Download a PDF copy of this week’s economic commentary here.

Markets

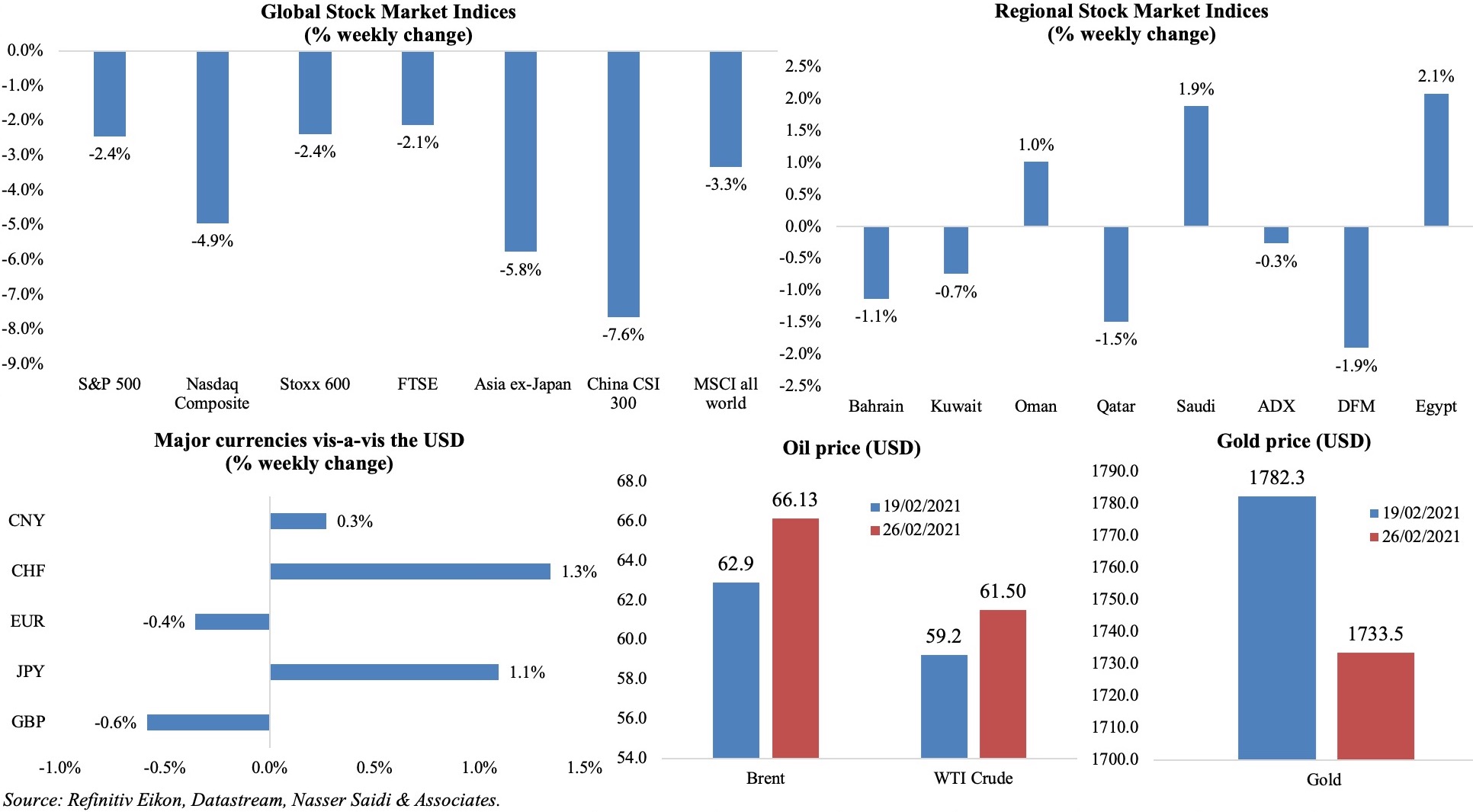

Global equity markets declined across the board last week, as investors reduced their exposure to risk amid US government bond yields spiking to near 1-year highs in a large US Treasury sell off. In the region, markets were mixed: Saudi gained after it successfully raised EUR 1.5bn in a Eurobond deal with a negative yield. The dollar was stronger vis-à-vis most major currencies including the Japanese yen and risky currencies like the Aussie dollar weakened; euro touched a 7-week high but closed lower. Gold fell by 2.7% to an 8-month low, while Brent oil touched a 13-month high last week (but closed lower) after a drop in crude output was reported following the Texas freeze and ahead of the OPEC+ meeting this week.

Weekly % changes for last week (25-26 Feb) from 18 Feb (regional) and 19 Feb (international).

Global Developments

US/Americas:

- US GDP grew by an upwardly revised 4.1% in Q4 at an annualized rate, thanks to stronger housing construction and business inventories, offsetting a slower increase in consumer spending. Annual GDP shrank by 3.5% for the full year 2020, posting the largest decline since 1946. Core PCE inflation was up by 0.3% mom and 1.5% yoy.

- US personal income surged by 10% in Jan – the biggest monthly gain since Apr 2020 – largely due to the stimulus cheques and unemployment benefits. Spending was up by 2.4% while the personal saving rate was 20.5%.

- US durable goods orders increased by 3.4% mom in Jan (Dec: 1.2%) – the most in 6 months, driven by the surge in orders for civilian aircraft and parts (+389.9%). Non-defense capital goods orders grew by 0.5% from a 1.5% rise in Dec.

- Chicago Fed national activity index inched up to 0.66 in Jan (Dec: 0.41), the strongest activity growth in 3 months.

- Chicago PMI declined by 4.3 points to 59.5 in Feb from Jan’s two and a half year high of 63.8; new orders posted the largest monthly decline while employment gained the most (up 5.7 points to a 16-month high).

- S&P Case Shiller home price index accelerated by 10.1% yoy in Dec (Nov: 9.2%), with the data also confirming the preference for suburban homes vs urban apartments during the pandemic amid record low mortgage rates.

- New home sales increased by 4.3% mom to 923k in Jan and though the median price of a new home sold slipped to USD 346,400, it was up more than 5% yoy. Pending home sales slipped by 2.8% mom in Jan (Dec: 0.5%).

- Initial jobless claims fell to 730k in the week ended Feb 20, a sharp drop from a downwardly revised 841k the prior week, with the 4-week average slowing to 833.25k. Continuing claims also fell by 101k to 4.42mn in the week ended Feb 13 – the lowest since March 21st.

Europe:

- CPI in the eurozone increased by 0.9% yoy in Jan – the highest level since Feb; core inflation stayed at 1.4% yoy in Jan though falling by 0.5% mom. Inflation rates diverged much across the eurozone: prices declined by 2.4% yoy in Greece, while it was up 1.6% in Germany.

- Loans to households in the Eurozone grew by 3.0% yoy in Jan (Dec: 3.1%) while loans to companies was up by 7%, following an increase of 7.1% the month prior.

- GDP in Germany increased by 0.3% qoq in Q4 (above the preliminary estimate of 0.1%); it declined by 2.7% in yoy terms.

- German Ifo readings improved in Feb: the current assessment increased to 90.6 (Jan: 89.2) while expectations rose to 94.2 (91.5) and business climate index was 92.4, rising from 90.3 in Jan. In manufacturing, the index jumped to its highest value since Nov 2018.

- UK ILO unemployment rate nudged up to 5.1% in the 3-months to Dec (5% before). Average earnings including bonus increased sharply to 4.7% in the 3 months to Dec (from 3.7% before).

Asia Pacific:

- Japan’s leading economic index slipped to 95.3 in Dec from Nov’s 96.1 reading, though higher than the preliminary estimate of 94.9. The coincident index also moved lower to 88.3 (Nov: 89.0).

- Tokyo’s inflation and core inflation (excluding fresh food) fell by 0.3% yoy in Feb while inflation excluding food and energy stayed steady at 0.2%.

- Industrial production in Japan rebounded by 4.2% mom in Jan (Dec: -1%), thanks to an increase in the production of electronic parts and general-purpose machinery, in addition to a smaller increase in car output as global demand picked up.

- Retail trade in Japan tumbled by 2.4% yoy in Jan (Dec: -0.2%) due to sharp contractions in general merchandise and fabrics apparel spending. Large retailer sales dropped even further: -7.2% from -3.4% the month before.

- India’s GDP grew by 0.4% in Oct-Dec 2020, with financial services posting a rebound while overall services sector contracted by 1%. The previous quarters data were revised: an upward revision in the Jul-Sep quarter to -7.3% from -7.5% earlier and a deeper 24.4% contraction in the worst hit Apr-Jun quarter (vs 9% estimated earlier).

- India fiscal deficit stood at USD 167bn or8% of the revised full year target during the period Apr-Jan. Fiscal deficit for the current financial year has been revised upwards to 9.5% of GDP, given the pandemic.

- Industrial production in Singapore grew by 8.6% yoy in Jan, rising for the 3rd consecutive month, though easing from Dec’s upwardly revised 16.2%.

Bottom line: With major global banks like Goldman Sachs and Morgan Stanley raising their oil price forecasts to USD 70 and many oil producers itching to raise production to corner higher revenues, the Mar 4th OPEC+ meeting will be interesting to watch: the slow pace of current vaccination drives implies that it will take much longer for the global economy to fully open up and attempt to reach pre-pandemic activity levels (implying subdued demand for oil). In the meanwhile, rising inflationary pressures are raising “taper tantrum” worries as central bankers try to soothe investor concerns over rising bond yields, recovery prospects and asset price bubbles.

Regional Developments

- Bahrain decided to extend its existing Covid19 measures for 3 more months, including social distancing measures and health screenings among others, once it expires on Feb 28th.

- Egypt’s central bank has directed banks to inject EGP 117bn (USD 7.46bn) into MSMEs until end-2022. The funds are a result of raising financing to these firms to 25% of the banks’ credit facilities portfolio from 20% before.

- The value of foreign investments in Egypt’s government debt instruments amounted to USD 29bn in Q1 of the current fiscal year. During the pandemic about USD 18bn of foreign investment exited the government debt market, bringing the total down to about USD 10bn.

- Egypt plans to repay a total of USD 21.4bn in foreign debts this year, of which USD 10.2bn will be paid in H1, according to the ministry of finance; a further USD 14.9bn will be repaid in 2022.

- Non-performing loans (NPLs) in Egypt stood at 3.4% in Sep 2020 (vs 3.9% in Jun 2020). Banks had made allocations covering 96.4% of their total non-performing loans in Sep 2020.

- The manufacturing and extractive industries of production index in Egypt inched up by 2% mom to 99.15 in Dec 2020, with the pharma sector up by 2.8% and demand for building materials driving up manufacture of non-metallic mineral products by 6.7%.

- Egypt’s central bank issued EGP 2bn (USD 128mn) to support the tourism sector, with half the amount going towards the Credit risk Guarantee Company.

- Egypt’s finance minister disclosed that spending on social protection programme increased by 24% to EGP 114bn during the period Jul 2020 to Jan 2021; also, more than EGP 5.3bn was disbursed to irregular workers since the start of the pandemic.

- Agricultural exports from Egypt to the US increased by 22% to a record high of USD 220mn in 2020, revealed the US Ambassador to Egypt.

- Egypt is expected to add about 7,000 hotel rooms by 2023, according to Colliers, as new projects delayed opening during the pandemic. The supply in Cairo and Alexandria is expected to grow by 4% and 12% respectively between 2020 and 2023.

- Oil exports from Iraq’s southern ports remained stable at 2.7mn barrels per day (affirming its commitment to the OPEC+ deal) as of Feb 24th, according to the Basra Oil Company chief.

- Iraq is looking for international investors to build seven solar power plants in the south of the country, with a total capacity of 750 megawatts, and is currently in talks with French Total and “Norwegian companies” according to the oil ministry.

- Jordan has reinstated Friday lockdown, in addition to extending daily curfew by 2 hours, given the recent uptick in Covid19 cases.

- Internet penetration in Jordan ticked up to 66.8% in Jan 2021, with a total of 6.84mn users in the country. Social media users increased by 11% yoy to 6.3mn (61.5% of the population).

- An IRENA report disclosed that Jordan’s share of electricity from renewable energy sources grew from almost zero in 2014 to around 20% in 2020.

- Kuwait’s government submitted a proposal to the parliament to allow for the withdrawal of up to KWD 5bn (USD 16.53bn) from the sovereign wealth fund annually. Over the past few months the fund transferred around KWD 6-7bn to the General Reserve Fund (with over 4bn in exchange for asset swaps) to finance the deficit. Budget deficit is estimated at KWD 55.4bn from fiscal year 2020-21 to fiscal year 2024-25.

- The capital adequacy ratio of banks in Kuwait stood at 19% at end-Dec, above the central bank’s requirement of 13%, and higher than 2019’s 18.5%. NPLs inched up by 0.5% to 2% last year while the NPL Coverage Ratio (provisions to NPLs) dropped from 271% to 222%.

- Expatriate population in Kuwait declined by 4% yoy to 3.21mn persons in 2020; Indians accounted for 52% of the expats that left the country last year, followed by Egypt (22.5%).

- Kuwait closed its land and sea border crossings till Mar 20th; also, restaurants and cafes have been asked to conduct only delivery and takeaway services.

- The central bank of Lebanon reiterated that the Feb 28 deadline for all banks to raise their capital by 20% and repatriate 3% of liquidity from correspondent banks will not be extended.

- Lebanon’s caretaker energy minister revealed that an emergency loan request worth LBP 1,500bn had been placed for the Electricite du Liban to buy more fuel to generate electricity. Unless financing is approved, electricity cannot be generated beyond Mar.

- Lebanon granted 20 private sector firms permission to negotiate with pharma companies to access the Covid19 vaccines: 13 for the Sputnik V vaccine and 7 for Sinopharm. Separately, the World Bank threatened to suspend financing for the vaccination drive, after fair vaccination violations by politicians were reported.

- Lebanon began phase 2 of easing the lockdown last week, after imposing a complete lockdown from Jan 14th. Most restrictions are likely to be lifted by Mar 22.

- Producer’s price index-based inflation in Oman fell by 22.9% yoy in Q4 2020 given the sharp decline in oil and gas prices (-28.3%) while non-oil products increased by 4.3%.

- SMEs registered in Oman’s Authority for Small and Medium Enterprises Development increased by 14.4% yoy to 49,337 in Jan 2021, with Muscat accounting for one-third of the registered SMEs.

- The new electricity tariffs in Oman will be applied in a phased manner: the Jan bill was calculated based on 11 baisas instead of 15 for consumption up to 2,000 kilowatts, and 14 baisas instead of 20 for electricity consumption up to 4,000 kilowatts.

- Pakistan signed a new 10-year deal – for 2 cargoes per month initially, rising to 4 in a month in “coming years”- for the supply of Liquefied Natural Gas (LNG) from Qatar.

Saudi Arabia Focus

- Saudi Arabia’s investment minister, in an interview with Arab News (link in Media Review section), revealed that though details were still being fine-tuned, companies choosing to relocate their headquarters to the Kingdom will not have Saudization staffing requirements imposed on them.

- Saudi Arabia raised EUR 5bn (USD 1.82bn) through the sale of euro-denominated bonds – the second deal in 2 months and its second time issuing euro-denominated bonds since Jul 2019. The issuance is the largest with a negative yield outside the EU and was oversubscribed more than 3 times.

- The Public Investment Fund in Saudi Arabia is launching a USD 3bn tourism and infrastructure venture – the Soudah Development Company (SDC), aimed at developing Soudah and Rijal Alma’a into a tourist destination. With plans to attract over 2mn visitors annually, the project is also estimated to create 8k (direct and indirect) jobs by 2030.

- Saudi Arabia launched the instant payment system “sarie”, allowing banking sector’s clients to send and receive low-value local transactions around the clock and for a low fee, not exceeding one riyal. Any financial transaction less than SAR 20k would be instantly credited.

- The value of Saudi Arabia’s oil exports plunged by 30% or SAR 19.5bn in Dec. Oil’s share of total exports fell to 71.6% in Dec from 76.7% a year ago.

- Saudi Arabia’s trade surplus stood at SAR 19.92bn in Dec, the highest since Feb 2020. China, Japan and India were the top export markets during the month. The final reading of the year resulted in a narrowing of the full year surplus to SAR 164.98bn (-59.8% yoy). Trade with its GCC counterparts declined by 6.06% yoy to SAR 98.1bn last year; trade with the GCC accounted for more than 2/3-rds of the total trade.

- Saudis trading in US stocks grew by more than 7 times to SAR 323.37bn last year, according to a Capital Markets Authority report.

- With an average of 16.8 hours for container handling in Saudi ports, Saudi Arabia ranked 5th globally in the list of UNCTAD’s annual index of ports.

- In the latest edition of the World Bank’s Women, Business and the Law report, Saudi Arabia scored 80, up from 70.6 last year, after it achieved a score of 100 in 5 indicators – mobility, workplace, salary, entrepreneurship and pension. The number of women-owned companies by 60% in the past two years while overall female labour force participation rates increased to nearly 30% from 22%.

- Saudi Arabia has opened up its armed forces to women: female applicants have to be within the age of 21-40, a height of 155cm and above, and not a government employee. Separately, the number of women in the civil service jumped by 25 times in 10 years to 484k in 2019, according to a report of the Family Affairs Council.

- The number of local and international companies operating in Saudi Arabia’s military industries sector grew to 70 by the end of 2020, representing estimated investment of SAR 24bn. About USD 20bn will be invested in Saudi Arabia’s domestic military industry over the next decade, with an aim to spend 50% of the military budget locally by 2030.

- Distance learning will be continued till end of the current academic year in Saudi Arabia.

UAE Focus![]()

- On the occasion of Kuwait’s 60th National Day, Dubai Customs disclosed that bilateral trade between Kuwait and Dubai touched AED 8.52bn (USD 2.32bn) in H1 2020. Separately, it was revealed that bilateral trade between Abu Dhabi and Kuwait reached AED 51.3bn during the past 5 years.

- Bilateral trade between UAE and Japan stood at USD 22.4bn in 2020: approximately 25% of its crude oil is imported from the UAE; the relation extends beyond energy as well with more than 340 Japanese companies having their largest bases in the Middle East in the UAE.

- UAE’s FDI in Spain reached over EUR 6bn (USD 7.3bn) according to the Spanish Minister of State for Trade. Spanish FDI in the UAE meanwhile is around EUR 3bn (USD 3.65bn).

- The daily decline limit for stocks listed on the UAE’s bourses will be increased to 10% from 5%, effective today (Feb 28th). It was lowered to 5% earlier in Mar 2020.

- Covid19-related restrictions in Dubai will be extended till the beginning of Ramadan (likely to start in the 3rd week of Apr) in the UAE.

- UAE’s central bank joined the second phase of a digital currency project, named the m-CBDC Bridge project, initiated by the Hong Kong Monetary Authority and the Bank of Thailand. The project will focus on developing a proof-of-concept prototype, enabling faster, easier cross-border transactions while removing complex regulatory compliance procedures.

- Masdar and Kazakhstan’s sovereign wealth fund Samruk-Kazyna signed an agreement to explore joint investments in renewable energy opportunities in the latter.

Media Review

Yuval Noah Harari: Lessons from a year of Covid (Free to read)

https://on.ft.com/2NK3pWx

No One Is Safe Until Everyone Is Safe

https://www.project-syndicate.org/commentary/g7-covid19-promises-must-go-beyond-financial-aid-by-mohamed-a-el-erian-2021-02

Interview with Saudi Arabia’s Investment Minister on Regional HQs

https://youtu.be/apypUCW19FE

https://www.arabnews.com/node/1813691/business-economy

Analysis: How rich is Saudi Arabia? Kingdom does the math in balance sheet overhaul

https://www.reuters.com/article/uk-saudi-economy-reforms-analysis/analysis-how-rich-is-saudi-arabia-kingdom-does-the-math-in-balance-sheet-overhaul-idUKKBN2AN0GX

Women, Business & the Law 2021

https://openknowledge.worldbank.org/bitstream/handle/10986/35094/9781464816529.pdf

https://blogs.worldbank.org/developmenttalk/women-business-and-law-2021-womens-economic-empowerment-critical-resilient-recovery

What is the cheapest way to cut carbon?

https://www.economist.com/finance-and-economics/2021/02/22/what-is-the-cheapest-way-to-cut-carbon

Powered by: