Markets

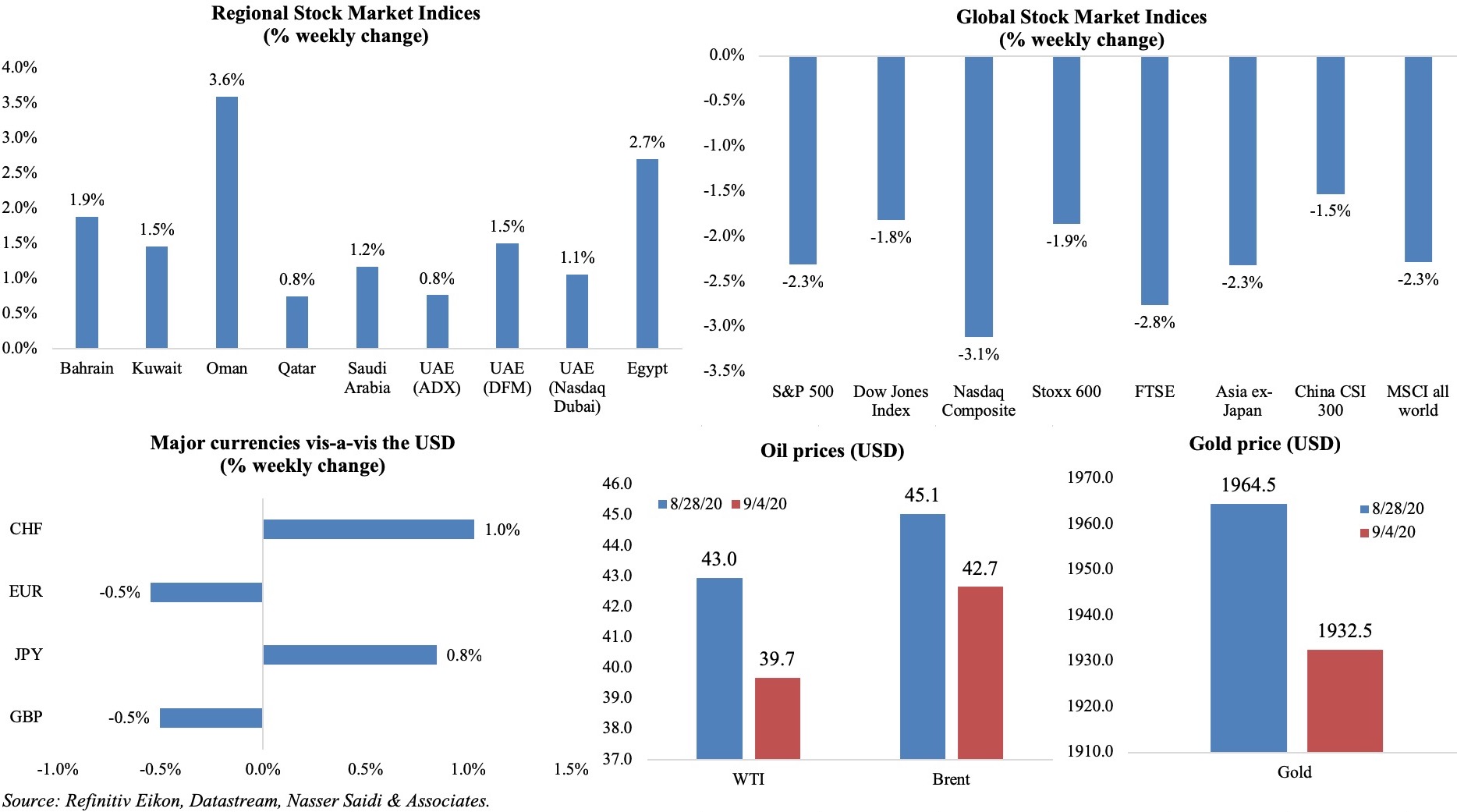

Most global equity markets were down last week, with the US Nasdaq’s run on technology stocks resulting in its worst weekly performance since Mar, while S&P posted its first weekly loss in 6 weeks. Though European equities ended the week lower, there was increased activity in financial shares on talks of potential mergers; UK markets are jittery, with EU talks set to resume on Sep 8th (and less than a month to the Oct 2 deadline for a deal). Asian markets mirrored the trend, also breaking a 6-week positive streak while in the Middle East, markets were up on positive news (e.g. Dubai’s retirement visa announcement boosted property stocks, Saudi CMA allowing foreign investors to invest directly in debt instruments supported the market). The dollar recovered from 2-year lows touched earlier, while the euro continued to decline: it hit USD 1.2 for the first time since 2018. Oil prices weakened on demand recovery concerns and gold prices dipped by 1.7%.

Weekly % changes for last week (3-4 Sep) from 27th Aug (regional) and 28th Aug (international).

Global Developments

US/Americas:

- Non-farm payrolls increased by 1.371mn in Aug (Jul: 1.734mn), supported by government hiring of workers for Census 2020. Labour force participation rate stood at 61.7% vs Jul’s 61.4%, while the average hourly earnings ticked up by 0.4% mom and 4.7% yoy (Jul: 0.1% mom and 4.7% yoy). However, while temporary layoffs declined, permanent job losses jumped rising by 534k to 3.4mn. Unemployment rate declined to 8.4% (Jul: 10.2%), falling below the 10%-mark for the first time since Mar.

- Factory orders climbed by 6.4% mom in Jul, thanks to an uptick in durable goods orders (+11.4%) and demand for transport equipment (+35.7%, boosted by vehicles and defense aircraft).

- ISM manufacturing increased for the 3rd straight month to 56 in Aug (Jul: 54.2), also posting the highest level since Nov 2018, thanks to a pickup in new orders (67.6 in Aug from 61.5). Employment however remained sub-50, at 46.4 (Jul: 44.3).

- The final Markit manufacturing PMI reading stood at 53.1 in Aug (flash estimate of 53.6, but higher than Jul’s 50.9), with an upturn in new orders while employment rose at the fastest since Nov 2019.

- Private payrolls grew by 428k in Aug (Jul: 212k), disclosed ADP, with leisure and hospitality adding the most new jobs (+129k).

- Initial jobless claims fell by 130k to a seasonally adjusted 881k in the last week of Aug. The Bureau of Labour Statistics has changed its method for adjusting initial jobless claims to account for seasonal swings in employment, given the yawning gap between the seasonally adjusted numbers and the actual number of people applying for benefits (A good pictorial analysis: https://twitter.com/econchart/status/1301532138261671936). Continuing claims eased to a pandemic-low of 13.25mn in the week of Aug 22 from 14.49mn a week prior.

Europe:

- Germany inflation stood at 0.0% yoy in Aug (Jul: -0.1%), with the harmonized index dropping to -0.1% yoy (Jul: 0% yoy). The easing reflects the temporary VAT cut and low energy costs.

- The German government revised upwards its forecast for the economy this year: to -5.8% from -6.3% previously. Forecasts for next year was lowered to 4.4% from 5.2% earlier.

- German unemployment rate remained steady at 6.4% in Aug, given the support of its short-time work schemes; the change in the number of people out of work fell by 9k last month, from a 17k drop the month before.

- Though German factory orders rose by 2.8% mom in Jul (Jun: +28.8%), it is still 8.2% lower than in Feb prior to the lockdown measures. A significant divergence was observed in orders: domestic industrial orders fell by 10.2% in Jul but orders from abroad were up 14.4%.

- Germany manufacturing PMI inched down to 52.2 in Aug (Jul: 51), thanks to output growth (30-month high) and a sustained rise in new orders and export orders. Aug services PMI eased from a 13-month high of 55.6 in Jul to 52.5, with slower growth in hotels and restaurants and “other services”. Composite PMI also slipped to 54.4 from Jul’s near 2-year high (55.3).

- EU manufacturing PMI was unchanged from the flash estimate of 7 in Aug (Jul: 51.8), thanks to gains in output and new orders. There were divergences across countries: while Italy posted the fastest growth rate in two years, Spain and France stagnated (readings of 49.9 and 49.8) respectively. Composite PMI fell to 51.9 (Jul: 54.9) as rate of growth eased in service sector activity (50.5 from Jul’s 54.7).

- UK Markit manufacturing PMI eased slightly to 55.2 in Aug (Jul: 55.3) while the services PMI posted the sharpest increase since Apr 2015, posting a reading of 58.8 in Aug (Jul: 56.5). Spending was buoyed by the Eat Out Help Out scheme, and there was a recovery in demand for overall business services.

- EU inflation fell to -0.2% yoy in Aug (Jul: 0.4%) while core CPI eased to 0.4% in Aug (Jul: 1.2%).

- Unemployment rate in the euro area inched up to 7.9% in Jul (Jun: 7.7%) while in the whole EU area, it was up to 7.2% from the previous month’s 7.1%.

Asia Pacific:

- China NBS manufacturing PMI edged down to 51 in Aug (Jul: 51.1), as while output and new orders grew (53.5 & 52 from 54 & 51.7 respectively), export sales and employment stayed below-50 (49.1 and 49.4 respectively). Non-manufacturing PMI rose to 55.2 in Aug (Jul: 52.1), staying above-50 for the 6th month running. Transportation and telecommunications sectors posted a faster recovery in business volume, the 4th consecutive month.

- Caixin manufacturing PMI increased to 53.1 in Aug (Jul: 52.8), the fastest expansion in 9 years. Total new work expanded at the sharpest rate since the start of 2011 and new export sales rose for the first time since Dec 2019. Caixin services PMI edged down slightly to 54 in Aug (Jul: 54.1); employment increased across the sector for the first time since Jan.

- Japan PMI picked up to 47.2 in Aug (Jul: 45.2), with weaker drops in output and orders.

- Industrial production in Japan increased by 8.0% mom in Jul – at the fastest pace on record – following Jun’s 1.9% gain. In yoy terms, IP is still down 16.1% and likely to remain below pre-crisis levels in the near-term.

- Japan retail sales declined by 3.3% mom and 2.8% yoy in Jul, falling for the 5th consecutive month, dragged down by a decline in car demand and dampened activity in department stores and supermarkets.

- Japan unemployment rate inched up to 2.9% in Jul (Jun: 2.8%), with the job-to-applicants ratio slipping for the 7th consecutive month, from 1.11 to 1.08, lowest since Apr 2014.

- Capital spending in Japan fell by 11.3% in Q2 (Q1: 0.1%), posting the worst decline since Q1 2010.

- India GDP plunged by 23.9% in Apr-Jun 2020 – the largest slump since quarterly GDP started being reported in 1996. Sector-wise, only agriculture recorded a positive growth, at 3.4%; construction, manufacturing and trade&hospitality were down by 50.3%, 39.3% and 47% respectively. While government consumption picked up by 16%, it was not sufficient to offset the 47.1% collapse in investment and 26.7% drop in household consumption.

- Manufacturing PMI in India expanded to 52 in Aug from 46 the previous month: both output and new orders expanded (the former for the first time since Mar). Services PMI removed below-50, though jumping to 41.8 in Aug from Jul’s 34.2 – the highest since Mar.

- India fiscal deficit in the four months to Jul widened to INR 8.2trn (Apr-Jun: INR 6.6trn), or 103.1% of the budgeted target for the current fiscal year. Deficit for the full year is estimated to be more than double the 3.5% of GDP estimated initially by the government.

- Korea GDP fell by 3.2% qoq and 2.7% yoy in Q2, revised from a 3.3% contraction estimated earlier. This still remains the sharpest decline since Q4 2008, and places the country in a technical recession (following Japan, Thailand and Singapore).

- PMI in Korea stayed below-50 in Aug, but the reading at 48.5 was at a 6-month high and up from Jul’s 46.9.

- South Korea’s current account surplus hit a 9-month high of USD 7.45bn in Jul – the highest since Oct 2019. Separately, trade surplus stood at USD 4.12bn in Aug as both exports and imports declined – by 9.9% and 16.3% respectively – for the 6th consecutive month.

- Singapore PMI weakened to 43.6 in Aug (Jul: 45.6) after weaker external demand led to a sharp decline in new business.

- Singapore retail sales fell by 8.5% yoy in Jul, following a revised 27.7% drop in Jun. Month-on-month values improved as most physical stores were closed during the circuit breaker measures in place till late Jun.

Bottom line: Last week saw a barrage of Aug PMI numbers: global manufacturing PMI reached its highest in 21 months (51.8 from Jul’s 50.6), as output and new orders rose at the fastest rates since Apr and Jun respectively, while export demand stabilised. The individual country numbers indicate that in many cases export demand has not recovered as much as domestic demand (post lockdowns). Recovery is choppy, with surges in Covid19 cases and restricted lockdowns (in a few places). Though PMIs have shown some improvement, the impact might be hampered by rising unemployment, subdued international demand alongside overall economic and health uncertainty. As in a first-in first-out model, China continues to outperform its global peers in terms of recovery (be it PMI numbers or GDP). Even in the IIF’s latest capital flows to emerging markets securities data, while overall flows fell more than 86% mom to USD 2.1bn in Aug, flows into China increased marginally by USD 600mn.

Regional Developments

- After raising USD 2bn in May, Bahrain plans to tap debt capital markets again this year, reported Reuters. The benchmark issue will include both conventional and Islamic bonds.

- Bahrain announced that organizational restructuring has been completed in 51 out of 57 government departments, in a move to increase operational efficiency and reduce costs.

- Bahrain’s flexi-work permit has resulted in a 43% drop in the number of illegal workers, according to a Labour Market Regulatory Authority official.

- Outdoor dining at cafes and restaurants have been reopened in Bahrain with appropriate social distancing and safety measures, after 5 months of closure.

- Egypt’s PMI stayed below-50 in Aug, with a reading of 49.4 from Jul’s 49.6. Output and new orders were marginally up in non-oil companies, but sales remained weak given low demand. Jobs declined for the 10th consecutive month and was the main drag on the index.

- Egypt repaid USD 6.8bn of foreign debt obligations in Q1, disclosed the central bank. The nation’s external debt decreased to USD 111.3bn by end-Q1.

- The IMF forecasts Egypt’s real GDP to rise to 6.4% in the fiscal year 2021-22 from 2.8% at the end of the current fiscal year, as per the latest staff report. The external financing gap was estimated at roughly USD 9.2bn in FY 19-20 and USD 4.5bn in FY 20-21. Access the complete report: https://www.imf.org/en/Publications/CR/Issues/2020/09/01/Arab-Republic-of-Egypt-Request-for-Purchase-Under-the-Rapid-Financing-Instrument-Press-49724

- Egypt signed a USD 2bn conventional and Islamic loan (approved by Parliament) with several banks (a deal coordinated by UAE’s lenders Emirates NBD and First Abu Dhabi Bank), to finance the state budget and support the economy.

- Egypt welcomed about 150k tourists to its cities of Sharm El-Sheikh and Hurghada since tourism activity was permitted to resume on 1st Jul.

- Egypt’s natural gas exports more than doubled to 4.5bn cubic metres in 2019, compared to 2bn in 2018, according to BP Statistics. Total gas output had touched a decade-high9bn cubic metres last year.

- Iraq is requesting an exemption from the OPEC+ deal during Q1 2021 while complying with the cut in Q4 this year. The nation is expected to cut oil production by an additional 400k barrels per day (bpd) in Aug and Sep – in addition to the committed 850k bpd – to compensate for previous overproduction. Iraq’s total exports averaged 2.6mn bpd in Aug, according to the oil ministry, down from 2.763 bpd in Jul.

- Iraq plans to speed up the petrochemical plant in Basra – currently in the pre-FEED (front end engineering design) stage – to diversify its income; once completed, the plant would make Iraq the region’s largest petrochem producer. The deal to build the USD 11bn plant was signed in 2015.

- Jordan will resume international flight operations from Sep 8: in addition to submitting negative PCR tests, those from “green” and “yellow” countries will need to spend 1 week of self-isolation (if tested negative again, on arrival in Jordan). Separately, nearly 2mn children returned to schools last week; an estimated 40k pupils have been withdrawn from private schools (that educate half of school-going students in the country) due to financial concerns.

- Jordan hiked fuel prices in Sep: prices of diesel and kerosene was increased by 3.2% mom to JD0.480 per litre. Petrol prices were up by 1.7%-3% mom, depending on the grade.

- Jordan received USD 699.9mn last week, as part of the USD 845.1mn annual aid from the US. Separately, it was revealed that total foreign assistance received by Jordan in Jan-Jul this year totaled USD 1.7bn.

- Kuwait’s government will discuss the proposed changes to the debt law, the finance minister revealed to the parliament. The government’s proposal of borrowing a maximum KWD 20bn over 30 years was countered by the parliament committee proposed debt ceiling of KWD 10bn and a repayment of 10 years. The committee also asked that the law be reconsidered within 3 years, with an onus on the minister to disclose repayment mechanisms.

- Inflation in Kuwait increased by 1.92% yoy and 0.43% mom in Jul, as a result of rising prices of home furnishings (+4.2% yoy), tobacco (+3.9%), food and beverages (+3.74% yoy) and clothing (+3.27%).

- Kuwait will not issue, transfer or renew work permits of those above 60 years of age, holding a high school diploma or lesser (or equivalent certificates): about 68,318 expats currently fall under this category. Those aged 59 or 60 can renew or transfer for only one year.

- Lebanon’s new PM Mustapha Adib, named hours before Macron’s visit to the country, called for an immediate start to reforms and agreement with the IMF. Separately, a 3rd member of the negotiating (with the IMF) team resigned over talks which are at a standstill.

- During his visit, Macron revealed that Lebanon’s leaders had promised the formation of a Cabinet in “not more than 15 days”, while reiterating that targeted sanctions (in coordination with the EU) could be imposed if corruption was proven. While promising to return in Dec, Macron also stated that expectations are for the government to deliver on promises within 8 weeks, and that “a blank check” would not be issued.

- Lebanon’s caretaker finance minister signed contracts – with Alvarez & Marsal, KPMG and Oliver Wyman – to conduct a forensic audit of national finances, with the former firm conducting a forensic audit of the central bank. The contracts were not disclosed to reveal the scope of the audits.

- The World Bank estimates that the Aug 4 explosion in Beirut caused up to USD 4.6bn in damage to infrastructure and physical assets in the capital city. The report estimates public sector reconstruction and recovery needs for this year and 2021 in the range of USD 1.8-2.2bn.

- Beirut port’s capacity has been restored to a limited handling of 1500-3000 tonnes a day versus 10-15k tonnes of wheat and bulk imports per day prior to the Aug 4 blast, according to a senior UN official. The UN World Food Program was able to unload a shipment of 12500 tonnes of wheat flour, roughly half a month’s supply for the country.

- World Bank cancelled USD 244mn in undisbursed funds for the Bisri Dam project in Lebanon, effective immediately due to government non-compliance with loan pre-conditions. The funding was put under partial suspension on Jun 26th.

- Oman’s joint committee of the State Council and Shura Council has sent a draft VAT law for approval to the Sultan: the proposal is to implement VAT after Jan 2022.

- Oman Civil Aviation Authority extended the ban on scheduled flights from Oman until further notice. Separately, Oman Air stated that their planes and staff were ready to fly anytime.

- Schools in Oman can reopen with just 16 students per classroom, and a blended learning approach can be utilized, according to the Ministry of Education’s plans.

- Qatar Airways reached a deal with Airbus to delay delivery of its airplanes, according to the former’s CEO, but continues to be in talks with Boeing.

- PMI in Saudi Arabia weakened to 48.8 in Aug (Jul: 50): new business declined as a result of an uptick in input costs (the sharpest increase since Sep 2012, given the VAT hike) and low consumer spending alongside Covid19 safety measures. Employment also declined for the 6th consecutive month, though the fall was the slowest since May. However, confidence regarding future activity strengthened to a 6-month high.

- Saudi Arabia’s Ministry of Investment issued 506 new business licenses in H1 2020 (-14% yoy); Q1 had registered a 20% yoy growth and was followed by a 47% decline in Q2. The ministry disclosed that in Q2, the primary sources of investment were US (54), India (49) and the UK (47) while entrepreneurship, education, financial services and housing were the most attractive sectors for investment.

- Saudi Arabia’s Capital Market Authority revealed that it will allow foreigners to invest directly in listed and non-listed debt instruments, to develop and open its capital markets. Furthermore, it was revealed that CMA is studying the possibility for foreign (domestically registered) firms to offer shares in the capital market and the related regulatory framework will be completed by end-2021; plans are also underway to allow local companies to pursue dual listing in international markets.

- The value of shares purchased at Tadawul increased by 32% mom to SAR 135.58bn (USD 36.15bn); shares purchased by citizens represented 90.14% of total shares purchased during this period.

- SAMA extended deferrals on bank payments for 3 more months. Housing loans in Saudi Arabia surged by 55% yoy to SAR 11.1bn in Jul, according to SAMA’s latest statistical bulletin. Bank deposits increased by 9.4% to SAR 1.837trn in Jul while credit picked up by 13.2% yoy to SAR 1.686trn. Foreign reserve assets edged up by 0.11% mom to SAR 1.679trn in Jul, thanks to a surge in foreign cash and deposits abroad.

- Saudi banks investments in government bonds grew by 20.8% yoy and 1.2% mom to SAR 433.25bn in Jul. Banks’ investments in government bonds accounted for 86.92% of total banks’ liabilities from the public sector (government and semi-government) by end- Jul.

- Expat remittances from Saudi Arabia increased by 32.7% yoy and 8.66% mom to SAR 15.213bn (USD 4.05bn) in Jul, bringing total remittances this year to SAR 84.6bn (+16% yoy).

- MSMEs in Saudi Arabia contribute 28.7% to GDP and 43.6% to non-oil GDP, according to the Saudi General Authority for Small and Medium Enterprises (Monshaat). The number of SMEs stood at 571,177 by end-Q2 and their employees’ salaries edged up by 1.6% yoy to SAR 10.675bn.

- The Wall Street Journal reported that Saudi Aramco is reviewing (and slowing) expansion plans and pausing investments in refineries in China, India and Pakistan. Within Saudi Arabia, Aramco is delaying plans by a year to boost crude production capacity to 13mn barrels per day, from currently about 12mn.

- Public sector employees in Saudi Arabia returned to offices after months; while work from home is still permitted, percentage of employees doing so should not exceed 25% of the total.

- Both UAE and Saudi Arabia climbed up 2 places in the Global Innovation Index, reaching 34th and 66th places in the 2020 edition.

UAE Focus

- UAE PMI declined to 49.4 in Aug (Jul: 50.8), in spite of expansions in the output and new orders sub-indices. Steep price discounting has resulted in rising domestic demand (And spending) but export sales are declining. Job cuts were widespread, with the PMI employment index at a record-low, while selling prices fell at the sharpest pace since Dec 2019.

- The Government of Dubai issued a USD 2bn Sukuk: it included a 10-year Sukuk of USD 1bn at a profit rate of 2.763% and 30-year government bonds of USD 1bn at an interest of 3.90%. The issue was 5 times oversubscribed, with the order book value above USD 10bn. The bond prospectus showed government’s outstanding direct debt at AED 123.5bn (USD 33.6bn) as of June 30 (or 28% of 2019’s GDP). However, it sidestepped the issue of GRE debt stating that “there is no official information on either the aggregate amount or maturity profile of the indebtedness” of Dubai’s GRE debt. The document also revealed that AED 7.3bn had been pumped into Emirates airlines after the impact from Covid19.

- Dubai announced a retirement visa programme: any resident or retiree outside the UAE, and over the age of 55 can apply for this program (initial phase will focus on residents). To qualify, the person needs to have a monthly income of AED 20k (USD 5446) – either from investments or pensions – or should have a savings of AED 1mn or a real estate assert worth AED 2mn. They can also work as independent advisors, board members or consultants.

- The UAE central bank injected AED 15.86bn in cash to boost liquidity in Jun, after certificates of deposit dropped to AED 194.33bn by end-May from Apr’s AED 198.77bn.

- In a bid to restrict competition between the government and private sector, Dubai has set new rules for establishing government companies. This standardizes procedures for setting up government-owned companies and ensures they have strong governance; in addition, the government entities can set up companies only if their main activities are in line with the agencies role and offer products of “strategic economic importance”.

- Credit provided to the logistics, storage and communications sectors in the UAE surged by 47.4% to AED 84bn by end-Jun from end-Dec.

- Consumer spending in the UAE increased by 63% in Aug (compared to Mar), according to FCSA data cited by Wam. Spending in restaurants, hotels and apparel were up by 75%, 29% and 78% respectively in the same period.

- Dubai recorded 2,457 property sales transactions worth AED 4.73bn in Aug, up 11.3% yoy and 2.2% mom, according to data from Property Finder; of these, 31.6% were off-plan and rest in the secondary market.

- Medical equipment including disposable suits, hand sanitisers, face masks, respirators for air purification and gloves will be subject to zero-rated VAT in UAE, as per a recent resolution.

- Exports of Dubai Chamber of Commerce and Industry members to Africa rose by 20% mom to AED 2.94mn in Jun this year.

- UAE approved a 5-day paternity paid leave for private sector employees, enabling them to take care of newborns. This can be availed anytime till the baby turns 6 months old.

Media Review

UAE Peace Deal Opens Doors for Secret Israeli-Iranian Pipeline and Big Oil Investments

https://foreignpolicy.com/2020/09/04/uae-israel-iran-oil/

SoftBank is the “Nasdaq whale”

https://www.ft.com/content/75587aa6-1f1f-4e9d-b334-3ff866753fa2

Macro consequences of pandemics

https://www.nber.org/papers/w27757.pdf

How did Americans use their coronavirus stimulus cheques? Less than half the money was spent

https://www.economist.com/graphic-detail/2020/09/02/how-did-americans-use-their-coronavirus-stimulus-cheques

World Bank: Decisive Action and Change Needed to Reform and Rebuild a Better Lebanon

https://www.worldbank.org/en/news/press-release/2020/08/30/beirut-explosion-decisive-action-and-change-needed-to-reform-and-rebuild-a-better-lebanon

Powered by: