Download a PDF copy of this week’s economic commentary here.

Markets

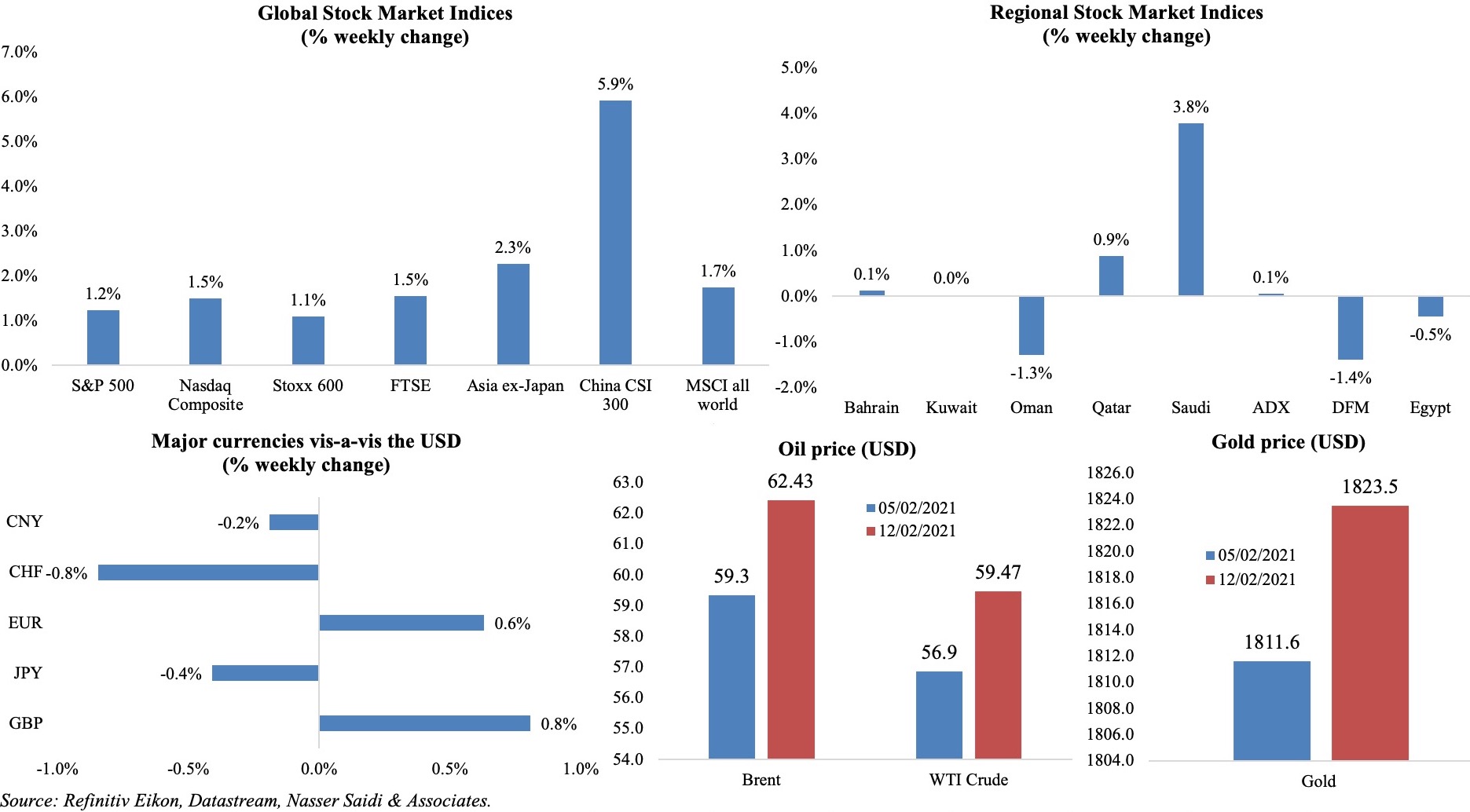

It was yet another week of record-highs across global equity markets, driven by investor exuberance on stimulus hopes while macroeconomic data remained tepid, though world shares dipped on Fri. The MSCI world equity index sustained a nine-day streak of gains, a first since Oct 2017 while shares in Tokyo reached a 30-year high before closing lower. In the region, most markets were down while Saudi Tadawul was up 3.8% from the previous week. Bitcoin surged to a record high of USD 49,000 while the dollar stumbled. Brent oil ended the week at USD 62.43 – close to its highest level since Jan 2020 while gold was up 0.7%. Other commodity prices surged: platinum touched a 6-year peak and copper lifted to an 8-year high.

Weekly % changes for last week (11-12 Feb) from 4 Feb (regional) and 5 Feb (international).

Global Developments

US/Americas:

- Inflation in the US remained tame, rising by just 0.3% mom in Jan from Dec’s 0.4%; in yoy terms, both inflation and core inflation stood at 1.4% yoy. Food prices fell by 0.3% mom and utility prices by 0.7%.

- The Fed’s stress test for banks will test the sector’s ability to cope with a “severely adverse” scenario, wherein unemployment rises by 4 ppts to reach nearly 11% in Q3 next year, as GDP falls and asset prices drop sharply, including a 55% fall in equity prices.

- Initial jobless claims increased to 793k in the week ended Feb 5 from an upwardly revised 812k the prior week, with the 4-week average slowing to 823k. Continuing claims slowed to 4.545mn in the week ended Jan 29 from 4.69mn the week before.

Europe:

- Inflation in Germany increased sharply by 1% yoy and 0.8% mom in Jan – rising for the first time since Jun 2020, after the temporary reduction in VAT ended in Dec and food prices increased by 2.2% (Dec: +0.5%). The harmonized index of consumer prices rose by 1.6% yoy and 1.4% mom (Dec: -0.7%).

- German industrial production was unchanged in Dec (Nov: 1.5% mom) after posting 7 consecutive months of gains. In yoy, IP declined by 1%, following a 2.5% drop in Nov. Compared to Feb, production was 3.6% lower in seasonally and calendar-adjusted terms.

- Exports in Germany grew by 0.1% mom in Dec (Nov: 2.3%) while imports slipped by 0.1%, causing the trade surplus to inch up to EUR 16.1bn in Dec (Nov: EUR 16bn). Overall in 2020, exports and imports slumped by 9.3% and 7.1% respectively and surplus fell for a fourth year in a row, amounting to EUR 179bn.

- Germany’s current account surplus widened to EUR 28.2bn in Dec (EUR 21.2bn) – the largest current account surplus since Mar 2019. For the full year 2020, overall surplus narrowed to EUR 236.2bn from EUR 244.8bn in 2019.

- UK GDP declined by 7.8% yoy in Q4 (Q3: -8.7%), clocking in the full year slump at 9.9% – the worst drop since 1709.

- UK industrial production inched up by 0.2% mom in Dec, following a 0.3% uptick in Nov. Manufacturing grew by 0.3% mom in Dec (Nov: 1.1%).

- UK like-for-like retail sales grew by 7.1% yoy in Jan (Dec: 4.8%) while overall retail sales dropped by 1.3% given the ongoing lockdown.

Asia Pacific:

- Inflation in China ticked up by 1% mom in Jan (Dec: 0.7%), but in yoy terms, inflation fell by 0.3%; food prices increased by 1.6% yoy in Jan, adding about 0.3 ppts to the rise in CPI. In contrast, producer price index grew by 0.3% yoy in Jan (Dec: -0.4%), rising for the first time in a year, on rising input prices and as domestic demand improved.

- Money supply (M2) expanded by 9.4% yoy in Jan (Dec: 10.1%). New loans jumped to new high of CNY 3.58trn in Jan (Dec: CNY 1.26trn), given seasonal demand. Outstanding yuan loans grew by 12.7% yoy in Jan (Dec: 12.8%). Outstanding total social financing slowed to a 6-month low of 13% yoy in Jan (Dec: 13.3%).

- FDI into China grew by 4.6% yoy to CNY 91.61bn (USD 14.2bn) in Jan. Separately, foreign reserves declined to CNY 3.211trn in Jan (Dec: USD 3.217trn).

- Current account surplus in Japan narrowed to JPY 1.166trn in Dec (Nov: JPY 1.878trn), remaining in the black for the 4th consecutive month, but shrinking from a year ago due to the travel numbers. Trade surplus increased to JPY 965.1bn (Nov: JPY 616.1bn) – a 13-fold increase from a year ago.

- Japan’s machine tool orders grew by 9.7% yoy to JPY 88.6bn in Jan (Dec: 9.9%), with orders from abroad rising by 21.6% to JPY 62.2bn while domestic orders dropped by 10.9% to JPY 26.3bn.

- Industrial output in India grew by 1% yoy in Dec, with electricity sector output and manufacturing grew by 5.1% and 1.6% respectively while mining contracted by 4.8%. Cumulative output in Apr-Dec slipped by 13.5% from 0.3% during the same period a year ago.

Bottom line: A fresh break of Covid19 cases put the brakes on Chinese New Year celebrations in China again this year: travel was restricted, and family gatherings limited. The Ministry of Transportation data showed a 70% drop in the number of passenger trips across the country in the two weeks leading up to New Year vs the same period in 2019. But, even though global vaccinations are picking up the pace – more than 162.8mn vaccine doses have been administered worldwide, equal to 2.1 doses for every 100 people – many developing nations are yet to receive even the first set of vaccines. A funding gap of close to USD 27bn for Covax is a major worry as it could derail proportional and equity in distribution across the globe. Meanwhile, the head of the Bundesbank issued a warning that rising inflation could result in policy tightening – a taper tantrum could play havoc as most countries are still below pre-Covid19 levels in most economic indicators. Last but not the least IEA expects a slow recovery, decreasing its forecast for global demand by 200k barrels a day.

Regional Developments

- Bahrain’s fiscal results for 2020 show a 27% drop in revenues compared to the budget estimate, while spending ticked up by 0.3% to BHD 3.76bn. Total fiscal deficit stood at BHD 1.6bn (vs. the budget estimate of BHD 807mn).

- MPs in Bahrain approved a proposal to continue wage support to Covid19 affected businesses from Feb to Apr: under this plan, 50% wage support will be provided to Bahraini employees. This follows a move earlier to pay, from the Unemployment Fund, 60% of their wages or up to BHD 1000 for a year to Bahrainis that lost their jobs.

- Egypt’s annual inflation slowed to 4.8% in Jan (Dec: 6.8%), on lower food prices (vegetable prices were down by 20.4%), while core inflation stood at 4.3% (vs Dec’s 5.4%).

- Food exports to China from Egypt accelerated by 21% yoy to USD 36mn in 2020, with sugar cane, sugar beet bulb and frozen strawberries constituting close to 98% of the total.

- Lenders to SMEs in Egypt need to follow new risk assessment and capital adequacy protocols: lenders’ capital adequacy ratio should be 12% or higher, loan term has to be 5 years or more and the financial institution must hold no less than 25% in the lending entities.

- The Central bank of Egypt’s new initiative cancels all fees (till Jun 2021) that private sector MSMEs need to bear to activate e-collection services.

- Egypt, which has received 100k doses of vaccine, is expected to receive 300k doses of the Chinese vaccines soon, disclosed the Egyptian President’s Health Affairs Advisor.

- The IMF Article IV report on Iraq estimated that the country will recover in 2021 and 2022, growing by 1.2% and 3.9% respectively, after shrinking by 11% in 2020. The report also forecast government debt to peak in 2023 and decline gradually after that. More: https://www.imf.org/en/Publications/CR/Issues/2021/02/10/Iraq-2020-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-Executive-50078

- Kuwait’s pension fund Public Institution for Social Security reported a 44% qoq and 57.5% yoy surge in profits to USD 6.8bn in Oct-Dec 2020. While net profits stood at USD 18.9 during Apr-Dec 2020, total assets of the investment portfolio grew by 19.4% compared with the total at the end of the previous financial year.

- Oman’s non-oil GDP is forecast to grow by 1.5% this year, according to the IMF, and this could potentially improve to 4% by 2026 if fiscal measures are successfully carried out. Given the low oil exports, current account deficit is estimated to have widened to 10% of GDP in 2020 from just 5.4% of GDP in 2019. The Article IV report also disclosed that the revenue measures within Oman’s Medium-Term Fiscal Balance Plan include introduction of VAT in 2021 as well as “a personal income tax on high-income earners” which is “being developed”. (More: https://www.imf.org/en/News/Articles/2021/02/11/mcs021221oman-staff-concluding-statement-of-an-imf-staff-visit)

- Oman has imposed a mandatory quarantine for those arriving into the country, at their own expense. Omani citizens have been given a grace period of 10 days until Feb 21st by which time they must enter Oman.

- Trade between Saudi Arabia and Qatar will resume through the Abu Samra border crossing from Feb 14th; Saudi Customs had resumed operations at the Salwa border crossing with Qatar on Jan 9th.

- Saudi Arabia grew by 2.8% qoq in Q4, following the 1.8% uptick in Q3, according to the preliminary estimates released by the GaStat. For the full year, the economy shrank by 4.1% yoy compared to 0.3% in 2019 and 2.4% the year before.

- Saudi Arabia will launch a new electronic instant payments system: after trials are successfully completed, the scheme would be activated with participating banks on Feb 21, reported Asharq Business.

- Foreign investors on Saudi Tadawul continued to record net buys during the week ended on 4 Feb. Foreign and GCC investors’ purchases netted SAR 157.61mn and SAR 16.43mn.

- Hotel occupancy rate in Riyadh’s hotels stood at 56.2% in Jan 2021, down 23.8% yoy while the revenue per available room plunged by 31.3% to USD 87.2 (or SAR 327.56), according to STR’s preliminary data.

- According to a Moody’s report, Saudi Arabia and Oman sovereign wealth funds are most exposed to the increased financial drawdowns across the GCC in light of lower oil revenues and rising fiscal deficits. Kuwait was highlighted in terms of increasing liquidity risks in the absence of a debt law.

- Oil exporters will face up to USD 13trn in revenue loss by 2020, as decarbonization efforts continue globally, according to Carbon Tracker. Nigeria will be the most affected in Africa. More: https://carbontracker.org/reports/petrostates-energy-transition-report/full-report/

- GCC nations ranked high in the annual Agility Emerging Markets Logistics Index, with UAE (4), Saudi Arabia (6), Qatar (9) and Bahrain (15) ranking among the top 15 globally. More: https://logisticsinsights.agility.com/emerging-markets-logistics-index/rankings/

UAE Focus

- Dubai PMI inched down to 50.6 in Jan (Dec: 51), with slight declines in output and new orders while employment expanded after almost a year. The rise in employment level was the quickest for 14 months. Among sectors, wholesale and retail was the best-performer.

- UAE central bank assets grew by 6% yoy to AED 470.5bn by end-Dec 2020.

- Abu Dhabi Securities Exchange (ADX) reduced its fees on all trading activities: starting this week, fees of all transactions that occur on ADX will be reduced to 0.175% from 0.225%. Additionally, brokerage firms that generate AED 20mn worth of trading commission will be exempt from paying any trading commission for the year in which the threshold is met.

- DP World announced that it had handled 71.2mn twenty-foot equivalent units (TEUs) in 2020, with gross volumes flat yoy and up 0.2% on a like-for-like basis.

- Rystad Energy reported that UAE’s renewable energy capacity is set to increase four-fold to about 9 gigawatts (GW) by the end of 2025 (from 2.3 GW at end-2020).

Media Review

How well will vaccines work?

https://www.economist.com/leaders/2021/02/13/how-well-will-vaccines-work

New-Model Central Banks

https://www.project-syndicate.org/commentary/central-banks-have-tools-for-climate-change-and-inequality-by-barry-eichengreen-2021-02

Mario Draghi, political animal

https://www.politico.eu/article/mario-draghi-political-animal/

Nouriel Roubini: bitcoin is not a hedge against tail risk

https://www.ft.com/content/9be5ad05-b17a-4449-807b-5dbcb5ef8170

Powered by: