Download a PDF copy of this week’s economic commentary here.

Markets

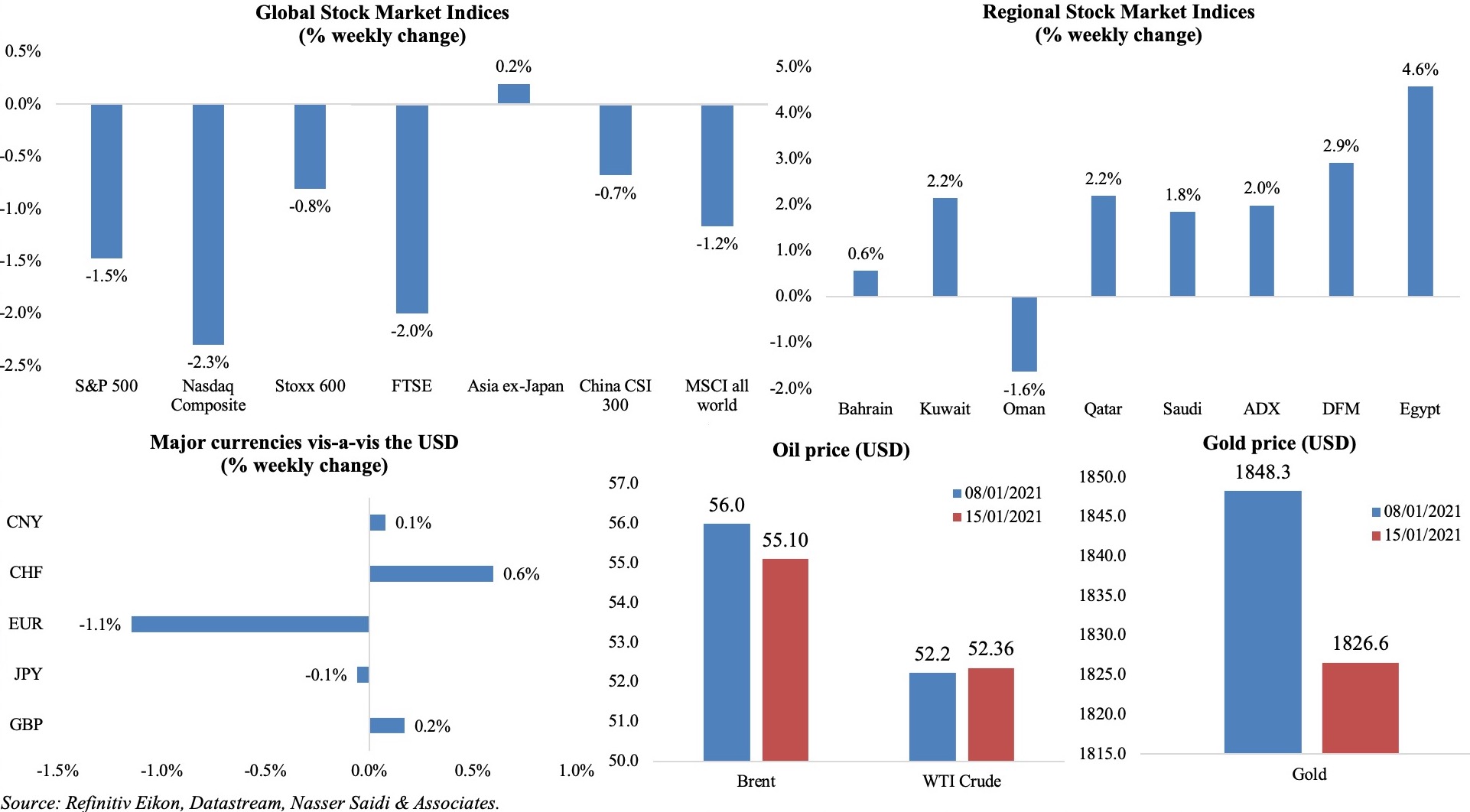

Global stocks tumbled, erasing gains made earlier in the week, given weak economic data amid rising Covid19 cases and deaths (94.5mn and over 2mn respectively) and stricter lockdown rules in China, France and Germany; among Asian markets, Nikkei ended Wednesday at its highest mark since Aug 1990. Regional markets mostly gained, though many indices weakened on Thurs given lower oil prices. Among currencies, a strong dollar emerged, while the Brent oil price slipped as concerns about demand recovery grew and gold price dropped by 1.2%.

Weekly % changes for last week (14-15 Jan) from 7 Jan (regional) and 8 Jan (international).

Global Developments

US/Americas:

- President Biden, whose first priorities would be to rebuild unity and democracy, outlined a USD 1.9trn economic rescue package called the “American Rescue Plan”. This includes USD 415bn in spending towards the Covid19 response, USD 1400 direct payment to households, and roughly USD 440bn for small businesses and communities hard hit by the pandemic and USD 350bn for state and local governments.

- Inflation in the US inched up by 0.4% mom and 1.4% yoy in Dec (Nov: 0.2% mom and 1.2% yoy), driven up by higher gas (+8.4%) and food prices; excluding food and energy, yoy prices were unchanged at 1.6%, but mom it was nudged up by 0.1%.

- Industrial production in US advanced by 1.6% mom in Dec (Nov: 0.5%), with manufacturing up by 0.9% (8th straight monthly gain), in spite of a 1.6% dip in production of motor vehicles and parts. In yoy terms, production declined by 3.6% – the smallest decline since Feb.

- US retail sales fell for the third consecutive month in Dec, with sales down by 0.7% from Nov’s upwardly revised 1.4% drop. Online sales were also down by 5.8% mom during the month which also saw declines across electronics and appliance stores (-4.9% mom), sporting goods’ retailers (-0.8%) and furniture and home furnishing stores (-0.6%).

- The Michigan Consumer Sentiment Index fell to 79.2 in Jan, from Dec’s 80.7; the current economic conditions sub-index eased to 87.7 from 90.0 and the gauge for consumer expectations declined to 73.8 from 74.6.

- JOLTS job openings fell modestly to 6.527mn in Nov (Oct: 6.632mn), with openings declining in durable goods manufacturing (-48k), information (-45k), and educational services (-21k).

- Initial jobless claims increased to 965k in the week ended Jan 9 – the largest total since Aug 22 – from 784k the prior week, with the 4-week average rising to 834.25k. Continuing claims picked up to 5.271mn in the week ended Jan 2 from 5.072mn the week before.

Europe:

- Industrial production in the eurozone increased by 2.5% mom in Nov (Oct: +2.3%), thanks to upticks in capital goods output (+7% vs 2.9% in Oct) and intermediate goods (+1.5% from Oct’s 2.3%) while durable consumer goods dropped (-1.2% from +1.5% in Oct).

- The eurozone’s trade surplus widened to EUR 25.8bn in Nov, from EUR 20.2bn a year ago; both exports and imports declined, at 1% and 4.2% respectively. EU’s trade deficit with Russia narrowed to EUR 13.8bn in Jan-Nov from EUR 52.1bn in the same period a year ago.

- GDP in the UK slipped by 2.6% mom in Nov, as lockdown measures were introduced to control the second wave of Covid19. This is 8.5% below pre-pandemic levels. Services sector suffered, contracting by 3.4% in Nov, and 9.9% below Feb levels, while construction activity grew by 1.9%.

- Manufacturing production in the UK inched up by 0.7% mom in Nov (Oct: +1.6%), supported by strong car production. Overall industrial production meanwhile declined by 0.1% mom (Oct: +1.1%).

- Armin Laschet, a centrist, was elected leader of Germany’s Christian Democrats (CDU), a likely successor to Angela Merkel.

Asia Pacific:

- New loans issued in China slowed to CNY 1260bn in Dec (Nov: CNY 1430bn); overall, banks made a record CNY 19.63trn (USD 3.03trn) in new loans in 2020, up 16.8% from 2019.

- China money supply M2 growth eased to a 9-month low of 10.1% yoy (Nov: 10.7%) while outstanding total social financing grew by 13.3% yoy to CNY 284.83trn (USD 44.09trn) at end-Dec (though slower than the recent peak of 13.7% in Oct).

- The PBoC left the rate on CNY 500bn (USD 77.24bn) worth of one-year medium-term lending facility (MLF) loans to financial institutions steady at 2.95% from previous operations.

- China exports grew by 18.1% yoy in Dec (Nov: 21.1%) and imports were up by 6.5% (vs 4.5% in Nov), widening the surplus to a record high USD 78.18bn. For the full year, exports grew by 3.6% and imports dropped 1.1% taking trade surplus to USD 535.03bn – the highest since 2015.

- China’s inflation edged up by 0.7% mom in Dec (Nov: -0.6%); in yoy terms, prices were up by 0.2% following a 0.5% drop, led by an increase in food prices (+1.2% yoy vs Nov’s -2%). Core CPI stood at 0.4% in Dec, down from Nov’s 0.5%. Producers price index meanwhile improved to -0.4% yoy in Dec, from a 1.5% decline the month before.

- Japan’s current account surplus increased by 29% yoy to JPY 1.88trn in Nov (Oct: JPY 2.15trn) – the 77th consecutive month of surplus.

- Machine tool orders in Japan recovered, edging up by 8.7% yoy in Dec (Nov: 8.6%).

- India’s industrial output period plunged by 15.5% yoy during the Apr-Nov period, from 17.5% during Apr-Oct. In Nov alone, manufacturing output slipped by 1.7% (Oct: 3.5%) and overall industrial output by 1.9% (3.6%).

- Retail inflation in India eased to 4.59% in Dec (Nov: 6.93%), driven by a decline in food prices (3.41% from Nov’s 9.5%).

Bottom line: Vaccine rollouts are picking up pace, with 34.48mn vaccine doses administered globally as of Jan 16th. India’s nation-wide vaccination drive saw more than 100k vaccinated on the first day, while Israel and UAE top the list in terms of dose administration rate – at 25.34 and 18.18 per 100 people respectively. With Biden taking over the US Presidency mid-week, faster Covid19 responses and rollout of the proposed USD 1.9trn stimulus package are expected. Recent data show that the latest round of lockdowns has not sharply affected the nation as the spring/summer shutdown, but there is likely to be more damage down the lane beyond 2020-21: including worries of rising public and private debt levels amid an eventual policy reversal from the central banks.

Regional Developments

- Bahrain has vaccinated almost 100k persons in less than a month, since the campaign started on Dec 17th.

- US and Bahrain signed an MoU to establish an American trade zone in the country. The US-Bahrain FTA has been in effect since 2006: bilateral trade between the nations stood at USD 2.45mn in 2019, with an additional USD 1.5bn in services trade.

- The re-opening of the King Fahd Causeway will add USD 2.9bn to Bahrain’s economy, according to a top official of the Bahrain Economists Society.

- Bahrain’s tourism industry suffered an estimated loss of BHD 1bn during the pandemic, losing almost 29k visitors per day. This is almost 5 times losses reported during the financial crisis period. Annual tourism levies collected during Q1-Q3 last year plunged to BHD 2.4mn from BHD 14.5mn in 2019.

- Egypt’s budget deficit narrowed to 3.6% during the period Jul-Dec (H1) 2020 from 4.1% previously. Annual revenues grew by 16% yoy to EGP 453bn during H1, with tax revenues up 10% to EGP 334bn. The finance minister also disclosed that health sector and education expenditures rose by about 14.7% and 7.4% during H1, with overall spending up by 9.6%.

- Egypt’s external debt increased to USD 125.3bn in Sep 2020 from USD 123.5bn in Jun. Long-term debt amounted to USD 113bn in Sep, accounting for 90.2% of total external debt.

- Annual urban inflation in Egypt slowed to 5.4% in Dec (Nov: 5.7%), largely due to driven by lower food prices and lower demand for clothing, while core inflation eased to 3.803% yoy in Dec, from 4.021% in Nov.

- Egypt’s banks’ balances held abroad surged to more than USD 20bn at end-Dec from just USD 10bn at end-Apr. Net international reserves rose by USD 841mn to USD 40.063bn.

- The central bank of Egypt stated that local banks will not be obliged to make cash dividends from the year’s profits or retained earnings that are distributable to shareholders, in a bid to support the banks’ capital base.

- Food exports from Egypt increased by 1% yoy to USD 3.2bn during Jan-Nov 2020, accounting for 13.2% of the country’s total non-oil exports.

- SME’s in Egypt will benefit from some of the new tax incentives: this includes a simplified tax system according to the volume of sales or businesses. MSMEs will therefore have no need for purchase books, documents or invoices.

- The tourism minister revealed that the tourism sector in Egypt recovered about 60% of its dues from overseas travel agents and tour operators.

- Iraq’s top commercial bank Trade Bank of Iraq has extended loans worth more than USD 3bn to reconstruction projects.

- Jordan received the first shipment of the China-UAE Sinopharm vaccine, and will receive the Pfizer vaccine on Mon, after which these will be rolled out for the public from Wednesday.

- Kuwait’s cabinet submitted its resignation last week, after a standoff with the Parliament.

- As Lebanon’s government formation remains at a standstill despite multiple crises. The parliament approved a law that paves the way for the government to sign deals for coronavirus vaccines. Apart from the anticipated Pfizer-BioNtech deal (2mn doses), the President approved the transfer of LBP 26.4bn to COVAX to book 2.73mn vaccines.

- Lebanon’s real estate developer Solidere disclosed that it settled its bank loans that exceeded USD 200mn in 2020.

- Oman announced the appointment of a Crown Prince for the first time as part of a constitutional overhaul which also created a new law on how the parliament will operate. It also sets the rule of law and the independence of the judiciary as the basis for governance.

- Reuters reported that Oman is selling USD-denominated bonds with maturities of 10 and 30 years and is expected to raise USD 2-3bn with the debt sale; it also re-opened USD 750mn bonds due in 2025. Earlier last week Oman was also reported to be raising upto USD 2bn funds from banks.

- China was the leading destination for Omani crude oil exports in Dec 2020: accounting for 81.4% of the total, the nation’s share rose 6.6% mom to average 806,831 barrels per day.

- Hotel revenues in Oman plunged by 61.4% to OMR 78mn (USD 202mn) until Nov 2020, with occupancy rates down to 26.4% (vs. 53.9% in the same period a year ago).

- Saudi Arabia unveiled an ambitious “The Line” project, a zero-carbon city at NEOM which will house a million people and have no cars nor streets; the project, with infrastructure costs of between USD 100-200bn, aims to contribute 380k jobs of the future and SAR 180bn (USD 48bn) to domestic GDP by 2030. Later in the week, during a WEF online session, it was disclosed that Saudi Arabia would offer USD 6trn worth of opportunities to investors over the next decade.

- Inflation in Saudi Arabia increased to 3.4% in 2020, largely owing to the tripling of VAT to 15% from Jul. Prices of food and beverages rose by 9% and that of transport by 3.8%.

- The industrial sector in Saudi Arabia created over 39k job opportunities for both men and women last year, with a 37% Saudization rate, disclosed the minister of industry and mineral resources.

- The Saudi Central Bank (SAMA) issued new rules for debt crowdfunding, requiring a minimum paid-up capital of SAR 5mn (USD 1.3mn) to get a license.

- Saudi Arabia approved 903 industrial projects in 2020, worth SAR 23.5bn (USD 6.3bn); this boosts the number of manufacturing units in the country to 9681 in total.

- Wa’ed, the entrepreneurship and investment arm of Saudi Aramco, gave 12 loans worth SAR 31mn (USD 8.27mn) to startups last year, up from 4 in 2019 (worth SAR 10mn).

- MENA startups were granted USD 1.03bn in funds from 496 deals (+13% yoy) last year, according to MAGNiTT. Though e-commerce deals dropped (-23%), funding to the sector grew by 24% to USD 162mn while funding to the F&B and healthcare sectors more than tripled to USD 122mn and USD 72mn respectively. UAE topped the list in terms of total funding and number of deals (56% and 26% respectively), following by Egypt acquiring 24% of number of deals and 17% of total value of funds. Together, Saudi Arabia, UAE and Egypt accounted for 68% of total deals last year.

- Investment banking fees generated in MENA fell by 12% yoy to an estimated USD 1.2bn in 2020 – the 4th highest total since 2000, according to Refinitiv data. Debt capital markets saw a 10% increase in fees to a record USD 282.3mn last year.

UAE Focus

- Non-oil trade in the UAE touched USD 281.28bn in Jan-Sep 2020. China, Saudi Arabia and India were the largest trading partners (together accounting for 28% of total trade) while gold topped the list of products traded (valued at AED 182bn).

- Dubai PMI increased to 51 in Dec (Nov: 49), led by an increase in output and new orders. Though all sectors expanded, growth was fastest in the retail and wholesale category. Meanwhile, falling employment continues to be worrisome as is lower stocks of purchases and shorter delivery times.

- One-year term deposits in the UAE, which account for 7.1% of all term deposits, grew by 34.7% yoy to AED 63.2bn as of end-Oct last year.

- The UAE issued a total 9,913 new business activities licenses across all the emirates during the first week of 2021. Separately, Dubai Economy disclosed that it issued 42,640 new licenses last year (+4.3%), alongside a 15% rise in license renewals.

- About 97% of SMEs in the UAE adopted new forms of digital payment technology last year, according to Visa’s Back to Business report. This compares to 83% globally. More importantly, 86% of these firms expect customers to continue the use of contactless payments even vaccines are rolled out to protect from the pandemic.

Media Review

A fragile recovery in 2021: Roubini

https://www.project-syndicate.org/onpoint/fragile-global-and-us-recovery-in-2021-by-nouriel-roubini-2021-01

China’s Ant Group kicks off the overhaul of its fintech operations

https://www.scmp.com/business/banking-finance/article/3117936/ant-group-kicks-overhaul-its-fintech-operations-under

Bitcoin securities trading surges as investors seek crypto exposure

https://www.ft.com/content/fb8ac343-6574-4aa0-8f47-c2c9e9d57541

US designates Bahrain, UAE ‘major security partners’

https://www.arabnews.com/node/1793896/middle-east

Is Egypt’s privatization program out of hibernation?

https://www.zawya.com/mena/en/markets/story/Is_Egypts_privatization_program_out_of_hibernation-SNG_197373470/

Economic Governance Reforms to Support Inclusive Growth in the MENA and Central Asia: IMF

https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2021/01/08/Economic-Governance-Reforms-to-Support-Inclusive-Growth-in-the-Middle-East-North-Africa-and-48826

Powered by: