Download a PDF copy of this week’s economic commentary here.

Markets

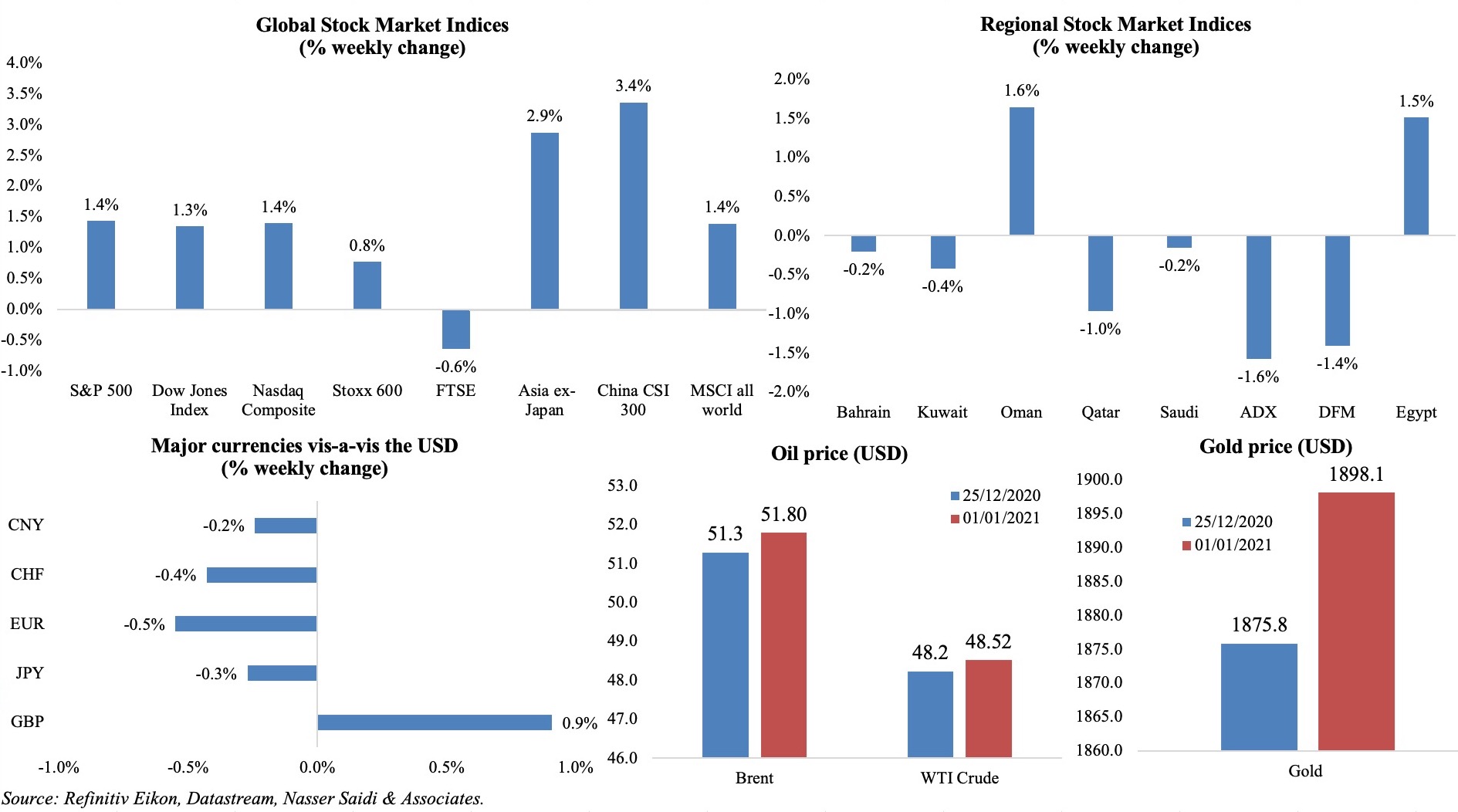

US equities closed on a high note last year (S&P 500 up more than 16% and Nasdaq more than 40%), as did China (+27% gain), while not surprisingly, UK’s FTSE 100 index had the worst annual performance since 2008. Regional markets were mixed: Saudi and Qatar equity markets posted modest annual gains while Egypt declined the most (-22.3%). Among currencies, dollar fell almost 7% versus a basket of currencies – the biggest drop since 2017 – while the pound, euro and yen gained. Oil rebounded to USD 51 last week, though ended almost 20% lower vis-à-vis 2019 while gold price was up more than 24% – the best annual performance since 2010.

Weekly % changes for last week (31 Dec-1 Jan) from 24 Dec (regional) and 25 Dec (international).

Global Developments

US/Americas:

- The US started sending out the USD 600 stimulus cheques. Though the House of Representatives approved a bill that will increase direct payments to USD 2000, it is still blocked in the Senate (the Majority Leader labelled it “socialism for the rich”).

- Chicago PMI edged up by 1.3 points to 59.5 in Dec: employment posted the largest monthly gain rising to a 1-year high while new orders recorded the biggest decline. Business sentiment recovered to 59.6 in Q4 – the strongest reading since Q4 2018.

- S&P Case Shiller home prices accelerated by 7.9% yoy in Oct (Sep: 6.6%), rising at the fastest pace in 6-years. Pending home sales declined for a 3rd consecutive month by 2.6% mom in Nov (Oct: -0.9%) though in yoy terms it increased by 16.4%.

- Trade deficit widened by 5.5% yoy to a new record of USD 84.82bn in Nov (Oct: USD 80.29bn). Goods exports inched up by 0.8% mom to USD 127.22bn while imports grew by 2.6% mom (and 5.5% yoy).

- Initial jobless claims unexpectedly declined for the second week to 787k in the week ended Dec 26 from 806k the prior week, with the 4-week average rising to 836.75k. Continuing claims slowed to 5.219mn in the week ended Dec 19 from 5.322mn the week before.

Europe:

- The Brexit transition period is now over: the post-Brexit trade deal with the EU was agreed to in late-Dec and passed by UK lawmakers on the eve of the deadline. Separately, Britain and Turkey signed a free-trade deal: this is Britain’s fifth largest deal, following those with Japan, Canada, Switzerland and Norway. With this, the UK signed a total 62 bilateral trade agreements ahead of the Brexit transition period.

- The EU and China reached an investment agreement after 7 years of negotiations: the agreement removes some barriers to EU companies’ hopes of investing in China (like specific joint-venture requirements and caps on foreign equity), in addition to improved market access terms for EU industries (e.g. automotive, private healthcare and cloud computing among others). While labour issues remain a sticky point, the aim is for the deal to take effect in early 2022.

Asia Pacific:

- China non-manufacturing PMI eased to 55.7 in Dec (Nov: 56.4), with new orders dropping to 51.9 from Nov’s 52.8 and the employment subindex down to 48.7 from 48.9. The official NBS manufacturing PMI slipped to 51.9 in Dec (Nov: 52.1), with drops across new orders (53.6 from Nov’s 53.9) and new export orders (51.3 from Nov’s 51.5). While both headline readings were lower compared to the month before, it remained above the 50-mark for the 10th consecutive month, with expansion continuing.

- Japan industrial production dipped by 3.4% yoy in Nov (Oct: -3%) but remained flat in mom terms after expanding in the previous 5 months (Oct: +4%). Auto production fell by 4.7% in Nov, given weak sales in North America while production machinery saw an increase in overseas demand (+6.5%).

- Current account surplus in India moderated to USD 15.5bn or 2.4% of GDP in Jul-Sep, according to the central bank, from USD 19.2bn or 3.8% of GDP in the previous quarter. This was a result of the trade deficit which widened to USD 14.8bn in Jul-Sep from USD 10.8bn. Net FDI inflows at USD 23.8bn in Apr-Sep 2020 (H1 of FY 2020-21) were higher than USD 21.3bn registered in H1 of the previous fiscal year. Separately, the fiscal deficit widened to 135% of the 2020-21 budget target at end-Nov.

- South Korea’s exports expanded by 12.6% yoy in Dec – the sharpest acceleration since Oct 2018 – driven by strong growth in semiconductors (+30%), mobile devices (39.8%) and IT products amid improved global demand. Exports to China grew by 3.3% while those to the US and EU were up 11.6% and 26.4% respectively.

Bottom line: 2020 ended on a brighter note what with Covid19 vaccines being rolled out across the globe, but inoculations happening at a faster pace in some nations than the rest. This is happening alongside a surge in Covid19 cases (given the new variants and holiday season) and extensions of restrictions/ lockdowns: seems a probable scenario till herd immunity is achieved with widespread vaccinations. With the Brexit trade deal finalised so close to the deadline and the drama concluded (?!), the focus is now on the OPEC+ (monthly) meeting this week: a will they or won’t they question, especially weighing vaccine optimism (and higher oil prices by 6-8% in Dec) with potential demand decline due to the fast-spreading Covid19 variant. Russia has already indicated a preference to raise production, which would be beneficial for countries under severe budgetary pressure (like Iraq).

Regional Developments

- The GCC Summit will be held in Riyadh on 5th Jan: point to note is that a formal invite was issued to Qatar’s emir to attend the summit, amid the ongoing diplomatic row.

- The central bank of Bahrain asked banks to extend loan repayments for 6 more months from Jan. Not only should the instalment amount remain unchanged, but banks are also not allowed to increase profit or interest rates on such loans.

- MPs in Bahrain voted to allow the government to raise borrowing cap to BHD 15bn (from BHD 13bn) to support its efforts to combat Covid19 and fund projects in the 2021-22 budget.

- Egypt’s central bank extended for 6 months (till end-Jun) a number of decisions taken to support the economy amid the pandemic including exemption for customers from all expenses and commissions on bank transfer services in Egyptian pounds, the free issuance of electronic wallets, cancelling of all commissions and fees related to transfers between mobile wallets and removing fees and commissions for cash withdrawals among others. Separately, the minister of finance revealed that submissions for real estate tax returns was extended until end-Mar, applicable to all established properties.

- The central bank of Egypt has set target inflation rate at 7% (±2%) on average during Q4 2022 compared to 9% (±3%) on average in Q4 2020. Separately, it was disclosed that Egypt will auction USD 850mn in one-year dollar denominated T-bills on Jan 4th.

- Money supply in Egypt increased by 19.56% yoy in Nov to EGP 4.85trn (USD 309.11bn).

- Egypt’s trade deficit narrowed to USD 2.9bn in Oct from USD 4.1bn a year ago (-28.8% yoy) as exports dropped by 13.1% to USD 2.2bn and imports fell by 22.8% (value of petroleum products were down by 32.8% and crude oil by 20.7%).

- Industrial sector in Egypt grew by 6.3% in 2019-20: its contribution to GDP inched up to 17.1% during the year from 16.4% in 2018-19 and accounted for nearly 28.2% of total employment in the country.

- Egypt’s Minister of Petroleum stated that nine new oil and gas exploration agreements worth USD 1bn (for drilling 17 wells) were signed with local and international companies. Separately, the ministry revealed that total consumption of oil and gas declined by 5.9% yoy to 71.3mn tonnes of oil equivalent in 2020, with the electricity sector accounting for 60.4% of total natural gas consumption.

- Egypt is expected to receive the final tranche of financial assistance from a group of Chinese banks to fund the New Administrative Capital’s business district: while the size and timeline of the credit facility remain undisclosed, the second tranche signed last year stood at USD 3bn.

- Self -sufficiency & food security: Egypt achieved self-sufficiency in rice in 2020 with the production of 6.5mn tonnes and plans to reach self-sufficiency in sugar production by the end of 2021; the country also has strategic wheat reserves sufficient for 5.5 months.

- Iraq’s southern oil exports remained stable at 2.7mn barrels per day in Dec, given the nation’s commitment to the OPEC+ production cut.

- Iraq renewed a contract to supply Egypt with 12mn barrels of Basra light crude for 2021: contract’s terms will remain unchanged if Egypt pays the value of shipments within the year.

- Given arrears of over USD 6bn, Iran’s state gas company stated earlier last week that it had reduced supplies to neighbouring Iraq from 50mn cubic meters per day (cm/d) to 5mn cm/d, threatening electricity shortages in the latter. Later in the week, an agreement led to resumption of Iranian gas pumping: part of the energy debt will be paid in the form of goods and Iran will use money from energy exports to Iraq to buy Covid19 vaccine from Europe.

- Jordan’s Capital Bank Group inked a deal with Bank Audi of Lebanon to buy its businesses in Jordan and Iraq; assets being acquired are valued at JOD 506mn and IQD 275bn in the two countries respectively and will raise Capital Bank Group’s assets by about a third to around JOD 7bn (USD 5.23bn).

- Kuwait resumed its commercial flight operations from Sat (Jan 2nd) while continuing its travel ban on 32 high risk countries. Arriving passengers need to present a 96-hour prior negative test and self-isolate for 14 days. Separately, Kuwait aims to vaccinate 80% of its population by Sep 2021 after an inoculation campaign started in the second-last week of Dec.

- The US state department approved USD 4.2bn in potential arms sales to Kuwait.

- Lebanon can stretch the USD 2bn in foreign reserves left for subsidies to last 6 more months, revealed the caretaker PM.

- The health minister disclosed that Lebanon had secured about 2mn doses of the Pfizer-BioNTech’s Covid19 vaccine, which will cover 20% of the country’s nationals.

- Oman expects to post a fiscal deficit of OMR 2.24bn in 2021, amounting to 8% of GDP: around OMR 1.6bn of the deficit will be covered via external and domestic borrowing, while another OMR 600mn will come from reserves. Revenue are expected to decline by 19% yoy to OMR 8.64bn while expenses are to drop by 14%; oil price was set at an estimated USD 45. The introduction of VAT this year is expected to raise OMR 300mn in revenues.

- The industrial sector’s value added is expected to grow in Oman to almost 4 times (by 40%) by 2040; exports from the sector is estimated to touch OMR 10.7bn by 2040.

- About 33 projects worth USD 2.5bn were open for investment in Oman, according to the Ministry of Commerce Industry and Investment Promotion, with hospitals and related healthcare ventures accounting for a third of the projects.

- In its latest reform move, Oman removed the requirement to obtain a NOC (No Objection Certificate) while changing jobs. An expatriate on a resident visa may be transferred from one employer to another by providing evidence of either expiry of the contract or termination of the employment contract.

- The expatriate population in Oman fell by nearly 16% (by more than 270k from end-2019) to 1.44mn as of end-Nov. About 340k had left in 2010, in the aftermath of the financial crisis.

- From the beginning of 2021 onwards, only Omani lawyers can appear and plead before the courts of appeal and the Supreme Court. There are around 600 expat lawyers in Oman courts, who can now function as legal advisers, solicitors or legal counsellors, legal sources, writers, clerks or the like.

- Oman reopened its land, air and sea borders from Dec 29th, allowing entry for those with a negative Covid19 test and another test on arrival.

- Exports from Qatar grew by 8% mom to QAR 16.6bn in Nov, with exports of non-crude surging by 168% mom while hydrocarbons fell by 2.1%. Overall trade surplus fell by 27.4% yoy to QAR 9.06bn.

- Saudi Arabia announced the discovery of 4 oil and gas fields: this includes 4,452 barrels of unconventional Arab extra light sweet oil and 3.2mn standard cubic feet of gas at a well in Al Reesh oil field, a well test showing a daily production rate of 3,850 barrels per day at Al Ajramiyah, in addition to non-conventional gas at the Al Minahhaz and al-Sahbaa well

- The Ministry of Human Resources and Social Development in Saudi Arabia is considering the possibility to make the expat levy and government fee (for iqama and work permit) payable quarterly instead of annually (as is the practice now).

- Saudi Arabia’s trade surplus narrowed by 60.3% yoy to SAR 134.71bn (USD 36bn) in Jan-Oct 2020, with total exports at SAR 534.58bn (-34.4%) and imports at SAR 399.87bn (-15.97%). Oil exports fell by nearly a third in Oct, while non-oil exports fell by 0.3%. Trade with the Arab states declined by 18.97% yoy to SAR 150.44bn (USD 40.12bn) during Jan-Oct 2020. UAE accounted for 41.7% of total trade during this period and remained Saudi’s main Arab trading partner.

- Assets of the Saudi Central Bank slipped by 3.18% yoy to SAR 1.86trn (USD 495.63bn) in Nov. Expat remittances from Saudi Arabia grew by 19.57% yoy to SAR 136.27bn in Jan-Nov 2020; in Nov alone, remittances jumped by 29.8% yoy to SAR 12.86bn.

- Saudi Arabia’s PIF established a company named National Security Services Co (SAFE) to develop and expand the private security sector. The company will focus on providing security consulting services, integrated security solutions, training and development programs as well as command and control centers. Separately, Saudi Arabian Military Industries (a PIF subsidiary) announced Saudi Arabia’s largest ever private military industry deal, purchasing the Advanced Electronics Company (expected to be completed in Q1 2020 after regulatory approvals) – a defense, energy, ICT, and security services company.

- Saudi Arabia launched a digital economy policy focusing on 7 guiding principles: access encompassing digital infrastructure, data and platforms, technology adoption, innovation, human capital, social prosperity and inclusion, trust in the digital ecosystem, and open markets.

- Saudi Arabia aims to import over 3mn doses of the Pfizer Covid19 vaccine by end-May, with 1mn doses arriving by end-Feb.

UAE Focus

- Budgets for 2021 were revealed across UAE’s emirates: Dubai unveiled this year’s budget with spending at AED 57.1bn (with salary and wage allowances accounting for 35% of total and security, justice and safety at 22%) and revenues at AED 52.31bn (tax revenues at 31% of total). Sharjah announced a AED 33.6bn budget for this year, up 12% versus 2020, with 43% of the budget allocated for developing and improving infrastructure in the emirate. Ajman revealed a zero-deficit AED 2.066bn budget with economic affairs accounting for 40% and public services for 22%.

- The UAE central bank projects growth this year at 2.5%, supported by a 3.6% uptick in non-oil sector growth. This follows an estimated 6% decline this year, with non-oil GDP dropping by 5%.

- Economic growth in Dubai declined by 10.8% in H1 2020 and is estimated to contract by 6.2% for the full year, according to the Dubai Statistics Centre. This year, growth is forecast to rebound to 4%. Population in Dubai meanwhile inched up by 1.6% yoy and 0.23% mom to 3.411mn by end-Q4 2020.

- Remittances from the UAE fell by 7.7% yoy to AED 40.1bn in Q3 2020, with India (30.8%), Pakistan (11%) and Egypt (6.5%) the top three destinations. In yoy terms, remittances to India dropped by 27.8% while those to Pakistan and Egypt inched up by 1.6% and 1.4% respectively.

- Abu Dhabi’s non-oil foreign trade edged up by 0.8% yoy to AED 16bn in Jun: exports surged by 74.6% to AED 6.67bn while re-exports and imports fell by 36.4% and 13.6% respectively.

- Inflation in Abu Dhabi slipped by 2.3% yoy in Oct, though rising by 0.4% mom. In Jan-Oct, inflation fell by 2.4% yoy, thanks to a 20.6% drop in recreation and culture as well as a 4.2% drop in furnishings and household equipment.

- Fuel prices in the UAE remain unchanged for the 10th consecutive month in Jan.

- Registered companies in the Abu Dhabi Global Market increased by 43% yoy to 3211 by end-2020.

- UAE’s Etihad Credit Insurance and India’s Export Credit Guarantee Corporation signed an agreement to promote bilateral trade: facilitating market access for SMEs and exploring insurance, reinsurance and co-insurance services for the export of goods in a 3rd country some of the opportunities being explored.

- Dubai, which rolled out the Pfizer-BioNTech’s Covid19 vaccine from 23rd Dec, expects to inoculate 70% of its population by end-2021.

- An estimated 545k passengers are expected to use the Dubai International Airport between Jan 1-7, with 2-3 Jan likely to see 78k departing passengers.

Media Review

How the pandemic is worsening inequality: FT

https://www.ft.com/content/cd075d91-fafa-47c8-a295-85bbd7a36b50

Is an infrastructure boom in the works?

https://www.economist.com/finance-and-economics/2021/01/02/is-an-infrastructure-boom-in-the-works

China’s Pro-Monopoly Antitrust Crusade

https://www.project-syndicate.org/commentary/alibaba-anti-monopoly-investigation-cpc-by-minxin-pei-2020-12

Powered by: