Download a PDF copy of this week’s insight piece here.

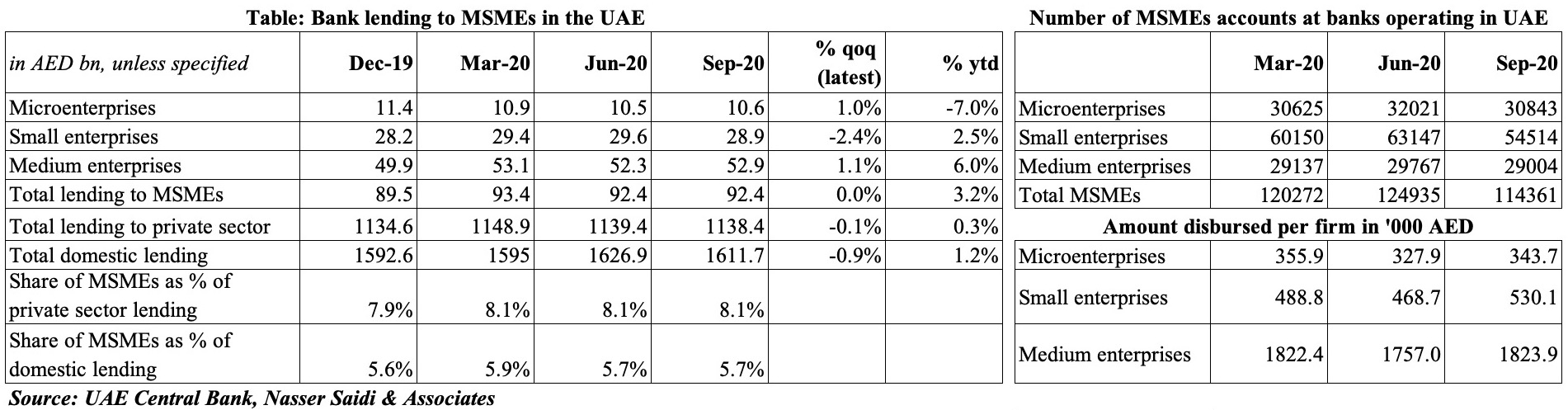

Chart 1. Will vaccines give a jab to growth?

- PMI readings for both Saudi Arabia and the UAE eased moderately in Feb 2021.

- An uptick in Covid19 cases since beginning of this year, in both UAE and Saudi Arabia – at vastly different levels – led to more restrictive measures (likely to remain till Ramadan in mid-Apr)

- UAE’s stringency index increased to 56.3 in Feb vs Jan’s 50 & seems to have spilled over in weaker demand, thereby hampering sales and new orders growth. Though near-term outlook is uncertain, businesses optimism was decidely higher for the 12-months ahead period, potentially due to the fast pace of vaccination rollout and the upcoming Expo event

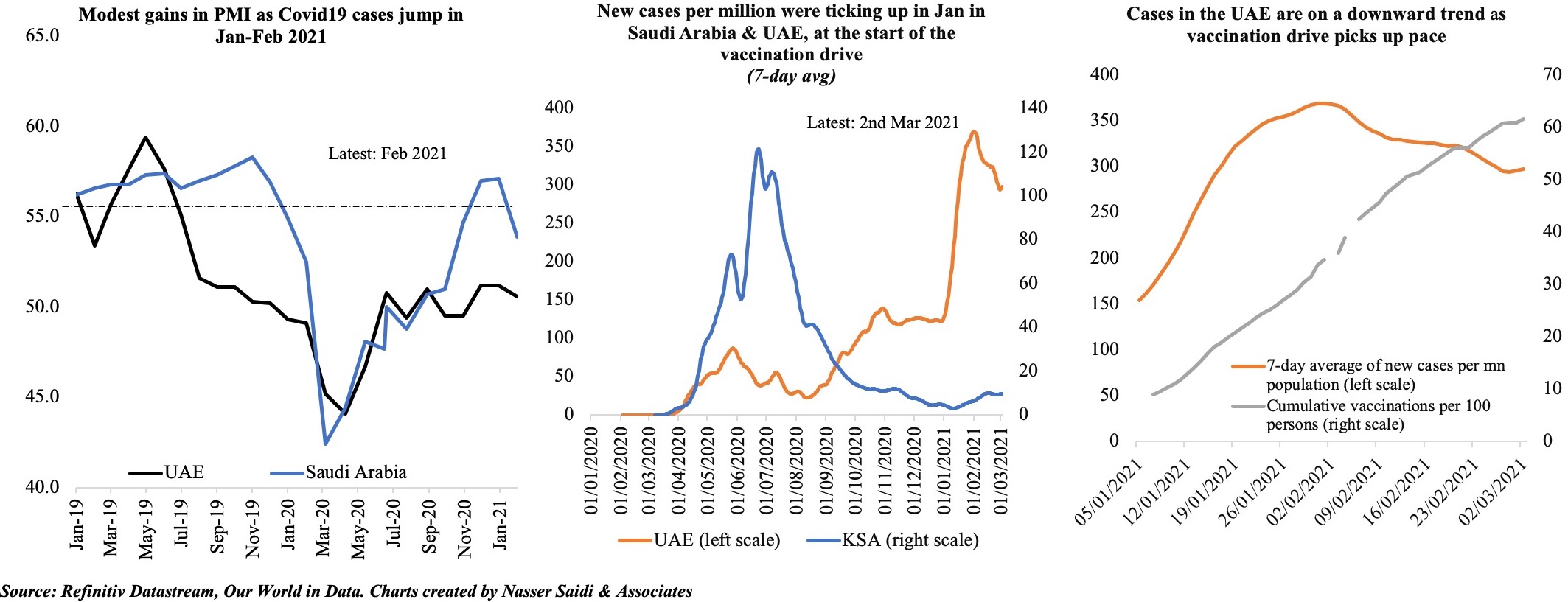

Chart 2. Saudi Arabia: Riding the digital wave

- Proxy indicators for consumer spending (ATM withdrawals & PoS transactions) continue diverging; recent restrictions on gatherings / entertainment will likely affect overall spending for Feb

- E-commerce received a jumpstart during the pandemic period: number of transactions picked up by 400% yoy in 2020 & sales value up by 341.2%. This compares to year 2017, when only 38.5% (of those aged 15+) had used the internet to pay bills or buy something online and just 25.7% had used mobile phone or internet to access an account (Source: Global Findex database)

- Overall loans picked up in the country, with loans to both the private and public sector rising around 15% and 18% respectively in Jan, after posting increases of 13% and 18% in 2020

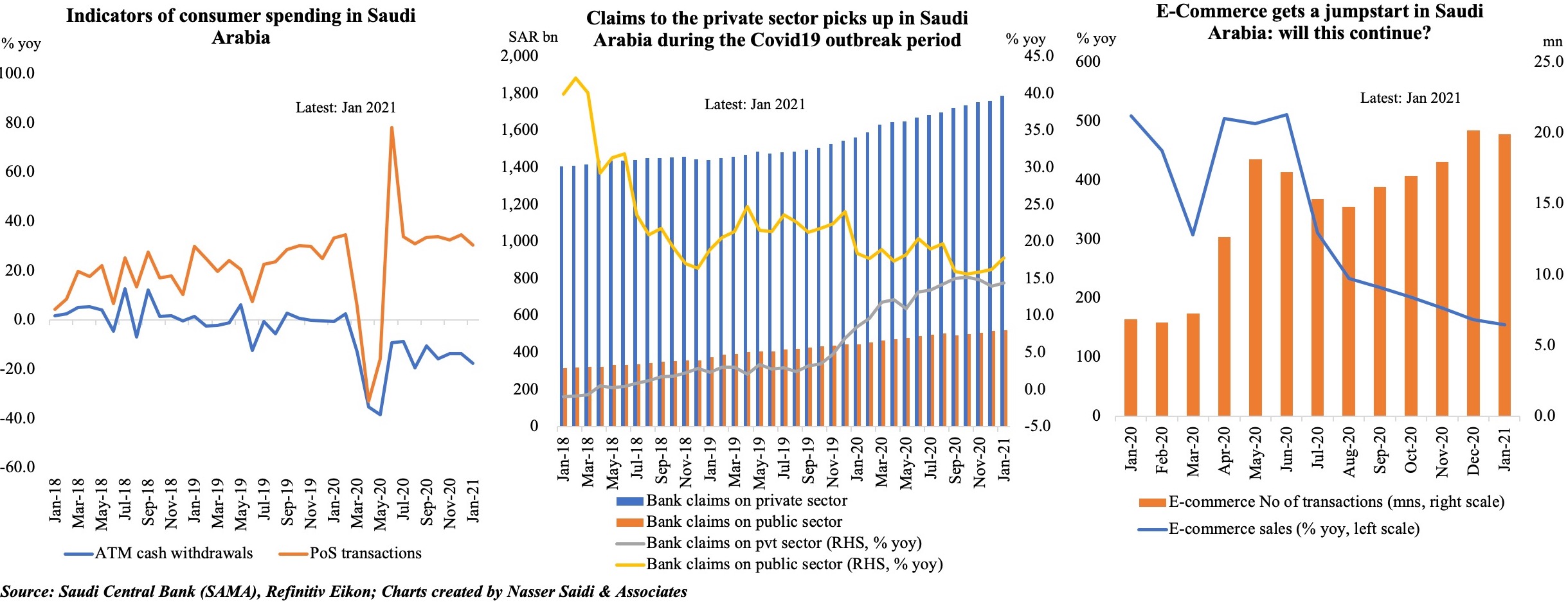

Chart 3. UAE bank loans: where’s the appetite?

- About 70% of UAE banks’ loans went to the private sector as of end-2020, with the public sector & government together accounting for ~30% of all loans

- Overall, the surge in lending to GREs and the government – at 16.1% yoy and 19.8% respectively – in 2020 contrasted the drop in lending to the private sector (-1.0%)

- The uptick in loans towards agriculture surged by 106.6% yoy at end-Dec 2020, following increases of 8.7% and 25.5% respectively in Jun and Sep 2020, underscoring the focus on food security and evidence of investments into vertical farming and agritech companies (its share of total loans is just 0.13%).

- Loans to construction sector (accounting for ~20.5% of total loans) ticked up by 5.2% yoy as of end-Dec (vs 0.2% drop in 2020); personal loans for consumption (~20.4% of total loans) dipped by 1.3% as of end-Dec

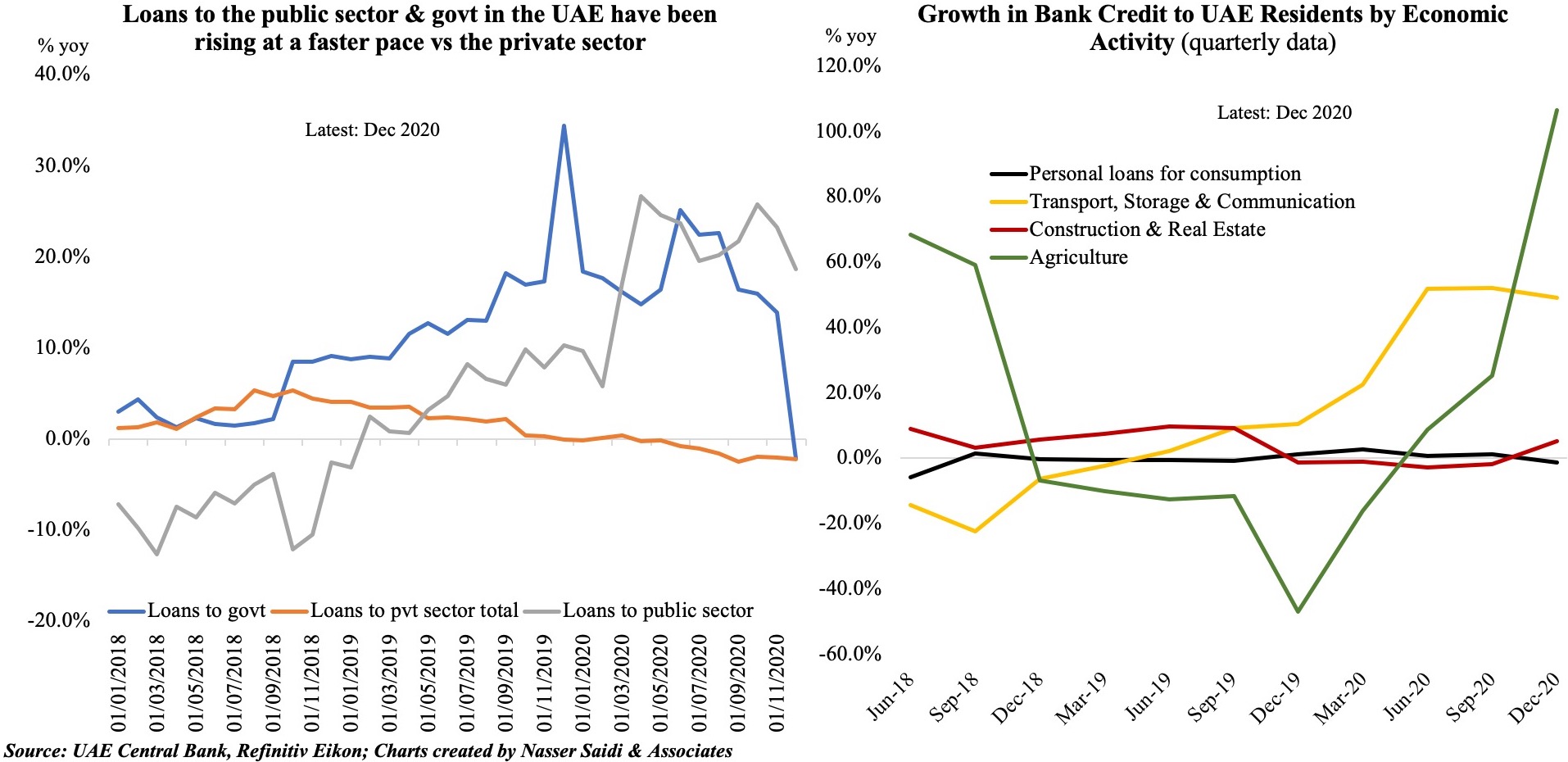

Chart 4. Growing Pains: UAE’s SMEs amid Covid19

- The share of SME lending in total domestic lending remained unchanged at 5.7% in Q3 (Q2 2020: 5.7%),though lower than 5.9% share as of end-Q1

- Within the MSME segment, as of end-Q3, the largest share of loans was disbursed to medium-sized firms (57.3%) and close to 1/3-rd to the small enterprises

- The number of MSMEs in the UAE declined by 8.5% qoq to 114,361 as of end-Sep. This drop was visible across all 3 segments, with small enterprises plunging by 13.7% qoq as of end-Sep (Jun: +5%) and micro and medium enterprises down by 3.7% and 2.6% respectively

- With total lending remaining almost stable alongside a sharp drop in number of MSMEs, the amount disbursed per firm increased across the board at end-Sep: overall by 9.2% qoq while amounts to micro, small and medium firms grew by 4.8%, 13% and 3.8% respectively

- Banks’ provisions for bad and doubtful debts amounted to USD 42.5bn as of Dec 2020, up from USD 36.1bn at end-2019. With a large number of MSMEs dropping out of business, expect non-performing loans to tick up & eat into banks’ profitability