Markets

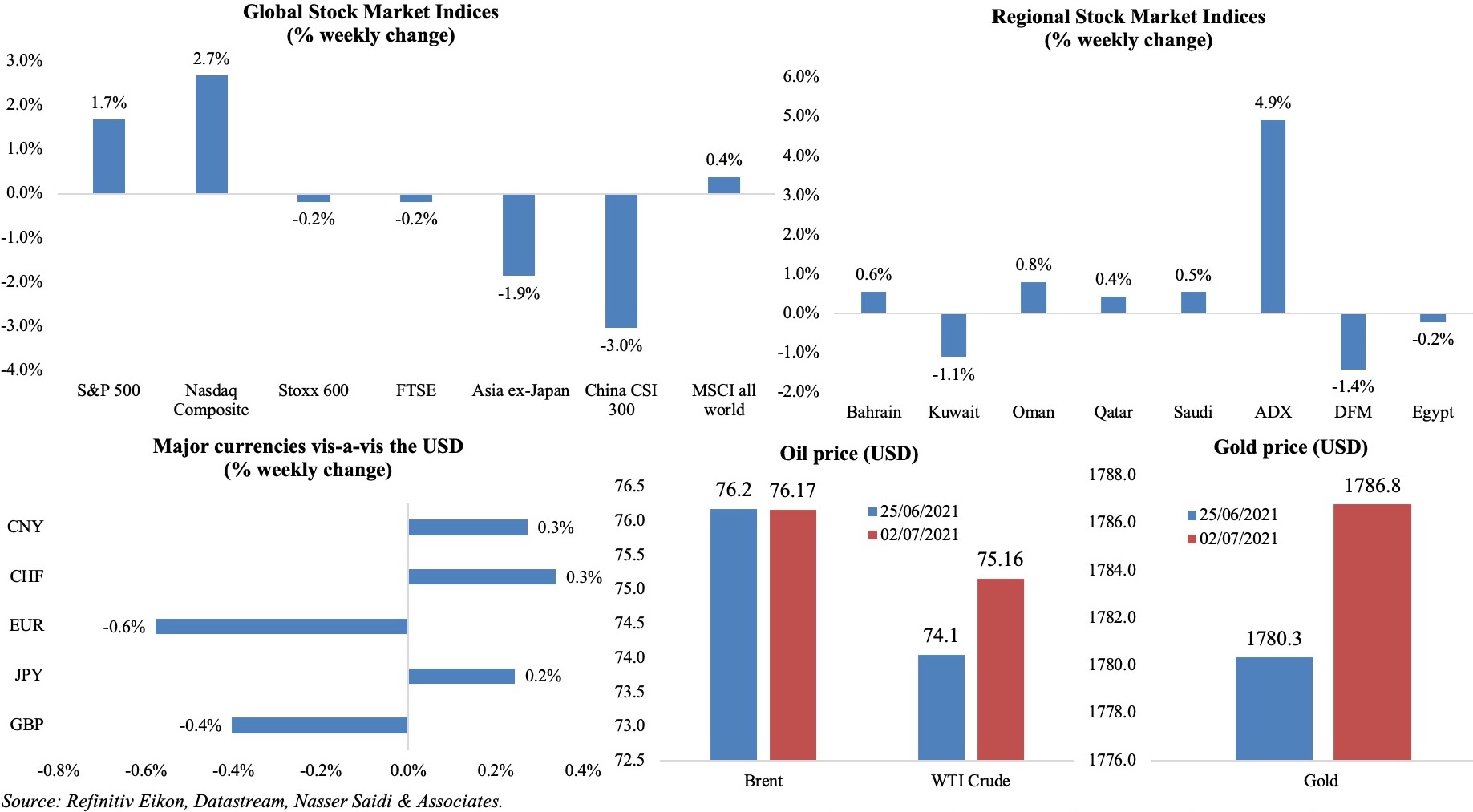

US stocks continued to rise to new records, with the latest better-than-expected jobs data: according to S&P Dow Jones indices, this winning streak was the longest run of consecutive record closes since June 1997. In Europe, both Stoxx600 and FTSE closed slightly lower than the week before. In Asia, China’s shares dropped a day after the Communist Party’s centenary celebrations, after some harsh rhetoric against nations criticizing China’s policies (trade, tech, human rights) and on expectations of tighter monetary policy. Regional markets were mixed last week: Abu Dhabi stocks touched a new record high while Saudi Tadawul posted its 8th weekly gain. In currency markets, dollar slipped from a 3-month high on Fri; the yen strengthened by 0.2% while the euro was down by 0.6%. With OPEC+ talks stalled over UAE’s opposition to the deal (UAE wants to raise its own output target), oil prices remained above USD 75 a barrel. Gold price closed nearer to USD 1,800.

Weekly % changes for last week (1-2 Jul) from 24 Jun (regional) and 25 Jun (international).

Global Developments

US/Americas:

- Non-farm payrolls increased for the 6th consecutive month, rising by 850k in Jun (May: 583k). Unemployment rate inched up to 5.9% from 5.8% a month ago. The labour force participation rate remained same at 61.6% while the average hourly earnings increased to 3.6% yoy (May: 1.9%), to reach the fastest pace since Mar.

- Initial jobless claims slowed to a new pandemic-era low of 364k in the week ended Jun 26th from an upwardly revised 415k the week before, taking the 4-week average down to 392.75k. Continuing claims increased by 56k to 3.47mn in the week ended Jun 19th while the 4-week average fell by 75k to 3.48mn – the lowest since Mar 21, 2020.

- The US private sector added 692k jobs in Jun (May: 886k), with the biggest hiring gain from the leisure and hospitality sector (+332k jobs), followed by education and health (+123k).

- Factory order grew by 1.7% mom in May (Apr: -0.1%), thanks to a 7.7% surge in orders for transportation equipment. Orders for non-defense capital goods, excluding aircraft, inched up 0.1% in May instead of dipping 0.1% as reported last month.

- ISM manufacturing PMI eased to 60.6 in Jun (May: 61.2), as new orders slowed to 66 (from 67) and employment slipped to below-50 and prices paid jumped to 92.1 (May: 88).

- Markit manufacturing PMI remained unchanged at 62.1 in Jun, but lower than the flash estimate of 62.6, with both new orders and production growing at fast paces. Meanwhile, supplier delivery times lengthened to greatest extent on record and input cost inflation touched a new series record.

- Chicago PMI fell to a 4-month low of 66.1 in Jun (May: 75.2); but through Q2, the index surged 7.9 points to 71.1, its highest quarterly reading since Q4 1973.

- Trade deficit in the US widened to USD 71.2bn in May, largely due to rising imports (+1.2% to USD 234.7bn) while exports gained by 0.3% to a record high USD 145.5bn.

- S&P home price index gained by 14.6% yoy in Apr (Mar: 13.3%) the highest reading in more than 30 years of since data collection began. Separately, pending home sales unexpectedly rebounded by 8% mom in May, the most in 11 months, following Apr’s 4.4% drop.

Europe:

- Germany’s harmonized index of consumer prices inched up to 0.4% mom in Jun (May: 0.3%). In yoy terms, prices eased to 2.1% in Jun, down from 2.4% the month before, but is still above the ECB target.

- Markit manufacturing PMI for Germany increased to 65.1 in Jun (May: 64.9), thanks to faster rate of output and new orders growth. Furthermore, employment increased for the fourth month in a row and at the quickest rate since Jan 2018.

- In the eurozone, manufacturing PMI increased to 63.4 in Jun (May: 63.1), staying in the expansionary territory for the 12th consecutive month. The report also noted the “expansion of capacity via record employment growth and greater capital expenditure on business equipment and machinery”.

- Retail sales in Germany recovered in May, rising by 4.2% mom (Apr: -6.8%); in yoy terms, retail sales were down by 2.4% though online retailers continued to benefit.

- The unadjusted unemployment rate in Germany declined to 5.7% in Jun (May: 5.9%) while in seasonally adjusted terms it remained unchanged at 5.9%. Though the number of furloughed workers dropped to 2.34mn in Apr, down from almost 6mn in Apr 2020.

- Unemployment rate in the eurozone fell to 7.9% in May from 8.1% the month prior; youth unemployment also declined to 17.3% from 18.2% the month before. Furthermore, the number of jobless people across the EU is still 1.9m above its pre-pandemic level, at 15.4mn.

- Inflation in the eurozone stood at 1.9% yoy in Jun (May: 2%), dropping for the first time in 9 months, while core inflation eased to 0.9% from 1% the month before. Prices of non-energy industrial goods grew at a faster rate, but was outweighed by drops in services and energy inflation.

- The Economic Sentiment Indicator touched a 21-year high in the EU and euro area, rising by 3 and 3.4 points to 117 and 117.9 respectively in Jun (from May). Separately, the Employment Expectations Indicator also increased (+1.2 points to 111.5 in the EU and +1.6 points to 111.6 in the euro area) to the highest level since Nov 2018.

- GDP in the UK was revised lower: it fell by 6.1% yoy and 1.6% qoq in Q1. Consumption was revised down to -4.6% qoq from -3.9% while the household saving ratio grew to 19.9% in Q1 (Q4: 16.1%) – the second highest quarterly reading since the series began in 1963.

- UK manufacturing PMI slowed slightly to 63.9 in Jun from May’s record high 65.6: improved demand came hand-in-hand with easing restrictions and new export orders rose again. However, record price increases were reported as average input costs rose at the fastest pace in survey history.

Asia Pacific:

- China’s NBS manufacturing PMI eased to 50.9 in Jun (May: 51), posting the weakest expansion since Feb. Exports orders fell for the 2nd consecutive month and employment remined below-50 at 49.2. Caixin manufacturing PMI slowed to a 3-month low of 51.3 in Jun (May: 52): new orders growth eased, but rate of job creations was the 2nd strongest since Jan 2013 and input prices rose the least in 7 months. Non-manufacturing PMI also slipped down to 53.5 in Jun (May: 55.2). Supply chain disruptions, as well as the recent outbreak of Covid19 cases and restrictions in China’s major export areas seems to have affected sentiment.

- Industrial production in Japan slumped by 5.9% mom in May (Apr: +2.9%), the largest drop since May 2020, largely due to a sharp fall in motor vehicle production (-19.4%). However, industrial output surged 22% yoy in May (Apr: 15.8%) – a result of low base effects.

- The au Jibun Bank manufacturing PMI dipped to 52.4 in Jun (May: 53), thanks to a softer increase in output. Covid19 restrictions and shortages of raw materials impacted production.

- Japan’s Tankan large manufacturing index surged to 14 in Q2 (Q1: 5) – the highest level since Dec 2018 – while non-manufacturers’ business confidence also improved to +1 from -1 in the previous survey, to reach its highest index reading since Mar 2020.

- Japan unemployment rate edged up to a 5-month high of 3.0% in May (Apr: 2.8%). The number of people at work declined by 130k to 45mn in May, while the number of unemployed people rose by 100k to 2.04mn.

- Retail trade in Japan fell by 0.4% mom in Apr; in yoy terms, it picked up (for the 3rd consecutive month) by 8.2%, given the base effect. Separately, large retailers saw sales surge by 6% in May.

- India’s manufacturing PMI slipped below 50 in Jun, posting a reading of 48.1 vs May’s 50.8, as Covid19 related restrictions subdued demand. Falling new orders, business closures, dampened business confidence and reduction in output was reported.

Bottomline: Manufacturing PMI data releases across major markets confirmed an upturn in manufacturing: J.P. Morgan global manufacturing PMI eased to 55.5 in Jun from May’s 11-year high of 56. While employment, output and orders rose, Asian nations were underperformers (China, Japan, India) compared to Europe and the US. However, supply disruptions and higher input costs were also widely reported. A deadlock in OPEC+ talks was unexpected, with the UAE holding out for higher own output targets. The cartel was also planning to extend the supply deal to beyond Apr 2022 (when it was set to expire). Covid19’s more infectious variants leading to spikes in cases across the globe is worrisome: 96 nations have reported Delta variant cases, with UK cases alone rising by 67% in a week. On the other hand, holiday travel is in full swing: ahead of the Jul 4th weekend in the US, TSA reported that airport screenings climbed above 2019 levels on Thursday (2.15mn persons vs 2.01mn on July 1, 2019); the EU COVID-19 travel certificate was launched to facilitate summer travel though recovery is expected at different paces (e.g. Spain is more optimistic than Greece; more in Media Review section) given new travel restrictions from the UK and Germany.

Regional Developments

- Egypt’s non-oil trade deficit widened by 12.7% yoy to USD 30.7bn between Jul 2020-Mar 2021. Non-oil exports increased by nearly USD 1bn to USD 14.6bn during the period while non-oil imports were up by 11% to USD 45.4bn.

- Current account deficit in Egypt almost doubled to USD 13.3bn in Jul 2020-Mar 2021 while the balance of payments surplus stood at USD 1.8bn. Tourism revenues fell to USD 3.1bn during this period (from USD 9.6bn a year ago) while net FDI plunged by 19.3% to USD 4.8bn. Remittances however increased by 8.8% yoy to USD 23.4bn.

- Budget deficit in Egypt declined to 7.8% in 2020-21 (ended Jun), disclosed the finance minister, and is expected to drop further to 6.7% in the current fiscal year. Primary surplus decreased to 1.1% last fiscal year, from 1.8% in the year ago (2019-20).

- The head of Egypt’s Financial regulatory Authority revealed that IPOs for state-owned enterprises would resume in Sep-Dec, with potentially 2-3 offerings.

- The IMF’s Egypt Mission Chief stated that external debt is expected to reach 36% of GDP at the end of the current fiscal year – relatively moderate compared to other emerging market nations. About 20% of this corresponds to public General Government external debt.

- Egypt received USD 1.9bn from multilateral and bilateral development partners for financing private sector projects, disclosed the minister of international cooperation. The IFC was the main partner, financing projects worth almost USD 1.2bn across infrastructure, education, health, mining and financial markets.

- Real estate taxes in Egypt raise about EGP 7bn annually, according to the finance minister. He also revealed that there is another tax imposed on real estate investment of up to 25%.

- Egypt plans to launch a 3-year international tourism push starting from the end of this year, revealed the nation’s minister of tourism and antiquities. It was also disclosed that travel bookings for Jul-Aug from Arab nations was higher than for May-Jun. Tourists were mostly from Saudi Arabia, followed by Kuwait, UAE, Jordan and Iraq.

- CIB Egypt received approval to be the first private sector firm (and bank) to issue green bonds, with a value of USD 100mn for a period of 5 years. Part of the proceeds (20%) will be used for the construction of an environmentally friendly building.

- The minimum wages of private sector workers in Egypt will be raised to at least EGP 2400 per month (from EGP 2000) from the beginning of next year. This decision is expected to impact about 12.6mn employees.

- The IMF approved a USD 200mn increase in financing to Jordan under its Extended Fund Facility, after a second review. This would bring total disbursements to around USD 900mn since the start of 2020.

- Kuwait’s Future Generations Fund, managed by the Kuwait Investment Authority and with more than half its investments in the US, reported a 33% growth in the year to Mar 31. Its assets were valued at about USD 670bn at the close of the last fiscal year on March 31, reported Bloomberg, citing a confidential source. The finance minister stated that growth in the Fund for the past 5 years exceeded that of total oil revenues during the same period.

- Covid-related travel restrictions were eased in Kuwait from Jul 1st, with direct flights permitted to 12 destinations including UK, Spain, the US and Switzerland. Vaccinated citizens will be permitted to travel abroad, while borders will be open from Aug 1 for those fully vaccinated with Pfizer, AstraZeneca, Moderna or Johnson & Johnson.

- As currency devaluation continues unabated (on the black market the LBP sold for more than 17k to the dollar), Lebanon hiked fuel prices last week: the price of 20 liters of 95-octane petrol shot up by 35% to LBP 61,000 (USD 40.6 at the official rate) but still substantially lower than international prices or prices in Syria implying continued incentives for smuggling. The central bank stated earlier in the week that it would start giving credit lines to import fuel at LBP 3,900 to the dollar, weaker than the official exchange rate of LBP 1,500.

- Lebanon’s parliament approved a USD 556mn cash injection for half a million families: while funding for this programme remains unclear, this is expected to complement the USD 246mn World Bank loan for a social safety net (approved by the World Bank, but not yet agreed with the authorities).

- Oman’s non-oil economy grew by 5.7% to USD 14.8bn in Q1 this year, according to the NCSI. However, with a 20.6% plunge in oil sector activity, overall GDP contracted by 2.5%.

- Oil revenues in Oman declined by 23% yoy during Jan-May 2021, while total revenues fell by 19%. Spending fell by 2.9% causing budget deficit to clock in at OMR 890.2mn (USD 2.32bn) during the first five months of this year.

- Qatar International Islamic Bank’s board of directors recommended allowing foreign investors to own up 100% of the bank’s capital instead of 49% previously.

- Qatar Investment Authority cut its stake in Credit Suisse Group to 4.8% (or about 128mn shares), reported Bloomberg. This reduction means that the QIA may no longer be the bank’s largest shareholder.

Saudi Arabia Focus

- Saudi Arabia plans to launch a second national airline – as part of a push to advance in the transport and logistics sector. The strategy is to increase the contribution of the transport and logistics sectors to 10% of GDP by 2030 (from 6% currently).

- Furthermore, there are reports of Saudi customs cancelling the import duty exemption of UAE/GCC made materials effective Saturday.

- The Saudi Capital Market Authority approved several IPO requests last week: this includes ACWA Power (plans to sell 81.1mn shares or 11.1% of its share capital), Arabian Internet and Communications Services Co (STC Solutions) 20% stake, Arabian Contracting Services Company (15mn shares or 30% of capital), Banan Real Estate Co. and Canadian Medical Center Co. (the latter two for Nomu).

- Saudi Arabia’s net foreign assets dropped by 0.83% mom to SAR 1.62trn (USD 432.6bn) in May. Investments in foreign securities dropped by 1% mom to SAR11trn.

- Overall unemployment rate among Saudi nationals fell to 11.7% in Q1 2021 – a 5-year low; more dramatic was the plunge in unemployment rate for Saudi females – 21% in Q1 2021 vs a high 34% at end-2016. By age group, the rate remained highest among females within 25-29 & 20-24 age group (37.9% and 37% respectively). Meanwhile, female participation in the workforce increased from 19% in 2016 to 32.3% in Q1 2021.

- About 121k Saudi nationals joined the private sector workforce in Q1 2021: financial and insurance activities sector recorded the highest localization rate at 83.1% while in the construction, wholesale and retail trade, and auto repair, it reached 42.42%. The average wage of Saudis in the private sector touched SAR 5,957 (USD 1,588) at end-Q1.

- Residential mortgages in Saudi Arabia increased to a 5-year high, according to a report from Knight Frank. In Q1 2021, about 38,285 mortgages were granted for purchasing villas and townhouses and SAR 48bn (USD 12.8bn) worth residential mortgages were issued.

- Saudi Arabia plans to vaccinate over 2.7mn students aged 12-18 years before the start of the academic year.

- From Sunday (Jul 4th, 11pm) onwards, Saudi Arabia will suspend travel to and from the UAE, Ethiopia and Vietnam.

- There are reports of Saudi customs cancelling the import duty exemption of UAE/GCC made materials effective Saturday (3rd Jul).

UAE Focus![]()

- UAE announced a new set of economic initiatives to support growth: this includes an accelerator for family-owned businesses to support them access new markets; an economic research institute established in collaboration with leading universities (UAE Growth Lab); an entrepreneurial academy (Skill-Up Academy) and a new platform to support the growth of startups (Scale-Up Platform), in addition to a web portal (Grow in UAE) to provide comprehensive information about policies and investment opportunities in the UAE; and a global investment conference (Investopia) to be held in Mar 2022.

- The UAE’s National Agenda for Non-oil Export Development aims to increase its exports by 50% in the “next few years”, promote Emirati products and access 25 new markets.

- The new Dubai Chambers focus will be on fuelling trade with 30 priority markets, establishment of more than 300 start-ups, as well as attracting more than 50 new large MNCs.

- Bilateral trade between the UAE and Israel stood at AED 2.48bn in the first 10 months after the signing of the Abraham Accords, according to the latter’s foreign minister.

- Dubai real estate transactions touched 2,020 over the week ending 1st Jul 2021 valued at AED 4.5bn.

- With the listing of Kuwait’s Ahli United Bank’s USD 600mn Sukuk, total value of debt issuances listed on Nasdaq Dubai by Kuwaiti issuers has increased to USD 1.51bn. Total Sukuk listings at the exchange now stands at USD 77.56bn.

- Bloomberg reported that ADNOC is in discussions with Masdar to acquire a minority stake in the latter in a bid to diversify into more carbon-neutral assets.

- The Jebel Ali Free Zone revealed investments in roads, infrastructure, and sustainability projects within the Zone worth AED 2.48bn (USD 675mn) over the last five years.

- As school holidays begin in the UAE, Emirates Airlines expects more than 450k passengers to travel to and from Terminal 3 at the Dubai International Airport till Jul 12.

- Dubai Expo tickets – priced at AED 95 (USD 26) for a day pass and 6-month for AED 495 – will go on sale globally from 18th July. Children under 18 years of age and students from across the world (with a valid student ID) will be able to enter for free. Being vaccinated is not mandatory for visitors.

- Effective Aug 20th, Abu Dhabi will allow only vaccinated persons to access public places: the emirate announced that more than 93% of target groups had been vaccinated already.

- The latest Mastercard Middle East and Africa SME Confidence survey showed that around 88% of UAE-based SMEs were optimistic about the 12-months ahead with 2/3-rds expecting revenues to either grow or stay stable.

Media Review

Dr. Nasser Saidi’s interview with CNBC on Lebanon’s currency plunge

https://nassersaidi.com/2021/06/30/interview-with-cnbc-on-lebanons-currency-plunge-29-jun-2021/

OPEC+ talks deadlock

https://www.ft.com/content/6f0580d8-5374-49b2-b5dc-8a8f0939a9e5

Economic crisis, severe shortages make Lebanon ‘unlivable’

https://www.arabnews.com/node/1885911/business-economy

Riyadh’s IPO tsunami

https://www.arabnews.com/node/1885076/business-economy

Europe’s summer tourism hopes

Powered by: