Download a PDF copy of this week’s insight piece here.

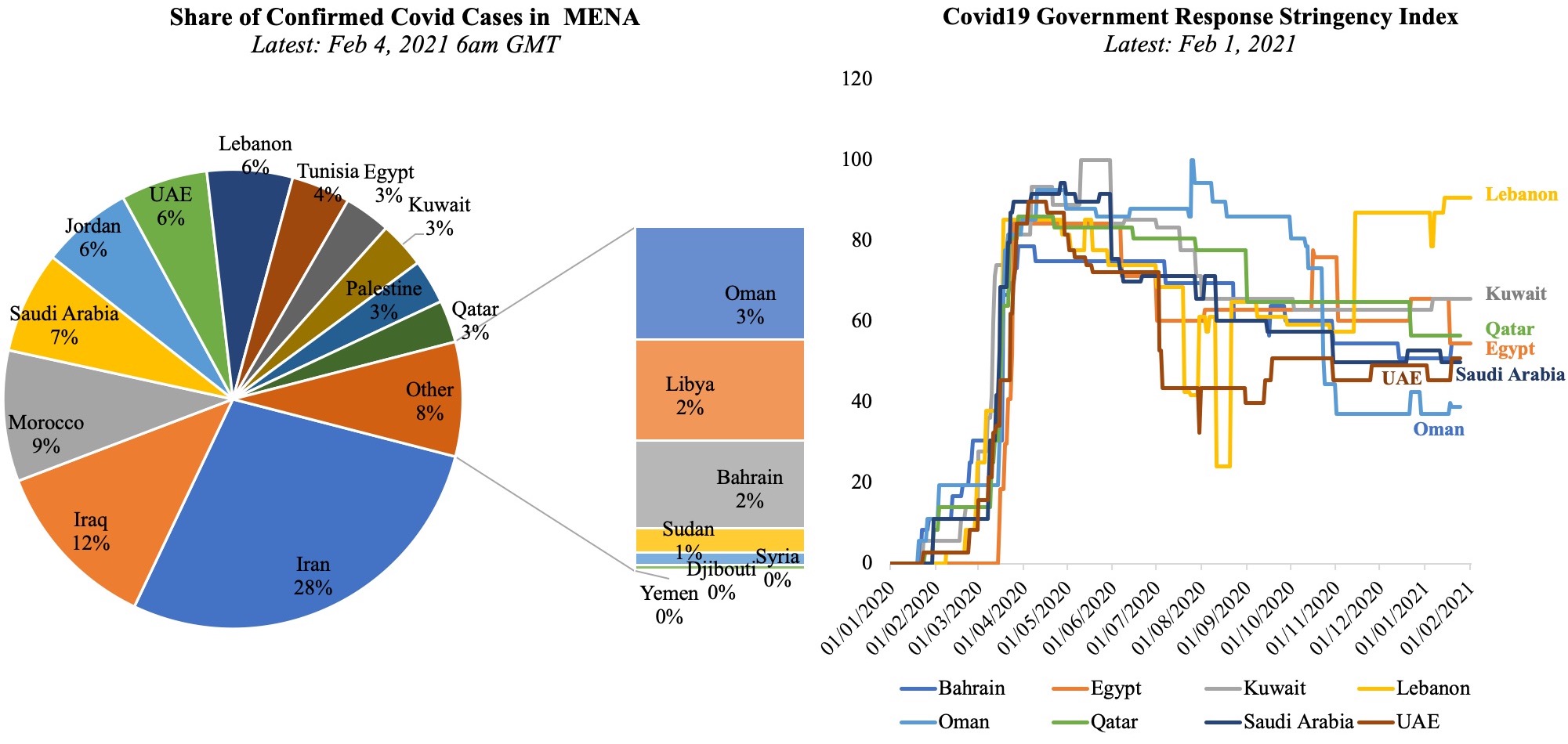

1. Covid19 cases rise in the Middle East & so do Restrictions

- Covid19 cases in MENA crossed 5 million; the GCC is home to 24% of confirmed cases

- The uptick in cases has seen many countries re-introduce border controls (e.g. Oman, Lebanon), flight restrictions (e.g. Saudi Arabia) as well as capacity/ recreational activity restrictions (e.g. UAE/ Dubai)

Source: John Hopkins University (https://coronavirus.jhu.edu/map.html), Oxford COVID-19 Government Response Tracker from Blavatnik School of Government – Our World in Data (https://ourworldindata.org/grapher/covid-stringency-index); Charts created by Nasser Saidi & Associates.

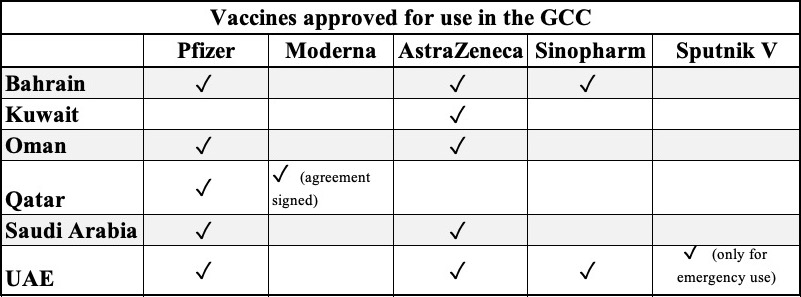

2. Vaccination drives are picking up

- Focus has shifted to vaccination drives, with almost all GCC nations receiving a combination of supplies including Pfizer, Moderna, AstraZeneca, Sinopharm and Sputnik V vaccines

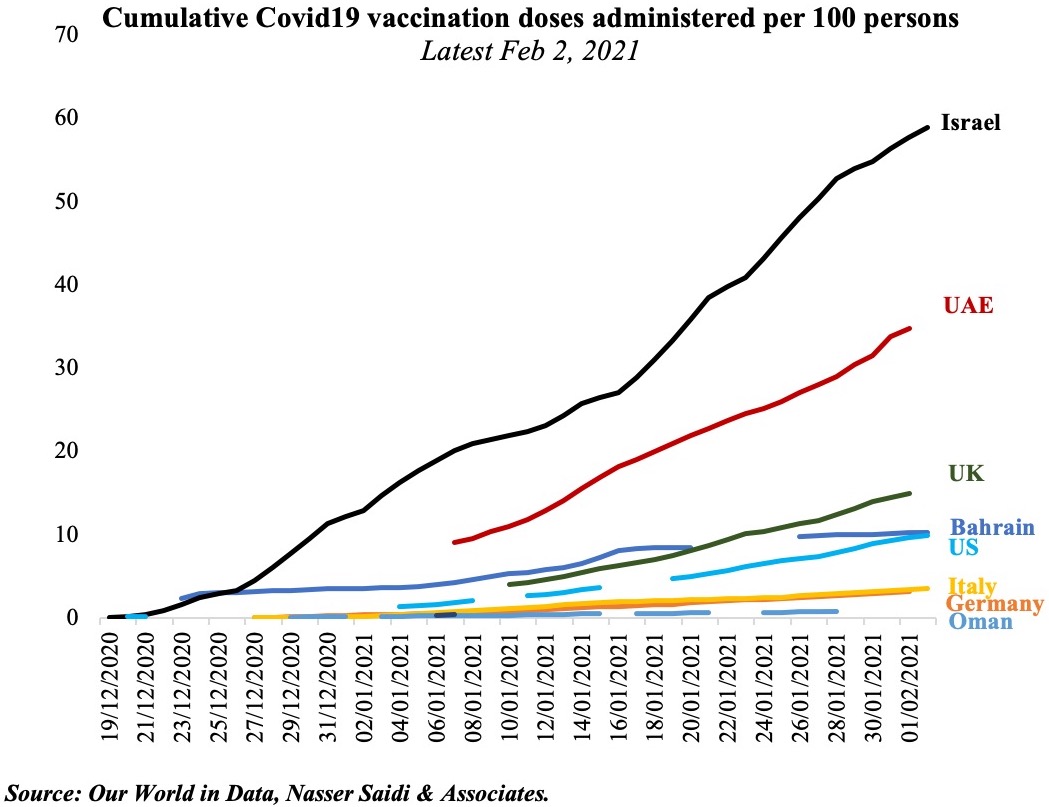

- UAE has administered a total 34.8 vaccination doses per 100 people, behind only Israel (58.8) globally

- In terms of the share of fully vaccinated population (i.e. both doses), Israel tops at 21.43% followed by UAE at 2.53% and US (1.81%)

- UAE’s hub status supports distribution: Dubai’s Vaccines Logistics Alliance & Abu Dhabi’s Hope Consortium to deliver vaccine doses across the globe

- A potential manufacturing hub? UAE is building up its capacity to manufacture the Covid19 vaccine in the future

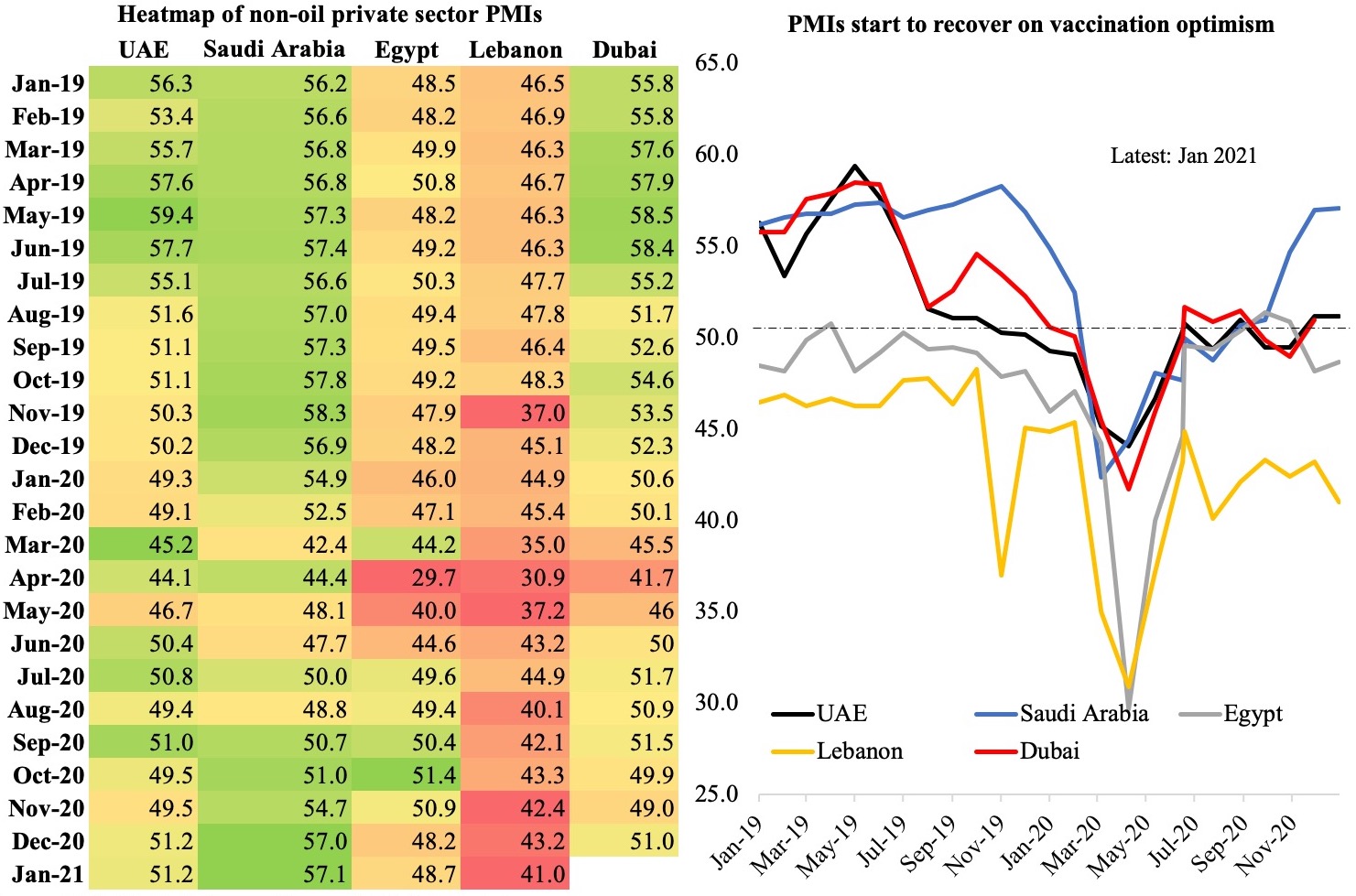

3. Businesses ride the wave of vaccine optimism in Saudi Arabia & UAE

- Jan 2021 PMI data showed Saudi ticking up to a 15-month high while in the UAE, though the headline number remain unchanged, jobs moved into positive territory for the first time in over a year

- Lebanon’s numbers remain dismal with the complete lockdown adding to the existing socio, economic and political woes

Source: Refinitiv Datastream, Nasser Saidi & Associates.

