Markets

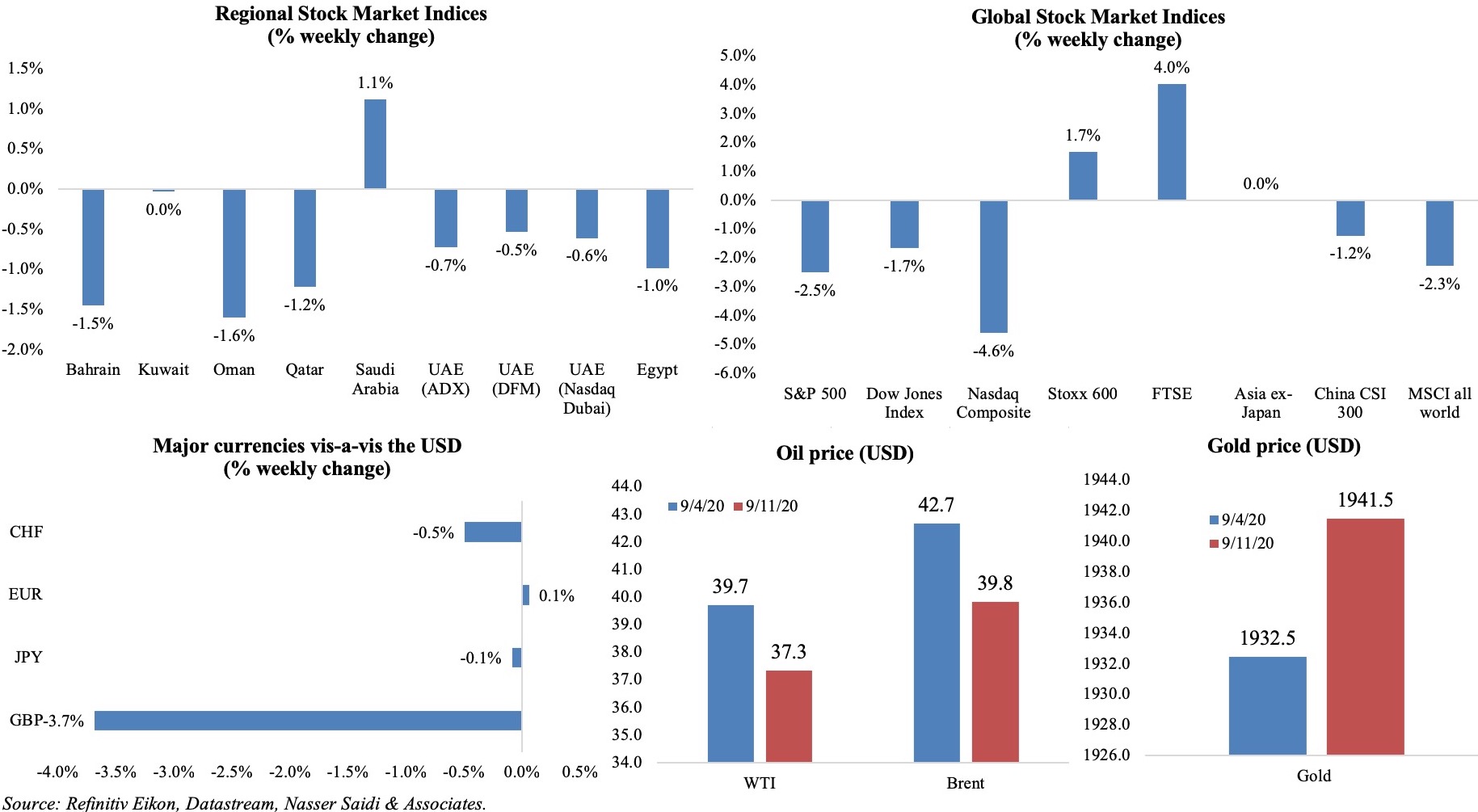

Markets were down in the US after a relief package was voted down on Thurs; in Europe, the FTSE finished 4% above compared to a week ago (partly thanks to the weaker pound and the UK-Japan trade deal) and Stoxx closed higher supported by a rebound in the tech and telecom sectors mid-week. I; in Asia, Chinese shares posted the biggest weekly drop in 8 weeks as US tensions rise. Regionally markets were mostly down, given weak oil prices and losses in financial shares, with the exception of Saudi Arabia. Among currencies, the sterling tumbled by 3.7% vis-à-vis the dollar given Brexit worries while the euro strengthened after comments from the ECB. Oil prices had a volatile week, with concerns about weak demand and crude futures falling below USD 40 a barrel for the first time since Jun; gold prices were up.

Weekly % changes for last week (10-11 Sep) from 3rd Sep (regional) and 4th Sep (international).

Global Developments

US/Americas:

- US producer price index edged up by 0.3% mom in Aug, following a 0.6% rise in Jul, led by a gain in services (+0.5%) while prices for goods were up only 0.1%.

- Inflation in the US nudged up by 0.4% mom in Aug, rising for the 3rd straight month. Used cars and trucks saw a 5.4% surge in prices and prices for eating out rose. Core CPI meanwhile increased to 1.7% yoy, the highest since the pandemic began.

- Initial jobless claims held steady at 884k after the previous week’s numbers were revised upward (that drop was largely a result of a change in methodology). Continuing claims rose to 13.385mn in the week of Aug 29 versus 13. 292mn a week before.

Europe:

- ECB left policy rates unchanged, as expected, while Lagarde revealed that the euro’s rise is being closely monitored, especially “with regard to its implications for the medium-term inflation outlook”.

- Q2 GDP in Germany plummeted by 11.8% qoq and 14.7% yoy, slightly lower than the initial estimate of a 12.1% decline.

- Germany industrial production inched up by 1.2% mom in Jul following Jun’s 9.3% surge, with intermediate goods, capital goods and consumer goods gaining by 4%, 2.1% and 1.8% respectively. Production in the auto sector is recovering, up 6.9% in Jul, but still over 15% below Feb 2020 readings.

- German trade surplus increased to EUR 18bn in Jul – the highest since Feb – from Jun’s EUR 14.5bn. Exports increased for a 3rd consecutive month, up 4.7% mom and imports by 1.1%. Current account surplus narrowed to EUR 20bn from EUR 20.4 the month prior.

- Inflation in Germany stalled at 0% in Aug, thanks to lower energy prices – motor fuel and heating oil prices were down 11.3% and 32.7% respectively – and the temporary reduction in VAT (in place till Dec).

- UK GDP expanded by 6.6% in Jul compared with the month before, following growth rates of 8.7% in Jun and 2.4% in May; growth was registered across the board in Jul: construction surged by 17.6% (thanks to a 30% expansion in new housing), manufacturing output increased by 6.3%, services were up 6.1% and agriculture expanded by 1.1%. The economy has recovered just over half its lost output during the shutdowns and in the 3 months to Jul, it shrank by 7.6%.

- UK industrial production plunged by 7.8% yoy in Jul (Jun: -12.5%), posting the 16th consecutive month of decline in activity. In month-on-month terms, manufacturing and industrial output grew by 6.3% (Jun: 11%) and 5.2% (Jun: 9.3%) respectively in Jul.

Asia Pacific:

- China’s exports increased by 9.5% yoy in Aug – the fastest pace in 1.5 years – while imports dipped by 2.1%, resulting in a lower trade surplus of USD 58.9bn. Lower imports point towards weaker domestic consumption. China’s trade surplus with the US widened to USD 34.24bn in Aug (Jul: USD 32.46bn).

- Chinese banks extended CNY 1.28trn (USD 187.25bn) in new loans in Aug, up 29% mom, as both household loans and corporate loans expanded by 11.1% and 119.2% respectively. Money supply grew by 10.4% yoy in Aug (unchanged from Jul’s pace) and the annual growth of outstanding total social financing (TSF) grew by 13.3% yoy (Jul: 12.9%). In Aug, TSF more than doubled to CNY 3.58trn from CNY 1.69trn in Jul.

- Inflation in China eased in Aug, rising by 2.4% yoy (Jul: 2.7%), as food prices increased at a slower pace (11.2% in Aug vs 13.2% in Jul). Excluding food and energy, core CPI rose 0.5% yoy, on par with Jul. Producers price index fell 2% yoy in Aug (Jul: -2.4%), though climbing by 0.3% mom.

- Foreign exchange reserves in China increased to USD 3.165trn in Aug (Jul: USD 3.154trn).

- Preliminary estimates for Japan’s leading economic index improved to 86.9 in Jul (Jun: 83.8); the coincident index also increased to 76.2 from 74.4 the month before. The Cabinet Office continued to rate the economy as “worsening” for the 12th straight month, the longest on record.

- Japan’s GDP declined by a revised 7.9% qoq (preliminary estimate of a 7.8% drop) in Q2 with annualised GDP collapsing by 28.1%. The revision showed that capital investment declined 4.7% qoq, compared with the initial estimate of a 1.5% fall.

- Overall household spending in Japan plunged by 7.6% yoy in Jul (Jun: -1.2%), the 10th straight monthly decline. Average monthly incomes have increased by 9.2% yoy in Jul, thanks to the government’s cash handouts, but people have been reluctant to spend. Spending on entertainment, clothing and transportation fell sharply by 21%, 20.2% and 19.6% respectively.

- Core machinery orders in Japan rose by 6.3% mom in Jul (Jun: -7.6%); overseas orders, an early indicator for future exports, increased (for the first time in 5 months) by 13.8%.

- Industrial output in India contracted for the fifth straight month, down 10.4% yoy in Jul (Jun: -15.7%; May: -34%). The consumer non-durables sector was the only subsector to post a growth (+6.7%) while consumer durables fell by 23.6% and capital goods productions dropped by 22.8% (Jun: -37.3%).

Bottom line: Even as Covid19 cases continue to surge – India recorded almost 100k cases in 24 hours, US cases rose by the most in a week, Israel (with 4k+ cases daily) is heading for a nationwide second lockdown (expected from this Fri) and Indonesia plans to reinstate a lockdown in Jakarta (from Sep 14) – politics seems to be taking a front seat with the runup to the US elections (latest being Trump’s calls to “decouple” from China) and the ongoing Brexit saga, where UK explicitly stated that it plans to breach parts of the Withdrawal Agreement treaty signed in Jan (clearly breaking international law); one positive move for UK was the signed trade deal with Japan.

Regional Developments

- Bahrain became the second Arab nation to normalize relations with Israel within a month, following a similar move by the UAE. Both UAE and Bahrain will sign and formalize the deal at a Sep 15 ceremony at the White House. 4 Arab nations have now full diplomatic ties with Israel: Bahrain, Egypt, Jordan and the UAE.

- Bahrain’s second international debt sale this year, USD 2-bn dual-tranche bond (which comprised a 7-year sukuk and a 12-year conventional tranche) received more than USD 7.6bn in combined orders.

- About 85% of Bahraini parliament’s workload has been performed remotely since Feb, thereby saving thousands of dinars.

- Bahrain resumed issuing visa on arrivals: for now, entry is restricted to citizens and for citizens of nationalities that are eligible for it. Separately, Bahrain and India entered an “air bubble” accord to permit bilateral travel of specific categories.

- Egypt government extended the timeline for privatizing the state-owned electricity companies by 2 years to 2025. The privatization plan not only moves the state to a regulator only role, but also includes separating power generation from transmission and distribution.

- Inflation in Egypt is estimated to average 6.2% in Q4 this year, according to the central bank governor. In Aug, the urban CPI decreased to 3.4% from the previous month’s 4.2%, largely due to the decline in food prices. Core inflation was at 0.8% in Aug (Jul: 0.7%).

- Trade deficit in Egypt narrowed by 8.6% yoy to USD 3.3bn in Jun: exports declined by 7.9% yoy to USD 2.26bn while imports decreased at a faster pace of 8.3%.

- Egypt’s net foreign reserves inched up to USD 38.36bn at end-Aug from Jul’s USD 38.315bn.

- Egypt’s finance ministry approved urgent financial allocations of EGP 7.5bn to several state-run bodies including the General Authority for Supply Commodities (EGP 4bn), General Authority for Roads, Bridges, and Land Transport (EGP 1.27bn) and Ministry of Manpower (EGP 300mn) among others.

- Investments into Egypt increased by 26% yoy in the fiscal year 2019-20, according to a Cabinet State. The planning minister disclosed that this year’s plan includes the implementation of 691 green projects at a total cost of EGP 447.3bn.

- Egypt plans to raise its tax-to-GDP ratio to 16.5% from 14% currently, thanks to the implementation of related reforms including an expansion of the tax base.

- The recently approved electronic payment law in Egypt will support the nation’s move to a non-cash economy, while also enabling financial inclusion, according to the finance minister. Entities to implement these regulations – schools and universities to communication services to transportation services – have been given a 6-month period to rollout non-cash payment methods at all outlets.

- Egypt’s commodities exchange – initially trading wheat, oils, sugar and rice – will have EGP 91mn in capital and launch in H1 2021. There was no clarity as to how the grains would be priced on the exchange and whether the government would purchase directly from it.

- Egypt’s 2020-21 academic year will start on Oct 17th, with the biggest challenge ensuring adherence to social distancing measures.

- Unemployment rate in Jordan rose to 23% in Q2 this year, up 3.8% yoy; more than half of the unemployed individuals (51.6%) held a secondary school certificate or more. Unemployment rates were higher among women (28.5%) versus male unemployment rate at 21.5%.

- Jordan resumed international flights from last Tues, handling a total of six flights a day to start with.

- Jordan is rolling out a compulsory 1-year military service for persons aged 25-29 (who are unemployed, and with no social security subscriptions in the last year prior to conscription) as “part of the plan to address poverty and unemployment while investing in our youth”. The plan includes three months of military training, with the other nine devoted to professional and technical training in the private sector. The women will be exempt from the 3-month military training phase. A monthly payment of JOD 100 will be offered during the service period.

- The Arab Monetary Fund extended a loan of USD 41mn to Jordan, to provide financial support to the Kingdom and meet its emergency needs.

- Kuwait Parliament’s Human Resources Development Committee is almost ready with its report on the demographics of the country. Sources revealed that the quota system will be applied on jobs rather than the nationality i.e. number of expats in a particular job should not exceed 20%. Separately, competency tests were being planned for expats applying to 20 professions.

- Kuwait plans to float three tenders, worth KWD 19.479mn, to develop and modernize the power network.

- Lebanon’s PM designate is still under pressure to announce his cabinet this week; US sanctions on two former Ministers ratchets pressure on the ruling political class.

- IMF stated that it stands ready to “redouble its efforts” to support Lebanon while reiterating the need for an accounting and financial audit of Lebanon’s central bank to assess its assets and liabilities. This audit will also help understand the central bank’s financing of government operations and its “financial engineering” of the apex bank’s own net worth. The finance ministry disclosed that the financial audit is underway with Alverez submitting to the finance minister a “preliminary list of information required from BdL”. More on the IMF’s press briefing: https://www.imf.org/en/News/Articles/2020/09/10/tr091020-transcript-of-imf-press-briefing

- A second stimulus package has been announced in Oman to support economic recovery: this includes an extension of the existing loan deferment scheme, enhancing the tenor and limit of the forex swap facility, revising the loan-to-value ratio for housing loans and a potential relaxation of the liquidity coverage ratio for banks (on a case-by-case basis).

- Oman plans to tap the local and international debt markets to support its finances that have been dented by the low oil prices and the Covid19 outbreak. So far, local development bonds worth OMR 550mn have been issued in addition to securing a USD 2bn bridge loan.

- The total number of SMEs registered in Oman increased by 11.8% yoy to 45,094 at end-Jul 2020. Muscat account for just above 1/3-rd of the total registered SMEs in the country.

- Citizens in Oman will be prioritized for sub-contracted roles across sectors including banking and finance, reported national daily Times of Oman.

- Oman will restart international flights from Oct 1st, with flights scheduled according to the health data for specific destinations.

- Saudi Arabia’s central bank governor disclosed that the outlook for the economy remains uncertain given current circumstances (low oil prices and the spread of the pandemic), while assuring the bank’s commitment to the dollar peg (an “overriding anchor”). He also cautioned against a deterioration in asset quality as central banks withdrew extraordinary support meted out to banks. Earlier in the week, the finance minister aired his view that the IMF’s growth forecast (-6.8%) this year is more pessimistic than their own.

- During a conference, Saudi Arabia’s finance minister disclosed a few signs of recovery in the economy: privatization programs saved SAR 15.7bn of government expenditure, room occupancy rates jumped to 85-90% in 11 tourist destinations. (The complete interview can be accessed here: https://www.youtube.com/watch?v=O4Zu8ABlk0U)

- Saudi Arabia improved its score in UNCTAD’s Liner Shipping Connectivity Index: it rose to 68.46 points in Q2 (vs Q1’s 56.3), above the average of 62.4 recorded in 2019.

- Saudi Arabia’s Ministry of Industry and Mineral Resources issued 71 new licenses in Aug; the firms have a combined total of SAR 1.6bn capital and employs 2,991 regular workers.

- Saudi Electricity Co issued the first-ever green sukuk by a Saudi Issuer, raising USD 1.3bn: projects identified include a smart metering project and renewable energy integration.

- Saudi Arabia’s PIF is “looking at” investing in the IPO by Ant Group – touted as the world’s biggest ever likely raising up to USD30bn.

- UAE’s ADIA ranked third among the top 89 global sovereign wealth funds, with USD 579.6bn in assets, according to the SWF Institute. ADIA was closely followed by the Kuwait Investment Authority (USD 533.7bn), Saudi PIF (USD 390bn) and the Investment Corporation of Dubai (USD 305.2bn).

- The Airport Council International expects passenger traffic in the Middle East to slump to 170mn this year (-59.5% yoy), as a result of which regional airports will lose revenues (forecast to touch USD 5bn from a pre-Covd19 estimate of USD 13.2bn).

UAE Focus

- Dubai PMI fell to 50.9 in Aug, from Jul’s 51.7: while output expanded for a 3rd consecutive month, it was at the slowest pace during the period (52.7 from Jul’s 56.1); employment fell for the 6th straight month (46 in Aug from Jul’s 46.8).

- UAE posted a record budget surplus of AED 9.75bn in H1, with surpluses of AED 1.8bn and AED 7.95bn in Q1 and Q2 respectively. Revenues in H1 exceeded AED 34.7bn, with 56% of Q2 revenue generated by the Ministry of Finance.

- The UAE central bank governor warned that central banks need to act in a “careful and phased manner” to avoid a credit supply squeeze when economies go through a recovery phase after Covid19.

- The recently passed UAE law “Securing Interest with Movable Property” allows companies to use its assets (ranging from tools and raw materials to receivables and collaterals) against loans, thereby supporting SMEs and also making it easier for banks to expand their lending operations.

- Etihad Airways will extend the period of reduced pay for its staff until end of this year. Salaries will be cut 10% from Sep (vs an earlier reduction of between 25-50%), reported Bloomberg though staff allowances had been reintroduced. In contrast, Emirates will be paying its full salaries starting Oct, as it flies to more destinations and after receiving support from the Dubai government as well as cutting spending (by also laying off its staff).

- Abu Dhabi launched a new open data platform “Abu Dhabi Open Data” that offers more than 550 data sets on various sectors including agriculture, tourism, education, energy and technology.

- UAE and South Korea have inked agreements to cooperate in 10 new sectors ranging from investments in SMEs to IT, AI, 5G technology as well as education, tourism and financial services (among others). The UAE is home to about 13k South Korean expats, and bilateral non-oil trade stood at USD 5bn last year.

- The newly launched Abu Dhabi Youth Council initiative allows for young Emiratis to provide services as freelancers to projects announced on the Abu Dhabi Government Services website TAMM (and before a public tendering process is initiated).

Media Review

Statistics, lies and the virus: Tim Harford’s five lessons from a pandemic

https://www.ft.com/content/92f64ea9-3378-4ffe-9fff-318ed8e3245e

Egypt Prime Minister approves amendments to capital market regulation

https://dailynewsegypt.com/2020/09/08/egypt-prime-minister-approves-amendments-to-capital-market-regulation/

CNBC’s interview with Lebanon’s central bank governor

https://www.cnbc.com/2020/09/08/lebanon-central-bank-governor-refuses-to-step-down-over-economic-crisis.html

https://www.youtube.com/watch?v=NEO4y-Jy5Pk

Create your own moody quarantine music with Google’s AI | MIT Technology Review

https://www.technologyreview.com/2020/09/04/1008151/google-ai-machine-learning-quarantine-music/

Is the office obsolete?

https://www.economist.com/graphic-detail/2020/09/11/the-home-office

IEA’s Energy Technology Perspectives 2020

https://www.iea.org/reports/energy-technology-perspectives-2020