Download a PDF copy of this week’s economic commentary here.

Markets

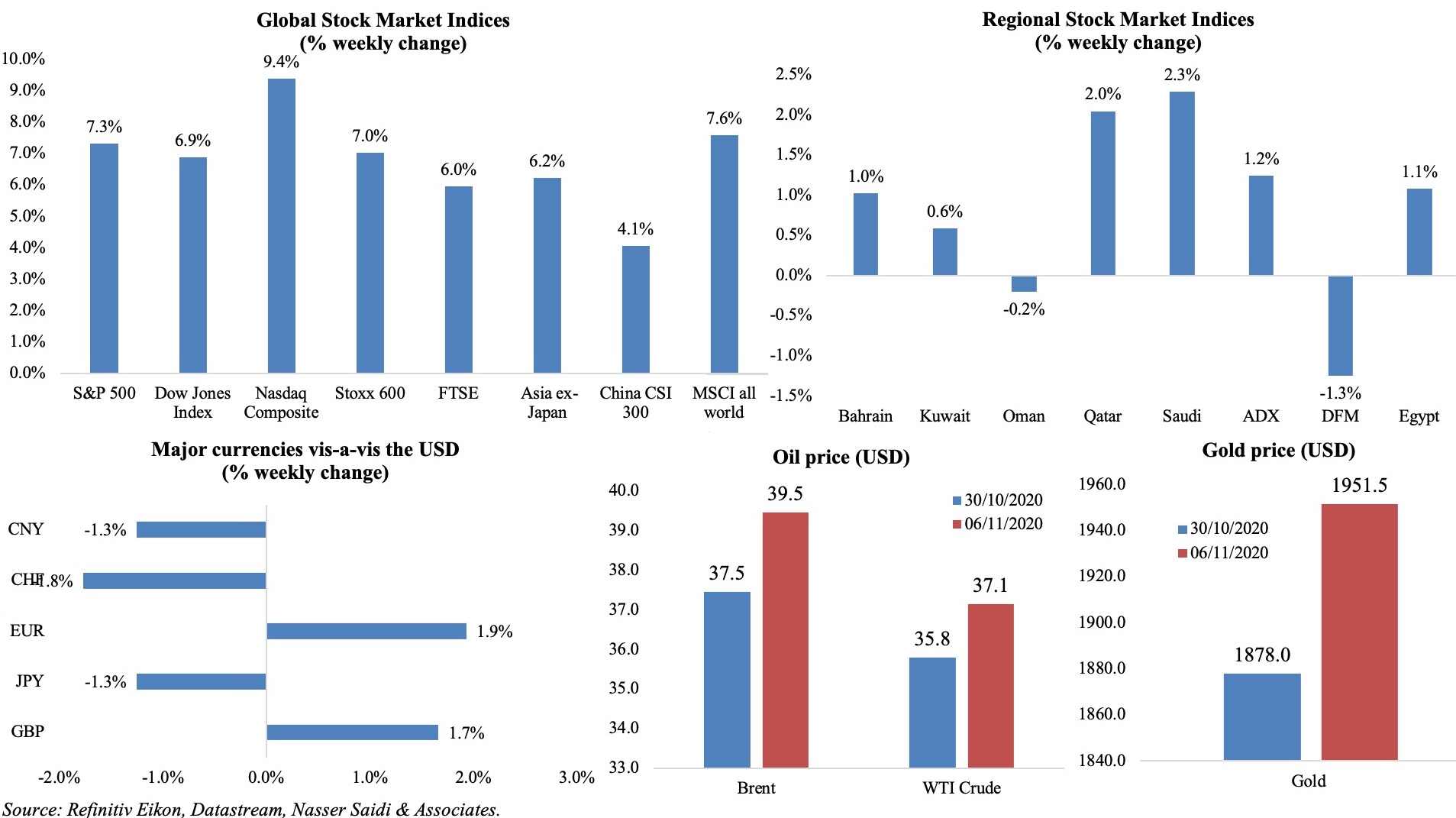

Stock markets had a good week across the globe: in the US, all markets gained while waiting for the Presidential election results; European markets posted the best weekly gain since Jun, while in Japan, the Nikkei average rose to a 29-year high; MSCI Asia Pacific (ex-Japan) touched a near 3-year high while the MSCI all-world index posted its best weekly gain in close to 7 months. In the region, most markets were higher compared to a week ago. The euro and pound gained on dollar weakness, oil prices closed below USD 40 last week, while gold price inched closer to the USD 2k mark.

Weekly % changes for last week (5-6 Nov) from 29th Oct (regional) and 30th Oct (international).

Global Developments

US/Americas:

- Non-farm payrolls grew by 638k in Oct (Sep: 672k) and the unemployment rate fell unexpectedly to 6.9% in Oct (Sep: 7.9%). Average hourly earnings by 4.5% yoy in Oct. The labour force participation rate inched up to 61.7% from 61.4% the month before.

- Private sector payrolls slowed by 365k in Oct (Sep: 753k), the lowest reported gains since Jul, with the services related businesses posting the biggest gains (+348k).

- Initial jobless claims fell by 7k to 751k in the week ended Oct 30 – the lowest initial claims total since the week of Mar 14. Continuing claims declined by 538k to a seasonally adjusted 29mn in the week ended Oct 24, a new low since the outbreak.

- Non-farm productivity increased at a 4.9% annualized rate in Q3 (Q2: 10.6%); hours worked rebounded at a 36.8% rate last quarter after plunging at a record 42.9% pace in Q2 while unit labour costs plunged by 8.9% from Q2’s 8.5%.

- Factory orders rose by 1.1% mom in Sep (Aug: 0.6%), thanks to a rebound in transport equipment (+4.1% vs -0.9%) while orders for machinery declined by 0.3%. orders for non-defense capital goods excluding aircraft inched up by 1% in Sep.

- The ISM manufacturing survey showed activity expanding to 59.3 in Oct, the most since Nov 2018, with new orders surging to the highest reading since Jan 2004 while production rose to 63 from 61 the month prior. ISM’s non-manufacturing activity index slowed to 56.6 from Sep’s 57.8 with employment staying above 50 for the second consecutive month after 6 straight moths of readings below-50.

- US Markit manufacturing PMI was revised upwards to 53.4 in Oct (preliminary reading: 53.3) – the strongest since Jan 2019. Though output and new orders growth picked up, new export orders fell for the first time since Jul due to the recent lockdown restrictions in Europe.

- Trade deficit narrowed to USD 63.9bn in Sep (from Aug’s 14-year high of USD 67bn) as exports rose by 2.6% to USD 176.4bn while imports edged up by 0.5%. Year-to-date, overall trade deficit grew by 8.6% to USD 485.6bn.

Europe:

- German factory orders grew for a 5th consecutive month, rising by 0.5% mom in Sep (Aug: 4.9%), supported by domestic orders (+2.3%) while foreign ones dropped by 0.8%, largely due to a 6% slump in purchases from the Euro Area.

- Germany’s Markit manufacturing increased to 58.2 in Oct, the strongest increase since Mar 2018, driven in part due strong domestic demand and also due to the rise in new export orders from (and sales to) Asia. Services PMI posted the first contraction in activity in 4 months, with the headline reading down to 49.5 in Oct (though higher than the preliminary estimate of 48.9).

- Industrial production in Germany grew by 1.6% mom in Sep (Aug: 0.5%), supported by the auto industry (+5.1% mom); in yoy terms, IP fell by 7.3%.

- Manufacturing PMI in the eurozone inched up to 54.8 in Oct (Sep: 53.7), the highest reading since Jul 2018. Services PMI inched up to 46.9 (preliminary estimate of 46.2) and composite PMI moved up to 50.

