Download a PDF copy of this week’s economic commentary here.

Markets

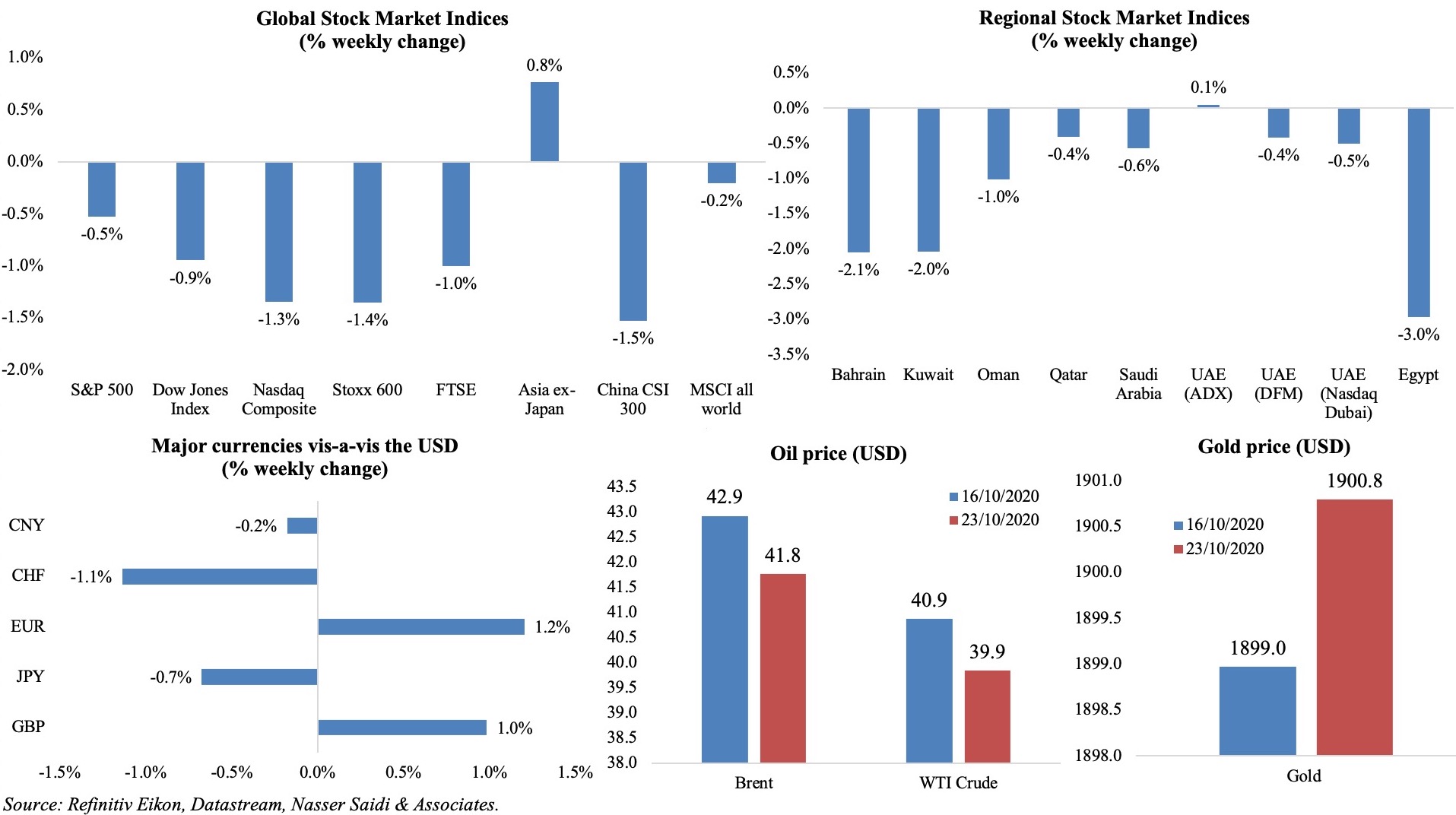

Most stock markets across the globe closed lower compared to the past week as investors braced for the US elections and further uncertainty from rising Covid19 cases. European markets recovered towards end of the week on better-than-expected earnings numbers, especially from financial stocks. Regional markets mirrored their global counterparts, with Egypt declining the most (-3%). On the currency front, the euro and pound gained, the latter on last-minute negotiations continuing with the EU. Oil prices fell on concerns about declining demand while gold gained.

Weekly % changes for last week (22-23 Oct) from 15th Oct (regional) and 16th Oct (international).

Global Developments

US/Americas:

- Housing starts increased by 1.9% mom to 1.415mn in Sep, registering gains in single-family house construction. Building permits grew by 5.2% mom to 1.553mn in Sep, the highest since Mar 2007; there was a higher preference for single-family units (+7.8% to 1.119mn) versus multifamily structures (-0.9% to 434k units).

- Existing home sales increased to a new 14-year high, up 9.4% mom and 21% yoy to 6.54mn in Sep, also marking the 4th consecutive month of higher sales. The median price for previously owned homes climbed 14.8% yoy to USD 311,800 while total inventory shrank by 1.3% to 1.47mn – supporting just 2.7 more months of sales under the current pace.

- Markit flash composite PMI output index in US jumped to a 21-month high of 55.5 in Oct (Sep: 54.3); manufacturing PMI edged up to 53.3 from Sep’s 53.2, with the acceleration in new orders coming from domestic clients as new export orders fell.

- US Fed Beige book reported that the pace of economic activity in most parts of the country was “slight to modest”.

- Initial jobless claims fell to 787k in the week ended Oct 17 – dropping below 800k for the first time since Mar – from a downwardly revised 842k the week before. Continuing claims declined once again by 02mn to a seasonally adjusted 8.37mn in the week ended Oct 10.

Europe:

- The divergence continues with German preliminary manufacturing PMI rising to 58 in Oct (Sep: 56.4) while services PMI fell below-50 (48.9 in Oct vs 50.6 in Sep). Composite PMI edged down to 54.5 from 54.7 the month before. In the services sector, though new business fell for the 1st time in 4 months, employment saw a 4th consecutive monthly rise in payroll numbers.

- Composite PMI in the eurozone fell for a 3rd consecutive month in Oct, down to 49.4 from Sep’s 50.4, but Germany remained the bright spot amidst others that fell deeper into declines. The preliminary manufacturing PMI rose to 54.4 in Oct (Sep: 53.7) – a 26-month high, and new orders surging at the quickest since Jan 2018 – while services PMI remained below-50 (46.2 in Oct vs 48 in Sep).

- Germany’s producer price index decreased by 1% yoy in Sep (Aug: -1.2% yoy), posting the 8th straight month of decline, thanks to a 3.3% drop in energy prices though prices for capital goods and durable consumer goods grew by 0.9% and 1.4% respectively.

- Inflation in the UK rose by 0.4% mom and 0.5% yoy in Sep (Aug: 0.2% mom), driven by prices for leisure and cultural activities; core inflation rose to 1.3% from 0.9% in Aug. Retail price index grew by 1.1% yoy in Sep (Aug: 0.5%).

- UK retail sales grew by 4.7% yoy and 1.5% mom in Sep, rising for the 5th straight month, on higher purchases of non-food items like DIY and garden supplies in addition to high grocery spending. Fuel was the only main sector to remain below Feb’s pre-pandemic level, with volume sales 8.6% lower in Sep when compared with Feb

- Preliminary manufacturing PMI in the UK moved lower to 53.3 in Oct (Sep: 54.1), with weaker rises in output and new orders, while services PMI slowed to 52.3 vs Sep’s 56.1. In both sectors, the speed of recovery was the slowest for four months.

- UK completed its first large post-Brexit trade deal after signing an agreement with Japan while negotiations resumed between the UK and EU, with the thorny issues of fishing rights in British waters, fair competition rules for business (subsidies) and dispute resolution mechanisms remaining on the agenda.

- S&P revised Italy’s sovereign outlook to stable from negative while affirming its long- and short-term credit rating at “BBB/A-2”.

Asia Pacific:

- China’s GDP grew by 4.9% yoy and 2.7% qoq in Q3 (Q2: 3.2% yoy and 11.7% qoq), supported by a rebound in consumption (adding 1.7 ppts to headline growth rate) while contribution from capital formation fell to less than 3ppts, in line with the pre-pandemic norm.

- Industrial production in China expanded by 6.9% yoy in Sep (Aug: 5.6%) – the highest since Dec 2010 – with manufacturing up 7.6% vs Aug’s 6%. Fixed asset investment edged up by 0.8% yoy in the 9 months to Sep. Investments by centrally-administered SoEs of China in fixed assets grew by 11.3% yoy to USD 268.94bn in Jan-Sep. Retail sales grew by 3.3% yoy in Sep (Aug: 0.5%). The recent months have seen a rebound in cosmetics, jewelry and car sales, the more higher end consumer goods.

- China’s one-year and five-year loan prime rates were left unchanged at 3.85% and 4.65% respectively at the latest PBoC meeting.

- Flash composite PMI in Japan remained below-50 in Oct: with services PMI inching lower to 46.6 in the preliminary reading for Oct (Sep: 46.9) and manufacturing PMI up 1 point to 47, the composite reading nudged up by 0.1 to 46.7. External demand was weaker though employment remained broadly unchanged, while the government’s “Go to Campaign” was providing a boost to tourism services.

- Japan’s imports dropped by 17.2% yoy in Sep (Aug: 20.8%) while exports declined by a smaller 9% (-14.8%), increasing the trade surplus to JPY 674.9bn (JPY 248.6bn).

Bottom line: We can expect a much lengthier time for Covid19 recovery. US posted a record high 83k+ infections in a single day while in Europe, with many nations reporting new record highs for daily Covid19 cases, there are a fresh round of restrictions (Poland adopted a nationwide “red zone” lockdown). Furthermore, the current outbreak clusters are in the same centres as those earlier in the spring, calling into question the herd immunity concept. A contested US election could cause market disruptions and volatility, adding to the economic uncertainty. Expect a rebound in EU Q3 GDP numbers to be released this week, but with fresh restrictions in most nations, a slowing momentum appears to be on the horizon in Q4. China, on the other hand, seems to have emerged stronger following the Q1 dip.

Regional Developments

- IMF, in its latest Regional Economic Outlook, forecasts growth in the Middle East and North Africa region (reeling from the effects of the global recession, Covid19 impact and oil exporters facing lower oil prices and demand), to recover a tad slower compared to the rest of the world, rising to only 3.3% from a 4.7% dip this year. Egypt is the only country in the region forecast to grow this year (+3.5% yoy in spite of the massive decline in tourism). GCC growth is forecast to shrink by 6.0% this year, with oil and non-oil GDP contracting by 6.2% and 5.7% respectively.

- Bahrain-origin exports accelerated by 15% yoy to BHD 669mn (USD 1.76bn) in Q3 2020. Saudi Arabia (BHD 137mn), Malaysia (BHD 83bn) and Oman (BHD 56mn) were the top destinations for these products. The value of re-exports declined by 29% (to BHD 143mn) and imports by 9% (to BHD 1.166bn) during the period. Deficit narrowed by 28% to BHD 355mn.

- Expats who contribute to Bahrain’s Social Insurance Organization declined by 4% yoy to 456,840 persons in Q2 this year. This is a drop of about 60k persons from 2016.

- Egypt’s finance minister stated that the country grew by 3.6% in the fiscal year 2019-20, in spite of the impact of Covid19. It also reduced deficit–to-GDP to 7.9% in FY 2019-20 versus2% the year before and recorded a primary surplus of 1.8% at end-Jun 2020.

- The Central Bank of Egypt revealed that loans and facilities granted to micro, small, and medium enterprises grew to EGP 201.7bn for 1.016mn projects during Dec 2015-Jun 2020. Small and medium enterprises accounted for 55.2% and 32.2% of the total disbursed amount respectively. By sector, services received the largest share (36.5%) followed by industries (33.3%).

- Mortgage financing in Egypt declined by 4.2% yoy to EGP 1.6bn in Jan-Aug this year, with mortgage refinancing plummeting by 85.3% to EGP 134mn at end-Aug.

- US invested USD 21.8bn in Egypt over the past 12 months, disclosed the latter’s minister of trade and industry. Bilateral trade had increased 14.5% yoy to USD 8.618bn in 2019.

- Remittances into Egypt increased by 9.4% yoy to USD 2.9bn in Jul this year, bringing overall growth this year to 7%.

- Egypt extended the consumer spending initiative “Not Too Expensive For You” for an additional month which provides local products at affordable prices. According to the government, vendors participating in the initiative clocked in sales worth EGP 277.9mn.

- Egypt invested EGP 377bn towards road and bridge projects between 2014 and 2020, according to the minister of transport.

- Polling for a new Parliament began in Egypt on Sat (Oct 24), with voting closing today (Oct 25). A second round is up on Nov 7-8.

- Oil projects in Iraq are being delayed due to the OPEC+ production cuts, according to the oil minister. He expects a recovery by Q2 2021 and also a rise in production capacity to 7mn barrels per day (bpd) in the next 5-6 years from around 5mn bpd now.

- Jordan will impose 24-hour comprehensive curfews every Friday until Dec 31, announced the PM. Remote education would continue till end of the first semester.

- Kuwait’s Parliament approved a law to reduce the number of expats in the country, aiming to “rebalance” the population. The government has to create the mechanisms to lower the number within 12 months and provide progress reports to the assembly.

- Banks in Kuwait have resumed the deduction of loan installments, following a 6-month delay owing to Covid19 and its impact on the economy.

- Saad Hariri has been appointed the PM-designate in Lebanon, after a 73-day political impasse, and almost a year after stepping down from the post following the uprisings. The PM-designate vowed to form a Cabinet of nonpartisan specialists with a view to “implement the economic, financial and administrative reforms put forward in the French initiative”.

- The Byblos Bank/AUB Consumer Confidence Index in Lebanon deteriorated in H1 2020, with the index declining by 51% qoq to 19 points in Q2; in Q1 the index’s monthly average was 38.7 (-19% qoq). Only 0.3% of respondents surveyed in Q2 expect their financial conditions to improve within six months.

- Oman’s ruler approved a medium-term fiscal plan for 2020-24 to diversify revenues and increase government income from non-oil sectors, in addition to establishing a social security system for low-income citizens. Separately, an Employment Security Scheme will be launched from next month to provide a safety net to Omanis who are laid off in the private sector; in its second phase, it will be expanded to include Omani jobseekers in general.

- Oman raised USD 2bn in its first international bond sale since Jul 2019. The prospectus disclosed that not only was the country in talks with its GCC neighbours for financial support but had also finalised a USD 24mn facility with the Islamic Development Bank.

- Oman announced the end of a partial curfew at 5 am on Oct. 24 and that school academic term would begin on Nov 1st.

- Inflation in Saudi Arabia eased to 5.7% in Sep, following 6.2% and 6.1% in Aug and Jul respectively (after the VAT hike).

- Saudi Arabia’s crude oil exports increased for a second consecutive month to 5.97mn barrels per day (bpd) in Aug (Jul: 5.73mn bpd). Total oil product demand grew by 170k bpd to 2.55mn bpd in Aug.

- Saudi Arabia increased its investments in US treasury bonds by 4.3% mom to USD 130bn in Aug – the highest in 5 months. In yoy terms, investments were down 29.3%. Saudi Arabia tops the list of Arab investors in US treasury bonds, followed by Kuwait (USD 46.4bn) and UAE (USD 36.6bn).

- Saudi Arabia will allow its citizens and residents to perform Umrah at 75% capacity in the second phase of resuming activity.

- Investment banking fees generated in MENA grew by 4% yoy to an estimated USD 895.7mn in Jan-Sep 2020, the highest ytd total since 2008, according to Refinitiv data. About USD 4mn worth of advisory fees were earned from completed M&A transactions in the region during this period – a record high ytd and up 23% yoy.

- A survey from McKinsey about consumer sentiment and behaviour in UAE and Saudi Arabia finds that respondents from the nations are optimistic that the economy will rebound in 2-3 months and grow just as strong or stronger than before the outbreak. UAE (90%) and Saudi Arabia (94%) have the highest rates of people not regularly engaging in out-of-home activities versus 70% global average. (More: https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/global-surveys-of-consumer-sentiment-during-the-coronavirus-crisis)

UAE Focus

- The UAE announced that the Insurance Authority will be merged with the central bank. Furthermore, all operational and executive powers of the Securities and Commodities Authority (SCA) are to be transferred to the local stock markets, while the SCA maintains regulation and oversight. These moves aim to increase efficiency and improve competitiveness.

- Dubai announced a further AED 500mn (USD 136.14mn) stimulus package to support the emirate, taking Dubai’s total stimulus to AED 6.8bn. These measures, which will last till end of this year, includes fee exemptions, license extensions, rent reductions and extension of previous exemptions.

- The UAE Ministry of Economy will begin carrying out the 33 initiatives, announced in Aug, to support the economy and aims to develop priority sectors, provide financing support and facilitate lending, promote tourism and stimulate innovation among others.

- The UAE central bank will introduce new regulations related to reserve requirements, effective Oct 28th. The length of the reserve maintenance period will be extended from 7 to 14 days to facilitate short-term liquidity management. Furthermore, deposit-taking licensed financial institutions will be allowed to draw on their reserve balances held in the central bank on any day up to 100% for daily settlement purposes or to deal with any swings on overnight money market rates while ensuring that they meet the daily average requirements over a 14-day reserve maintenance period.

- The UAE Cabinet amended the bankruptcy law, with specific reference to emergencies affecting trade or investment (like the Covid19 outbreak): new amendments stipulate the addition of new provisions to the law with regards to “emergency situations” and also that the debtor shall be exempted from commencing procedures to declare bankruptcy.

- In line with the recent normalization of UAE-Israel relations, a mutual visa waiver was signed to allow travel without a visa for a maximum of 90 days per visit. Additionally, plans were announced to transport Emirati crude from the Red Sea to the Mediterranean through Israel, essentially sidestepping the Suez Canal.

- Total foreign currency deposits held by UAE national banks grew by 7.3% yoy to AED 409bn in Aug; these deposit account for about 30% of total deposits.

- Dubai’s investment arm ICD sold USD 600 mn in long five-year bonds at 275 basis points over mid-swaps.

Media Review

IMF’s Regional Economic Outlook

https://www.imf.org/en/Publications/REO/MECA/Issues/2020/10/14/regional-economic-outlook-menap-cca

https://blogs.imf.org/2020/10/19/building-a-resilient-recovery-in-the-middle-east-and-central-asia/

Emerging and Frontier Markets: Policy Tools in Times of Financial Stress

https://blogs.imf.org/2020/10/23/emerging-and-frontier-markets-policy-tools-in-times-of-financial-stress/

What Brexit will do to the City of London

https://www.economist.com/britain/2020/10/24/what-brexit-will-do-to-the-city-of-london

Everything You Think About the Geopolitics of Climate Change Is Wrong

https://foreignpolicy.com/2020/10/05/climate-geopolitics-petrostates-russia-china/

Investors Gauge Future Climate Risks With Satellite Imaging

https://www.bloomberg.com/news/articles/2020-10-22/investors-gauge-future-climate-risks-with-satellite-imaging

Covid-19: The global crisis — in data

https://ig.ft.com/coronavirus-global-data/

Powered by: