Markets

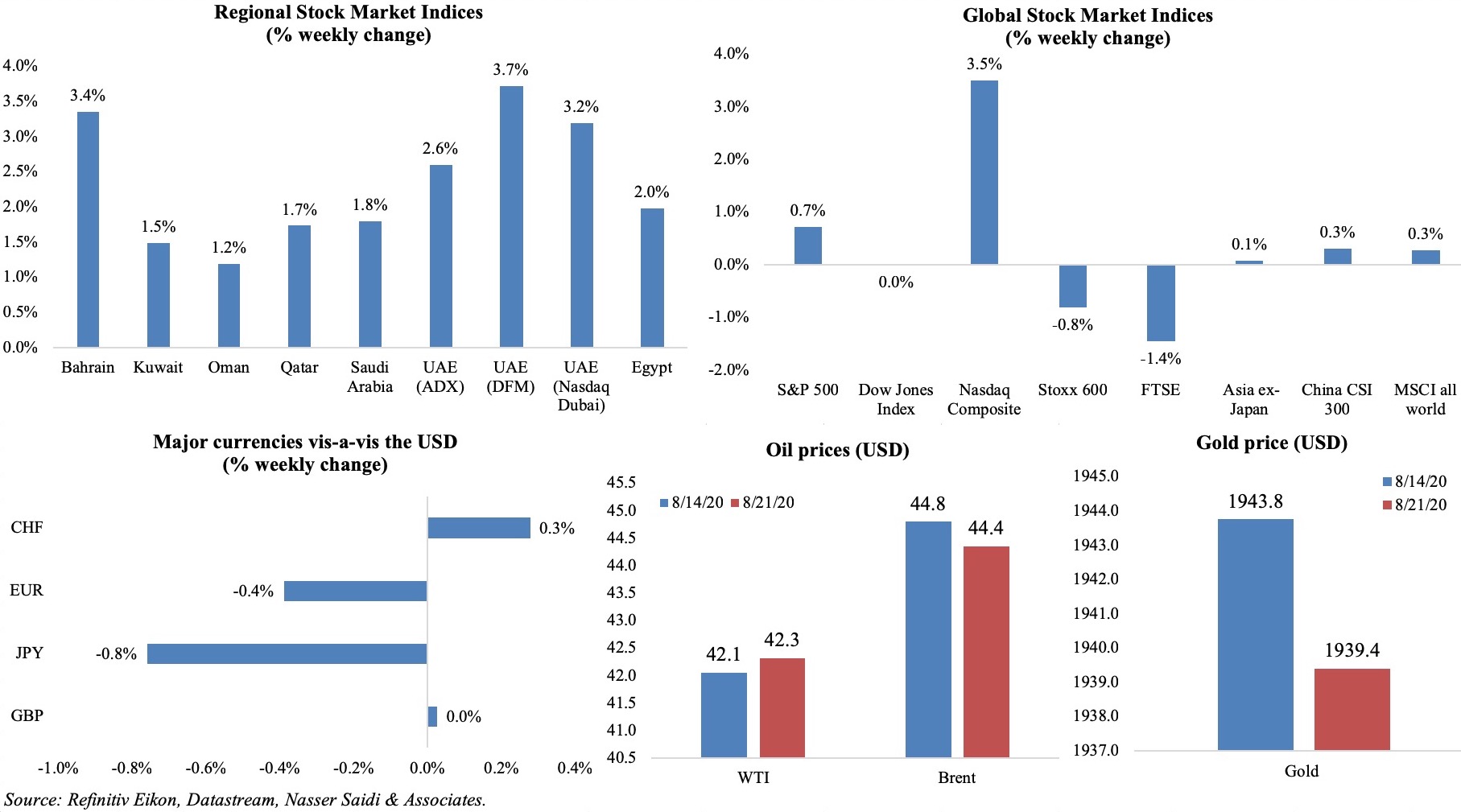

Global stock markets were weaker last week, as new economic data pointed to a muted recovery, with flash PMIs pointing to slow recovery (especially in the services sector) while Brexit talks proceeded with “little progress”. In the Middle East, financial stocks supported gains. The dollar dropped to a two-year low against a basket of currencies, while the pound had a rollercoaster ride, posting both its biggest one-day drop in 2 months and largest daily gain since Jun 1 last week. Brent prices fell, as did gold.

Weekly % changes for last week (20-21 Aug) from 13th Aug (regional) and 14th Aug (international).

Global Developments

US/Americas:

- Housing starts in the US surged by 22.6%, posting its biggest gain since Oct 2016 – to 1.496mn (Jun: + 17.5%). Building permits also accelerated by 18.8% mom to 1.495mn in Jul (Jun: +3.5%).

- Existing home sales grew by a record-high monthly gain of 24.7% to 5.86mn in Jul (Jun: +20.2%). Sales were up 8.7% yoy. The supply of existing homes however plummeted 21.1% annually, with just 1.5mn homes for sale at end-Jul. This shortage led to an uptick of 8.5% in median price of a home to USD 304,100.

- Preliminary estimates for the Markit Composite PMI Output Index moved up to 54.7 in Aug (Jul: 50.3) – the strongest increase in business activity since Feb 2019. Manufacturing PMI rose to 53.6 in Aug (Jul: 50.9), thanks to quicker expansions in both output and new orders; foreign client demand increased for the first time since Dec 2019. Services PMI grew to 54.8 from 50, supported by growth in new export orders, while rate of employment growth was the steepest since Feb 2019.

- Initial jobless claims climbed back above 1mn in the week ended Aug 15, rising by 135k to 1.106mn, taking the 4-week average to 1.175mn. Continuing claims eased to 14.84mn in the week ended Aug 7 – the lowest level since 1st week of Apr – from 15.48mn a week ago.

Europe:

- Inflation in the Eurozone fell by 0.4% mom in Jul (Jun: 0.3%), the biggest drop since Jan; core inflation also declined by 0.3% mom (-0.2%). In yoy terms, inflation picked up by 0.4% in Jul, with the highest contributions from non-energy industrial goods and services (both +0.42 ppts) as well as food, alcohol & tobacco (+0.38 pp).

- Flash manufacturing PMI in the Eurozone eased slightly to 51.7 in Aug (Jul: 51.8), with modest expansions in business activity and new orders. Services PMI was worse-hit, with the index easing to 50.1 from 54.7 the month before. The composite PMI fell to 51.6 (Jul: 54.9), with employment declining across the board amid fall in new export orders.

- Germany’s flash composite PMI reading eased to 53.7 in Aug, slipping from Jul’s near 2-year high of 55.3. Manufacturing PMI showed an uptick to 53 in Aug (Jul: 52), supported by a rise in export sales (panelists referred to demand from China and Turkey) while services PMI eased to 50.8 from 55.6 the month before (as travel restrictions were imposed, domestic demand declined and employment continued to fall).

- German producer price index ticked up by 0.2% mom in Jul, after a flat Jun reading. It fell 1.7% yoy, compared to a drop of 1.8% in Jun.

- UK government debt rose to above GBP 2trn for the first time this Jul: it’s now above 100% of GDP, on higher government spending to support the economy. The July borrowing figure (i.e. difference between spending and tax income) was GBP 26.7bn (Jun: GBP 29.5bn) – the 4th highest borrowing in any month since records began in 1993.

- Consumer price index in the UK inched up by 0.4% mom and 1% yoy in Jul (Jun: +0.1% mom and 0.6% yoy), with petrol prices (+4.5% mom), household goods and clothing accounting for the rise. Core inflation clocked in at 1.8% yoy. Producer price index core output gained by 0.1% yoy (Jun: 0.5%) while retail price index grew to 1.6% (Jun: 1.1%).

- Retail sales in the UK increased by 3.6% mom and 1.4% yoy in Jul (Jun: +13.9% mom and -1.6% yoy), climbing back to pre-Covid19 levels. Sales in clothing shops grew by 11.9% last month while online shopping fell by 7%.

- The flash composite PMI for UK touched 60.3 in Aug – the highest since Oct 2013, as more businesses reopened. Services PMI surged to 60.1 in Aug (Jul: 56.5), amid a trend for staycations and hotels/ restaurants reporting boosts from the Eat Out to Help Out scheme; manufacturing PMI picked up to 55.3 (Jul: 53.3), with production rising most since Apr 2014.

Asia Pacific:

- China’s central bank held interest rates steady, as expected, with the 1-year and 5-year loan prime rates at 3.85% and 4.65% respectively. Separately, the apex bank revealed that it would not expand its efforts to extend credit to small businesses.

- Japan GDP declined by 7.8% qoq and 27.8% yoy in Q2, posting the sharpest yoy contraction on record and the third consecutive quarter of negative growth. Private consumption shrank by 8.2% qoq alongside a plunge in consumer spending (steepest on record), capital expenditure declined by 1.5% while exports of goods and services witnessed a 18.5% plunge.

- Inflation in Japan inched up by 0.3% yoy in Jul, from Jun’s 3-year low of 0.1%, as food prices increased (1.9% from Jun’s 1.5%). Excluding fresh food, prices were flat, while excluding food and energy, prices were up by 0.4%.

- Industrial production in Japan fell by 18.2% yoy in Jun, following a 17.7% drop the month before. In mom terms, production inched up by 1.9% (May: +2.7%).

- Japan’s exports and imports plummeted for a 5th straight month, falling by 19.2% and 22.3% yoy respectively in Jul. While shipments to the US dropped by 19.5% yoy in Jul, exports to China rose for the first time in 7 months (+8.2%).

- Japan’s machinery orders unexpectedly dropped to a 7-year low: falling by 7.6% mom and 22.5% yoy in Jun (+1.7% mom and -16.3% yoy in May). Foreign orders fell by 3.9% mom, declining for a 4th consecutive month, but slowing from the 2-digit dips.

- Japan’s preliminary manufacturing PMI for Aug improved to 46.6 (Jul: 45.2), with declines in production and new orders though at a softer rate. Services PMI fell to 45.0 in Aug from a final 45.4 in Jul, with employment shrinking for a 6th consecutive month.

- Thailand Q2 GDP shrank by 12.2% yoy – the weakest in 22 years – given its reliance on exports and tourism. The Q2 unemployment rate was at 1.95%, and an additional 1.8mn workers at risk of losing their jobs.

- Taiwan export orders continued to grow for the 5th consecutive month: orders surged by 12.4% yoy, supported by the strong demand for electronic products (thanks to the work-from-home trend), as well as a gradual recovery in oil and raw material prices.

Bottom line: Global Covid19 confirmed cases have crossed 23mn, with numbers in the US inching closer to 6mn and India crossing the 3mn mark. As global economic recovery remains muted (with continuing declines across trade and FDI indicators amid higher unemployment rates), and gloomy Brexit talks continue, on the immediate horizon are the Jackson Hole meetings (looking for clues on central bankers next steps), a potential step up in US-China tensions ahead of the US Presidential elections in just over 2 months’ time. The outlook and waters are very choppy for markets even if VIX rates are sharply lower compared to March highs.

Regional Developments

- A memo by Bahrain’s Finance and National Economy Ministry showed a number of improvement signs across the economy in Jun & Jul: sales of non-essential goods grew by 12% in Jun and 28% in Jul, sales at food outlets increased by 9% and 15%, exports were up by 2% and 12%, visitors to shopping malls surged by 20% and 30%, petrol sales rose by 15% and 13%, real estate transactions jumped by 55% and 19%, and building permits more than doubled, increasing 124% in Jun.

- Compulsory PCR tests will be conducted at Bahrain Airport, but mandatory 10-day quarantine will be lifted on those that test negative.

- All MPs in Bahrain have backed the proposal to defer bank loan instalments owed by Bahrainis till end of the year. The original reprieve period finishes this week.

- Data from the Bahrain Tourism and Exhibition Authority show a 47% decline in number of tourists in Q1 this year, alongside a 49.5% reduction in total tourism nights and tourism expenditure plummeting by 55.4%.

- Bahrain awarded 769 tenders worth USD 1.7bn in H1 2020, revealed the Tender Board. Construction and engineering accounted for the largest share, being awarded 34.6% of tenders.

- Fitch downgraded two Bahraini GREs – Mumtalakat Holding Company and the Oil and Gas Holding Company (Nogaholding) – to B+ from BB-, with a stable outlook.

- About 120k corporates and 1mn individual borrowers have benefited from the Central Bank of Egypt’s SME initiative (funding of approximately EGP 180bn).

- Egypt’s holdings of US Treasuries edged up by 3.9% yoy to USD 2.235bn in Jun.

- Unemployment rate in Egypt increased to 9.6% in Q2 this year from 7.7% in Q1 and 7.5% a year ago.

- Estimated investments in Egypt’s manufacturing industry for the current fiscal year 2020/2021 plan amounts to EGP 80.6bn, disclosed the planning minister. The sector employs around 15% of the workforce and contributes about 17% of GDP.

- Traffic at the Suez Canal ticked up by 4% in the 2019-20 fiscal year, but canal’s revenues were down by 1.8% yoy to USD 5.7bn. This was largely attributed to the Covid19-led sharp decline in trade by 18.5% in Q2.

- Egypt’s 18 commercial and logistics zones and projects have attracted EGP 49bn in investments, and created 400k+ jobs, as per the assistant minister of supply and internal trade.

- Over 100k tourists have visited Egypt’s Red Sea resorts since international tourism restarted on Jul 1st. Hotel occupancy rates at these resorts have inched up to between 20-40%.

- Egypt signed a deal to build a wind power plant: the plant will have a capacity of 250MW, with an estimated project cost of around EUR 228mn.

- Five US firms signed agreements worth USD 8bn with the Iraqi government, in a bid to boost the latter’s energy independence.

- Iraq’s Qi Card (the leading electronic payment solution and national debit/credit card) loan program data revealed that paying off a medical bill or funding a small business venture were the reason more than 85% of Iraqis sought loans for.

- Jordan extended the closure of the Jaber border crossing (Syria) for another week.

- Private school enrolments in Jordan has declined by 50%, with parents opting for public schools given financial pressures and possibility of remote learning.

- Jordan’s government allocated JOD 1.341mn (USD 1.89mn) to UNRWA-run schools to cover the costs of textbooks during the 2019-2020 school year. UNRWA Jordan provides education services to over 118k students attending 169 UNRWA schools.

- Kuwait’s Parliament returned the public debt law – which would allow the government to borrow KWD 20bn over 30 years – back to the finance committee. This happened in spite of the finance minister stating that the country has KWD 2bn (USD 6.6bn) worth of liquidity in its Treasury and not enough to cover state salaries beyond Oct. Liquidity in the General Reserve Fund decreased from KWD 5bn in the start of the 2020-2021 fiscal year, with the government withdrawing KWD 4bn in less than 100 days.

- Kuwait’s finance ministry expects budget deficit to widen to KWD 14bn (USD 46bn) in the 2020-21 fiscal year, from the previous estimate of KWD 7.7bn, reported Reuters, citing a parliamentary document.

- Kuwait’s national assembly approved the law that makes transfers to the Future Generations Fund dependent on budget surplus. The Fund currently automatically receives 10% of oil revenue.

- Kuwait’s Parliament approved a law to protect troubled businesses: failure to pay debt is not seen as a criminal offence under the new law, unless fraudulent. Businesses can avoid bankruptcy by providing either a settlement with creditors or a restructuring plan.

- About 35k Indian nationals will leave Kuwait during the period 18-31 Aug, in the second phase of flights to India.

- Lebanon’s central bank will be able to subsidize fuel, wheat and medicine only for three more months – estimated at USD 700mn per month – to prevent reserves from falling below USD 17.5bn.

- About 2,500 claims amounting to USD 425mn have been submitted to insurance companies for damages incurred by the Aug. 4 Beirut blast, revealed the caretaker economy minister.

- According to UN ESCWA, about 55% of Lebanon’s population lived in poverty as of May this year, up from 28% last year. It estimated that the middle class had shrunk from 57 to 40% of the population and that those in extreme poverty had risen to 23% (from 8% last year).

- A partial lockdown has been imposed in Lebanon for two weeks to counter the rise in Covid19 infections.

- Oman appointed a new finance minister and chairman of the central bank, both occupied in the past by the country’s ruler. These were part of a wider set of measures enacted through 28 royal decrees, creating new ministries, renaming, dissolving and/or merging other entities (10 ministries were merged into five and five councils were abolished).

- Fitch lowered Oman’s credit rating for the second time this year to BB- from BB, while keeping the outlook negative.

- Oman’s crude oil output declined by 4.6% yoy to 147.76mn barrels in H1. Daily average crude oil output was 964,200 barrels at end-Jun, from an average 970,600 barrels a year ago.

- Oman became one of the first countries in the region to fully fulfill the requirements of the WTO’s Trade Facilitation Agreement.

- Inflation in Saudi Arabia soared by 6.1% yoy in Jul (Jun: 0.5%), the highest since 2011, as VAT tripled to 15%. Food and transport costs spiked, by 14.6% and 7.3% respectively. Wholesale price index also increased by 5.1% in Jul, rebounding from the 2% drop in May-Jun, thanks to higher price of metals and machinery as well as the VAT hike.

- Crude oil exports from Saudi Arabia fell by 17.3% mom to 98mn barrels per day in Jun – the lowest since at least Jan 2002.

- Saudi investments in US Treasuries fell by 30.46% yoy to USD 124.9bn by end-Jun.

- Saudi Arabia’s nationalization program was extended to 9 new categories in the wholesale and retail sector; these outlets should employ 70% locals. Should targets not be met, the firms will have to pay additional tariffs.

- Fintech startups in Saudi Arabia expanded by a massive 147% in two years, according to Magnitt’s Fintech Saudi Annual report. The fintech market is estimated to reach a transaction value of USD 33bn by 2023, with payments, personal finance and online insurance sales leading the space.

- More than 87,000 Indian nationals (out of a total 162k applicants) have been repatriated from Saudi Arabia, according to the Indian Ambassador.

UAE Focus

- UAE real GDP declined by 2.7% yoy to AED 368.52bn in Q1 this year, as a 2.7% drop in the overall non-oil sector was outpaced by the 3.3% uptick in the mining and quarrying sector. The government sector (public admin, defense, social security) posted a drop of 2.7% yoy.

- The UAE plans to make digital economy a priority for the country: the contribution of the digital economy to GDP was 4.3% in 2019.

- The Abu Dhabi government is in talks for a new international bond issuance, reported Reuters. The emirate has already raised USD 10bn this year via debt issuances.

- The Agriculture Producer Price Index (APPI) in Abu Dhabi increased by 13.2% yoy in May 2020, following a pickup of 19.8% in Apr.

- The Dubai Electricity and Water Authority (DEWA) announced a 6.6% yoy rise in the peak load of electricity to 9074 MW in Dubai this year to date: this is the highest recorded increase since 2012.

- About 14,000 residential units were completed in Dubai in H1 2020 – this accounts for just 30% of the 45,700 units scheduled for handover this year.

- UAE’s First Abu Dhabi Bank’s commitment to offer a 50% discount on the merchant service fee charged to SME customers for credit card transactions (for the period Apr-Jun 2020) is estimated to have benefitted more than 6,000 firms to the tune of AED 3.97mn.

- Assets of UAE’s listed banks increased by 8.2% yoy to around AED 3trn in H1 this year. Deposits picked up by 13% yoy and loans by 8% to AED 1.629bn during this period. First Abu Dhabi Bank and Emirates NBD together account for 51.9% of total assets.

- A senior GDFRA official disclosed that more than 20k travelers pass through the Dubai Airport daily since doors were opened to tourists on Jul 7th.

- Dubai issued a new law to regulate family-owned businesses: this law allows for new family ownership contracts to be formed setting out the rights and responsibilities of family members. For it to be legally binding, all parties of the contract must be members of the same family and have a single common interest. Exceptions to the law are family ownership in public joint-stock companies and movable and immovable property.

- Sharjah Airport became the first carbon-neutral airport in GCC and second in the Middle East to attain Level 3+ Neutrality accreditation from the Airport Carbon Accreditation programme. The certificate is given when net CO2 emissions over a full year are zero.

- Separate surveys from Visa and Mastercard highlight the ease of consumers and businesses in moving online and adoption of digital payments: Visa’s survey revealed that business models 94% of small and micro businesses in the UAE have evolved following the Covid19 outbreak versus 67% globally. Although almost 44% have initiated contactless payments (more than double global average), more than 90% of UAE merchants have concerns about moving their business online (vs. 74% globally). Mastercard highlighted that online shopping gained traction in the UAE, with 54% of UAE consumers expecting online shopping trend to continue post-Covid19, and that users were moving away from cash payments.

Media Review

Can Dubai enter the premier league of financial centres? (long read)

https://www.economist.com/finance-and-economics/2020/08/22/can-dubai-enter-the-premier-league-of-financial-centres

Saudi exchange Tadawul weighs next steps in global and regional plans

https://www.arabnews.com/node/1723106/business-economy

What steps will central bankers reveal at Jackson Hole summit?

https://www.ft.com/content/e37c586d-df75-4edc-b96f-36dbaaa87558

Falling Trade, Rising Imbalances…

https://www.cfr.org/blog/falling-trade-rising-imbalances

Is the Almighty Dollar Slipping?

https://www.project-syndicate.org/commentary/us-dollar-position-as-global-reserve-currency-over-short-and-long-term-by-nouriel-roubini-2020-08

Covid-19 is threatening Europe’s Schengen passport-free zone

https://www.economist.com/europe/2020/08/22/covid-19-is-threatening-europes-schengen-passport-free-zone

Powered by: