Markets

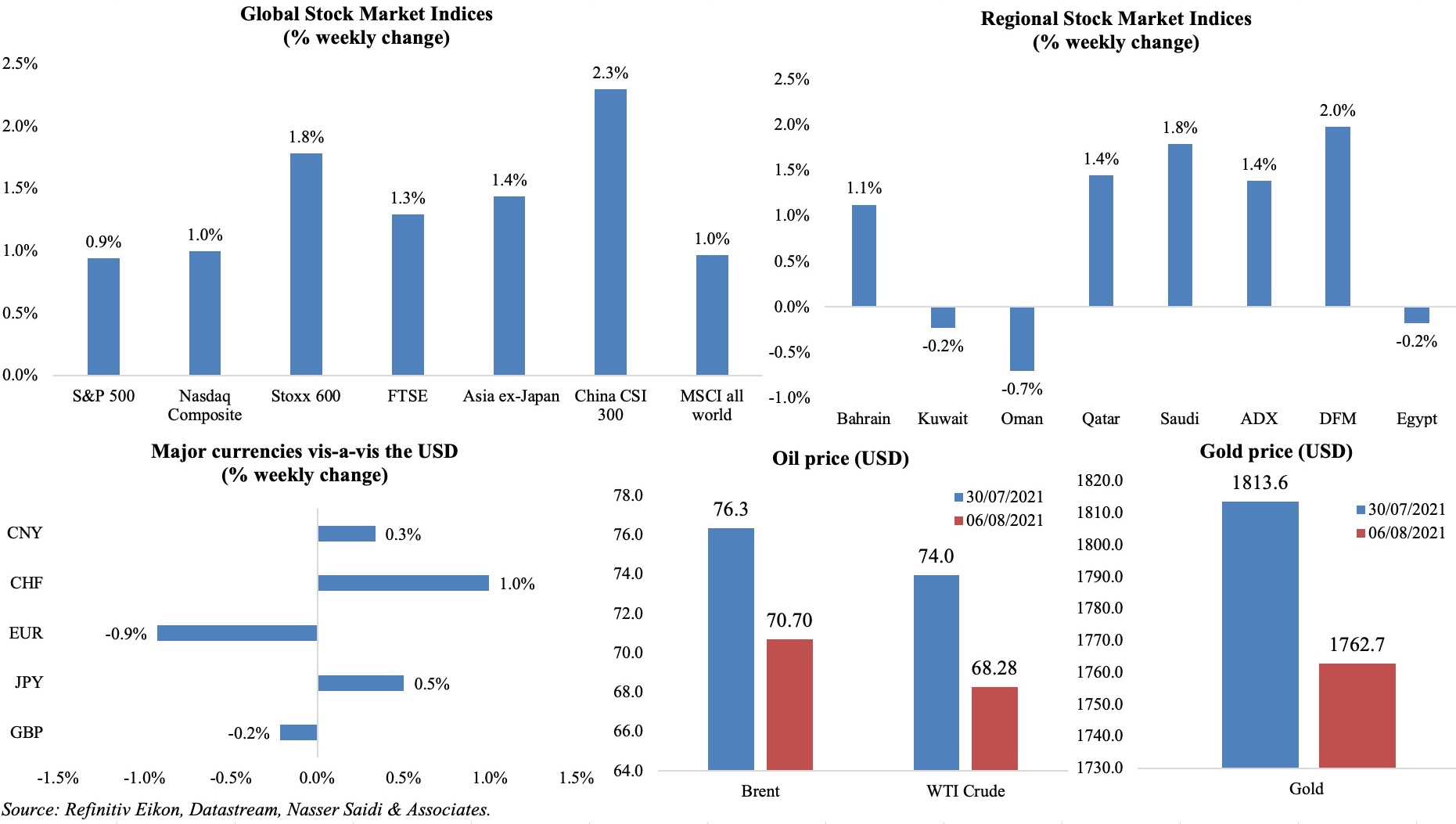

Dow, S&P 500 and Stoxx600 posted record highs at the end of last week, thanks to a strong jobs report in the US and an overall good earnings season; Chinese stocks recorded their biggest weekly gains since late Jun after sharp drops the previous week given the regulatory crackdown. Regional markets had a good run during the week despite rising geopolitical tensions; Abu Dhabi’s exchange hitting a record high early in the week. Among currencies, the dollar index increased especially against safe havens JPY and CHF (biggest gains since Jul) while both EUR and GBP fell. The delta variant worries gained momentum causing oil prices to drop (anticipating a decline in demand for oil): both Brent and WTI prices fell by more than 7%, recording its biggest weekly loss in 4 and 9 months respectively.

Weekly % changes for last week (5-6 Aug) from 29 Jul (regional) and 30 Jul (international).

Global Developments

US/Americas:

- Non-farm payrolls increased by 943k in Jul, above expectations, from an upwardly revised 938k in Jun, posting the fastest pace since Aug 2020. Average hourly earnings increased by 4% yoy in Jul (Jun: 3.7%) while labour force participation rate inched up to 61.7% (the highest level since the pandemic hit) from 61.6% in Jun and unemployment dropped to 5.4% – the lowest level since Mar 2020 – from 5.9% in Jun.

- Initial jobless claims fell to a new pandemic era low of 385k in the week ended Jul 31st from a downwardly revised 399k the week before. Continuing claims plunged by 366k to 2.93mn in the week ended Jul 24th, the lowest since Mar 14th last year.

- ADP employment data showed that private sector jobs increased by 330k in Jul (Jun: 680k), marking the smallest gain since Feb. The biggest job gains for July were unsurprisingly in the leisure and hospitality sector (+139k), followed by education and health (+64k) and professional and business services (+36k).

- Factory orders in the US inched up by 1.5% mom in Jun (May: 2.3%), with transportation equipment leading the gains (2%). Orders for non-defense capital goods, excluding aircraft, rose by a higher7% in Jun instead of 0.5% reported last month.

- ISM manufacturing PMI slipped to 59.5 in Jul (Jun: 60.6), as new orders slowed (64.9 from 66) while employment index posted an expansion (52.9 from 49.9). Services PMI improved to 64.1 from 60.1 the month before, supported by new orders (63.7 from 62.1) and employment (53.8 from 49.3).

- Markit manufacturing PMI inched up to 63.4 in Jul (Jun: 62.1), thanks to an upturn in production linked to booming demand. Services PMI stood at 59.9, in line with the flash estimate of 59.8 but lower than Jun’s 64.6, thanks to strong domestic and foreign demand. Composite PMI was at 59.5 from Jun’s 63.7, with softer new orders growth and substantial inflationary pressures.

- Foreign trade deficit in the US widened to a record high of USD 75.7bn in Jun (May: USD 71bn). A USD 2bn increase in exports was more than offset by a USD 6bn increase in imports in the month.

Europe:

- Factory orders in Germany rebounded by 4.1% mom in Jun (May: -3.2%), thanks to strong domestic orders (+9.6%) while foreign orders inched up by just 0.4%; in yoy terms, overall orders increased by 26.2% (May: 54.9%).

- Industrial production in Germany dropped by 1.3% mom in Jun, following a 0.8% dip the month before, as supply disruptions and shortages continued; IP is now 6.8% below pre-pandemic levels. Vehicle production was down by 0.9% mom and almost a third below pre-pandemic levels.

- Retail sales in Germany expanded by 6.2% yoy and 4.2% mom in Jun, with department stores sales surging by 34% mom while online sales dropped. Compared to Feb 2020, sales in Jun were 9.1% higher in real terms.

- Retail sales in the wider eurozone increased by 5% yoy and 1.5% mom in Jun to a record high, though slowing from the 8.6% yoy and 4.1% mom gain in May. The rise in Jul was largely in non-food products.

- Markit manufacturing PMI for Germany inched up to 65.9 in Jul (Jun: 65.1), thanks to faster growth of new orders and employment (the latter posted the highest ever reading) while the output index fell. Supplier prices rose at a record pace in response to heightened demand and the 12-month outlook was the weakest since last Dec. Services PMI surged to a new record high of 61.8 (Jun: 57.5) on stronger orders and new record rate of job creation while composite PMI also rose to a record high 62.4 (Jun: 60.1).

- Eurozone’s manufacturing PMI stood at 62.8 in Jul (Jun: 63.4), with a broad decrease across national manufacturing PMIs other than in Germany. Services PMI edged up to 59.8 (58.3), posting the highest reading since Jun 2006. Composite PMI rose to a 15-year high of 60.2 (below the flash estimate of 60.6, but higher than Jun’s 59.5), and employment increased at the fastest rate in almost 21 years.

- Producer price index in the eurozone increased for the 13th consecutive month, rising by 10.2% yoy and 1.4% mom in Jun (May: 9.6% yoy and 1.3% mom). Prices rose for energy (+3.3% vs May’s 2.1%), intermediate goods (+1.3%) and capital goods (+0.4%) among others.

- The Bank of England left interest rates unchanged while warning that inflation will rise temporarily to 4% in Q4 2021 and Q1 2022 alongside an upwardly revised growth forecast of 8% (up from the previous forecast of 7.25%).

- Manufacturing PMI in the UK clocked in 60.4 in Jul (Jun: 63.9), with slower rates of expansion in both output and new orders. Services PMI improved for the 5th consecutive month, up to 59.6 (higher than the flash estimate of 57.8, but lower than 62.4 the month before); staff shortages and supply chain issues constrained businesses while inflationary pressures touched a new record high.

Asia Pacific:

- China’s Caixin manufacturing PMI edged lower to 50.3 in Jul (Jun: 51.3) – the lowest reading since Apr 2020 – with new orders falling for the first time since May 2020 while output grew the least in 16 months. Caixin services PMI increased to 54.9 in Jul (Jun: 50.3), supported by an acceleration in new orders and an increase in employment.

- China’s exports grew for the 13th consecutive month by 19.3% yoy to USD 282.66bn in Jul, though slowing from Jun’s 32.2% rise. Imports accelerated for the 10th straight month, rising by 28.1% to USD 226.08bn, and overall trade surplus widened to USD 56.58bn. Trade surplus with the US rose to USD 35.4bn in Jul (Jun: USD 32.58bn).

- Foreign exchange reserves in China rose by USD 21.88bn to USD 3.236trn last month while the value of gold reserves rose to USD 114.37bn at end-Jul (Jun: USD 110.45bn).

- Japan’s leading economic index increased to 104.1 in Jun (May: 102.6), the highest reading since Feb 2014. The coincident indicator increased to 94 from 92.1 the month before.

- Manufacturing PMI in Japan increased to 53 in Jul (Jun: 52.4), thanks to faster growth in both output and new orders; employment continued to expand for the 4th consecutive month. Meanwhile, input cost inflation accelerated to the fastest pace since Sep 2008, due to a faster rise in raw material prices.

- Inflation in Tokyo stood at -0.1% yoy in Jul (Jun: 0%); excluding fresh food, CPI unexpectedly inched up to 0.1% as electricity costs stabilized and newspaper prices rose.

- Overall household spending in Japan unexpectedly fell by 5.1% yoy in Jun (May: 11.6%), as firms cut bonuses and domestic demand remains weak. Separately, wages fell 0.1% yoy in Jun, marking the first annual decline in four months after a 1.9% rise in May.

- The Reserve Bank of India held rates steady – repo rate at 4% and reverse repo at 3.35% – while policy stance continues to be “accommodative”. The RBI revised its inflation forecasts upward to 5.7% recognising the recent inflation spikes, while growth forecast was maintained at 9.5% for 2021-22 (ending Mar) though aggregate demand was still considered weak.

- India’s composite PMI moved up to 49.2 in Jul (Jun: 43.1), given a rebound in production (up to 55.3 from 48.1 in Jun, as all sub-indices moved to expansion territory, as did employment) though services activity contracted (at a softer pace). Employment dropped for the 17th month in a row while new orders fell for a 3rd straight month, given the pandemic and local restrictions.

- Singapore’s manufacturing PMI edged up to 51 in Jul (Jun: 50.8), in expansionary territory for the 13th straight month, and posting the highest reading since Dec 2018.

- Retail sales in Singapore increased by 1.8% mom and 25.8% yoy in Jun, rising from a low base in 2020. Excluding motor vehicles, retail sales was up by 0.4% mom and 19% yoy.

Bottomline: Overall, the global economy continued on its recovery path -albeit at different rates with Europe now catching- during Q2, despite the Delta Covid variant. The JPMorgan global manufacturing PMI expanded for the 13th month, though inching down to 55.4 in Jul (Jun: 55.5). PMI numbers weakened in China and US (Covid19 daily cases reached the highest in the current outbreak in China and a 6-month high in the US), while Europe remained a success story, witnessing a surge in activity after lifting of Covid19 restrictions amid strong domestic and overseas demand even though logistics delays persisted, and inflationary pressures remained elevated. Covid19 surges in many ASEAN nations is likely to prolong supply chain delays: factories are likely to remain closed (e.g. China, Thailand, Vietnam to name a few) as governments try to contain the spread of the virus variant.

Regional Developments

- The World Bank forecasts growth in the GCC at 2.2% this year, and an average annual growth of 3.3% in 2022-23, after contracting by 4.8% in 2020. Highlighting the urgency for diversification, the World Bank also expects Bahrain, Kuwait and Oman (with the largest fiscal deficits in 2020) to remain in deficit till 2023.

- Bahrain issued a new decree amending discrimination in the wages between male and female workers in jobs of the same value across the country, a move to support gender equality.

- The new edict 40 of 2021 in Bahrain specifies the commercial activities that companies with foreign capital can be licensed to participate in.

- Egypt’s central bank left interest rates unchanged at the latest meeting, for the 6th consecutive time: overnight lending rate at 9.25% and the overnight deposit rate at 8.25%. The bank stated that GDP grew 2.8% in the 2020-21 fiscal year, down from 3.6% the previous year and that an “unfavorable base effect” would continue to affect annual inflation rates.

- PMI in Egypt fell to 49.1 in Jul (Jun: 49.9), as new orders sub-index fell to below-50 and output fell for the 7th time in 8 months. The only silver lining was the uptick in employment, rising for the first time since Oct 2019.

- Domestic liquidity in Egypt increased by 1.9% mom and 18.3% yoy to EGP 5.36trn (USD 213.9bn) as of end-Jun. Money supply rose to EGP 1.25trn in Jun, from EGP 1.22trn in May. Net foreign reserves inched up by 0.06% mom to EGP 40.609bn.

- Egypt’s President called for an increase in the price of subsidised bread, without specifying either the cost or the timing, stating that “it’s incredible to sell 20 loaves for the price of a cigarette”. Later, the supply minister stated that the ministry would begin to study raising the price of bread, and its results would be presented to the cabinet “as soon as possible”.

- The wheat imports bill declined by 13% this year, revealed the Egypt’s supply minister. The nation has increased its milling capacity to 3.4mn tonnes and aims to reach 5mn, according to the minister, who also stated that reserves were sufficient for 6.5 months of consumption.

- Hotel occupancy in Egypt is expected to range between 43-57% in 2021, according to Colliers. Within the country, tourism hotspots like Hurghada and Sharm El-Sheikh will see occupancy at 51% and 43% respectively while Cairo’s is forecast at 49%.

- An Iraqi official revealed that the first phase of Iraq’s power link with Kuwait (as part of the joint GCC power network) will be completed in mid-2022 and another project to connect with Jordan will be completed within 26 months (this would supply Iraq with 150 MW of electricity, to be increased to 960 MW in a second phase).

- Jordan’s trade surplus with the US stood at JOD 142mn until end-May. Exports to the US increased by 17% to JOD 535.6mn while imports inched up by only 0.2%.

- The real estate trade volume in Jordan increased by 6% to JOD 2.602bn in Jan-Jul 2021 vs the same period in 2019.

- Total foreign assistance committed to Jordan reached about USD 301mn in H1 2021, according to the ministry of planning and international cooperation. Of this, grants totalled USD 265mn and concessional loans stood at USD 36mn.

- Kuwaiti employees in the oil sector who hold a petroleum engineering degree has reached 1,150 versus 97 expats (with the similar degree), reported Al-Anba daily.

- Kuwait Ports Authority approved a proposal to build Middle East’s first city to serve electric vehicle manufacturers, with the tendering process expected during the current fiscal year.

- PMI in Lebanon slipped further to 47 in Jul (Jun: 47.5), as domestic demand continued to suffer amid the economic turmoil. Output and new orders were in contractionary territory while liquidity issues led to cost pressures; the saving grace was the increase in new export orders, up for the first time since mid-2015.

- An international donors’ conference raised USD 370mn on the anniversary of the Beirut port blast. Macron, in his opening remarks clearly stated that “There will be no blank cheque for the Lebanese political system”. About USD 280mn raised at last year’s conference was distributed via NGOs and aid groups, and the new aid will be unconditional (the USD 11bn raised in 2018 is still unused and is conditional on rolling out reforms).

- In March 2021, 78% of the Lebanese population (3mn people) was estimated to be in poverty, according to a new study published by the UN Office for the Co-ordination of Humanitarian Affairs. The report also cites that extreme poverty (or food poverty) increased threefold from 2019 to 2020, rising to 23% from 8%.

- Oman adjusted the recently hiked electricity tariffs to ease cost burdens: the consumption categories were expanded and applied retroactively for May and June. Consumers paying a tariff of 12 (or 16) baisas per kilowatt/hour (kw/h) will now be able to get up to 4,000 (or 6,000) kw/h of electricity, up from a previous cap of 2,000 (or 4,000) kw/h.

- Qatar PMI increased to 55.9 in Jul (Jun: 54.6), the 4th highest figure on record. Total business activity rose at the fastest rate since Aug 2020 and the 3rd-strongest recorded to date.

- Financial wealth in the GCC stood at USD 2.2trn in 2020 and is forecast to touch USD 2.7trn in 2025, according to BCG. Saudi Arabia, which represents 45% of GCC wealth, grew by 4.1% on annual basis to USD 1trn in 2020 (84% of which is investable wealth). UAE’s financial wealth touched USD 600bn in 2020 (+3% CAGR annually from 2015, 69% of investable wealth) while Oman’s stood at USD 64bn (+3.8% growth, 49% investable wealth).

Saudi Arabia Focus

- Saudi Arabia’s PMI eased to 55.8 (Jun: 56.4), on weaker growth in output, new orders and employment. The PMI readings have stayed above 50 for the 11th straight month. Respondents mention improvements in demand given competitive pricing.

- Net foreign assets in Saudi Arabia increased by over 2% mom to SAR 1.65trn in Jun, according to the central bank. Investments in foreign securities, which account for 61% of its total assets rose nearly 8% yoy to SAR 125trn in Jun.

- While ATM transactions in Saudi Arabia declined by 4% yoy in H1, e-commerce transactions are still rising, having almost doubled in H1 2021 compared to the same period a year ago. Point-of-sale transactions in Jun increased the most (in yoy) within the “hotels” and “restaurants and cafes” categories. Big-ticket items like electronics and jewelry declined in yoy terms, given the impact of big purchases in Jun 2020 (ahead of the tripling of VAT).

- Saudi banks have lent SAR 77bn in H1 2021 for new residential mortgages for individuals, up from USD 60bn in the same period a year ago. Credit to the private sector has accelerated by an average of near 15% yoy in H1, rising in line with the pre-pandemic pace.

- The Saudi Zakat, Tax and Customs Authority registered over 543k transactions related to the Real Estate Transaction Tax since its implementation in Oct 2020, revealed the Saudi Press Agency.

- The real estate price index in Saudi Arabia rose by 0.4% yoy in Q2 2021: residential real estate prices edged up by 0.8% while commercial and agricultural property prices dipped by 0.5% and 0.2% respectively.

- A report by Fintech Saudi found that only 18% of Saudis aged between 16 and 22 years use cash, while almost half of people who are 60 and above use cash till date.

- The Saudi Capital Market Authority received record IPO requests recently (30), revealed the chairman of the CMA. He also revealed that more than SAR 20bn in foreign investments has entered Tadawul since it was included in global indexes. The CMA has a target to list 20 new companies in 2021 on the Saudi index and has already achieved half of this target in H1.

- Tanmiah Food Company listed on the Saudi Exchange following a successful IPO: the sale of 30% of its share capital raised a total of SAR 402mn (USD 107.2mn).

- Saudi Arabia raised the September official selling prices for the flagship Arab light crude to USD 3 a barrel above the Oman/Dubai average for Asia, revealed Aramco.

- International flights from Saudi Arabia dropped by 66.5% yoy to 53,537 in 2020, according to the General Authority of Civil Aviation. Domestic flights also fell by 46.6% to 120,395 in 2020.

- Saudi Ports Authority disclosed that it had handled 3.6mn TEU in H1 2021, up by 5.18% yoy. Transshipment containers increased by 24.49% to 1.4mn TEU, while it handled a total of 138mn tons of cargo.

- Saudi Arabia started the trial of the first wind turbine in the Dumat Al-Jandal wind farm: once fully operational, it will reduce CO2 emissions by nearly 1mn tons annually and supply 72k homes with clean energy.

- The Public Pension Agency in Saudi Arabia, which invested in 77 Tadawul-listed firms among others, reported 9.5% returns on its investments in 2020.

- Saudi Arabia announced that vaccinated foreign pilgrims will be allowed to perform the Umrah starting from Aug 9th, with an initial capacity of 60k per month – to be increased every month to upto 2mn.

UAE Focus![]()

- UAE’s PMI jumped to a 2-year high of 54 in Jul (Jun: 52.2), on strong output and new orders readings while employment rose at the fastest pace since Jan 2019. Domestic demand played a significant role in the recovery. In spite of optimism about Expo and easing of restrictions, overall business expectations declined month-on-month in July for the first time in eight months.

- Non-oil foreign trade grew by 10% yoy to AED 354.4bn (USD 96.48bn) in Q1 in Dubai, according to Dubai Customs.

- Dubai’s external trade with Korea reached AED 3.238bn (USD 882mn) in Q1: imports stood at AED 2.551bn while exports were at AED 549.782mn during the period.

- Dubai International Airport is targeting 8% yoy growth in passenger traffic this year to 28mn (and compares to 86.4mn in 2019). The airport expects a surge in passenger traffic as the flight ban applied to passengers from 12 countries (including India) has been partially overturned: those with valid residence visa and were fully vaccinated in the UAE can return. Furthermore, being moved on to the amber list in the UK will also see an increase in passenger traffic. India and UK were among the top 3 source nations in 2019 and Covid19-hit 2020, accounting for almost 2mn (2020: 865k) and 1.2mn (2020: 392k) visitors into Dubai respectively.

- A total of 31k licenses were issued by Dubai Economy’s Business Registration and Licensing sector in H1 this year, an acceleration by 77% yoy.

- According to the Dubai Land Department’s real estate market performance report, total real estate transactions during Jan-Jul grew by 43% to 46,038 while value of transactions expanded by 68% to AED 163bn.

- UAE approved the Sinopharm vaccine for children aged 3 to 17 year olds, after clinical trial with 900 children.

- ADNOC disclosed its partnership with Fertiglobe to sell its first cargo of blue ammonia to Itochu in Japan, for use in fertilizer production. Separately, Reuters reported that TAQA is closing in on a deal to sell some light oil and natural gas-producing assets in Alberta and British Columbia to privately-owned Blue Sky Resources Ltd.

Media Review

How climate targets compare against a common baseline

The Dangers of Endless Quantitative Easing

The US has spent more than $2 trillion on the war in Afghanistan

Strong growth in US jobs, but labour market remains well short of normal: PIIE

China’s nanny state: why Xi is cracking down on gaming and private tutors

https://www.ft.com/content/1a7476ee-bcd4-45ac-a165-3418e2de286a

Powered by: