Download a PDF copy of this week’s economic commentary here.

Markets

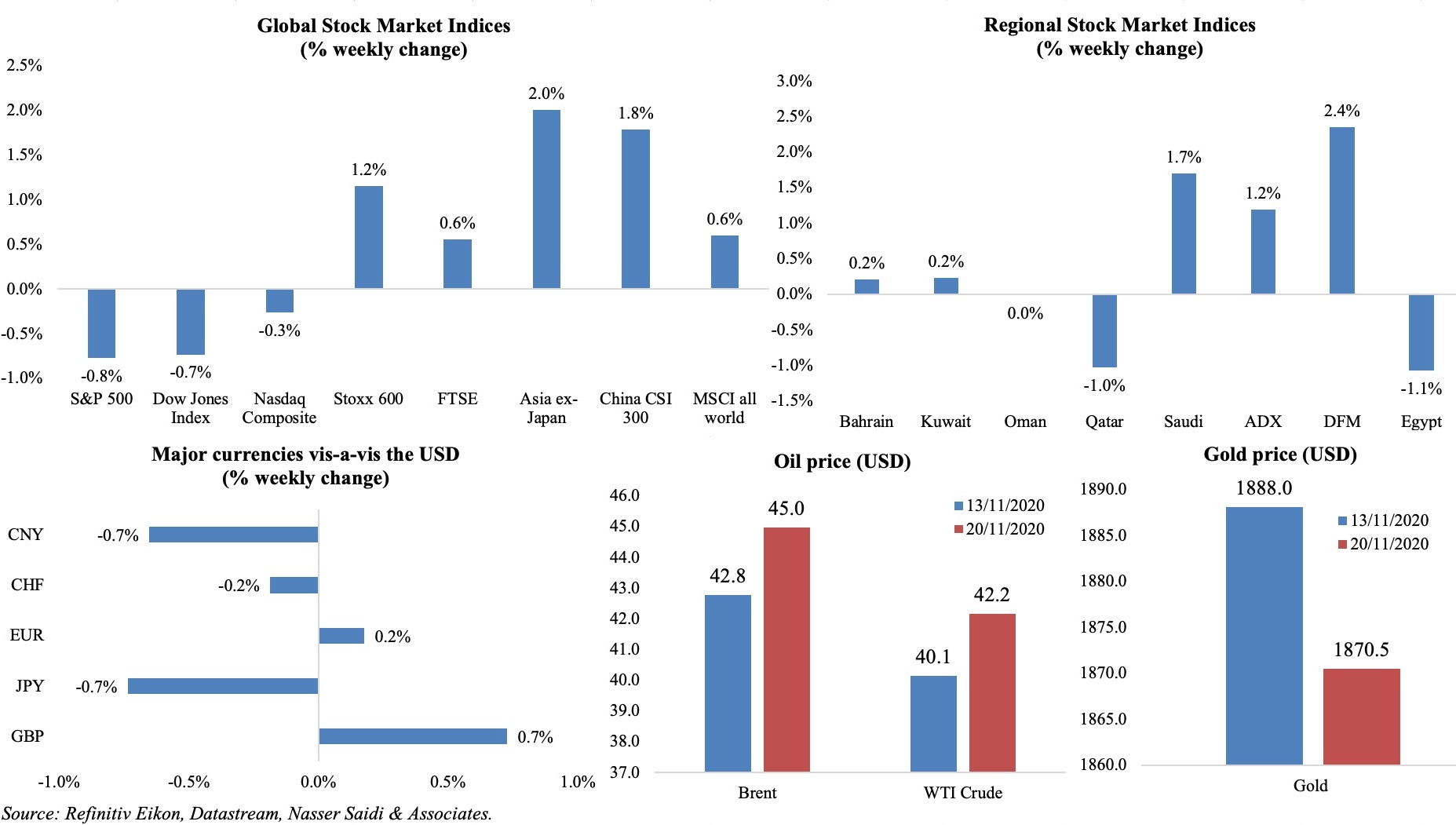

Equity markets picked up on optimism from positive results from the Covid19 vaccine trials: Stoxx600 and UK FTSE posted strong monthly rallies, while Japan’s Nikkei touched its highest level since Jun 1991. In the US, rising Covid19 deaths and the “tussle” between the Fed and Treasury on extending emergency funding programs beyond end of this year resulted in weekly losses. In the region, markets were mixed with UAE and Saudi the biggest gainers, while Qatar and Egypt fell by 1% compared to a week ago. Among currencies, as the dollar dropped to more than a 1-week low, both pound and euro gained. Oil prices inched up, posting a third week of gains and ahead of the OPEC+ meeting end of this month, while gold price posted a weekly loss.

Weekly % changes for last week (19-20 Nov) from 12 Nov (regional) and 13 Nov (international).

Global Developments

US/Americas:

- US industrial production grew by 1.1% mom in Oct (Sep: -0.4%), supported by utilities (+3.9%) and manufacturing (+1%); output is 5.6% below where it was in Feb (pre-pandemic). During Oct, industry operated at 72.8% capacity, up from 72% the month before.

- Building permits remained unchanged at 1.545mn in Oct, still at the highest level since Mar 2007. Housing starts increased by 4.9% mom to a seasonally adjusted annual rate of 1.53mn in Oct, supported by low mortgage rates, and with single-family homebuilding up 6.4% to 1.179mn units – the highest since Apr 2007. Existing home sales rose for the fifth straight month, up by 4.3% mom to 6.85mn in Oct, with median price 16% yoy higher at USD 313k.

- Retail sales inched up by 0.3% mom in Oct, from a downwardly revised Sep reading of 1.6%. Excluding autos, retail sales was up by just 0.2% (1.2%). However, the rising spread of the pandemic and related restrictions alongside expiry of various unemployment benefits is likely to affect sales in the coming months. This was evident in a JPMorgan survey of credit and debit cardholders which showed a broad decline in spending through Nov. 9, with larger drops in states where Covid-19 is spreading most rapidly.

- Household debt in the US rose by 0.6% to USD 14.35trn from Q2’s USD 14.27trn, largely due to a surge in mortgage loans (USD 1.05trn) while balances on credit cards fell to USD 807bn, the lowest total since 2017.

- Initial jobless claims increased for the first time in 5 weeks, expanding by 31k to 742k in the week ended Nov 14, with the 4-week average slowing to 742k. Continuing claims rose by 233.5k to 4.38mn in the week ended Oct 31.

Europe:

- Eurozone current account surplus narrowed to EUR 33.5bn in Sep from a year ago, as the services surplus declined to EUR 11.7bn (Sep 2019: EUR 20.1bn) while the primary income account posted a EUR 2.9bn defici

- German producer price index inched up by 0.1% mom in Oct (Sep: 0.4%), with energy prices and non-durable consumer goods down by 2.9% and 0.5% respectively. In yoy terms, PPI was down by 0.7% after a 1% drop the month before.

- Inflation in the UK ticked up by 0.7% yoy in Oct (Sep: 0.5%), the highest in 3 months, largely due to increases in costs of transport (1.2%) and food (0.6%). Core CPI increased by 1.5% (Sep: 1.3%).

- Retail sales in the UK grew for the 6th straight month, rising by 1.2% mom and 5.8% yoy in Oct; while online sales surged by 52.8%, store sales were down by 3.3%. Compared to Feb, retail sales have rebounded by a strong 6.7%.

- Public sector borrowing in the UK touched a new high of GBP 214.9bn in the Apr-Oct period; in Oct alone, the government borrowed GBP 22.3bn vs GBP 10.8bn a year ago.

- The GfK consumer confidence index in the UK fell by 2 points to -33 in Nov, only a point away from the low of -34 recorded in Apr during the first lockdown.

Asia Pacific:

- Japan’s Q3 GDP increased by 5% qoq in Q3 (Q2: -8.2%) – the fastest pace of growth since Q4 1968 and following three quarters of contraction – supported by a 2.2% uptick in public spending and growth in exports. GDP expanded at an annualized pace of 21.4%; Japan has recovered only about 56% of what was lost in Apr-Jun and just 43% for the past three quarters.

- The PBoC left the one-year loan prime rate unchanged at 3.85% in the latest meeting – for the 7th straight month – while holding the five-year LPR steady at 4.65%.

- FDI into China increased by 6.4% yoy in Jan-Oct (Jan-Sep: 5.2%), with Oct posting the 7th consecutive month of growth (+18.3% yoy to CNY 82bn). Fixed asset investment grew by 1.8% yoy in Jan-Oct to CNY 48.33trn (USD 7.32trn) from 0.8% in Jan-Sep.

- Industrial production in China grew by 6.9% in Oct, in line with Sep’s reading, thanks to the auto industry’s robust 12.5% growth. Retail sales picked up by 4.3% in Oct, faster than Sep’s 3.3% and the biggest rise since Dec 2019, as consumption recovered across the board.

- Japan’s exports declined (for the 23rd straight month) by 0.2% yoy in Oct and imports plunged by 13.3%, widening the trade surplus to JPY 872.9bn. Exports to Asia increased (China up by 10.2%, Taiwan 1.9% and Korea’s 9%) while exports to Western Europe was down by 7.9%.

- Wholesale price inflation in India inched up for the third month in a row, rising by 1.48% in Oct (Sep: 1.32%) – an 8-month high, as manufacturing WPI ticked up by 2.1% (Sep: 1.6%).

Bottom line: UNCTAD expects global FDI to post a U-shaped recovery in 2022 amid expectations of a V-shaped recovery in trade and global growth. The WTO’s latest goods barometer report signaled trade resilience in recent months – consistent with the trade forecast of a 9.2% decline in trade volume this year – though the lockdowns in Q4 are likely to cause a further slowdown in demand. With global Covid19 cases inching closer to 60mn, it is prudent to be cautious in optimism: in spite of the promising vaccine trials, it remains to be seen how soon these vaccines can be circulated across the globe. Even in the US, with delays in the transition, process of distributing vaccines could be unnecessarily hindered.

Regional Developments

- Bahrain-origin exports surged by 29% yoy to BHD 198mn (USD 522mn) in Oct, with the top 10 destinations accounting for close to 80% of the total. Trade deficit during the month narrowed by 44% yoy to BHD 111mn, as the value of imports declined by 14%.

- Further to the MoU signed between Bahrain and Israel, the two nations have agreed to start operating commercial flights and initiate the process to open embassies. 14 weekly flights are scheduled to operate from the beginning of 2021, in addition to 5 cargo flights.

- Bahrain is in the process of discussing key pension reforms, according to a senior official from Aon, who stated that reforms could include later-age retirement, change in benefit formula, higher contribution rates and conditional indexation (vs full inflation-proofing).

- Families in Bahrain will now be allowed to start construction of homes within 3 years after acquiring government land (instead of 2) and complete it within 7 years (versus 3).

- The IMF reached a staff-level agreement with Egypt after the first review of the USD 5.2bn financing approved in Jun, subject to the executive board’s approval.

- Egypt’s budget deficit narrowed to 2.6% of GDP in the first four months of the 2020-21 fiscal year, according to the finance minister. Revenues grew by 15.5% yoy during this period, thanks to an 11.4% hike in tax proceeds. For the full year, deficit is estimated to decline to 6.5% of GDP (vs 7.9% in FY 2019-20 but higher than the targeted 6.3% this year).

- Unemployment in Egypt declined to 7.3% in Jul-Sep, down 0.5% yoy and compared to 9.6% in Apr-Jun this year.

- The minister of planning disclosed that Egypt’s women hold 45% of total government jobs in the country (above the global average of 32%). Women’s representation in banks’ boards has ticked up to 12% last year from 10% the year before.

- The fintech firm, e-finance, from Egypt is expected to launch its IPO in Q1 next year on the Egyptian Exchange. The IPO was scheduled for earlier this year, but postponed due to the pandemic.

- Egypt’s new customs law came into effect from Nov 13th: changes include expedited clearance, introduction of electronic methods and automation. It was previously stated that nearly 90% of the trade system would be operated electronically by the end of this year.

- An Egypt-UK trade agreement will come into effect on Dec 31, reported Ahram Online: based on the EU-Egypt Association Agreement, this will regulate bilateral ties post-Brexit.

- At a meeting of the joint Egyptian-UAE Business Council, it was revealed that the UAE receives about 11% of Egypt’s total exports and that UAE investments in Egypt exceeded USD 7bn in different projects (with an additional USD 7bn worth as part of a recent MoU).

- Egypt’s Suez Canal revenues ticked up by 4.14% mom to USD 490.2mn in Oct.

- Passenger car and truck sales in Egypt grew by 24% yoy (to 17051) and 9.6% (to 3348) respectively in Sep, according to the Automotive Marketing Information Council.

- The volume of electronic transactions through mobile wallets in Egypt increased to 9.9mn transactions in Oct (+156% from Mar’s 3.9mn transactions).

- The Iraq-Saudi Arabia border crossing opened for trade for the first time since 1990 last week. Separately, Saudi Arabia completed Iraq border road maintenance work, allowing for opening of the Jadeedah Arar port.

- Iraq will invite international energy companies to bid for building an oil refinery in the southern port of Fao – the refinery is estimated to have a 300k barrels per day capacity.

- The IMF is proposing that a part of the USD 1.3bn 4-year Extended Fund Facility credit to be disbursed to Jordan be brought forward to 2021 to support its financing efforts to tackle Covid19.

- Exports from Kuwait declined by 41% yoy to KWD 6.99bn in Jan-Jul 2020 while imports declined by 20% (to KWD 4.8bn), bringing trade balance down to KWD 2.1bn (-62.7%).

- Permits for private residential buildings in Kuwait plunged by around 46% yoy in Jan-Oct while permits for investment housing projects dropped by 65%, according to Arabic language daily Alanba.

- Number of expats in Kuwait fell to 2.65mn recently, compared to 3.3mn prior to the Covid19 crisis, reported Al Rai.

- Alvarez & Marsal withdrew from conducting Lebanon’s central bank forensic audit citing non-receipt of requested information. The audit was a necessary requirement for foreign donors and the IMF.

- Cabinet formation in Lebanon is at a standstill, with the PM designate not having met with the President for more than a week. Lack of consensus stems from the distribution of key ministerial posts among various sects and deciding who names Christian ministers. Lebanese pound crossed 8000 to the dollar last week for the first time since the new PM-designate was named on Oct 22nd.

- Oman is discussing a loan of at least USD 1bn with a group of banks, reported Reuters. Oman’s USD 2bn bonds last month was met with lackluster demand given its external debt picture.

- Bilateral trade between Oman and Dubai grew by 8.4% yoy to AED 37.85bn in 2019. This year in H1, total trade between the two stood at AED 14.85bn.

- Inflation in Saudi Arabia increased by 5.8% yoy in Oct (Sep: 5.7%), largely due to hikes in of food (+13%) and transport costs (+7%). Separately, the country’s acting information minister revealed that the VAT hike could be reviewed once the pandemic ends.

- Crude oil exports from Saudi Arabia increased for a third straight month to 6.07mn barrels per day (bpd) in Sep from 5.97mn bpd in Aug. Crude output in Sep was 8.98mn bpd while oil product demand fell by 168,000 bpd to 2.38mn bpd.

- Saudi Aramco raised USD 8bn from a 5-part bond deal to support its USD 75bn dividend target. Its bond prospectus showed that the company amended and extended the maturity of two revolving credit facilities it took in 2015. As of Sep 30, Aramco had USD 55bn in total borrowings, up from USD 46.82bn at end-2019, attributed largely to the Sabic acquisition.

- The minimum wages for Saudi employees under the “Nitaqat” employment program has been raised to SAR 4000 from SAR3k before. Accordingly, if a worker is paid only SAR 3k, he will be counted as half a worker.

- FDI into Saudi Arabia increased by 12% yoy in H1 this year, disclosed the minister of investment. The minister also stated that special economic zones will be launched next year, focusing on “qualitative growth” in areas like cloud computing, renewable energy, tourism, culture, entertainment, and logistics.

- Saudi Arabia’s power sector reforms are expected to result in more efficient power generation, reduction in the use of liquid fuels for electricity generation and increased environmental protection. Furthermore, the government will turn liabilities from the Saudi Electricity Company – amounting to USD 77bn (SAR 167.92bn) – into an Islamic bond.

- Saudi Arabia’s investments in US Treasury bills fell by 27.7% yoy to USD 131.2bn in Sep; in mom terms, it inched up by 0.92%. Kuwait and UAE hold USD 46.6bn and USD 33.1bn respectively.

- The Public Investment Fund cut its exposure to US equities by USD 3bn in Q3; it cut ETFs holdings to USD 96bn as of end-Sep, from nearly USD 4.7bn in Q2. Separately, the PIF increased its stake in Acwa Power from 33.36% to 50%.

- Gender equality in the workplace can add more than USD 400bn to Saudi GDP by 2030, according to the “Women in KSA Workforce” report issued by Accenture. Full report here.

- Saudi Arabia plans to allocate 5% of total available parking spaces for electric cars, reported the Al-Watan newspaper.

- Saudi Arabia plans to invest more than SAR 20bn (USD 5.3bn) in artificial intelligence projects by 2030, reported Saudi state TV, citing the Saudi Data and Artificial Intelligence Authority.

- Saudi Arabia called for OPEC+ members to be flexible in dealing with the markets given ongoing weak demand. A full meeting is scheduled on Nov 30 and Dec 1 to decide output policy for next year. Bloomberg reported that UAE were considering leaving OPEC+, while also stating that it was unclear whether the warning was “a maneuver to force a negotiation over production levels, or represents a genuine policy debate”; later on, the UAE energy minister clarified that no such plan was in the offing and that it was committed to OPEC.

UAE Focus

- The UAE central bank extended the AED 50bn Zero-Cost facility for another 6 months until Jun 30, 2021. This benefits retail and corporate banking customers and facilitates liquidity management for banks through collateralised funding at zero cos

- UAE’s non-oil trade reached AED 658.3bn in H1 this year, accounting for 41% of total value of trade last year. Gold trade, at AED 104bn, accounted for 15.7% of total trade; the top 5 trade partners – China, Saudi Arabia, India, US and Switzerland – accounted for 37.1% of total trade.

- UAE announced plans to extend its 10-year visa to all doctors, PhD holders and highly skilled workers including scientists and data experts.

- Inflation in Dubai declined by 3.4% in Oct, with housing and utilities and transport costs falling by 6.96% and 6.29% respectively.

- The real estate sector contributed 7.2% of Dubai’s GDP in 2019, and compares to a contribution of 6.3% in 2014, according to the Dubai Land Department. Real estate transactions value had increased by 2.1% yoy to AED 226bn.

- UAE banks’ profits will remain profitable in 2020-21, though the higher cost of risk and lower margins will reduce profitability, according to S&P.

- UAE ranked 42nd among 167 countries in the 2020 Prosperity Index, down 2 ranks from the 2019 edition: enterprise conditions improved 11 places to 20th and market access and infrastructure pillar were up 6 places to 21st. Access the rankings here.

- Abu Dhabi was ranked among the top 10 and Dubai top 18th in the Global Cities Outlook, while Dubai was also ranked the 27th most competitive city in the Global Cities Index (published by Kearney).

Media Review

A no-brainer for the G20

https://www.project-syndicate.org/commentary/g20-must-fund-covid19-aid-act-accelerator-by-jim-o-neill-2020-11

China goes from strength to strength in global trade

https://www.piie.com/blogs/china-economic-watch/china-goes-strength-strength-global-trade

Current sovereign debt challenges and priorities in the period ahead

https://www.imf.org/en/News/Articles/2020/11/16/vc111620-current-sovereign-debt-challenges-and-priorities-in-the-period-ahead

Why inflation could be on the way back

https://www.ft.com/content/dea66630-d054-401a-ad1c-65ebd0d10b38

Ten trends to watch in 2021

https://www.economist.com/the-world-ahead/2020/11/16/ten-trends-to-watch-in-the-coming-year

China’s post-pandemic revival has been stoked by coal-powered industry, jeopardizing Xi’s climate pledge

https://www.ft.com/content/d452aef8-9fd7-422a-a034-4558f0e66e53

Where are the world’s most expensive cities?

https://www.economist.com/graphic-detail/2020/11/18/where-are-the-worlds-most-expensive-cities

Powered by: