Download a PDF copy of this week’s insight piece here.

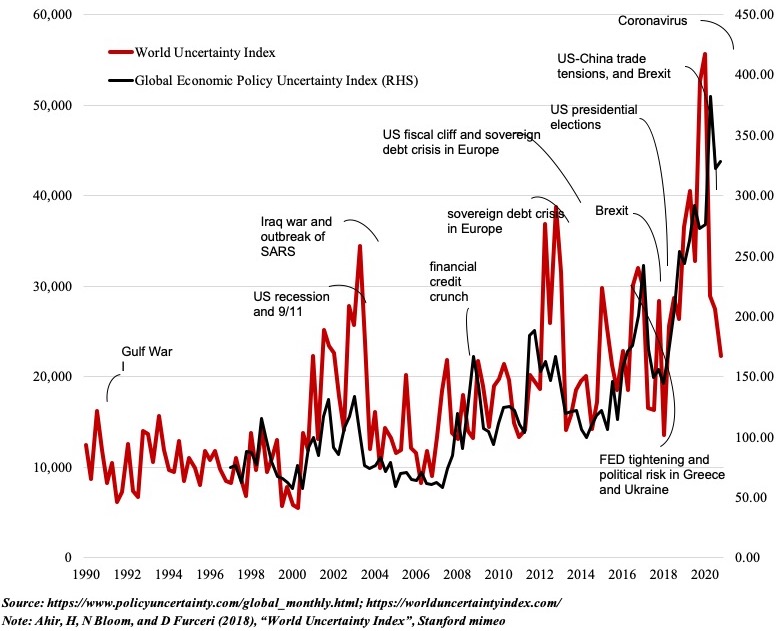

1. Global Uncertainty Drops, but Economic Policy Uncertainty Remains High

- World continues in the throes of the Covid19 pandemic, even as vaccines offer a light at the end of the tunnel

- The rollout has been slow in many nations; approval of other vaccines will help alleviate production/ distribution hurdles

- Other policy concerns continue: fallouts from Covid19 across the globe, implementation of Brexit, US new administration’s policies (China, Iran,…)

- Political turmoil/ uncertainty: Italy, Israel, Malaysia…

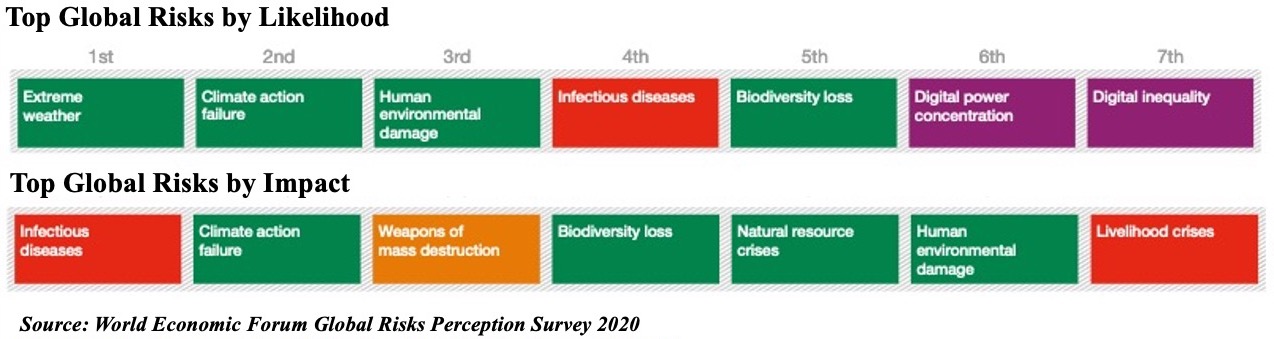

2. Global Risks Shift Gear in 2021

- The World Economic Forum’s Global Risks Report 2021 perceives higher risks from environmental categories with extreme weather, climate action failure & human environmental damage taking the top 3 spots

- With spillover effects from the Covid19 outbreak likely to continue this year and possibly next, it is not surprising that infectious diseases top global risks by impact (& 4th on the “likelihood” list)

- Growing evidence that the Covid19 outbreak has widened existing disparities (poverty, gender, access to health facilities…); digital divide and adoption of technology further adds another layer to the inequalities (ability to work remotely, access online learning, e-commerce…)

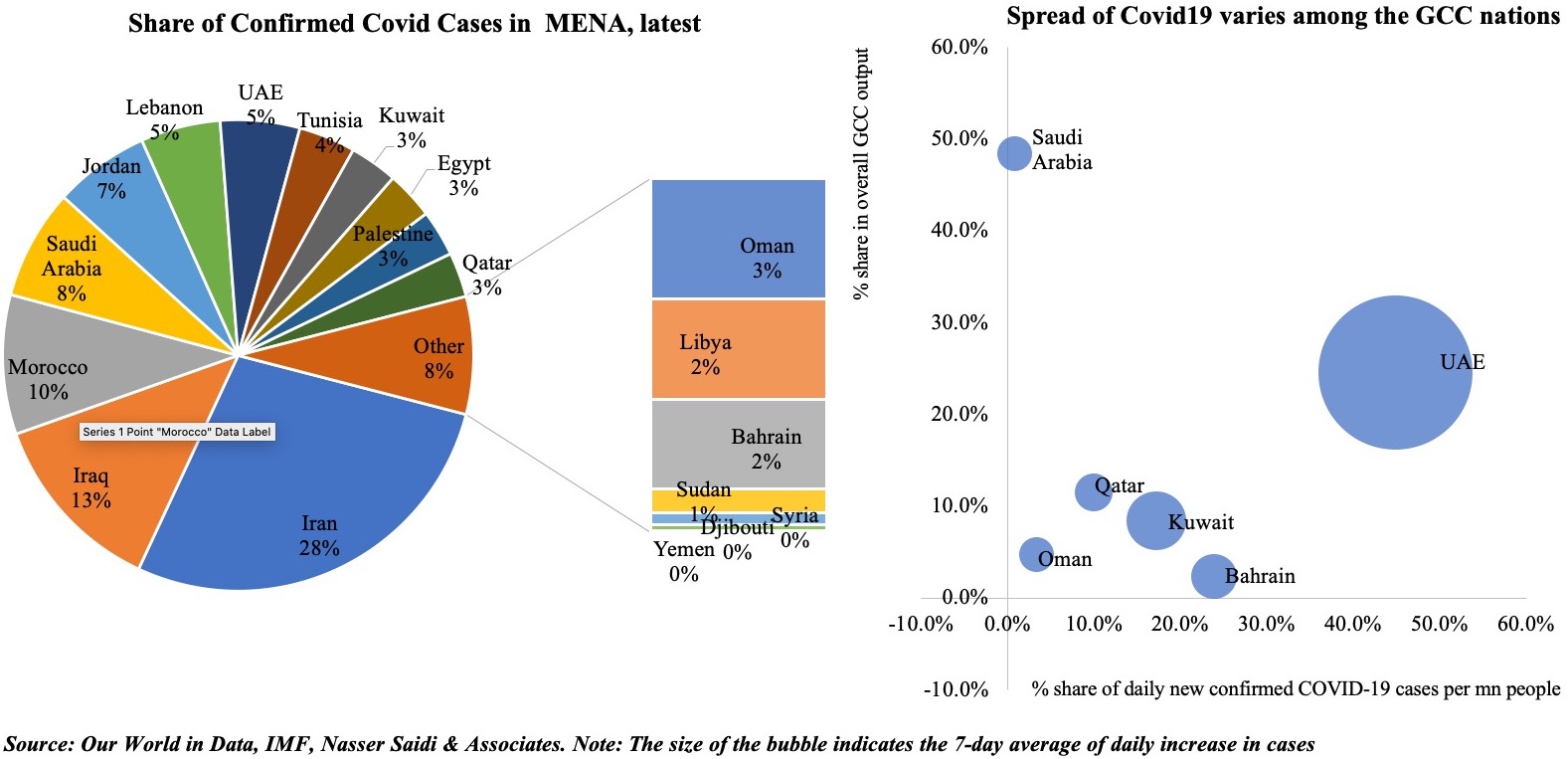

3. Covid19 outbreak continues unabated in the Middle East

- The number of cases in the Middle East continue to rise with Iran the major hotspot accounting for 28% of cases in the region; the GCC nations combined are home to 24% of total cases

- Among the GCC nations, Saudi Arabia accounts for the largest share of cases, while UAE’s share of daily confirmed cases per mn persons is highest (the size of the bubble indicates the 7-day average of daily increase in cases). A concerted vaccination effort ongoing in most of the GCC nations offer a glimmer of optimism

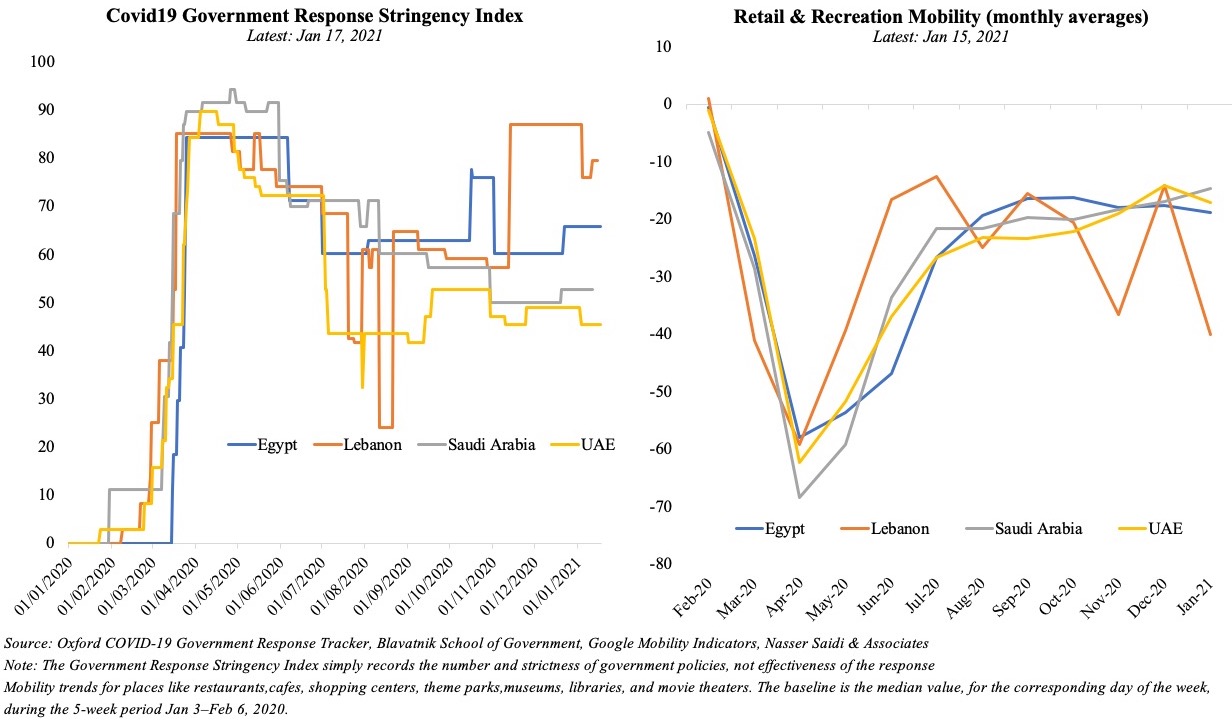

4. Greater the restrictions, larger the drop in mobility; recovery in Saudi

- With cases rising at a faster rate in the recent weeks, some economies in the Middle East have enforced restrictions recently: Lebanon’s lockdown has resulted in an uptick in the Stringency Index while UAE remains one of the most open (least stringent) in the region

- Mobility (retail and recreation) has dropped in a highly restricted Lebanon (-40% compared to the 5-week period Jan 3- Feb 6, 2020). Egypt and UAE are still around 20% below the baseline, while in Saudi, mobility is picking up

5. Vaccination Drives Raise Hope for Recovery in 2021

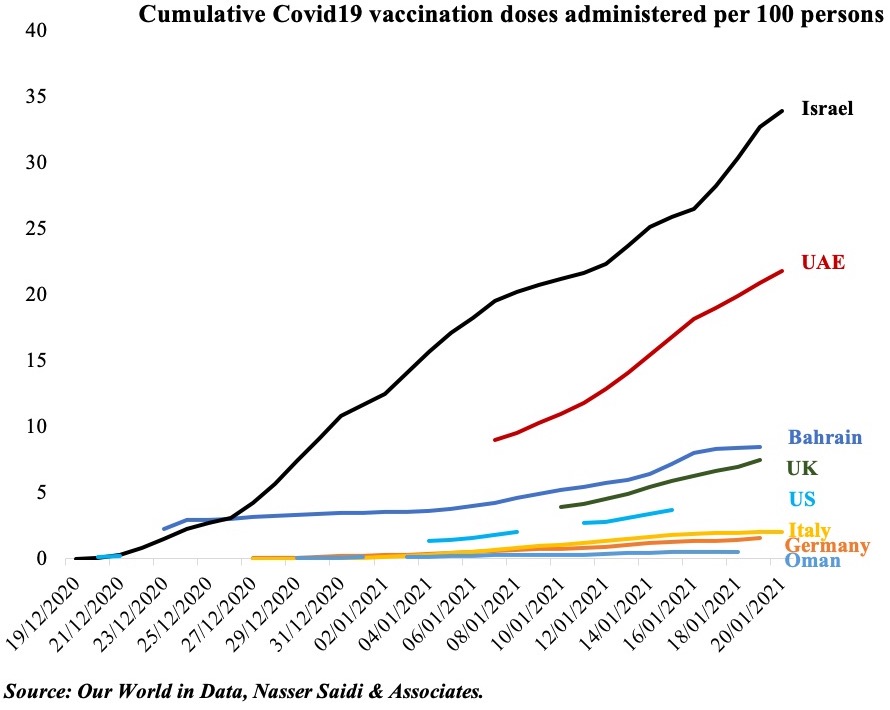

- Israel, UAE and Bahrain top the list of cumulative vaccine doses administered per 100 persons (chart)

- Almost 1 in 5 persons in the UAE have received at least one dose of the vaccine, and 2.5% of the population are fully vaccinated (i.e. both doses received)

- The vaccination drives in both Israel and UAE have picked up pace recently, with the 7-day average of daily vaccine doses administered per 100 persons was at 1.46 and 1.11 respectively (as of Jan 20, 2021)

Benefits from the vaccination drive for UAE

- Race towards herd immunity

- Lower uncertainty, greater consumer & business confidence

- Ability to reopen the economy fully, resume economic activity at pre-Covid19 pace

- Travel corridors open up, supporting tourism & hospitality sectors

- Support for domestic sectors including trade & logistics as global demand picks up

- Stronger links with Asia, given the region’s faster paced recovery vis-à-vis US/ Europe

- Support regional economies with vaccination doses