Weekly Insights 16 Sep 2021: Saudi Arabia’s economic activity picks up pace

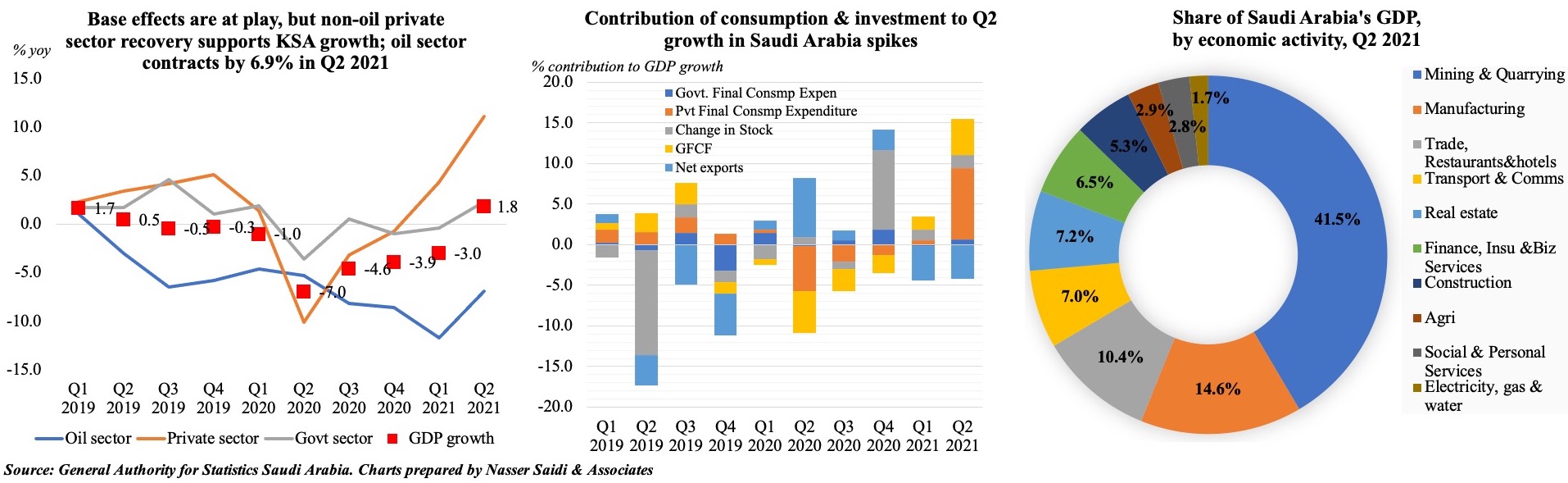

1. Saudi Arabia grows at 1.8% yoy in Q2, with the non-oil sector growing at 8.4%

- Saudi Arabia’s GDP grew by 1.8% yoy in Q2 2021 (Q1: -3.0%), with the non-oil private sector reporting a 11.1% uptick, after rising by 4.4% in Q1.

- The major share of activity lies with mining and quarrying (~42%); together with manufacturing and trade, restaurants and hotels, these 3 sectors account for just over two-thirds of the share of GDP in Q2 2021.

- Investment (GFCF) and private consumption expenditure were key drivers contributing to GDP growth in Q2. Given the base effects, both surged in Q2, private consumption by 22.1% and investment by 18.3%.

- With easing of Covid19 restrictions, Saudi is likely to see an increase in recovery pace, supported by both domestic demand and investment as well as its implementation of major projects (in non-oil manufacturing, tourism as well as long-term projects in NEOM among others)

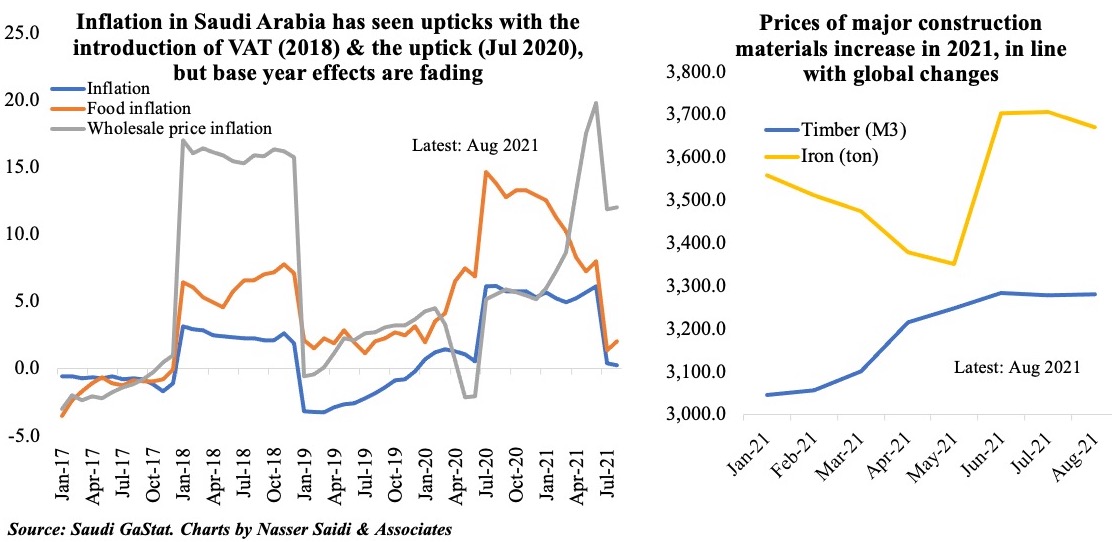

2. Inflation in Saudi Arabia eased for the 2nd month in the row, given base effects; food costs spike

- Inflation in Saudi Arabia eased to 0.3% yoy in Aug (Jul: 0.4%); however, this compares to last year’s surge in the months of Jul-Aug, immediately after the increase in VAT to 15% from 5% before.

- Food inflation however continues to rise, up by 2% yoy and 0.8% mom in Aug (Jul: 1.4% yoy) while sectors like transport and clothing showed weaker inflation.

- Wholesale price index surged by 12% yoy and 0.7% mom in Aug (Jul: 11.9% yoy), with increase in prices of metal products (given the surge in basic metal prices & electrical machinery) and other transportable goods (given hike in refined petroleum products and basic chemicals prices). Prices of major construction materials have also been on the rise, in line with global trends.

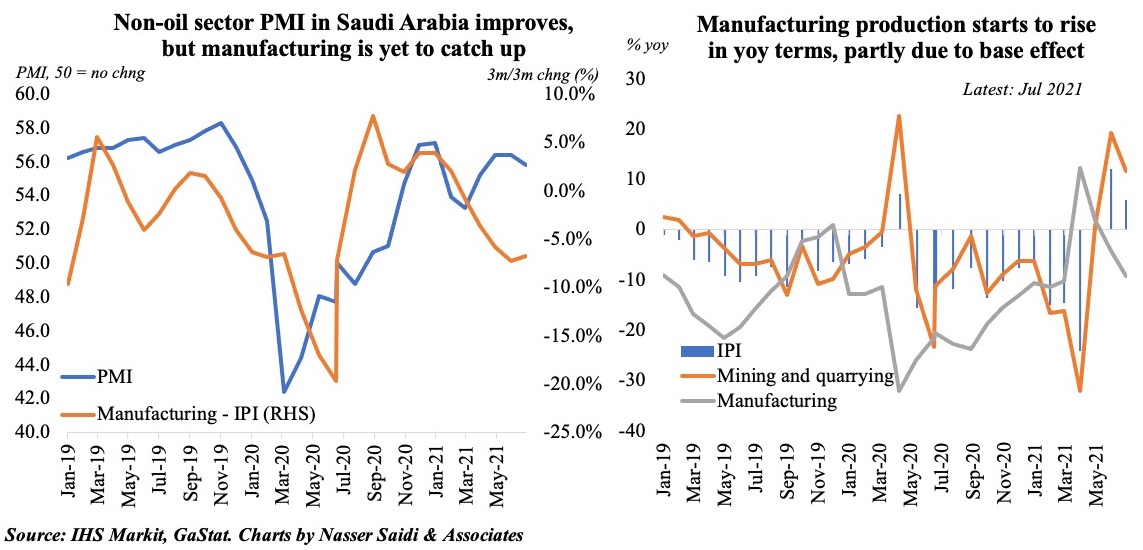

3. Saudi Arabia’s PMI stood at an average 55.3 in Jan-Aug 2021; industrial production is playing catch up

- Saudi non-oil sector PMI declined to 54.1 in Aug, a tad lower than the average so far this year. The month saw new orders growth slowing alonside a softer recovery in export orders as output expanded at the slowest pace in 10 months.

- Official data show that overall industrial production (IP) inched up by 5.9% in Jul while manufacturing dropped by 9.3% as mining/ quarrying sector production improves. The chart tracks three-month-on-three-month changes in the official IP data to remove some volatility. It shows that improvement in non-oil sector is happening faster than in official manufacturing – pointing to the strength in recovery of the non-oil, non-manufacturing sectors.

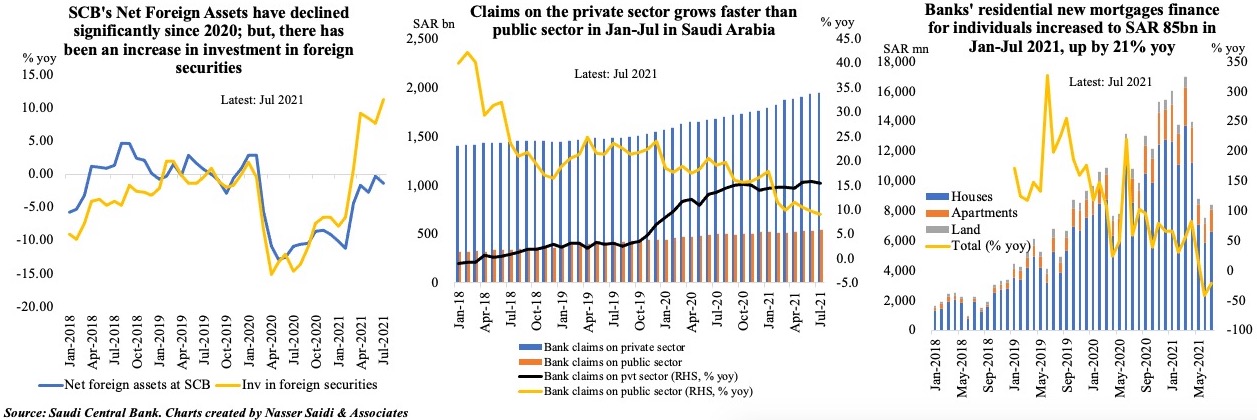

4. Saudi net foreign assets decline in Jul amid upticks in credit disbursed & mortgages

- Saudi net foreign assets posted a 1% mom decline to SAR 1.64trn in Jul. However, the amount of money invested in foreign securities rose by SAR5bn to SAR 1.13trn in Jul, the highest monthly figure since Apr.

- Credit to the private sector has accelerated by an average of 15% yoy in Jan-Jul 2021 while lending to the public sector was growing at a slightly lower pace of 11.4%. Meanwhile the number of branches have been on the decline considering many consumers’ move online and prominence of digital banking.

- Residential mortgage finance has been one of the fastest growing segments, surging on the back of plans to increase home ownership. The banks have lent SAR 85.4bn for new residential mortgages for individuals during Jan-Jul 2021, up from USD 70bn in the same period a year ago. From the chart a significant decline can be seen in the last few months.

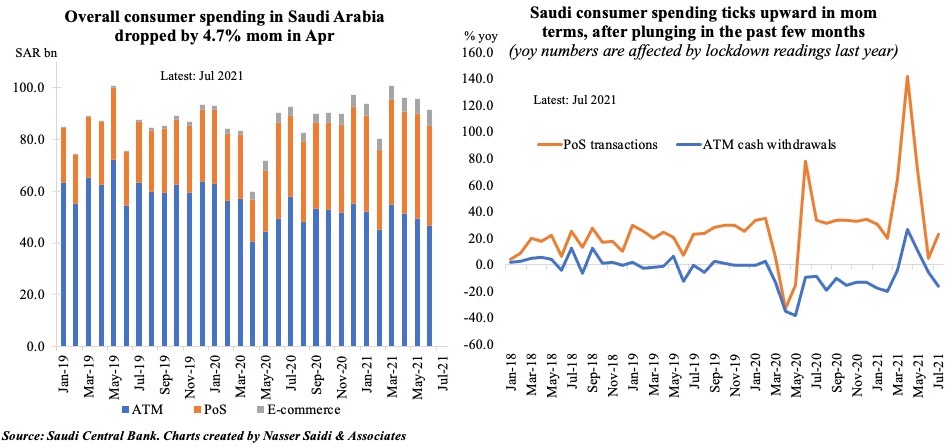

5. Consumer spending in Saudi Arabia is picking up as digital adoption surges

- Overall consumer spending has been rising through 2021, while digital adoption is surging.

- ATM transactions have declined by 6% yoy in Jan-Jul 2021; PoS transactions are up by 42% yoy during the period compared to a year ago while e-commerce transactions have almost doubled!

- Such a pattern is underscored by the results of a recent McKinsey survey about consumer preferences: about 58% of Middle East consumers expressed a strong preference for digital payments, while only 10% strongly preferred cash.

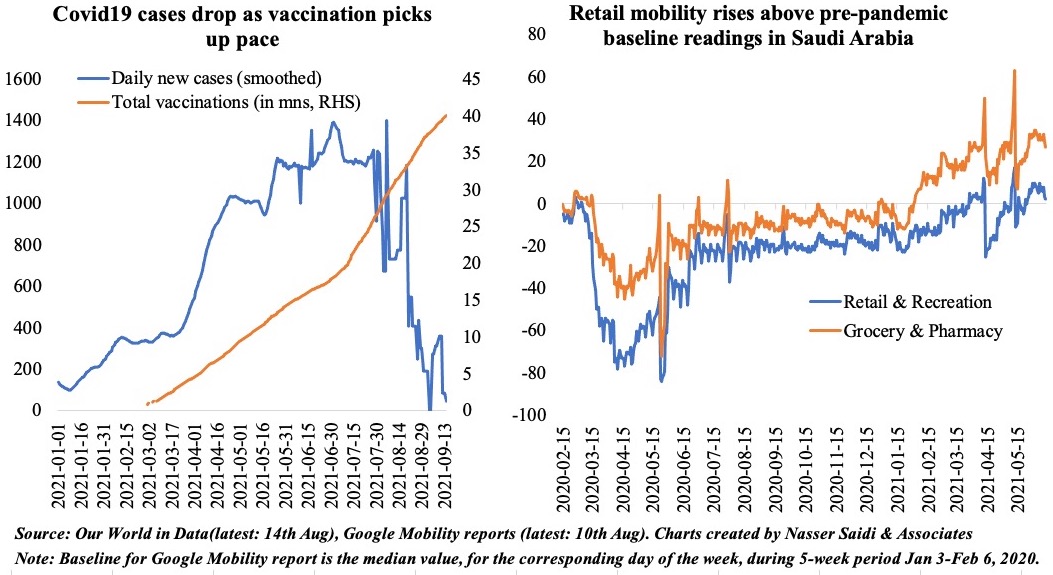

6. Daily cases in Saudi fall & as restrictions are eased; with higher vaccination doses as well, retail mobility returns to pre-pandemic rates

- Daily new cases in Saudi Arabia have fallen to less than 500 in the past few weeks or so as vaccination pace increased significantly. Just under 50% of the population is fully vaccinated and another 16% are partly vaccinated. Stringency levels, as tracked by the Oxford COVID-19 Government Response Tracker, has come also down: at an average 51.3 in Aug (Jul: 53.1).

- In addition to easing restrictions, high levels of vaccination are leading to greater mobility: retail/ recreation/ shopping mobility has risen above pre-pandemic baseline levels in Saudi Arabia as vaccination doses per 100 people touched 113.82 (UAE: 191.8; Bahrain: 144.7).

Powered by: