Download a PDF copy of this week’s insight piece here.

PMIs & Recovery (?) Indicators in the Middle East/ GCC: A pictorial representation

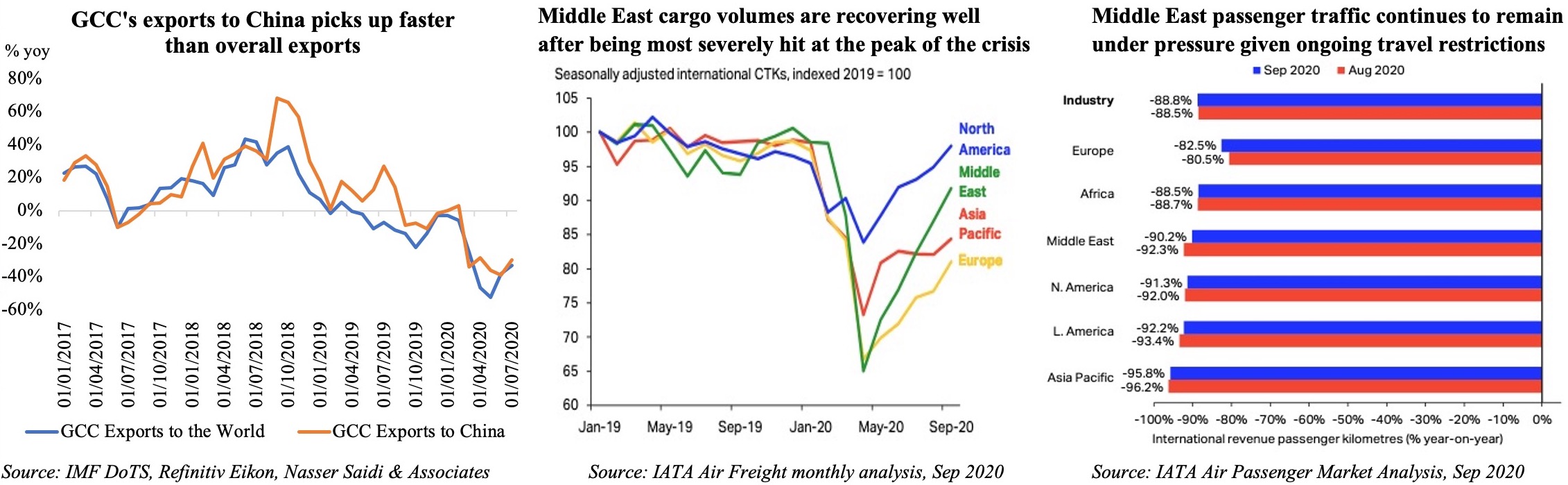

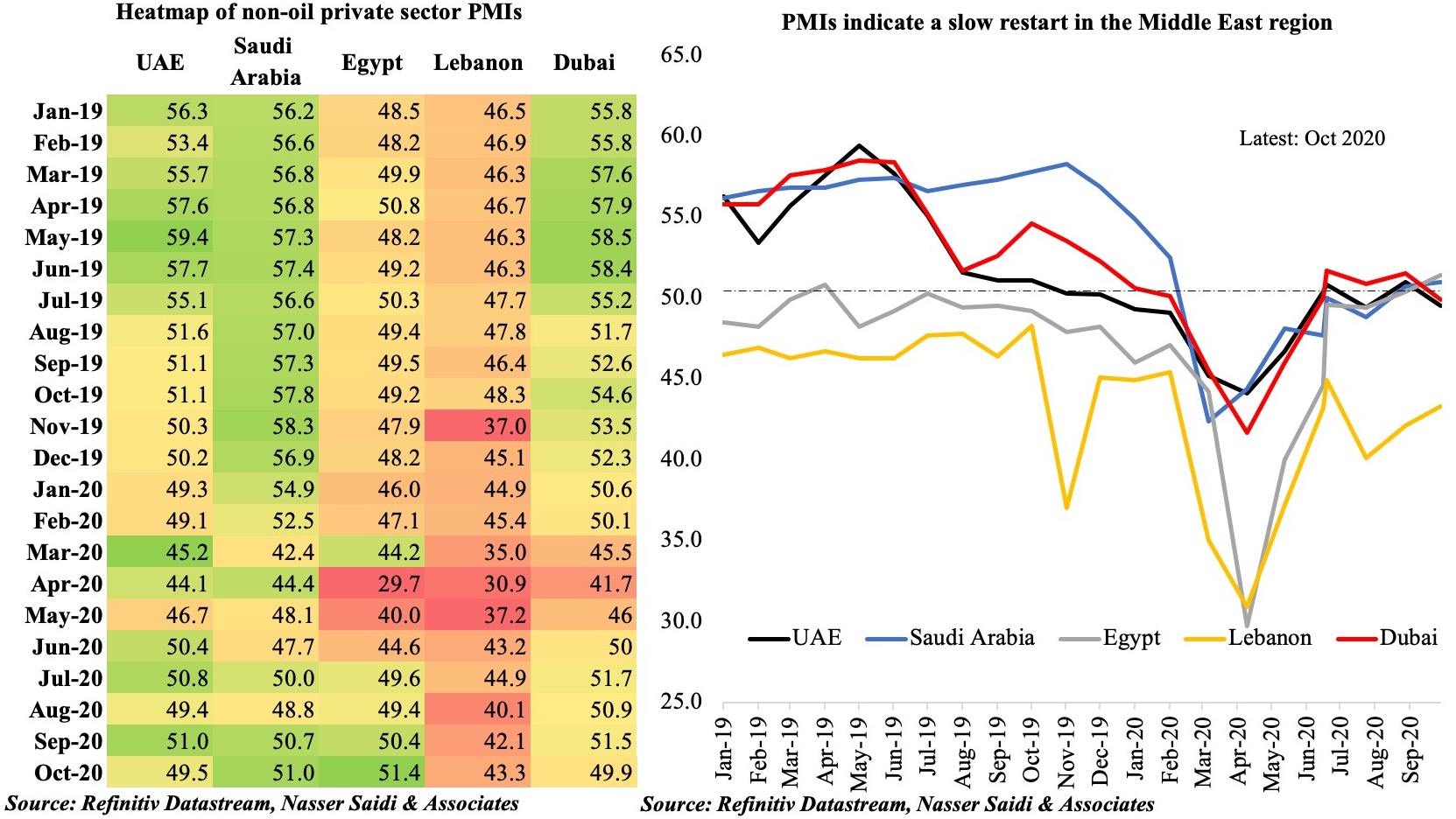

Chart 1: PMIs in the Middle East/ GCC

PMIs in the Middle East/ GCC have not kept pace with the increases seen across the US/ Europe/ Asia post-lockdown. Non-oil sector activity has been subdued given sector composition, a majority of which are still negatively impacted by the outbreak: tourism, wholesale/ retail & construction. Job cuts continue as part of overall cost-cutting measures & business confidence remains weak.

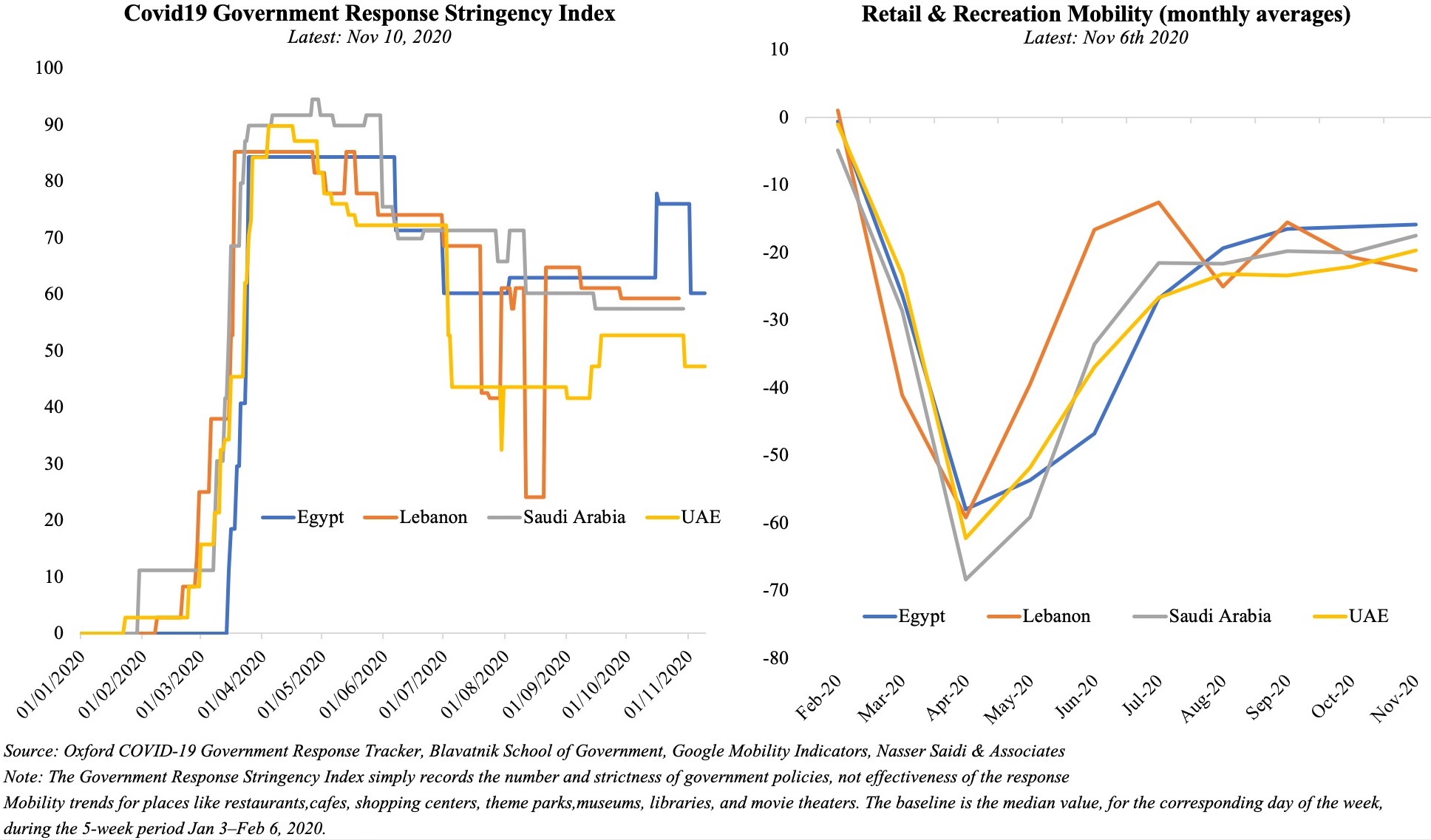

Chart 2: Stringency Index & Mobility

Most economies in the Middle East are re-opening in phases, with restricted lockdowns where cases are surging. The UAE remains one of the most open (least stringent) nations in the region.

However, when it comes to mobility, the UAE seems to be a few steps behind its regional peers. This seems to be in line with a recent McKinsey finding that countries focused on keeping virus spread near zero witnessed their economies moving faster. So, ending lockdowns and reopening the country is not sufficient for resumption of economic activity. Another potential reason could be that increased use of e-commerce is leading to less footfall in retail and recreational facilities.

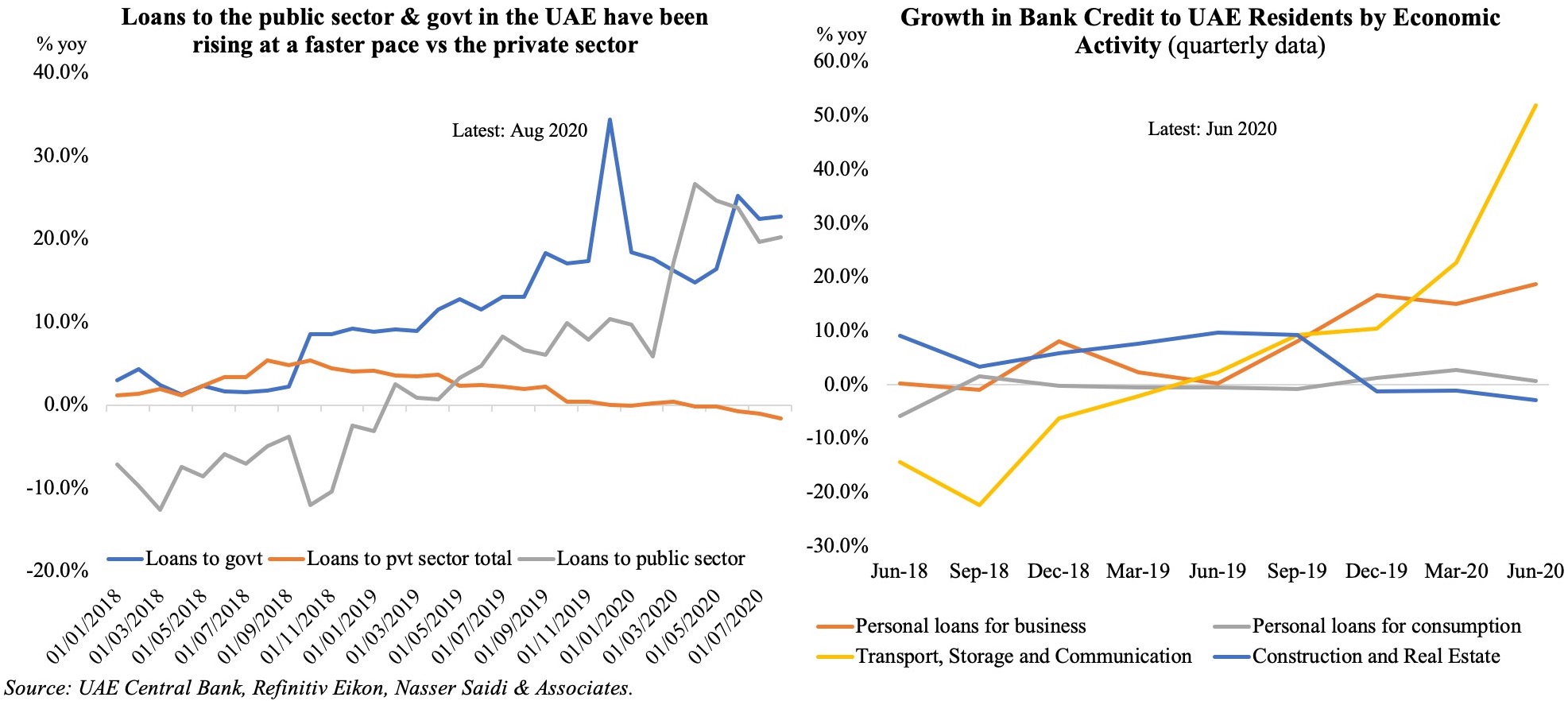

Chart 3: Indicators of economic activity in the UAE

Last week, the UAE central bank disclosed that its Targeted Economic Support Scheme directly impacted more than 321k beneficiaries including 310k distressed residents, 1,500 companies and 10k SMEs. The overall pace of lending to GREs (+23% yoy during Apr-Aug 2020) and the government (+20.3%) have outpaced lending to the private sector (-0.7%).

UAE banks still lent most to the private sector (70.1% of total as of Aug 2020 vs. 76% in end-2018 and 72% in end-2019), while the public sector & government together account for close to 30% of all loans in Aug 2020 (vs. 25% a year ago). Breaking it down by sector, there has been upticks in credit to both transport, storage and communication (+51.9% yoy as of end-Jun) as well as personal loans for business (+18.7% yoy) while construction sector has seen a dip (-2.9%).

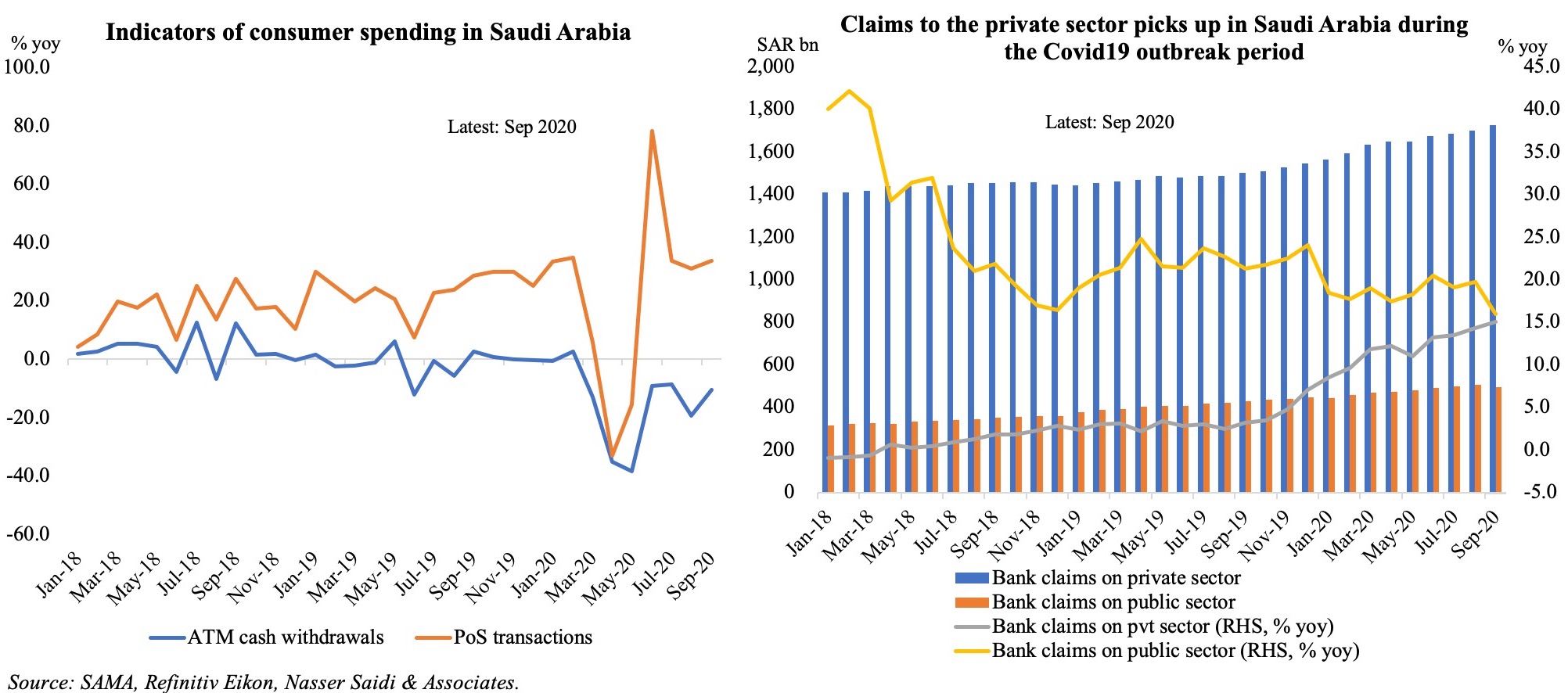

Chart 4: Indicators of economic activity in Saudi Arabia

In contrast to the UAE, loans to the private sector has been edging up in Saudi Arabia, growing by an average 13.2% yoy during the Apr-Sep period. Proxy indicators for consumer spending – ATM withdrawals and PoS transactions – are on the rise post-lockdown. Ahead of the VAT hike to 15% in Jul, there was a surge in PoS transactions in Jun, which has since then stabilized. By category, food and beverage and restaurants and cafes, continue to post increases.

Saudi Arabia published its first-ever flash estimates for GDP this week: showing a 1.2% qoq increase in Q3, though in yoy terms, growth was still down by 4.2%.

Chart 5: Linkages with the global economy

In linkages with the global economy, we consider

- Trade: for the GCC region, there was a significant drop in overall trade with the world during the lockdown period. While exports have started to pick up again, the pace of exports to China are relatively faster.

- Passenger traffic: though international revenue passenger kilometers in the Middle East improved slightly in Sep, it continues to be the worst affected globally in terms of year-to-date data (-68.7% till Sep), as travel restrictions remain. Resumption of domestic travel (e.g. Russia, China) has supported rebounds in some regions.

- Cargo volumes (cargo tonne-kilometers or CTKs) show a clear V-shaped recovery for the Middle East, due to “added capacity” following the peak of the crisis, according to IATA.