Download a PDF copy of this week’s economic commentary here.

Markets

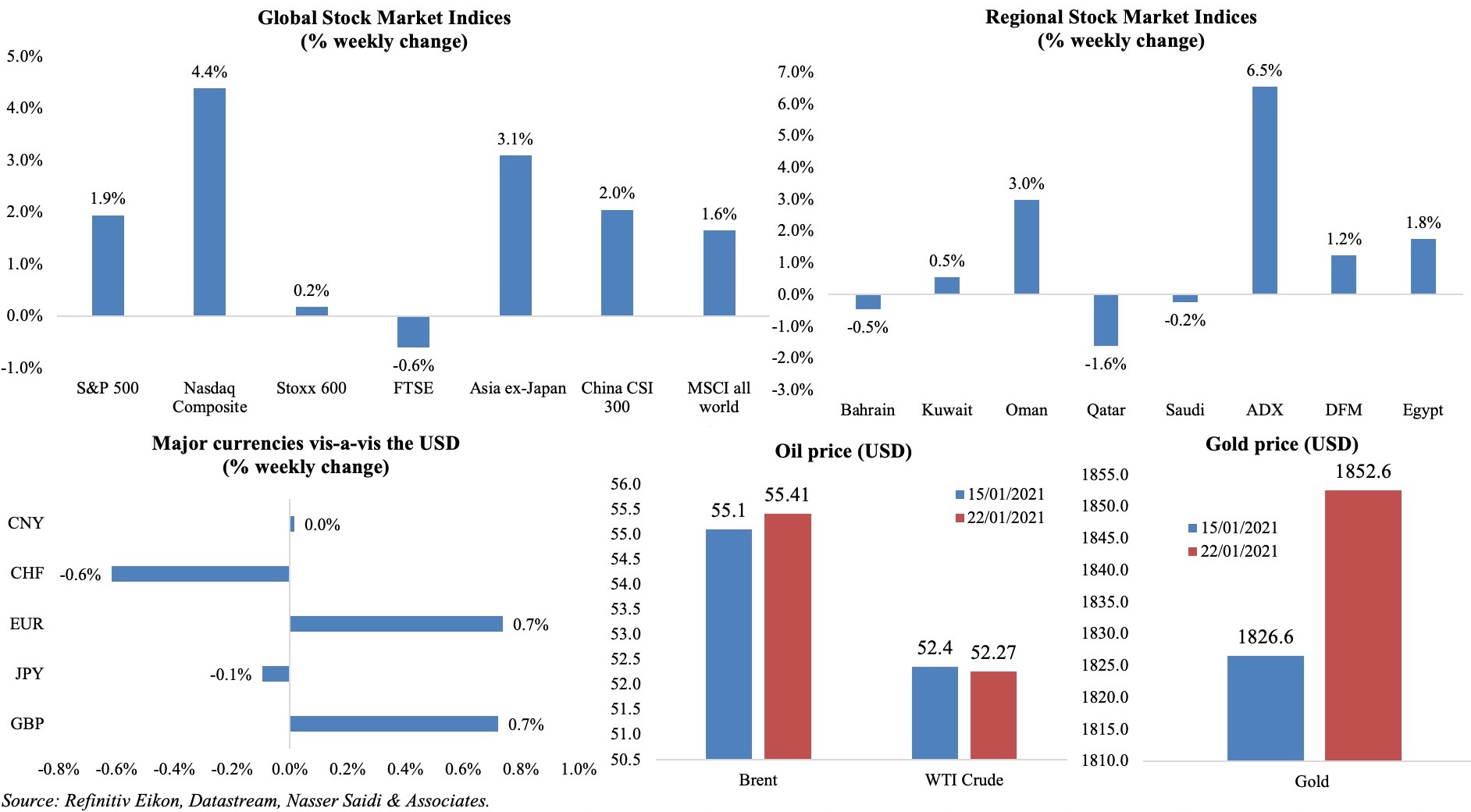

Equities across the globe ended the week in positive territory after posting record highs on Thurs and in spite of slipping on Fri: in the US, it dropped on weaker earnings as well as potential for pushback in the Congress for President Biden’s spending plans; in Europe, markets were dragged down after weak economic data; Asian markets fell on profit taking and also given worries on China’s Covid19 restrictions. In the region, markets were mixed: UAE posted weekly gains though higher Covid cases and new restrictions led to a drop later in the week. The dollar slipped, the euro and pound were higher by 0.7%, while bitcoin lost its charm, down 12.3% ytd – posting its worst weekly performance since early 2020 – as regulatory chatter increased. Oil prices fell after an unexpected increase in US inventories and worries of lower demand due to a second wave/ restrictions in China; spot gold prices gained.

Weekly % changes for last week (21-22 Jan) from 14 Jan (regional) and 15 Jan (international).

Global Developments

US/Americas:

- US building permits increased by 4.5% to 1.709mn in Dec, with an acceleration in single-family homebuilding (up 12.0% to a seasonally adjusted annual rate of 1.338mn units). Housing starts accelerated by 5.8% to an annually adjusted rate of 1.669mn in Dec; overall, starts grew by 7% yoy to 1.380mn in 2020.

- Existing home sales inched up by 0.7% in Dec to a seasonally adjusted annual rate of 6.76mn units. For the full year, home resales surged by 22.2% yoy to 5.64mn – the highest since 2006 – as the pandemic drove up demand for larger sub-urban homes conducive to work & school from home.

- US flash manufacturing PMI touched a series high of 59.1 in Jan (Dec: 57.1), thanks to stronger expansions in output and new orders, while services PMI ticked up to 57.5 (Dec: 54.8) on a rise in customer demand.

- Initial jobless claims slowed to 900k in the week ended Jan 16 from a downwardly revised 926k the prior week, with the 4-week average rising to 848k. Continuing claims slowed to 5.054mn in the week ended Jan 2 from 5.181mn the week before.

Europe:

- The ECB held policy rates and its stimulus program unchanged, with risks for the eurozone outlook “tilted to the downside but less pronounced” and even as the pandemic still “poses serious risk”. The apex bank stated that emergency bond purchases would be “conducted to preserve favourable financing conditions over the pandemic period”.

- The flash consumer confidence in the EU declined by 1.6 points to -16.5 in Jan (Dec: -13.8). Furthermore, economic sentiment and employment expectations indicators recovered in Dec from the month before.

- The harmonized index of consumer prices in Germany remained unchanged at -0.7% yoy in Dec. Overall in 2020, prices were up by a marginal 0.4%, thanks to the temporary cut to VAT in H2 and lower energy prices (-4.8%) while food prices were up 2.4%. German PPI ticked up by 0.8% mom in Dec, following Nov’s 0.2% rise.

- Germany’s composite PMI slipped to a 7-month low of 50.8 in Jan (Dec: 52). At 58.6, manufacturing PMI showed an expansion (Dec: 61.3), supported by exports due to stronger demand from China and US. Services PMI remained depressed, falling to 46.8 from Dec’s 47.

- Even though Eurozone’s flash manufacturing PMI eased to 54.7 in Jan (Dec: 55.2), the reading is among the highest over the past three years. The headline composite PMI fell to 47.5 from 49.1 in Dec, as services activity fell for the 5th consecutive month.

- Germany’s economic sentiment surged to 61.8 in Jan, as per the ZEW survey, from a reading of 55 in Dec. Meanwhile, current economic situation assessment inched up by 0.1 to -66.4 in Jan. Economic sentiment in the Eurozone improved to 58.3 in Jan (Dec: 54.4); in contrast to all the positive moves, the indicator for the current economic situation in the Eurozone dropped by 3.2 points to -9 points.

- CPI in the UK increased to 0.6% yoy in Dec (Nov: 0.3%) and core CPI grew to 1.4% from 1.1% the month before. Retail price index moved up, rising by 2% yoy from 0.9% in Nov. PPI core output inched up by 1.2% (vs Nov: 1%).

- Retail sales in the UK increased by 0.3% mom and 2.9% yoy in Dec (Nov: -4.1% mom and 2.1% yoy), as shops opened after the Nov lockdown. Overall, in 2020, retail sales fell by 1.9% – the biggest since 1997 (when records began). Online retailing jumped by nearly 50% – the highest annual growth since 2008 – with food retailers posting a growth rate of nearly double that.

- The latest round of national lockdown in the UK resulted in a decline in PMIs, with the composite indicator at 40.6 in Jan (Dec: 50.4). While weak exports and short-term supply chain issues slowed the manufacturing output index (8-month low of 50.3), services sector business activity contracted at the fastest pace since May 2020 (38.8 in Jan vs Dec’s 49.4).

Asia Pacific:

- China GDP increased by 2.6% qoq and 6.5% yoy in Q4 last year (Q3: 2.7% qoq and 4.9% yoy), bringing the full year growth to 2.3% yoy – the slowest on record since 1976.

- The People’s Bank of China (PBoC) left its loan prime rate unchanged.

- Industrial production in China grew by 7.3% yoy in Dec (Nov: 7%). Separately, retail sales grew by 4.6% in Dec, easing from Nov’s 5% reading. In Q4, IP grew by 7.1% (Q3: +5.8%) while domestic consumption was weaker (retail sales up +4.6% in Q4 vs -3.9% in 2020).

- FDI into the country grew to a record high of CNY 999.98bn (USD 144.37bn) in 2020, up 6.2%. Separately, fixed asset investment in China inched up by 2.9% yoy in Jan-Dec to CNY 51.89trn (USD 8trn) from 2.6% during the Jan-Nov period.

- Bank of Japan left policy rates and asset buying settings unchanged, as expected. The Bank also raised its growth forecast for the next fiscal year to 3.9% from a 3.6% gain predicted 3 months ago. This is to be supported by the government’s spending package, though services spending is likely to be under “strong downward pressure” given recent restrictions.

- Industrial production in Japan declined by 0.5% mom and 3.9% yoy in Nov (Oct: -3.4% yoy); it was the first mom fall in 6 months, as shipments fell by 1.2%.

- Japan’s trade surplus more than doubled to JPY 751bn in Dec (Nov: JPY 366.1bn), as exports increased by 2% yoy – rising for the first time yoy in 25 months – amid a 11.6% drop in imports. For the full year, exports tumbled by 1.1% yoy, posting the largest fall in 11 years.

- Core CPI (excluding fresh food costs) in Japan fell by 1% yoy in Dec – the biggest annual fall since Sep 2010 – while headline inflation dropped by 1.2% (Nov: -0.9%). Excluding fresh food and energy, inflation fell by 0.4% (Nov: -0.3%).

- Japan’s flash manufacturing PMI fell to 49.7 in Jan, from a neutral 50 in Dec: though new orders grew for the first time since Dec 2018, falling output and employment as well as rising cost pressures dragged the index down. Services PMI slipped 2 points to 45.7 in Jan.

Bottom line: Flash PMI estimates from Europe confirmed that while business activity declined due to increased restrictions, the decline was milder compared to the plunge following initial lockdowns. Germany continues to be the driver of economic activity and manufacturing fared well vis-à-vis services. But, all signs point to double-dip recession given the ongoing rise in Covid19 cases and restrictions. While China’s GDP posted a positive growth last year, an uptick in new Covid19 cases and restrictions are raising concerns of a potential demand weakening.

Regional Developments

- National-origin exports from Bahrain increased by 12% yoy to BHD 599mn in Q4 2020; While Saudi Arabia, US and UAE were the main importers, the top 10 partners accounted for 72% of total exports value.

- Bahrain attracted BHD 333mn (USD 885mn) in FDI last year and is expected to create more than 4,300 jobs over the next 3 years: this was announced following a board meeting of the Economic Development Board.

- Bahrain approved a 3% increase for those who earn less than BHD 500 in pensions. This was part of 6 urgent steps approved by the Cabinet, which also included merging the public and private sector funds, halting annual pension increases, unless there is a surplus and decoupling salaries and pensions among others. Separately, an actuarial study is underway to include expats in pension funds.

- Bahrain plans to spend BHD 1.3bn (USD 3.4bn) on 64 major projects over 2 years: three-fourths will be financed with GCC support and the rest covered by national revenues.

- Urban inflation in Egypt declined to 5.4% in Dec (Nov: 5.7%), thanks to a decline in annual food inflation (2.8% from Nov’s 3.6%).

- Egypt’s manufacturing and extractive industries index inched up by 0.84% mom to 97.76 in Nov 2020, with the pharmaceutical index up 7% and mining and quarrying rising 18.65%.

- Holdings of US Treasuries by Egypt increased by 3.13% yoy to USD 2.244bn in Nov. During Jan-Nov, holdings grew by USD62mn from USD 2.182bn at end-2019.

- Egypt signed an agreement to design and build its first high-speed rail network, to be completed within 2 years and at an overall cost of about EGP 360bn (USD 23bn).

- According to the Institute of International Finance, Iraq’s economic growth shrank by 11.2% last year, given the lower oil prices and the Covid19 outbreak shocks. Forecasts for this year places real oil GDP growth at 1.6% due to higher oil exports while non-oil GDP is estimated to grow1%, supported by a recovery in public investment.

- Iraq’s draft 2021 budget allows for the flexibility to issue bonds (either domestic or international) to fund the budget deficit.

- In a bid to meet its OPEC+ cut requirements, Iraq has cut annual supplies of Basra crude oil to several Indian refiners by up to 20% this year.

- Economic growth in Jordan contracted by 3% last year, given lockdowns, fall in tourism and business activity, but is expected to recover by posting 2.5% growth this year, according to the finance minister.

- The Central Bank of Jordan’s circular permits banks to distribute dividends to shareholders, provided that the distribution does not exceed 12% of the capital.

- Kuwait’s Legislative Committee will discuss (among others) imposing of a 1% tax on remittances irrespective of the currency, individuals or companies undertaking the transfers.

- Lebanon’s Cabinet deadlock continues for the 6th month, with the latest attempt by the mediator caretaker PM also failing to resolve the differences.

- The lockdown in Lebanon has been extended for two more weeks till Feb 8th. The health ministry has signed a deal to secure 2.1mn doses of Pfizer-BioNTech’s vaccine, which is expected to arrive in batches in Feb. Furthermore, the ministry is cooperating with the private sector to secure 2mn doses from Astrazenca and Sinopharm and signed up for 2.7mn doses via Covax.

- Oman’s new parliament law requires that state budget talks and sessions for questioning of ministers be undertaken in secret, reducing transparency. The previous Basic Law did not specify such secrecy.

- Oman closed its land borders for one week starting last Monday, to curb the spread of Covid19, with the option to extend for longer should the need arise.

- Unemployment in Saudi Arabia dropped to 14.9% in Q3 from 15.4% the previous quarter, though higher than Q1’s 11.8%. The gap between male and female unemployment remained significant, with the former at 7.9% and latter at 30.2%.

- Saudi Arabia’s trade surplus with China tumbled by 63.9% yoy to USD 10.93bn in 2020; imports from China rose by 17.8% to USD 28.1bn in 2020.

- In a bid to support the economy, Saudi Arabia’s General Authority of Zakat and Tax extended the waiver period of fines and financial penalties for taxpayers until Jun 30th.

- Saudi Arabia’s real estate price index inched down by 0.2% yoy in Q4 2020, largely due a drop of 1.9% in prices of commercial real estate.

- The Projects Support Fund Initiative will provide stimulus to Saudi Tadawul’s listed companies, with targets in healthcare, education and real estate development sectors.

- Saudi Arabia launched a SAR 1bn (USD 270mn) closed joint-stock company Kidana to maintain, develop and preserve the holy sites.

- Container handling at Saudi ports increased by 6% yoy to a total of 631k containers in Dec 2020.

- Many nations are rescheduling administration of the Pfizer vaccine, including Saudi Arabia, Bahrain and UAE’s Dubai, given delays in supply as the company is upgrading its production capacity.

- Saudi Arabia, Kuwait and UAE remained among the top holders of US Treasury securities though holdings fell by 23% yoy to USD 137.6 in Saudi Arabia and by 8% to USD 36.8bn in the UAE, while in Kuwait holdings were up by 7%.

UAE Focus

- Abu Dhabi announced a AED 6bn supply chain financing initiative to support SMEs, funded by the Ghadan 21 SME credit guarantee scheme. The initiative, initially supporting the healthcare sector, will facilitate quick payment of SMEs’ receivables, hence reducing costs of working capital.

- Sharjah attracted USD 220mn worth FDI into 24 projects last year and led to the creation of 1117 new jobs, according to a study by market intelligence firm Wavteq.

- Saudi Arabia and Iraq were the UAE’s biggest export markets during Jan-Sep 2020, with trade touching AED 73.58bn (USD 20bn) and AED 36.5bn respectively. In total, UAE’s exports touched AED 460bn during the period till Sep 2020. The Dubai Chamber estimates UAE’s non-oil trade volume to grow by up to 12.9% this year.

- Dubai Economy announced a 132% yoy surge in DED Trader licenses to 5,799 last year: this license supports freelancers and startups to conduct businesses online. A total of 9,949 licenses have been issued since this license was launched in 2017, of which 57% have been issued to women.

- Foreign companies operating in the UAE grew by 3.5% mom to 3209 in Dec 2020, according to the UAE’s National Economic register.

- Prior to leaving office, the former President Trump added UAE to the list of nations exempted from a 10% tariff imposed on metal imports: this will come into effect from Feb 3rd. Other countries excluded from the tariff include Argentina, Australia, Canada and Mexico.

- The UAE signed agreements with the US to purchase up to 50 F-35 jets, 18 armed drones and other defense equipment in a deal worth USD 23bn.

- Abu Dhabi Fund for Development disclosed the completion of renewable energy projects – in Cuba, Somaliland, the Bahamas, Barbados and Saint Vincent and the Grenadines – worth AED 117.3mn (USD 31.9mn) in 2020.

- Dubai’s consumer confidence index increased to 142 points in Q4 2020 – its highest level in since 2017 – from 133 points a year ago and 132 points in Q3 2020, according to Dubai Economy.

Media Review

‘A massive second-half recovery’: Biden, China and the global economy

https://www.ft.com/content/d77f9713-3950-4814-84be-f12614921957

The marathon of covid-19 vaccination

https://www.economist.com/leaders/2021/01/20/the-marathon-of-covid-19-vaccination

The Year of the Renminbi?

https://www.project-syndicate.org/commentary/2021-could-be-the-year-of-the-renminbi-by-arvind-subramanian-and-josh-felman-2021-01

Chinese monopoly rules threaten super-app model

https://www.reuters.com/article/us-china-payment-cenbank-breakingviews-idUSKBN29Q0J1

Powered by: