 56 (USD 14.9) per share, plans to issue green bonds from next year to finance its renewable projects. The company received orders of SAR 1.127trn (USD 300.4bn) from institutional investors, to which it is allocating 90% of the 81.2mn shares on offer.

- Saudia was bestowed the titled “World’s most improved airline of 2021” in the Skytrax ranking, moving up by 55% to 26th position. In 2017, the airline had moved up to 51 from 82.

- FTSE Russell announced the inclusion of Saudi Arabia in FTSE Emerging Markets Government Bond Index (EMGBI) effective Apr 2022. It will likely include 42 government Sukuk which comprise 2.75% of the index on a market value weighted basis.

UAE Focus![]()

- The IMF expects UAE’s non-oil GDP growth to exceed 3% this year, with oil GDP rising with higher production, together improving both fiscal and external balances. The Fund warned that banks’ asset quality has weakened “somewhat” amid subdued corporate credit growth and that banks’ balances sheet might still be impacted (including from the Covid19 crisis).

- Expo 2020 opened for the public from Fri: there are up to 60 live events each day and more than 200 pavilions at the event. Dubai government employees have been granted 6 days of paid leave to attend the Expo, to be used anytime during the 6-month period.

- Dubai reported a 31% yoy surge in non-oil exports in H1 2021. This follows the pandemic-hit drop in H1 2020, but when compared to H1 2019, trade is up by a significant 6.8%. Top trade partners for Dubai remained the same over the last 3 years: China, India and US on top, followed by Saudi Arabia (the largest partner in the Arab region) and Switzerland.

- Dubai increased the housing loan limit for UAE citizens to AED 1mn (USD 272k); the government is also in the process of allocating 4k plots of land and housing for citizens at a cost of AED 5.2bn.

- Fuel prices in the UAE increased in Oct: petrol prices were up by 2% while diesel prices rose by 5.4% to AED 2.51 per litre.

- The book building for ADNOC Drilling has been completed: it raised more than USD 1.1bn after being oversubscribed with gross demand totaling more than USD 34bn.

- The Dubai Financial Market will operate from 10am to 3pm starting today (Oct 3) instead of till 2pm before.

- Abu Dhabi extended the electricity tariffs incentive programme (EITP) to SMEs in the industrial sector. The programme has granted around AED 610mn (USD 166mn) in benefits to manufacturers.

- Real estate transactions in Abu Dhabi touched AED 23.57bn from 7046 transactions in H1 this year, according to the Department of Municipalities and Transport.

- Etihad Airways is working on its third sustainable financing transaction, revealed the company’s treasurer at a conference. The airline has committed to net zero carbon emissions by 2050.

- Etihad Rail disclosed that the construction work for package A of stage two (that extends 139kms) and its connection through Al Ghuwaifat on the border of Saudi Arabia with Stage One (which extends 264 kilometres from Habshan to Al Ruwais) was completed.

- Emirates airline disclosed that the operator is on track to restore 70% of its capacity before the end of the year.

Media Review

Crypto Boom Poses New Challenges to Financial Stability

https://blogs.imf.org/2021/10/01/crypto-boom-poses-new-challenges-to-financial-stability/

The latest shock to China’s economy: power shortages

https://www.economist.com/finance-and-economics/2021/10/02/the-latest-shock-to-chinas-economy-power-shortages

Lebanon’s path back from the brink of collapse

https://oecd-development-matters.org/2021/09/15/lebanons-path-back-from-the-brink-of-collapse/

Based on the OECD article, report in Al Arabiya (Arabic)

https://bit.ly/3A6wPAc

How investment in Expo 2020 will pay off for UAE economy, burnish Dubai brand

https://www.arabnews.com/node/1938241/middle-east

Powered by: