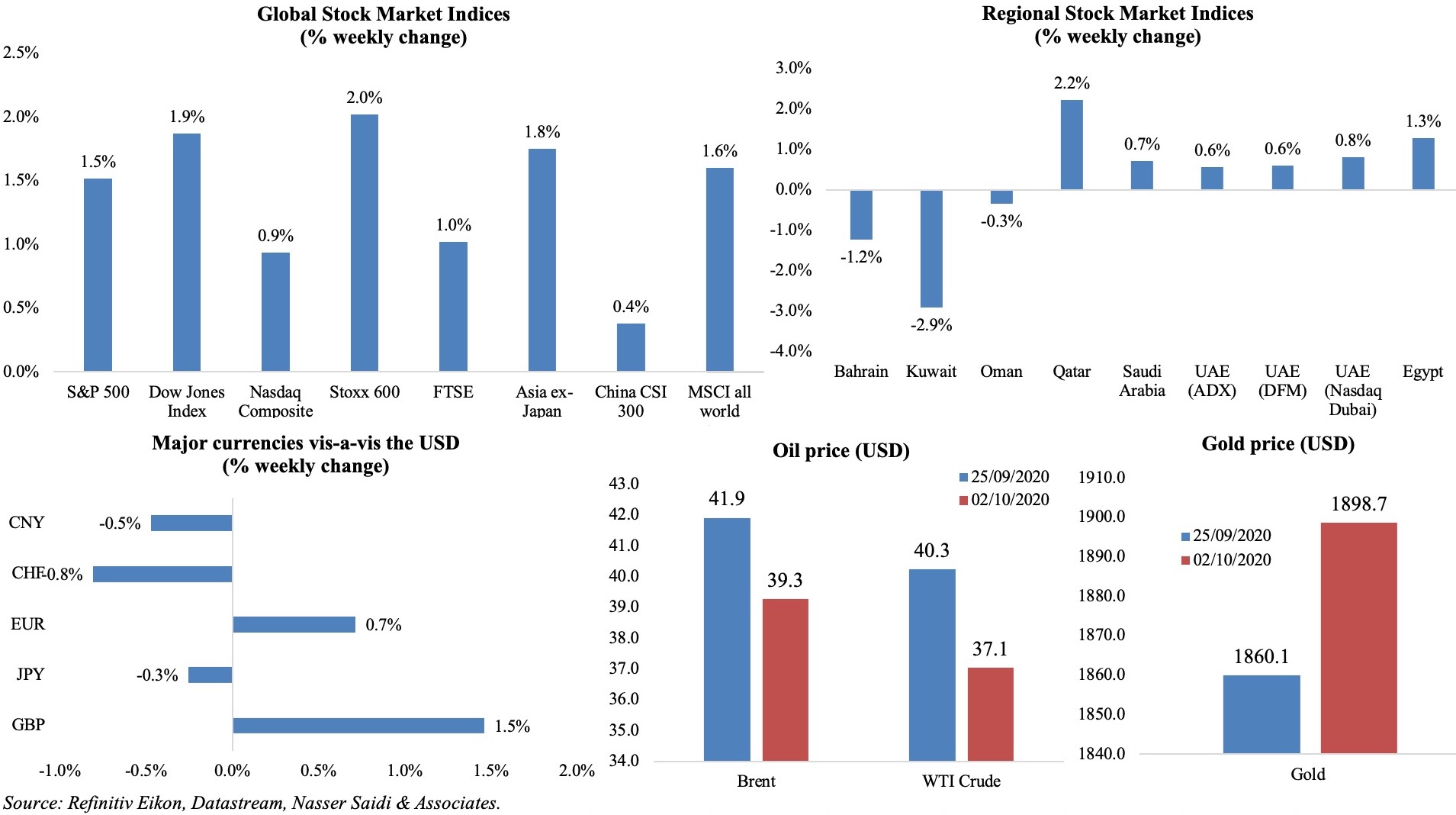

Markets

Stock markets gained compared to the week before, though declining towards the end of last week: with Trump testing positive for Covid19 and the next round of fiscal stimulus likely to be held up by political bickering (the House already approved the USD 2.2trn relief package) in the US, continuing Brexit negotiations and the latest wave of Covid19 hitting record highs in many countries, investors are getting uneasy. In the region, most markets gained slightly though in Kuwait, the main index posted its biggest intraday fall on news of the Emir Sheikh Sabah al-Ahmad al-Sabah’s death. The pound fell on Brexit-related news, while the yen gained on its safe haven asset stance. Oil prices slipped below USD 40 a barrel last week (touching a 4-month low) on tepid demand alongside higher global crude oil output; gold price gained on heightened uncertainties, posting its best week in eight.

Weekly % changes for last week (1-2 Oct) from 24th Sep (regional) and 25th Sep (international).

Global Developments

US/Americas:

- US GDP plunged by 31.4% annualized pace in Q2 – the sharpest contraction in at least 73 years in Q2 – revised up from the 31.7% drop disclosed a month ago. Consumer spending contracted by 32.2% while business investment in structures and equipment each sank by more than 30%. In yoy terms, GDP fell by -2.1% yoy in Q2, following a -2.3% drop in Q1.

- Core PCE was up by 0.3% mom and 1.6% yoy in Aug (Jul: 1.4% yoy); personal consumption was up by 1% while personal income dropped by 2.7% (Jul: +0.5%).

- Non-farm payrolls rose by 661k in Sep, much lower than market expectations, with leisure and hospitality leading job gains (+318k). With the latest figure, only about 12mn jobs have been recovered versus mid-Mar’s shutdown that resulted in about 22mn layoffs. Though unemployment rate fell to 7.9% from 8.4% in Aug, the labour market participation rate fell to 61.4% (a decline of nearly 700k). Earlier in the week, the ADP employment report showed that private sector employment increased by 749k jobs in Sep (Aug: 481k).

- ISM manufacturing edged lower to 55.4 in Sep (Aug: 56), with the new orders sub-index declining to 60.2 from 67.6 (a 16.5 year high) while the employment sub-index improved to 49.6 from 46.4. Separately, Markit manufacturing slipped lower to 53.2 in Sep from a preliminary reading of 53.5, but remained a tad higher than Aug’s reading of 53.1.

- S&P Case Shiller home price indices inched up by 3.9% yoy in Jul (Jun: 3.5%), thanks to strong demand for homebuying amid low mortgage rates.

- Pending home sales index grew by 8.8% mom and 24.2% yoy in Aug (Jul: 5.9% mom and 15.5% yoy), rising to a record high of 132.8. However, there is a demand-supply imbalance and if the pace of new home sales continue, supply will be exhausted in just 3.3 months.

- Initial jobless claims fell to 837k in the week ended Sep 26, from a revised 873k the week before. Continuing claims declined by 980k to a seasonally adjusted 11.8Mn in the week ended Sep 19 – the lowest level since Mar.

Europe:

- Germany’s harmonized inflation fell to -0.4% yoy in Sep (Aug: -0.1%), partly due to the cut in VAT as part of the support during Covid19 and also given the lower energy costs.

- Inflation in the eurozone was down 0.3% in Sep (Aug: -0.2%); core CPI (excluding fuel and food prices) was 0.2% in Sep (Aug: 0.4%). Services inflation, which was 1.6% in Feb, has dropped to just 0.5% in Sep.

- Retail sales in Germany increased by 3.1% mom and 3.7% yoy in Aug (Jul: -0.2% mom and 5% yoy), probably supported by the VAT cut. Online retailers posted a 23% increase in sales while sales of furnishings and household appliances were up by 8%.

- German unemployment rate inched lower for the third consecutive month to 6.3% in Sep (Aug: 6.4%). Number of people out of work fell by 8k in seasonally adjusted terms to 2.907mn.

- Final readings of Markit manufacturing PMI was released: in Germany, PMI hit a 26-month high in spite of being revised down to 56.4 (prelim estimate: 56.6, Aug: 52.2), thanks to record-high new order growth and new export orders rising the most since Dec 2017. In the Eurozone, an increase in activity and new orders (export trade posted the sharpest gain since Feb 2018) supported the rise in PMI to 53.7 in Sep; in UK, manufacturing PMI was revised down to 54.1 from 54.3 before (Aug’s two and a half year high of 55.2).

- The European Commission’s monthly survey showed an uptick in overall eurozone economic sentiment indicator by 3.6 points to 91.1 in Sep, its highest level since the pandemic struck in Mar (but below the 103.4 reported in Feb).

- UK GDP contracted by 19.8% in Q2, revised up from a 2nd estimate of a 20.4% plunge. The lockdown period witnessed a record-breaking 23.6% fall in household spending in Q2, while the household saving ratio soared to an all-time high of 29.1%. The current account deficit in UK fell to its lowest level for nine years, at GBP 2.8bn or 0.6% of GDP in Q2, down from GBP 20.8bn in Q1 2020.

Asia Pacific:

- China’s NBS manufacturing PMI edged up to 51.5 in Sep (Aug: 51), with the sub-index for new orders at 52.8 the highest in a year and the steepest growth since the start of 2011. New export orders showed an expansion for the first time this year, up 1.7 points to 50.8. Non-manufacturing PMI rose in Sep for the 7th straight month, up to 55.9 (Aug: 55.2), with sub-indices of new orders (54 from 52.3) and employment (49.1 from 48.3) rising.

- Caixin manufacturing PMI for China inched down to 53 in Sep (Aug: 53.1). In spite of the fall, new orders expanded at the fastest pace since Jan 2011 and new export orders climbed to the highest in three years.

- Tokyo’s CPI eased to 0.2% yoy in Sep (Aug: 0.3%); inflation excluding fresh food eased to -0.2% in Sep (-0.3%). These are way short of the BoJ’s 2% target.

- Japanese Tankan showed an improvement in business sentiment: the headline index improved to -27 in Sep from Jun’s -34 (the lowest level since Jun 2009). The survey also showed that firms expected business conditions to improve three months ahead.

- Japan’s headline manufacturing PMI touched a 7-month high of 47.7 in Sep, with the latest declines in output and new orders the slowest since Q1 2020.

- Retail trade in Japan increased by 4.6% mom in Aug (Jul: -3.4%); in yoy terms, retail trade fell by a small -1.9% (Jul: -2.9%). Sales were up for food & beverages (2.7% from Aug’s 1.4%); machinery & equipment (3.8% from 8.1%) and medicine & toiletry stores (1.6% from 1.2%) while apparel and motor vehicle sales fell by 17.4% and 14.1% respectively.

- Japan industrial production rose by 1.7% in Aug, following an 8.7% jump in Jul, thanks to a pickup in auto demand. However, the index level remains low compared to the pre-coronavirus reading of 95.8 in Mar.

- As Covid19-related restrictions were loosened, manufacturing PMI in India increased to 56.8 in Sep -the highest reading since Jan 2012 – thanks to increases in new orders and output increased at third-fastest pace in survey history.

- India reported a current account surplus of USD 19.8bn in Apr-Jun 2020 (or 3.9% of GDP) – the second consecutive quarter of surplus (Jan-Mar: USD 0.6bn) – as trade deficit narrowed to USD 10bn.

- Singapore PMI inched up to 50.3 in Sep (Aug: 50.1), as output, new orders and export sales increased while employment declined for the 8th consecutive month.

Bottom line: Global manufacturing PMI rose to a 25-month high of 52.3 in Sep, supported by new order intakes (quickest pace in almost 2.5 years) and expansions in new export business (for the 1st time since May 2018). Interestingly, this rise in export orders has yet to translate into air cargo demand, though ocean container throughputs and global trade have improved. Covid19 cases are rising, with record daily numbers reported in France, UK and others, so it remains to be seen if the manufacturing momentum continues. There is already a clear divergence between services and manufacturing PMI numbers, given the strain of social distancing policies on the former. Separately, Brexit negotiations are in its last stretch: the two sides agreed on Sat (Oct 3rd) that there was enough common ground to aim for a final settlement, so the uncertainty drags on.

Regional Developments

- GDP in Bahrain declined by 8.9% yoy in Q2: the non-oil sector plunged by 11.5% while the oil and government sectors grew by 3.2% and 0.1% respectively.

- Bahrain’s government will continue to pay 50% of wages of citizens in private sector firms affected by Covid19 during Oct-Dec. Separately, a 3-month waiver (starting from Oct) was announced on tourism establishments fees in the country.

- The finance and national economy ministry highlighted some economic indicators that signal a recovery in Bahrain: the value of imports picked up by 88.1% mom in Aug, hotel occupancy rates in four- and five-star hotels increased by 13.3% mom and 17.6% in Jul and Aug respectively, the number of monthly real estate transactions ticked up by 19.1% mom and 21.6% in Jul and Aug respectively.

- Money supply in Egypt increased by 19.17% yoy in Aug to EGP 4.68trn (USD 297.9bn).

- Egypt’s foreign trade amounted to USD 69.965bn in Jul 2019-Mar 2020: imports stood at USD 49.021bn in the period while exports touched USD 20.953bn. UAE, China, US, Saudi Arabia and the UK were the top five trade partners of the country.

- Egypt plans to borrow EGP 640bn from the local market this quarter via the issuance of T-bills and bonds, to finance the fiscal deficit. Domestic public debt in the country touched about EGP 4.354trn by end-Dec 2019: of this, 87.8% was owed by the government, 5.9% by economic public bodies, and 6.3% by the National Investment Bank.

- Egypt’s finance minister disclosed that an initiative was underway for the payment of all overdue dues to exporters (in cash) at a 15% discount before end of the year.

- Three electronic payment companies in Egypt – Masary, Bee, and Aman – are considering IPOs on the Egyptian Exchange next year.

- The World Bank approved a 6-year USD 200mn project for Egypt to reduce air pollution and improve quality of life. The annual economic cost of air pollution on health in the Cairo area alone is equivalent to about 1.4% of Egypt’s GDP, revealed the World Bank.

- Iran’s rial weakened to a record low against the dollar, breaching 300k for the first time on the unregulated market.

- Iraq’s GDP growth is estimated to decline by 9.7% this year, according to the World Bank. In its latest report on the country, the Bank calls for the development of the private sector to overcome socio-economic challenges, strengthen the management and allocation of its oil wealth and improve accountability. (Access the report: https://www.worldbank.org/en/country/iraq/publication/breaking-out-of-fragility-a-country-economic-memorandum-for-diversification-and-growth-in-iraq)

- Jordan reopened mosques and churches last Thursday, but with social distancing norms in place. Restaurants were also allowed to restart dine-in services, but at 50% capacity.

- Kuwait’s new ruler was sworn in after the death of his brother, who was known as an effective mediator in the region. The succession process has been smooth. Speculation of an imminent devaluation, which started circulating after the passing of the country’s ruler last week, was denied by the central bank (which also reiterated commitment to the dollar peg).

- A new bill was submitted by Kuwait’s government to the Parliament, to support SMEs during the Covid19 outbreak: this includes allowing banks to provide loans of up to KWD 25k to SMEs payable within 5 years.

- About 150 expats working in Kuwait’s ministry of public works have been fired, while another 400 are expected to receive termination letters soon – in total, expats account for ~5% of staff.

- The Lebanese pound has been falling versus the dollar on the black market, as the country’s troubles and uncertainties continue with the PM-designate stepping down, warnings by the central bank that it is running of reserves to subsidise essential commodity imports, and discussions with the IMF on hold till a new Cabinet is formed.

- After having exceeded 1000 daily infections, Lebanon ordered 111 towns and villages into lockdown from Oct 4th to 12th, to curb the Covid19 outbreak.

- Lebanon and Israel are planning to hold maritime border talks: talks are scheduled to begin after mid-Oct, under the auspices of the UN.

- Qatar Airways received a cash injection of QAR 7.3bn (USD 1.95bn) from the government as support for the company during the Covid19 outbreak. The cash injection was later converted to new shares.

- GDP in Saudi Arabia declined by 7% in Q2 (Q1: -1%), with the private and government sectors contracting by 10.1% and 3.5% respectively. Non-oil GDP shrank by 8.2% and the oil GDP down by 5.3%.

- Saudi Arabia, in its preliminary budget statement, disclosed that it plans to cut spending by 7.5% yoy to SAR 990bn next year. This year’s revenue is estimated to drop by 17% to SAR 770bn before rising to SAR 846bn in 2021. Budget deficit will narrow to 5.1% in 2021 from an estimated 12% in 2020.

- Inflation in Saudi Arabia is estimated to touch 3.7% this year (disclosed in the preliminary budget statement), partly due to the VAT hike, before declining to 2.9% in 2021.

- Foreign exchange reserves in Saudi Arabia edged down by 0.75% mom to SAR 272.57bn in Aug. Assets of SAMA increased by 1.3% mom to SAR 1.83trn in Aug; in yoy terms, assets were down by 5.4%.

- Saudi Arabia’s oil exports fell by 46% yoy in Jul while non-oil exports fell by 8.3% yoy; merchandise imports plunged by 30.5% mom to SAR 37.6bn, largely due to vehicles (-64.3%) and electrical equipment (-30.1%).

- Vehicle imports into Saudi Arabia fell to the lowest level since 2015 in Jul, reported Bloomberg, after VAT was tripled. Imports of vehicles, aircraft, vessels, and associated transport equipment fell 64% yoy to SAR 3.9bn in Jul.

- Saudi Tadawul updated the free float shares of all companies starting from today (4th Oct, 2020) whilst also adding four companies to the market indices.

- In a bid to support citizens that want to own homes, Saudi Arabia will exempt real estate deals from the 15% VAT and instead imposed a new 5% tax on transactions. Furthermore, the government would bear the cost of the new Real Estate Transaction Tax “for up to SAR 1Mn” for the purchase of first homes.

- Unemployment rate of Saudi citizens increased to 15.4% in Q2 vs Q1’s 11.8%. About 400k Saudis and expats have quit the labour market in Apr-Jun, according to the General Authority for Statistics. Separately, average monthly salaries paid to Saudi citizens declined by 3.9% yoy to SAR 9970 as of end-Q2 while salaries to expats grew by 2.17% to SAR 4136.

- A maximum 50% of Saudi citizens working in private sector firms affected by the pandemic will get a 3-month extension of support from the government via “Saned”, an unemployment insurance scheme.

- Moody’s estimates that Saudi Arabia’s financing needs will more than double to around SAR 318bn (USD 85bn) this year from SAR 153bn in 2019. Of this, nearly half is expected to come from sukuk issuances.

- Saudi Arabia will enforce a mandatory 14 days between two Umrahs for pilgrims; so far 35k requests have been registered to perform Umrah.

- OPEC pumped an average 24.38mn barrels per day (bpd) in Sep, up 160k bpd from Aug. While Libya and Iran are exempt from the OPEC+ supply pact, UAE posted the largest drop in production in Sep (compensating for previous months of oversupply). UAE’s shipments of crude and condensate fell to 2.43mn barrels per day in Sep, a decline of 480k bpd on Aug and the lowest since Oct 2018.

- Airlines based in the Middle East recorded a 92.5% yoy decline in revenue passenger kilometers in Jul, one of the weakest outcomes of all regions, according to IATA; international demand remains weak, with passenger volumes contracting by more than 90% annually on all of the key routes – not very different from the crisis low in Apr. Before the end of the year, an estimated 1.7Mn people in the aviation industry (half of the 3.3mn in aviation and related industries) are expected to be out of employment.

UAE Focus

- UAE, Israel and US will establish a joint strategic vision for energy partnership: this collaboration would imply cooperation on various fields including “renewable energy, energy efficiency, oil, natural gas resources and related technologies, and water desalination technologies”.

- Fuel prices in the UAE will remain unchanged for the 7th consecutive month in Oct.

- Inflation in the UAE declined by 0.13% mom and 2.59% yoy in Aug: higher prices in food, clothing, education and restaurants (among others) were more than offset by declines in housing and utilities, healthcare, transport costs.

- Dubai’s Arabtec shareholders voted to file for liquidation. Reuters reported that shareholders authorized Arabtec to appoint AlixPartners and Matthew Wilde, or any other person or persons the board considered fit, as liquidator. It is likely that deteriorating economic conditions, property oversupply and weak growth prospects contributed to its demise, along with management and corporate governance lapses.

- Japan imported 18.143Mn barrels of crude oil from the UAE in Aug; oil imports from the UAE represented 24.8% of the total Japanese oil imports.

- Remittances from the UAE amounted to AED 79.6bn in H1 this year, according to the central bank. Indians, Philippines, Pakistan, Bangladesh, Egypt and the US accounted for the top receiving nations.

- Ras al Khaimah’s manufacturing exports increased by 32% between 2017 and 2019 to AED 3.803bn. Saudi Arabia was the biggest importer from the emirate (26% of total industrial exports) followed by Kuwait (10%) and India (9%).

- Dubai announced free parking for all electric cars registered in the emirate until 2022; but, this is not valid for electric cars registered elsewhere in the UAE. Currently there are around 1803 electric cars registered in Dubai.

- UAE has resumed issuing entry permits into the country though work permits are not being issued at this stage.

Media Review

Six Charts on Social Spending in the Middle East and Central Asia

https://www.imf.org/en/News/Articles/2020/09/25/na092920-six-charts-on-social-spending-in-the-middle-east-and-central-asia

Electric mobility is a game-changer for MENA’s energy and transport sectors

https://blogs.worldbank.org/arabvoices/electric-mobility-game-changer-menas-energy-and-transport-sectors

Why Biden Is Better Than Trump for the Economy: Roubini

https://www.project-syndicate.org/commentary/biden-is-better-than-trump-for-the-economy-by-nouriel-roubini-2020-09

1 in 4 women are considering leaving the workforce or downshifting careers due to Covid19: McKinsey’s Women in the Workplace 2020

https://www.mckinsey.com/featured-insights/diversity-and-inclusion/women-in-the-workplace

FCA gives City 15 months’ grace on most post-Brexit rules

https://www.ft.com/content/0d808db0-b583-462f-99b9-44b976980610