Download a PDF copy of this week’s economic commentary here.

Markets

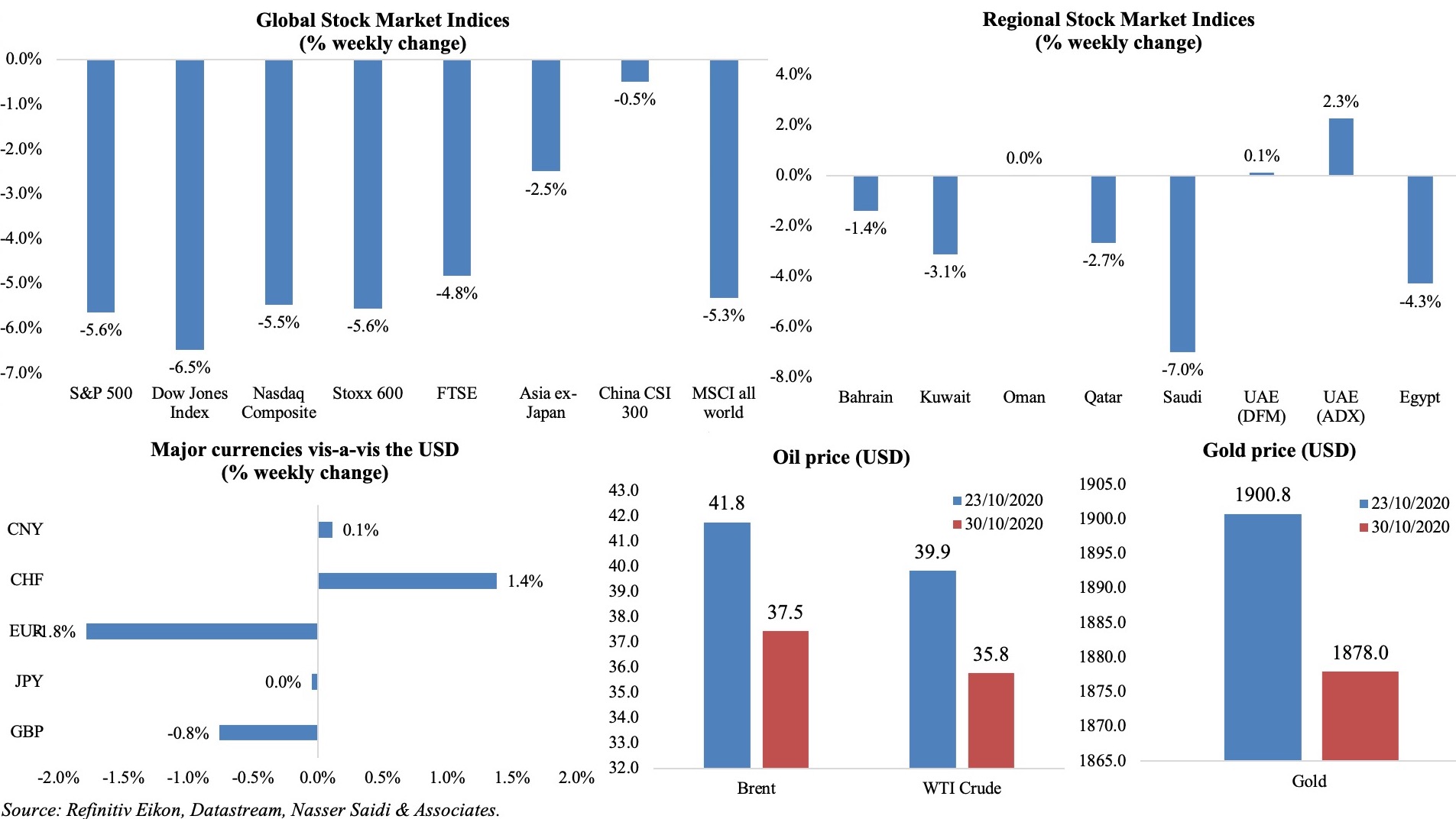

Stock markets took a tumble last week, ahead of the US election and resurgence of Covid19 cases in Europe leading to new lockdowns. US Dow Jones industrial average was down 6.5% this week, while European stock markets suffered their joint worst week in seven months: Stoxx 600 has tumbled by 5.6% this week; FTSE down 4.8% worst since Jun. The MSCI All Country World index of global equities declined 5.3%, its worst weekly sell-off since Mar. Regional markets were mostly subdued last week, mirroring global counterparts’ performance and due to disappointing earnings results. The euro slid to a 4-week low last week, while oil prices fell by a massive 10% compared to a week ago on demand concerns, while gold prices declined.

Weekly % changes for last week (29-30 Oct) from 22nd Oct (regional) and 23rd Oct (international).

Global Developments

US/Americas:

- Q3 GDP accelerated at a 33.1% annualized pace from a 31.4% plunge the quarter before, supported by a rise in business and residential investment alongside stronger consumer activity and exports. Core PCE increased by 3.5% qoq in Q3 (Q2: -0.8%). This pace is unlikely to be sustained, given a negative impact from the resurgence in Covid19 cases and since most stimulus programs have ended.

- Both personal income and spending gained in Sep: personal income was up by 0.9% mom thanks to employment gains and higher pay while spending rose for the 5th consecutive month (+1.4%).

- Chicago PMI inched down to 61.1 in Oct, though from Sep’s near-two-year high of 62.4. Breaking down by component, production recorded the largest decline while new orders – the only category with a monthly uptick – rose to the highest since Nov 2018.

- The University of Michigan index of consumer sentiment increased to 81.8 in Oct, marginally higher than the initial estimate and Sep’s 80.4. However, confidence is 14.3% lower vs Oct 2019.

- Durable goods in Sep increased by 1.9% mom (Aug: 0.4%), driven by a 4.1% rebound in orders for transportation equipment (Aug: -0.9%). Non-defense capital goods orders excluding aircraft eased to 1% (Aug: 2.1%).

- New home sales declined unexpectedly by 3.5% mom to 959k in Sep; in yoy terms, sales surged by 32.1%. Pending home sales fell by 2.2% mom in Sep (Aug: 8.8%). The housing market however remains supported by record low mortgage rates and a greater demand during the outbreak for standalone houses and more space.

- S&P Case Shiller home price indices rose by 5.2% in Aug (Jul: 4.1%) – the biggest gain in more than 2 years – as a result of an uptick in demand amid supply shortages.

- US goods trade deficit narrowed to USD 79.37bn in Sep (Aug: USD 83.11bn): exports of goods rose USD 3.2bn, while imports fell USD 0.5bn.

- Initial jobless claims fell by 40k to 751k in the week ended Oct 24 – the lowest initial claims total since the week of Mar 14. Continuing claims declined by 709k to a seasonally adjusted 7.75mn in the week ended Oct 17.

Europe:

- The ECB signaled more easing ahead, stating that risks were “tilted to the downside”; with resurgence in Covid19 cases, European nations are imposing more lockdowns. The ECB kept its deposit rate at -0.5% and held its emergency bond-buying plan at EUR 1.35trn.

- Eurozone GDP surged by 12.7% qoq in Q3 (Q2: -11.8%), with better-than-expected results from France (+18.2%), Spain (+16.7%), Germany and Italy (+16.1%). The wider EU expanded by 12.1% in Q3. GDP in Germany grew by a record 8.2% in Q3 but down by 4.1% yoy (Q2: -11.3%).

- Germany’s IFO business climate edged down to 92.7 in Oct (Sep: 86.7) – the first fall after 5 straight rises – and so did expectations (95 in Oct from 97.4 in Sep); in contrast, the current assessment improved to 90.3 from 89.2 the month before.

- Inflation in Germany stayed negative in Oct, at -0.2% yoy, unchanged from Sep. The harmonized index dropped to -0.5% yoy (Sep: -0.4%).

- Retail sales in Germany fell by 2.2% mom in Sep (Aug: +1.8%); retail sales were up by 6.5% yoy, supported by food, beverages and tobacco (+6.8%), supermarkets (+7%), and non-food (6.5%). Compared to Feb (pre-pandemic), retail sales were 2.8% more in Sep.

- Unemployment rate in Germany unexpectedly slowed to 6.2% in Oct (Sep: 6.3%). Eurozone unemployment remained steady at 8.3% yoy.

Asia Pacific:

- China’s official manufacturing PMI was stable at 51.4 in Oct (Sep: 51.5), but the subindex for small manufacturing companies fell to 49.4 in Oct (Sep: 50.1). Non-manufacturing PMI increased to 56.2 in Oct (Sep: 55.9) and within the non-manufacturing service sector sentiment rose to 55.5 (55.2).

- The Bank of Japan left rates unchanged while lowering its economic growth and inflation forecasts. It expects the economy to contract by 5.5% this year (from an estimate of 4.7% earlier) while inflation is forecast to decline by 0.6%.

- Japan leading economic index increased to 88.4 in Aug (Jul: 86.7), the highest since Feb, while coincident index inched up to 79.2 (78.3).

- Inflation in Tokyo was -0.3% in Oct (Sep: 0.2%). Core CPI excluding food and energy fell by 0.2% (Sep: 0%).

- Industrial production in Japan increased by 4% mom in Sep but fell by 9% yoy (Aug: -13.8%); index of industrial shipments rose 3.8% to 90.4, while inventories fell 0.3% to 97.7.

- Unemployment rate in Aug edged up to 3% in Japan (Jul: 2.9%); the number of unemployed persons topped 2mn for the first time since May 2017.

- Retail trade in Japan dropped by 8.7% yoy and 0.1% mom in Sep, down for a 7th consecutive month. Large retailer sales plummeted by 13.9% in Sep (Aug: -3.2%)

- Korea’s preliminary GDP for Q3 increased by 1.9% qoq, rebounding from contractions in the previous two quarters and the steepest quarterly increase since 2010 (after the financial crisis); but in yoy terms GDP was down 1.3%.

- Singapore industrial production grew by 10.1% mom and 24.2% yoy in Sep (Aug: +15.4% yoy) – the second straight yoy rise and the strongest growth since Dec 2011. Pharmaceuticals were up by 113.6% and electronics picked up by 30.1%.

- Unemployment rate in Singapore rose to 3.6% in Sep (Aug: 3.4%); though the pace of increase slowed, the total number of unemployed residents to 112,500, of which 97,700 are Singaporeans.

Bottom line: A big week ahead with US elections results: the Vix “fear gauge” index climbed to almost 40 on Fri, double its long-run average, after growing fears of a contested election and that a potential Trump loss might lead to widespread civil unrest. Last week, most nations published better-than-expected GDP numbers for Q3, picking up from the dismal Q2 results. This feat is unlikely to be repeated in Q4 given the current trend of rising Covid19 cases and new lockdowns across Europe. The main questions are how severe this contraction will be compared to Q2, and how the countries plan to finance any stimulus packages.

Regional Developments

- Bilateral non-oil trade between Bahrain and Saudi Arabia accelerated by 43% yoy to USD 688.4mn in Q3 2020. In Jan-Sep this year, two-way trade surged by 12% to USD 2.17bn.

- A statement disclosed that women account for 41% of the Bahrain Bourse workforce and 30% of leadership roles in the exchange.

- Egypt’s trade deficit narrowed by 20.5% yoy to USD 3.02bn in Aug, as exports declined by 9.4% to USD 1.91bn and imports by 16.6% to USD 4.93bn.

- Trade between Egypt and Saudi Arabia declined by 4.2% yoy to USD 6.8bn in 2019, with exports to Saudi rising to USD 1.68bn in 2019 (2018: USD 1.43bn). Egypt’s top export market was the UAE (USD 2.05bn).

- Money supply in Egypt increased62% yoy to EGP 4.76trn in Sep.

- Egypt’s external debt increased by 12.2% qoq and 14.8% yoy to USD 123.49bn at end-Jun.

- Foreigners have increased investments in Egypt’s treasury bills and bonds to USD 21.1bn in mid-Oct from USD 10.4bn last May, reported Bloomberg, citing the head of debt management unit at the ministry of finance. These were still below the USD 27.8bn held in Feb, prior to the Covid19 outbreak.

- Remittances into Egypt grew by 10.3% yoy to USD 27.8bn in the 2019-20 financial year, according to the central bank. Remittances in the last quarter (Apr-Jun) dropped by 10.5% yoy to USD 6.2bn.

- Egypt is disbursing the second and third batches of emergency aid, estimated at EGP 317.31mn, to 146,610 tourism workers from 2,204 tourism establishments who were affected by the Covid19 crisis. The aid represents 100% of workers’ basic wage of EGP 600 minimum.

- About EGP 136.4bn has been earmarked for Egypt’s urban development sector in the fiscal year 2020-21: this is equivalent of 18.5% of total investment. This is split into three parts: real estate with the lion’s share of 45.6% (EGP 62.1bn), followed by construction works (28.5%) and water and sanitation projects (25.9%).

- Cement sales in Egypt accelerated by 10% mom to 3.8mn in Sep – the highest demand for cement since Apr this year; in yoy terms, however, this constitutes a 12.5% drop. Separately, exports of cement had declined by 19% yoy to USD 90mn in Jan-Aug this year.

- Egypt’s auto sector has been hit by the Covid19 outbreak: with closure of government and notary offices across the country, only 130k units have been sold in Jan-Aug.

- Jordan and the IMF have reached a staff-level agreement on the first review of the authorities’ economic reform programme supported by the Extended Fund Facility arrangement. Following an approval by the IMF Executive Board, an amount of around USD 146mn will be released, bringing the total disbursements to USD 687mn this year.

- Jordan’s oil import bill plummeted by 50.1% yoy to JOD 836.5mn in Jan-Aug this year. Trade deficit during the period narrowed by 22.7% yoy to JOD 4.076bn, with the fall in imports (down by 15.3% to JOD 7.7bn) outpacing the 5.1% drop in exports.

- Kuwait’s central bank maintained its discount rate at 1.5% while lowering repo rates and other rates across the interest rate yield curve up to the 10-year term by 0.125%.

- Kuwait’s oil minister clarified that the country will “support whatever necessary joint decisions will be agreed to under the OPEC+ framework”, after being reported that the nation wanted to find ways to increase supply by reviewing their output targets.

- Reuters reported that the restructuring consultancy Alvarez & Marsal was yet to receive all the information requested to conduct a forensic audit of Lebanon’s central bank, with the latter citing that some of the requests “violated money and credit law as well as banking secrecy”. The central bank had confirmed providing “all the documents and information which Lebanese laws allow” earlier this month.

- New car sales in Lebanon stood at just 338 cars in Sep compared to 1,700 in Sep 2019.

- Oman received USD 1bn in direct financial support from Qatar, reported FT. Discussions are ongoing with the UAE, including commercial loans or investments in projects.

- Oman will raise costs of expatriates’ employment visa and work permit renewal by 5%, with the additional funds redirected towards financing the Job Security System. The JSS will start operating from Nov 1st.

- The number of expats in Oman dropped by 16.4% or 263,392 persons in Jan-Sep this year. Expat employees in the government sector has fallen by more than one-fifth and by 17.1% in the private sector.

- Budget deficit in Saudi Arabia touched SAR 40.768bn (USD 10.87bn) in Q3, as oil revenues plummeted by 30% yoy to SAR 92.582bn thanks to a combination of lower oil prices and production cuts. Compared to Q2, the deficit more than halved, supported by the increase in total non-oil revenues (+63% yoy, supported by the VAT hike). Government spending was up 7% yoy to SAR 256.345, with subsidies rising by more than 3 times to SAR 8.189bn. Saudi Arabia expects budget deficit to narrow to SAR 145bn or 5.1% of GDP in 2021.

- Saudi Arabia’s Tadawul will triple the daily trading limits for newly listed companies from Nov 8: applicable for the first 3 days on the main market and on an ongoing basis for all listed firms in the parallel market Nomu.

- Trade surplus in Saudi Arabia narrowed by 61.4% yoy to SAR 107.57bn in Jan-Aug 2020. Both exports and imports fell during the period, by 35.9% and 17.3% respectively. In Aug alone, China, Japan and UAE were the top trading partners.

- Bloomberg (citing Maaal) reported that Saudi Arabia was working to abolish the “Kafala” sponsorship system (with rules to be published this week), though the Ministry of Human Resources and Social Development responded that it is “working on many initiatives to organise and develop the labour market, and it will be announced as soon as it is ready”.

- SAMA’s assets declined by 5% yoy and 0.7% mom to SAR 1.82trn in Sep. Foreign exchange reserves dropped by 2.5% mom to SAR 265.89bn in Sep. The value of point-of-sale transactions increased by 33.7% yoy to SAR 33.21bn in Sep.

- Mortgage loans in Saudi Arabia touched 208,505 contracts (+90% yoy), valued at more than 96.7bn (+84%) until Q3 2020.

- Remittances from Saudi Arabia increased by 18.5% yoy to SAR 110.24bn in Jan-Sep this year. In Sep alone, remittances were up 28.6% to SAR 13.21bn.

- Saudi Arabia is planning an SAR 8bn (USD 2.1bn) boost for its space programme by 2030.

- Saudi Arabia will open the Umrah pilgrimage to Mecca for Muslims from other countries from Nov 1st.

- Saudi Arabia plans to expand its airports’ capacities to 100mn passengers per year by 2030, revealed the country’s minister of investment. Just Umrah pilgrims are expected to rise from 8mn to 30mn per year in the coming years.

- Nationalisation rate in Saudi Arabia’s private sector increased to 21.54% in Q3 vs 20.4% in Q3 2019.

UAE Focus

- UAE set up a National Covid-19 Crisis Recovery Management and Governance Committee to support and boost businesses in the post-Covid era. The committee will also establish an electronic data link for digital indicator-based statistics, in addition to identifying the financial and economic resources required for supporting the recovery phase.

- Abu Dhabi’s non-oil foreign trade tumbled by 9.5% yoy to AED 80.2bn in Jan-May 2020; non-oil exports were down by 7.2% to AED 25bn while imports edged up by 0.4% to AED 42.24mn during the period.

- S&P downgraded Sharjah and Ras Al Khaimah’s ratings, citing a rise in government debt burden amidst a contraction in growth, though both were awarded a stable outlook. Sharjah’s long-term foreign and local currency sovereign credit ratings was revised to ‘BBB-’ from ‘BBB’ and its short-term rating to ‘A-3’ from ‘A-2’. Ras Al Khaimah’s long-term rating was revised down to ‘A-’ from ‘A’ and the short-term rating to ‘A-2’ from ‘A-1’.

- Dubai launched Nasdaq growth market aimed at attracting growth companies, to support SMEs looking to expand their businesses by attracting investors to finance projects.

- Japan imported 20.173mn barrels of crude oil from UAE in Sep 2020, accounting for 31.4% of Japan’s total crude imports. Saudi Arabia provided 25.721mn barrels, or 40.1% of the total and Kuwait 5.139mn barrels or 8.0%.

- Dubai announced 29 projects including green spaces and gardens at a cost of AED 2bn, in addition to the development of beaches (at a cost of AED 500mn), to improve the quality of living in the country.

Media Review

Covid19 underpins the need for economic diversification and structural reforms in MENA

https://www.thenationalnews.com/business/economy/covid-19-underpins-need-for-economic-diversification-and-structural-reforms-in-mena-imf-says-1.1100759

Europe grapples with what went wrong in Covid-19 resurgence

https://www.ft.com/content/88113840-757e-4b7b-8be6-f8c2ce942021

China leads again

https://www.project-syndicate.org/commentary/china-strong-economic-recovery-versus-american-weakness-by-stephen-s-roach-2020-10

Japan promises to be carbon-neutral by 2050

https://www.economist.com/asia/2020/10/29/japan-promises-to-be-carbon-neutral-by-2050

Eight steps to pull the Lebanese economy back from the brink

https://www.thenationalnews.com/opinion/comment/eight-steps-to-pull-the-lebanese-economy-back-from-the-brink-1.1100684

Powered by: