Download a PDF copy of this week’s economic commentary here.

Markets

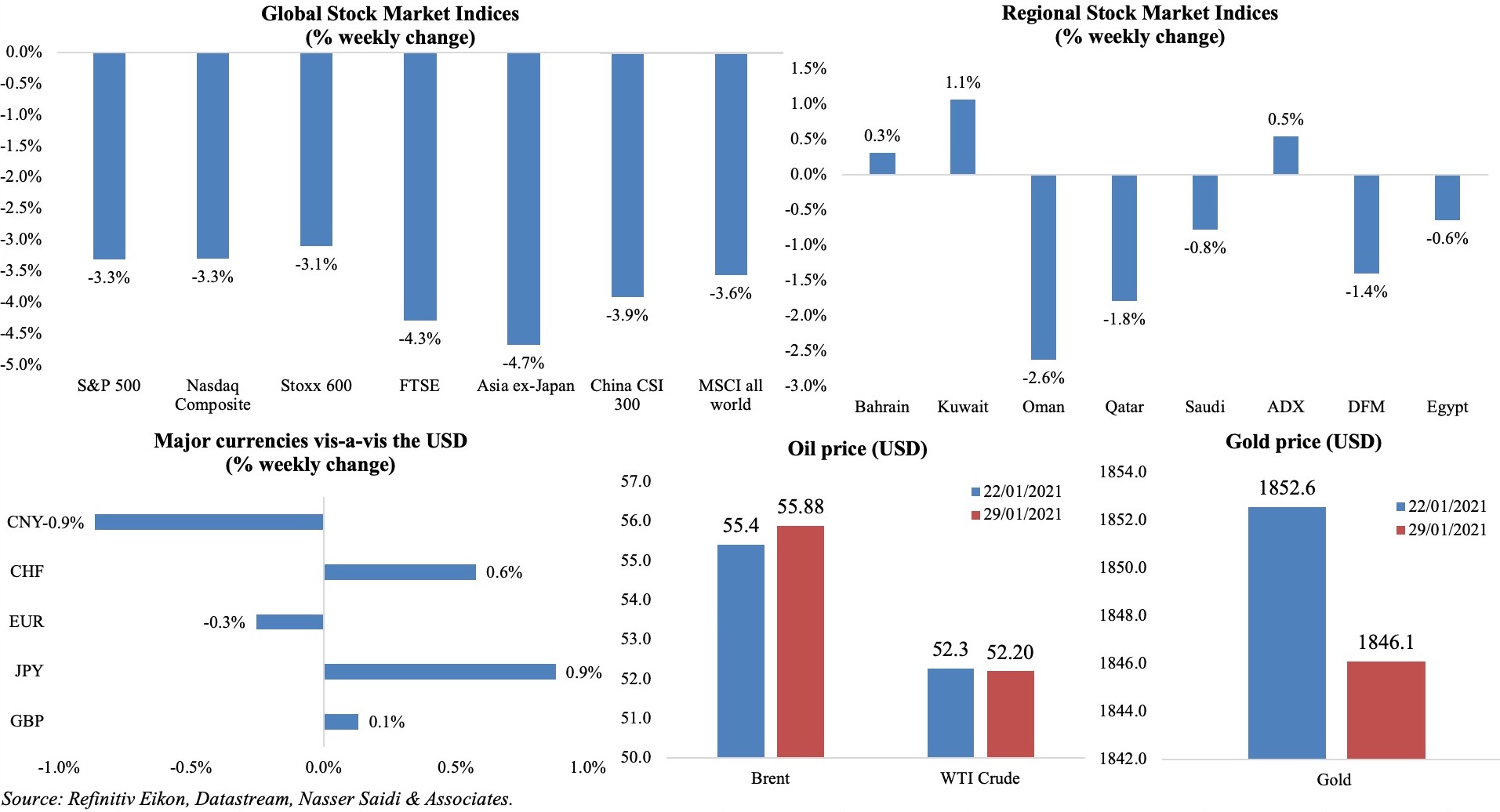

Equity markets across the globe felt the reverberations of the battle between hedge funds and speculative buying from Reddit retail investors over GameStop, as volatility ticked up. Wall Street had the worst week since Oct, while Stoxx and FTSE closed 3.1% and 4.3% lower. Asian markets were affected as well, with day-trading also affecting the Malaysian stock market. Meanwhile, as Covid19 cases surpassed 100mn cases globally, and faced with delivery shortfalls, the EU announced export controls on vaccines produced within the bloc, which could derail global recovery. Regional markets were mostly down, tracking global market patterns. The dollar rose to a seven-week high against the yen while overnight offshore yuan borrowing rates hit their highest level since June 2017. Oil prices held steady in the last week and come Feb-Mar, Saudi will cut output by 1mn barrels per day. Gold prices fell and remains on track for the worst Jan since 2011.

Weekly % changes for last week (28-29 Jan) from 21 Jan (regional) and 22 Jan (international).

Global Developments

US/Americas:

- The Fed, after keeping policy rates unchanged and making no change to its monthly bond purchases, pointed out in its statement that “the path of the economy will depend significantly on the course of the virus, including progress on vaccinations”.

- GDP in the US increased at an annualized rate of just 4% in Q4 (following Q3’s 33.4% surge): making this the worst decline since 1946. Personal consumption in Q4 rose at an only 2.5% annualized rate (vs a record 41% rate in Q3) while core PCE rose by 1.4% (Q3: 3.4%).

- Personal incomes in the US climbed by 0.6% in Dec (Nov: -1.3%), data also showing the largest annual increase in disposable personal income since 1984. Personal spending dipped by 0.2% in Dec (Nov: -0.7%), thereby raising personal saving as a percentage of disposable income to 13.7% in Dec (Nov:9%).

- Richmond Fed Manufacturing Index slowed to 14 in Jan (Dec: 19), with manufacturers reporting lengthening vendor lead times – this index rose to 39, its highest reading since Jan 1996.

- Chicago PMI jumped up to 63.8 in Jan (Dec: 58.7), the strongest expansion since Jul 2018, thanks to large monthly gains in production and new orders.

- The Conference Board’s consumer confidence index increased to a reading of 89.3 in Jan (Dec: 87.1). The current conditions measure fell to 84.4 from Dec’s 87.2 while expectations nudged up to 92.5 (Dec: 87). Separately, the Michigan consumer sentiment index showed a decline to 79 in Jan (down from the flash estimate of 79.2 and Dec’s 80.7).

- S&P Case Shiller home prices index posted a 9.1% yoy gain in Nov (Oct: 8% yoy). New home sales grew by 1.6% mom to a seasonally adjusted annual rate of 842k in Dec, while the median price rose by 8% yoy to USD 355,900. Pending home sales fell for the 4th straight month, down by 0.3% mom in Dec, thanks to record-high prices and low supply. In yoy terms, sales were up 21.4% – the highest Dec reading on record.

- Durable goods orders eased in Dec, rising by 0.2% from 1.2% rise in Nov, constrained by the 51.8% plunge in orders for civilian aircraft. Non-defense capital goods orders excluding aircraft posted a 0.6% rise down from the 1% and 1.7% hikes in Dec and Nov respectively. Overall output still remains about 2.6% below its pre-pandemic level.

- Initial jobless claims slowed slightly to 847k in the week ended Jan 22 from an upwardly revised 914k the prior week, with the 4-week average rising to 868k. Continuing claims slowed to 4.771mn in the week ended Jan 15 from 4.974mn the week before.

Europe:

- GDP in Germany declined by 3.9% yoy in Q4, following a 4% drop in Q3. In qoq terms, growth nudged up by 0.1% in Q4 from 8.5% in Q3. This brings the full year decline to 5% – the second-biggest plunge, after the -5.7% drop in 2009. The growth forecast for this year was slashed to 3% from last autumn’s 4.4% estimate.

- German Ifo showed falls across the board for Jan: business climate index slipped to a 6-month low of 90.1 from Dec’s 92.2, while the current assessment and expectations slowed to 89.2 and 91.1 respectively (from 91.3 and 93 in Dec).

- The GfK consumer confidence survey showed a massive decline to -15.6 in Feb (Jan: -7.5), given the strict lockdown: this was the lowest reading since Jun.

- The harmonized index of consumer prices in Germany increased by 1.4% mom and 1.6% yoy in Jan (0.6% mom and -0.7% yoy). The uptick was due to multiple factors including the changes in VAT rates, the CO2 price and increase in the statutory minimum wage.

- The unemployment rate in Germany remained stable at 6% in Dec, with 41,000 fewer people out of work.

- UK’s claimant count rose by 7k in Dec, with the overall level having increased by 113.2% since Mar 2020. ILO unemployment rate inched up to 5% in the 3 months to Nov – the highest level since early 2016 and 1.2% higher than a year ago.

Asia Pacific:

- The People’s Bank of China (PBOC) injected a net CNY 98bn into the financial system on Friday, following a week of reducing liquidity. This was however not sufficient to stop the hike in short-term money rates, which rose for a fifth straight day on Friday.

- Industrial production in Japan declined by 3.2% yoy in Dec (Nov: -3.9%); in mom terms, IP fell by 1.6%, following a 0.5% dip in Nov, dragged down by business-oriented machinery (-11.7%) and auto (-3%). Overall IP last year fell by 10% to a 7-year low.

- Inflation Tokyo fell by 0.5% yoy in Jan (Dec: -1.3%) while core CPI was down by 0.4%. Excluding food and energy, inflation ticked up by 0.2% (Dec: -0.4%).

- Japan’s leading economic index improved to 96.4 in Nov (Oct: 94.3), but lower than the preliminary reading of 96.6. The coincident reading edged down to 89 (Oct: 89.4) while the lagging index slowed to 91 from 91.2.

- Retail trade in Japan dropped by 0.3% yoy in Dec (Nov: 0.6%). Large retailer sales also slipped by 3.5% following a 3.4% drop the month before.

- Unemployment rate in Japan held steady at 2.9% in Dec. Overall, the jobless rate in 2020 stood at 2.8%, up4% from the previous year, posting the first increase since 2009.

- Preliminary GDP in Korea grew by a seasonally adjusted 1.1% qoq in Q4 following the 2.1% expansion in Q3, limiting the full year decline to 1%. In yoy terms, it declined by 1.4% yoy in Q4 (Q3: -1.1%). Growth in exports (+5.2% qoq) offset the drop in private consumption (-1.7%) while construction investment grew by 6.5%.

- India’s fiscal deficit widened to INR 11.6trn for the 9 months till end-Dec, or 145.5% of the Budget Estimate at end-Dec, as revenue collected stood at INR 11.21trn (50% of budget estimate of total receipts).

- Industrial production in Singapore increased by 2.4% mom and 14.3% yoy in Dec, though slowing from the previous month’s 7.5% mom and 18.7% yoy. The increase was largely due to the 41.8% yoy surge in electronics alongside a 51% rise in semiconductors.

- Singapore inflation stood at 0% in Dec, after a 0.1% yoy decline the previous month, thanks to a rise in private transport costs. Core inflation fell to -0.3% yoy (Nov: -0.1%).

- Unemployment in Singapore fell for a second straight month in Dec, slowing to 3.2% in Dec (Nov: 3.3%). For the full year, unemployment ticked up to 3% from 2019’s 2.3%.

Bottom line: As Jan 2021 comes to a close, the IMF released its updated global forecasts wherein economic recovery is estimated at 5.5% this year and 4.2% in 2022, from a contraction of 3.5% in 2020. Emerging markets recover at a faster 6.3%, thanks to the effective containment of Covid19 in China and many of the South-east Asian nations. Even as global debt likely reached 98% of economic output at the end of 2020, the IMF called for continued fiscal support until recovery gets underway. Financing needs have seen governments and companies in the emerging markets sell a record USD 115.23bn of international bonds in the first 27 days of 2021, surpassing the previous all-time monthly high of USD 112.78bn set last Jan. Separately, UNCTAD expects FDI flows to remain weak this year, after posting a 42% drop to an estimated USD 859bn last year.

Regional Developments

- Bahrain’s trade with the GCC, at USD 5.7bn in 2020, accounted for 25% of its overall global trade. Bahrain-origin exports grew by 12% yoy to USD 1.59bn while overall trade deficit narrowed by 18% to USD 16bn. Saudi Arabia was the top importer of Bahraini goods (USD 320mn), followed by the US (USD 138mn) and the UAE (USD 135mn).

- Real-time electronic fund transfers in Bahrain rose for the 6th consecutive month, with the number of transactions surging 6 times to 7,447,526 in Dec compared to a year ago and the value accelerating by 243.38% to BHD 284.11mn.

- Under Bahrain’s new National Employment Programme, wages of Bahraini employees in the private sector will be subsidised by up to 70% for three years.

- As Covid19 cases picked up in Bahrain, with many cases showing the new variant, the nation stopped indoor dining and moved schools to remote learning for 3 weeks. The AstraZeneca vaccine, approved for emergency use, was delivered from India.

- Bahrain officially launched operations at the new 207,000-sq-m passenger terminal last week; the terminal, implemented under the USD 1bn Airport Modernisation Programme, is anticipated to raise the airport’s capacity to 14mn passengers annually.

- Egypt will use development finance to support private sector engagement, disclosed the international cooperation minister; development financing represents about 10% of public debt and 25% of external debt. While the country has a development finance portfolio of nearly USD 25bn, it attracted USD 9bn in 2020, a third of which was directed to the private sector.

- Egypt will offer more oil and gas blocks for tender in a new bid in the coming weeks, according to the minister of petroleum. Separately, the nation’s LNG export capacity is expected to increase to 12.5mn tonnes in Q1 this year from upto 8mn tonnes currently.

- Iraq, which requested emergency assistance from the IMF, is in discussions for loans worth USD 6bn; the news led to gains in the sovereign dollar-denominated bonds issued by Iraq.

- Iraq plans to set up large oil and gas projects in the Southern Dhi Qar Governorate in partnership with foreign companies. Separately, the nation set a target to upgrade renewable energy production to between 20-30% of the total power output by 2027.

- Jordan’s trade deficit narrowed by 17.8% yoy to JOD 5.888bn in Jan-Nov 2020, as exports declined by 5.2% during the period alongside a larger 12.4% drop in imports.

- Tourism revenues transferred to the Treasury in Jordan dropped by 81% yoy in 2020, according to a study prepared by the National Academy for Tourism and Aviation.

- Kuwait’s 2021-22 budget forecasts KWD 23bn in expenditures (USD 76.2bn, +6.9% compared to the current budget) and KWD 10.9bn in revenues (+45.7%), raising the deficit of KWD 12.1bn (+13.8%). Non-oil revenues are estimated at 17% of total revenue.

- Kuwaiti banks will be allowed to distribute 2020 dividends, according to the central bank.

- Kuwait’s health ministry approved the emergency use of the Oxford/AstraZeneca Covid19 vaccine. The first batch is expected to be delivered “within days” from India.

- Lebanon and the World Bank signed a USD 246mn loan agreement for a social safety net support program including emergency cash transfers and access to social services.

- Oman’s new labour and civil service laws are expected to be in place by end-Mar or the first week of Apr. The laws aim to reduce the gap between the public and private sectors’ salaries, vacations and working hours.

- The Ministry of Energy and Minerals of Oman revealed new initiatives to further liberalize the electricity sector: this includes bilateral electricity deals between large consumers and generators as well as planned introduction of a credit trading system to monetise energy efficiency gains, among others.

- Oman extended the close of its land borders for a week until Feb 1st.

- Saudi Arabia is forecast to grow by 2.6% yoy this year, according to the latest IMF World Economic Outlook report released last week. This follows a 3.9% contraction in 2020.

- Saudi Arabia unveiled the next phase of Vision 2030 last week. Among the plans included the PIF strategy for the next 5 years – this comprises USD 40bn of investment every year for the next five years, an investment of USD 800bn in new sectors over the next 10 years, a contribution of USD 320bn to non-oil GDP through companies in which it holds stakes and the creation of 1.8mn jobs by end-2025. Furthermore, PIF plans to double its assets to SAR 4trn (USD 1.07trn) by 2025. The Saudi Crown Prince also stated that a potential second listing of Aramco could be part of the plans to raise funds for the PIF.

- A 5-year Riyadh strategy was revealed at the Future Investment Initiative conference: about USD 220bn will be invested to transform Riyadh to a global city by 2030. Highlighting that Riyadh represents about 50% of the non-oil economy, it was disclosed that the cost to create jobs in the city are 30% less than the other cities in the country while the cost of developing infrastructure and real estate was also 29% less. Going forward, the aim is to raise the residents to 15-20mn from 7.5mn currently.

- Tadawul’s plans and timeline to go public will be announced this year, according to the CEO. 2020 saw 22 IPO listings, a 26% rise in the number of qualified foreign investors opening portfolios as well as more than 100k local investors joining the market.

- FDI into Saudi Arabia increased in 2020, stated the minister of investment (without disclosing the amount), as a result of the enactment of 400 investment laws, half which were amended to improve the investment climate. Separately, UNCTAD data showed that FDI into Saudi Arabia increased by 4% yoy to an estimated USD 4.7bn last year – this is in spite of the 42% drop in global FDI flows (with further weakness expected in 2021) and the 24% decline in flows to West Asia.

- Saudi Arabia’s finance minister expects to see further growth in the domestic debt market, with the debt market liquidity having grown by about 200% in 2020.

- Reuters reported that Saudi Arabia raised USD 5bn in a dual-tranche benchmark USD-denominated bond sale with tenors of 12 and 40 years. It received more than USD 13bn in orders for the 12-year bonds and over USD 9bn in orders for the 40-year paper.

- Industrial production in Saudi Arabia fell by 10% yoy in Nov, with mining and quarrying activity down by 9% and manufacturing falling by 15.6%.

- Saudi ports handled 7.3mn containers in 2020, a 4.36% uptick compared to a year ago: total cargo touched 299mn tons, coming on board 11,482 ships.

- Saudi Arabia named Fahad al-Mubarak as the new central bank governor – his second time at the helm of the apex bank.

- Over 257k expats left the Saudi job market in Q3 2020 bringing the non-Saudi employees to 10.2mn; during the period, Saudi employees increased by 82k to 3.25mn, according to GaStat data. Separately, GOSI reported that the number of Saudis working in the private sector grew by9% to 1.75mn last year while expats edged down by 2.6%.

- In a bid to reduce the burden on companies, Saudi Arabia will allow for the payment of issuance and renewals of work permits on a quarterly basis instead of an annual lumpsum.

- Saudi Arabia extended its travel ban and border closures till May 17th from Mar 31st previously cited, given the delays in vaccine delivery. The country is expected to receive 3mn doses of the AstraZeneca vaccine from India this week.

UAE Focus

- UAE will grant Emirati citizenship to expats who are “investors, specialised talents & professionals including scientists, doctors, engineers, artists, authors and their families”. The skilled professionals would be nominated by government or royal court officials including the Cabinet, the executive council of each of the seven emirates, the rulers’ courts, or their crown princes. This follows previous reforms allowing for a 10-year residency visa, retirement visa, remote working visa and residency visas for families of students.

- A new public debt strategy was approved by the UAE federal government aimed at developing its market for local currency bonds; though a public debt law allowing for the issuance of federal bonds was passed in 2018, no UAE government debt has been issued yet.

- According to the Index of Global Trade Health released by Tradeshift, the UAE supply chain activity saw trade volumes increase by more than 13% in Q4 2020 over a Jan 2020 baseline and nearly 30% from the lowest point in

- Bilateral trade between Dubai and Israel touched AED 1bn (USD 272.2mn) during the Sep 2020 – Jan 2021 period. Dubai’s main imports from Israel include vegetables, fruits, diamonds, flat screens, hi-tech devices as well as medical and mechanical devices.

- The Abu Dhabi Securities Exchange plans to double its market capitalisation over the next three years. Over 2020, ADX’s market cap grew by almost 40% to AED 750bn.

- Dubai revamped requirements to list local joint stock companies: all non-local companies are required to list their shares on DFM and Nasdaq Dubai if they generate more than half of their annual profits or revenues from activities in Dubai or if their total assets in the emirate amount to 50% or more of their entire assets. Non-local companies which generate less than 50% of revenues from Dubai are also eligible to list while foreign companies can list their shares in local bourses either in the form of a primary or secondary listing.

- Closing the skills gap in the UAE can generate an additional 43k jobs by 2030 and allow the nation to gain USD 4.3bn in GDP (roughly 0.6% of GDP), according to a WEF report “Upskilling for shared Prosperity”.

Media Review

GameStop’s wild ride: how Reddit traders sparked a ‘short squeeze’

https://www.ft.com/content/47e3eaad-e087-4250-97fd-e428bac4b5e9

https://www.ft.com/content/4916c465-99ec-46f4-a889-df845ad1bcd2

Europe’s dangerous vaccine nationalism

https://www.economist.com/leaders/2021/01/30/europe-needs-quicker-vaccinations-and-more-stimulus

England’s lockdown lessons

https://www.project-syndicate.org/commentary/uk-government-pandemic-response-lessons-for-future-crises-by-mohamed-a-el-erian-2021-01

Powered by: