Download a PDF copy of this week’s insight piece here.

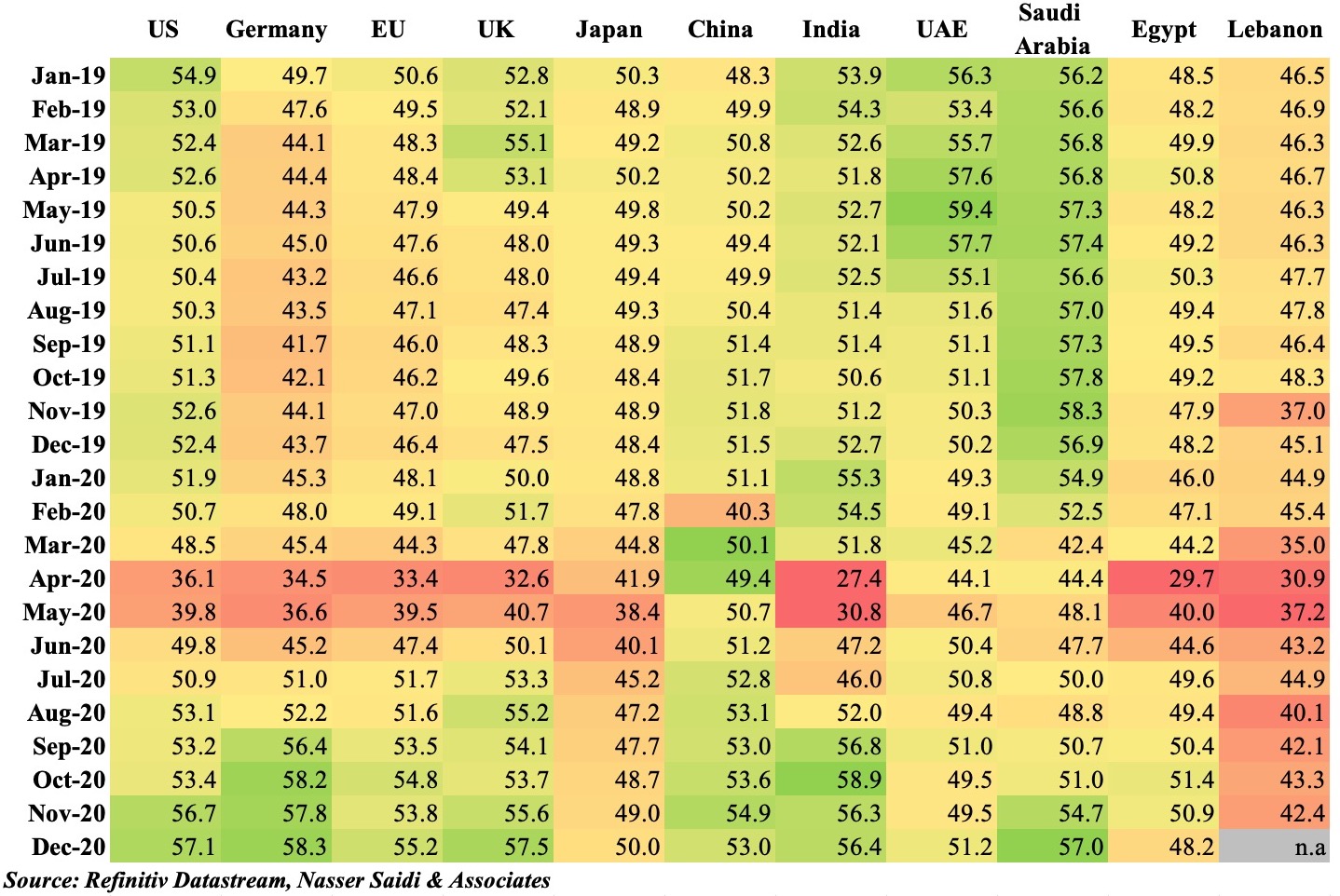

1. Heatmap of Manufacturing/ non-oil private sector PMIs

PMIs across the globe were released this week. Overall, recovery seems to be the keyword with improvements in Dec – in spite of the recent Covid19 surge, the Covid variant and ongoing lockdowns/ restrictions – with new orders and export orders supporting sentiment, with some stability in job creation. However, supply chain issues continue to be a sticking point: the JP Morgan global manufacturing PMI – which remains at a 33-month high of 53.8 in Dec – identifies “marked delays and disruption to raw material deliveries, production schedules and distribution timetables”.

In the Middle East, while UAE and Saudi Arabia PMIs improved (the former recovering from 2 straight months of sub-50 readings), Egypt slipped to below-50 after 3 months in expansionary territory. While Egypt’s sentiment dipped on the recent surge in Covid19 cases, the 12-month outlook improved on optimism around the vaccine rollout. However, the UAE’s announcement of the rollout of Sinopharm vaccine in early-Dec seems to have had little impact on the year-ahead outlook, with business activity expected to remain flat over 2021 (survey responses were collected Dec 4-17) and job losses continuing to fall at an accelerated rate.

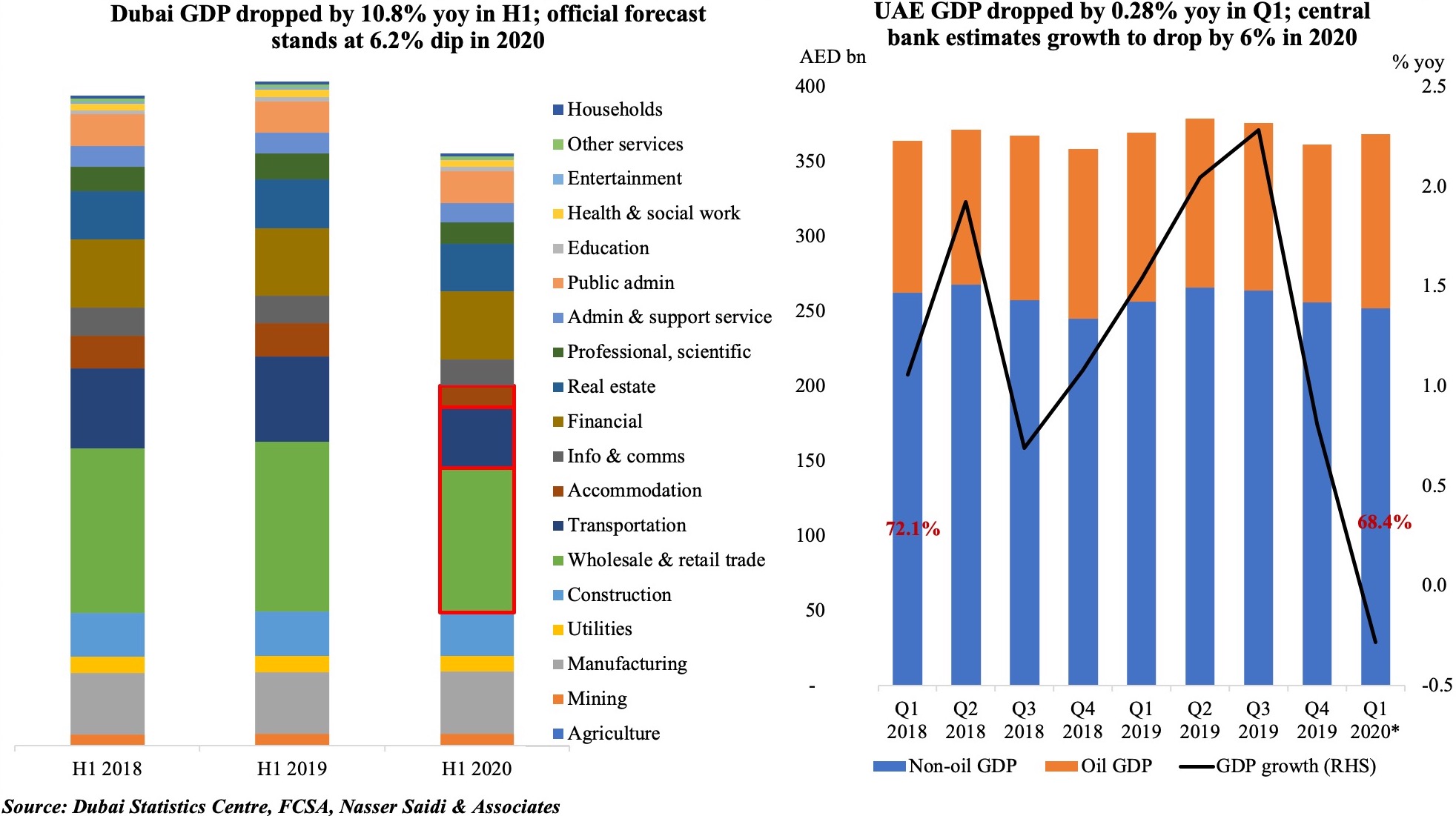

2. Covid19 & impact on Dubai & UAE GDP

The UAE has seen a negative impact from Covid19: the central bank estimates growth this year to contract by 6% yoy, with both oil and non-oil sector expected to contribute to the dip (this is less than the IMF’s estimate of a 6.6% drop in 2020). Oil production fell in Q2 and Q3 by 4.1% and 17.7% yoy respectively, in line with the OPEC+ agreement, and spillover effects on the non-oil economy saw the latter’s growth contract by 1.9% yoy in Q1 (vs oil sector’s growth of 3.3%). The latest GDP numbers from Dubai underscore the emirate’s dependence on trade and tourism to support the non-oil economy: overall GDP dropped by 10.8% yoy in H1 2020; the three sectors (highlighted in red border below) trade, transportation and accommodation (tourism-related) which together accounted for nearly 40% of GDP declined by 15%, 28% and 35% respectively. Dubai forecasts growth to decline by 6.2% this year, before rising to 4% in 2021.

News of a 5th stimulus package worth AED 315mn (announced on 6th Jan) for Dubai – an extension of some incentives till Jun 202, refunds on hotel sales and tourism dirham fees, one-time market fees exemption for establishments that did not benefit from reductions in previous packages and decision to renew licenses without mandatory lease renewal among others – will support growth this year, as well as the uptick from Expo 2021 (based on widespread vaccinations across the globe and potential resumption of air travel by H2 this year). With plans to inoculate 70% of the UAE population by 2021, we remain optimistic about UAE/ Dubai prospects subject to the effective implementation of the recent spate of reforms (including the 100% foreign ownership of businesses, retirement & remote working visas etc.) as well as embracing new and old synergies – Israel and Qatar respectively. Medium-term prospects can be further enhanced by accelerating decarbonization and digitisation – read a related op-ed published in Dec.

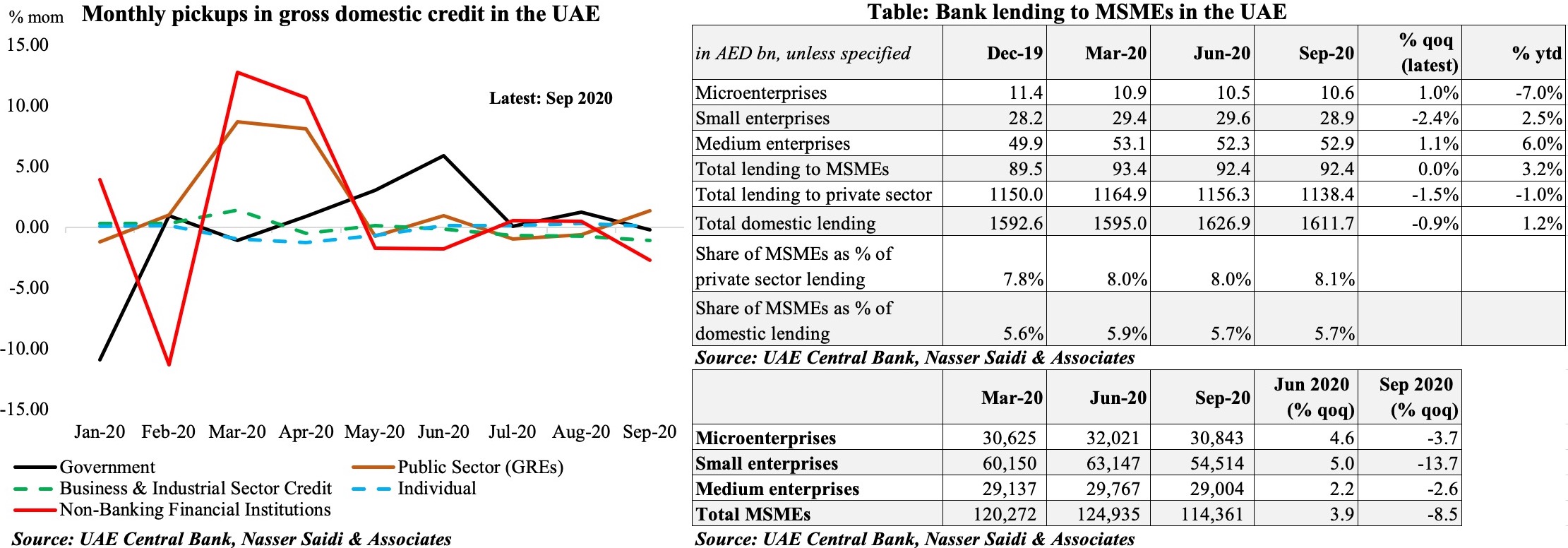

3. UAE credit and SMEs

The UAE central bank has extended support to those persons and businesses affected by Covid19 by launching the Targeted Economic Support Scheme, which is now extended till Jun 2021. Overall credit disbursed till Sep 2020 was up 2.9% yoy and up 1.2% ytd: but during the Apr-Sep 2020, the pace of lending to GREs (+22.7% yoy) and government (+19.6%) have outpaced that to the private sector (-1.0%).

It has been a difficult period for MSMEs (Micro, Small and Medium Enterprises): the number of MSMEs declined by 8.5% qoq in Sep 2020, following an uptick of 3.9% qoq in Jun 2020, signaling deteriorating business conditions that may have forced such firms to close. This also suggests a potential increase in NPLs once the current banks’ support (e.g. deferring loan periods) come to a close. Overall domestic lending also fell by 0.9% qoq as of Sep 2020. The largest share of loans within the MSME sector continues to be to the medium-sized firms (57.3%) and about 1/3-rd to the small enterprises. Considering the amount disbursed per firm, medium enterprises pocketed AED 1.8mn in Q3: this is 3.4 times the amount disbursed per small firm and 5.3 times the amount disbursed to microenterprises.

SMEs also need to think beyond the financial pain point to survive in the post-pandemic era. In addition to reducing/ streamlining operational costs[1], learning digital skills, boosting online profiles and hosting a robust payments and collections platform will also support SMEs to be more bankable in the future.

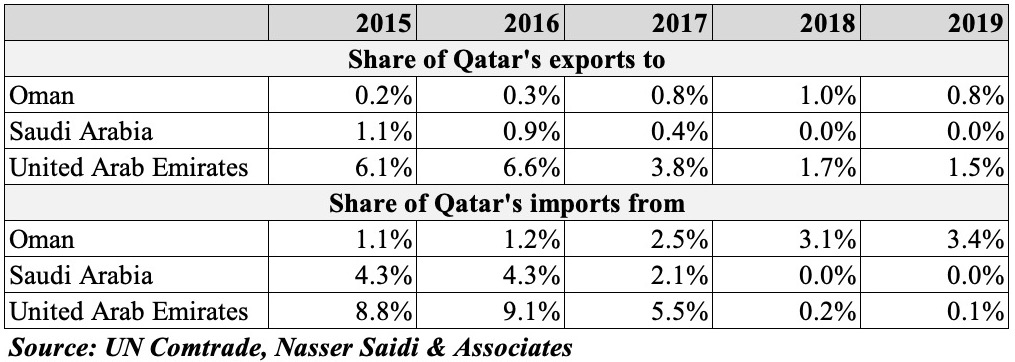

4. Back to “business as usual” for the GCC

The recent GCC Summit saw Qatar’s blockade (imposed in 2017) being lifted: this improves and will support political stability (a “united GCC” front) and is likely to restore UAE and Saudi businesses direct trade and investment links. Allowing bilateral tourist movements will support upcoming mega-events in the region like the Dubai Expo this year and Qatar’s 2022 World Cup. Trade will be restored among the nations: imports from the UAE had dropped to a negligible 0.1% last year, from close to 10% in the year before the blockade. Oman, meanwhile, had gained – with businesses opting to re-route trade with Qatar through Oman’s ports.

Greater GCC regional stability, implies lower perceived sovereign risk, including credit risk which –other things equal- will lead to an improvement in sovereign credit ratings, lower spreads and CDS rates and encourage foreign portfolio inflows as well as FDI.

[1] Even Mashreq Bank, Dubai’s 3rd largest lender, is planning to reduce operational costs by moving nearly half its jobs to cheaper locations in the emerging markets (to be completed by Oct 2021), according to a Bloomberg report.

Powered by:

Weekly Insights 7 Jan 2021: UAE’s silver linings – has the country turned a corner?

7 January, 2021

Covid19 credit growth GDP growth PMI political stability Qatar reform Saudi Arabia SME Tourism trade UAE uncertainty vaccine

read 5 minutes

Read Next

publication

Weekly Insights 25 Jul 2024: GCC are adjusting to lower oil revenues

Dubai GDP & inflation. Saudi foreign trade. Kuwait 2023-24 fiscal deficit. GCC US Treasury holdings.

25 July, 2024

publication

Weekly Economic Commentary – Jul 22, 2024

Download a PDF copy of the weekly economic commentary here. Markets Major equities

22 July, 2024

publication

Weekly Insights 19 Jul 2024: MENA growth projections lowered by the IMF; GCC’s non-oil sector growth will stay robust

IMF growth downgrades. UAE monetary stats. Abu Dhabi GDP. Saudi consumer & wholesale price indices.

19 July, 2024