Markets

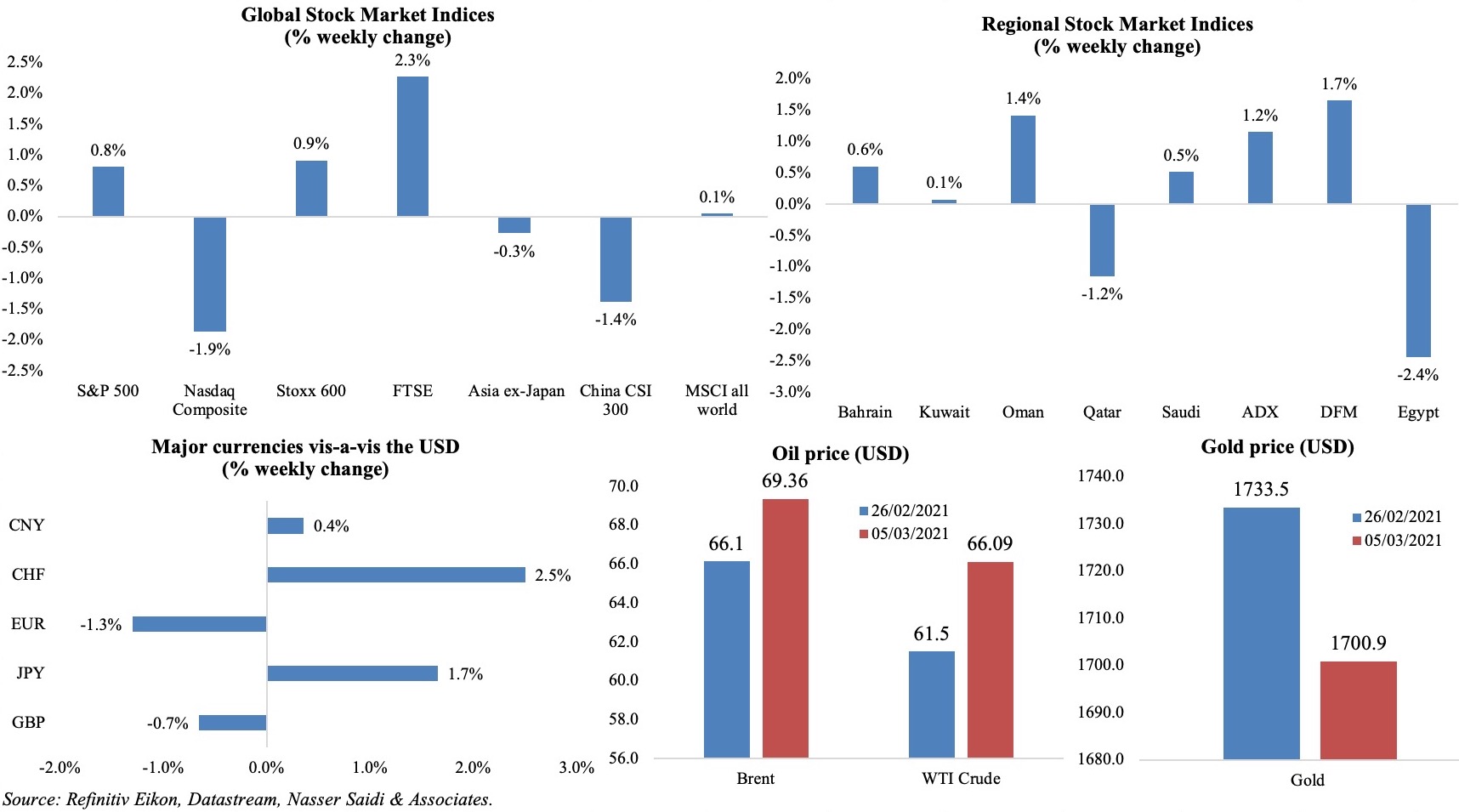

Mixed performance across global equity markets: tech-heavy Nasdaq declined while in Europe, the Stoxx600 index gained on support for sectors likely to benefit from a bounce back; the MSCI all world index managed to eke out a 0.1% gain. Regional markets were mostly up on the week, though both Egypt and Qatar ended in the red on selling pressures. The dollar strengthened, resulting in the yen touching a 9-month low and the Swiss franc falling to a 7-month low. OPEC+’s move to maintain oil supply restrictions through Apr along with Saudi Arabia’s voluntary cuts extension drove oil price up to near 14-month highs. Gold price dropped to below USD 1700, for the first time since Jun 2020.

Weekly % changes for last week (4-5 Feb) from 25 Feb (regional) and 26 Feb (international).

Global Developments

US/Americas:

- The US Senate passed the USD 1.9trn pandemic aid plan, which includes USD 1400 in direct payments to taxpayers and weekly unemployment benefits at USD 300, in addition to new funding for vaccine distribution and testing among others. A final approval is expected from the House Democrats this week.

- Non-farm payrolls surged by 379k in Feb (Jan: 166k), with most new hires from the hospitality sector (+355k) while sectors like education, construction and mining posting declines. The labour force participation rate held steady at 61.4% while unemployment rate fell to 6.2% (From 6.3% the month before).

- US factory orders increased by 2.6% mom in Jan (Dec: 1.6%): while demand was strong for electrical equipment, appliances and components, orders for machinery fell. orders for non-defense capital goods excluding aircraft increased by 0.4% vs previous estimates of 0.5% uptick.

- ADP reported an increase in private sector jobs by 117k in Feb (Jan: 195k), with medium-sized business (of 50–499 employees) posting the largest increase at 57,000.

- ISM manufacturing PMI moved up to a 3-year high of 60.8 in Feb (Jan: 58.7), with new orders rising to 64.8 from 61.1 the month before. Services PMI slipped to 55.3 from Jan’s 58.7 reading (the highest since Feb 2019), after new orders index slowed to a 9-month low of 51.9. Both manufacturing and services industries saw prices paid jump to 86 and 71.8 – the highest reading since Jul and Sep 2008 respectively.

- Markit manufacturing PMI clocked in 58.6 in Feb, easing from Jan’s 59.2: increases in output and new orders were posted while employment grew at the steepest rate since Sep 2014; input costs posted a substantial rise, and supply chain disruptions were evident. Services PMI was revised higher to 59.8 in Feb (Jan: 58.9) and composite PMI grew to 59.5 – the strongest expansions since Jul and Aug 2014 respectively.

- Initial jobless claims increased to 745k in the week ended Feb 27, rising from an upwardly revised 736k the prior week, with the 4-week average slowing to 790.75k. Continuing claims also fell by 124k to 4.295mn in the week ended Feb 20 – another pandemic-era low.

Europe:

- Germany’s manufacturing PMI stood at a 3-year high of 60.7 in Feb (Jan: 57.1), ticking up thanks to order book growth, including demand from abroad. Composite PMI was 51.1 (Jan: 50.8) with continued weakness in services PMI (45.7 vs 46.7).

- Manufacturing PMI in the Eurozone was up at 57.9 in Feb (Jan: 54.8) – the fastest rise in growth in 3 years while input costs increased. Germany, the Netherlands and Austria reported the strongest growth, with only Greece weakening. Composite PMI was 48.8 with services PMI down to 45.7

- Inflation in Germany grew by 0.7% mom and 1.3% yoy in Feb, as the temporary VAT cut was reversed and thanks to higher energy prices. The harmonized index of consumer prices rose by 1.6% yoy and 0.6% mom in Feb.

- Inflation in the Eurozone remained steady at 0.9% in Feb: its highest level for the past year, largely due to a combination of higher food and energy prices. Core inflation dipped from Jan’s 1.4% yoy to 1.1% in Feb.

- Retail sales in Germany declined by 4.5% mom and 8.7% yoy in Jan (Dec: -9.1% mom and +2.8% yoy): unsurprising given the recent rise in sales tax and ongoing Covid19 restrictions.

- In the Eurozone, retail sales plunged by 5.9% mom and 6.4% yoy in Jan (1.8% mom and 0.9% yoy) – posting the steepest decline since Apr 2020.

- Unemployment in the Eurozone was steady at 8.1% in Jan. Spanish unemployment hit a five-year high and recorded the highest percentage of youth and female unemployment (1 in 5 Europeans under 25 years of age who are unemployed is Spanish). Separately, unemployment in Germany rose by 9k to 2.9mn (Dec: -37k).

- The UK budget unveiled last week confirmed an extension of the furlough scheme until the end of Sep in addition to the GBP 5bn restart grant for businesses, while adding a big tax break for business investment. While the total Covid support package this year and next stands at GBP 352bn, budget deficit will be GBP 355bn or 17% of GDP.

- UK manufacturing PMI touched 55.1 in Feb (Jan: 54.1), with output rising at the weakest pace in the 9-months of increases; domestic demand improved, as did new export business and optimism rose to a 77-month high.

Asia Pacific:

- China’s NBS manufacturing PMI declined by 0.7 points to 50.6 in Feb, with output expanding the least in a year (51.9), new order growth slowing to an 8-month low and export orders dropping for the first time in 6 months. Non-manufacturing PMI eased to 51.4 in Feb (Jan: 52.4), with employment remaining below-50. Caixin manufacturing eased to 50.9 in Feb (Jan: 51.5) – the lowest since May 2020.

- Exports from China surged by 60.6% yoy in Jan-Feb while imports expanded by 22.2%, thereby posting a trade surplus of USD 103.25bn.

- China’s foreign exchange reserves fell by USD 5.677bn to USD 3.205trn in Feb; it held an unchanged 64 million fine troy ounces of gold at end-Feb though its value fell to USD 109.18bn in Feb from Jan’s USD 116.76bn.

- Japan’s manufacturing PMI rose to 51.4 in Feb (Jan: 49.8), with output growing for the first time since Dec 2018 while employment levels continued to decline albeit at a softer pace.

- Unemployment rate in Japan remained steady at 2.9% in Jan. The jobs-to-applicant ratio came in at 1.10 and the participation rate was 61.8% (Dec: 62.0%).

- South Korea’s GDP expanded by a seasonally adjusted 1.2% qoq in Q4, supported by a 5.2% rise in exports while private consumption and facility investment declined by 1.5% and 2% respectively. For the full year 2020, the economy shrank by 1%.

- Retail sales in Singapore declined for the 24th consecutive month, falling by 6.1% yoy in Jan (Dec: -3.3%), partly due to the timing of the Chinese New Year holidays. Excluding motor vehicles, retail sales fell 8.4% in Jan.

Bottom line: As vaccination drives gather speed, the WHO confirmed on March 1st that the number of confirmed Covid19 increased globally for the first time in 6 weeks as a result of the spread of multiple variants and premature easing of restrictions. Meanwhile, global manufacturing PMI rose to a 3-year high of 53.9 in Feb (Jan: 53.6), in spite of the growth of new order intakes easing to a five-month low and as inflationary pressures continue to build. Fears of a taper tantrum are also hitting hard: the IIF reported daily outflows (for the first time since Oct) of about USD 290mn from emerging markets, compared with daily inflows of about USD 325mn in Feb this year.

Regional Developments

- Bahrain’s MPs approved the 2021-22 national budget: with total revenue at an estimated BHD 4.863bn, deficit is expected to be around BHD 2.319bn over both years and to be covered through borrowing. The Future Generations Fund will receive USD 1 from every exported barrel of oil and is expected to touch BHD 41.2mn this year and the next.

- About 18.1% of Bahrain’s population has received at least 1 dose of the Covid19 vaccine (as of Mar 5th) after having launched the campaign on Dec 17th. The nation aims to vaccinate an additional 300k persons by end of this month i.e. at an average 10k persons a day.

- Egypt’s PMI edged up to 49.3 in Feb (Jan: 48.7), staying above the long-run average of 48.2. Though domestic demand remained weak, export sales picked up and employment declined at the slowest rate in 16 months.

- Net foreign assets of Egypt’s banking sector increased by 4% mom to EGP 281.7bn in Jan.

- The fuel subsidy bill in Egypt plunged by 45% to EGP 8.4bn (USD 537.8mn) between Jul and Dec (H1 2020-21), according to the petroleum minister, versus a budgeted EGP 14.1bn.

- Foreign investment in Egypt’s debt instruments recorded a new high of USD 28.5bn at end-Feb.

- Egypt needs to inject USD 20bn in investments to achieve sustainable development goals by 2030, disclosed the minister of planning and economic development. She also disclosed that the nation targets doubling of green projects by 2022.

- Egypt launched the Closing the Gender Gap Accelerator (in cooperation with the World Economic Forum) to advance women’s economic empowerment, in line with achieving the SDGs related to gender equality and reduce gender gap in the labour market. A dedicated SDGs fund will spend USD 3.3bn to implement 34 projects to close gender gap across sectors.

- About EGP 3bn (USD 191mn) worth of projects are being implemented to digitize all government services in Egypt, according to the ministry of communications. About 45 digital services have already been launched.

- Egypt’s ministry of trade and industry is encouraging the local industrial community to manufacture raw materials, deepen local manufacturing and network national manufacturing chains.

- The minister of tourism and antiquities stated that tourism in Egypt would return to pre-pandemic levels only by fall 2022. Separately, the initiative to support domestic tourism has been extended till 15th May: this includes reduced domestic airline prices to connect tourist cities as well as lower ticket prices to enter archaeological areas and museums.

- Egypt’s car sales surged by 49% yoy in Jan to 20,700 units; however, in mom terms, sales were down by 24%.

- The Covid19 vaccination rollout in Egypt has been extended to include the elderly and persons with chronic illnesses.

- Iraq’s oil exports increased to 2.96mn barrels per day (bpd) in Feb, according to the oil ministry, from Jan’s 2.868mn bpd.

- A senior official disclosed that Iraq is considering the creation of a sovereign wealth fund as a “fund for future generations” in the country.

- In a bid to support e-commerce, Jordan expanded the tax exemption for online purchases (for personal use) from abroad to JOD 200 from JOD 100 before. No taxes or fees will be collected on the packages except for the 10% fixed rate for those below the threshold.

- A study in Jordan disclosed the effectiveness of lockdowns on reducing spread of Covid19: Friday’s all-day curfew was seen to reduce infections by 37% and deaths by 35%.

- Kuwait’s government proposed new amendments to the public debt law: this includes capping borrowing to a maximum 60% of GDP and a change in the duration of debt – no maturity limit versus the existing law’s maximum limit of 30 years.

- Kuwait will start imposing a 5pm-5am curfew starting today (Mar 7th) in an effort to contain the Covid19 cases.

- Lebanon’s PMI nudged up to 42.2 in Feb (Jan: 41), with some stabilisation in employment (after 17 straight months of declines) amidst muted declines in output, new orders and new export orders. However, an overall pessimistic sentiment continues given the political deadlock and economic meltdown.

- The Lebanese pound hit a record low last week: dealers were buying the greenback for LBP 9,950 and selling it for LBP 10,000.

- Lebanon needs to vaccinate close to 30k persons per day to reach herd immunity in a year, according to the head of the main government hospital (that is tackling Covid19 cases). Only about 15% of eligible citizens had registered for the vaccine. Just above 60k doses have been administered (as of Mar 5th) since the inoculation campaign began on Feb 14th.

- Oman raised a loan of USD 2.2bn, reported Reuters: the new loan has a 15-month maturity with the possibility to extend it by an additional 12 months at the borrower’s discretion.

- A new government-owned energy company called Energy Development Oman has been set up in Oman. The company will not only own a shareholding in Petroleum Development Oman LLC and an interest in Block 6 (one of the biggest crude deposits in the Middle East, with production capacity of 650k barrels a day), but also can borrow money “in any manner”, according to a government gazette.

- Refinery production in Oman dropped by 6.8% yoy by end of 2020, according to NCSI.

- Oman aims to increase the contribution of renewable energy to the total energy produced from 11% in 2023 to 30% by 2030. The nation is home to 11 hybrid solar energy projects as well as the largest wind energy project in the Gulf region.

- All commercial activities in Oman (including restaurants and cafes within tourist establishments) will remain closed from 8pm to 5am till Mar 20th to reduce the spread of Covid19 cases.

- People aged 60 will be added to the vaccination target group in Oman from this week. According to the minister of health, the first Immunization Campaign covered 95% of its target segments vaccinated against Covid-19 – a total of 52,858 people. Separately, the nation has booked 200k doses of Johnson & Johnson vaccine.

- PMI in Qatar edged down to 53.2 in Feb (Jan: 53.9) – though still the 5th highest level on record – with all 5 sub-components posting positive overall contributions. Manufacturing was the best performer in Feb, with a 6-month high reading.

- The World Bank approved a second grant of USD 10mn to support job creation for Palestinians during the Covid19 pandemic.

Saudi Arabia Focus

- PMI in Saudi Arabia dropped to a 4-month low of 53.9 in Feb, from Jan’s 57.1, with employment falling for the 3rd consecutive month. New business inflows and export sales continued to rise, as did input purchases and inventories, but business sentiment was the weakest since Oct.

- Non-oil exports from Saudi Arabia – which accounted for 30.65% of total exports – declined by 11% yoy to SAR 201.5bn in 2020. Oil exports plunged by 33% to SAR 657.56bn last year.

- Saudi Arabia’s foreign reserves declined by 10.3% yoy and 0.82% mom to SAR 1.687trn (USD 450bn) in Jan this year.

- Total banks’ investments in Saudi bonds grew by 15.45% yoy to SAR 446.45bn by end-Jan, according to data from the Saudi Central Bank (previously SAMA).

- Mortgage loans in Saudi Arabia continue to rise: the number of new residential mortgage loans for individuals grew by 35% yoy to 32,811 in Jan and its value surged by 60% to SAR 16.4bn. Separately, the minister of justice revealed that a digital platform was in the works, allowing for properties to be bought and sold online in the Kingdom. Already 10mn of an estimated 100mn real estate ownership documents had been digitized.

- Saudi Arabia paid the salaries of 349 workers employed by distressed firms last month: about SAR 60.5mn was paid in late salaries and end-of-service benefits.

- Saudization in 7 major economic activities surpassed 50% in Q3 2020: financial and insurance activities topped the list, with a rate of 83.6%, followed by public administration (71.9%) and activities of foreign organisations (71.5%) among others. Overall, rate of Saudization in the private sector touched8% in Q3.

- Remittances from Saudi Arabia increased by 12% yoy to SAR 12.06bn (USD 3.2bn) in Jan; however, in mom terms, remittances declined by 10%. In 2020, remittances had increased by 19.25% to SAR 149.69bn, following two years of declines.

- Tadawul was MENA’s most active IPO market in 2020 with four listings totaling USD 1.45bn, representing 78% of the total amount raised by MENA IPOs in 2020. According to EY’s MENA IPO Eye, nine IPOs in the region raised USD 1.86bn in 2020.

- Saudi Arabia’s PIF is in talks to raise USD 15bn from a group of international banks, reported Bloomberg. Though the PIF declined to comment, sources revealed that the funds are to be used to finance new investments.

- Sovereign borrowing by Saudi Arabia is estimated to reach USD 37.3bn this year, from USD 40bn last year, according to S&P. It will be the largest sovereign issuer in the GCC this year, ahead of UAE (USD 14.1bn, excluding Dubai), Oman (USD 10.8), Qatar (USD 7.4), Bahrain (USD 6.7bn) and Kuwait (USD 3.3bn).

- Saudi Arabia was the top crude oil supplier to Japan in Jan, with 36.54mn barrels or 45.7% of total imports. About 93.7% of Japan’s oil imports were from 7 Arab nations including the UAE (24.25mn barrels or 30.3%) and Qatar (6.189mn barrels or 7.7%).

- Bloomberg reported that Saudi Arabia plans to ship gas to South Korea where it would be used to make hydrogen and the carbon dioxide by-product would be transported back. More on Saudi’s plan to build a USD 5bn plant to export hydrogen – https://www.bloombergquint.com/technology/saudi-arabia-s-plan-to-rule-700-billion-hydrogen-market

UAE Focus![]()

- UAE PMI fell to 50.6 in Feb (Jan: 51.2), supported by output growth even as respondents commented on weaker demand trends in retail and services due to the re-introduction of restrictions. Though 12-month ahead expectations improved to a 5-month high, only 6% of businesses gave a positive outlook for the next 12 months period.

- Abu Dhabi’s industrial sector contributed nearly 11% to the emirate’s non-oil GDP and 6% to overall GDP in 2020. Total investments in the sector stood at AED 4bn (USD 1.01bn) last year, with 51 industrial facilities starting production in the emirate.

- The DIFC Employee Workplace Savings Plan, which was launched in Feb 2020, has so far registered 19,182 individuals working for 1,187 companies: about 75% of the assets in the savings scheme remain invested in the low/moderate growth fund – default fund of the Plan.

- S&P forecasts gross commercial long-term borrowing in Abu Dhabi to reach USD 10bn this year (versus USD 15bn in 2020), while Sharjah is likely to borrow USD 4.1bn, up from USD 3bn last year.

- Sharjah Research Technology and Innovation Park, a research and development free zone, launched a new MEA Energy Innovation Hub targeting opportunities in energy and low carbon; a new focus area for innovation would be hydrogen.

Media Review

What should Joe Biden do in the Middle East?

https://www.economist.com/leaders/2021/03/06/what-should-joe-biden-do-in-the-middle-east

The Covid Bubble: Roubini

https://www.project-syndicate.org/commentary/us-economy-faces-risks-of-bubble-medium-term-stagflation-by-nouriel-roubini-2021-03

Changes in Saudi Arabia so far just tip of the iceberg, Saudi PIF chief tells the ‘oil man’s Davos’

https://www.arabnews.com/node/1818816/business-economy

Dubai Risks Driving Out Investors as Public Companies Delist

https://www.bloombergquint.com/business/dubai-risks-driving-out-investors-as-public-companies-delist