Markets

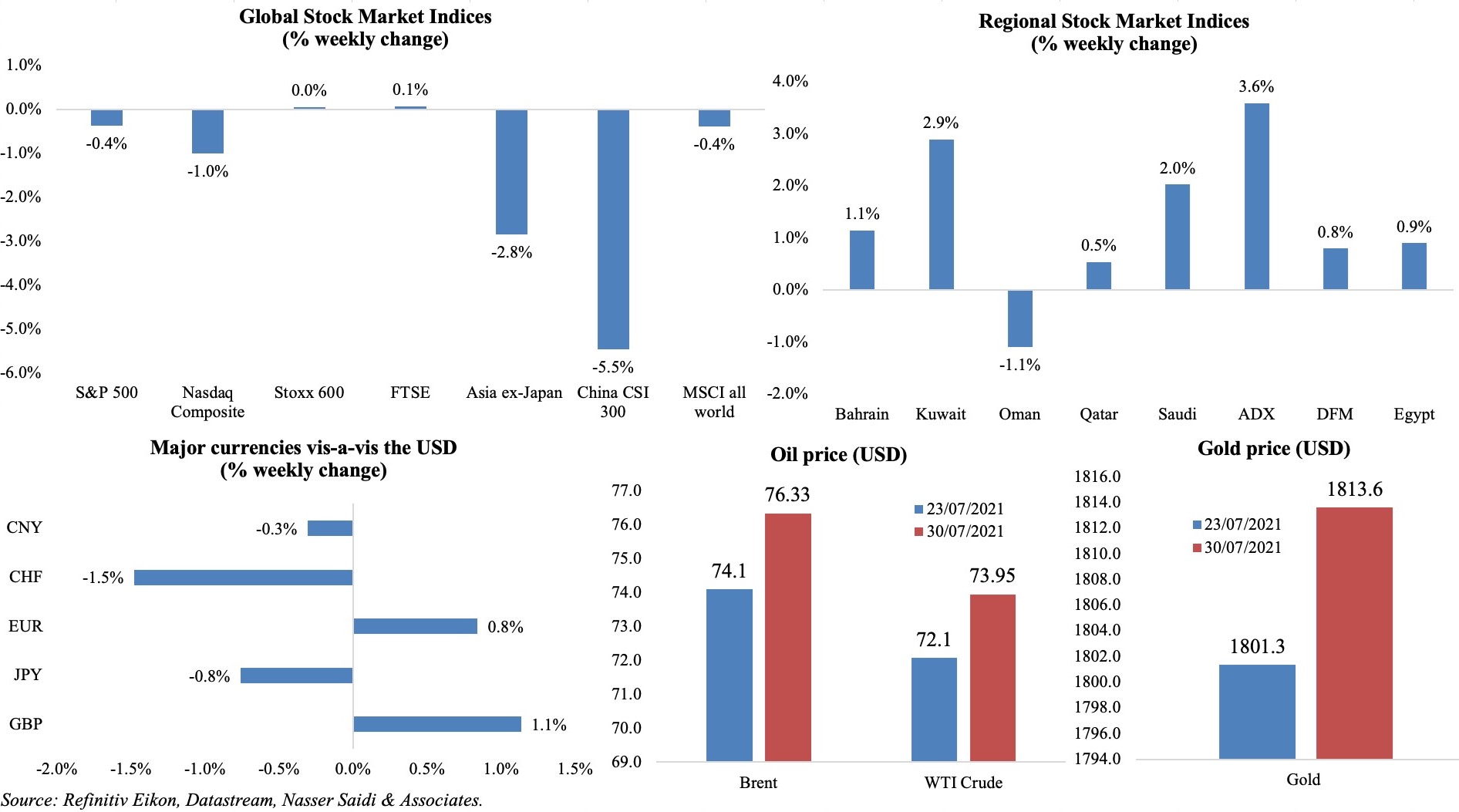

Equity markets had a tough week in spite of strong corporate earnings results, as concerns grew about global growth and China’s ongoing regulatory crackdown (on its education and tech sectors); Stoxx600 rose for the 6th straight month in Jul though staying flat compared to a week ago; MSCI’s global index was down by 0. 4%. Regional markets were mostly up, supported by good earnings results; Abu Dhabi’s equity index touched a record high on Thurs. The dollar hit a 1-month low on Thursday and posted its worst week since May 9th; the euro posted near a 1-month high after EU GDP data was released. Both oil and gold prices increased from a week ago.

Weekly % changes for last week (29-30 Jul) from 22 Jul (regional) and 23 Jul (international).

Global Developments

US/Americas:

- Fed interest rates were left unchanged, as widely expected, while also leaving its bond-buying plans unchanged.

- US GDP increased by an annualized 6.5% in Q2 (Q1: 6.3%), thanks to higher personal consumption (+11.8%) while gross private domestic investment fell 3.5% (dragged down by a drop in residential investment). Personal savings rate tumbled to USD 1.97trn from USD 4.1trn in the previous period. Rising inflation was also evident: PCE price index increased to 6.4% (Q1: 3.8%) while core PCE ticked up to 6.1% (Q1: 2.7%).

- Consumer spending rebounded by 1% in Jun, following the 0.1% dip in May; spending on services increased by 1.2%, thanks to spending at restaurants and hotels, while spending on goods rose by 0.5%. Personal income gained 0.1% in Jun (May: -2.2%) as transfers from the government declined. The saving rate fell to 9.4% from 10.3% in May.

- US durable goods orders inched up by 0.8% mom in Jun, slowing down from May’s 3.2% rise. Non-defense capital goods orders excluding aircraft grew by a marginal 0.5% in Jun, after posting a similar gain in May. Excluding transportation, new orders edged up 0.3% only.

- S&P Case Shiller home price indices increased by 17% yoy in May (Apr: 15%), given strong demand alongside weak supply.

- New home sales unexpectedly declined by 6.6% mom to a seasonally adjusted rate of 676k units in Jun – the lowest level since Apr 2020 affected by high home prices. In yoy terms, sales tumbled by 19.4% – the first annual decline since the pandemic. Separately, pending home sales declined by 1.9% mom.

- The Dallas Fed manufacturing business index slowed to 27.3 in Jul (Jun: 31.1). However, manufacturing production remains strong: the Texas Manufacturing Outlook Survey increased to 31.0 in Jul from 29.4 in Jun.

- Trade deficit widened to USD 91.2bn in Jun (May: USD 89.2bn), as imports of goods (+1.5% to USD 236.7bn) outpaced exports (+0.3% to USD 145.5bn).

- Initial jobless claims eased to 400k in the week ended Jul 24th, near a pandemic low, from an upwardly revised 424k the week before. Continuing claims inched up to 3.269mn in the week ended Jul 17th. Separately, employers posted a record 9.2mn job openings in May, with many businesses stating that they are not able to find workers.

Europe:

- GDP in the eurozone expanded by 2.2% qoq and 13.7% yoy in Q2 (Q1: -0.3% qoq and -1.3% yoy). Portugal (+4.9%), Austria (4.3%) and Latvia (3.7%) registered the highest quarterly growth rates.

- Germany’s Q2 GDP increased by a lower-than-expected 1.5% qoq and 9.2% yoy (Q1: -2.1% qoq and -3.1% yoy), “mainly due to higher household and government final consumption expenditure”. GDP was still 3.4% below the pre-crisis level in Q4 2019.

- Inflation in the eurozone edged up to 2.2% yoy in Jul (Jun: 1.9%) – higher than the ECB’s 2% target – while core CPI eased to 0.7% (Jun: 0.9%). The price increase was largely due to energy costs (+14% in Jul) as well as food, alcohol and tobacco (+1.6%).

- The harmonized index of consumer prices in Germany increased by 0.5% mom and 3.1% yoy in Jul (Jun: 0.4% and 2.1%). This is the highest level since 2008, and was driven up by higher costs for clothing, food and recreation.

- German IFO business climate index fell to 100.8 in Jul (Jun: 101.7) and so did expectations (101.2 from 103.7); however, the current assessment improved by 0.7 points to 100.4. The manufacturing sub-index fell for the 4th consecutive month, though companies’ assessments of the current situation rose to their highest level since Aug 2018.

- Unemployment rate in Germany nudged down to 5.7% in Jul (Jun: 5.9%); the number of people in employment in Germany rose by 78,000 in Jun – the biggest increase since the pandemic. Unemployment rate in the wider eurozone also fell to 7.7% in Jun (May: 8%): some 14.9mn people were unemployed in the EU in June, including 12.5mn in the eurozone. Youth unemployment also declined to 17.3% from May’s 17.9%.

- Consumer confidence in the eurozone declined to -4.4 in Jul, down from Jun’s 3.5 year high of -3.3. Business climate however improved to 1.9 from 1.7. Additionally, economic confidence hit a record high in Jul (119 from 117.9 in Jun) driven by rising sentiment in the industrial and service sectors.

Asia Pacific:

- China’s NBS manufacturing PMI dropped by 0.5 points to 50.4 in Jul, posting the weakest pace of increase since the contraction in Feb 2020. Export sales declined the most in 3 months (47.7 vs 48.1) while employment shrank for the 4th consecutive month. Non-manufacturing PMI fell to a 5-month low of 53.3 in Jul: new orders fell for the 2nd straight month (49.7 from Jun’s 49.6), employment fell (48.2 vs 48) and export orders dropped for the 4th consecutive month (47.7 from 45.4).

- Japan’s manufacturing PMI slipped to 52.2 in Jul, from the final reading of 52.4 in Jun, posting the weakest pace of expansion, with both output and new orders at 6-month lows.

- The leading economic index in Japan eased to 102.6 in May (Apr: 103.8); coincident index also decreased to 92.1 from 95.3 the month before.

- Japan’s industrial production surged by 22.6% yoy and 6.2% mom in Jun, thanks to a recovery in production of autos (+22.6%) and production machinery, including semiconductor-making equipment (+8.9%).

- Unemployment rate in Japan dropped to 2.9% in Jun (May: 3%), improving for the first time since Mar. The job availability ratio increased to 1.13 from 1.09 for the previous month.

- Retail trade in Japan increased by 3.1% mom and 0.1% yoy in Jun (May: -0.3% mom and +8.3% yoy). In yoy terms, sales softened for motor vehicles (11.9% vs May’s 4%), fuel (25.9% from 34.8%) and medicine & toiletry (0.8% from 2.1%). Large retailers’ sales slipped by 2.2%.

- Korea’s GDP edged up by 0.7% qoq and 5.9% yoy in Q2, posting the fastest GDP growth in a decade (since Q4 2010). The increase was largely due to a rebound in private consumption and government spending.

- Exports from South Korea accelerated for the 9th consecutive month, rising by 29.6% yoy in Jul (Jun: 39.8%), thanks to overseas demand for chips and bio-health products. Imports surged by 38.2% from a year ago (Jun: 40.7%).

- Singapore industrial production fell by 3% mom in Jun, though excluding the volatile biomedical manufacturing, production was up by 0.7%. In yoy terms, IP grew for the 8th consecutive month, rising by 27.5% supported by a low base (May: 27%).

Bottomline: The latest update of the IMF’s World Economic Outlook forecasts global growth at 6% this year (unchanged from the Apr 2021 estimate). However, the underlying forecasts show greater divergence: an uptick in advanced nations growth estimates (+0.5 ppt from Apr 2021 forecast) was offset by a 0.4 ppt drop in emerging markets growth. Among the latest Q2 GDP data releases, most European nations (except Germany) beat expectations though supply chain and Delta variant risks remain a concern; additionally, the improvements in the labour market (lower unemployment rates) could add to some inflation risk in the medium-term. Though US GDP report was below consensus, the level of real economic output is back to pre-pandemic levels (a big plus) and consumer spending continues unabated; once again, inflationary pressures are building up though the Fed is still judging it to be “transitory”. The Bank of England meets this week: given the Delta variant and cases in the UK (though vaccines are effective against hospitalization), it seems unlikely that any decision on ending the QE program will be announced.

Regional Developments

- The IMF, in its latest World Economic Outlook, forecasts the Middle East and North Africa region to grow at 4% this year and at 3.7% in 2022. Saudi Arabia, meanwhile, is estimated to grow by 2.4% (revised down due to subdued oil production) and 4.8% (revised up) this year and next respectively.

- Bahrain plans to provide booster shots for 80% of those aged 40 and above.

- Egypt’s government revenues grew by 12.2% yoy and expenditures grew by 9% in the fiscal year 2020-21: tax revenues increased by 12.8%. Primary surplus stood at EGP 93.1bn (1.4% of GDP) in the year while deficit fell to 7.4% from 8% in 2019-20.

- Debt to GDP ratio in Egypt fell to 90.6% in 2020-21, from 108% in the 2016-17 fiscal year. Cost of debt service was lowered to 36% of total spending in 2020-21 (vs 40% in 2019-2020).

- Total government investments implemented in Egypt in 2020-21 grew by 50.5% to EGP 289bn, according to the minister of finance.

- Egypt’s food industry exports expanded by 13% yoy to USD 2.052bn in H1 2021, according to the Egyptian Export Council for Food Industries.

- Moody’s affirmed the long-term foreign and local currency issuance ratings for Egypt at B2, with a stable outlook, citing “government’s track record of economic and fiscal reform implementation” while warning about “continued exposure to volatile financing conditions driven by weak debt affordability and high gross borrowing requirements”.

- Non-performing loans in Kuwait increased by 43% in 2020, according to the central bank, mostly originating in the real estate sector. However, NPL ratio remained at just 2%. Separately, the governor called for an “urgent need for economic reforms”, to “address all imbalances”, without mentioning any specific reforms.

- The Central Bank of Kuwait issued bonds and related Tawarruq worth KWD 200mn (USD 664.72mn) in Jul; it compares to KWD 280mn worth debt instruments offered in Jun.

- Kuwait removed its 8pm commercial curfew from Tuesday last week; further restrictions were eased as well, allowing for all activities to resume from Sep 1 except for large gatherings (conferences, weddings, social events). Vaccinated persons will be permitted to take part in all activities from Aug 1, whereas unvaccinated will be allowed only to pharmacies, consumer cooperative societies, and food and catering marketing outlets.

- Lebanon’s Najib Mikati has been designated as PM-elect, after securing 72 out of 118 votes from the MPs.

- Electricité du Liban warned that Lebanon may face total blackout very soon if funds were not provided for the purchase of fuel oil for power plants, necessary spare parts and to carry out urgent maintenance work on all facilities.

- Only vaccinated persons or those that have taken antibodies tests will be allowed entry to restaurants, cafes, pubs and beaches in Lebanon, according to the tourism ministry.

- Businesses in Oman will need to provide cashless payment options to customers from Jan 1st 2022 onwards. Towards this end, PoS devices were issued for merchants free of installation fees or monthly/ annual charges.

- The number of commercial activities registered at Oman’s Ministry of Commerce, Industry and Investment Promotion (MoCIIP) grew by 31.09% yoy to 5,811.

- Total revenues of Omani hotels fell by 35.8% yoy to OMR 37mn in H1 2021 within 3 to 5 star categories. Overall occupancy rates remained low at 34% in H1 2021 (H1 2020: 32.4%).

- With a 7-day average of close to 1000 cases, Oman announced an extension of the nightly lockdown (from 10pm to 4am) until further notice. Capacity in shopping complexes and restaurants will continue to be restricted at 50%. Vaccination rates are relatively low, with only 7% of the eligible population having received 2 doses and 24% with at least 1 dose.

- Qatar approved an electoral law, paving the way for its first legislative election in Oct, when two-thirds of the Shura Council can be elected. Candidates need to be at least 30 years old and campaign spending is capped at QAR 2mn (USD 550k).

- The decline in revenue passenger-kilometres (RPKs) in Middle East airlines eased to 79.4% in Jun 2021 vs Jun 2019, according to IATA. Overall global RPKs eased to 80.9% (from 85.4% in May 2021).

- Many Gulf cities feature among the fastest 5G cities globally, according to Ookla: Abu Dhabi was the fastest Gulf capital and 3rd globally (with a median download speed of26 Mbps), followed by Doha (413.40 Mbps) while Riyadh was 6th fastest globally (384.66 Mbps), in a list topped by Oslo (526.74 Mbps) and Seoul (467.84 Mbps).

Saudi Arabia Focus

- Saudi Arabia’s oil exports increased by 147% yoy to just over SAR 60bn (USD 16bn) in May while non-oil exports rose by 70%; overall merchandise exports increased by 120.1% yoy – largely due to the low base last year. Share of oil exports to overall exports jumped to 73.2% in May 2021 (vs. 65.3% in May 2020). Saudi exports to China accounted for 21.4% of total exports, followed by India and Japan, with 9.3% and 7.5% respectively of all Saudi exports.

- Saudi Arabia signed an agreement with government entities to support localization efforts in the financial sector, likely to create more than 200k jobs. Meanwhile, Okaz/ Saudi Gazette, citing “well-informed sources”, reported that finance and insurance sectors are planning to implement total Saudization by replacing almost 91k expats.

- Fitch revised 6 Saudi banks’ credit outlooks to stable from negative and affirmed ratings at BBB+.

- Saudi Arabia announced a new Centre for the Fourth Industrial Revolution (4IR) to advance discussions on the use of 4IR technology (like 5G and AI). The investments in 4IR are expected to reach USD 200bn in the country, while the use of advanced 4IR technology is expected to generate around USD 1trn in new revenue streams.

- A USD 15bn private-public partnership technology fund was announced by Saudi Arabia’s vice minister of the Ministry of Communications & Information Technology.

- The privatization of Saudi Arabia’s Ras Al Khair Desalination and Power Plant has been suspended amid a review of strategy. Seven pre-qualified companies were invited to submit bids to be part of the privatization process (to own 60% of the project company) last Jan.

- Mortgage lending in Saudi Arabia increased 27% yoy in Jan-May, while interest rates decreased to between 1% and 4.9% (from 6% early last year).

- Saudi Arabia’s Sakani housing program beneficiaries received SAR 734mn (USD 7mn) from the Ministry of Municipal and Rural Affairs and Housing and The Real Estate Development Fund in Jul, up 25% yoy.

- Fitch has revised Saudi Aramco’s outlook to stable from negative, given the uptick in oil prices and expectations of improved demand for oil as vaccination drive progresses globally.

- The volume of investment in Saudi Arabia’s confectionery industry reached SAR 35mn (USD 3mn) into 1066 factories as of July 15, 2021.

- Saudi Arabia’s National Energy Services Company (Tarshid) plans to reduce energy consumption, and save 8 terawatts and SAR 5bn annually, resulting in overall savings of SAR 25bn (USD 6.6bn) by 2030. Retrofitting buildings and streetlights as well as use of renewable energy (including rooftop PV) are services being offered.

- Reuters reported that Saudi Arabia is expected to raise prices across various grades of crude oil it sells to Asia in Sep following a 17-month high in Aug.

- Saudi Arabia topped MSCI’s emerging markets league table, being the best performer since 2020.

- A study by the Saudi Capital Market Authority found that there were 128 CEO resignations from 97 companies listed on the Tadawul’s main and parallel markets over the past five years e. an average of about 25 a year. However, in the past 6 months, 26 CEOs resigned.

- Saudi Arabia will be open to vaccinated tourist visa holders from Aug 1st onwards, according to the Tourism Ministry. Accepted vaccines include Pfizer, Astrazeneca, Moderna and Johnson & Johnson. Separately, a 3-year travel ban will be imposed on citizens who travel to ‘red list’ countries, according to the state news agency.

UAE Focus![]()

- Cutting business costs to support businesses: Abu Dhabi lowered business set-up fees by 94% to reduce fees to AED 1000; new fees are applicable to 6 activities within business license while all federal fees will continue to apply. In Dubai, fees for 88 government services were either reduced or cancelled, in a bid to lower living costs: this includes fees at the Dubai Maritime City Authority, Dubai Municipality and Dubai Tourism among others.

- Dubai’s property deals touched AED 61.97bn (USD 17bn) in H1 2021. Total sales transaction volumes increased by more than 40% (vs H2 2020) to 27,373 in H1.

- Dubai Airport Free Zone Authority (Dafza) reported a 4.7% yoy increase in trade to more than USD 39bn in Q1 2021: this accounts for 11% of Dubai’s trade during the quarter. Trade with China – Dafza’s biggest trading partner (31% of total trade in Q1) – grew by 56.4%.

- DP World shipping volumes increased by 17.1% yoy to 19.7mn TEUs in Q2 2021, led by growth in India and the Asia-Pacific region. Jebel Ali port handled 3.4mn TEUs, up by 4.2%.

- Dubai is planning to build a USD 1bn waste-to-energy plant – one of the largest in the world – while a smaller plant in Sharjah will begin operations this year, reported Bloomberg.

- Hotel occupancy in Dubai increased to 61.9% in Jun, surging by 139% yoy (when borders were closed), according to STR: the increase was supported by Eid staycations and regional travel. Revenue per available room (RevPar) declined by 17% mom as hotels slashed rates to attract customers during peak summer.

- Dubai-based Swvl (a mass transit and shared mobility services provider) with a USD 1.5bn valuation, will list on Nasdaq through a SPAC.

Media Review

Drawing Further Apart: Widening Gaps in the Global Recovery

https://blogs.imf.org/2021/07/27/drawing-further-apart-widening-gaps-in-the-global-recovery/

Growth in emerging markets: unrest & underperformance

Saudi Arabia tops emerging markets league table

https://www.arabnews.com/node/1900666/business-economy

Planetary ‘vital signs’ show extent of climate stress — and some hope

https://www.ft.com/content/a52f32ea-c9ed-4bcd-8eef-8eb9ca8da2b1

Powered by: