Download a PDF copy of this week’s economic commentary here.

Markets

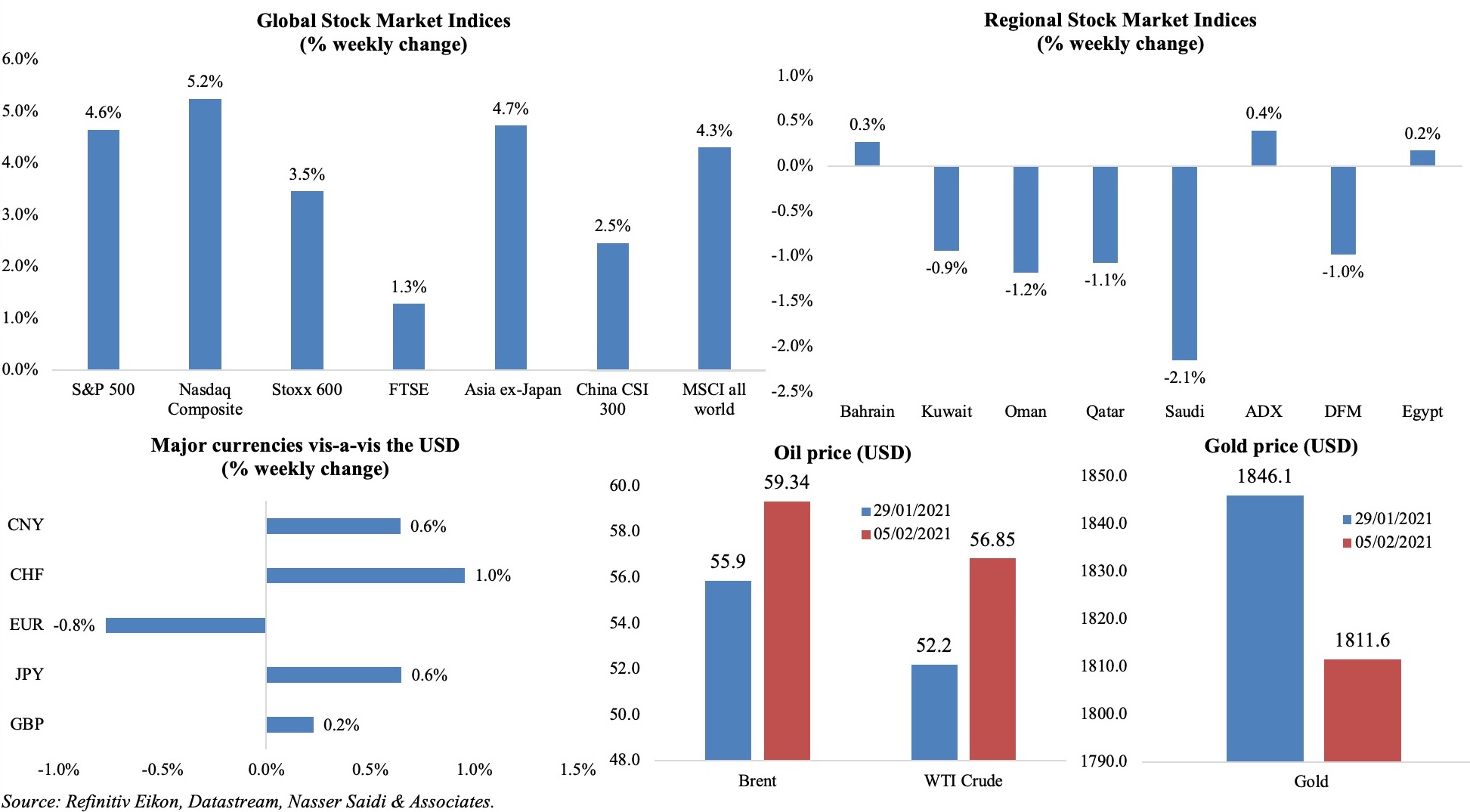

After the retail trading havoc subsided, major equity markets across the globe had a good week: Nasdaq and S&P 500 hit new highs, as expectations of stimulus deals supported market sentiment while the published Q4 earnings showed US firms performing better compared to their European counterparts. Regional markets were mostly down, with many markets introducing restrictions to dampen the rise in Covid19 cases. Among currencies, the dollar hit a near-three-month high vis-à-vis the yen during the week, but a 2-month low against the euro. Oil advanced to hit the highest level in a year, inching closer to USD 60, after OPEC+ extended production cuts, falling inventories and expectations of vaccination drives leading to faster economic recovery; gold price fell.

Weekly % changes for last week (4-5 Feb) from 28 Jan (regional) and 29 Jan (international).

Global Developments

US/Americas:

- Non-farm payrolls added a lower-than-expected 49k in Jan, following downward revisions to its Dec (by 87k to -227k) and Nov (72k to 264k) readings. Unemployment rate unexpectedly declined to 6.3% in Jan (Dec: 6.7%) – the first decline in 2 months – while the labour force participation rate ticked lower. Earlier in the week, ADP employment increased by 174k in Jan, thanks to a rebound in services providing sector (+156k) and following Dec’s 74k decline.

- Factory orders inched up by 1.1% mom in Dec (Nov: 1.3%), rising for the 8th consecutive month, supported by strong demand for machinery, electrical equipment, appliances and components. orders for non-defense capital goods excluding aircraft increased by 0.7% (a tad higher than the initial estimate of 0.6%).

- Trade deficit in the US soared to USD 679bn in 2020 – the highest since 2008 – up 17.7% yoy, with exports declining by 15.7% to the lowest level since 2010 while imports dropped by 9.5% to a 4-year low. Goods trade deficit alone widened to USD 916bn, a record high.

- The final reading of the US Markit manufacturing PMI stood at 59.2 in Jan (preliminary reading of 59.1 and Dec’s 57.1), thanks to accelerated expansions in output and new orders – this was the highest reading since data collection began in 2007. In contrast, the ISM manufacturing PMI slipped to 58.7 in Jan (Dec: 60.5), with the employment sub-index rising to 52.6 from 51.7 the month before while forward-looking new orders sub-index fell to 61.1 from 67.5 in Dec. Services PMI readings improved in both Markit (58.3 in Jan from Dec’s 57.5) and ISM (58.7 in Jan from Dec’s 57.7) reports.

- Initial jobless claims improved to 779k in the week ended Jan 29 from a downwardly revised 812k the prior week, with the 4-week average slowing to 848.25k. Continuing claims slowed to 4.592mn in the week ended Jan 22 from 4.785mn the week before.

Europe:

- Eurozone GDP shrank by 0.7% qoq and by 5.1% yoy in Q4 (Q3: +12.5% qoq and -4.3% yoy), taking the 2020 GDP down by 6.8%. The contraction was milder than the dip in Q2, which saw the initial period of lockdown and restrictions. GDP across the block posted post-war record falls: it fell 5% in Germany, 8.3% in France, 8.8% in Italy and 11% in Spain.

- German retail sales fell by 9.6% mom in Dec (Nov: 1.1%), the steepest monthly drop since records began in 1994, as tighter restrictions and lockdowns curbed consumer spending. For the full year, retail sales grew by 3.9% yoy in real terms with online retailers benefitting most.

- German Markit manufacturing PMI stood at 57.1 in Jan, from Dec’s 3-year high of 58.3; more concerning was reports of delivery delays and logistical issues and an associated acceleration in input price inflation. In the Eurozone, the index was 54.8 in Jan (Dec: 55.2), with gains in new orders and output. Germany and Netherlands, with strong export bases, saw the largest expansions but there was a worsening of supplier delivery times.

- German composite PMI declined to a 7-month low of 50.8 in Jan (Dec: 52), as services inched down to 46.7 from 47 the month before. Expectations towards output in 12-month’s time reached the highest since Feb 2018. The eurozone PMI composite slipped to 47.8 in Jan (Dec: 49.1) as services PMI fell to 45.4 (46.4).

- Factory orders in Germany plunged by 1.9% mom in Dec (Nov: 2.7%) – the first decline in new orders since a record slump in Apr – as both domestic and foreign orders declined by 0.9% and 2.6% respectively.

- Core CPI in the eurozone increased to a 5-year high of 1.4% yoy in Jan (Dec: 0.2%) while inflation inched up to an 11-month high of 0.9% from a 0.3% drop in Dec – the largest monthly rise ever recorded. Factors like supply chain disruptions and Germany’s temporary VAT reductions have distorted inflation readings during the year.

- Retail sales in the eurozone grew bv 2% mom and 0.6% yoy in Dec (Nov: -5.7% mom and -2.2% yoy). Some countries re-opened physical stores for part of Dec, while others were closed: Sales in Germany and Netherlands were down by 9.6% and 10.9% while in France, Ireland and Belgium, sales rebounded by 22.3%, 11.4% and 15.9% respectively.

- Unemployment rate in the eurozone remained unchanged at 8.3% in Dec; youth unemployment rate was 18.5% (Nov: 18.1%). Compared to a year ago, the number of unemployed persons rose by 1.5mn in the eurozone.

- At the latest Bank of England meeting, the main lending rate was left unchanged at 0.1% while the target stock of asset purchases was maintained at GBP 895bn (USD 1.2trn). The apex bank also downgraded its economic growth forecast for this year to 5%, from a previous projection of 7.25% growth in its Nov Monetary Policy Report.

- In the UK, Markit manufacturing PMI was revised up to 54.1 in Jan from a preliminary reading of 52.9, but it remained much lower than Dec’s 57.5; a silver lining was the rise in employment for the first time in a year. Services PMI declined at its fastest pace since May, clocking in a reading of 39.5 in Jan (from a preliminary estimate of 38.8 and Dec’s 49.4).

Asia Pacific:

- China non-manufacturing PMI slowed to a 10-month low of 52.4 in Jan 2021 (Dec: 55.7), with new business falling below the neutral 50-mark (48.7 in Jan from Dec’s 51.9) while export orders and employment also declined (48 and 47.8 respectively). Business sentiment deteriorated to an eleven-month low (55.1 vs 60.6).

- China’s official NBS manufacturing PMI eased to 51.3 in Jan (Dec: 51.9) – the weakest growth in factory activity since Aug. New orders (52.3 vs 53.6), export sales (50.2 vs 51.3), and buying levels (52.0 vs 53.2) all expanded at the softest pace since Aug.

- China Caixin manufacturing PMI clocked in a 7-month low of 51.5 in Jan (Dec: 53), with both output and new orders rising at softer paces while export sales shrank for the first time in 6 months. Caixin services PMI fell to 52 from 56.3 in Dec – the slowest growth in 9 months.

- Leading economic index in Japan slowed to 94.9 in Dec (Nov: 96.1) – the first deterioration in 7 months, reflecting weaker consumer confidence amid new Covid19 cases.

- Japan’s manufacturing PMI nudged up to 49.8 in Jan from a preliminary estimate of 49.7 (Dec: 50), the highest reading since May 2019. New orders grew for first time in over two years while employment fell below-50.

- Overall household spending in Japan fell by 0.6% yoy in Dec (Nov: 1.1%). For the full year, average monthly spending fell a real 5.3% yoy – the sharpest on record – to an average JPY 277,926.

- The Reserve Bank of India kept policy rates unchanged: the repo rate stands at 4% and the reverse repo rate at 3.35%. The cash reserve ratio (CRR) will be scaled back to 4% in 2 phases: effective March 27, it will be raised to 3.5% from 3% now, and from May 22, the CRR will be normalised back to 4%. It forecast real GDP growth at 10.5% in 2021-22.

- Markit manufacturing PMI in India increased to a 3-month high of 57.7 in Jan (Dec: 56.4), with output accelerating to the fastest pace since Oct while employment fell further.

- South Korea’s Markit manufacturing PMI improved to 53.2 in Jan (Dec: 52.9), the highest since Feb 2011, with output rising the most since Feb 2011 while new orders and export orders expanding for 4 straight months. Additionally, confidence strengthened to the highest level since Apr 2014.

- Singapore PMI inched up to 50.7 in Jan – the highest since Mar 2019 – from 50.5 in Dec.

- Retail sales in Singapore fell by 0.9% mom and 3.6% yoy in Dec.

Bottom line: A spate of global PMIs were released last week: the main sticking point was stretched supply chains/ logistics delays leading to longer input delivery times, thereby building up price pressures. Global food prices have also hit their highest in 7 years, driven by higher grain prices. The situation is taking a turn for the worse, especially in highly import dependent nations: case in point is Lebanon where a family is estimated to spend about 11% of monthly (minimum) wages to have a pack of bread daily. Separately, in spite of vaccine delays and related logistical issues, the total number of vaccination doses administered across the globe (127.8mn) surpassed the overall number of confirmed Covid19 cases (105.8mn). At this pace of vaccination, Bloomberg analysis estimates that it would take 7 years for life to return to normal (i.e. vaccinating 75% of their populations)!

Regional Developments

- Bahrain-origin exports grew by 4% yoy to BHD 2.387bn (USD 6.3bn) in 2020, with Saudi Arabia, UAE and the US its top importers. The value of re-exports fell by 15% to BHD 676mn in 2020, while imports fell by 4%, thereby narrowing trade deficit by 8% to BHD 1.735bn.

- Egypt’s headline PMI remained below-50 in Jan, though inching upto to 48.7 from Dec’s 48.2; output (48.6 from 46.9), new orders (48 from 46.9) and employment (48.7 from 47.6) sub-indices rose month-on-month though remaining contractionary. Business outlook for the year ahead improved to a 6-month high, with ~40% of businesses expecting to expand output.

- The central bank of Egypt left interest rates unchanged at this year’s initial meeting: the overnight deposit rate, overnight lending rate, and rate of the main operation remained at 8.25%, 9.25%, and 8.75% respectively. The bank forecast preliminary real GDP growth of 0.3% in Q3 2020 from the 1.7% decline in Q2 2020, while also stating that demand-side leading indicators were showing signs of recovery in Q4.

- Money supply in Egypt increased by 19.7% yoy to EGP 4.92trn (USD 311.46bn) in Dec.

- Net foreign assets in Egypt’s banking sector grew by 8.4% mom to EGP 270.,692bn (USD 1.33bn) in Dec 2020, thanks to a 3.11% mom rise in the volume of foreign assets.

- Current account deficit in Egypt doubled to USD 2.8bn in Jul-Sep 2020 from a year ago, as tourism receipts plunged to USD 801mn during the quarter from USD 4.2bn in the same period a year ago. Net FDI plummeted by 31% to USD 1.6bn while remittances grew by 19.6% to USD 8bn. Overall balance of payments moved to a deficit of USD 69.2mn in the quarter from a surplus USD 227mn a year ago.

- Egypt’s central bank announced that it would auction USD 980mn of one-year dollar-denominated treasury bills on Feb 8th.

- Hotel occupancy rates in Egypt is expected to rise between 43% to 62% this year, according to Colliers, thanks to high 80%+ hikes in occupancy rates in tourism hotspots.

- An IMF report warned that Iraq was “substantially exposed to fiscal risks related to guarantees issued by the State”. The government had backstopped USD 7bn of foreign currency payments and debt (or 12% of GDP) as of Jun 2017, comprising USD 19.4bn for service payments to independent power producers by state-owned electricity companies and USD 2.3bn of debt. The Fund recommended that the government should develop a comprehensive guarantees registry, and develop capacity to understand the risks associated with guaranteeing certain transactions.

- Iraq’s oil exports increased to 2.868mn barrels per day (bpd) in Jan from 2.846mn bpd in Dec, according to the oil ministry. Jan’s oil revenues stood at USD 4.74bn with an average price per barrel of USD 53.294.

- Jordan plans to become the energy exchange hub for the region: its renewable energy projects have enabled it to reduce import dependence and generate surplus energy for the first time. The country is in the process of strengthening links with its neighbouring nations to export excess electricity.

- The IMF called for acceleration of reforms in Kuwait and a gradual reduction in its dependence on oil amid high levels of buffers. Separately, Fitch affirmed downgraded Kuwait’s outlook to “negative” from “stable” while affirming its long-term rating at “AA”.

- Kuwait invited bids from contractors to build 11 separate oil pipelines at various locations at a cost of around KWD 205mn (USD 675mn).

- With the faster spread of Covid19 cases, Kuwait is imposing a 2-week ban on the entry of non-Kuwaitis into the country from today (Feb 7); furthermore, all commercial facilities (excluding pharmacies, medical and food supplying outlets) will be closed between 8pm to 5am for one month from Feb 7th.

- PMI in Lebanon fell to 41 in Jan (Dec: 43.2), as output continued to contract, and new orders fell sharply amid subdued demand conditions. Firms also were severely pessimistic concerning the 12-month outlook.

- Banks in Lebanon are likely to request the central bank to extend the Feb 28 deadline to comply with BDL’s request that lenders to increase their capital base and repatriate part of funds transferred abroad, reported The Daily Star.

- Lebanon’s national coronavirus committee is discussing the involvement of the private sector in importing Covid19 vaccines including Russia’s Sputnik V and China’s Sinopharm vaccine as well as India’s under-development vaccine.

- Oman’s new fee structure to hire expats for specified senior or top-level temporary posts is set at OMR 336 for 4 months, or OMR 502 or OMR 752 for 6 and 9 months respectively while a recruitment license (for salaries of OMR 4k+) is set to cost OMR 2001.

- Qatar’s PMI expanded to 53.9 in Jan (Dec: 51.8) – the fourth-highest ever reading on record – thanks to upticks in new orders and output. Sector-wise, construction was the strongest (55.0), followed by manufacturing (54.8) and wholesale and retail (53).

- Qatar has re-imposed restrictions, given the new wave of Covid19 cases, on businesses (to operate at 50% capacity), nurseries (operate at 30% capacity) and a limitation of maximum 15 persons for outdoor gatherings.

- Saudi Arabia’s PMI inched up to 57.1 in Jan (Dec: 57) – the highest reading since Nov 2019 – thanks to a marked improvement in output as well a rise in new orders; foreign orders rose to the “greatest degree in almost 4 years”. However, employment fell for the 10th time in 11 months.

- About SAR 300.2mn (USD 80mn) was disbursed to around 133k Saudi citizens working in the private sector companies as part of the wage support scheme. Workers earning between SAR 3200-15k were eligible for support.

- Bank investments in Saudi Arabia’s bonds increased by 14.69% yoy to SAR 440.02bn in 2020, as per data from the central bank.

- It was disclosed that 24 international firms had officially signed agreements to establish regional offices in Riyadh, including PepsiCo, Schlumberger, Deloitte and PWC among others. This is part of the Riyadh government’s aim to create 35k new jobs for its citizens and boost GDP by up to SAR 70bn (USD 18.67bn) by 2030.

- Consumer loans in Saudi Arabia grew by 9.5% yoy to SAR 365.04bn in 2020, of which property renovation loans stood at SAR 23.85bn; credit card loans fell 3.8% to SAR 18.33bn.

- Expat remittances from Saudi Arabia surged by 19.3% yoy to SAR 149.69bn (USD 39.92bn) in 2020: this is the highest since 2016.

- The localisation rate in Saudi Arabia’s private sector firms increased to 21.81% in Q4 2020, compared with 20.9% in Q4 2019.

- Saudi Arabia imposed restrictions given an uptick in Covid19 cases: suspension of recreational events (cinemas, indoor entertainments) as well as closure of gyms and sports centres for 10 days.

- The UAE and Bahrain are 2nd and 4th highest respectively in terms of share of people who have received at least one dose of the Covid19 vaccine – at 36.39% and 10.55% respectively (as of Feb 4 and 5 respectively).

- The latest edition of the Corruption Perceptions Index shows dismal readings for the MENA region: the worst performers were Libya (score of 17), Yemen (15) and Syria (14) while on the other end of the spectrum were UAE and Qatar (scores of 71 and 63 respectively); among those that performed worse in the latest report was Lebanon, which scored just 25, dropping five points since 2012. More: https://www.transparency.org/en/news/cpi-2020-middle-east-north-africa

UAE Focus

- UAE’s PMI was unchanged at 51.2 in Jan, thanks to an “increase in client sales and a resumption of construction projects”. While employment moved above 50 for the first time in over a year, the headline index remained lower than the index average of 54.2.

- Inflation in Abu Dhabi declined by 2.6% yoy in Nov, clocking in a negative reading for the 18th consecutive month. During Jan-Nov 2020, inflation fell by 2.4%, with prices of housing and utilities down by 3.1%.

- The Abu Dhabi Pension Fund in a USD 900mn transaction – is taking a 31% share in the Abu Dhabi Energy Real Estate Company (which was formed after Adnoc signed an agreement with Apollo Global Management to lease some of its properties on a long-term basis).

- The UAE Centre for the Fourth Industrial Revolution (C4IR UAE) agreed with the Dubai Financial Services Authority (DFSA) and the Dubai International Financial Centre (DIFC) to provide “a controlled regulatory forum” to test the tokenisation of digital assets.

- According to the UAE National Economic Register, there were 3899 branches of GCC- and foreign business operating in the UAE as of end-Jan: of this, most are based in Abu Dhabi and Dubai. (Detailed breakdowns can be accessed via: https://cbls.economy.gov.ae/ReportsMisc.aspx?RPT=4267)

- The White House, under President Biden, disclosed that the US will maintain a tariff of 10% on aluminium imports from the UAE.

- The UAE is ranked first in the region, and fourth globally in the Global Entrepreneurship Index 2020 created by the Global Entrepreneurship Monitor.

Media Review

The Perils of an Uneven Global Recovery

https://www.project-syndicate.org/commentary/covid19-uneven-global-recovery-emerging-market-risks-by-kenneth-rogoff-2021-02

The pandemic is not under control anywhere unless it is controlled everywhere

https://www.piie.com/blogs/realtime-economic-issues-watch/pandemic-not-under-control-anywhere-unless-it-controlled

How SoftBank’s $100bn Vision Fund bounced back

https://www.ft.com/content/f78abc14-abd0-427d-9e44-e5e593104432

What the favourite stocks of r/wallstreetbets have in common

https://www.economist.com/graphic-detail/2021/02/06/what-the-favourite-stocks-of-r/wallstreetbets-have-in-common

Cooperation Critical to Reducing Divergent Paths to Recovery in Middle East and Central Asia: IMF

https://blogs.imf.org/2021/02/04/cooperation-critical-to-reducing-divergent-paths-to-recovery-in-middle-east-and-central-asia/

https://www.thenationalnews.com/business/economy/technology-and-green-infrastructure-investment-can-boost-mena-recovery-imf-says-1.1159432

Powered by: