Markets

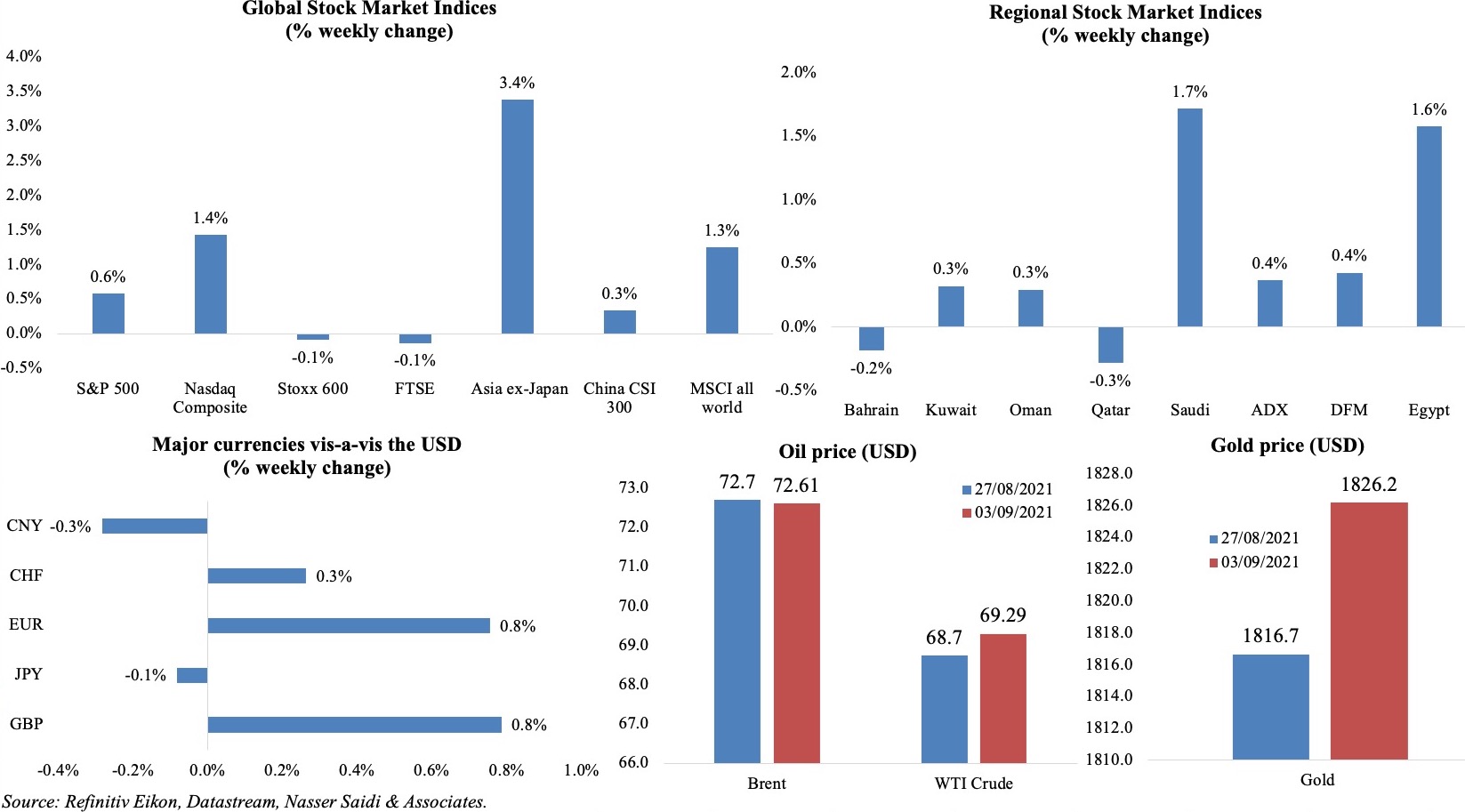

Though equity markets wavered after the disappointing payrolls data from the US, MSCI’s all-country world index posted a sixth consecutive closing high while the FTSE and Stoxx600 posted marginal declines compared to a week ago; Japan’s Topix rose to a 30-year high after news that the PM Suga would step down. Regional markets were mostly up, with Abu Dhabi posting a 6th consecutive weekly gain while Dubai’s index on Wednesday climbed to its highest in over 2 years. Among currencies, the euro strengthened ahead of the ECB meeting this week while the dollar index declined. Oil prices steadied after the OPEC+ agreed to previously announced gradual output hikes: Brent closed marginally lower (compared to a week ago) at USD 72.61 and WTI slightly higher at USD 69.29. Gold price was up by more than 1% to its highest in nearly two and a half months.

Weekly % changes for last week (2-3 Sep) from 26 Aug (regional) and 27 Aug (international).

Global Developments

US/Americas:

- Non-farm payrolls disappointed, clocking in at 235k jobs in Aug versus the 1.1mn jobs created in Jul. Leisure and hospitality industry posted no job gains for the month compared to an average monthly increase of 350k positions seen over the past 6 months. Unemployment rate declined to 5.2% (Jul: 5.4%), but the economy remains far from the Fed’s goal of “maximum employment”, with nearly 6mn more out of work than pre-pandemic. Labour supply shortages still exist and employers are having to raise wages to attract new people: average hourly earnings jumped 0.6% mom and 4.3% yoy. Apart from frictional unemployment issues the US economy is also undergoing post-Covid structural change.

- Private sector employment increased by 374k in Aug (Jul: 326k), according to the ADP national employment report. Most of the new jobs came from leisure and hospitality, which added 201k positions while education and health services combined to add 59,000 in the month.

- Initial jobless claims eased to 340k in the week ended Aug 28th – the lowest levels since Mar 14, 2020 – from an upwardly revised 354k the week before and slowing the 4-week average to 355k. Continuing claims slipped by 160k to 2.748mn in the week ended Aug 21st.

- Non-farm productivity was revised lower in Q2, to an annualised 2.1% rate from the previously reported 2.3% (Q1: 4.3%). Unit labour costs increased by 1.3% in Q2 versus the 1% pace previously reported and Q1’s 2.8% gain.

- US factory orders inched up by 0.4% mom in Jul (Jun: 1.5%), supported by orders for primary metals and machinery. While orders for transportation equipment fell by 2.1%, orders for non-defense capital goods edged up by 0.1% in Jul.

- Overall trade deficit (including services) in the US narrowed to USD 70.1bn from Jun’s record high of USD 73.2bn. Imports of goods declined by 1.2% to USD 236.3bn, given supply constraints, and demand is gearing towards services away from goods. Goods trade deficit widened to USD 87.7bn in Jul (Jun: 86.4bn).

- Pending home sales dipped for a second consecutive month, down by 1.8% mom and 8.5% yoy in Jul (Aug: -2% mom and -1.9% yoy).

- S&P Case Shiller home price indices gained by 19.1% in Jun (May: 17.1%). Home prices surged by 18.6% in the year that ended in Jun – the largest annual gain in the history of the series and 41% higher than the previous peak in 2006’s housing boom driven by fiscal stimulus and ultra-loose monetary policy and low mortgage rates.

- Dallas Fed manufacturing business index fell to 9 in Aug (Jul: 27.3) – the lowest reading since Jan. While 72% of firms said supply-chain disruptions were restraining revenues, new orders index, at 15.6, was more than double the series average of 6.5 though down from the previous month’s 26.8 reading. The employment index rose to its highest reading since 2007.

- Chicago PMI declined to 66.8 in Aug (Jul: 73.4): order backlogs hit the highest level since 1951 and short supplies pushed input prices to the highest point since 1979.

- ISM manufacturing PMI in the US improved to 59.9 in Aug (Jul: 59.5), thanks to an expansion in new orders (66.7 from 64.9) and production (60 from 58.4) amid an easing in prices (79.4 from 85.7 in Jul, the lowest since Dec). Employment index fell to 49 (Jul: 52.9). ISM services fell to 61.7 in Aug from Jul’s record-high 64.1, reflecting a slowdown in new orders (63.2 from 63.7) while price pressures eased.

- US Markit manufacturing PMI fell to 61.1 in Aug (Jul’s record 63.4), with rate of both input and output price inflation touching fresh series highs; services PMI slowed to 55.1 (Jul: 59.9) – the weakest pace of expansion since Dec 2020 – with new orders growth slowing to the weakest since Aug 2020.

Europe:

- Inflation in the eurozone jumped to 3% in Aug (Jul: 2.2%) – recording the highest rate of inflation since Nov 2011; energy costs rose by 15.4% in Aug (Jul: 14.3%) and food prices by 2% (Jul: 1.6%). Core inflation rose to 1.6% (Jul: 0.7%), the highest rate since Jul 2012.

- Producer price index in the eurozone increased to 2.3% mom and 12.1% yoy in Jul (Jun: 1.4% mom and 10.2% yoy). This was the largest monthly increase since Jan 1995 and the highest ever yoy increase.

- Germany’s harmonized index of consumer prices inched up to 3.4% in Aug (Jul: 3.1%). The last time inflation touched 3.4% was ahead of the 2008 financial crisis. German goods inflation rose to 5.6% in Aug, while services inflation hit 2.5%.

- Retail sales in Germany slumped by 5.1% mom and 0.3% yoy in Jul (Jun: 4.5% mom and 6.5% yoy). Compared with Feb 2020 (pre-pandemic), retail sales are up by 3.8%.

- In the eurozone, retail sales dropped by 2.3% mom in Jul; internet and mail order sales fell the most (-7.3%) while sales of non-food products and automotive fuel fell by 3.5% and 1.6% respectively.

- Unemployment rate in Germany eased to 5.5% in Aug (Jul: 5.6%), the lowest level since Mar 2020, with the number of unemployed falling by 53k (Jul: -90k). Separately, unemployment rate in the eurozone dropped to 7.6% in Jul (Jun: 7.8%): Greece and Spain posted the highest unemployment rates in the region, at 14.3% and 14.6% respectively.

- The preliminary manufacturing PMI in Germany declined to a 6-month low of 62.6 in Aug (Jul: 65.9), with the output index slipping the most, to its lowest since Aug 2020. Services PMI fell to 60.8 from a record high 61.8 in Jul. Overall, inflationary pressures remained high (including personnel costs) with a near-record rise in business costs, though business sentiment remains optimistic towards future activity.

- Eurozone’s manufacturing PMI (preliminary) fell to a 6-month low of 61.4 in Aug (Jul: 62.8), with slower growth linked primarily to supply chain constraints while output and new orders fell from Mar’s survey-highs. Services PMI ticked down to 59.0 from 59.8 the month before though service sector jobs growth was the strongest since Sep 2018.

- Consumer confidence in the euro area worsened to -5.3 in Aug (Jul: -4.4), as did industrial confidence (13.7 in Aug from Jul’s 14.5). Business climate eased as well: down to 1.75 from 1.88.

- Manufacturing PMI in the UK slipped to a 5-month low of 60.3 from 60.4 in Jul, with supply issues resulting in weaker production growth while employment grew for the 8th month in a row. Services PMI declined at a much sharper rate: down to 55.0 in Aug (Jul: 59.6), with lack of inbound tourists and Brexit trade frictions cited as the reason for subdued orders.

Asia Pacific:

- Three of the 4 PMIs in China fell below 50 in Aug: the NBS non-manufacturing PMI dipped to 47.5 from the previous month’s 53.3, posting the first contraction since Feb 2020, as new Covid19 restrictions dampened activity. Caixin manufacturing PMI dropped down to 49.2 from 50.3 in Jul – the first drip below 50 since Apr 2020 – with output shrinking for the first time in 17 months. Caixin services PMI plunged to 46.7 in Aug (Jul: 54.9), with new orders below-50 for the first time in 16 months. The NBS manufacturing PMI ticked down to 50.1 in Aug (Jul: 50.4), just barely above the 50-mark: declines were evident across new orders (49.6 from 50.9), export sales (46.7 from 47.7) and employment (49.6).

- Japan’s manufacturing PMI eased to 52.7 in Aug (Jul: 53) but was higher than the preliminary reading of 52.4. Both output and new orders expanded at slower paces; supply chain disruptions affected production inputs. Employment rose at fastest pace since Jan 2020.

- Industrial production in Japan fell by 1.5% mom in Jul (Jun: +6.5%), dragged down by a decline in auto production (including passenger cars and small buses). In yoy terms, IP grew by 11.6% (23%).

- Retail trade in Japan picked up in Jul, rising by 1.1% mom and 2.4% yoy, posting the 5th consecutive month of gains. Large retailer sales rebounded by 1.3% from Jun’s 2.3% dip.

- Unemployment rate in Japan edged down to 2.8% in Jul (Jun: 2.9%), with the actual number of those unemployed posting the first yoy fall in 18 months. According to the labour ministry, an index gauging job availability gained slightly to 1.15 from 1.13 in Jun.

- India’s GDP increased by 20.1% yoy in Apr-Jun 2021, largely due to the effect of a lower base (Apr-Jun 2020: -24.4%): construction and manufacturing sectors supported growth, clocking in growth rates of 68.3% and 49.6% respectively.

- Federal fiscal deficit in India widened to INR 3211.4bn in Jul (Jun: INR 2742.45bn). Fiscal deficit for the Apr-Jul period narrowed to a 9-year low thanks to higher GST collections and came in at only 21.3% of the full-year target.

- Infrastructure output in India grew by 9.4% yoy in Jul; it increased by 21.2% in Apr-Jul.

- South Korea’s GDP was revised up in Q2: the new growth estimates stand at 8% qoq and 6% yoy (Q1: 1.7% qoq and 5.9% yoy). Private consumption, which climbed by 3.6% qoq, supported Q2 growth, while fiscal spending and facility investment grew by 3.9% and 1.1%.

- Industrial output in South Korea grew (for the 9th consecutive month) by 7.9% yoy in Jul (Jun’s downwardly revised 11.5%).

- Retail sales in Singapore increased marginally by 0.8% mom and 0.2% yoy in Jul; food and beverage service sales were lower largely due to the suspension of dining in services from Jul 22. Excluding motor vehicles, retail sales rose by 2.9% mom and 2% yoy in Jul.

Bottomline: August PMIs are in – global manufacturing PMI fell to a 6-month low as supply chain issues constrained output growth amid the spread of the Delta variant. Purchasing costs continue to rise, and for now, it looks like inflationary pressures (including wage) are building up. Inflation rates across the US and Europe are rising above central bank targets, but “transitory” is still the main rhetoric. This week the ECB meets on policy: with EU recovery more heterogeneous across countries, it seems unlikely that it would taper before the US.

Regional Developments

- Egypt’s GDP grew by 7.7% yoy in Mar-Jun 2021 compared to a 1.7% drop in the same quarter a year ago. GDP growth in the fiscal year 2020-21 (which ended in Jun) was nearly 3.3%, according to the cabinet. Growth is expected to touch 5.4% in the current fiscal year.

- PMI in Egypt inched up to 49.8 in Aug (Jul: 49.1), with non-oil output and new orders growing for the second time in 9 months. However, input cost inflation was the highest since Aug 2019 as material prices increased.

- The Egyptian Commodity Exchange will be launched in Q1 2022, reported Daily News, citing the head of the Internal Trade Development Authority.

- Egypt’s exports to France increased by 21% yoy to EUR 350mn in H1 2021 while imports from France dipped by 9% to EUR 913mn.

- Egypt signed a USD 4.45bn deal to construct a high-speed electric rail line to link its Red Sea and Mediterranean coasts: the 660km line will include both passenger (30mn+ passengers annually) and freight lines. Financial close on the contract is expected in 2022.

- Egypt is on track to increase production of the Covid19 vaccine for export to Africa and to inoculate its own population. A new facility is expected to begin production in Nov, with a capacity to produce a billion vaccines per year.

- Iraq and Saudi Arabia have signed multiple agreements covering trade and transport (including maritime); an agreement was reached to increase the volume of trade exchange through Al Jadida-Arar port by limiting processing time to four hours per container.

- Iraq approved plans to build a 7.5 GW solar power project, reported Asharq. This is part of its plan to award 10-12 GW of solar power projects through 2025.

- Reuters reported that Kuwait is currently seeking cash injections from private companies to ensure that power projects are well-funded over the next two decades. Kuwait’s electricity capacity is estimated at 17,000 MW and about 14,000 MW are scheduled to be added over the next twenty years, with PPPs key in delivering this increase.

- A new ESCWA report on Lebanon revealed that 82% of the population lives in multi-dimensional poverty (i.e. takes into account factors like access to health, education and public utilities in addition to income), almost doubling from 42% in 2019. “Extreme multidimensional poverty”, affects 34% of the population today, exceeding half, in some areas.

- Iranian fuel cargo to Lebanon will be delivered via Syria by truck to avoid sanctions-related complications, reported Reuters.

- Fiscal deficit in Oman narrowed to OMR 1.2bn in Jan-Jul, after revenues rose marginally by 0.5% during the period while oil revenues climbed by 3.4%. Spending declined by 4.7%.

- Oman’s Supreme Committee mandated that all incoming travelers need to be vaccinated against Covid19. The country also recently received 86,400 doses of AstraZeneca through COVAX.

- The Islamic Development Bank’s annual report revealed that Egypt had received the most financing in 2020, to the tune of USD 1.13bn in value. However, this was just 0.2% of the overall USD 6.8bn disbursed last year.

- Iata’s recent report indicated that Middle East airlines continue to post a significant reduction in demand compared to 2019. In Jul 2021, global air travel demand was down by 53.1% (vs 2019) but the same figure in Middle East stood at 74.5%.

Saudi Arabia Focus

- Saudi Arabia’s PMI slipped to 54.1 in Aug (Jul: 55.8), largely due to the fall in output sub-index (lowest level since Oct 2020) while domestic orders remained strong. Confidence was subdued, with just 11% of survey respondents expecting output to increase over the coming year.

- Saudi PIF and Tadawul plan to establish a voluntary carbon credits exchange in Riyadh: it will aim to be the primary destination and main platform for companies and institutes that target reducing their emissions, or contributing towards the reduction

- Residential mortgages issued by Saudi banks and financial institutions touched 171,757 (+8% yoy) in Jan-Jul, valued at SAR 87.7bn (+20%). The number of new mortgage loans grew by 5% mom to 18,703 in Jul while the value increased by 12% to 8.6bn during the month.

- Credit disbursed continues to increase in Saudi Arabia, a trend seen since Q2 2019: lending to individuals surged by 17% to SAR 394bn in Q2 this year. Compared to that bank branches are declining: the number fell by 4.6% yoy to 1969 in Q2 this year. Not surprising, considering the move online and prominence of digital banking. As banks discuss strategy, it would be worthwhile to move physical branches to areas with low connectivity and/or with limited bank penetration/ financial inclusion.

- Net foreign assets dipped to SAR 1.64trn in Jul in Saudi Arabia. The amount of money invested in foreign securities increased by SAR5bn to SAR 1.13trn in Jul, the highest monthly figure since Apr.

- Foreign investment in Tadawul accelerated by more than 150% by end-Q2 compared to late 2018. The CMA disclosed that banking, basic materials, energy and communications attracted the most foreign investment.

- Saudi Arabia’s state-owned Al-Arabiya and Al Hadath TV channels are planning to broadcast from Riyadh starting Jan 2022; reports indicate that MBC and Asharq News are also internally discussing plans to move to Riyadh. This seems to be in line with Riyadh’s goal to be a regional business hub and attract firms to locate and operate out of the city.

- Saudi Arabia’s ACWA Power, half owned by the PIF, is preparing for an IPO: the company plans to issue 85.3mn shares, representing 11.67% of the company; of this around 4.14mn shares will be allocated as part of the company’s employee IPO grant plan. The IPO is expected to raise more than USD 1bn, valuing the company at around USD 10bn.

- Aramco is planning to resume development of the Jafurah gas field, with investments reaching about USD 110bn, reported CNBC. The largest natural gas field is estimated at 200 trillion cubic feet of rich raw gas.

- Saudi Arabia plans to start production from the Mansoura and Masarah gold mines in mid-2022, reported Al Eqtisadiah. The SAR 3bn (USD 880mn) gold mine project is anticipated to have a production capacity of 250k ounces of gold and silver.

- Saudi Arabia launched an initiative to provide loans of up to SAR 15mn(USD 4mn) for micro, small, and medium size businesses related to IT and digital projects. Loans will range from SAR 100k to SAR 15mn supporting firms to carry out projects and expand.

- An MoU between Saudi Tourism Authority and China’s Alibaba Cloud is expected to create an “experience” for Chinese tourists traveling to the Kingdom. The latter is expected to create an improved digital experience for Chinese tourists while also providing tech support to STA to promote the Kingdom as a tourist destination for the Chinese.

UAE Focus![]()

- UAE PMI ticked down to 53.8 in Aug (Jul: 54). While demand continued to rebound, export sales decreased for the 4th consecutive month. Employment levels rose at the fastest rate since the beginning of 2018, potentially also due to Expo-related temporary jobs.

- The UAE plans to announce a series of 50 “significant economic projects” this month. The underlying aim is to increase economic diversification, and towards this end projects are expected to focus on entrepreneurship, the digital and circular economies, and applications of the Fourth Industrial Revolution to promote economic and social development. The projects announced today include the introduction of highly flexible “Green Visas” for entrepreneurs, pioneers and other professions (along with a doubling of cancelled visa grace period to 180 days), as well as focus on upskilling and AI (with an aim to prepare the nation for the 4th IR), and AED 5bn allocated to Emirates Development Bank to support the industrial sector to support projects by UAE nationals among others.

- UAE’s non-oil trade with Arab nations grew by 29% yoy to AED 191bn in H1 2021, according to the Minister of Economy. Trade between Arab nations and rest of the world was USD 1.27trn in 2020, of which UAE accounted for 25% share.

- UAE and Indonesia have initiated trade negotiations with an aim to increase bilateral trade by almost 10 times from USD 2.93bn in 2020. A deal is expected within a year, with more investment plans likely to be announced during the Indonesian President’s Nov visit to UAE.

- Abu Dhabi Securities Exchange plans to launch a derivatives market in Q4 this year: beginning with singles stock futures and index futures, it will then expand to a range of derivatives products in the future. The exchange had already signed an agreement with Nasdaq in Sep 2021 for the impending launch: this includes technology solutions, matching as well as real-time clearing and settlement technology.

- Emirates Global Aluminium is proceeding with its potential IPO, by preparing to bring on Citigroup, Goldman Sachs Group and JPMorgan Chase & Co as lead underwriters, reported Bloomberg. The company had planned to list in 2018 before Trump imposed tariffs on aluminium imports from the UAE.

- The UAE ranks 30th in the latest edition of UNIDO’s Competitive Industrial Performance Index. UAE improved its performance in 4 of the total 8 indicators: rising to 17th in manufacturing exports per capita and up to 32nd for total manufacturing exports.

- Abu Dhabi National Energy Company (TAQA) plans to sell some or all of its oil and gas assets as it “transitions towards a cleaner and more sustainable future”. The company’s energy portfolio includes assets in UK’s North Sea, Netherlands, Canada and Iraqi Kurdistan.

- According to S&P Global Platts, Middle East crude benchmark Dubai fell to an average of USD 485 a barrel in Aug (Jul: USD 72.903) – the lowest since May.

- UAE announced lower petrol and diesel prices in Sep, down by ~1.2% mom and 2.9% respectively.

- DMCC disclosed that a record–breaking 204 new companies registered in the freezone in Aug. More than 1500 new firms have joined since the beginning of this year – its best-ever 8-month performance.

- ADNOC confirmed that it had secured a USD 1.2bn credit facility to finance ADNOC Global Trading’s (a JV between ADNOC, Italy’s Eni and Austria’s OMV, that trades trade refined products and supply feedstocks) trade flows and growth.

- According to the chairman of the Dubai Sports Council, the contribution of sports to the Dubai economy exceeds AED 4bn annually. More than 20k persons are employed in the sports sector in Dubai, which organises ~400 sports events (including 130 international ones).

- UAE issued a new decree that allows for the investigation of ministers and senior officials of the UAE in order to enhance transparency, oversight and accountability in the government.

- According to Dubai Taxi’s strategic plan 2021-23, about 5% of the taxi fleet will be converted to autonomous vehicles by 2023 while the share of environmentally friendly vehicles will rise to 56%.

- Abu Dhabi updated its Covid19 travel requirements: vaccinated international travelers are no longer required to quarantine in the emirate; a negative PCR remains mandatory.

Media Review

Without help for oil-producing countries, net zero by 2050 is a distant dream

https://www.theguardian.com/commentisfree/2021/sep/01/oil-producing-countries-net-zero-2050-iraq

Qatar emerges as bridge between Taliban and the west

https://www.ft.com/content/5d95c09f-da93-421e-ac6e-02d250738a5f

From tech to entertainment, China’s season of regulatory crackdown

https://www.reuters.com/world/china/education-bitcoin-chinas-season-regulatory-crackdown-2021-07-27/

As a rich-world covid-vaccine glut looms, poor countries miss out

The stagflation threat is real: Roubini

Australia, Malaysia, Singapore and South Africa launch cenbank digital currency scheme

Clean & Green Finance: Mark Carney

https://www.imf.org/external/pubs/ft/fandd/2021/09/mark-carney-net-zero-climate-change.htm

IMF F&D Climate issue: https://www.imf.org/external/pubs/ft/fandd/2021/09/index.htm

Powered by: