This article, titled “Overcoming Lebanon’s economic crisis”, appeared as a viewpoint in the Oct 2020 edition of The Banker. The article, posted below, can be directly accessed on The Banker’s website.

Overcoming Lebanon’s economic crisis

Lebanon’s financial and economic crises can only be solved with meaningful reform, without which it faces a lost decade of mass migration, social and political unrest and violence.

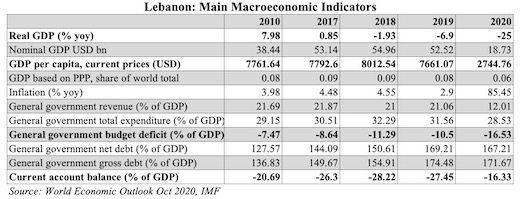

Violence and crises have shattered Lebanon’s pre-1975 Civil War standing as the banking and financial centre of the Middle East. Lebanon is engulfed in overlapping fiscal, debt, banking, currency and balance of payments crises, resulting in an economic depression and humanitarian crisis with poverty and food poverty affecting some 50% and 25% respectively of the population. The Lebanese Pound has depreciated by some 80% over the past year, with inflation running at 120% and heading to hyperinflation. A Covid-19 lockdown and the Port of Beirut horrendous explosion on August 4th created an apocalyptic landscape, aggravating the economic and unprecedented humanitarian crises. The cost of rebuilding is estimated to exceed $10 billion, more than 25% of current GDP, which Lebanon is incapable of financing.

The economic and financial meltdown is a culmination of unsustainable fiscal and monetary policies, combined with an overvalued fixed exchange rate. Persistently large budget deficits (averaging 8.6% of GDP over the past 10 years), structural budget rigidities, an eroding revenue base, wasteful subsidies, government procurement riddled with endemic corruption, all exacerbated fiscal imbalances.

Meanwhile, a monetary policy geared to protecting an increasingly overvalued exchange rate, led to growing trade and current account imbalances and increasingly higher interest rates to attract deposits and capital inflows to shore up dwindling international reserves. Deficits financed current spending, with limited real investment or buildup of real assets, while high real interest rates stifled investment and growth.

The unsustainable twin (current account and fiscal) deficits led to a rapid build-up of public debt. Public debt in 2020 is running at $111 bn, including $20 bn of debt at Banque du Liban (BdL), the country’s central bank. This figure represents more than 184% of GDP– the second highest ratio in the world behind Japan, according to the the IMF, Most of this debt is held by domestic banks and BdL, with 13% held by foreigners.

Financing government spend

The BdL’s financing of government budget deficits, debt monetisation, large quasi-fiscal operations (such as subsidising real estate investment) and bank bailouts, created an organic link between the balance sheets of the government, the BdL and banks. In effect, depositors’ monies were used by the banks and the BdL to finance budget deficits, contravening Basel III rules and prudent risk management.

BdL policies led to a crowding-out of both the private and public sectors, and to disintermediation: the government could no longer tap markets, so BdL acted as financial intermediary i.e. paying high rates to the banking system, while allowing the government to borrow at lower rates. The higher rates increased the cost of servicing the public debt, with debt service representing some 50% of government revenue in 2019 and over one third of spending. Credit worthiness rapidly deteriorated, leading to a ‘sudden stop’ in 2019, with expatriate remittances and capital inflows moving into reverse.

The crisis Lebanon is now experiencing is the dramatic collapse of what economists describe as a Ponzi-like scheme engineered by the BdL, starting in 2016 with a massive bailout of the banks equivalent to about 12.6% of GDP. Ina bid to protect an overvalued LBP and finance the workings of government, the BdL started borrowing at ever higher interest rates, through so-called “financial engineering” schemes, which evolved into a vicious cycle of additional borrowing to pay maturing debt and debt service, until confidence evaporated and reserves were exhausted.

With the BdL unable to honour its foreign currency obligations, Lebanon defaulted on its March 2020 Eurobond and is seeking to restructure its domestic and foreign debt. The resulting losses of the BDL exceed $50 bn, equivalent to 2019 GDP, a historically unprecedented loss by any central bank.

With the core of the banking system, the BDL, unable to repay banks’ deposits, the banks froze payments to depositors. The banking and financial system imploded. The bubble burst in the last quarter of 2019, with a rapid depreciation of the LBP during 2020. The BDL’s costly attempt to defy the “impossible trinity” by simultaneously pursuing an independent monetary policy, with fixed exchange rates and free capital mobility resulted in growing imbalances, a collapse of the exchange rate and an unprecedented financial meltdown.

Economic disaster

A series of policy errors triggered the banking and financial crisis, starting with the closure of banks in October 2019, ostensibly because of anti-government protests decrying government endemic corruption, incompetence and lack of reforms. A predictable run on banks ensued, followed by informal capital controls, foreign exchange licensing, freezing of deposits, inconvertibility of the LBP and payment restrictions to protect the dwindling reserves of the BDL. These errors precipitated the financial crisis, generating a sharp liquidity and credit squeeze, the sudden stop of remittances and the emergence of a system of multiple exchange rates.

The squeeze severely curtailed domestic and international trade and resulted in a loss of confidence in the monetary system and the Lebanese pound. With the outbreak of Covid19 and lockdown measures came a severe drop in tax receipts, resulting in the printing of currency to cover the fiscal deficit, generating a vicious cycle of exchange rate depreciation and inflation. The black market exchange rate touched a high of LBP 9800 in early July, before steadying to around LBP 7400 in early September (versus the official peg at 1507). In turn these policy measures led to a severe economic depression, with GDP forecast to decline by 25% in 2020, with unemployment rising to 50%.

In response to the crisis, the government of Hassan Diab prepared a financial recovery plan that comprised fiscal, banking, and structural reforms as a basis for negotiations with the IMF. In effect, the Diab government and Riad Salameh, governor of the BDL deliberately implemented an inflation tax and an illegal ‘lirafication’ – a forced conversion, a spoliation, of foreign currency deposits into LBP to achieve internal real deflation. The objective is to impose a ‘domestic solution’ and preclude an IMF programme and associated reforms.

The apocalyptic Port of Beirut explosion on August 4, compounded by official inertia in responding to the calamity, has led to the resignation of the Diab government and appointment of a new PM, Mustafa Adib. Economic activity, consumption and investment are plummeting, unemployment rates are surging, while inflation is accelerating. Confidence in the banking system and in macroeconomic and monetary stability has collapsed.

Rebuilding the economy

Prospects for an economic recovery are dismal unless there is official recognition of the large fiscal and monetary gaps, and a comprehensive, credible and sustainable reform programme is immediately implemented by a new Adib government. Such a programme needs to include immediate confidence building measures with an appropriate sequencing of reforms. The government must immediately passing a credible capital controls act to help restore confidence and encourage a return flow of remittances and capital inflows. Immediate measures need to be taken to cut the budget deficit, including by removing fuel subsidies and all electricity subsidies (which account for one-third of budget deficits). The removal of these subsidies is necessary to stop smuggling into neighbouring Syria, which has been a major drain on international reserves.

Monetary policy reform is needed to unify the country’s multiple exchange rates, moving to inflation targeting and a flexible exchange rate regime. Multiple rates create market distortions and incentivise more corruption. In addition, the BdL will have to repair and strengthen its balance sheet, stop all quasi-fiscal operations and government lending. Credible reform requires a strong and politically independent regulator and policy-maker.

There is a need to restructure the public domestic and foreign debt (including BdL debt) to reach a sustainable debt to GDP in the range of 80 to 90% over the medium term; this implies a write down of some 60 to 70% of the debt. Given the exposure of the banking system to government and BDL debt, a debt restructuring implies a restructuring of the banking sector whose equity has been wiped out.

A bank recapitalization and restructuring process should top the list of reforms, including a combination of resolving some banks and merging smaller banks into larger banks. Bank recapitalisation requires a bail-in of the banks and their shareholders (through a cash injection, sale of foreign subsidiaries and assets) of some $25 bn to minimise a haircut on deposits. As part of such far-reaching reforms, Lebanon needs a well-targeted social safety net to provide support for the elderly and vulnerable segments of the population

Crucially, the new government needs to rapidly implement an agreement with the IMF. Lebanon desperately needs the equivalent of a Marshall Plan, a “Reconstruction, Stabilisation and Liquidity Fund’ of about $30 to 35bn, along with policy reform conditionality.

A comprehensive IMF macroeconomic-fiscal-financial reform programme that includes structural reforms, debt, and banking sector restructuring would help restore faith in the economy in the eyes of the Lebanese diaspora, foreign investors/aid providers and help attract multilateral funding from international financial institutions and Cedre conference participants, including the EU and the Gulf Cooperation Council. This would translate into financing for reconstruction, access to liquidity, stabilise and revive private sector economic activity.

Without such deep and immediate policy reforms, Lebanon is heading for a lost decade, with mass migration, social and political unrest and violence. If the new government fails to act, Lebanon may turn into “Libazuela”!