Download a PDF copy of this week’s economic commentary here.

Markets

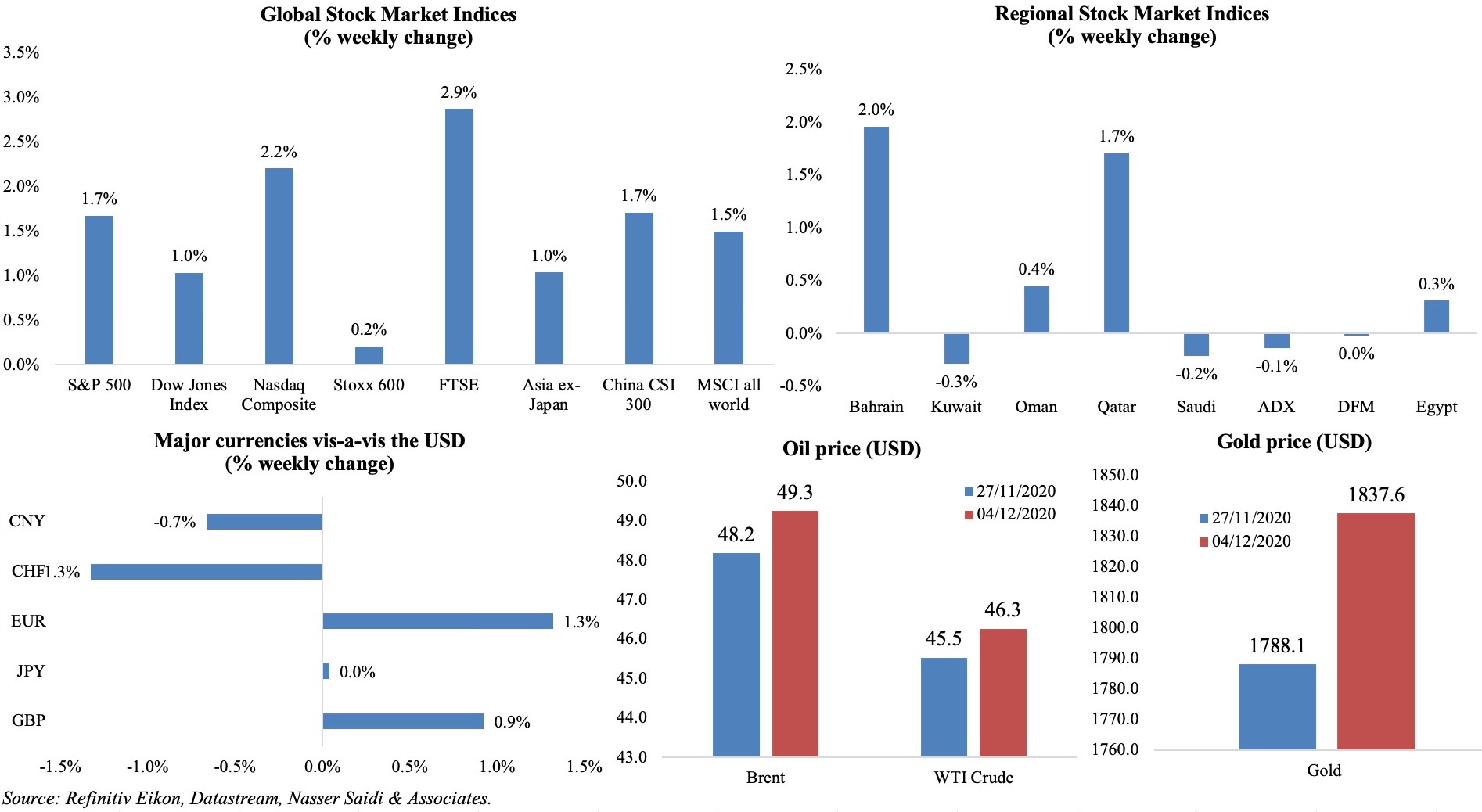

Equity markets continue to rally as vaccine approvals are being fast-tracked (UK already approved Pfizer’s vaccine) and in spite of record-high cases in the US and ongoing social restrictions in many parts of Europe. The MSCI world share index posted a 5th straight week of gains, UK’s FTSE100 touched a 9-month high, the Indian stock market touched a record high last week (in spite of the recent weak GDP numbers) while in the region, markets were mixed (they were closed during the delayed OPEC+ meeting and decision to raise oil supply by 500k barrels a day from Jan). The dollar fell to its weakest level in more than two and a half years, while the UK pound (still in Brexit deal negotiations) posted a new 2020 high last week (USD 1.35) and the euro is at a 2.5-year high. Oil prices ended higher, with Brent close to USD 50 (highest since early Mar), on the OPEC+ decision and a weaker dollar. Gold price ended higher vs last week.

Weekly % changes for last week (3-4 Dec) from 27 Nov (regional) and 28 Nov (international).

Global Developments

US/Americas:

- Non-farm payrolls increased by 245k in Nov, posting the 7th consecutive month of gains, though dropping from Oct’s revised 610k reading. Job gains were mainly from transportation and warehousing (+145k), professional and business services (+60k) and healthcare (+46k) while retail lost 35k jobs. Unemployment rate fell to 6.7% from 6.9% the month before. Labour force participation rate edged down to 61.5% from 61.7% the previous month.

- Factory orders posted a 6th monthly gain, rising by 1% mom in Oct (Sep: 1.3%), thanks to led by orders for computers and electronics (3.2%), transport equipment (1.4%) and fabricated metal products (2.3%). Orders for non-defense capital goods excluding aircraft increased by8%.

- Activity slows sharply across the US: Chicago PMI fell to a 3-month low of 58.2 in Nov (Oct: 61.1); the Dallas Fed manufacturing business index dropped to 12 (Oct: 19.8) as the production index tumbled to 7.2 (Oct: 25.5). This was also evident in the Fed Beige Book survey: while firms’ outlooks remained positive, “optimism has waned”, with “four districts describ[ing] little or no growth, and five narratives not[ing] that activity remained below pre-pandemic levels for at least some sectors”.

- ISM manufacturing PMI slipped to 57.5 in Nov (Oct: 59.3), as new orders slowed (65.1 from 67.9) and employment index slipped to 48.4 from 53.2 the month before. In contrast, however, Markit PMI increased to 56.7 in Nov (Oct: 53.4), the strongest pickup since Sep 2014, thanks to a strong rise in production and new order inflows.

- While ISM services PMI eased to 55.9 in Nov (Oct: 56.6), Markit services PMI improved to 58.4 (Oct: 56.9), as did composite PMI (58.6 from 56.3), posting the sharpest increases since Mar 2017 and 2015 respectively.

- Pending home sales declined unexpectedly by 1.1% mom in Oct (-2% in Sep), on higher prices, though in yoy terms it picked up by 20.2%. Both inventory of homes for sale and mortgage rates are at historic lows, and the current dip implies a near-term softening of existing home sales.

- Trade deficit widened to USD 63.1bn in Oct (Sep: USD 62.1bn), as both exports and imports increased – for a 5th consecutive month – by 2.2% and 2.1% respectively.

- Initial jobless claims slowed to 712k in the week ended Nov 28 from an upwardly revised 787k the prior week, and the 4-week average easing to 739.5k. Continuing claims fell to 5.52mn in the week ended Nov 21 from 6.1mn the week before.

Europe:

- German factory orders increased by 2.9% mom and 1.8% yoy in Oct (1.1% mom and -1.1% yoy), led by demand for capital goods (+3.8%), as both domestic and foreign orders picked up (by 2.4% and 3.2% respectively). Additionally, compared with Feb, orders were 0.8% higher.

- Germany’s harmonized index of consumer prices slipped by 0.7% yoy and 1% mom in Nov (Oct: -0.5% yoy and 0% mom). Headline inflation has been negative since Aug.

- Unemployment rate in Germany stood at 6.1% in Nov (Oct: 6.2%). Separately, unemployment rate in the euro area slowed to 8.4% in Oct from 8.5% the month before.

- Germany Markit manufacturing PMI edged down to 57.8 in Nov (Oct: 58.2), posting the first fall in 7 months; while new orders slowed on weaker demand, export orders rose to Europe and Asia. With services PMI slipping even further down (46 in Nov – one of the worst since Jun 2009 – from 49.5 in Oct) given the forced closures amid the new restrictions, it was not surprising that the composite PMI eased (51.7 from 52 – the lowest in 5 months).

- Eurozone manufacturing PMI slowed to 53.8 (Oct: 54.8), with growth in output and new orders easing; as always, Germany remained the brightest spot and the divergence with the rest of the region is the widest on record. There was substantial decline in services activity, (41.7 in Nov from 46.9 in Oct), also dragging down composite PMI (45.3 from Oct’s 50).

- Retail sales in Germany increased by 2.6% mom (Sep: -1.9%) in Oct – before the partial lockdown, posting the largest pickup since Apr 2018; compared to Feb, sales are 5.9% higher. In yoy terms, sales rose by 8.2% yoy (Sep: 6.5%) – the biggest climb since May 2000 on strong demand for food, furnishings and household appliances. Eurozone retail sales rose by 4.3% yoy and 1.5% mom (2.5% yoy and -1.7% mom); compared to Feb, sales were up 3.1%.

- Manufacturing PMI in the UK accelerated to a 35-month high of 55.6 in Nov – though a downturn in consumer goods production continued – while services PMI declined to 47.6 from 51.4 the month before as the second national lockdown was imposed. The composite PMI slipped below 50 for the first time since Jun, clocking in 49 in Nov (Oct: 52.1) as services sector downturn more than offset manufacturing growth.

Asia Pacific:

- China’s NBS manufacturing PMI increased to 52.1 in Nov (Oct: 51.4), the 9th straight month of growth and the strongest since Sep 2017, thanks to output (54.7 in Nov from 53.9 in Oct), new orders (53.9 from 52.8) and export sales (51.5 from 51). Non-manufacturing PMI improved to 56.4 from 56.2 the month before – the fastest rise since Jun 2012, as new businesses increased amid a decline in employment (48.9 from Oct’s 49.4).

- Caixin manufacturing PMI rose to 54.9 in Nov (Oct: 53.6) – the highest level since Nov 2010 – as new order volumes picked up thanks to domestic demand. Services activity increased to 57.8 in Nov (Oct: 56.8) – the second quickest pace since Apr 2010 – supported by strong overseas demand.

- Japan industrial production increased for a 5th consecutive month in Oct, up by 3.8% mom (Sep: 3.9%), thanks to gains in general machinery (+17.9%), auto production (+6.8%) and electrical and electronics equipment (8.4%).

- Unemployment rate in Japan ticked up to a 3-year high of 3.1% in Oct (Sep: 3%), with the total number of unemployed people rising by 80k to 2.14

- Retail trade in Japan picked up by 0.4% mom and 6.4% yoy in Oct (Oct 2019, with the sales tax hike, had seen curtailed spending); large retailer sales were up 2.9% after a 13.9% drop.

- Japan’s manufacturing PMI rose to 49 in Nov (Oct: 48.7) – the highest level since Aug 2019 – with softer falls in production new orders and employment levels. Services PMI also inched up to 47.8 from the previous month’s 47.7, though activity and new business declined for the 10th consecutive month, alongside decline in employment.

- The Reserve Bank of India left the repo and reverse repo rates unchanged at 4% and 3.35% respectively while maintaining an “accommodative stance”. The apex bank also revised its real GDP growth rate projection to -7.5% during the 2020-21 fiscal year from its previous forecast of a 9.5% drop.

- India’s manufacturing PMI fell to a 3-month low of 56.3, on slower increases in orders, exports and output while employment remained in the contractionary zone.

- Singapore PMI dropped to 46.7 in Nov (Oct: 48.6), with falling export orders dragging down the headline number alongside weaker demand conditions.

- Retail sales in Singapore ticked up by 0.2% mom in Oct, though down by 8.6% yoy (Sep: -10.7%). Supermarkets and hypermarkets were the best performers in yoy terms (+22.3% yoy) while petrol service stations picked up the most in mom terms (+5.1% mom).

Bottom line: The dramatically delayed OPEC+ meeting last week eventually reached a consensus to raise oil supply by 500k barrels per day starting from Jan – about 1/4th of what was expected. Even as Brexit trade negotiations continue with the EU in the last four weeks this year, two other milestone meetings are on the cards this week: the EU meets to decide on its USD 1.8trn spending package and in the US, Covid19 relief packages and a spending bill to avert a potential government shutdown loom large. The JP Morgan global composite PMI stood at 53.1 in Nov – a tad below Oct’s 26-month high of 53.3 – supported by manufacturing (posting a 33-month high) and in spite of a slow expansion in services (52.2 in Nov vs 52.9 in Oct). Business optimism surged to a 6.5 year high, thanks to an encouraging 3rd straight month of improving export orders. As has been the case in the past few months, Asia is performing better than its global peers, and within Europe, the divergence between Germany and the others are blatant.

Regional Developments

- Bahrain awarded 1022 tenders worth a total USD 2.7bn in Jan-Sep this year, with the oil sector accounting for 13% of tenders (27% of value), followed by the construction and engineering (15.8% of projects, 26% of value). As of H1, there were 769 tenders issued valued at USD 1.7bn.

- Net profits for Bahrain’s listed companies declined by 51.1% yoy to USD 230.7mn in Q3 this year, with only 3 sectors out of 13 posting a rise in profits, according to Kamco Invest.

- Bahrain Bourse signed an MoU with the Supreme Council for Environment to encourage listed firms to disclose information related to environmental compliance. This follows the bourse’s issuance of ESG voluntary reporting guidelines in Jun this year.

- PMI in Egypt slowed to 50.9 in Nov (Oct: 51.4), with weaker increase in output (52 in Nov from 53.4) and new orders (52.7 from 53.6), while business optimism fell to a record-low and employment continued to slip for the 13th straight month (48.5 in Nov, from 47.8 in Oct).

- In a bid to finance the budget deficit, Egypt will provide 12 offerings for bonds worth EGP 48.5bn and 20 offerings for T-bills worth EGP 198bn in Dec.

- Spending on oil subsidies in Egypt declined by 46% yoy to EGP 3.9bn in Jul-Sep this year, revealed the petroleum minister. About EGP 28.19bn has been allocated for fuel subsidies this financial year.

- Foreign holdings of Egyptian treasuries climbed to more than USD 23bn, disclosed the finance minister, after reaching a low of USD 7.1bn this May. He also stated that Egypt would receive USD 1.6bn as part of the USD 5.2bn IMF loan by end-Dec.

- Current account deficit in Egypt widened by 2.75% yoy to USD 11.2bn in the fiscal year 2019-2020. Net inflows of Egypt’s capital and financial account fell by about 50% to USD 5.4bn and tourism revenues fell by USD 2.7bn to USD 9.9bn in 2019-2020, with Q4 revenues at just USD 305mn.

- The volume of public investments in Egypt surged by 70% to EGP 595bn, according to the minister of planning.

- Egypt’s manufacturing and extractive industries index (excluding crude oil and petroleum products) inched up by 1.6% mom to 97.03 in Sep.

- Almost 2.3mn Egyptians reported job losses in Q4 of 2019-2020, with the retail and wholesale sector accounting for 28% of overall job cuts, followed by the manufacturing (25%) and food and hospitality sector (21%).

- Suez Canal revenue increased by 2.4% yoy to USD 488.1mn in Nov; this followed Oct’s revenue at USD 490.2mn.

- Poverty rate in Egypt declined for the first time since 1999 – declining to 29.7% in 2019-20 from 32.5% in 2017-18. Net annual average household income increased by 15% to EGP 69,100 in 2019-20.

- Iraq’s oil exports averaged 2.7mn barrels per day (bpd) in Nov versus 2.876mn bpd in Oct, according to the oil ministry, with exports from the southern terminals standing at 2.6mn bpd. Oil revenues totaled USD 3.394bn in Oct, with an average price of USD 41.778 per barrel.

- A financial advisor to Iraq’s PM disclosed that Iraq’s oil for projects deal with China will continue, though some of the projects will require parliamentary approval as it involves federal budget support.

- Iraq is kickstarting multiple infrastructure projects including a 240km road to the Makkah region, rehabilitation work at the Abu Flous Commercial Port and building a new city in the central Karbala governorate among others.

- Jordan’s budget for 2021 estimates spending at JOD 9.93bn – focusing on health sector and social protection – and a deficit of JOD 1.18bn, accounting for 3.7% of GDP. Expenses could be broken down into 65% for government salaries and pensions, 17% for interests on public debt, 10% for operational costs and 8% for “other” expenses.

- Unemployment rate in Jordan increased to 23.9% in Q3, compared to just 4.8% in Q3 2019. Male unemployment was 21.2% during the quarter versus female unemployment at 33.6%. The highest unemployment rates were registered in the 15-19 and 20-24 age brackets at1% and 45% respectively.

- Jordan’s trade deficit narrowed by 20% yoy to JOD 4.692bn by end-Q3 2020; exports were down by 5.5% and imports inched down by 0.7%. Trade balance with the US meanwhile widened to JOD 231mn by end of Q3 2020, as exports fell by 11.2% and imports by a larger 22.4% yoy during the period.

- Japan disclosed that a joint oil storage deal had been reached with the Kuwait Petroleum Corp: the latter can use storage tanks in southern Japan as an export base for eastern Asia, while in return Japan gets priority claim on the stockpiles in case of an emergency.

- Assets of Kuwait central bank inched up by 0.6% mom to KWD 14.06bn at end-Oct, with gold balance at a stable KWD 31.7mn. Currency in circulation grew by 1.1% to KWD 2.322bn.

- Lebanon’s PMI fell to 42.4 in Nov from Oct’s 43.3, on accelerated declines in output and new orders alongside deteriorating demand.

- Lebanese pound fell against the dollar last week, trading at around LBP 8200, after extended delays in cabinet formation.

- At an international aid conference co-hosted by France and the UN, the IMF and many participants were vocal about Lebanon’s current economic situation, underscoring that aid was dependent on structural reforms as well as a full audit of the central bank. The IMF lamented the “absence of an empowered government”, also stating that “a coherent fiscal framework that can restore debt sustainability is still lacking, as is a credible strategy to rehabilitate the banking system”.

- The World Bank, in its “Lebanon Economic Monitor”, forecast economic growth to plummet by 19.2% this year, with debt-to-GDP rising to 194% (2019: 171%) and more than half of the population poor by 2021.

- Oman’s foreign minister disclosed that labour law amendments were in the offing – abolishing a requirement that expats needed permission to transfer to a new employer – along with new taxes and ending “long-standing” subsidies.

- Revenues of 3- to 5-star hotels in Oman dropped by 60.2% yoy to OMR 70.7 (USD 183.1mn) in Jan-Oct this year, according to the National Centre for Statistics and Information. Occupancy rates fell by 50.1% to 26.1% until end-Oct and total guests were down by 53.9% to 646,841.

- Production of crude oil and condensates in Oman touched 290.3mn barrels in Jan-Oct, at a daily average of 952,100. Total crude oil exports by end-Oct was 238.7mn barrels, with China (210mn barrels), India (11mn), South Korea (4.996mn) and Japan (2.605mn) the top oil importers.

- Qatar PMI rose to 52.5 in Nov (Oct: 51.5), with output rising at the fastest rate since Aug and job creation the strongest since Jan 2019.

- Saudi Arabia’s PMI increased to 54.7 in Nov (Oct: 51) – the strongest rise since Jan – with accelerated rises in both output and new orders while hiring activity turned positive.

- Saudi Arabia’s Public Investment Fund is in talks with banks for a revolving loan of upto USD 7bn, reported Bloomberg, with the funds to be used for “opportunistic investments”. This would be the third time PIF has tapped international banks, following its debut loan of USD 11bn in 2018 and repayment of a USD 10bn bridge loan in Aug (2 months ahead of schedule).

- The Law of the Saudi Central Bank allows the apex bank to buy or own real estate with the intention of diversifying foreign investments, but prevents it from financing or lending to the government or any individuals and also from engaging in trade or participating in commercial activities or taking interest in any commercial, industrial or agricultural projects.

- The Saudi Central Bank announced an extension of the Deferred Payments Programme until end-Q1 2021.

- Saudi Arabia’s new Chambers of Commerce Law, which also has provisions to further ease the procedures for the start and practice of business activities, will allow foreign investors to become members of the board of directors of the chambers.

- Bank deposits in Saudi Arabia increased to a record high SAR 1.899trn in Oct (+10.9% yoy, +1% mom). Bank credit also surged by 15.9% yoy to SAR 1.7trn.

- Consumer spending in Saudi Arabia fell by 13% yoy to SAR 785.288bn in Jan-Oct this year. While PoS transactions were up by 22% yoy to SAR 285.414bn, ATM transactions dropped by one-fourth to SAR 499.87bn.

- Saudi banks’ investments in government bond holdings increased by 12.49% to SAR 431.58bn until end-Oct from end-2019. In Oct 2020 alone, banks’ holdings of government bonds grew by 13.86%.

- The value of contracts awarded in Saudi Arabia fell to SAR 7.4bn (USD 2bn) in Q3 and to SAR 63.6bn in Q1-Q3 2020, according to the US-Saudi Business Council. Transportation, power and real estate together accounted for close to 60% of total value of contracts awarded.

- Remittances from Saudi Arabia surged by 18.5% yoy to SAR 123.4bn in Jan-Oct this year, according to the Saudi Central Bank.

- New residential mortgage loans for individuals in Saudi Arabia till Oct this year reached 234,466 contracts (+73% yoy), with value of SAR 2bn (+81% yoy). This surpassed the number and value of all mortgages disbursed in 2018 and 2019.

- Saudi Arabia’s tourism project on the west coast is moving “at pace”, with SAR 7.5bn worth of contracts awarded to date, and the value to increase to SAR 15bn by end of this year, according to the chief executive of the Red Sea Development Company.

- The total volume of electronic commerce transactions in Saudi Arabia reached SAR 44bn, according to the Saudi Payments Company (a subsidiary of the central bank).

UAE Focus

- UAE banks’ loans to SMEs inched up to AED 92.6bn by end-Sep from AED 92.5bn in Jun 2020, according to central bank data.

- Abu Dhabi’s non-oil exports accelerated by 62.5% to AED 32.8bn in Jun-Aug from the prior 3-month period Mar-May. In Jan-Sep, overall non-oil trade grew to AED 151.18bn, with imports at AED 69.33bn and exports at AED 55.37bn.

- Dubai’s external trade touched AED 551bn in H1 this year. In 2019, trade clocked in at AED 1.271trn, almost 10 times from AED 143bn two decades ago.

Media Review

The Saudi & UAE Central Banks’ joint digital currency & distributed ledger “Aber” project: proof of concept

https://www.centralbank.ae/sites/default/files/2020-11/Aber%20Report%202020%20-%20EN_4.pdf

Singapore awards 4 digital full bank licenses

https://www.straitstimes.com/business/banking/mas-awards-digital-full-bank-licences-to-grab-singtel-and-sea-ant-gets-digital

The ‘everything rally’: vaccines prompt wave of market exuberance

https://www.ft.com/content/d785632d-d9a0-45ae-ae57-7b98bb2fb8d6

Making Sense of Sky-High Stock Prices

https://www.project-syndicate.org/commentary/making-sense-of-soaring-stock-prices-by-robert-j-shiller-et-al-2020-11

Working from Home: Will it Persist? (Nick Bloom, Professor of Economics at Stanford University)

https://www.youtube.com/watch?v=N8_rvy-hqUs

Powered by: