Download a PDF copy of this week’s insight piece here.

1. Oman: 4th GCC nation to implement VAT

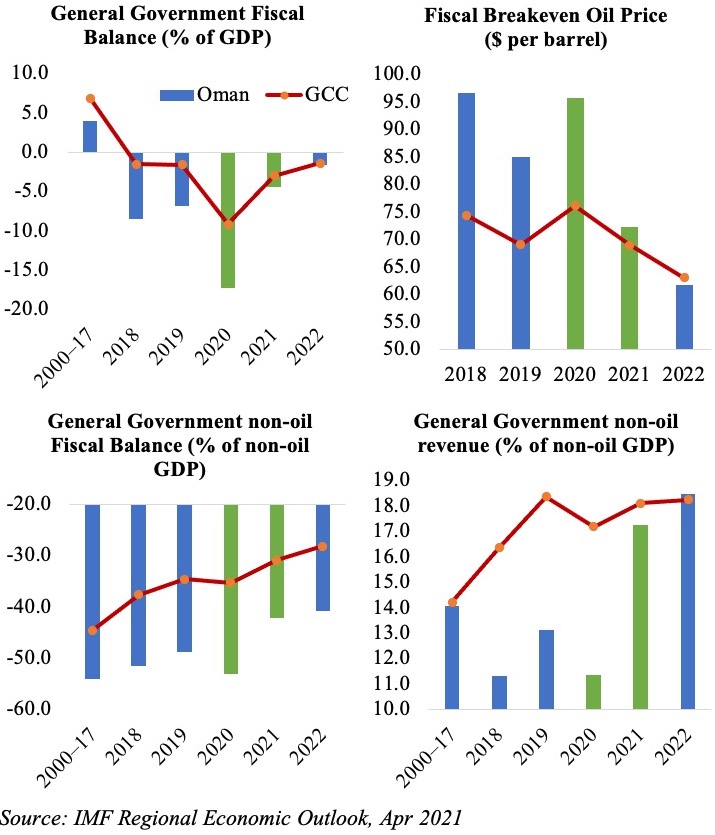

- Oman introduced 5% VAT on most goods and services, starting Apr 16

- UAE and Saudi Arabia rolled out 5% VAT in 2018 & Bahrain in 2019

- According to Ministry of Finance estimates, Saudi increased non-oil tax revenues to 32% in 2018 (vs just 10% in 2010), 36% in 2019 and estimated to rise to 46% in 2020 (given tripling of VAT)

- UAE collected AED 27bn in VAT in 2018 (1st year) & AED 11.6bn in Jan-Aug 2020 (pandemic year); VAT revenues in Bahrain touched BHD 260mn in 2019 and BHD 220mn in 2020.

- Oman’s VAT is estimated to generate ~OMR 400mn (USD 1bn) in revenue annually, roughly ~1.5% of GDP (if effectively and efficiently implemented)

- As a result, the IMF projects fiscal deficit to decline to 4.5% of GDP in 2021 (2020: 17.5%) & non-oil revenue to rise to 17.2% of non-oil GDP in 2021 (2020: 11.4%)

- This move will lead to an improvement of Oman’s sovereign credit rating + lower the cost of credit + attract more FDI & portfolio investment as a result of the ensuing reduction in macroeconomic risks

2. GCC’s Diversification Efforts & Renewable Energy policies => Transition to a lower-oil dependent region

- Unsustainable path of dependence on oil: current oil demand vs supply, pressure on oil prices + current fiscal & social spending policies => fiscal unsustainability: GCC’s aggregate net financial wealth (est. at $2trn) could be depleted by 2034 (IMF)

- Oil market structure & dynamics are changing, given global energy transitions: pre-Covid19, shale & renewables were already displacing conventional oil

- Major challenges for the oil market (non-exhaustive list):

–Demand-side factors:

-

- Gov’t plans for sustainable recovery, ambitious goals for net-zero emissions

- Covid19-led collapse in demand: potential WFH policies & mobility, question marks over recovery of business/ leisure air travel

- Energy efficiency improvements, EV penetration

–Supply-side factors:

-

- Spending cuts and project delays could slow oil supply growth

- Large cost reductions in renewables + advances in digital technologies

- Climate Change & Decarbonisation Risks are growing – could lead to sharp fall in fossil fuel asset prices => stranded assets risk

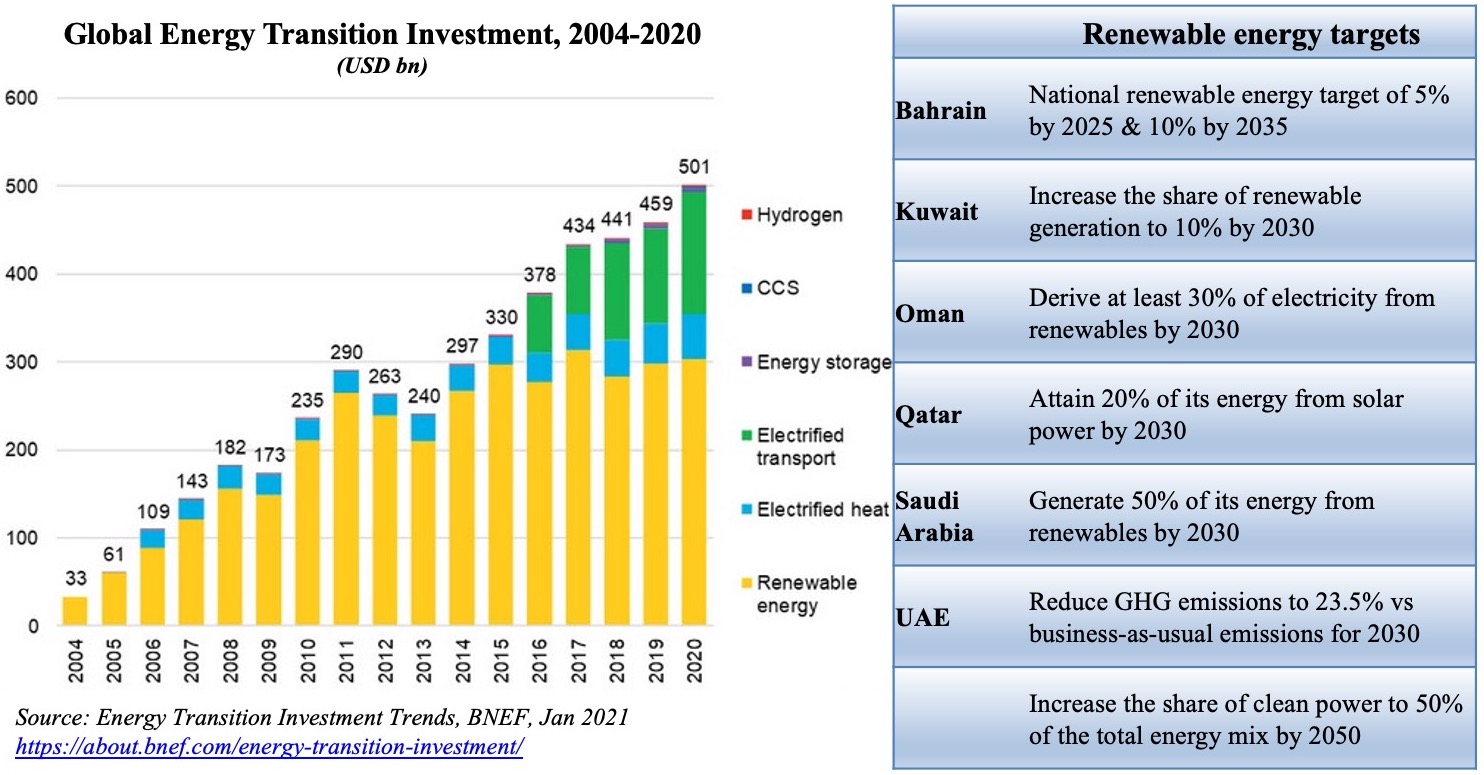

3. Energy Transitions & GCC’s ambitious targets

- The two-day virtual Leaders Summit on Climate (from today), hosted by the US President, brings the US back into play with respect to global action against climate change

- Latest news that banks & financial institutions with USD 70trn+ assets pledged to cut their greenhouse gas emissions & ensure their investment portfolios align with the science on the climate adds to the commitment

4. Are the GCC nations prepared for a low-carbon economy transition?

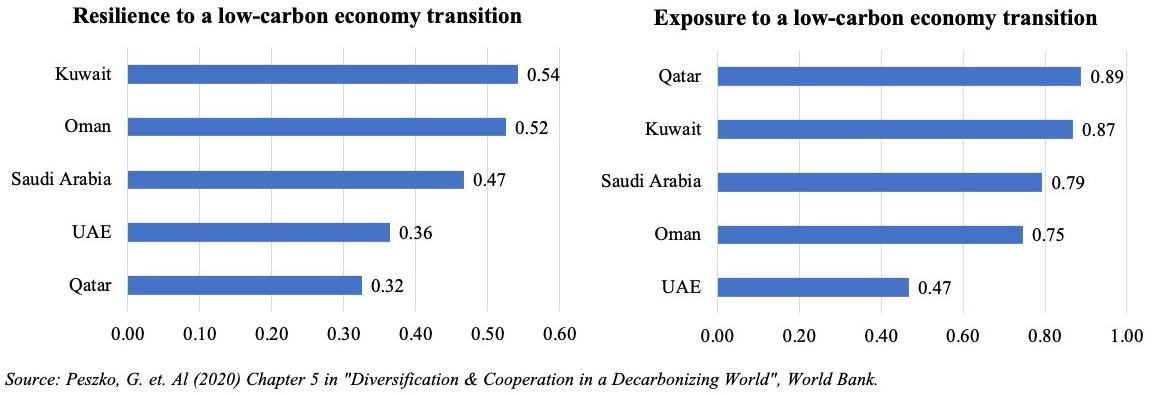

- The preparedness of countries for a low-carbon transition (LCT) is measured by exposure and resilience indexes: highlights turning the risks of an LCT into opportunities for robust growth.

- GCC nations are signifcantly exposed, especially given dependence on oil (resource rents, carbon intensity, GHG emissions): Qatar scores highest exposure & UAE the least

- However, the GCC are relatively well prepared for an LCT thanks to its resilience, particularly its relatively good macro stability and supportive business environment alongside high quality of infrastructure, human capital and institutions

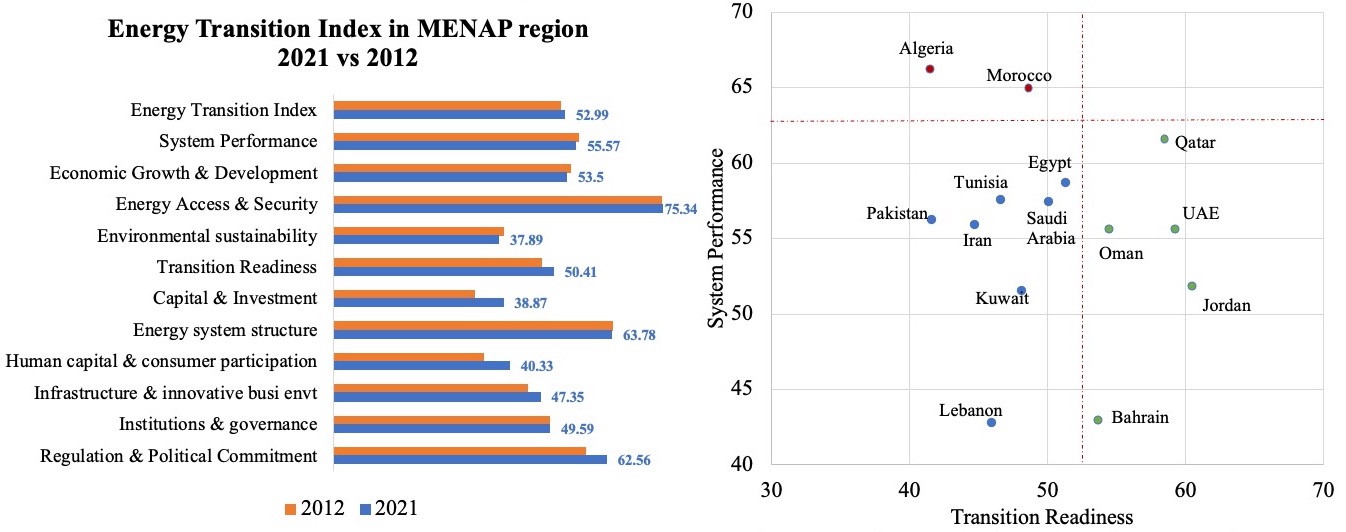

5. WEF’s Energy Transition Index ranks UAE just behind Qatar wrt energy systems & pathways to clean energy

- UAE ranked 64th globally on WEF’s latest Energy Transition Index (2021) out of a total 115 nations, just behind Qatar at 53rd position. Lebanon ranked lowest in the Middle East region at 112th.

- Among the various components of the Index, MENAP’s average falls farthest from the world average in two: environmental sustainability (37.89 in MENAP vs 61.32 globally) and capital & investment (38.87 vs 55.17). Of the 11 categories, region is worse-off compared to 2012 (initial year of results) in 4: system performance, environmental sustainability, energy system structure and economic growth & development

- The chart on the right shows no MENAP countries in the top-right quadrant (high transition readiness & well-performing energy systems). 4 of 6 GCC nations are in the “leapfrog” quadrant (green dots, high readiness but system performance below the mean); two countries Algeria and Morocco fall among those with potential challenges (red dots, above-average system performance but readiness below the mean).

Source: Energy Transition Index 2021, World Economic Forum. https://www.weforum.org/reports/fostering-effective-energy-transition-2021#report-nav

6. GCC risk for climate-driven hazards is much lower than regional counterparts

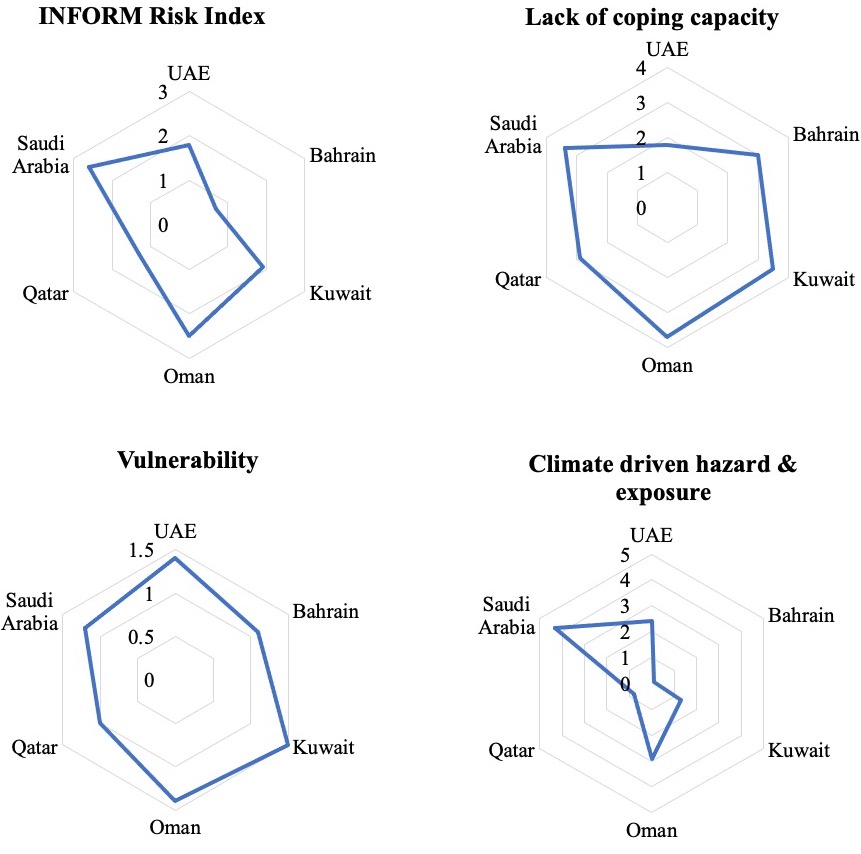

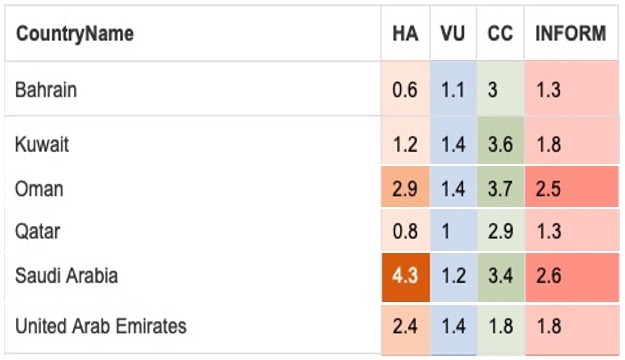

- The climate-driven INFORM Risk 2021 Index is derived from 3 dimensions: climate-driven hazard & exposure, vulnerability and lack of coping capacity.

- GCC nations fare relatively better, scoring between 1.3 to 2.6 out of a total 10 (riskiest). But, two scores are comparatively higher: Saudi Arabia’s hazard & exposure score (largely due to conflict risk) and Oman’s lack of coping capacity (institutional & governance indicators related to increasing the resilience of the society need improvement).

Source: INFORM Global Risk Index 2021. https://drmkc.jrc.ec.europa.eu/inform-index/INFORM-Risk

Powered by: