Markets

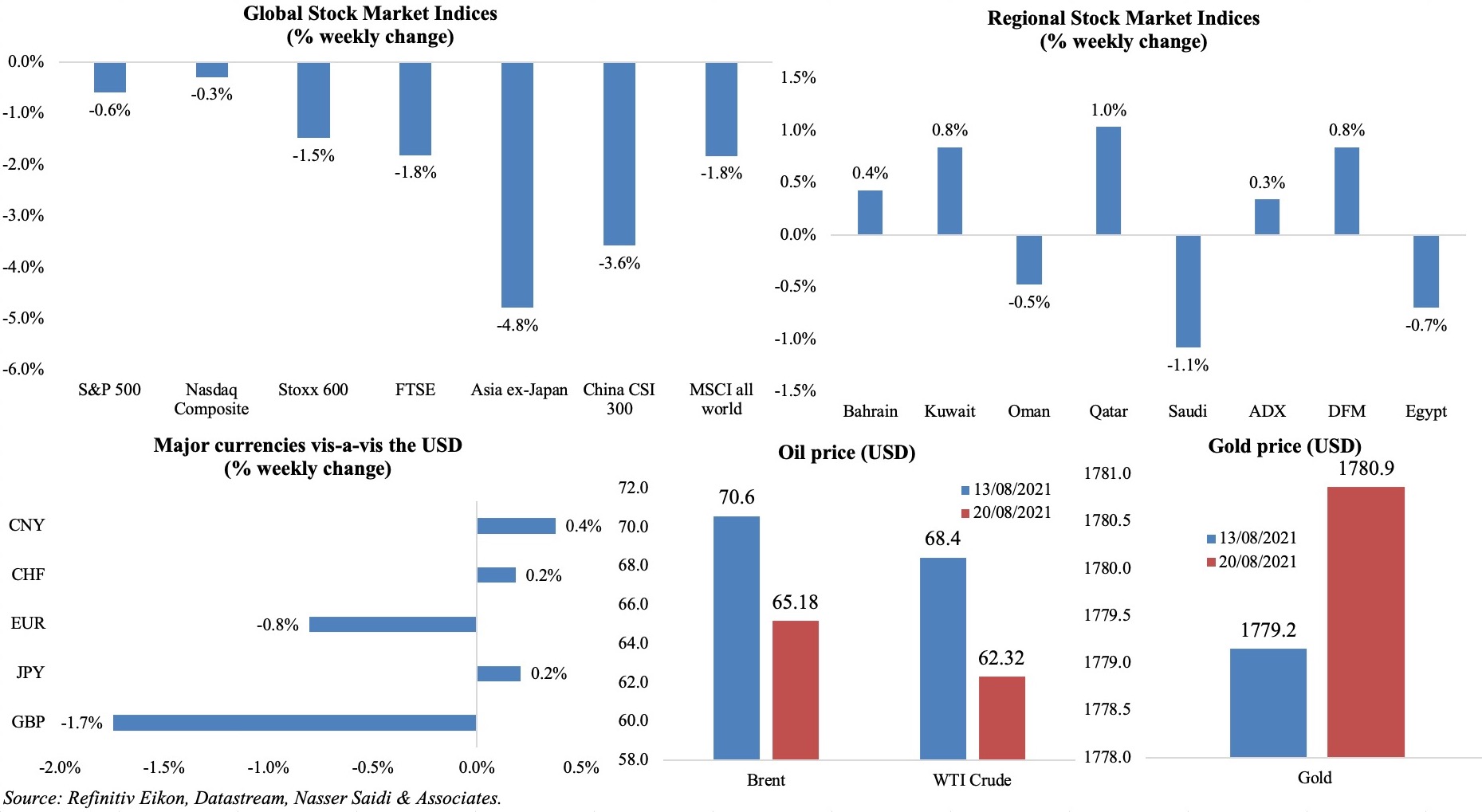

Equity markets had a difficult week as concerns over the Delta variant and potential economic slowdown weighed on sentiment. US indices reported losses and Stoxx600 posted its worst week since Feb. Weak data from China through the week put pressure on Asian markets which closed 4.8% lower vs a week ago and the Hang Seng Index dropped by 5.8%. Among regional markets, Tadawul posted the highest close since Jan 2008 last Sun (11,352) but slipped by 1.1% for the week; banks supported the boost in Qatar equities. The dollar gained by 1% in the week (most in 2 months), GBP slumped to a month-long low versus the greenback and CNY slipped to a new 3-week low of 6.51. Oil prices fell, with Brent closing at USD 65.18 a barrel on Fri: biggest weekly loss in 9 months+. Gold price was up slightly.

Weekly % changes for last week (19-20 Aug) from 12 Aug (regional) and 13 Aug (international).

Global Developments

US/Americas:

- Industrial production in the US inched up by 0.9% mom in Jul (Jun: 0.2%), with gains largely due to the increase in motor vehicle production (+11.2%). Manufacturing output jumped 1.4% last month after falling 0.3% in Jun and remained 0.8% above its pre-pandemic level. Capacity utilization increased to 76.1% (75.4%).

- FOMC minutes indicated that many officials were readying to announce/ implement a taper of the bond-buying programme before year-end. A broad consensus was emerging as to “when” to start tapering.

- Initial jobless claims eased to 348k in the week ended Aug 13th, from 377k the week before, slowing the 4-week average to 377.75k. Continuing claims slipped to 2.82mn in the week ended Aug 6th, down by 79k from the week before.

- Retail sales slipped by 1.1% mom in Jul, following the upwardly revised 0.7% reading in Jun. Online sales dropped by 3.1% and clothing stores reported a 2.6% decline as well though spending at restaurants and bars ticked up by 1.7%. Excluding autos, sales fell by 0.4% from 1.6% a month ago.

- Housing starts in the US fell by 7% mom and 2.5% yoy to 1.534mn in Jul: single-family starts fell by 4.5% to 1.111mn while multi-family segment plunged by 13.1% to 423k. Building permits increased by 2.6% to 1.635mn in Jul, following three straight months of declines: single-family permits fell by 1.7% while multi-family projects surged by 11.2%.

- Philadelphia Fed manufacturing survey index slipped to 19.4 in Aug (Jul: 21.9), the lowest reading since Dec. Employment index meanwhile rose to a record-high of 32.6 (Jul: 29.2).

Europe:

- GDP in the eurozone grew by 2% qoq and 13.6% yoy in Q2, confirming the estimate announced previously. Spain and Italy posted the largest increases, at 2.8% qoq and 2.7% respectively while Germany and France expanded by a more modest 1.5% and 0.9%. Employment in the eurozone increased by 1.8% yoy in Q2, offsetting the 1.8% drop in the prior quarter.

- Inflation in the eurozone ticked up to 2.2% yoy in Jul (Jun: 1.9%), the highest since Oct 2018, with energy prices up by 14.3% while food and services costs rose by 1.6% and 0.9% respectively. Core CPI eased to 0.7% yoy (Jun: 0.9%).

- Producer price index in Germany increased by 1.9% mom and 10.4% yoy in Jul (Jun: 1.3% mom and 8.5% yoy). This is the highest yoy increase since Jan 1975 and was driven by intermediate goods and energy (which rose by 2.3% and 4.1% respectively).

- Inflation in the UK eased to 2% yoy in Jul (Jun: 2.5%), slowing for the first time since Feb. Core CPI eased to 1.8% from 2.3% the month before. Retail price index eased to 0.5% mom (and 3.8% yoy) from 0.7% mom (and 3.9% yoy) in Jun. PPI core output gained: rising to 3.9% yoy (Jun: 3.1%).

- UK’s ILO unemployment rate dropped to 4.7% in the 3 months to Jun, down by 0.2 ppt from the previous quarter. Job vacancies in the UK increased to a record high of above 1mn in May-Jul. Average earnings jumped by 8.8% in the 3 months to Jun (May: 7.4%) including bonuses and 7.4% excluding bonuses.

- Retail sales in the UK unexpectedly fell by 2.5% mom in Jul, the biggest drop since Jan; overall, sales are 5.8% above their pre-pandemic levels. Sales at food and non-food stores were down by 1.5% and 4.4%. Excluding fuel, sales were down by 2.4% mom following an unchanged reading in Jun.

Asia Pacific:

- The People’s Bank of China kept benchmark interest rates unchanged for the 16th straight month: one-year loan prime rate stands at 3.85% and five-year LPR at 4.65%.

- The latest data releases from China showed a sharp slowdown from previous months’ performance: industrial production increased by 6.4% yoy in Jul, easing from 8.3% the month before. Retail sales expanded by 8.5%, also slowly sharply from the 12.1% growth in Jun. Fixed asset investment grew by 10.3% in Jan-Jul, slowing slightly after the 12.6% gain till Jun, and easing in both public (7.1% vs 9.6% in H1) and private (13.4% vs 15.4%) sectors. Covid19 infections and supply chain disruptions (also due to the floods) are affecting businesses and could lead to further slowdowns in Aug.

- Japan’s GDP rebounded at an annualized 1.3% in Q2, after a 3.7% slump in Q1, with private consumption rising by 0.8% qoq (Q1: -1%) and capital expenditure up by 1.7% (Q1: -1.3%). In qoq terms, growth was up by 0.3% following the 0.9% drop the previous quarter.

- Inflation in Japan clocked in at -0.3% yoy in Jul (Jun: -0.5%), partly due to a change in the base year for CPI; excluding food and energy, inflation was down to -0.6% from Jun’s -0.9%.

- Industrial production in Japan grew by 6.2% mom and 23% yoy in Jun (May: -6.5% mom), with production in the auto industry posting a 22.6% increase from a month ago and an 8.9% rise in production machinery.

- Japan posted a trade surplus of JPY 441bn (USD 4.02bn) in Jul, higher than the JPY 384bn the prior month. Exports grew by 37% and imports by 28.5%; Japan posted a trade surplus of JPY 612.88bn with US and a deficit of JPY 56.93bn with China (its largest trading partner).

- Japan’s core machinery orders dropped by 1.5% mom in Jun (May: +7.8%), falling for the first time since Feb. Non-manufacturing orders slowed (3.8% from 10% in May) while manufacturing orders grew faster (3.6% from 2.8%).

- Wholesale price inflation in India eased to 11.16% yoy in Jul (Jun: 12.07%), partly due to the low base effect while food costs remained unchanged compared to a year ago (Jun: 3.09%) and fuel costs slowed (26.02% from 32.83%).

Bottomline: Last week’s weaker Chinese macro data called attention to the slowdown in demand as the country tries to clamp down on the latest bout of Covid19 cases. This week sees the release of preliminary PMI readings for Aug: in all likelihood, supply chain disruptions and delays are going to be a major talking point. Recent closure of the Ningbo Zhoushan port in China (following a Covid19 case) is leading to congestion at several other Chinese ports and an uptick in freight charges (the Freightos Baltic Global Container Index touched a record high of USD 9,770 per forty-foot equivalent (FEU) container last week). This week also sees the annual meeting of central bankers at Jackson Hole: could the Fed signal an easing of its monetary support here? Already, the White House revealed that it will not be pushing for an extension of the pandemic unemployment benefits when it expires Sep 6th claiming “back to work” labour conditions.

Regional Developments

- Budget deficit in Bahrain narrowed to BHD 520mn in H1 2021 (-35% yoy), supported by a 23% pick up in revenues (largely due to the 33% rise in oil revenues) and a 4% drop in expenditures. Overall, revenues (& expenditures) in H1 account for 46.5% (& 45.4%) of the total budgeted for the full year 2021.

- Bahrain’s national-origin exports surged by 62% yoy to BHD 327mn (USD 862mn) in Jul 2021. Saudi Arabia, US and Egypt were the top destinations, together accounting for 48% of overall exports. Imports ticked up by 10% to BHD 418mn with Brazil, China and UAE the top 3 source nations.

- E-services transactions in Bahrain accelerated in H1 this year, growing almost 4-fold to over BHD 200mn. The number of transactions doubled to over 1.6mn during the period.

- Bahrain’s carbon footprint declined by 25% last year, alongside a “slight” improvement in air quality (by 4%), according to a Derasat study.

- Net FDI inflows into Egypt accelerated by 47.3% yoy to USD 1.429bn in Jan-Mar 2021 (Q3 of the 2020-21 financial year). Non-oil net FDI increased by 21.7% to USD 1.911bn.

- Egypt’s external debt touched USD 134.8bn in Mar 2021, rising from USD 11.3in Jun 2020. This jump was a result of the increase in net disbursements of loans and facilities, in addition to depreciation of the dollar. Long-term debt accounted for 90.2% of the total.

- Remittances into Egypt increased by 13% yoy to USD 28.5bn during Jul 2020-May 2021, according to the central bank. In May alone, remittances surged by 45.2% to USD 2.6bn.

- Unemployment rate in Egypt declined to 7.3% in Q2 2021 (Q1: 7.4%): male unemployment stood at 5.4% while female unemployment was 15%.

- Egypt could lose over EGP 31mn daily (and more than EGP 1bn a month) in tourism revenues if it continues to stay on UK’s travel “red list”, according to research by WTTC. UK was the 3rd largest source market for the country, with visitors from the country accounting for 5% of all international arrivals in 2019. It was also disclosed that around 844k jobs were lost in the tourism industry last year.

- Egypt allocated EGP 3.9bn towards social housing projects in 2019-20, according to the finance minister. This compares to EGP 7.8bn towards cash support and public facilities in social housing projects in 2020-21.

- Mobile wallets in Egypt increased by 15.6% yoy to 16.3mn in H1 2021 and overall transactions touched 81mn (+175%), according to the National Telecom Regulatory Authority.

- Egypt aims to build 17 renewable energy-powered desalination plants by 2025: the initiative is estimated to cost USD 2.5bn and each of these plants will be built, owned and operated by Egypt’s sovereign wealth fund in partnership with a group of local and foreign investors, according to the fund CEO, reported Bloomberg.

- Egypt’s sovereign sukuk law has been ratified by the President: the next step is the issuance of executive regulations three months after the law comes into effect.

- Remittances into Jordan inched up by 0.2% yoy to JOD 1.174bn in H1 this year, according to the central bank. Remittances from Qatar into Jordan exceeded USD 220mn, doubling from a year ago; there are about 65k Jordanians in Qatar.

- Tourism revenues in Jordan declined by 44.8% to JOD 441.4mn in H1 2021; this also compares to JOD 1.9bn clocked in pre-pandemic during H1 2019.

- Kuwait’s Cabinet announced that all government departments are to reduce spending by no less than 10% in the current fiscal year (2021-22). Furthermore, the government is considering a maximum threshold (of KWD 3000) for the disbursement of national labour support to private sector employees as well as spending on medical treatments abroad. Separately, Reuters reported that the finance minister offered his resignations days after the set of government measures were announced.

- Following the approval of a “request for the Bank of Lebanon to open a temporary account to cover urgent and exceptional subsidies for fuel”, Lebanon’s cabinet and central bank allocated USD 225mn for the purchase of gasoline, diesel and gas. Subsidies will be totally lifted at end-Sep.

- The Lebanese presidency disclosed that the US would assist with electricity provision. The statement further disclosed that the plan involved provision of Egyptian natural gas to Jordan for generation into additional electricity which would then be transmitted to Lebanon via Syria, as well as facilitating the transfer of natural gas to Lebanon. Financing the cost of gas is being negotiated with the World Bank.

- UNICEF warned, citing the fuel crisis, that more than 4 million people in Lebanon could face a critical shortage of water or be cut off completely within a few days.

- Oman eased its Covid19 nighttime curfew (8pm-4am) from Saturday. From Sep 1, restrictions will be reimposed during those hours on unvaccinated persons. Furthermore, vaccination will be introduced as a necessary condition for visitors into Oman, in addition to the 7-day quarantine requirement.

- Domestic production and import of natural gas in Oman increased by 12.1% yoy to 24.71bn cubic metres by end-Jun, according to NCSI.

- Oman announced that 19,023 job opportunities were created in the government and private sectors in H1 this year: this accounts for 58.9% of the total target for this year.

- Expenditure by Oman’s ministry of health increased by 22.6% yoy to OMR 972.5mn in 2020. Employees in the ministry totaled 38,566 at end-Dec, with an Omanisation rate of 73%.

- Net profits of Moody’s-rated Qatari banks returned to pre-pandemic levels in H1 2021 despite higher levels of provisioning charges. Net profits for these banks grew by 12% yoy and 1% higher than H1 2019 to QAR 11.8bn (USD 3.2bn).

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia slowed to 0.4% yoy in Jul, largely due to the uptick in Jul 2020 when VAT was hiked to 15% (on a monthly basis, prices were up by 0.2%). Transport costs rose by 7.8% and food and beverages increased by 1.2%. However, food costs are now up 8.4% on average this year (till Jul) vs overall inflation at 4.8%.

- Wholesale prices inflation in Saudi Arabia increased to 11.9% yoy in Jul (Jun: 19.76%), as the effect from the Jul 2020 VAT hike dissipates. Other transportable goods, with a weightage of 33.72% and which includes refined petroleum products prices, reported the largest rise in Jul (+20.49%). Rising global prices of metals and electrical machinery are also reflected in the country.

- Industrial production in Saudi Arabia increased by almost 12% in Jun 2021, attributed mostly to the increase in oil production as non-oil manufacturing sector activity dropped by 4.2% yoy and 0.4% mom.

- Saudi Aramco is planning to raise at least USD 17bn from the sale of a minority stake in its gas pipelines – higher than the USD 12.4bn from its oil pipeline deal. Reuters reported that the deal size may include USD 3.5bn of equity and the remainder funded by bank debt.

- Crude oil exports increased for the 2nd straight month in Jun: it grew by 5.6% yoy to 5.965mn barrels per day (bpd). Production rose by 383k bpd to 8.927mn bpd in Jun.

- Saudi Arabia is resuming negotiations for Free Trade Agreements (FTAs) with 11 countries including China, India, Australia, the Philippines and the US among others, reported Okaz paper. The Saudi Exports Development Authority announced that it would identify over 120 international tendering opportunities across target countries, mainly covering construction and industrial supplies and infrastructure projects.

- The Saudi EXIM Bank has accepted more than 81 financing requests worth SAR 9bn (USD 3bn), according to its CEO. The Bank has signed an MoU with the Federation of Saudi Chambers to provide loans and other financial services to exporters and importers.

- Consumer spending in Saudi Arabia increased to SAR 71bn (via 104.7mn transactions) during the week of Aug. 8-14. About SAR 1.3bn was spent on food and beverages, SAR 1.2bn on restaurants and cafes and SAR 1.1bn on “other sectors”.

- Home ownership subsidies in Saudi Arabia, disbursed by the Real Estate Development Fund, touched SAR 29.6bn over 4 years ending Jun 2021. More than 520k families were supported with the funds.

- Cement output in Saudi Arabia dropped by 20% yoy to 3.6mn tons in Jul, in spite of the revival in the real estate sector. Average selling price has declined by 15% compared to last year, according to the Arabian Cement CEO.

- The August 2021 issuance under the Saudi Arabian Government SAR-denominated Sukuk Program has been closed: the size was set at SAR 358bn (USD 3bn). Saudi Arabia had approximately SAR 854bn debt outstanding by year-end 2020, of which 59% are SAR-denominated and 41% in foreign currency, as per the National Debt Management Center.

- Trading in US equities via Saudi CMA licensed institutions fell by 25.4% yoy to SAR 60.65bn (USD 16.17bn) in Q2 2021, falling for the 3rd consecutive quarter. US accounts for about 96.9% of total trades in foreign markets, followed by GCC (1.9%), Arab markets (0.4%) and the rest in Asian markets.

- Saudi Arabia plans to build two renewable energy solar plants (with a capacity of 600MW) on two plots with a total area of 12mn sqms: these will be located in the Third Industrial City in Jeddah and the Industrial City in Rabigh.

UAE Focus![]()

- The UAE central bank has issued new guidelines on anti-money laundering and combatting the financing of terrorism (AML/CFT) to Registered Hawala Providers in the UAE and Licensed Financial Institutions that provide services to RHPs.

- Abu Dhabi announced an end to the partial lockdown, which restricted movement between midnight and 5am. Furthermore, those vaccinated against Covid19 can enter the emirate if they have a “green pass” on the Al Hosn app: this is also applicable for visitors into the country.

- Tourism revenues in the UAE increased by 31.4% yoy to AED 11.3bn in H1 2021. Average hotel occupancy rates increased to 62% in H1 from 53.6% in the same period a year ago.

- After the UK announced UAE’s move to the amber list, in the week from Aug 5-11, flight booking between the two nations surged: to 30% over pre-pandemic levels for tickets from the UAE to the UK, and to 8% over 2019 levels in the opposite direction, according to aviation analytics firm ForwardKeys.

- DP World’s profit surged by 51.8% yoy to USD 475mn in H1 2021. Revenues increased by 21% to USD 4.95bn during the period.

- The 300MW first stage of the 900MW fifth phase of the Mohammed bin Rashid Al Maktoum Solar Park was inaugurated last week: with investments amounting to AED 2.058bn, this phase will provide clean energy to over 270k residences in Dubai and reduce 1.18mn tonnes of carbon emissions annually.

- The Emirati Human Resources Development Council in Dubai will develop a 100-day action plan to enhance the employment of UAE nationals in the private sector. This will include coordination with education sector to link learning with job market requirements as well as partnership measures with companies and free zone entities in the private sector.

Media Review

The Afghan economy in charts: what has changed in two decades?

https://www.ft.com/content/bfdb94a5-654b-4286-8da9-34c0ff3b88aa

Central banks should make clear what QE is for, and then reverse it

Saudi Arabia’s Vision 2030 aims to empower the non-profit sector. Three areas to focus on

The Taliban takeover of Afghanistan: what it means for

US and Afghanistan: https://www.economist.com/leaders/2021/08/21/the-fiasco-in-afghanistan-is-a-grave-blow-to-americas-standing

India & Pakistan: https://www.economist.com/asia/2021/08/21/what-the-taliban-takeover-of-afghanistan-means-for-india-and-pakistan

China: https://www.economist.com/china/2021/08/21/china-is-happy-to-see-america-humbled-in-afghanistan

Powered by: