Markets

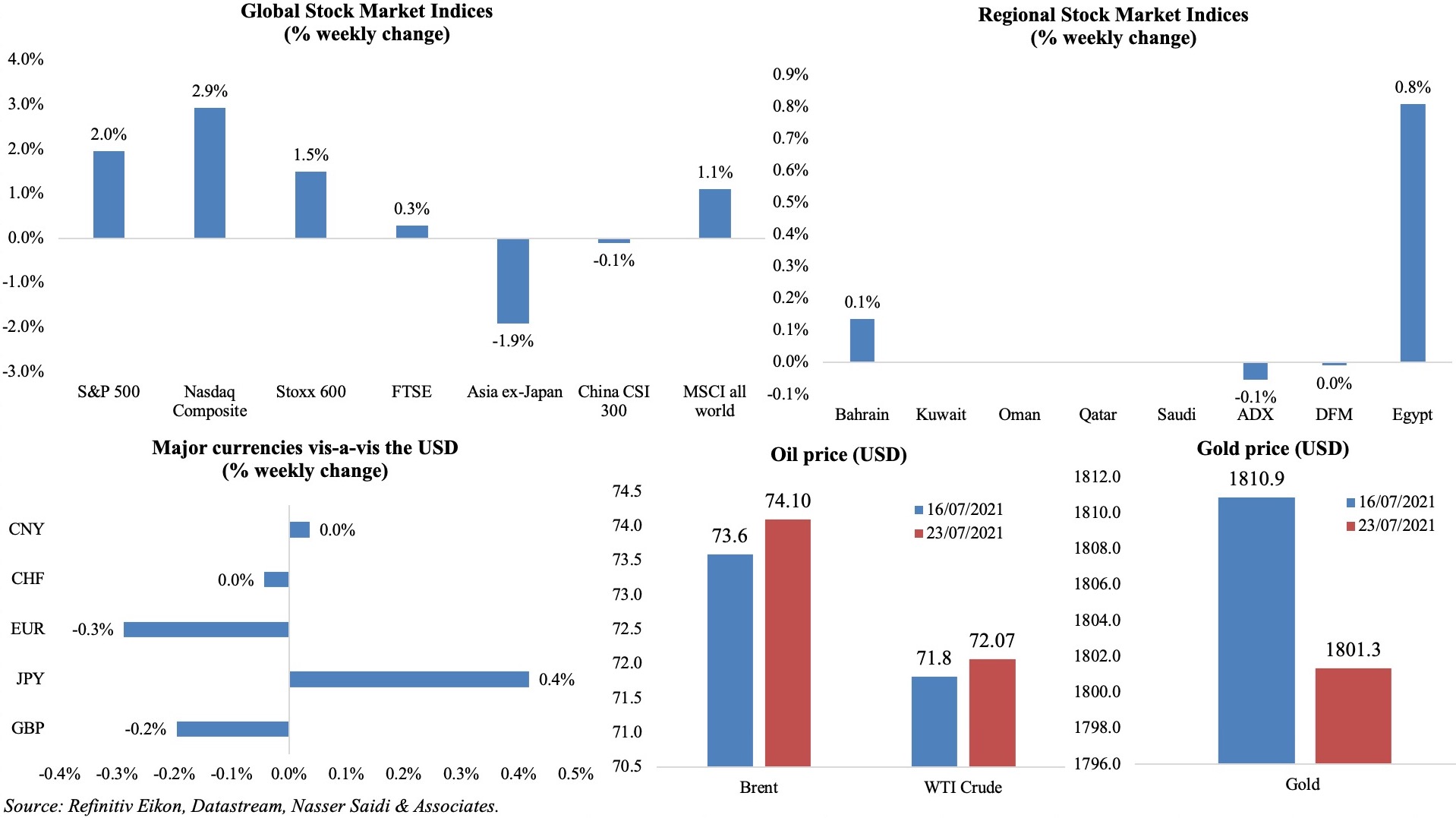

A rollercoaster ride for equity markets last week: overall S&P 500 and Stoxx600 posted weekly gains while also reporting steep day/ session drops during the week. This was largely due to a combination of Delta variant concerns (and potential for renewed restrictions) alongside strong corporate earnings reports and central bank support. Many regional markets (Kuwait, Oman, Qatar, Saudi) were closed last week for Eid holidays. Among currencies, the dollar strengthened, while the euro dropped against JPY to its lowest in 4 months. Gold price dipped by 0.5% while oil prices recovered by end of the week – Brent by 0.7% to USD 74.1 and WTI by 0.4% to USD 72.07 – after sliding on Monday after the OPEC+ decision to gradually increase production.

Weekly % changes for last week (22-23 Jul) from 15 Jul (regional) and 16 Jul (international).

Global Developments

US/Americas:

- Flash manufacturing PMI in the US stood at a series high of 63.1 in Jul (Jun: 62.1), supported by quicker rise in new orders and strong uptick in foreign demand. There was a slight moderation in services PMI as well (59.8 vs Jun’s 64.6), a result of labour shortages and scarcity of stock.

- Building permits in the US fell by 5.1% mom to an 8-month low of 1.598mn units in Jun. Housing starts increased by 6.3% to a seasonally adjusted annual rate of 1.643mn last month (May: 1.546mn). Rising price of building materials and supply shortages are keeping house prices high.

- Existing home sales inched up by 1.4% mom and 22.9% yoy to 5.86mn in Jun. Inventory of homes for sale was 1.25mn at end-Jun, implying a 2.6-month supply at the current sales pace. Low inventory is pushing prices higher: the median price of an existing home sold in Jun hit an all-time high of USD 363,300.

- Initial jobless claims unexpectedly increased to 419k in the week ended Jul 17th from an upwardly revised 368k the week before. Continuing claims declined by 29k to 3.236mn in the week ended Jul 10th, posting a new pandemic low.

Europe:

- With the Covid19 virus strain identified as a risk to recovery in the eurozone, the ECB pledged to keep interest rates lower for longer. The apex bank also stated that borrowing costs will not be hiked until inflation reaches the 2% target “well ahead of the end of its projection horizon and durably”.

- Producer price index in Germany eased to 1.3% mom in Jun, from the 1.5% uptick in May. In yoy terms, PPI edged up to 8.5% – the highest yoy increase since Jan 1982 – from 7.2% the month before. Energy prices, which surged by 16.9% yoy as a result of low base last year, was the main reason for the uptick.

- Preliminary estimates for the Markit composite PMI for Germany rose to a series-record of 62.5 in Jul (Jun: 60.1), supported by an “ongoing rapid recovery in services activity” while manufacturing slipped on widely reported material shortages.

- In the wider eurozone, though manufacturing PMI eased to 62.6 in Jul from 63.4 last month, the composite PMI rose to 60.6 – its highest reading since Jul 2000.

- Consumer confidence in the euro area slipped to -4.4 in Jul (Jun’s 3.5 year high of -3.3) as rising Covid19 cases led to new restrictions.

- Manufacturing PMI in the UK eased to a 4-month low of 60.4 in Jul, slowing from the 63.9 reading in Jun, given weaker rates of output and new order growth. Composite PMI dropped to 57.7 in Jul – the lowest since the ease of restrictions in Mar: survey respondents that referred to a drop in output cited “severe shortages of raw materials and the impact of COVID-19 isolation on staff availability”.

- Retail sales in the UK increased by 0.5% mom and 9.7% yoy in Jun: this was a result of a 4.2% increase in sales of food and drink (as England progressed to the finals of the Euro 2020) amid a 1.7% decline in sales of household goods, clothing and furniture. Excluding fuel, retail sales were up by 0.3% mom and 7.4% yoy. Overall, the sector has recovered to 9% above pre-pandemic level.

Asia Pacific:

- The People’s Bank of China (PBoC) disclosed that its digital yuan trial reached USD 3bn in transaction value by the end of June, with over 70.75mn transactions. Separately, as part of regulatory changes, the central bank stated that non-bank payment firms must report plans for domestic and overseas initial public offerings and listings, while also providing “detailed arrangement” of their variable interest entity structures.

- Japan’s inflation stood at 0.2% yoy in Jun (May: -0.1%); core inflation clocked in at 0.2% (0.1%) – the fastest pace in 15 months, and largely due to rise in energy costs (+4.6%). Meanwhile inflation excluding both food and energy stayed unchanged at -0.2%.

- Exports from Japan accelerated by 48.6% yoy in Jun (May: 49.6%) while imports also grew by 32.7% (from 27.9%), causing trade balance to widen to a surplus JPY 383.2bn. Exports grew by 23.2% in H1, posting the fastest growth since H1 2010. Exports to China was up by 27.7% in Jun, given demand for chip-making equipment, while exports to the US surged by 85.5%, thanks to shipments of cars, auto parts and motors.

Bottomline: The flash PMIs show expansion in economic activity as restrictions are eased; however, with shortage of materials and supply chain risks, firms are struggling to keep up with demand and higher costs are on the cards. After the ECB’s dovish stance, the Fed is set to meet this week and unlikely to move away from its “transitory inflation” rhetoric (keep an ear out for “tapering” talks). On the other hand, emerging markets seem to be turning more hawkish: Russia raised its key lending rate by 1ppt last week – it was the largest hike in more than 6 years, as inflation touched 6.5% in Jun. GDP and inflation data for both the US and eurozone will be released this week. It is likely to underscore divergent recoveries. Slower vaccination pace is evident across emerging markets – worthwhile to remember that these nations accounted for 57.8% of global GDP based on PPP in 2020 (58% estimated in 2021) – and with recent surges affecting the Asia-Pacific region, a growth revision can be expected from the IMF this week. Probably in line with the World Bank’s growth forecasts – low-income economies will grow at 2.9% this year, the slowest in the past 20 years other than 2020, and at a time their debt/GDP ratios are reaching historical highs.

Regional Developments

- At the OPEC+ meeting last week, it was decided to increase the output by 400k barrels per day from Aug onwards. A few producers including UAE and Saudi Arabia will be allowed to increase the baseline from which production is calculated. Furthermore, the OPEC+ alliance will be extended at least until end of 2022 (vs Apr 2022 agreed before).

- Non-oil trade between Bahrain and Saudi Arabia benefited from the opening of the King Fahd Causeway: non-oil trade between the 2 nations rose by 18% yoy to USD 781mn in Q2 this year. Trade with Saudi accounted for around half of Bahrain’s trade with the GCC.

- Egypt hiked fuel prices from Friday: gasoline prices were hiked by EGP 0.25 to between EGP 6.75 (USD 0.43) to EGP9 depending on quality of the fuel. Diesel prices were unchanged.

- The Egyptian government allocated around EGP 500mn (USD 31.88mn) to pay for contractual public workers’ salaries.

- The state of emergency was extended in Egypt for a further 3 months on 24th Jul.

- Iran opened a new oil terminal in the Gulf of Oman, allowing tankers to bypass the Strait of Hormuz. A 1000-km pipeline has also been built to carry oil to the terminal from the southwestern province. The President stated that Iran aimed to export 1mn barrels per day of oil from the Bandar-e Jask port.

- Iran, currently in the fifth wave of Covid19, ordered a 1-week lockdown in the capital from last Tuesday.

- Oil exports from Iraq averaged 3.336mn barrels per day in Jun, slightly lower compared to May, but revenues are estimated at over USD 6bn (higher vis-à-vis May).

- Iraq signed a fuel deal with Lebanon, allowing for the latter to pay for 1mn tonnes of heavy fuel oil a year in medical services. The fuel, worth about USD 300-400mn, will allow for electricity generation and is estimated to last for 4 months.

- As part of the Saudi-Iraqi Coordination Council, the two nations plan to launch a joint investment company, reported Al Arabiya. The company will help channel capital from Saudi to Iraq and act as a guarantor for investments, according to the Saudi commerce minister.

- Morocco’s economic growth is expected to slow to 2.9% in 2022 from the 5.8% forecasted for this year, according to the planning agency. The nation is home to Africa’s largest vaccinated population, with around 20mn disbursed doses.

- Kuwait is working on a law to limit withdrawals from the Future Generations Reserve Fund, reported Al Anba newspaper.

- About KWD 19.6bn has been allocated to finance 19 strategic projects in Kuwait’s current development plan. Diversified and sustainable economy projects account for almost half of the spending, according to a report filed by the Al Anba newspaper.

- Lebanon will begin formal consultations from this week to form a new government.

- Qatar’s emir directed the allocation of USD 100mn to support food security in Yemen.

- Equity and equity-related issuance in the MENA region totaled USD 2.1bn in H1 2021, the highest total since 2018 and up 139% yoy, according to Refinitiv data (https://www.zawya.com/images/features/CHART1.png). UAE was the most active, with proceeds raised equaling USD 1.7bn (vs USD 30mn in H1 2020); half of this was due to ADNOC’s convertible offering of USD 1.1bn in May.

- Corporate cash reserves of non-financial companies in the Europe Middle East and Africa (EMEA) region hit a record high of more than USD 1.53trn in 2020, according to Moody’s. Cash holdings spiked in 2020: top 25 companies accounted for USD 564bn or 37% of the total.

- The SWF Institute lists 4 sovereign wealth funds (SWFs) from the region among the top 10 SWFs by assets. Kuwait Investment Authority (3rd, with USD 692.9bn), Abu Dhabi Investment Authority (4th, USD 649.175bn), Public Investment Fund (8th, USD 430bn) and the Investment Corporation of Dubai (10th, USD 302.326bn). Others within the top 40 include the Qatar Investment Authority, Mubadala, Mumtalakat and Oman Investment Authority.

Saudi Arabia Focus

- Saudi Arabia plans to disburse more than SAR 73bn (USD 19bn) to the private sector: this accounts for 97% of the total payment orders received for public sector claims in H1 2021.

- Saudi Arabia’s holding of US Treasury bonds stood at USD 127.3bn in May – the 14th largest holder of US debt. The holding was down 3% mom but grew by 2.25% yoy.

- It was announced that Saudi citizens will need two COVID-19 vaccine doses before they can travel outside the country from Aug 9 Separately, only vaccinated persons will be allowed to enter both public and private establishments from Aug 1st.

- Startups in Saudi Arabia raised a total of USD 257.88mn in VC funding in H1 2021, according to Magnitt. Together, MENA nations raised USD 1.228bn in the period, with UAE accounting for 26% of the total funding. Food and beverages was the most popular sector for VC investment while fintech generated the most deals.

UAE Focus![]()

- Abu Dhabi’s Crown Prince met with Saudi Arabia’s Crown Prince last week. WAM reported that discussions centered around cooperation and acceleration of joint efforts (including efforts to eliminate political challenges) as well as reviewing the latest regional, Arab and international developments of mutual concern.

- UAE banks’ assets nudged up by 0.4% mom and 0.5% yoy to AED 3.18trn in May 2021. Banks’ investments surged by 25.4% yoy to AED 520.2bn in May.

- Dubai Expo 2020 tickets are on sale with a single-entry ticket priced at AED 95 (USD 26).

- About AED 1.1bn in housing loans will be distributed to 803 Emiratis: this was announced ahead of Eid Al Adha.

- Dubai electricity and Water Authority doubled water connections between 2016 and 2020. Water connections increased to 67,768 in 2020.

- Emirates Airlines disclosed that AED 8.5bn worth of tickets had been refunded in cash back to passengers.

- A survey by London-based Nickel Digital Asset Management found that institutional investors and wealth managers in the UAE plan to either dramatically increase their exposure to or include cryptocurrency assets to their portfolio between now and 2023. The reasons cited for this plan include capital appreciation, improving regulations and a larger liquidity pool.

Media Review

Dr. Nasser Saidi’s interview on Bloomberg Middle East Daybreak, 25 Jul 2021

https://www.bloomberg.com/news/videos/2021-07-25/fed-to-grapple-with-delta-risks-video

The Economist’s Big Mac Index: the cheapest burger is in Lebanon, but at what “cost”?!

Why there is no solution to our age of crisis without China

Five pandemic truths that defy intuition: Tim Hartford (Undercover Economist) in the FT

https://www.ft.com/content/a8c0f5f2-d27c-4b13-a1a4-440710bc6967

Powered by: