Weekly Insights 23 Sep 2021: UAE’s growth forecasts rebound in 2021 & 2022

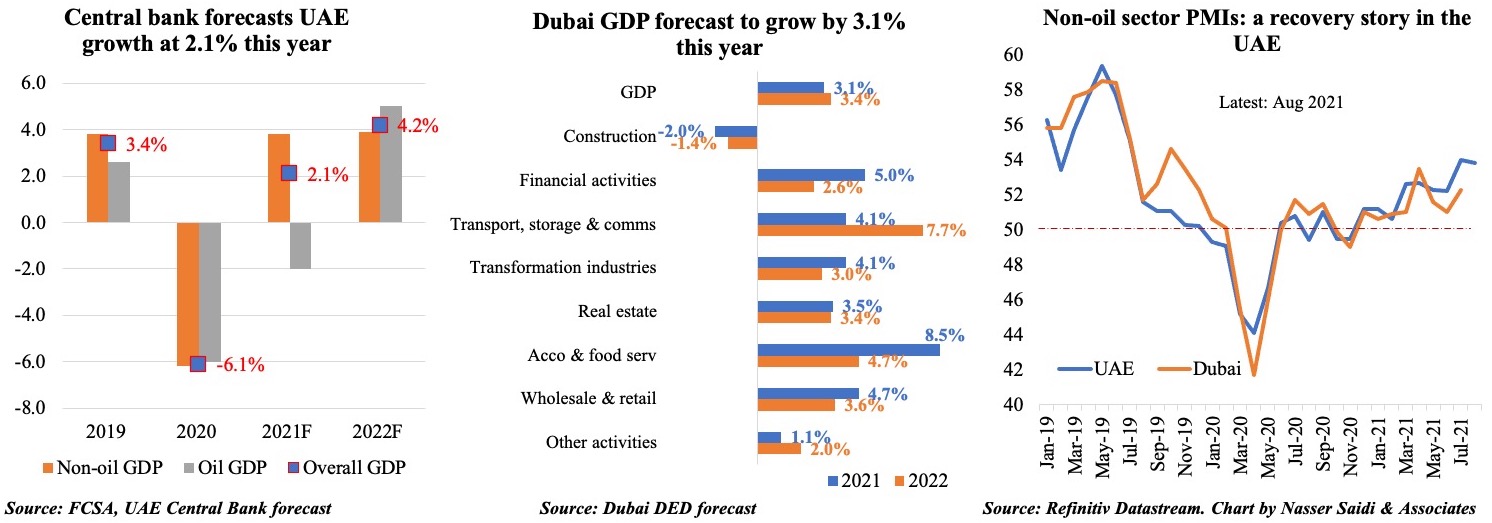

1. UAE expected to grow by 2.1% this year (Central Bank); Dubai by 3.1% (Dubai DED)

- The UAE central bank expects UAE growth to rebound by 2.1% this year (2020: -6.1%), supported by a recovery in the non-oil GDP (+3.8% from -6.2% in 2020)

- Separately, the Dubai Department of Economic Development forecasts Dubai’s GDP to increase by 3.1% yoy in 2021, with recoveries the most among Covid19-affected sectors like accommodation and food services (+8.5%) and wholesale & retail (4.7%). This is underscored by the 5 stimulus packages announced by the emirate’s government since the start of the pandemic that amounted to AED 7.1bn, or 1.6% of Dubai’s GDP. (Dubai Statistics Centre preliminary estimates for GDP growth stood at an estimated 1% qoq in Q1 2021)

- The PMI indicators for both UAE and Dubai remain in expansionary, supported by optimism ahead of the Expo event which begins in Oct, with a drop in daily cases alongside a strong vaccination campaign.

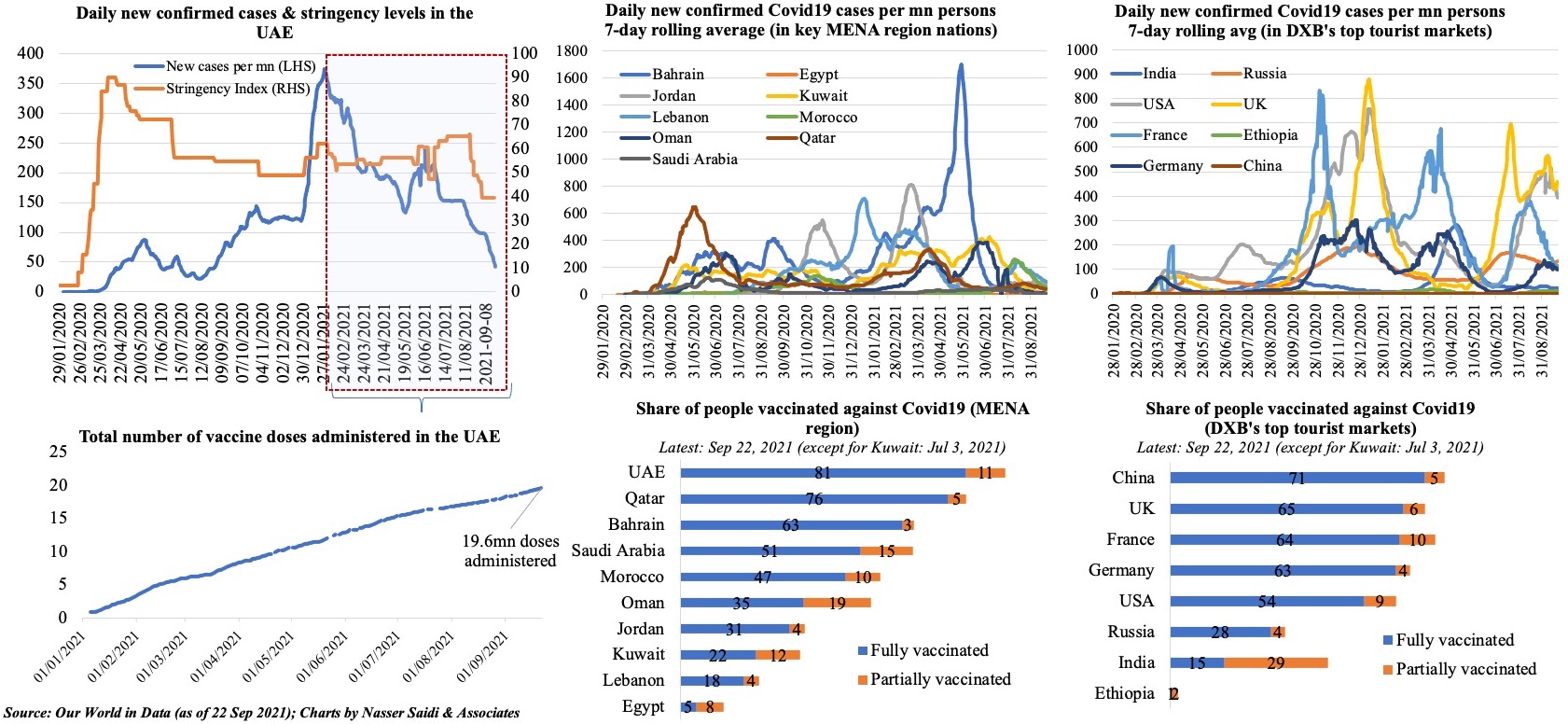

2. An update on Covid19 cases & vaccination campaigns ahead of the start of the Expo

- Daily cases in the UAE have been falling consistently (under 500 for the past few days), and with test positivity rates at just 0.2%, stringency levels have been eased slowly.

- Visitors to the Expo need to be either vaccinated or present a negative PCR: the share of vaccinated people in DXB’s main tourist market all exceed 60%, with daily cases on the decline (except in the UK & US) and vaccination rates are also picking up (especially in Europe & China).

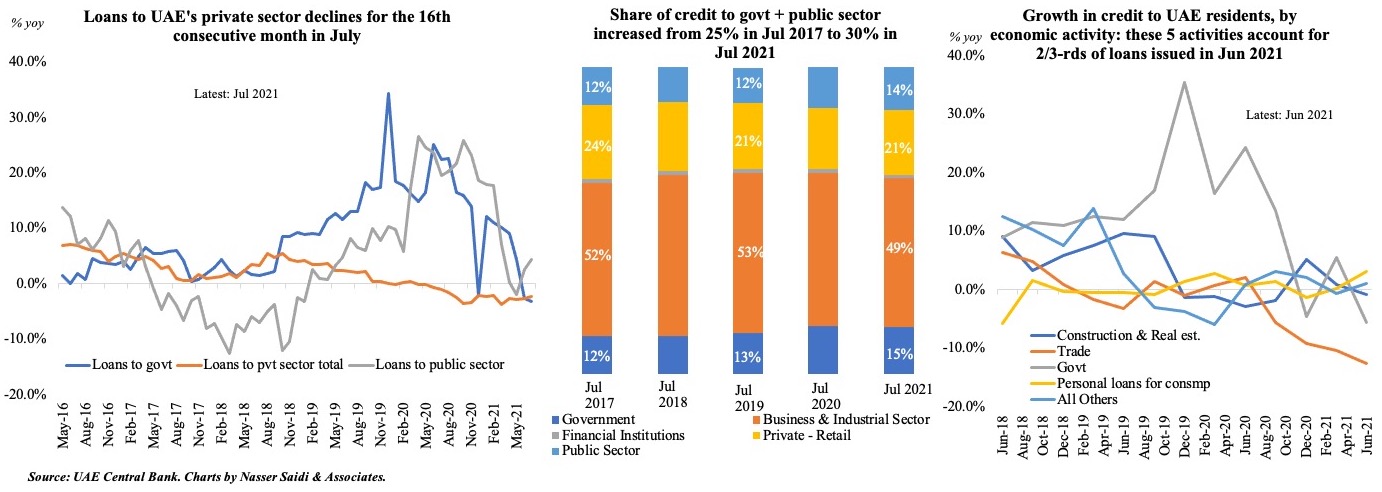

3. The decline in credit disbursed to UAE’s private sector continues past H1 2021

- Overall domestic credit disbursed in UAE fell by 1.6% yoy and 0.1% mom in Jul 2021

- July marks the 16th consecutive month of yoy decline in credit to the private sector and 13th consecutive month of yoy decline in lending to the business sector.

- A breakdown of lending by economic activity shows that the major shares with respect to credit by economic activity remain largely unchanged in Jun 2021: personal loans for consumption (21.3%), construction (20.3%), government (14.6%), others (9.3%) and trade (8.6%) together accounted for 65% of total loans.

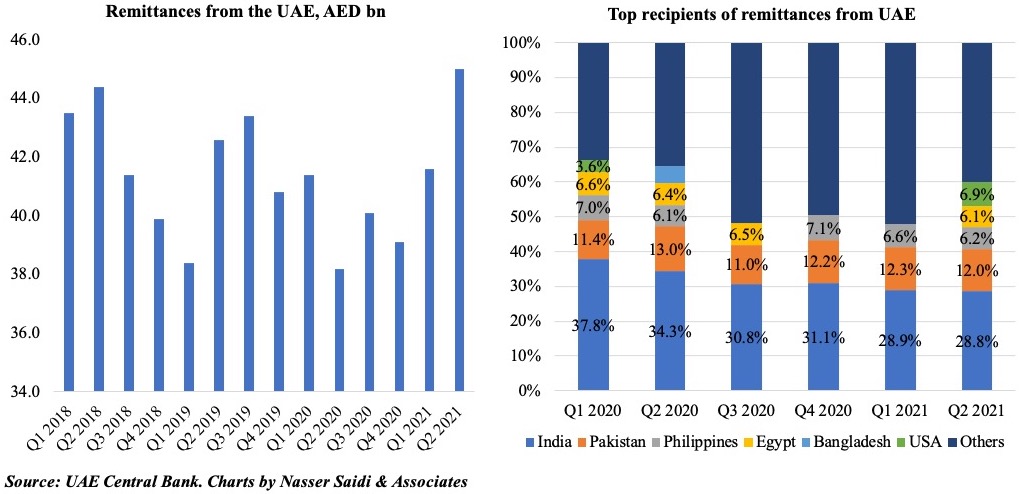

4. Remittances from the UAE surge in Q2 2021

- In Q2 2021, total remittances from the UAE surged by 17.8% yoy and 8.2% qoq to a total of USD 45.0bn. In Q1 2020, given the stringent lockdowns, remittances had dropped by 10.3% yoy to USD 38.2bn.

- Remittance transfers via exchange houses declined in Q2 2021; transfers via banks have gained traction after Covid19, up 31% qoq and 12% qoq in Q1 and Q2 this year respectively.

- India retains its spot as the largest recipient of remittances from the UAE. However, its share in remittances dropped to 28.8% of the total in Q2 this year (vs. 31% at end-Q4 2020 and 37.8% at end-Q1 2020). The decline in share of remittances to India could be due to two factors: one, job losses; two, residents who were affected by the flight ban and stuck in India.

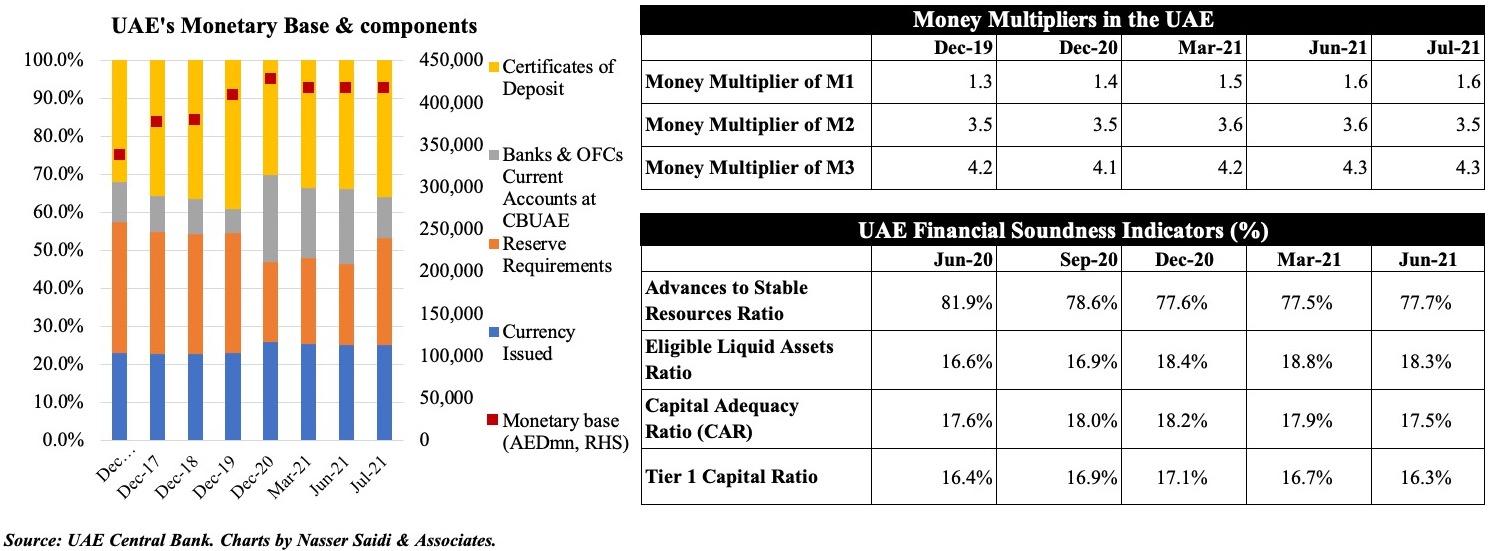

5. UAE banking system remains well capitalized; monetary base contracted in Jul 2021

- UAE’s monetary base contracted by 1.4% mom in Jul, with Banks & OFC’s Excess Reserves (11% of monetary base) declining by almost half (vs a month ago) while Certificates of Deposits purchased by banks (35.9% of monetary base) rose by 4.0% mom.

- Of the monetary aggregates, M1 and M2 declined by 0.8% mom and 0.7% respectively in Jul while M3 inched up by 0.1%, thanks to the 4.5% rise in government deposits. (These values are not seasonally adjusted)

- The increases in the multipliers of M1, M2 and M3 indicate slower decline (/faster uptick) in the monetary aggregates M1, M2 (and M3) compared to the contraction of the monetary base

Powered by: