Download a PDF copy of this week’s insight piece here.

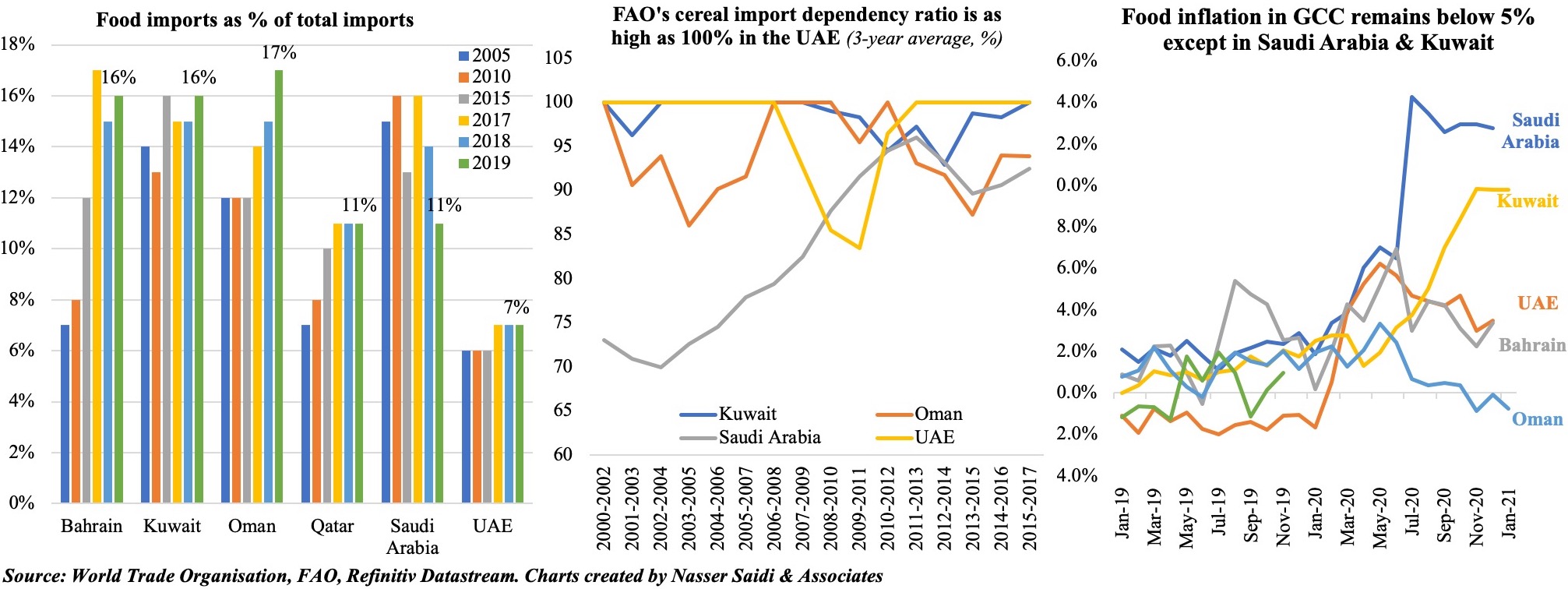

Chart 1. PMIs indicate rising manufacturing activity vs restrictions-hit services weakness

- Forward looking manufacturing PMIs are recovering, thanks to new orders

- But pain points include supply chain disruption, delivery delays & rising input prices

- Weakness in services PMI continues

- UK & Germany (among the most stringent nations currently, with scores at 86.11 & 83.33 respectively) show the divergence, though the former is starting to stabilise

- Declines during the current lockdown period is not as severe as in Apr 2020

- Vaccine roll-out will lead to greater confidence in the months ahead

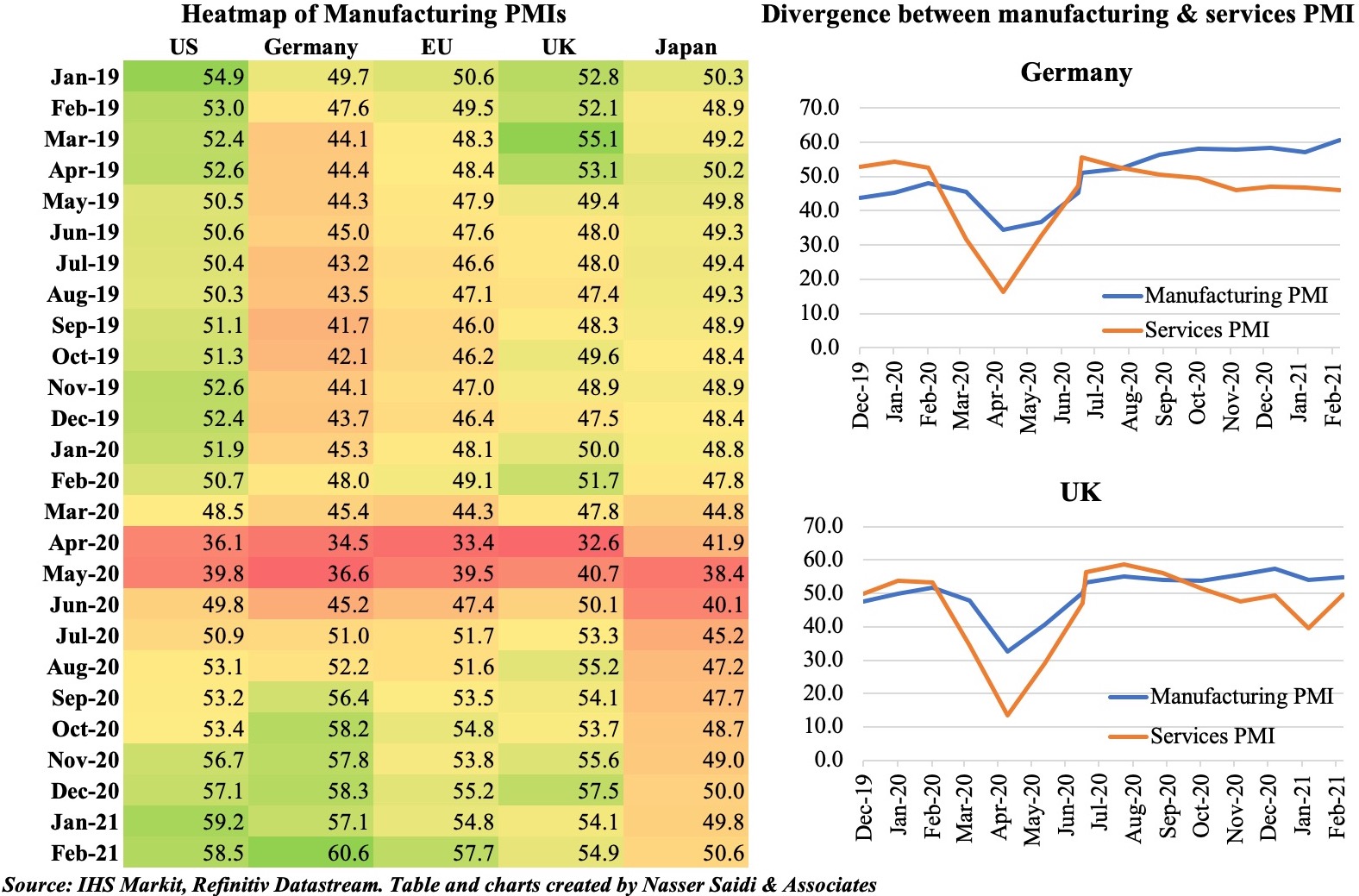

Chart 2. Global trade recovers in Q4 2020; Q1 2021’s restrictions in likely to cause deceleration

- WTO estimates show a strong Q4 (index reading of 103.9). New Covid variants & lockdown restrictions is likely to have a negative impact on goods trade in Q1

- Container shipping costs have been surging, given the increase in demand alongside delays at ports and lack of ships/ containers

- The reduction in air freight capacity adds to the capacity conundrum. In 2020 overall, industry-wide cargo tonne-kilometres fell by 10.6% yoy – the largest decline on record (IATA)

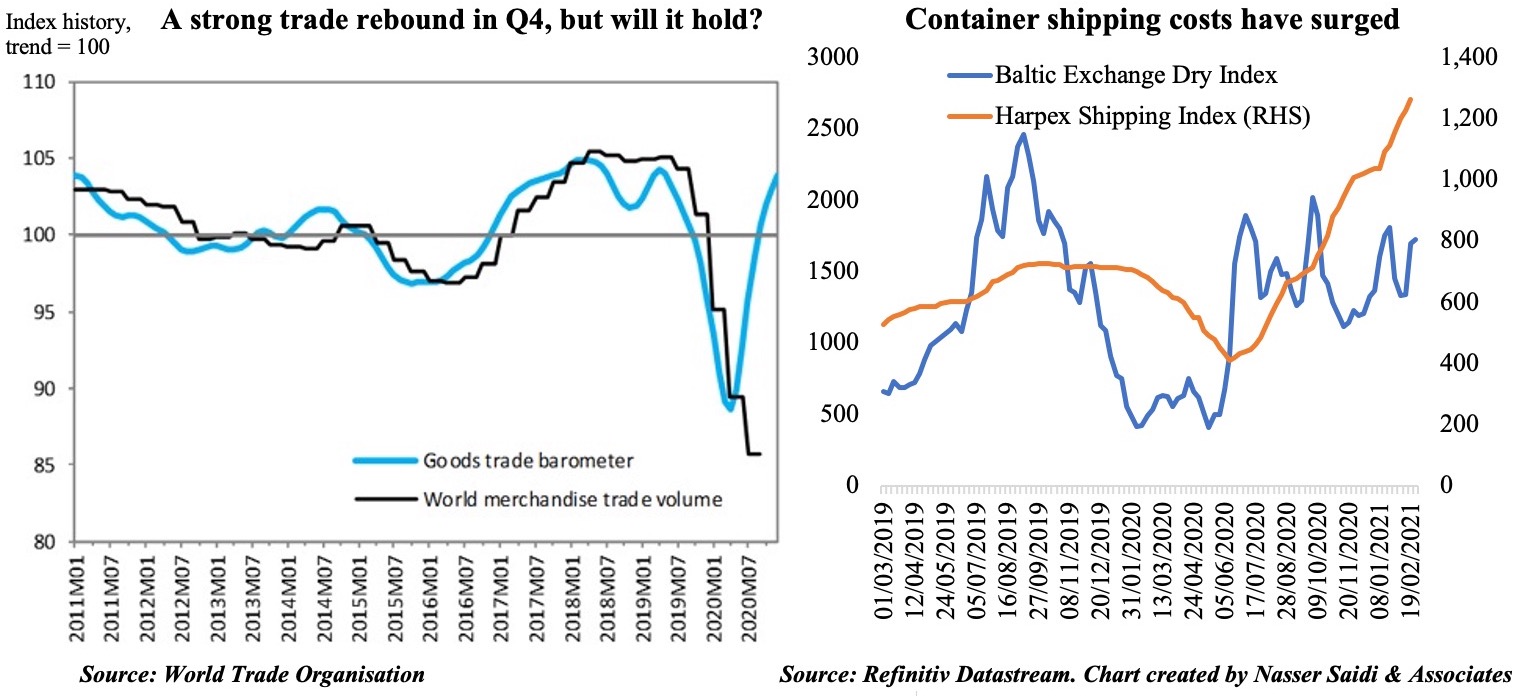

Chart 3. Global food prices are rising: will MENA’s food importers be severely hit?

- The increase in freight prices have also spilled over into global food prices: pandemic-led supply chain issues aside, production shortfalls due to unfavourable weather conditions and high export tariffs have also contributed to the uptick.

- Over the past six months, the IMF’s food price index has seen a 6% spike, outpacing the all commodities price index which averaged a 1% increase!

- Food security is a major concern in the MENA region, given water-constraints. 12 of the 17 most water-stressed nations are in the Middle East (World Resources Institute) => high dependence on food imports & hence highly exposed to global food price volatility

- High income but resource-constrained nations like UAE are taking steps to counter this, including support for domestic production via technological innovations (AgriTech, hydroponics, vertical farming)

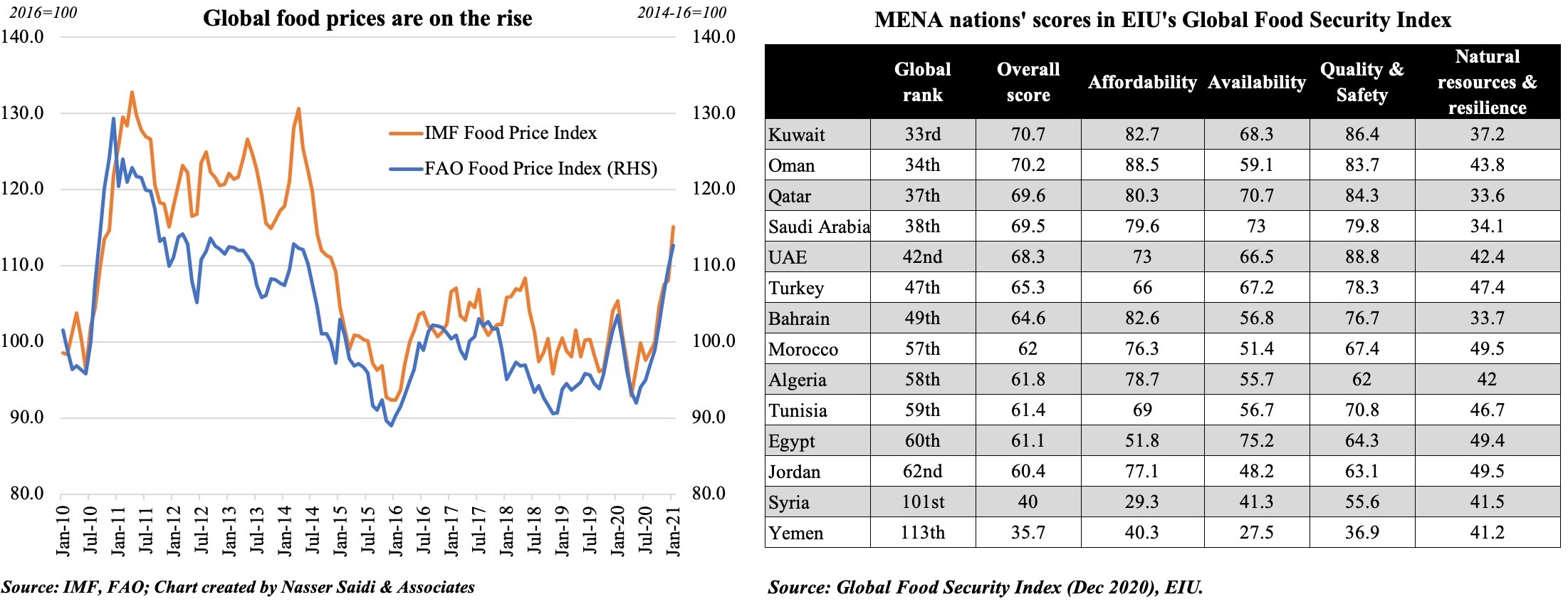

Chart 4. Will this lead to rising food inflation in the GCC?

- Food imports as a share of total imports ranged from UAE’s 7% to Oman’s 17% in 2019 (WTO)

- Further breakdowns reveal the extend of dependence: the FAO’s cereal import dependency ratio (3-year average) places UAE at 100% & Saudi Arabia at 92.5% (for the period 2015-2017); GCC imports almost 100% of its rice consumption and approximately 62% of meat and 56% of vegetables (PwC).

- Food inflation is still less than 5% in most GCC nations other than Saudi Arabia (affected by the VAT hike) and Kuwait (fruits, vegetables and meat/poultry have seen double-digit rises since last Jul).

- The higher share of disposable income spent on food by poorer segments of the population would imply that rising food prices would affect them more, thereby widening the inequality gap further (in addition to Covid19’s impact)

- Imported inflation in the backdrop of being pegged to the dollar implies that price controls might be need to contain food inflation if it continues to surge further. However, overall inflation remains low, with other major components like utilities & rent on a decline.