Download a PDF copy of this week’s economic commentary here.

Markets

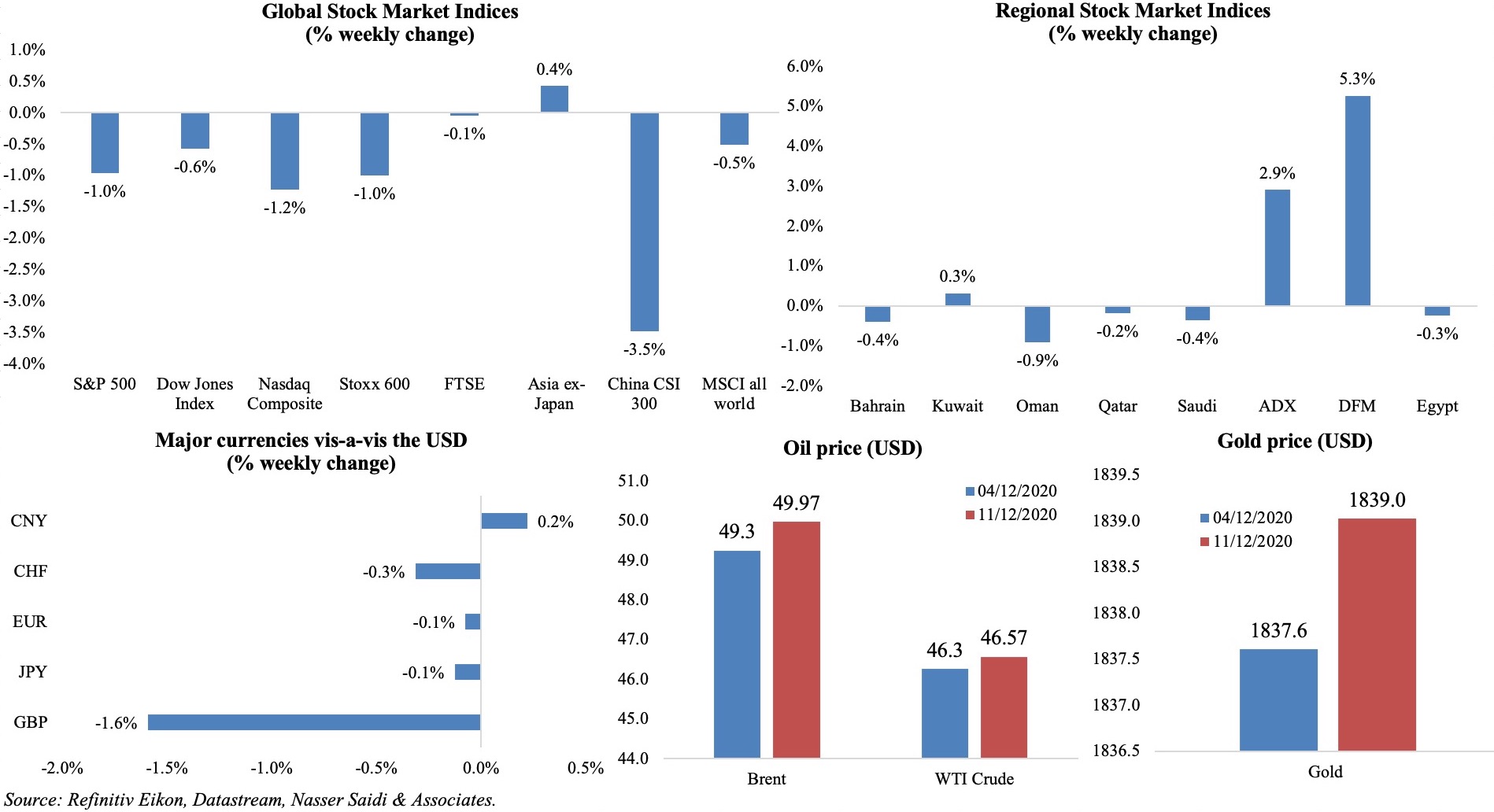

Equity markets in the US declined, as new stimulus talks dragged on with a consensus unlikely to be reached before Christmas; pan-European Stoxx was down after 5 weeks of gains and MSCI World declined by 0.5%. Regionally, most markets were down while the UAE markets gained on news of the Sinopharm vaccine’s efficacy and potential resumption of activities in Abu Dhabi within the next few days. The dollar index gained; while sterling slipped on prospects of exiting EU minus a trade deal the Chinese yuan is on its longest expansionary streak since 2014 (rising vis-a-vis the greenback for the past six months). Oil prices faltered after hitting USD 50 a barrel during the week on demand worries, and gold price gained.

Weekly % changes for last week (10-11 Dec) from 3 Dec (regional) and 4 Dec (international).

Global Developments

US/Americas:

- Non-farm productivity increased by 4.6% in Q3 (Q2: 10.6%), as output surged by 43.4% and hours worked rose by 37.1% while unit labour costs declined by 6.6% in Q3 (Q2: -8.9%).

- Inflation in the US climbed up by 0.2% mom in Nov, following a flat reading in Oct; in yoy terms, inflation was unchanged at 1.2%, with higher prices for new vehicles (+1.6%) while prices slowed for food (3.7% from 3.9%) and used cars and trucks (10.9% from 11.5%). Producer price index edged up by just 0.1% yoy in Nov (Oct: 0.3%), recording the smallest gain since Apr. Excluding food, energy and trade services components, producer prices inched up 0.1%.

- Monthly budget deficit stood at USD 145bn in Nov from USD 284bn the month before, bringing the deficit in the first two months of the budget year to USD 429.3bn (+25.1% yoy).

- Initial jobless claims swelled to a 3-month high of 853k in the week ended Dec 5 from an upwardly revised 716k the prior week, with the 4-week average rising to 776k. Continuing claims rose to 5.757mn in the week ended Nov 28 from 5.527mn the week before.

Europe:

- The ECB increased the size of its pandemic emergency purchase programme (PEPP) to EUR 1.85trn from EUR 35trn, while also extending its end until at least Mar 2022; furthermore, the apex bank extended its offer to finance banks at negative rates till Jun 2022.

- The EU approved a seven-year budget worth EUR 1.1trn in addition to a one-off EUR 750bn fund, financed by joint borrowing, to support in its recovery from the Covid19 crisis.

- GDP in eurozone grew by 12.5% qoq in Q3 (down from an earlier estimate of 12.6% and from Q2’s 11.7% drop), thanks to a rebound in demand and as exports grew by 17% while investment is down 10.2% from pre-crisis levels; in yoy terms, GDP declined by 4.3% yoy.

- Exports from Germany increased by 0.8% mom in Oct, though at a slower pace than Sep’s 2.3% uptick; imports were up by 0.3%, widening the surplus to EUR 18.2bn (EUR 17.6bn). Exports to China increased by 0.3% yoy while those to the US, UK and EU were down by 10.5%, 11.7% and 5.1% respectively.

- Germany’s industrial production increased by 3.2% mom in Oct (Sep: 1.6%) – the largest rise in 4 months – though output is still 4.9% below Feb’s levels.

- German CPI fell by 0.8% mom (the biggest fall in a year) and 0.3% yoy in Nov, posting the 4th month of deflation this year. The harmonized index fell by 0.7% yoy in Nov.

- German ZEW economic sentiment improved to 55 in Dec from Nov’s 39 reading. Current situation worsened by 2.2 points to -66.5, also below Sep’s reading of -66.2.

- The ZEW economic sentiment indicator for the eurozone added 6 points in Dec, rising to 54.4, while the indicator for the current situation ticked up by 0.7 to -75.5.

- UK GDP increased by 0.4% mom in Oct, following an expansion of 1.1% in Sep – the weakest growth since the collapse in Apr. Output in Oct was 7.9% lower than it was in Feb and weaker by 8.2% yoy. (Chart – output vs Feb levels, by sector: https://tmsnrt.rs/3mdp4By)

- Industrial production in the UK declined for the 19th consecutive month, down by 5.5% yoy in Oct (Sep: -6.3%); in mom terms, IP grew by 1.3% (Oct: 0.5%).

Asia Pacific:

- China’s exports increased by 21.1% yoy – the highest growth rate since Feb 2018, and the 6th consecutive month of export growth – and imports by 4.5% in Nov, widening the trade surplus to USD 75.42bn (+102.9% yoy and from Oct’s USD 58.44bn).

- Inflation in China fell by 0.6% mom and 0.5% yoy in Nov (Oct: -0.3% mom and 0.5%), declining for the first time since Oct 2009, thanks to a drop in food prices (-2% yoy). Money supply increased by 10.7% following 10.5% the month before. Foreign exchange reserves moved up to USD 3.178trn (Oct: USD 3.128trn).

- New loans in China increased to USD 1.43trn in Nov (Oct: 689.8bn); banks extended CNY 18.38trn in new loans in Jan-Nov 2020 (on track for a new record, given CNY 16.81trn disbursed in 2019).

- Japan’s leading economic index inched up to 93.8 in Oct (Sep: 93.3) – the highest reading since Jun 2019 – while coincident index increased to 89.7 in Oct (84.8) – the highest since Feb.

- GDP in Japan grew by 5.3% qoq in Q3 and at an annualized real 22.9% from the previous quarter, thanks to firmer private consumption (+5.1%).

- Overall household spending in Japan rose by 1.9% yoy in Oct (Sep: -10.2%), posting the first rise in 13 months. Demand for durable goods like automobiles and refrigerators increased. Separately, real wages fell for the 8th consecutive month in Oct.

- Industrial output in India increased by 3.6% yoy in Oct (Sep: 0.2%), the fastest pace in 7 months, thanks to a recovery in electricity and manufacturing sectors (+11.2% and 3.5% respectively). During Apr-Oct, industrial growth contracted by 17.5% (vs +0.1% a year ago).

Bottom line: Brexit talks continued last week, with both parties warning that a trade deal seemed unlikely by the Sunday deadline, though negotiations will continue. Will the Bank of England meeting this week see another stimulus plan, given year-end Brexit potentially sans a deal? The Fed also meets this week, most likely continuing on its dovish rhetoric and calling for continued stimulus given the surge in Covid19 cases (1mn cases were added in just 4 days and hospitalizations hit a record high for a 7th consecutive day on Sat). The positive note is that regulatory approvals have been forthcoming across the globe, with many nations starting vaccinations. However, while the airline industry will support distribution of vaccines globally, its success is also dependent on the last mile delivery hurdles and vaccine storage facilities.

Regional Developments

- Bahrain allocated BHD 19mn towards housing loans to 600 Bahrainis this year: this includes construction loans, as well as loans for the purchase of plots and renovations.

- Expats at Bahrain’s Works, Municipalities Affairs and Urban Planning Ministry, accounting for 17% of the workforce, have cost the government BHD 17mn over the past two years, according to the minister. The expats will all be replaced by 2024.

- Egypt received its first shipment of the Sinopharm vaccine, to be distributed free of charge, with priority for medical staff and people with chronic diseases.

- Urban inflation in Egypt increased to 5.7% in Nov (Oct: 4.5%), largely due to the uptick in food prices (vegetables were up 25%). Core inflation inched up to 4.012% from 3.889% the month before.

- Egypt’s budget deficit narrowed to EGP 134.97bn in Q1 of 2020-21, representing 2.1% of GDP. State revenues increased by 18.4% yoy to EGP 204.71bn, thanks to a 14.1% hike in tax revenues. Expenditures were up by 11% to EGP 336.8bn, with spending on wages up 5.1%. The country plans to narrow the budget deficit to 7.5% of GDP during the current fiscal year.

- Egypt’s net international reserves inched up to USD 39.221bn in Nov (Oct: USD 39.22bn). Net reserves have been above EGP 38bn since Jun this year. Separately, gold reserves fell for the 3rd consecutive month, down by USD 246mn from Oct to USD 4.082bn in Nov.

- Domestic liquidity in Egypt grew by 1% mom and 19.5% yoy to a record EGP 4.805trn in Oct. Money supply increased to EGP 1.14trn in Oct, from EGP 1.13trn in Sep.

- Egypt received USD 7.3bn in development funds this year, disclosed the Minister of International Cooperation, of which USD 2.7bn is directed to the private sector.

- Remittances into Egypt increased by USD 1.3bn to USD 8bn in Jul-Sep, according to the central bank. In Sep alone, remittances grew by 17.4% yoy to USD 2.7bn.

- Egypt’s central bank will extend support to the tourism sector until end-2021. Not only will any requests for postponement of bank entitlements be accepted for a maximum period of three years, but the validity period of the retail loan initiative for those employed in the tourism sector will also be extended for a year.

- Bilateral trade between Egypt and France touched USD 1.6bn in Jan-Sep 2020, from a total of USD 2.4bn in 2019.

- An executive agreement to activate the Egyptian-Saudi Investment Fund has been finalized, revealed Egypt’s Cabinet spokesman.

- Remittances from Kuwait dropped by 21.8% qoq to KWD 1.056bn in Q2; remittances were up by 12.13% yoy to KWD 2.41bn in H1. Separately, given travel restrictions due to Covid19, total travel spending by Kuwaitis plunged by 56.35% yoy to KWD 1.27bn in H1 this year.

- The Al-Anba daily reported that more than 90% of SME owners in Kuwait were unable to pay rents or salaries, given the impact from Covid19; most SMEs were operational in the storage, aviation and tourism sectors.

- Lebanon President’s counterproposal to the 18-member Cabinet lineup proposed by PM-designate Hariri will likely result in further delays to the formation of a government and thereby the reform process.

- Imminent subsidy cuts in Lebanon are likely to amount to a “social catastrophe”, if no safety net is created, warn officials. For now, only USD 800mn remains to allocate towards subsidies – which will last for another two months even with subsidy rationing.

- A new 100% government-owned energy company – Energy Development Oman (EDO) – was launched by Oman, with the aim to transfer government stake in Concession Area 6 to EDO. The new company will receive oil and gas revenues to settle annual capital and operational costs of production.

- Oman announced a visa-free entry for nationals from 103 countries, in a bid to boost tourism into the nation. This will allow visitors with a confirmed hotel reservation, health insurance and a return ticket to visit for a period of 10 days.

- Personal loans disbursed by Oman’s banks grew by 2.4% yoy to OMR 10.242bn in 2019, according to the central bank. Overall bank credit growth was up 3.1%.

- About 3.9mn passengers passed through Oman’s airports in Sep this year, according to NSCI.

- Qatar’s 2021 budget, based on an average oil price of USD 40 per barrel, estimates a deficit of QAR 34.6bn (USD 9.5bn). Expenditure was down by 7.5% yoy to QAR 194.7bn while revenues are expected to decline by almost 25% to QAR 160.1bn.

- Talks with Qatar are progressing well, according to officials from both the UAE and Saudi Arabia. This follows Kuwait’s statement the week before that a resolution was underway.

- Saudi Arabia issued over 400k tourist visas in 6 months between Sep 2019-Mar 2020. About SAR 160mn has been provided in loans to support the tourism sector.

- Value of mortgage loans in Saudi Arabia surged by 88% to SAR 105.52bn (USD 28.142bn in Jan-Oct 2020. Breaking this down further shows that mortgages to buy villas accounted for 81% of the total.

- Saudi Arabia’s investment in new projects in the non-oil industrial sector grew to a record high of around SAR 1.086trn in 2020, of which metal products accounted for the bulk (20%).

- Oil exports to the US from Saudi Arabia fell to the lowest since Jun 2010: about 73k barrels per day were shipped to the US 2 weeks ago, according to EIA data

- Local cement sales in Saudi Arabia increased by 16.5% yoy and 0.7% mom to 4.75mn tonnes in Nov 2020. Cement exports declined by 20.4% mom and 6.7% yoy to 179k tonnes.

- Women employees in Saudi Arabia’s industrial cities surged by 120% yoy to 17k by end-Q1 this year.

- Saudi Arabia’s education minister disclosed that the nation was ranked first in the Arab world and 17th globally for Saudi universities’ efforts to publish research on Covid19, accounting for 1.8% of global research production.

- During the period from 29 Nov to 5 Dec, POS sales volume in Saudi Arabia grew by 4.1% to SAR 9bn from the week before. Food and beverages topped POS purchases, followed by restaurants and cafes.

UAE Focus

- The first phase of UAE’s economic recovery plan – with 15 initiatives – is more than 46% complete, according to the economy ministry. Implemented initiatives include amendments to the bankruptcy law, allocation of grants and incentives to tourism establishments, promotion of FDI through amendments to the commercial companies law, amendments to the commercial transactions law and the decriminalization of cheques without balance, reduction of fees and taxes on the tourism sector, enhancing the flexibility of labour market and the comprehensive targeted economic support plan among others.

- UAE non-oil private sector activity contracted in Nov: PMI stood unchanged from Oct at 49.5, on weak demand. While new orders increased at a slower pace, employment fell at the slowest rate since Nov. Business confidence fell, with respondents providing a negative outlook for the next 12 months for the first time since data were collected in Apr 2012.

- Amendments in the UAE allowing for full ownership of businesses will lead to more than a 3-fold increase in number of companies in the UAE to 1mn over the next decade, according to the economy minister. Separately, Dubai Economy’s director general expects the reforms to create more jobs and investments are estimated to rise by 35%.

- Abu Dhabi is planning to resume all economic, cultural, tourist and entertainment activities within two weeks, it was revealed last week.

- The UAE government received an Aa2 rating in creditworthiness – the highest sovereign rating in the region – with a stable outlook from Moody’s.

- Bilateral trade between UAE and UK touched USD 5.5bn in Jan-Aug 2020 and UAE’s non-oil export to the UK accounted for nearly USD 500mn (+25%). UK accounts for 16% of the total FDI balance in the UAE as of end-2018 while UAE’s direct investments in the UK accounted for USD 2bn by end-2018.

- About 9 in 10 companies in the UAE expect to be profitable by the end of 2022, according to the HSBC Navigator survey, versus a global average of 81%. Around 18% expect to be profitable by end of this year.

Media Review

Amateur traders’ euphoria & US IPOs (“dazzling 2020 debuts”)

https://www.reuters.com/article/us-usa-ipo-trading-idUSKBN28L2UW

https://www.ft.com/content/cfdab1d0-ee5a-4e4a-a37b-20acfc0628e3

A thin, last-minute Brexit trade deal is better than no deal at all

https://www.economist.com/leaders/2020/12/12/a-thin-last-minute-brexit-trade-deal-is-better-than-no-deal-at-all

China’s exports pinched by global run on shipping containers

https://in.reuters.com/article/global-shipping-container/boxed-out-chinas-exports-pinched-by-global-run-on-shipping-containers-idINL4N2IP1TV

China pulls back from the world: rethinking Xi’s ‘project of the century’

https://www.ft.com/content/d9bd8059-d05c-4e6f-968b-1672241ec1f6

Powered by: