Markets

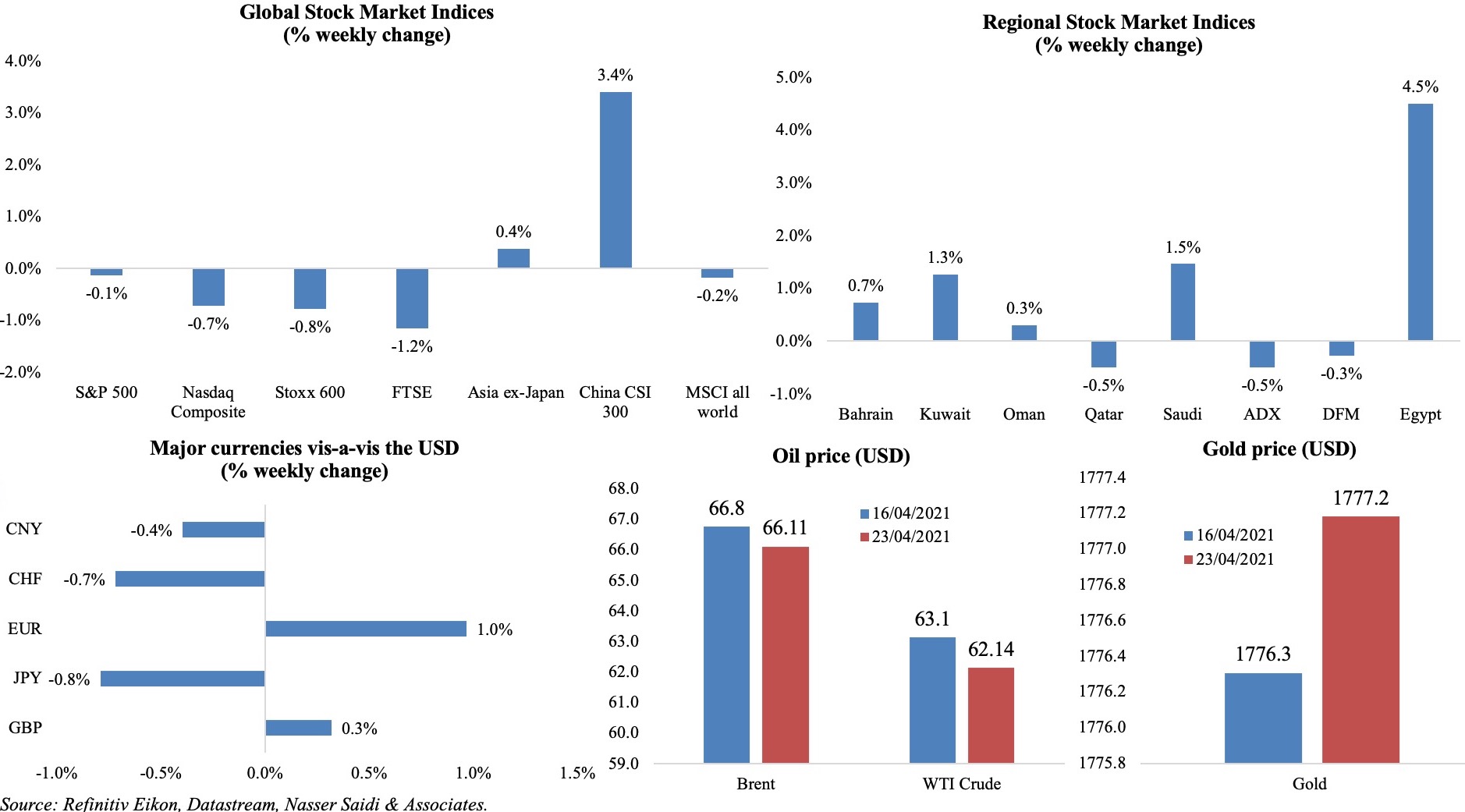

Equity markets were mostly down on widespread sell-offs and concerns about the recent spike in Covid19 cases, in spite of strong earnings season (86% of U.S. firms have beaten earnings expectations). China’s equity markets ended on a strong week, aided by clean energy and healthcare sector shares; the CSI300 was up by 3.4% – the biggest gain in 2 months. Regional markets were mixed: most were supported by a good corporate earnings season, while Egypt posted the highest increase of 4.5% last week, in spite of a blue-chip sell-ff on Thursday. The euro appreciated as the dollar lost some ground. Bitcoin and other cryptocurrencies slid on Biden’s plans to raise capital gains taxes. Oil prices declined on the Covid19 impact on two major oil importers – surge in India and Japan’s state of emergency; as a safe-haven asset, gold price edged up by 0.05%, still hovering near a 2-month high.

Weekly % changes for last week (22-23 Apr) from 15 Apr (regional) and 16 Apr (international)

Global Developments

US/Americas:

- The preliminary reading of Markit manufacturing PMI increased to a record-high 60.6 in Apr (Mar: 58.9), as new order growth accelerated and in spite of being affected by delivery delays and “difficulty sourcing raw materials”. Services PMI jumped to a series record high of 60.1, from 56.3 in Mar, as businesses re-opened and restrictions were eased.

- The Chicago Fed National Activity Index climbed to 1.71 in Mar (Feb: -1.2), implying a rebound in growth, as all 4 broad categories of indicators made positive contributions.

- Existing home sales fell (for the 2nd consecutive month) by 3.7% mom to a seasonally adjusted annualized rate of 6.01mn in Mar – the decline largely attributed to limited supply (supply is down 28.2% yoy); homes are selling at an average of just 18 days.

- New home sales rebounded by 20.7% mom to 1.021mn in Mar (Feb: -16.2%) – the fastest sales pace since Sep 2006 – and inventory fell to 3.6 months of supply. Consumer demand is propped up by low mortgage rates and in spite of higher lumber prices adding roughly USD 24k to the cost of a new home.

- Initial jobless claims fell further to 547k in the week ended Apr 10, a new pandemic-era low, from the upwardly revised 586k the prior week, with the 4-week average slipping down to 651k. Continuing claims fell to 3.674mn in the week ended Apr 3 (also a new low since Mar 2020) compared to the previous week’s 3.708mn.

Europe:

- ECB kept interest rates unchanged and expects to keep buying more bonds in the future (compared to the ECB purchases of EUR60bn, EUR 53bn and EUR 74bn in Jan, Feb and Mar).

- The preliminary Markit manufacturing PMI in Germany declined slightly by 0.2 points to 66.4 in Apr, with many respondents citing supply issues. Services PMI slipped to 50.1 (Mar: 51.5) on stricter lockdown measures. Composite PMI slipped to 56 from 57.3 the month before.

- Eurozone’s preliminary manufacturing PMI increased for a 10th straight month to 63.3 in Apr (Mar: 62.5), with record surges in both output and new orders. Services PMI crossed the 50-mark, rising to 50.3 from 49.6 in Mar. Composite PMI improved to a 9-month high of 60.1 (Mar: 56.3). Future expectations improved, climbing to the highest since mid-2012.

- German producer price index inched up by 0.9% mom in Mar from Feb’s 0.7% increase, largely due to the prices of energy (+0.9% mom) and of intermediate products (+1.6%). In yoy terms, PPI grew by 3.7% from 1.9% the month before – the highest increase since Nov 2011.

- Inflation in the UK increased by 0.7% yoy in Mar (Feb: 0.4%), given upticks in transport costs and clothing prices though food prices fell. Core CPI increased by 1.1% yoy from Feb’s 0.9% reading. Retail price index grew by 1.5% in Mar (Feb: 1.4%), the biggest increase in 8 months while the PPI core output stood unchanged at 1.7% yoy.

- UK retail sales accelerated by 5.4% mom and 7.2% yoy in Mar (Feb: 2.2% mom and -3.6% yoy); clothing sales rose by more than 17% and fuel sales were up by 11% as restrictions were eased towards end of the month. The share of online spending declined to 34.7% in Mar, down from 36.2% in Feb 2021, but still above the 23.1% reported in Mar 2020.

- The ILO unemployment rate in the UK ticked down to 4.9% in the 3 months to Feb from 5% before. Average earnings excluding bonus increased to 4.4% from 4.2% previously.

- Flash manufacturing PMI in the UK jumped to 60.7 in Apr (Mar: 58.9) – the highest since Jul 1994 – supported by the steepest rise in new orders since Nov 2013. Services PMI also ticked up to 60.1 from 56.3 – posting the fastest expansion pace in 6.5 years.

- Public sector borrowing in the UK increased to GBP 303.1bn as of Mar – the highest level since the end of WWII – up EUR 246bn from the previous 12-month period.

Asia Pacific:

- China left interest rates unchanged for the 12th month in a row at 3.85%. Meanwhile, credit growth has been slowing with the regulator actively warning about asset bubble risks (especially in the domestic real estate market).

- Exports from Japan grew by 16.1% yoy in Mar – the steepest growth since Nov 2017, supported by machinery (+12.7%), motor vehicles (+11.2%) and cars (+1-0.5%). Imports rose by 5.7%, widening the trade surplus to JPY 663.7bn. Exports to China surged by 37.2% yoy, to the EU accelerated by 12.8% (largest rise in ~3 years) and to the US rose by 4.9%.

- Industrial production in Japan declined by 2% yoy and 1.3% mom in Feb, following the drop in Jan (-2.6% yoy and -2.1% mom).

- Inflation in Japan fell by 0.2% yoy in Mar (Feb: -0.4%) while core inflation (includes oil products but excludes fresh food) slid for the 8th straight month by 0.1% yoy (Feb: 0.4%).

- The au Jibun Bank’s preliminary manufacturing PMI for Japan increased to 53.3 in Apr (Mar: 52.7). The composite output index returned to expansion, posting 50.2 in Apr, for the first time since Jan 2020.

- Inflation in Singapore jumped to 1.3% yoy in Mar (Feb: 0.7%), the fastest in nearly 4 years, on transport costs (+7.2%) and services inflation (+1.2%); core inflation quickened to 0.5% yoy (Feb: +0.2%) – the most in more than a year.

Bottomline: The release of preliminary PMI numbers underscored that rising production costs (on higher shipping costs) and delivery delays are evident across the globe (which could spill over into inflation numbers in the near-term). While data from the US points to a faster economic recovery, how Europe recovers will depend on its pace of vaccine rollout – already, there are fears of opening up “too early” (France to ease travel restrictions from May 3, Italy to reopen restaurants & cinemas, Greece lifting quarantine requirement for vaccinated persons or those with a negative PCR from key tourism markets). In Asia, Japan declared new lockdowns in Tokyo, Osaka and two other prefectures; with India struggling to contain its second wave, its new strains could potentially derail global recovery. Adding to the worries are concerns about vaccine production: India’s Serum Institute has not fulfilled its commitment to supply the AstraZeneca vaccine globally (to UK, EU and Covax), but is also planning to sell the vaccine to state governments and private hospitals in the country (at higher rates).

Divergence in growth seems to be the medium-term story: how recovery pans out will depend on the simultaneous impact of countries vaccination pace and achieving herd immunity while keeping 3rd/ 4th/ 5th waves at bay. Separately, among central banks, Bank of Canada signaled an exit from stimulus – tapering its bond-buying program – while Russia raised its interest rate by 50bps to 5% given the weak Rouble amid high inflation levels, while also signaling more were to come. Lastly, the OPEC+ meeting on April 28 to review oil production/ supply is unlikely to see any changes.

Regional Developments

- Exports from Bahrain jumped by 17.9% yoy to BHD 684mn (USD 1.8bn) in Q1 2021, with the main export partners being Saudi Arabia (22.4%), UAE (11.1%) and the US (10.4%). Imports inched up by 3% to BHD 1.312bn, with the top 10 nations accounting for 72% of value of imports (list topped by Brazil, China and the UAE).

- Employment of expats in Bahrain declined by 9.7% yoy to 535,022 as of Q4 2020 while citizens’ employment posted a 0.7% drop to 152,678.

- Bahrain and Israel have signed a bilateral agreement with respect to “mutual recognition of vaccination and green passports”. This will permit vaccinated persons from either country to be exempt from quarantine (in the other), also allowing them to enter places that require a “green passport”.

- Economic growth in Egypt averaged 1.3% yoy in Q1-Q3 2020, according to the central bank, supported by domestic consumption and offsetting the negative contributions from investments and net exports.

- Egypt raised domestic fuel prices for the first time since 2019 (when all subsidies were phased out as part of the IMF-backed reform plan). Prices were lowered twice afterwards: in Oct 2019 and Apr 2020.

- Non-oil exports from Egypt increased by 7.2% yoy in Q1 2020 to USD 7.4bn. Imports inched up by 1.4% to USD 16.9bn, allowing trade deficit to narrow by 1% to USD 9.5bn. Separately, iron and steel exports from Egypt rose by 61.2% to USD 187mn in Jan-Feb 2021; it was shipped to 49 destinations with Italy, Saudi Arabia and Spain topping the list (accounting for 64% of total).

- Egypt provided EGP 2.4bn (USD 153mn) towards export subsidy dues payment. This initiative allows for the payment of 85% of the total value of dues in lump-sum, instead of paying it in installments.

- Egypt plans to raise EGP 1.25trn (USD 80bn) as part of its investment plan for the fiscal year 2021-2022, disclosed the minister of planning and economic development. This includes a 125% surge in funding for the production sector and a 30% rise for the services sector.

- The central bank of Egypt issued Treasury bonds worth EGP 16.5bn (USD 1.05bn) to support financing of the budget deficit. Government banks were the largest buyers.

- Egypt’s Tax Authority disclosed that offices and commercial spaces would be subject to 14% VAT.

- The largest independent solar power project in Egypt, the 200 MW Kom Ombo photovoltaic power plant, received a USD 114mn financing package from a group of development financial institutions (including EBRD, AfDB) and banks.

- Egypt agreed to produce more than 40 million doses a year of Russia’s Sputnik V coronavirus vaccine, in an agreement between the pharma firm Minapharm and the Russian Direct Investment Fund. Rollout is expected in Q3 this year.

- Iraq withdrew permits for 1,128 projects due to long delays as part of a new law requiring project owners to finish them on time. Projects with an execution rate of 0-35% after deadline for completion were affected by this decision.

- The central bank of Iraq signed an agreement with Mastercard to promote digital payments in the country. Though almost 99.8% of the USD 122bn personal consumption expenditure was made in cash in 2019 (according to the World Bank), a 70% smartphone penetration rate and 22% share of young and tech-savvy population denotes untapped potential for digitisation.

- Remittances flow to and from Jordan dropped by 10-20% during Ramadan in comparison with the same period in the past before the pandemic, according to the President of the Jordanian Money Exchange Association.

- The Central Bank of Kuwait clarified regulations for postponing collection of loan payments from eligible citizens for a period of 6 months.

- Annual reports of Kuwaiti banks indicate that 55% of the management positions (excluding middle management) are occupied by Kuwaitis, according to EFG Hermes financial group.

- Businesses in Oman are allowed to bear the VAT instead of the customers should they opt to do so, according to a Tax Authority official.

- Total Omanis working in the private sector inched up by 0.3% mom to 254,999 as of Mar.

- Investment banking fees in MENA ticked up by 5% yoy to a 3-year high of USD 218mn in Q1 this year; advisory fees from M&A Activity plunged by 74% to USD 20.4mn – the second lowest total in the past decade.

- Sukuk issuance in the GCC declined to USD 6.5bn in Q1 2020 from USD 10.2bn in Q1 last year, according to Refinitiv data.

- The GCC is home to over 22k active construction projects valued at USD 2.2trn, according to BNC Network. Project awards totalled USD 35.6bn in Q1 (already 55% of total announced in 2020): Saudi Arabia topped the list (54%) followed by Qatar (21%).

Saudi Arabia Focus

- Saudi Aramco is expected to refinance a USD 10bn debt facility raised in 2015, reported Reuters.

- Saudi Arabia plans to save about SAR 800bn (USD 213.34bn) over the next 10 years by replacing fuel for domestic consumption with gas and renewable energy, according to the finance minister.

- Foreign investments into Saudi Arabia increased to record level of SAR 2.1trn in 2020, up 9.45% yoy. The licenses granted by the ministry of investment to foreign investors reached 466 during Q4, registering the highest quarterly rise.

- Domestic sukuk issuance in Saudi Arabia stood at SAR 11.713bn (USD 3.1bn) in Apr.

- Public debt issuance in Saudi Arabia grew by nearly 50% yoy to SAR 163bn in 2020, disclosed the Capital Market Authority. Non-government debt issuance surged by more than 250% to SAR 31bn.

- Saudi Arabia’s holdings of US treasury bonds declined by 27.9% yoy and 1.6% mom to USD 132.9bn in Feb. This is the lowest level since Sep 2020.

- Saudi Arabia’s King authorized SAR 1.9bn to be paid to Saudis who receive social security benefits.

- China’s crude oil imports from Saudi Arabia increased by 8.8% to 7.84mn tonnes or 1.85mn barrels per day in Mar – Saudi continues to be the biggest crude oil supplier to China for the 7th straight month. China’s imports from Oman, UAE and Kuwait increased as well – by 60% (to 0.86mn bpd), 86% (to 0.71mn bpd) and 29% (to 0.6mn bpd) respectively.

- Crude oil exports from Saudi Arabia fell to 5.625mn barrels per day in Feb – the lowest since Jun 2020, and up from Jan’s 6.582mn bpd (the highest since Apr 2020).

- The Saudi Export-Import Bank approved nearly SAR 8bn (USD 2.13bn) in lending to non-oil exporters since this was launched early last year.

- Saudi Grains Organisation announced the completion of the sale of its entire stake in the last two milling companies, as part of the privatization programme.

- Saudi ports handled more than 253k twenty-foot equivalent units (TEUs) in Mar, up more than 33% yoy.

- Saudi Arabia recorded a 110% mom surge in people searching for flights in Mar, according to the travel platform Skyscanner. Domestic flights were most searched, in addition to international flights to India, Pakistan, Philippines and Egypt.

UAE Focus![]()

- UAE plans to include 10 new sectors – chemical, petrochemical, pharmaceutical, defence and heavy industries; national food and healthcare security industries; industries of the future, including space and renewable energy among others – under the commercial companies’ law, allowing for 100% ownership of onshore firms.

- UAE central bank will extend its monetary support measures till Jun 2022. Furthermore, “to support the recovery phase”, financing for loan deferrals under the Targeted Economic Support Scheme will be extended until end-2021.

- 65 new commercial agencies were registered in the UAE in Q1 this year; the total number of commercial registrations stood at 5944 as of end-2020, including 348 new firms.

- The Sharjah Economic Development Department declared a 12% increase in number of issued and renewed licenses in Q1 this year to 15,920. E-commerce licenses surged by 292% yoy while industrial and commercial licenses grew by 19% and 13% respectively.

- DP World reported a 10.2% yoy rise in Q1 container shipping volumes, handling 18.9mn twenty-foot equivalent units (TEUs), with growth across all regions. Gross volumes were 9.6% higher than Q1 2020 on a like-for-like basis while consolidated volumes grew 8.2% yoy on a reported basis and up 7% on a like-for-like basis.

- UAE extended repayment of a USD 2bn deposit that was given to Pakistan in Jan 2019: the payment was due Apr 19th this year.

- About 86% of respondents in the UAE prefer to work completely virtually or see remote and on-site working together, according to a BCG-Bayt.com study. About 43% are currently virtual in some form of remote working compared to 51% globally.

Media Review

Vaccines are working – charts that show the Covid endgame

https://www.ft.com/content/d71729a3-72e8-490c-bd7e-757027f9b226

The YOLO economy

https://www.nytimes.com/2021/04/21/technology/welcome-to-the-yolo-economy.html

The spectacular surge of the Saudi female labor force

https://www.brookings.edu/blog/future-development/2021/04/21/the-spectacular-surge-of-the-saudi-female-labor-force/

UAE has potential to become a manufacturing hub for hydrogen infrastructure

https://www.thenationalnews.com/business/energy/uae-has-potential-to-become-a-manufacturing-hub-for-hydrogen-infrastructure-1.1208322

Swiss probe Lebanon’s central bank chief over alleged USD 300mn embezzlement

https://www.ft.com/content/106b1ddd-d8dc-49e5-90ec-eb216c147125