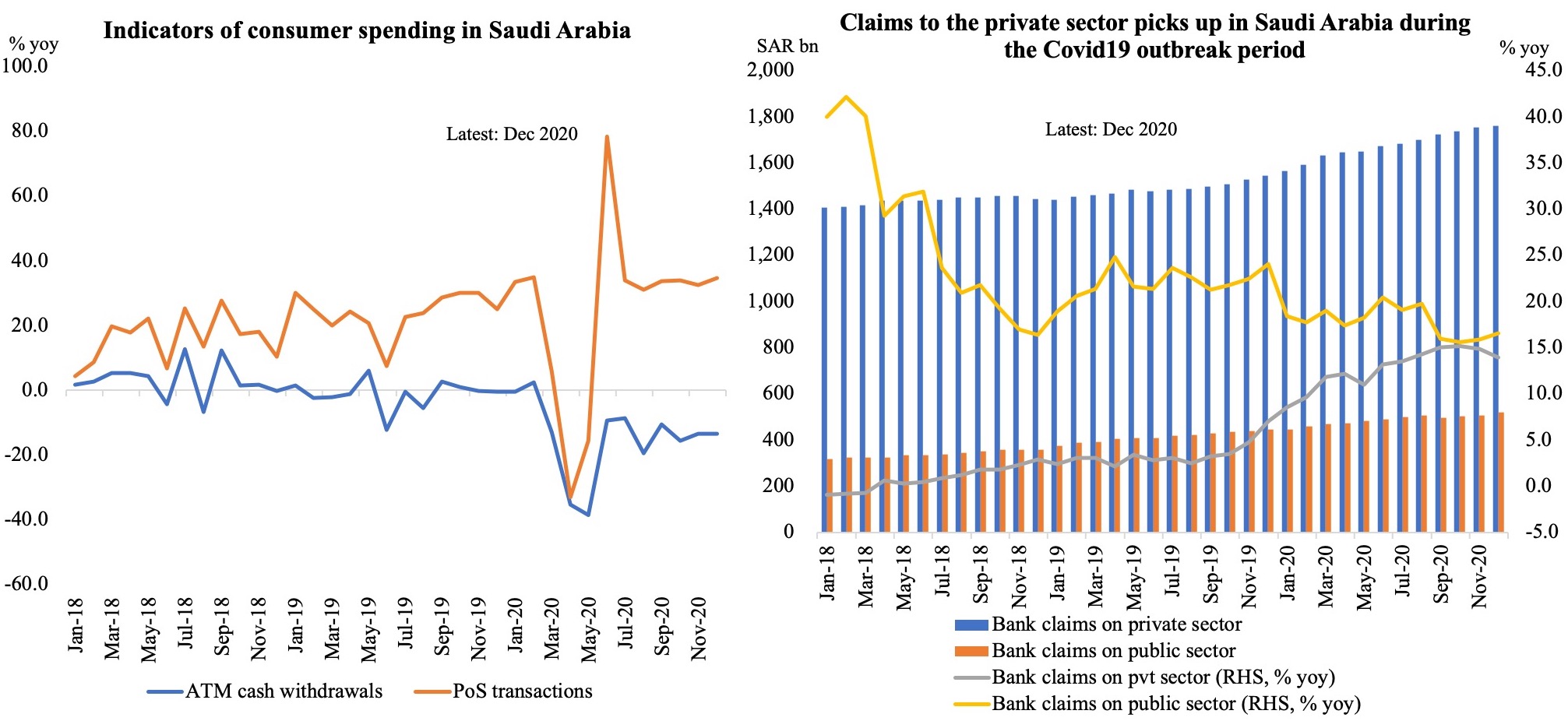

4. Indicators of economic activity in Saudi Arabia

- Proxy indicators for consumer spending – ATM withdrawals and PoS transactions – have shown a divergence during the pandemic year

- For the full year 2020, PoS transactions rose by 24% yoy while ATM cash withdrawals were negative, declining by 15% – pointing to the rise in digital/ contactless/ e-payments in a Covid19 backdrop

- Overall loans picked up in the country, with loans to the private sector for the full year rising at 12.8% versus a 17.8% uptick in loans to the public sector

Source: Saudi Central Bank (SAMA), Refinitiv Eikon, Nasser Saidi & Associates.

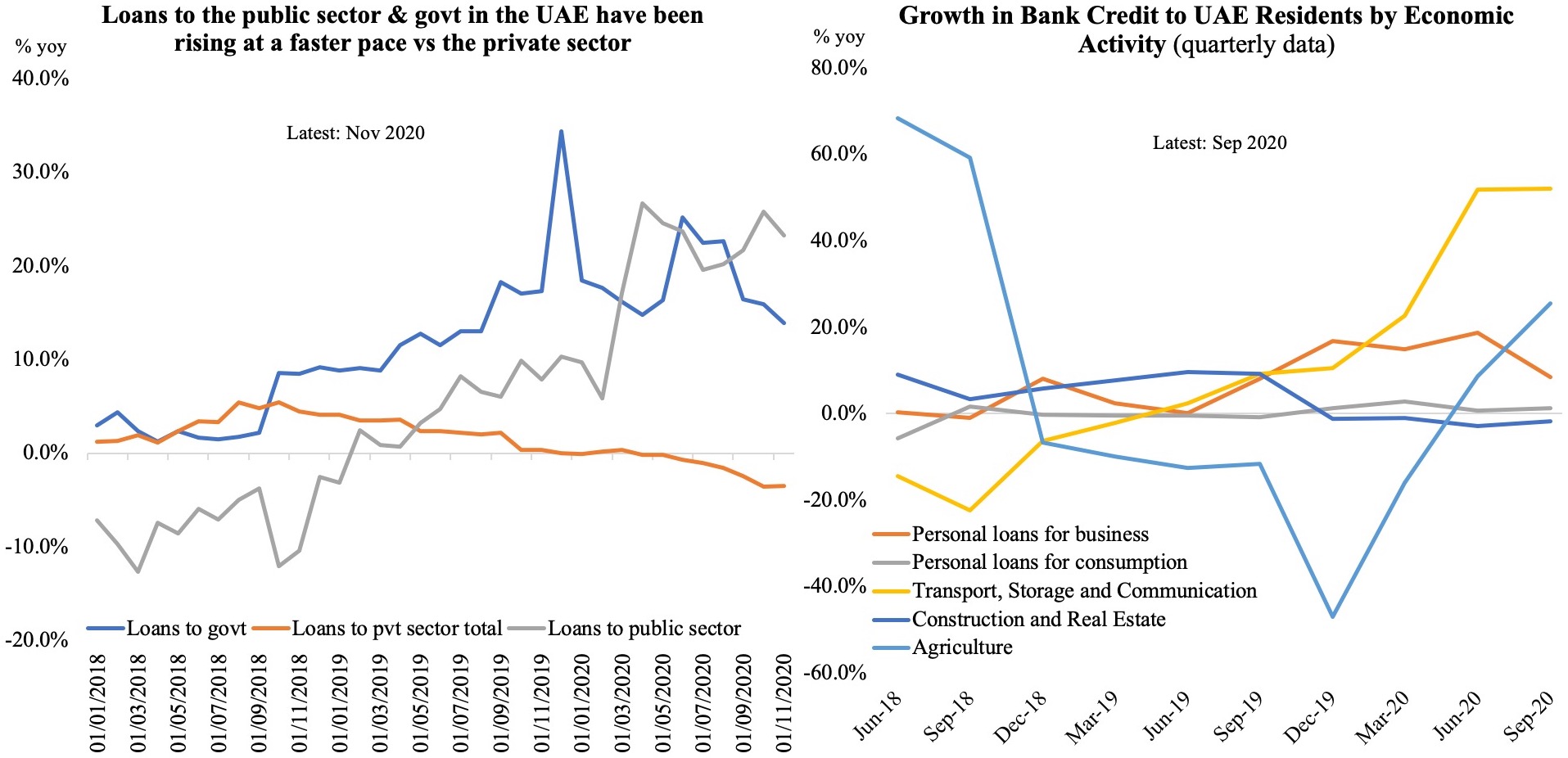

5. Indicators of economic activity in the UAE

- More than 2/3-rds of UAE banks’ loans went to the private sector (69.4% as of Nov 2020 vs. 76% in end-2018 & 72% in end-2019), while public sector & government together account for ~30% of all loans in Nov 2020 (vs. 25% a year ago)

- However, the overall pace of lending to GREs (+23.2% yoy during Apr-Nov 2020) and the government (+18.5%) outpaced the drop in lending to the private sector (-1.6%)

- Bank credit by business activity showed an interesting pattern: as of end-Sep 2020, loans towards agriculture surged by 18.6% qoq, following a 18% uptick in end-Jun, underscoring the recent focus on food security and evidence of investments into vertical farming and agritech companies (its share of total loans is just 0.13%). Loans to the transport & logistics have shown a strong upsurge, rising by 52.1% yoy as of end-Sep.

- Personal loans for consumption (accounting for 20.6% of total loans) rose by 1.3% yoy at end-Sep (Jun: 0.7%).