Weekly Insights 1 Sep 2021: Thinking beyond the Expo 2020 Dubai

Dubai is gearing up for the Expo extravaganza, scheduled to start in just over a month’s time on October 1st. Plans and preparations have been underway since the Emirate won the rights to hold the mega-event in Nov 2013.

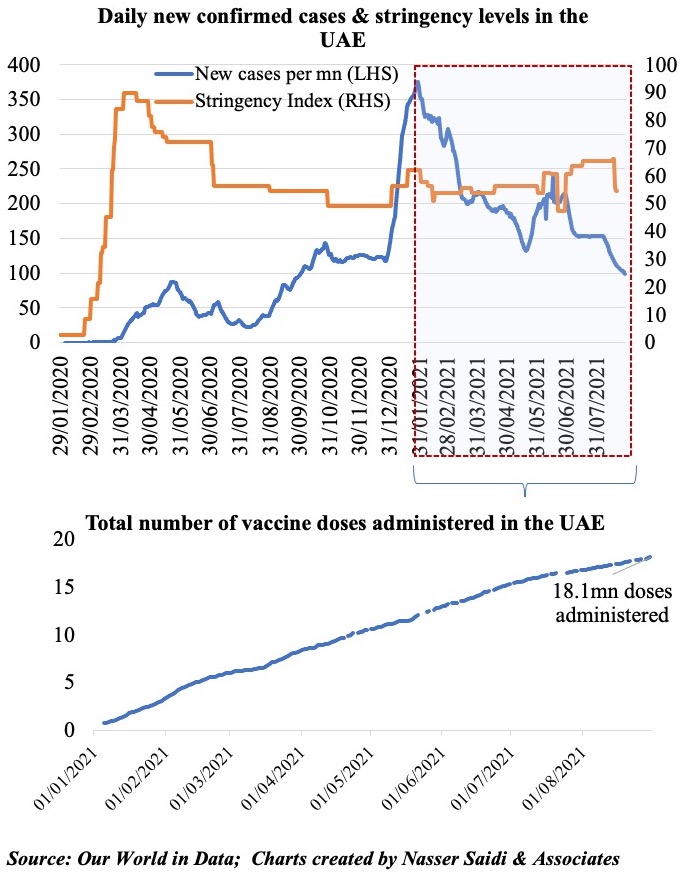

Little did anyone envisage the scenario within which the Expo would eventually take place. Expo 2020 will be the first global mega-event to be held permitting physical entry of visitors, after the Tokyo Olympics and Paralympics went ahead sans spectators (given the spiraling Covid19 crisis in the country). Holding a mega event during a global pandemic will be no mean feat. Nevertheless, Dubai has been open for tourists since July 2020 and has managed to control the epidemic amid a highly effective vaccination campaign. Restrictions were tightened when cases surged and eased later. Vaccination rates are among the highest globally: over 18 million doses have been administered to a population of 10 million.

From Oct 2020, the Emirate opened to host multiple global conferences and sports events – albeit at a smaller scale compared to the Expo – and have other major events on the horizon like the Indian T20 IPL championship matches (mid-Sep), T20 Cricket World Cup (mid-Oct) and Formula 1 (Dec 3-5) among others. These will be testing grounds for the control of crowds ahead of the Expo. Of course, having a well-connected airport will be critical in this regard: some 2/3rd of the world’s population lives within 8 hours flight from Dubai and 1/3rd lives within 4 hours. Expo 2020 will be the first expo with the vast majority of visitors using international travel. Even though passenger traffic at Dubai’s international airport plummeted to 25.9mn in Covid19-affected 2020 (from 86.4mn in 2019), it was ranked the world’s busiest airport for international passengers, and passengers are expected to rise to 28mn this year. Anecdotal evidence suggests a surge in tourist visa applications and ticket demand following the recent announcement of entry for all WHO-approved vaccinated persons into the UAE: while the 25mn Expo visitors may be a tad too optimistic during an ongoing pandemic, the WHO approval will increase the likelihood and perception of health safety and encourage visitors.

Hosting such mega-events are usually found to be a drain on country or city budgets: to take an example of the recently concluded spectator-free Tokyo Olympics, the official budget by 2019 stood at USD 12.6bn (vs the estimation of USD 7.5bn in 2013) though the audit board places the amount as at least double. In the Expo’s case this year, where visitors are allowed entry, they also have to account for additional spending given the Covid19 countermeasures (i.e. costs of testing, adapting to social distancing policies etc.). However, the economic case for hosting such events is based on the increase in economic activity (infrastructure development, job creation and the multiplier effect, event-related revenues), rise in tourists and spending (supported by enhancement to key tourism infrastructure e.g. extension of the Dubai Metro to the Expo, roads to and hotels near the Expo etc.), building the intangible “Dubai brand” as well as other qualitative and social impacts (strengthening trade and business with global counterparts, the “feel-good” factor – more important during a pandemic when trying to return to “normal”).

Expo 2020 has prioritized health and safety guidelines (including a mask mandate), and plans to dazzle the rest of the world with its AI-assisted queue and crowd controls and roving paramedics. A trial period earlier this year saw these practices being tested as residents previewed the area. While this should put visitors’ minds at ease, we expect that the Expo will benefit from UAE residents’ multiple visits (domestic) in addition to those from its major regional and international source countries (India, Saudi Arabia, UK, Russia etc.). Having hosted 2.5mn overnight visitors in H1 2021, and 5.51mn persons in 2020 (of which 3.27mn were in Jan-Feb), Dubai has already gained sufficient experience to safely secure visitors (& manage events during a pandemic – this is just scaling it up many times over!).

Will the Expo affect UAE’s growth prospects?

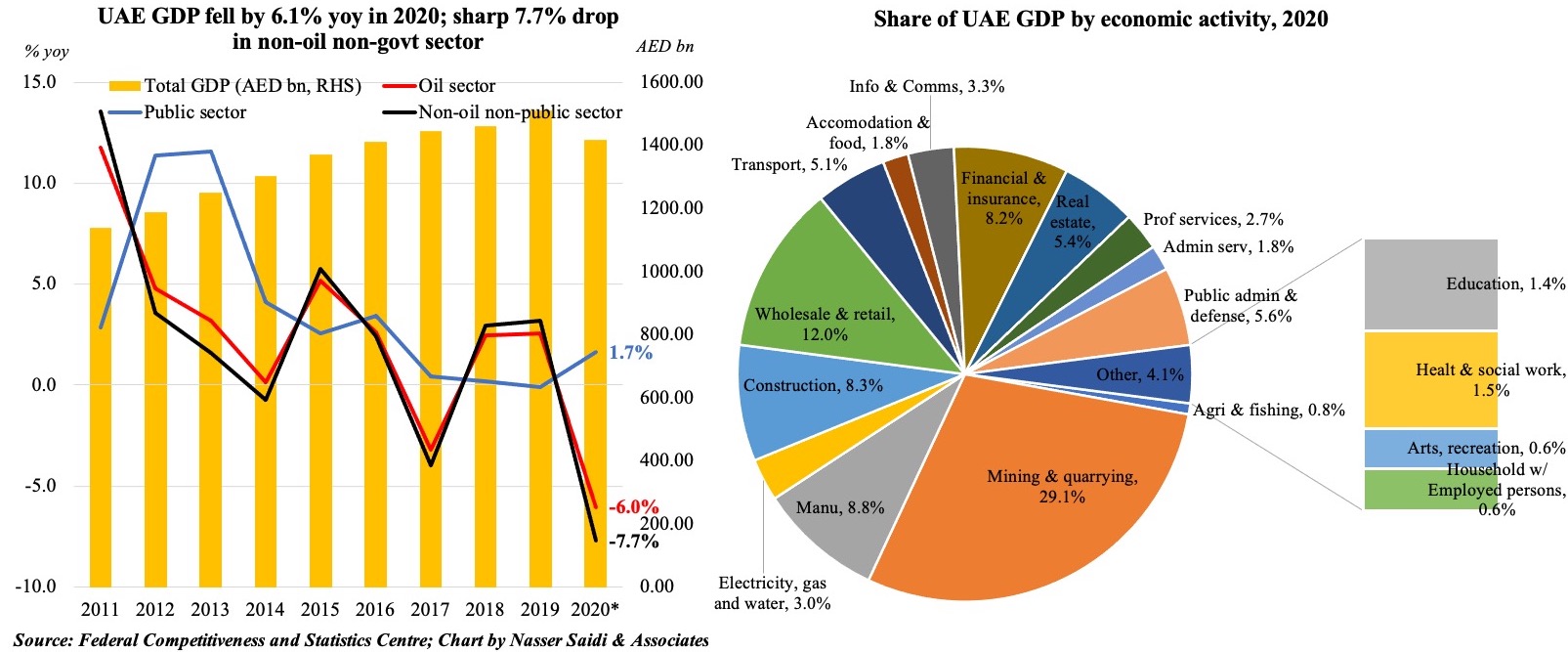

In 2020, UAE’s growth fell by 6.1% yoy dragged down by a 7.7% plunge in private sector activity. By economic activity, four sectors saw double-digit declines last year: accommodation and food (-23.6%), transport (-15.5%), wholesale and retail (-13.1%), construction (-10.4%). Not surprising considering that these sectors were directly affected by the pandemic. This is in addition to the oil sector which fell by 6%, given compliance with lower production levels agreed by the OPEC+ bloc. However, the UAE’s diversification policy measures have meant that the oil sector now accounts for less than 1/3-rd of GDP, thereby lessening the impact of the global slowdown in the demand for oil. However, the sectors it diversified into – including trade, tourism and hospitality – were significantly impacted by Covid19.

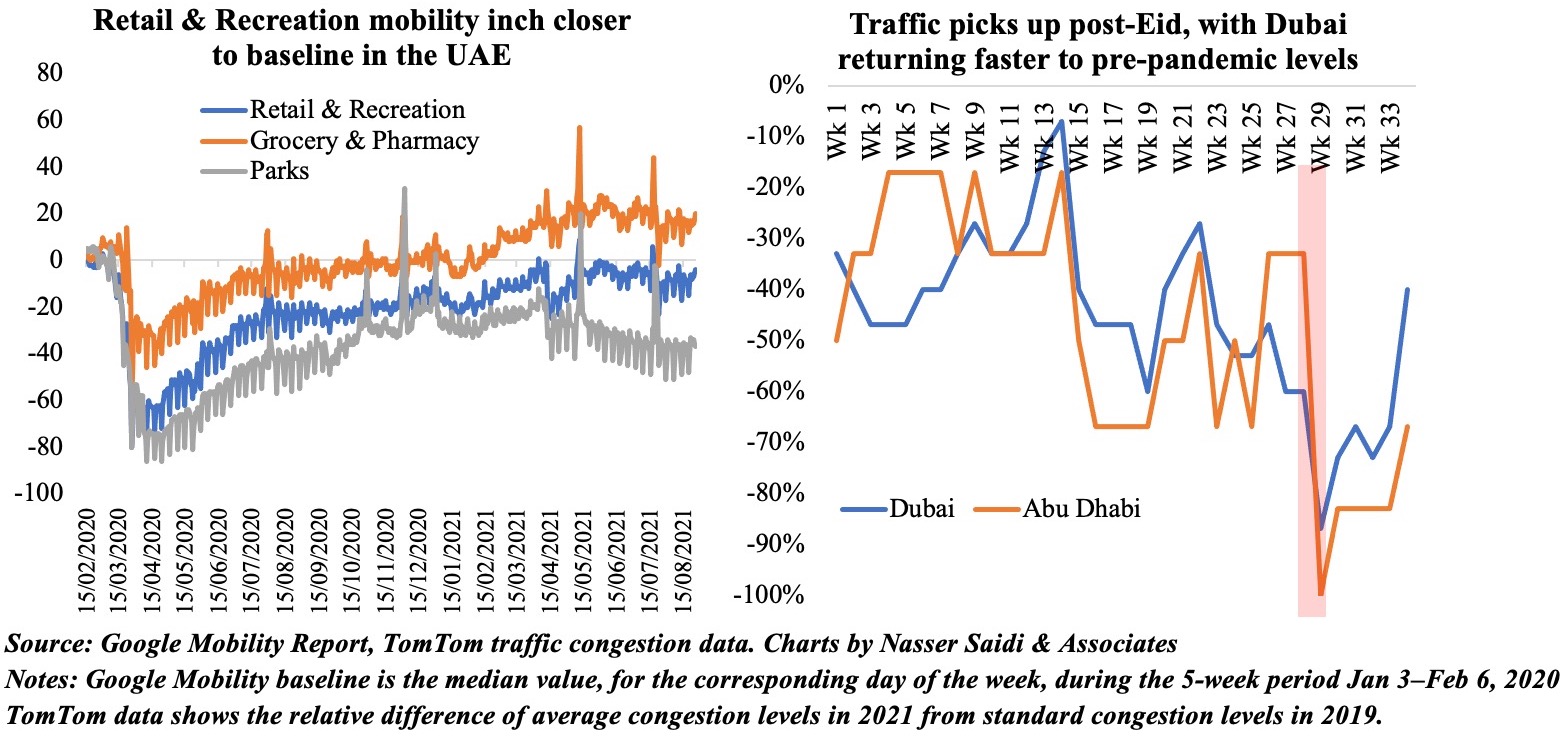

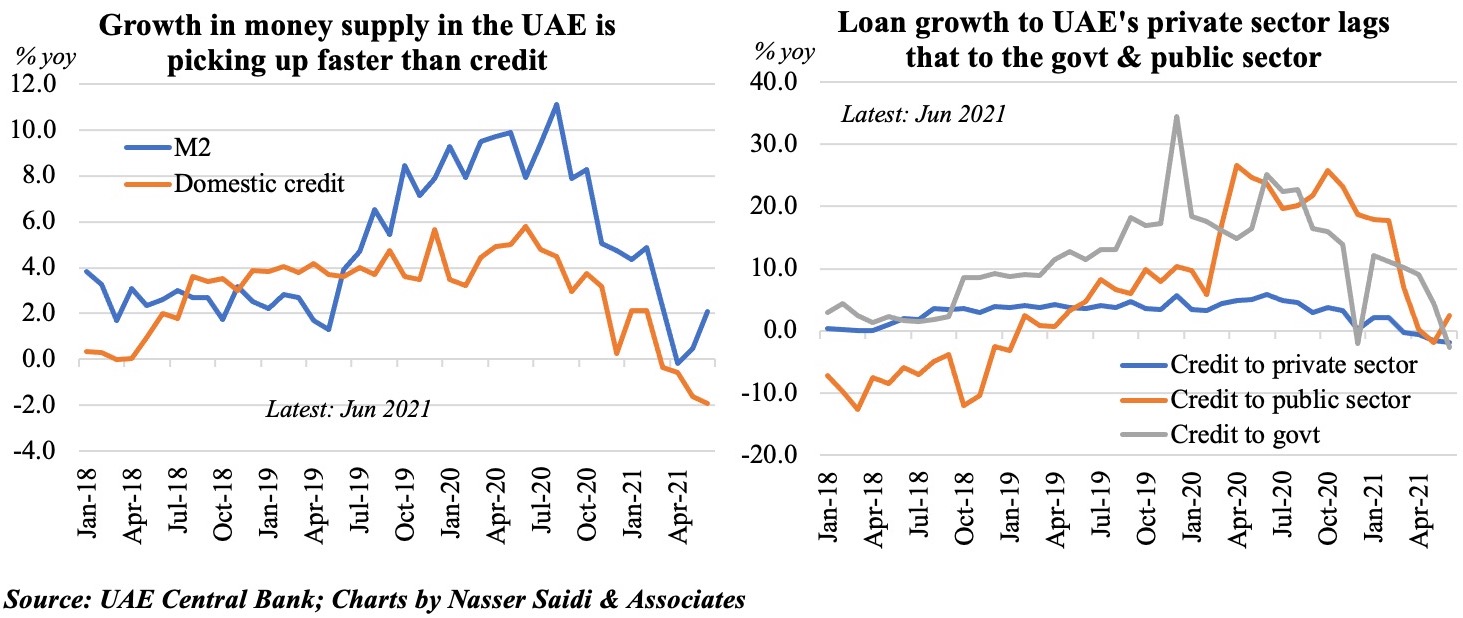

How soon these sectors recover is a critical question. High immunization rates and the easing of restrictions allowing for tourists’ entry, along with the ability to host global conferences, entertainment and sporting events have already boosted the confidence of consumers and businesses. Consider the UAE’s non-oil sector PMI: at 54 in Jul, this was the highest reading since Jul 2019; it has already improved to an average reading of 52.2 in H1 this year vs 50.2 in H2 2021, thanks to the pace of vaccination, improvements in domestic demand and recovery in employment. Tourism numbers and hotel occupancy rates have been picking up, despite having restricted entry from India (during its Covid19 wave), the UK (since UAE was placed on UK’s Red and Amber lists requiring mandatory “quarantine on return”) and direct travel from Saudi Arabia still suspended. Higher frequency indicators like mobility, traffic and money supply growth also indicate a broad-based improvement.

Some pain points need to be tackled, key among them being the dip in loans to the private sector. Private sector loans, which accounted for roughly 70% of overall loans in H1 2021, witnessed a marginal 0.4% growth year-to-date (till Jun) vis-à-vis the 1.7% uptick in loans to GREs. Furthermore, funding to SMEs remains trivial, with the Jun reading at 12.2% of overall business and industrial sector credit and just 5.9% of overall domestic credit.

Standing at the 1-month countdown to the start of the Expo, the 192 pavilions, around 50k employees (so far) and the related infrastructure are ready to receive the world: a successfully run event will boost Dubai’s/ UAE’s image as a global frontrunner in safely hosting large-scale events during the pandemic era. The Expo will act as a stepping stone for potential investors to buy into “Brand Dubai” and move businesses and families into the country. A long list of recent reforms including visa changes (long-term golden visas, retirement visas, remote visas) and ownership rules (allowing 100% foreign ownership outside the free zones) make Dubai/ UAE an attractive global hub to live, work and play. A successfully managed Expo will only further accentuate this message to the world.

Powered by: