Download a PDF copy of this week’s insight piece here.

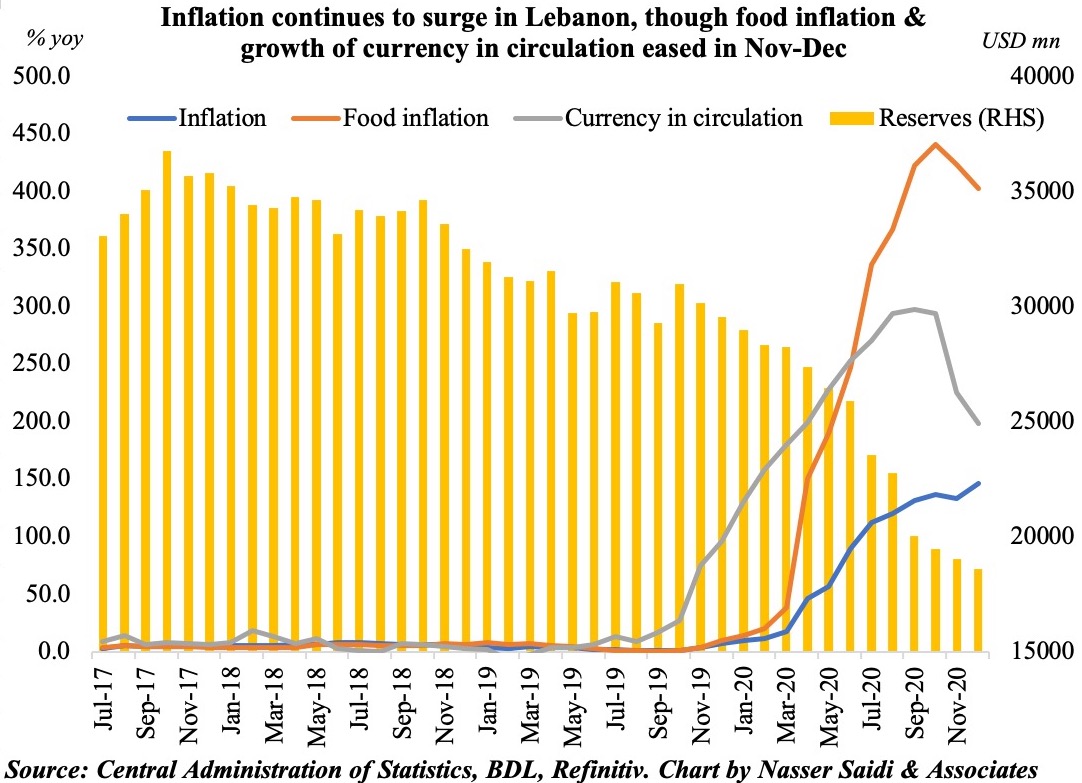

Chart 1. Lebanon: Cascading Collapses

- According to the finance minister, the central bank has only USD 1-1.5bn to use to fund subsidies (i.e. just for 2-3 months more).

- The Lebanese pound plummeted to record lows of 15000 per dollar on the black market on Tuesday (from 10k on Mar 2nd)

- Overall inflation was at 146% and food inflation at 402% in Dec 2020. The pound’s fall has further hiked food prices.

- This latest collapse, alongside statements of potential lifting of subsidies, has triggered fears of shortages of food.

- Funding of (ill-designed) subsidies can no longer be continued at the same pace.

- “Reserves”, which are really “banks’ dollar Legal Reserve Requirements at the Banque du Liban” (this is a liability of the BDL – these are depositors’ money deposited by the banks at the BDL), have halved from a year ago. News of BDL’s “revised” mandatory minimum reserves to USD 15bn (down from USD 17bn) is only a stopgap solution.

- Given the ongoing political deadlock (the current caretaker government had resigned last Aug), it looks like a very long and painful road to reforms and some semblance of “normalcy”.

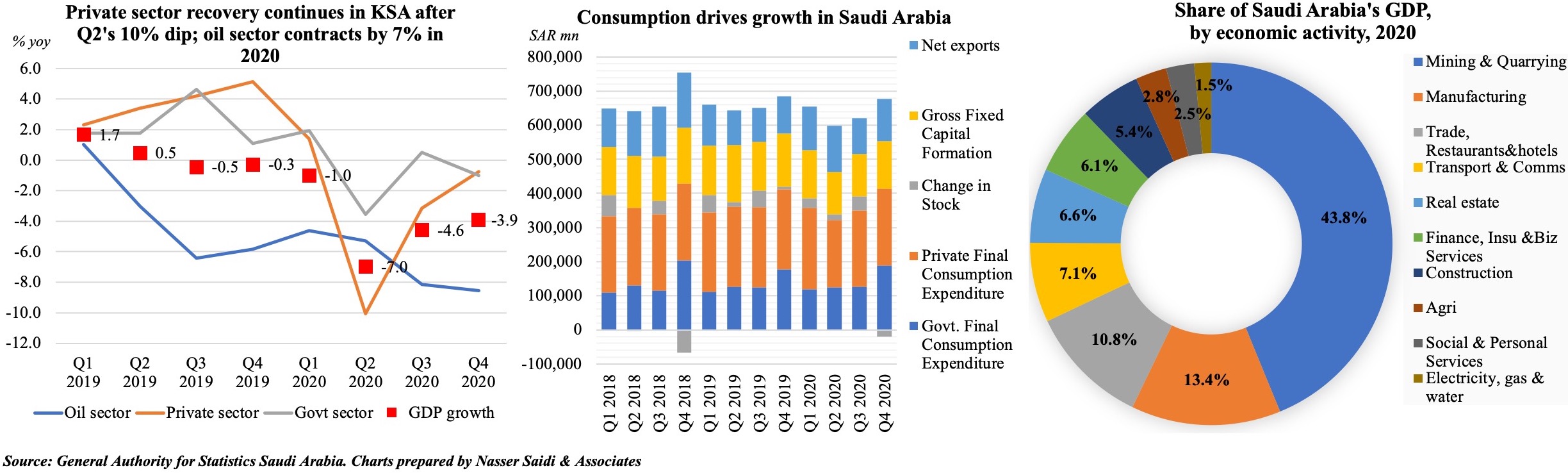

Chart 2. Saudi Arabia: Reforms to Boost Recovery?

- Saudi Arabia’s GDP declined by 4.1% in 2020, driven by substantial drops in both oil and non-oil sector acivity (at -6.7% and -2.3% respectively). Private sector was recovering at a faster pace in Q4 vs other sectors.

- By economic activity, the mining and quarrying sector accounted for 44% of overall GDP in 2020 (growing by 0.8% yoy) though the finance insurance and business services (share of 6.1%) grew the fastest, up by 1.3%.

- By expenditure compoenents, consumption accounts for around 50% of overall GDP; last year, government final consumption expenditure was the sole component showing positive growth (+4.2%) while gross fixed capital formation plunged by 13.5%.

- PMI (which hit a 14-month high in Jan and eased in Feb) and rising credit growth alongside various announcements to increase private sector activity (regional HQs and approval of the Private Sector Participation law, to name a few) and attract FDI will bode well for the economy in the medium to long run.

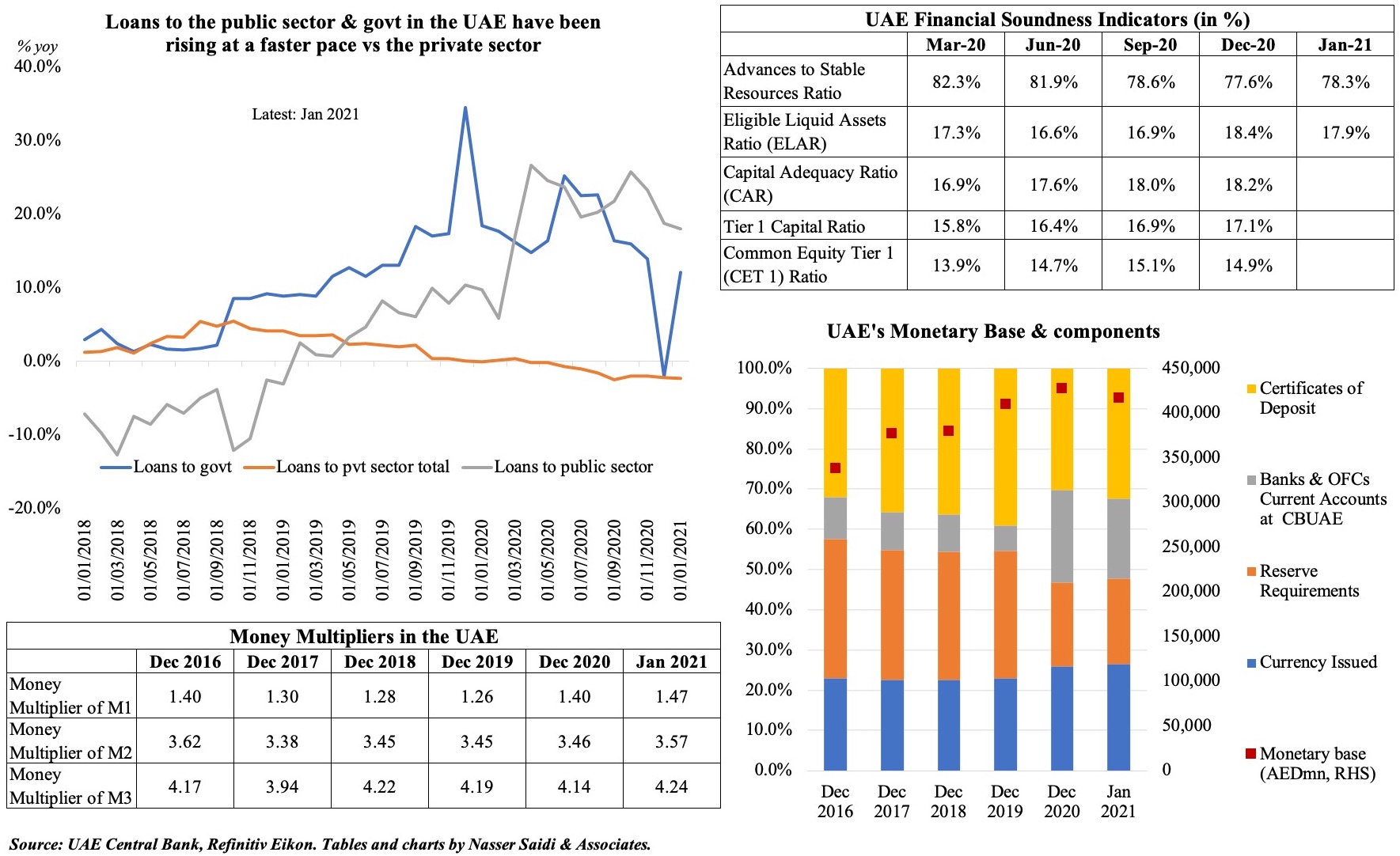

Chart 3. UAE: Successfully (?) Mitigating Covid19’s Impact

- UAE Central Bank governor: banking system’s overall liquidity has returned to pre-Covid level; 320k+ cutomers benefitted from the Targeted Economic Support Scheme (TESS) & ~175k customers are under deferral arrangements

- Loans to the private sector dropped by 1.5% during Apr 2020- Jan 2021 while credit to government and GREs surged by 16% and 22% respectively. Financial soundness indicators have improved: ELAR remained above the 10% reegulatory minimum requirement while CAR, Tiel 1 capital ratio and CET 1 indicate well-capitalised banks.

- In Jan 2021, monetary base contracted by 2.47% mom, due to a 15.6% drop in Banks & OFC’s Excess Reserves (which accounts for 19.8% of monetary base) while Certificates of Deposits purchased by banks (32.5% of monetary base) rose by 4.6%

- The increases in the multipliers of M1, M2 and M3 indicate faster rise in the monetary aggregates M1, M2 and M3 vs contraction of the monetary base.

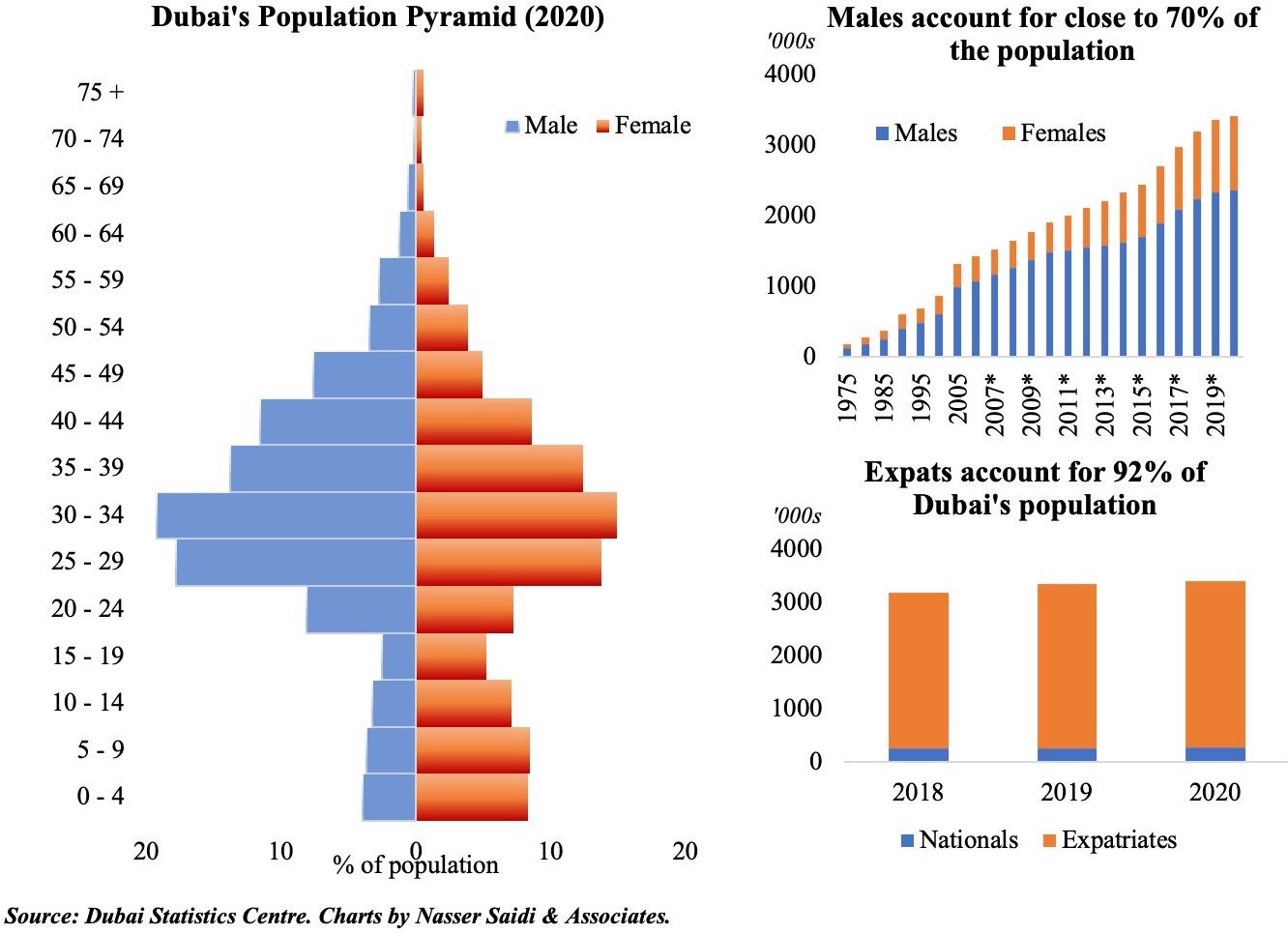

Chart 4. Up, Up & Away? Dubai’s Population ticks up to 3.4mn in Covid19-struck 2020

- In spite of anecdotal evidence of job losses and repatriation flights, official Dubai Statistics Centre estimates that Dubai’s population grew by 1.6% yoy to 3.41mn in 2020.

- As expected, expatriate population accounted for more than 90% of overall population; males accounted for close to 70% of overall population – not surprising, with the construction sector accounting for almost 1/3-rd of employment in the UAE

- The population pyramid shows that about 70% of males and 55% of females are between the 25-49 years age group. The gap between males and females are largest in the age groups of 30-34 and 25-29.

- The Dubai Urban Masterplan 2040 projects population to surge by 76% to 5.8mn. This follows recent reform measures including in visas (long term visas for professionals and investors, retirement and remote working visas), 100% foreign ownership and even a path towards citizenship – all of which are likely to boost population numbers.

- Dubai’s openness at a time when other regional nations are pursuing localisation policies will likely work in its benefit, though competition might be rife should Saudi Arabia emerge successful in its current reform path.