- Retail sales in the eurozone fell by 2.0% mom in Sep (Aug: +4.2%), with volume of retail trade decreasing by 2.6% fornon-food products, by 1.4% for food, drinks and tobacco and by 0.2%for automotive fuels. In yoy terms, retail sales were down by2% in Sep (Aug: 4.4%).

- The final UK manufacturing PMI reading was revised down to 53.7 in Oct (Sep: 54.1). Momentum slowed in both output and new order growth and employment slipped for the 9th straight month; a silver lining was that business optimism hit the highest level since Jan 2018.

- The Bank of England kept interest rates unchanged at a record low 0.1% and also announced a further GBP 150bn of support amid tighter lockdown rules in the country. The Bank expects unemployment to peak at 7.75% in the middle of next year, from 4.5% currently: this would be the highest rate since 2013.

Asia Pacific:

- China’s Caixin manufacturing increased to 53.6 in Oct (Sep: 53), the highest since Jan 2011, with business confidence at a multi-year high and total new orders rising to the highest level since 2010. Caixin services PMI surged to 56.8 (Sep: 54.8), supported by domestic demand and employment ticked up at the fastest pace since Sep 2019, while new export business slipped below-50.

- China’s export growth remained strong in Oct, up 11.4% yoy (Sep: 9.9%), while imports grew by 4.7% (Sep: +13.2%), widening the trade surplus to USD 58.44bn.

- Manufacturing PMI in South Korea picked up by 4 points to 51.2 in Sep, rising above 50 for the first time this year, as new orders increased for the first time in 9 months.

- Japan’s manufacturing PMI declined for a record 18th straight month, clocking in 48.7 in Oct (Sep: 47.7), though export orders grew for the first time in nearly 2 years (thanks to demand from the Asia Pacific region).

- Overall household spending in Japan fell by 10.2% yoy in Sep (Aug: -6.9%), the fourth largest drop ever; however, in mom terms, spending edged up by 3.8%. Separately, real wages declined by 1.1% yoy in Sep, with overtime pay and bonuses plunging.

- Indonesia fell into recession after 22 years: GDP fell by 3.49% yoy in Q3, following a 5.32% dip in Q2.

- India’s manufacturing PMI climbed to 58.9 in Oct (Sep: 56.8) – the highest reading since May 2010 – with upticks in output and new orders, as foreign demand expanded at its quickest pace since Dec 2014, though employment cuts continued for the 7th straight month.

Bottom line: With the new US President-elect announced, one of the biggest challenges for the new administration will be its strategy to contain the Covid19 outbreak, with daily cases crossing 100k for the last 4 days. Many policy changes are likely to be revealed in the next few weeks: ranging from taxes and spending to energy and climate as well as trade, foreign policy (hopefully, an end of Twitter-based policy making) and tech. Overall, the change is likely to reduce US and global policy uncertainty, on greater support for global growth, trade and investment. This will give a strong push for risk assets and markets. Europe meanwhile is reeling from its recent Covid19 surge: though not going into extreme lockdowns as before, its healthcare systems are being stretched given the record high cases. While China seems to be recovering (thanks to domestic demand) and “out of the woods” for now, slowing demand from the rest of the world is likely to slow its pace of recovery.

Regional Developments

- Bahrain approved its state budget for 2021-22, based on oil price at USD 45, generating estimated total revenues of BHD 4.624bn and overall deficits of 2.421bn. Not only does the budget expect a decline in primary deficits, but also a continued drop in government administrative expenses (by 30%) during the period.

- Occupancy levels in Bahrain’s hotels have started to recover in Aug-Sep: levels touched 22%, supported by domestic tourism (a trend visible in other GCC nations as well).

- Egypt’s cabinet approved a new law to issue sovereign sukuk last week, according to the finance minister; once approved by the Parliament and President, the country can issue its first sovereign sukuk.

- Non-oil PMI in Egypt expanded to 51.4 in Oct (Sep: 50.4), the second straight month of above-50 following 13 months below. Output and new orders growth supported activity though employment fell for the 12th consecutive month (47.8 in Oct from Sep’s 48.3).

- Egypt’s net foreign reserves rose to USD 39.22bn in Oct (Sep: USD 38.425bn); FX reserves rose by USD 827mn to USD 34.683bn in Oct, while gold reserves decreased by USD 33mn to USD 4.361bn in the same period.

- Net foreign assets of Egypt’s banking sector increased to the equivalent of about EGP 51.958bn during Sep 2020.

- Exports into Egypt increased by 4.1% yoy to USD 30.5bn in 2019, with value of non-oil exports rising by 3.9% to USD 25.5bn. Separately, Egypt’s green exports touched USD 11.2bn in 2015-2019. According to the minister of planning, green exports accounted for3% of total Egyptian exports last year, while green imports accounted for 16% of total Egyptian imports.

- International tourists’ arrival into Egypt dived by 62.3% yoy leading to a 54.9% plunge in tourism receipts in H1 this year, according to the World Tourism Barometer.

- Egypt will become the top recipient of remittances this year, at a value of USD 24.4bn or 6.7% of GDP, according to the latest Migration and Development report from the World Bank.

- Egypt and Iraq agreed to establish an oil-for-reconstruction mechanism whereby companies would undertake development projects in return for oil.

- Iraqi oil exports increased by 10.1% mom to 2.876mn barrels per day in Oct; revenue from oil touched USD 3.43bn in Oct at an average price per barrel of USD 38.48.

- Iraq unveiled a “single window” for business registration, an entirely contactless registration, regulation and reporting portal to improve the business environment.

- The central bank of Jordan extended support for SMEs by allowing them to defer instalments until end-2021. Furthermore, the regulations of the programme at the Jordan Loan Guarantee Corporation was amended to help those negatively affected by the outbreak.

- Jordan imported a total of 262k barrels of Iraqi crude oil in Oct at an average 8,448 barrels per day. A total 3.219 mn barrels of Iraqi crude oil were supplied during Sep 2019-Oct 2020.

- Kuwait’s State Audit Bureau reported that, in the absence of a debt law, the country has no option but to borrow to finance its deficits but “under the presence of controls and a package of financial, economic and legislative reforms”.

- Private sector deposits in Kuwait inched up by 4.8% yoy to KWD 38bn during Jan-Aug 2020. Dinar deposits accounted for 94.3% of total deposits at end-Aug (end-2019: 93%).

- Lebanon extended the deadline for the central bank to provide all data required for a forensic audit by 3 months, disclosed the caretaker finance minister; only 42% of the documents requested had been provided, citing existing legislation and banking secrecy. Separately, the central bank stated that the government should be the one submitting full accounts to a forensic audit.

- US sanctioned Lebanon’s Free Patriotic Movement President for his involvement in corruption and embezzlement of public funds among other charges.

- Oman’s National Plan for Fiscal Balance 2020-2024 aims to bring the fiscal deficit down to 1.7% of GDP by 2024, from a preliminary deficit of 15.8% this year. Non-oil revenues are expected to account for 28% of total revenues this year and estimated to rise to 35% by next year. Oman will introduce VAT next year and plans to impose income tax on high earners to boost non-oil revenues. Five sectors have been identified for expansion (based on existing resources): agriculture and fisheries, mining and energy, transportation and logistics, manufacturing, and tourism.

- FDI into Oman increased by 5.9% yoy to OMR 15.064bn in Q1 this year, with UK, US, UAE and Kuwait the most significant investors in the country.

- Measures to support the real estate sector have been initiated in Oman including a reduction in real estate fees to 3% (from 5%) as well as licensing of leasing operations leading to ownership or sale in installments and permission to add upper floors in buildings in exchange for a fee among others.

- Qatar’s state budget will be based on the assumption of an oil price of USD 40 a barrel, disclosed the Emir. He also stated that fiscal deficit in H1 this year stands close to QAR 1.5bn (USD 412mn).

- Qatar plans to hold an election for its Shura Council for the first time ever in Oct 2021: members were directly appointed by the Emir till now.

- Non-oil sector PMI in Saudi Arabia improved to 51 in Oct (Sep: 50.7) – the highest reading in 8 months – with new orders rising for a second straight month though employment continues to decline.

- Saudi Arabia rolled out a spate of labour reforms under its “Labour Relation Initiative”, effective Mar 2021, giving more rights to expat workers including permitting employees to change their employer and requesting Exit/Re-Entry Visas without the employer’s consent.

- Money supply in Saudi Arabia (M3) hit a record high of SAR 2.088trn in Q3 this year, rising 10.6% yoy and 1.78% qoq.

- Consumer spending in Saudi Arabia fell by 5.57% yoy to SAR 721.18bn in Jan-Sep 2020. Cash withdrawals declined by 15.4% yoy to SAR 469.41bn while point of sales surged by 20.53% to SAR 251.78bn.

- Gross public external financing needs in MENA is forecast to touch USD 100bn in 2021, driven largely by the GCC, according to the IIF. Non-resident capital inflows to the region is also estimated to edge up slightly to USD 177bn next year, equivalent to 6.6% of GDP.

UAE Focus

- UAE central bank disclosed that its Targeted Economic Support Scheme directly impacted more than 321k beneficiaries including 310k distressed residents, 1,500 companies and 10k SMEs.

- PMI in the UAE fell to 49.5 in Oct (Sep: 51), with the new orders sub-index falling to 49.3 (for the first time since May) while business sentiment towards the 12-month outlook was at a joint-record low.

- The UAE 2021 budget was set at AED 58bn, down 5.8% from this year’s record high budget: it sets AED 21.3bn towards government affairs, AED 26.04bn in social projects and AED 3.93bn in federal projects.

- Inflation in the UAE fell by 2.36% yoy and 0.5% mom in Sep. Prices of food and restaurant costs were higher by 4.2% and 3.1% yoy respectively, but were more than offset by declines in recreation and culture (-28%) and transportation costs (-6.9%).

- Trade surplus between the UAE and GCC nations (excluding Qatar) rose to AED 5.37bn in Q1 this year, thanks to an increase in exports to AED 17.83bn. Among the 4 nations, top trade partners were Saudi Arabia, Oman, Kuwait and Bahrain.

- Bilateral trade between Dubai and China grew by 50% yoy to AED 2.42bn in Jan-Aug 2020. During this period, the total number of certificate of origins issued for China-bound shipments reached 1,936 certificates – twice the number from a year ago.

- Net investment by the federal government and local governments in non-financial assets surged by 40% yoy to AED 32.2bn in H1 this year, according to the Ministry of Finance.

- UAE’s federal entities posted total revenues of AED 40.16bn (USD 10.94bn) in Q3, expenditures of AED 36.69bn, resulting in a surplus of AED 3.48bn.

- The UAE Federal Tax Authority, in coordination with the Ministry of Finance, will issue digital Tax Residency and Commercial Activities Certificates from Nov 14th onwards, reported WAM.

- The UAE has been ranked second globally as a source of remittances, according to the World Bank, accounting for 10.7% of GDP. US topped the list at USD 71bn.

- UAE announced an overhaul of the existing legal system that sees changes to existing laws including family, civil and criminal law: this includes changes to inheritance laws, judicial procedures (provision of translators) and alcohol consumption (ending the alcohol license system) among others.

Media Review

The Crisis is Not Over, Keep Spending (Wisely)

https://blogs.imf.org/2020/11/02/the-crisis-is-not-over-keep-spending-wisely/

China’s “dual-circulation” strategy means relying less on foreigners

https://www.economist.com/china/2020/11/07/chinas-dual-circulation-strategy-means-relying-less-on-foreigners

Rescuing U.S. Foreign Policy After Trump By Joseph R. Biden, Jr.

https://www.foreignaffairs.com/articles/united-states/2020-01-23/why-america-must-lead-again

This is how Republicans keep their power: Fareed Zakaria (video)

https://youtu.be/VBgw-eEK30w

Powered by: