State of the UAE & Saudi Arabia economies: a peek into the latest macroeconomic data

(GDP, Fiscal, Money & Credit, Labour Market, Trade, Inflation)

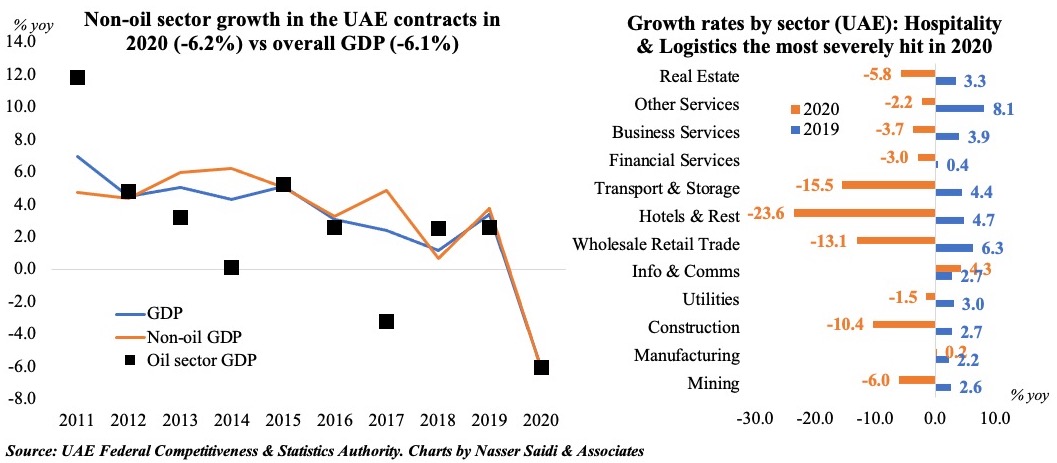

1. UAE’s GDP declined by 6.1% in 2020; hospitality and logistics were the worst affected sectors

- The UAE’s GDP declined by 6.1% in 2020, according to the FCSA, down from an upwardly revised 3.4% growth in 2019. The slump was driven by both oil and non-oil sector, which fell by 6% & 6.2% respectively.

- While the share of oil sector to overall GDP remained unchanged at 29.1%, the sectors that posted a slight increase in overall contribution to GDP include manufacturing (8.8% in 2020 from 2019’s 8.3%), communication (3.3% vs 2.9%), finance and insurance (8.2% from 7.9%) and public sector (5.6% from 5.2%).

- Only a few sectors posted positive growth in 2020; unsurprisingly, the most negatively affected were hospitality (-23.6%), transportation (-15.5%) and trade (-13.1%).

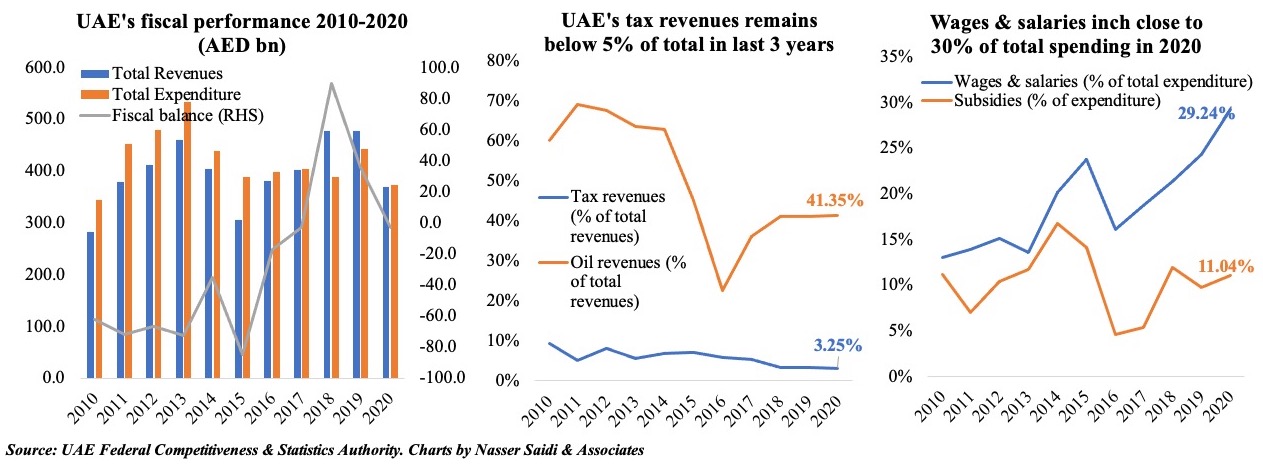

2. UAE fiscal balance moves into deficit in 2020, following two years of surplus

- Both public revenues and expenditures in the UAE declined in 2020, by 22.7% yoy and 15.8% respectively, thereby moving the balance into a deficit of AED 3.04bn. Oil revenues fell by 22.4% yoy

- Oil revenues accounted for 41.35% of overall revenues and 42.7% of non-tax revenues in 2020. Though total tax revenues fell by 22.4% yoy in 2020, its share in total revenues continued to be ~3.25% (similar to 2018 & 2019)

- Wages and salaries continue to represent about 30% of total spending in 2020 but in yoy terms, it declined by 16.7%. Subsidies also fell by 5% yoy, but account for 11% of overall spending

- Fiscal consolidation should be major policy reform for the UAE in the medium- to long-term to reduce dependence on oil & gas revenue. Subsidy reform and reducing public sector wage bills could be reforms on the spending side while new/ higher taxes can support revenues (e.g. carbon tax, property tax)

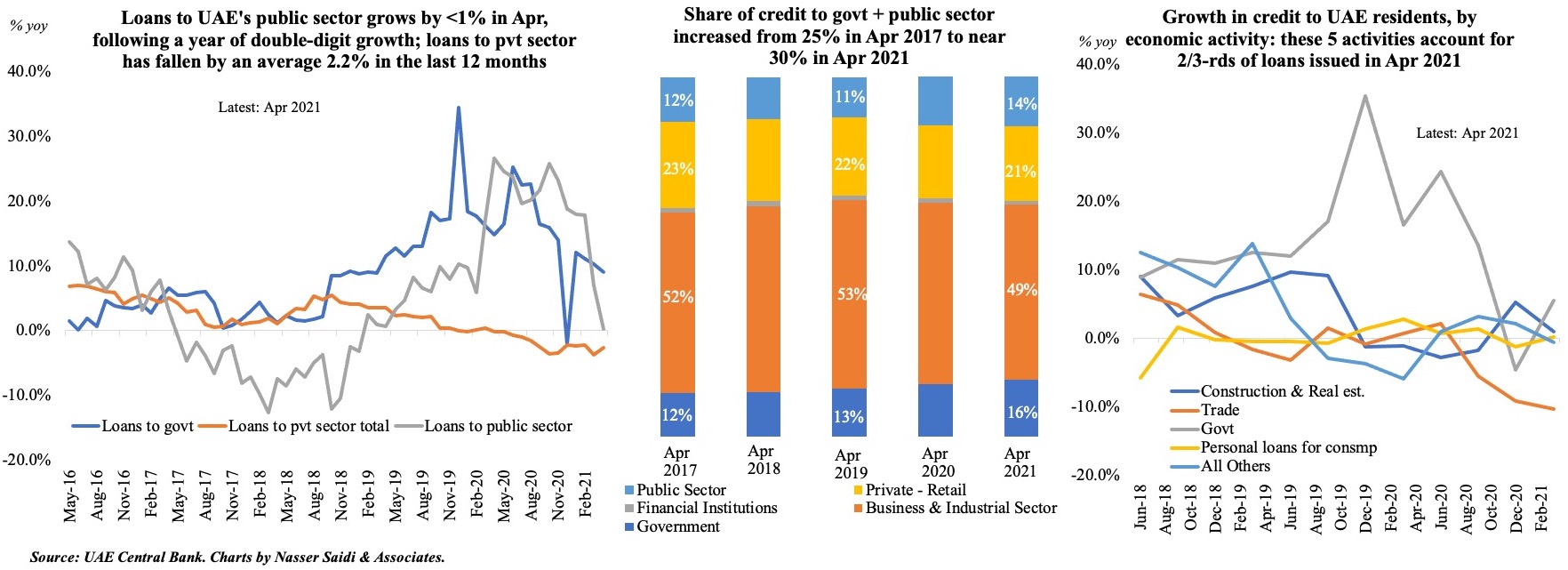

3. Credit to UAE’s private sector continues to decline in 2021; activity-wise differences exist

- Overall domestic credit disbursed in UAE fell by 0.6% yoy in Apr 2021 though rebounding by a marginal 0.52% mom (Mar: -0.9% mom)

- April marks the 13th consecutive month of yoy decline in credit to the private sector and 10th consecutive month of yoy decline in lending to the business sector. Loans to the public sector (which includes government-related enterprises) broke the pattern by ticking up just 0.2% in Apr (Mar: 7.0% and following 12 months of double-digit growth)

- A breakdown of lending by economic activity shows that the major shares with respect to credit by economic activity remain largely unchanged: construction (20.5%), personal loans for consumption (20.4%), government (15%), others (9%) and trade (8.7%) together accounted for 65% of total loans. Sectors with continuous growth for 4 quarters (from Jun 2020) include transport (average 46.7% yoy growth), agriculture (44%) and utilities (29%).

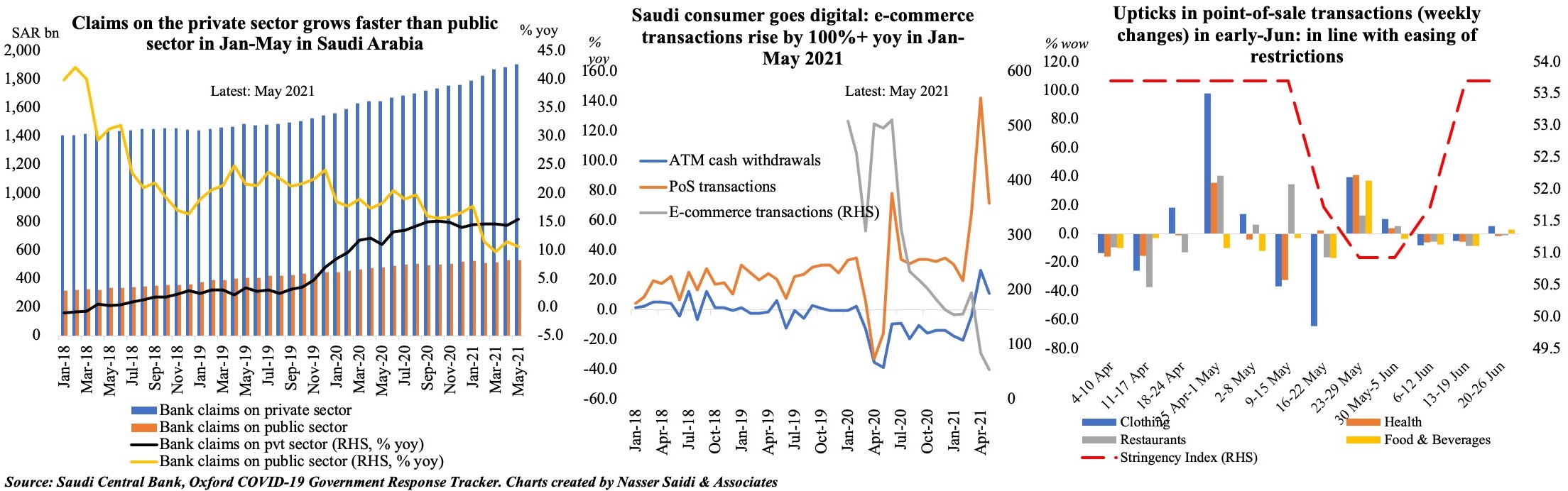

4. Rising credit & changing consumer preference (away from cash) is the story in Saudi Arabia

- Data from the Saudi Central Bank shows claims from the private sector outpacing public sector loans in May 2021 – as seen in most months this year

- A continued preference for PoS/ e-commerce transactions from a previously preferred “cash is king” position. ATM transactions have dropped by 0.7% in the Jan-May period vs a 65.8% and 125.9% hike in PoS & e-commerce transactions

- Weekly PoS transactions show an uptick in early Jun: the distinct rise in PoS transactions in clothing, health, restaurants coincides with when restrictions were eased (tracked by the Oxford COVID-19 Government Response Tracker)

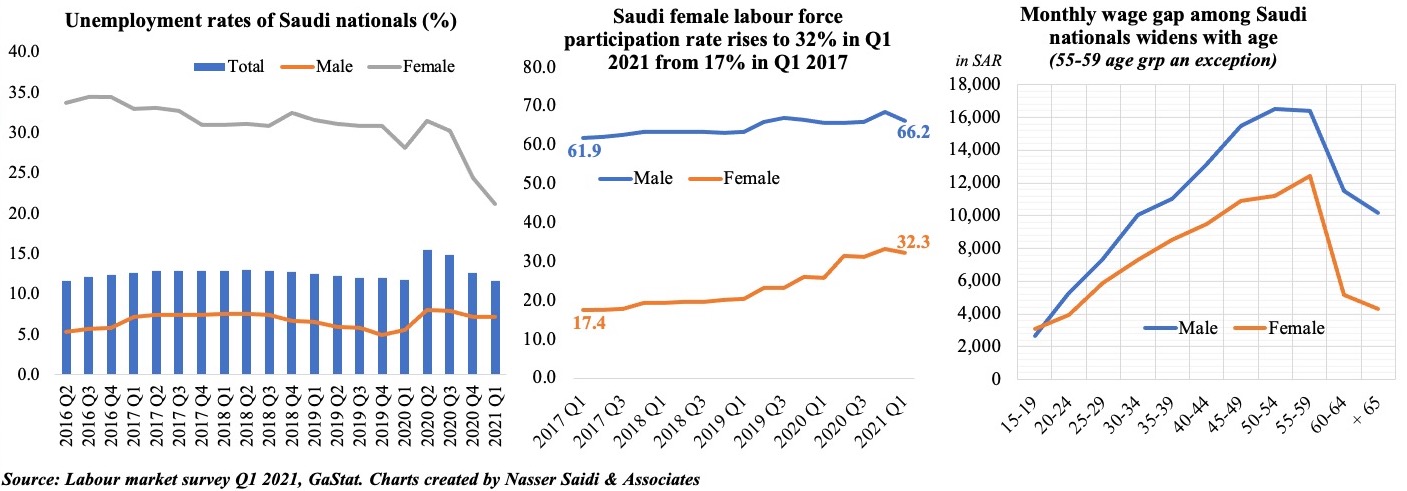

5. Unemployment rate among Saudi nationals (apecially females) dip to a 5 year-low in Q1 2021

- Overall unemployment rate among Saudi nationals fell to 11.7% in Q1 2021 – a 5-year low; more dramatic was the plunge in unemployment rate for Saudi females – 21% in Q1 2021 vs a high 34% at end-2016. By age group, the rate remained highest among females within 25-29 & 20-24 age group (37.9% and 37% respectively).

- Meanwhile, female participation in the workforce increased from 19% in 2016 to 32.3% in Q1 2021. However, both male & female labour force participation rates declined slightly compared to Q4 2020. Though women are joining the workforce in large numbers, many of the job opportunities fall in the lower-paid sectors.

- Women earn slightly more than men in the 15-19 age group, but the pay gap widens after that. On average, in Q1 2021, a Saudi male employee is paid 1.3 times compared to a female national and at the oldest age bracket (65+) it stands at around 2.4 times! The gap has narrowed however compared to previous years.

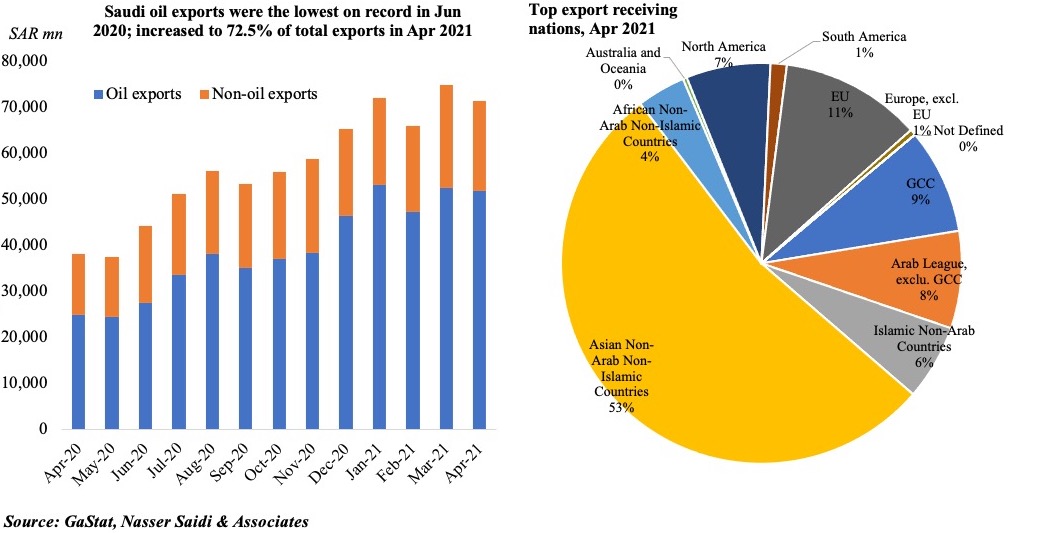

6. Oil exports from Saudi Arabia increase to 72.5% of total exports in Apr; Exports to Asia account for more than half of total exports

- Oil was trading at USD 75 a barrel yesterday (30 Jun), about 40% higher compared to the start of the year, after a report revealed lower US inventories for a 6th straight week. All eyes are on the OPEC+ (set to meet today), who have already warned of “significant uncertainties” ahead: a modest increase in production is likely amid higher demand for oil (summer travel bookings, anecdotal evidence suggests, are picking up in US & Europe)

- Oil exports are rising, accounting for 72.5% of total exports in Apr 2021. The top region for Saudi Arabia’s exports is still Asian nations, and much of the exports is oil. Though many nations – India, Japan and Malaysia – continue to struggle with the pandemic, many others have relatively low levels of cases; as restrictions ease, demand will increase and oil exports will pick up faster.

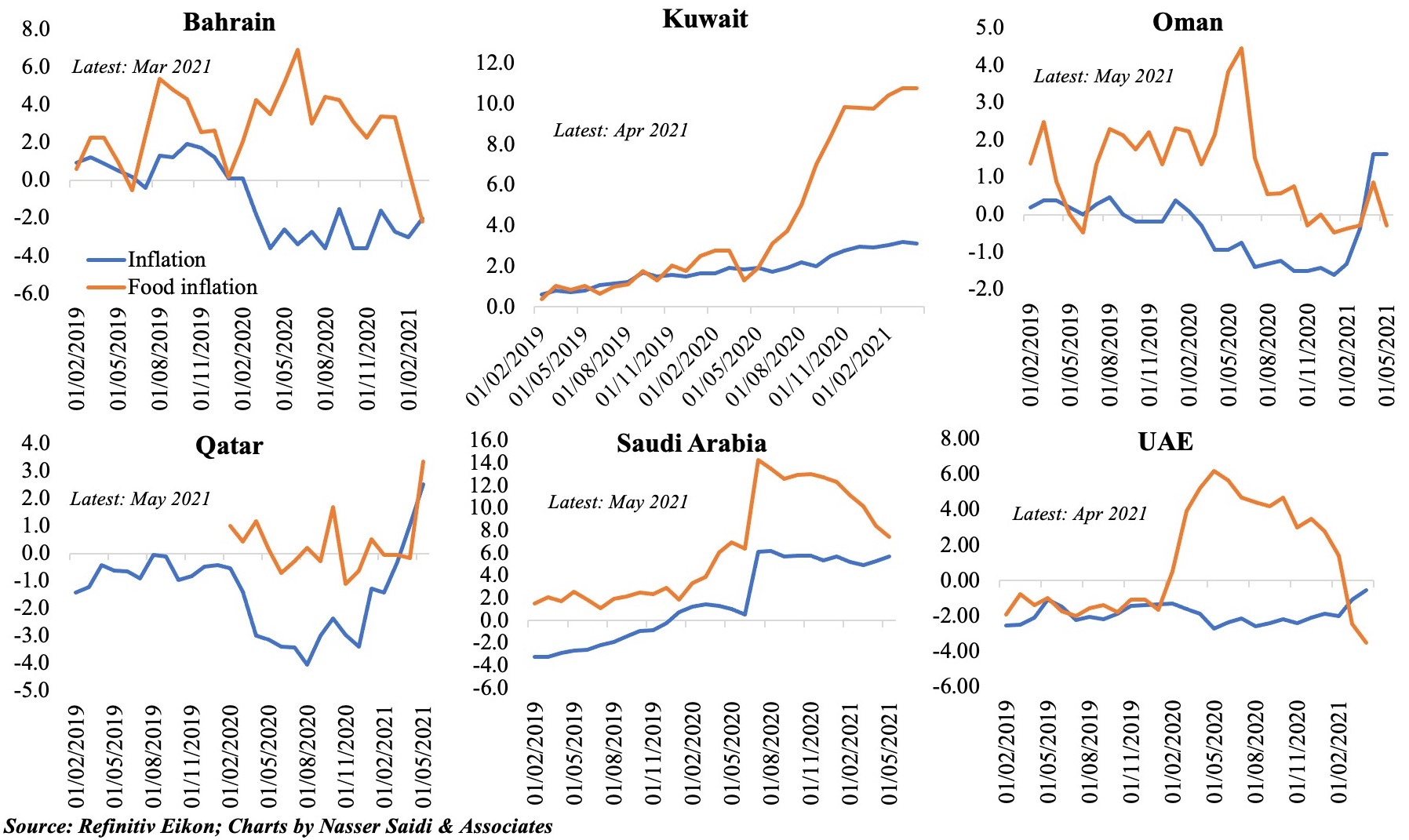

7. GCC inflation (% yoy): Kuwait’s food inflation is running at 10%+; Saudi’s inflation is influenced by the VAT hike last year; May’s month-on-month readings have food inflation rising at a faster pace than headline

Powered by: