Download a PDF copy of this week’s economic commentary here.

Markets

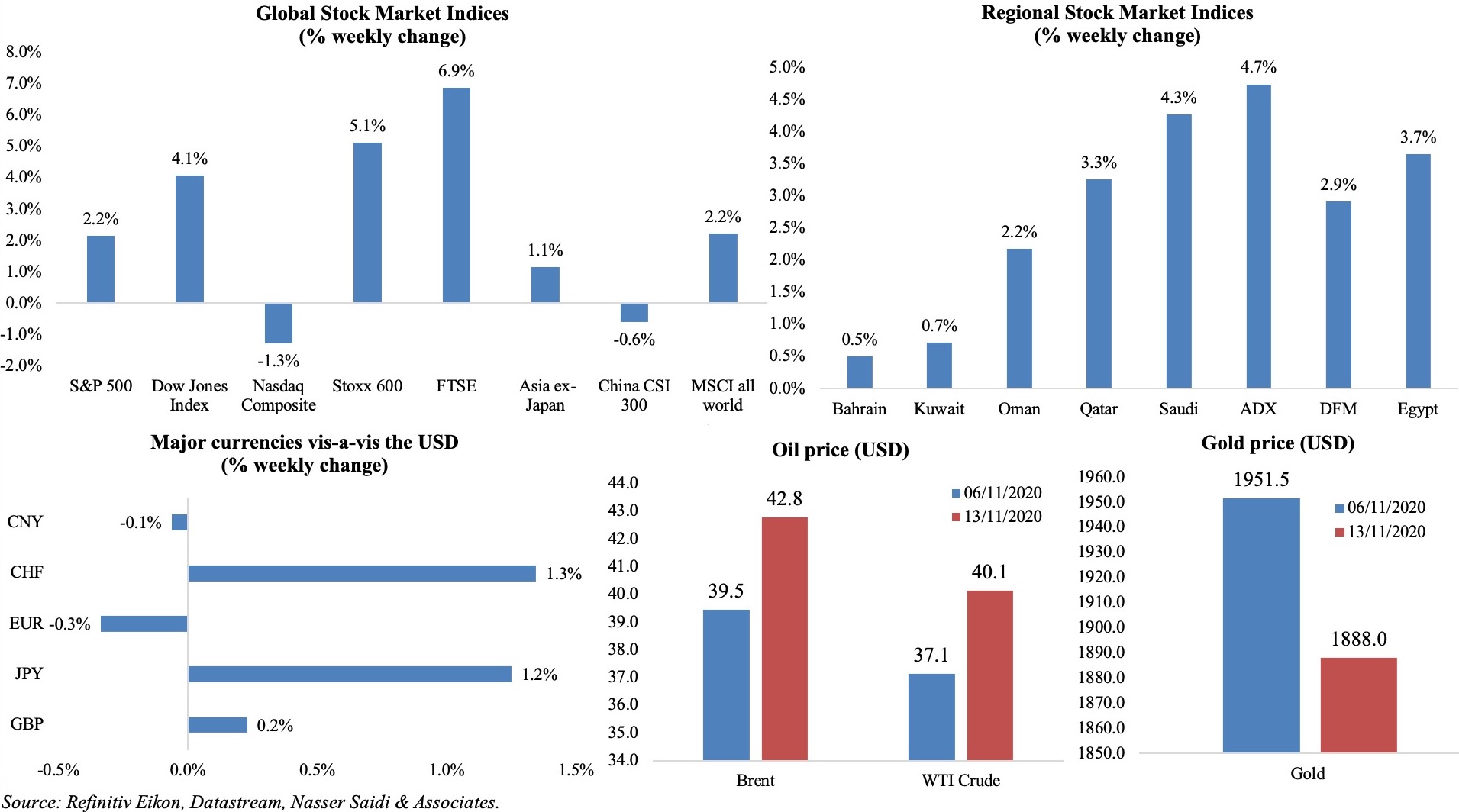

Stock markets cheered the breakthrough for the Covid19 vaccine, with new records set in the MSCI All World Index and the S&500. Tech stocks suffered on the news of the vaccine, with the likes of Zoom declining sharply while travel/ tourism/ entertainment stocks picked up. Most markets ended lower by end of the week, as Covid19 cases surged, but posted weekly gains. Asian equities slumped after an executive order was issued prohibiting US investors to hold shares in companies linked to China’s military. Regional markets were mostly up, mirroring its global peers. Safe-haven currencies like the yen and Swiss franc currencies strengthened. Oil prices picked up for a 2nd week, while gold price eased.

Weekly % changes for last week (12-13 Nov) from 5th Nov (regional) and 6th Nov (international).

Global Developments

US/Americas:

- Inflation in the US remained unchanged in Oct after rising by 0.2% mom in Sep. In yoy terms, inflation fell to 1.2% (Sep: 1.4%), as prices fell across energy prices (-9.2%), transportation services (-5.1%) and medical care (-0.8%). Core inflation was flat in mom terms and slowed to 1.6% yoy from Sep’s 1.7%.

- Producer price index inched up by 0.3% mom in Oct (Sep: 0.4%), given higher costs of food and gasoline. Core producer price index increased by 0.2% mom and 0.8% yoy in Oct (Sep: 0.4% mom and 0.7% yoy).

- University of Michigan’s consumer sentiment index declined to 77 in early Nov – the lowest since Aug – from a final reading of 81.8 in Oct. The resurgence of Covid19 cases and Presidential elections outcomes weighed on sentiment.

- The US federal budget deficit more than doubled to a record USD 284.1bn from a year ago in Oct, as spending ticked up by 37.3% yoy.

- Home prices of single-family homes in the US increased by 12% yoy to USD 313,500 in Q3 – the fastest pace since 2013.

- Initial jobless claims fell to a 7-month low, declining by 48k to 709k in the week ended Nov 7, with the 4-week average slowing to 755.25k. This is still higher than the peak of 665k recorded during the 2007-09 recession period.

Europe:

- Eurozone GDP grew by 12.6% qoq in Q3 (Q2: -11.8%), according to revised estimates. in yoy terms, GDP was down by 4.4% (Q2: -14.8%).

- German ZEW survey showed a plunge in economic sentiment to 39 in Nov (Oct: 56.1). The current situation assessment worsened, falling to -64.3 from -59.5 the month before. The corresponding indicators for the eurozone showed economic sentiment drop by 19.5 points to 32.8 in Nov, while the current situation inched up by 0.2 50 -76.4.

- Harmonised index of consumer prices in Germany decreased by -0.5% yoy in Oct, following a 0.4% decline in Sep.

- Germany exports grew by 2.3% mom in Sep (Aug: 2.9%) while imports edged down by 0.1%, widening the overall trade surplus to EUR 17.8bn in Sep; exports were 7.7% lower compared to Feb (pre-pandemic). Current account balance increased to EUR 26.3bn (Aug: EUR 16.5bn).

- Industrial production in the eurozone declined by 0.4% mom and 6.8% yoy in Sep (Aug: 0.6% mom and -6.7% yoy), as production of durable consumer foods and energy fell by 5.3% and 1% respectively while capital goods and non-durable consumer goods production edged up by 0.5% and 2.1%.

- Temporary contract employment in the EU plunged almost 11% during the lockdowns in Q2, compared with less than 3% for total employment, and accounted for over 80% of EU job losses during the period.

- UK’s GDP expanded by 15.5% qoq in Q3 (Q2: -19.8%), the sharpest quarterly expansion ever; in yoy terms, but GDP dropped by 9.6% yoy (Q2: -21.5%). According to ONS, GDP expanded by 6.3% in Jul, slowing to 2.2% in Aug and 1.1% in Sep, when it was driven by the professional, scientific and technical industries. The current lockdown is likely to result in a drop in GDP this quarter.

- Industrial production in the UK increased by 0.5% mom in Sep, following a 0.3% nudge up in Aug. Manufacturing production, however, slowed to 0.2% mom rise after a relatively stronger 0.9% reading the month before.

- Unemployment rate in the UK inched up to 4.8% in the 3 months to Sep – the highest since 2016 – from 4.5% before; redundancies reached a record high of 314,000 in Q3. Average earning excluding bonus meanwhile picked up by 1.9% during the same period (0.9%).

Asia Pacific:

- China’s inflation slowed to an 11-year low of 0.5% yoy in Oct (Sep: 1.7%), with core inflation edging up by 0.5%. Producers price index fell by -2.1% yoy in Oct, at the same pace as Sep.

- Money supply (M2) growth in China slowed to 10.5% yoy in Oct (Sep: 10.9%). Bank lending starts to slow as the year and annual quotas come to a close: new loans slowed to CNY 689.8bn (USD 104.22bn) in Oct, sharply down from Sep’s CNY 1900bn. Annual growth of outstanding total social financing (TSF), a broad measure of credit and liquidity, rose to 13.7% in Oct (Sep: 13.5%).

- Japan leading economic index inched up to 92.9 in Sep (Aug: 88.5), the highest reading since Jul 2019, as restrictions eased.

- Current account surplus in Japan narrowed to JPY 1660.2bn in Sep from Aug’s JPY 2102.8bn. In the first half of the fiscal year (Apr-Sep 2020), surplus fell by 36.2% yoy to JPY 6.69trn – the smallest since H2 2014.

- Japan’s machinery orders declined by 11.5% yoy and 4.4% mom in Sep (Aug: -15.2% yoy, +0.2% mom). Overseas orders slowed7% to JPY 765.6bn, following Aug’s 49.6% spike.

- Petroleum demand increased in India by 2.7% yoy to 17.8mn tonnes, rising for the first time after Feb.

Bottom line: In spite of the resurgence in Covid19 cases across the US and Europe, the announcement of a Covid19 vaccine with 90% effectiveness brought in a wave of optimism and cheer across the globe, with many nations planning its disbursement by end of the year to early next year. While there is light at the end of the tunnel, many questions remain – how will it be distributed globally, its storage conditions (the Pfizer vaccine needs to be stored at -70 degree Celsius), will everyone have access to the vaccine, and if so, how long will it take for the vaccine to reach everyone, how long it will remain effective and so on. Meanwhile, any effort towards initiating a new stimulus package in the US will remain stalled as long as the current election results gridlock remains unresolved. In the EU, an agreement was reached to unlock the EUR 1.8tn budget and stimulus money. Separately, the G20 agreed on a new “common framework” for an extended debt restructuring plan for poor countries hit by the pandemic to avert a messy wave of defaults.

Regional Developments

- Bahrain introduced amendments to its Companies Law: changes include the elimination of single person companies, increase in disclosures and introduction of ‘not-for-profit’ companies among others.

- Bilateral trade between Bahrain and Italy surged by 43.4% yoy to BHD 196.3bn in Jan-Sep this year.

- Egypt’s central bank cut interest rates by 50 bps at its second consecutive meeting: the overnight lending rate was lowered to 9.25% from 9.75% and the overnight deposit rate to 8.25% from 8.75%.

- Inflation in Egypt increased to 4.5% in Oct, still near a 14-year low, from 3.7% and 3.4% in Sep and Aug respectively. The uptick was largely due to increase in prices of vegetables and education.

- Total foreign currency deposits held by Egypt’s banking sector declined for the third month in a row by 1.75% mom and 6% yoy to EGP 644.505bn (USD 41.18bn). Foreign reserves increased by EGP 795mn to EGP 39.22bn by end-Oct.

- Following the approval of a new law on issuance of sovereign sukuk, Egypt’s cabinet approved a draft bill to exempt revenues from bonds offered to overseas investors from all taxes and fees. No further details were provided.

- Egypt’s total non-oil imports declined by 13.19% yoy to USD 55bn in Jan-Sep this year; food exports increased by 2% yoy to USD 2.6bn during this period. Total non-oil exports decreased by 2.5% yoy to USD 18.76bn during this period.

- Planned public investments in Egypt surged by 70% to EGP 595bn in fiscal year 2020-21, according to the minister of planning.

- Egypt signed 86 agreements with major oil and gas companies with minimum investment commitments totaling USD 15bn over the last six years, disclosed the petroleum minister. Separately, it was revealed that 14 exploration and production deals were signed in Mar-Oct this year.

- Egypt’s Ministry of International Cooperation disclosed that it had concluded agreements worth USD 7.308bn this year – with 62.2% towards financing sovereign projects and the rest to the private sector. This includes agreements worth USD 15bn signed with the World Bank to support health and housing sectors as well as the environment.

- Current daily gas exports from Egypt reach 300-800mn cubic feet per day, but with gas production at 72bn cubic feet per day (bcf), the country has a gas export capacity of around 1bcf, according to the minister of petroleum.

- The Sovereign Fund of Egypt is set to establish several sub-funds covering infrastructure and utilities, tourism and real estate, healthcare services and pharmaceutical industries, as well as financial services and digital transformation.

- Egypt’s Sharm El-Sheikh and Hurghada have received around 430k tourists since it opened up in Jul this year. Currently, tourists are at just 10% of normal rates during this time.

- Passenger car sales in Egypt increased by 24% yoy to 17051 in Sep while truck sales increased by 9.6% to 3348 vehicles.

- Egypt’s minister of health confirmed that it had reserved vaccines from Pfizer and Oxford University to cover 20% and 30% of the country’s vaccine needs.

- Iraq passed an emergency spending bill, allowing the finance ministry to borrow USD 10.1bn from international markets and local banks, though this amount is much lower than the USD 35bn sought by the government. The funds are expected to cover public servants’ salaries, food imports and crucial projects.

- Iraq and China agreed to restart its oil-for-projects agreement allowing Chinese companies to execute projects in the country in return for crude oil supply. Though a similar deal was reported with Egypt, the planning minister denied it in a statement in Aliqtisad News.

- Kuwait started granting work permits (after 8 months) for the recruitment of workers from abroad for medical and teaching specialists as well as companies that have government and oil-related contracts.

- France pressed for speeding up “the formation of an efficient government, accepted by all political parties” in Lebanon. Though the latest PM-designate was declared Oct 22, a government is absent still given no consensus on number of portfolios, ministers and the like.

- Private sector bank deposits in Lebanon declined by USD 30.4bn to USD 142.2bn in the 13-month period till Sep, given deposit outflows as well as repayment of loans. The central bank governor stated that Lebanese citizens are hoarding close to USD 10bn in cash leading to a liquidity crunch.

- Lebanon has gone into a 2-week lockdown from Nov 14 till Nov 30, after the localized lockdown failed to have the desired effect.

- Oman’s health minister confirmed that 40% of the population would receive vaccination when it first arrives, by end of this year. Priority would be given to front line workers, checkpoints’ employees, people with chronic diseases, and the elderly.

- Travel, hospitality and tourism sector grew by 4.9% yoy to contribute OMR 1.293bn to Oman’s economy last year, according to the the National Centre for Statistics and Information. Tourists spent OMR 684.7mn in 2019 from OMR 364.8mn in 2015, clocking an annual average increase of 17%.

- Saudi Arabia grew by 1.2% qoq in Q3 (Q2: -4.9%), as per its first ever “flash estimates” for GDP. In yoy terms, growth declined by 4.2%.

- Saudi Arabia’s PIF will inject SAR 150bn (USD 40bn) into the economy in 2021 and 2022, according to the Crown Prince. He disclosed that the PIF has doubled its assets to over SAR 1.3trn and is on track to achieve its SAR 7trn target by 2030. It was also revealed that Saudi Arabia had collected SAR 247bn from anti-corruption campaigns over the past 3 years, equivalent to 20% of total non-oil revenue.

- In Oct 2020, Saudi Arabia issued licenses to 124 industrial units, adding close to 3k Saudi workers and with total investments reaching SAR 56bn.

- The Red Sea Development Co – Saudi Arabia’s tourism project- plans to have 16 hotels ready by end–2023, two more than initially planned, on hopes for a V-shaped recovery in tourism.

- Driven by an uptick in sales, combined profits of 14 Tadawul-listed Saudi cement companies grew by 39.32% yoy in Q3 2020.

- The MENA region witnessed just one IPO in Q3 (Amlak International in Saudi Arabia) valued at USD 115.9mn, according to EY’s MENA IPO Eye report. This follows no listings in Q2 – the first time in more than 10 years.

UAE Focus

- Dubai non-oil sector activity slowed in Oct: PMI declined to 49.9 from Sep’s 51.5, with the overall level of confidence at the weakest in the series’ eight-year history. The decline was widespread with construction and travel and tourism posting output declines while job cuts continued.

- UAE non-oil trade fell by 16.2% yoy to AED 658.3bn in H1 2020; gold topped the list of non-oil commodities trade at AED 104bn, accounting for 15.7% of total trade in H1. China, Saudi Arabia, India, US and Switzerland were the top 5 trading partners, constituting 37.1% of total.

- Abu Dhabi’s non-oil trade touched AED 151.18bn in Jan-Sep 2020. Saudi Arabia, US, Italy, China and Hong Kong were top trade partners while pearls, precious stones and precious metals topped the list of commodities.

- UAE’s VAT revenue amounted to AED 11.6bn (USD 3.15bn) in Jan-Aug this year, disclosed the finance ministry, while excise tax amounted to AED 1.9bn (+47% yoy). Tax revenues last year had increased by 7% yoy to AED 31bn. Separately, it was revealed that the number of accredited tax agents increased by 10% yoy to 515 in Jan-Oct.

- Fitch rates UAE at AA- with a stable outlook in advance of issuing its first Federal bond, though warning of “significant indebtedness” of Dubai’s entities including GREs (at close to 80% of GDP).

- E-commerce transactions will account for 28.2% of total card payments in the UAE, given change in habits due to the Covid19 pandemic, according to a Dubai Economy-Visa study. The UAE not only had the biggest annual spend per online shopper at $1,648 in the wider MENA and South Asia region, but also had an average transaction value of USD 122 between 2019 and 2020 (vs USD 76 in mature markets and USD 22 in emerging markets). The report can be accessed here.

- Omani citizens will be permitted to enter the UAE via land ports from Nov 16th, provided a negative PCR test result is presented.

- Etihad Airways is planning to ground its A380 fleet “indefinitely”, reported Reuters, due to the slow recovery in travel. The company was also planning to undertake a new round of job cuts (Reuters source revealing close to 1000 cabin crew jobs). Separately, Bloomberg reported that Dubai was seeking a buyer for the airport’s cooling system operations in a bid to reduce costs and shore up finances.

- UAE’s nation brand, valued at USD 672bn, increased to 18th spot globally, according to the Nation Brands 2020 report. The report, which ranks US, China and Japan as the top three valuable nation brands, found that the top 100 nation brands lost an estimated USD 1trn of brand value this year due to the Covid19 pandemic.

Media Review

The struggle for America’s soul

https://magazine.newstatesman.com/editions/com.progressivemediagroup.newstatesman.issue.NS202046/data/212649/index.html

Saudi Crown Prince Says Reforms Saved Budget as Revenue Plunged

https://www.bloomberg.com/news/articles/2020-11-12/saudi-crown-prince-says-reforms-saved-budget-as-revenue-plunged

Dr. Nasser Saidi on The National’s Beyond the Headlines: How will Joe Biden change US policy in the Middle East?

https://www.thenationalnews.com/podcasts/beyond-the-headlines/beyond-the-headlines-how-will-joe-biden-change-us-policy-in-the-middle-east-1.1110861

Employees working from home should pay ‘privilege’ tax to support workers who cannot: Deutsche Bank

https://www.bbc.com/news/business-54876526

Powered by: