Download a PDF copy of this week’s insight piece here.

1. Trade recovers in Q3; services trade lags

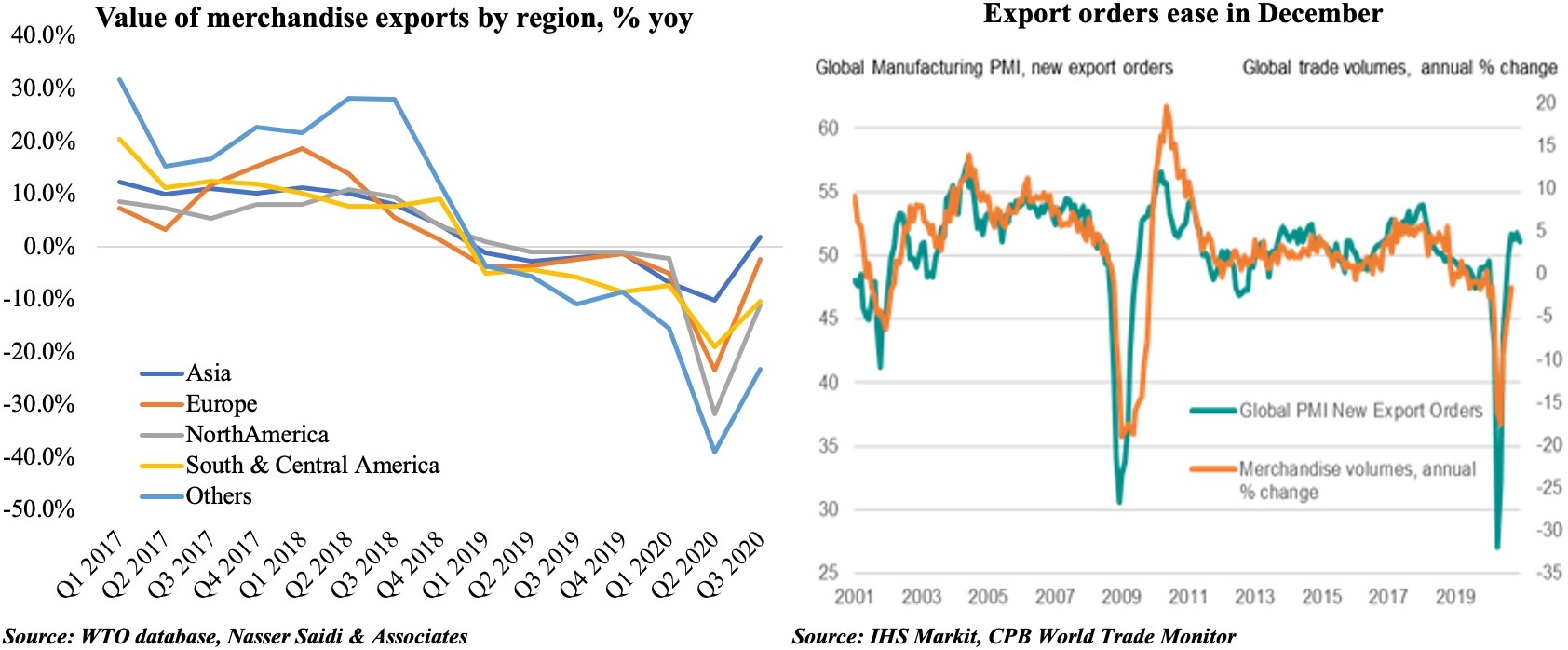

WTO’s latest Q3 data indicate a distinct rebound in trade: the volume of merchandise trade globally was up 11.6% qoq from an upwardly revised 12.7% drop in Q2. Exports dropped in yoy terms among all regional groups with the exception of Asia, where the value and volume inched up by 2% and 0.4% respectively. With Covid19 cases surging in Q4 across most regions, partial lockdowns and restrictions were re-imposed, which is likely to lead to a drop in overall trade in the final quarter.

Global new export orders growth – a leading indicator for trade activity – slowed in December, according to the latest global manufacturing PMI, and was linked to intensifying supply chain delays. The most cited response for delays amid rising demand was the lack of shipping capacity/shortage of containers. The recent surge in freight prices underscores the dilemma: sea freight on the China-Brazil route reached an unprecedented USD 10k per TEU from USD 2k per TEU a year ago. Other routes from Asia have also posted above-average values: trip costs to Europe and the US reached more than USD 4k per TEU.

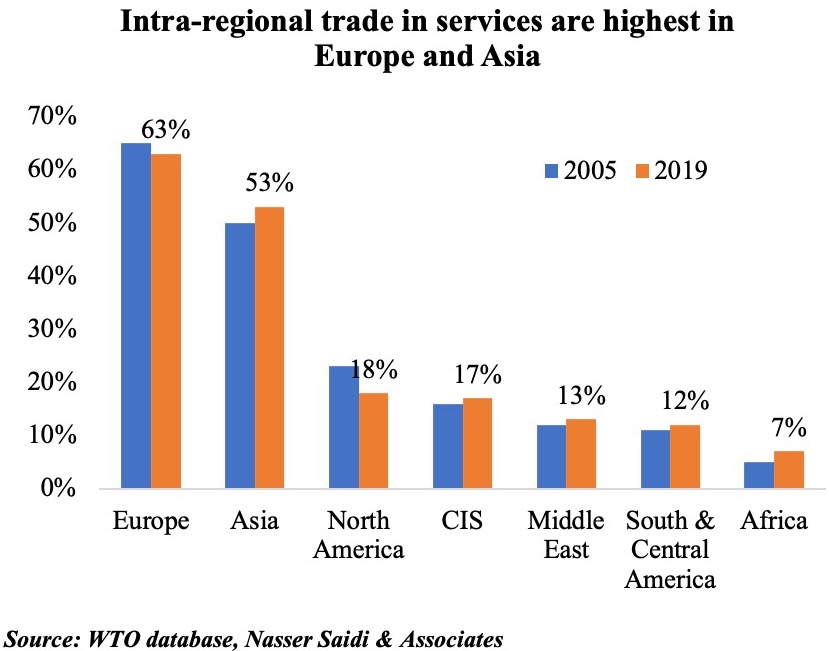

This week, the WTO launched a new dataset along with the OECD tracking bilateral services trade of over 200 economies. The chart shows that the share of intra-regional trade in services is low in Africa (7%), South & Central America (12%) and the Middle East (13%). Unfortunately, since no bilateral services transactions are reported by African or Middle Eastern economies, it is difficult to gauge the underlying factors leading to this situation. The decline in services trade was significant in 2020 given restrictions on international travel and related drop in tourism revenues.

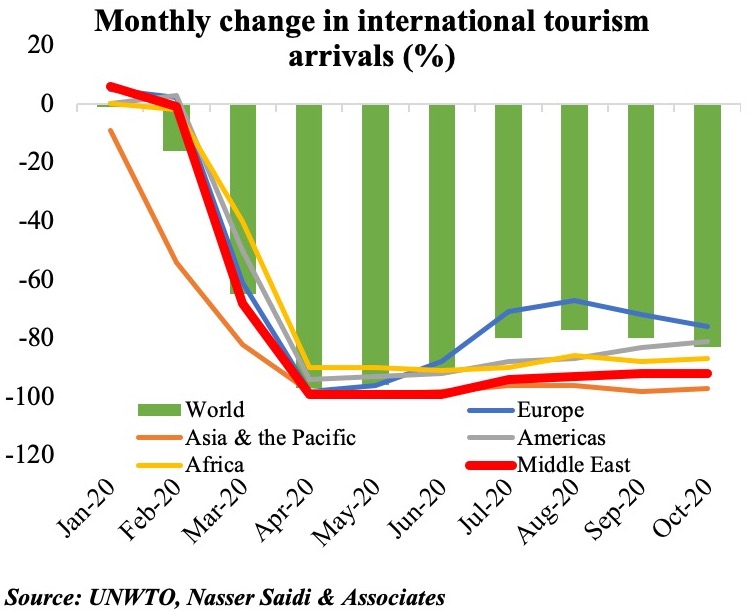

2. Tourism woes continue globally; Middle East significantly affected

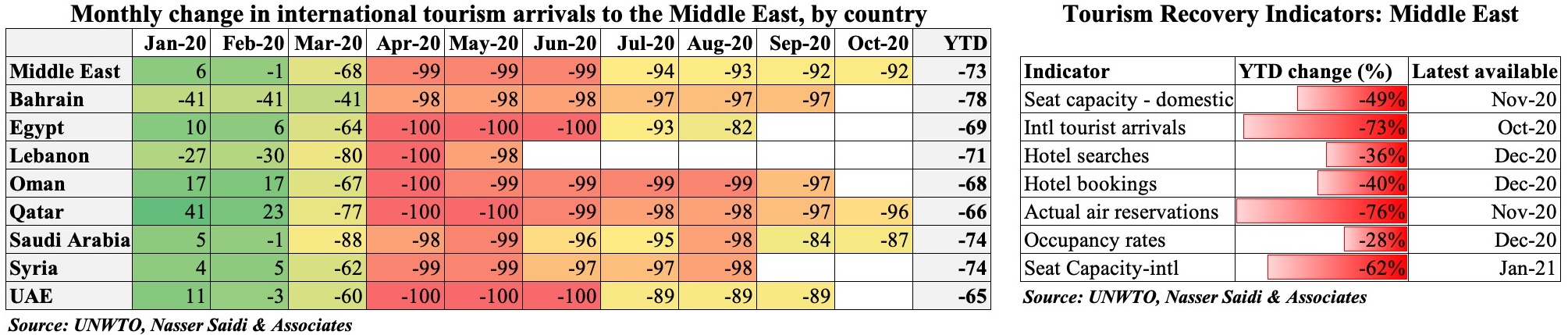

The UNWTO reported a 72% drop in international tourist arrivals during the Jan-Oct period, with the Middle East region continuing to lag its global counterparts in tourism arrivals (-73% year-to-date). International tourism as a share of total tourism is significantly high in Bahrain (97%) and UAE (83%), making these nations more vulnerable than say, Saudi Arabia, with its share at 26%. With air travel restrictions still in place in many nations, and hotels either closed or open at lower capacity, the road to recovery will be long.

The UNWTO reported a 72% drop in international tourist arrivals during the Jan-Oct period, with the Middle East region continuing to lag its global counterparts in tourism arrivals (-73% year-to-date). International tourism as a share of total tourism is significantly high in Bahrain (97%) and UAE (83%), making these nations more vulnerable than say, Saudi Arabia, with its share at 26%. With air travel restrictions still in place in many nations, and hotels either closed or open at lower capacity, the road to recovery will be long.

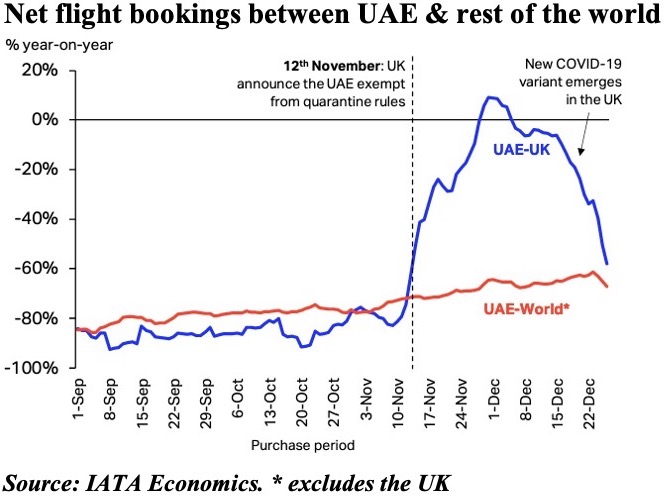

Occupancy rates in the region have improved towards the end of 2020, with residents opting for staycations than international travel given restrictions. Egypt reopened international tourist flights to three governorates (including Red Sea) last Jul: overall, the country welcomed 3.5mn tourists last year, resulting in overall revenues of USD 4bn, down from 11.6mn tourists and USD 13bn in revenues in 2019. In the UAE, Dubai opened for tourists in July: almost 17.88 million passengers passed through the Dubai Airports last year, while occupancy rates in the emirate’s hotels touched 71% in Dec, the highest since Feb. The UAE-UK travel corridor (announced 12th of Nov) resulted in an acceleration in bookings, with the Dubai-London Heathrow travel corridor revealed as the busiest international air route globally in the first week of January. Interestingly, Cairo-Jeddah was the second most popular route.

With the rollout of vaccines, and nations heading towards achieving herd immunity, the latter half of this year might see a pickup in air travel and tourism: this should also support Dubai’s Expo event scheduled to start in Oct 2021 and Qatar’s 2022 FIFA World Cup.

3. The Global Vaccination Drive picks up

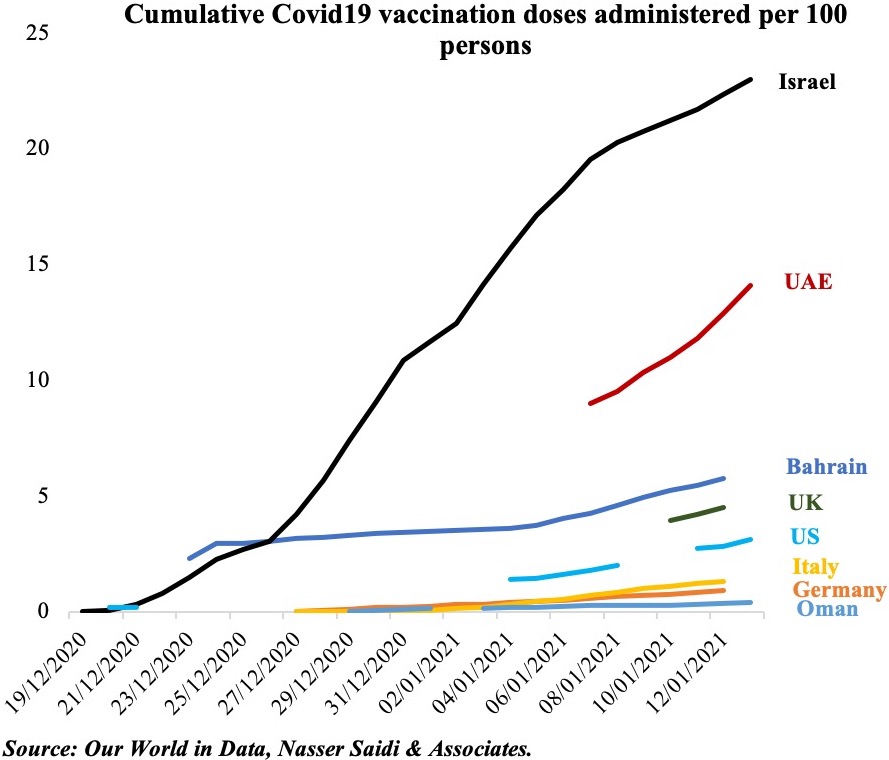

Israel, the UAE and Bahrain top the list of the share of total population that have received at least one dose of the Covid19 vaccine – at 22.4%, 11.57% and 5.96% respectively (updated at 1:30pm UAE time on 14th Jan 2021). In terms of the share of fully vaccinated population, UAE tops at 2.53% followed by Israel at 1.21% and the UK at 0.63%.

UAE’s ability to vaccinate quickly its small and highly concentrated, urbanised populations – with 96 vaccination locations across Abu Dhabi alone and others in the rest of the emirates, more than 100k persons were vaccinated per day in the last two days – is also a testament to its established and reliable healthcare systems.

Given the data, UAE’s aim to vaccinate 50% of the population by end-Q1 does not seem far-fetched. The faster the vaccination drive, the greater relaxation of quarantine rules, higher the number of travel corridors (“immunity passports”) and UAE could become one of the top tourist destinations globally. One step further, and if the nation manages to achieve herd immunity, could the nation also aspire to become a “vaccine tourism” hub? (setting aside the ethical aspect). Furthermore, with UAE also planning to manufacture the Sinopharm vaccine, the potential for Abu Dhabi/ Dubai as vaccine manufacturing and distributing hubs is rising (with the international connectivity of its Etihad and Emirates airlines).

Bottomline: With the global vaccination drive, depending on how soon countries are able to achieve herd immunity, we can expect a resumption of activity in travel and tourism. Additionally, efficacy of the vaccines will not only raise consumer confidence (and demand), but also result in lowering business uncertainty, resume manufacturing and services sector activity and ease supply constraints, thereby boosting global trade.

Powered by:

Weekly Insights 14 Jan 2021: Trade, Tourism & the Global Vaccination Drive

14 January, 2021

read 4 minutes

Read Next

publication

Weekly Insights 25 Jul 2024: GCC are adjusting to lower oil revenues

Dubai GDP & inflation. Saudi foreign trade. Kuwait 2023-24 fiscal deficit. GCC US Treasury holdings.

25 July, 2024

publication

Weekly Economic Commentary – Jul 22, 2024

Download a PDF copy of the weekly economic commentary here. Markets Major equities

22 July, 2024

publication

Weekly Insights 19 Jul 2024: MENA growth projections lowered by the IMF; GCC’s non-oil sector growth will stay robust

IMF growth downgrades. UAE monetary stats. Abu Dhabi GDP. Saudi consumer & wholesale price indices.

19 July, 2024