Markets

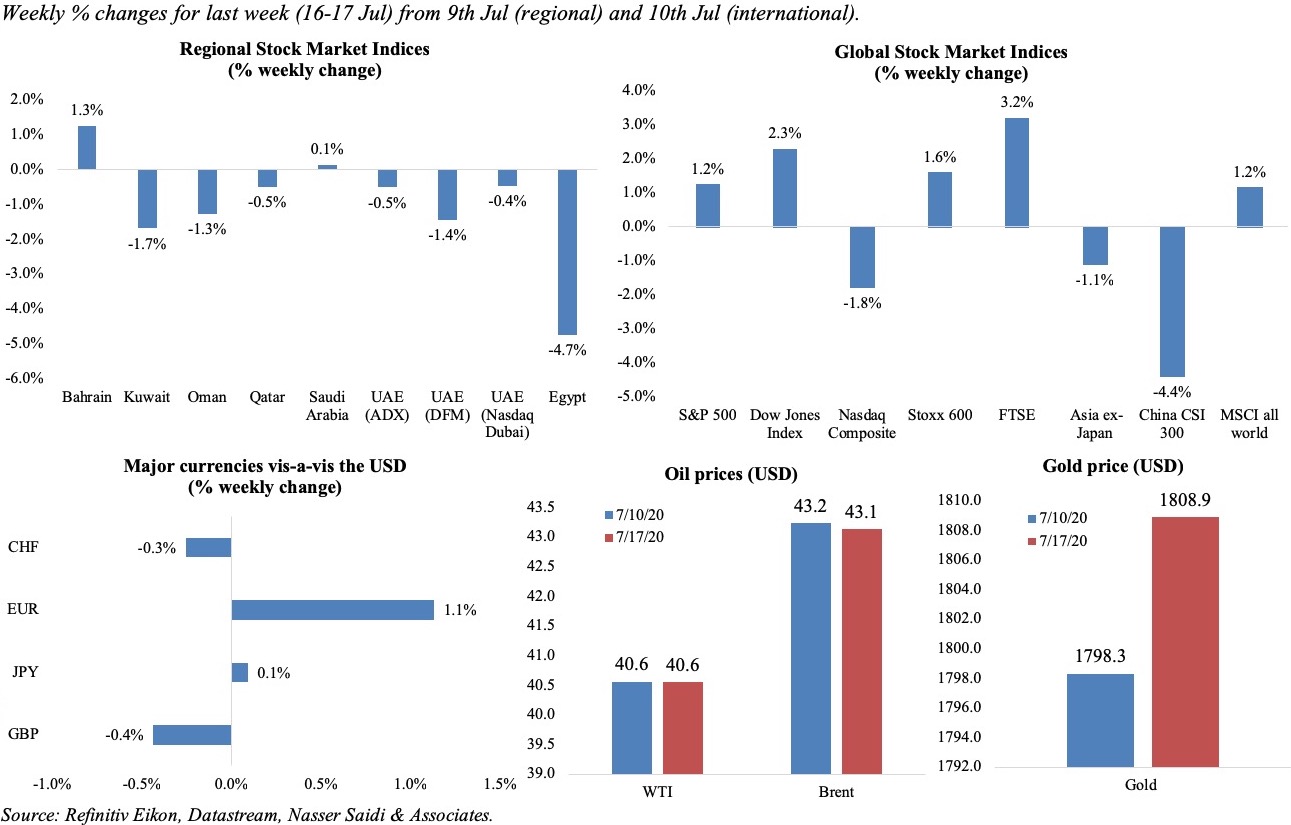

Stock markets across the globe posted gains – S&P 500, Stoxx 600, FTSE 100, MSCI all world index – on expectations of further government stimulus as Covid19 confirmed cases continue to rise. Regional markets were mostly down, with Egypt’s shares dropped to a 6-week low on Thurs. Safe haven assets were supported through the week: yields on 10-year German bunds rose slightly and gold prices gained for a 6th consecutive week. The pound was down 0.4% on weak economic data while euro rose to just under four-month highs. Both WTI and Brent oil prices edged lower. (Graphs in the last section.)

Global Developments

US/Americas:

- Inflation in the US inched up by 0.2% mom and 0.6% yoy in Jun (May: 0.1%), triggered by higher prices for gas (+12.3%) and food (0.6%). Core inflation, excluding food and energy, stayed unchanged at 1.2% yoy.

- US’s monthly budget deficit surged to USD 864bn in Jun – almost close to the fiscal deficit for 2019 (USD 984bn)– as federal spending tripled (nearly half went towards small business loans) in the backdrop of the Covid19 outbreak while tax revenues fell sharply. This follows a deficit of USD 399bn in May.

- Industrial production in US increased by 5.4% mom in Jun – the largest monthly gain since 1959 and a second consecutive monthly gain, following a 1.4% rise in May. Manufacturing output gained 7.2% while production of motor vehicles and parts posted the largest monthly gain of 105%.

- Retail sales improved in Jun as more stores reopened: sales were up 7.5% mom and 1.1% yoy to USD 524.3bn (May: +18.2% mom). Increases were seen across the board: clothing stores (105.1%), electronics and appliances (37.4%), furniture (32.5%), food services and drinking places (20%) and gasoline stations (15.3%). The uptick was likely supported by the additional weekly USD 600 federal unemployment cheques, though it is set to expire end-Jul.

- Housing starts accelerated by 17.3% to a seasonally adjusted annual rate of 1.186mn in Jun, though down 4% in yoy terms. Building permits, a proxy for future activity, rose by 2.1% mom to 1.24mn units (in yoy terms, dropping by 2.5%).

- Initial jobless claims fell to 1.30mn in the week ended Jul 11, lifting the total reported since Mar 21st to 51.3mn while the 4-week average eased to 1.38mn. Continuing claims decreased to 17.34mn in the week ended Jul 4.

Europe:

- The ECB left its main deposit rate unchanged at -0.5% and maintained the bond-buying program at current levels; risks to recovery and “exceptionally elevated uncertainty” remain. The multiple stimulus measures are estimated to add 1.3ppts to eurozone GDP and 0.8ppts to inflation by 2022.

- EU leaders have gathered for a 3rd day of discussions (on Jul 19) after reaching no agreement on the proposed EUR 750bn recovery package yet.

- ZEW Survey results show a drop in sentiment in Germany, alongside a slight improvement in the Eurozone: the Economic Sentiment index in Germany slipped to 59.3 in Jul, after posting a reading of 63.4 the month before, while an assessment of the current situation eased to -80.9 from -83.1. In the eurozone, economic sentiment edged up for the 4th consecutive month, rising to 59.6 from 58.6 in Jun. The indicator for the current economic situation in the eurozone climbed 0.9 points to a level of minus 88.7 points.

- GDP in the UK inched up by 1.8% mom in May following a severe 20.3% plunge in Apr; the economy was still 24.5% smaller than in Feb. In Mar-May, output fell by 19.1%. Industrial production in the UK rebounded by 6% mom in May (Apr: -20.2%), supported by the expansion in the construction sector (+8.2%) while manufacturing also rose (+8.4% from Apr’s 24.4% drop). Services sector grew by just 0.9% in May.

- UK unemployment rate held steady at 3.9% in the 3 months to May. In the three months to May, total weekly hours worked decreased by 16.7% to 877.1m hours – the largest annual decrease since estimates began in 1971. Average weekly earnings dropped 0.3% during this period- the first contraction since 2014. The Office for Budgetary Responsibility estimates that unemployment could reach 4mn, if UK’s economic recovery is poor, up from 1.3mn in 2019.

- Inflation in the UK edged up by 0.1% mom and 0.6% yoy in Jun (May: 0% mom and 0.5% yoy), on higher prices for clothes, footwear and recreational activities.

Asia Pacific:

- GDP growth in China inched up by 3.2% yoy and 11.5% qoq in Q2 after falling by 6.8% yoy and 9.8% qoq in Q1, supported by a recovery in industrial production (+4.4% yoy) while retail spending remains dampened (-3.9%).

- China’s exports inched up by 0.5% yoy in Jun, thanks to shipments of face masks, PPE and computers, while imports also rose by 2.7% (May: -16.7%; iron ore imports jumped to the highest in 33 months). Trade balance dropped to USD 46.42bn from the previous month’s USD 62.93bn. Trade surplus with US widened to USD 29.41bn in Jun (May: USD 27.89bn).

- Industrial production in China improved for the 3rd consecutive month in Jun, rising by 4.8% yoy (May: 4.4%), as production resumed. Fixed asset investment fell by 1% yoy in H1, after a 6.3% decline during Jan-May. Retail sales declined by -1.8% yoy in Jun, after a 2.8% drop the month before.

- The Bank of Japan kept policy rates on hold, but revised down growth forecasts to -4.7% in the current fiscal year (till Mar 2021) and prices fall 0.5%, with a rebound in 2021 and 2022.

- Industrial production in Japan dropped by 26.3% yoy in May, following the 15% yoy dip in Apr.

- WPI inflation in India declined by 1.81% in May, after a 3.21% drop in Apr, given the declines in price of fuel and power (-13.6%) while food prices remained higher (+2.04%).

- Trade balance in India recorded a surplus of USD 0.79bn in Jun – its first ever in 18 years – after exports dipped by 12.4% alongside a 47.6% plunge in imports; crude oil imports fell by 55.3%.

- Singapore’s GDP slumped by 41.2% qoq in Q2, following a 3.3% drop in Q1 – its steepest recession ever. In yoy terms, GDP was dropped by 12.6% after an upwardly revised 0.3% dip in Q1. Construction and services dipped by 55% and 14% yoy respectively while manufacturing posted a slight 2.5% gain.

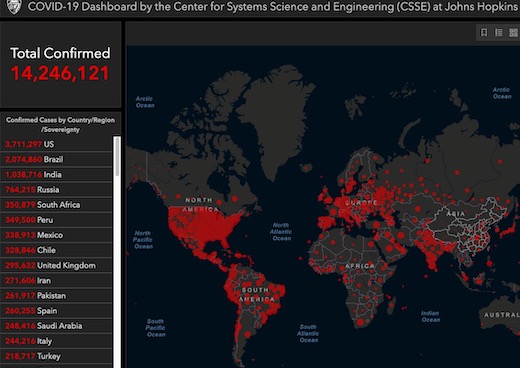

Bottom line: Total Covid19 confirmed cases have crossed 14mn, after posting a record single-day rise in new infections worldwide. Our World in Data calculations indicate that while it took the world 88 days to confirm the first 2mn cases, the latest jump from 12 to 14mn took just 9 days! With some initial Covid19 benefits set to expire this month, expectations remain high for further stimulus measures to support the global economy, though the EU recovery fund discussions remain deadlocked. The IMF disclosed that SME bankruptcies could rise to 12% this year from 4% pre-pandemic, based on a sample of 17 nations. The poorest nations will bear the maximum brunt: the G20 disclosed that 42 countries have requested deferring payments worth USD 5.3bn (of which USD 2bn will be deferred by China alone), falling short of World Bank data which show that debt suspension could postpone payments worth USD 11.5bn this year. Separately, the IIF reported that debt-to-GDP ratio jumped by over 10ppts – the largest quarterly surge on record – to reach a record 331% in Q1.

Regional Developments

- The IMF downgraded growth rates in the MENA region: growth will decline by 5.7% this year, before rebounding to 3.4% in 2021. GCC growth rates will drop by 7.1% this year, with non-oil growth falling at 7.6%; fiscal deficit will rise to 10.5% this year, before easing to 8% of GDP next year. (More: https://www.imf.org/en/Publications/REO/MECA/Issues/2020/07/13/regional-economic-outlook-update-menap-cca)

- Bahrain added BHD 177.36mn (USD 470mn) to the state budget this year to support Covid19 related expenses. Furthermore, deduction from oil revenues earmarked for Future Generations Reserve Fund has been suspended temporarily, until end of fiscal year 2020. The government employees’ pension fund and social insurance fund were merged to a new entity called the Pension and Social Insurance Fund.

- Bahrain’s government have exempt businesses affected (partially or fully) by Covid19 from paying their monthly dues for 3 months (starting Jul 1) and also from paying fees levied on issuing/ renewing work permits in the 1st year of validity. Additionally, the government will pay 50% of the salaries of insured Bahrainis working in the private sector in 12 most adversely affected sectors for a period of three months, starting Jul 2020.

- The King Fahad Causeway between Bahrain and Saudi Arabia will be opened gradually in phases, after the Eid Al Adha holidays, according to Saudi media.

- Egypt’s GDP is expected to grow between 3.7-3.8% by end of fiscal year 2019-2020, disclosed the minister of planning. During the H1 of this fiscal year, GDP stood at 5.6%, remittances had increased by 13% and deficit-to-GDP had fallen to 8.1%.

- Local liquidity in Egypt grew by 12.7% to EGP 4.353trn in the period Jul 2019-Apr 2020, driven by the growth of quasi-money (+12.1%) and money supply (+14.4%).

- Egypt plans to launch a 3-month initiative before end-Jul to support the consumption of local products: durable and non-durable goods will be provided at low prices, and those with ration cards will receive a further 10% discount (estimated to cost EGP 12bn during 2020-21).

- Egypt’s minister of finance disclosed the launch of the EGP 2bn (USD 125.6mn) insurance fund, financed from the public treasury, to stimulate domestic consumption and facilitate the ability of citizens to obtain goods, services, and property.

- Foreign investors are returning to Egypt: the market attracted USD 592mn in investments on 9th Jul, the largest daily level since the Covid19 crisis and a further USD 367mn on 12 Jul. This follows the injection of USD 3bn worth investments in a month.

- International tourists are back in Egypt: Almost 10k tourists (from a total of 56 flights) visited Sharm El-Sheikh and Hurghada since the beginning of Jul when permissions were given to resume tourism activity.

- New contract regulations in Egypt specify that contractors should receive their financial dues in under 30 days from the date of examination, acceptance, and approval.

- Egypt exported 3.62 million tons of agricultural products during the period Jan 1 to Jul 8th, with the list topped by citrus plants, potatoes and onions.

- Jordan will reopen airports for commercial flights from a limited number of European and Asian destinations from the 1st or 2nd week of Aug, according to a spokesperson.

- Jordan’s trade deficit narrowed by 26.3% yoy in Jan-Apr 2020. With the EU, deficit narrowed by 21.8% yoy to JOD 666mn in Jan-Apr, with exports falling by 9.9% and imports plunging 21.2%. Jordan’s exports to the US edged up by 1.8% yoy to JOD 387mn while imports declined by 6.7%, thereby marking a surplus of JOD 60mn during Jan-Apr this year.

- Real estate trade volume in Jordan dived by 44% yoy to JOD 1.125bn in H1 this year. The Department of Land and Survey reported a 56% drop in revenues to JOD 46mn in H1.

- The 2020-2021 academic year in Jordan will start on Aug 25 for teachers and on Sep 1 for students; the education process will be determined by the “pandemic situation” and “alternative plans” have been developed, according to the ministry of education.

- S&P revised Kuwait’s outlook to “negative” from “stable”, citing the deterioration in central government deficit alongside a reduction in the General Reserve Fund’s balance. Ratings were affirmed at “AA-/A-1+”.

- Kuwait oil production declined by around 94k barrels per day (bpd) to 2.103mn bpd in Jun, as a result of compliance with the OPEC+ output cuts.

- Value of projects awarded in Kuwait to local listed companies tumbled nearly 40% yoy to KWD 500mn (USD 1.65bn) in H1 this year, reported the Arabic language daily Alanba.

- Kuwait banned visa transfer for expats from the private sector to the government sector; the decision made on Jul 14th excludes medical professionals, Palestinian nationals and those married to Kuwaiti citizens, children and wives.

- Kuwait plans to implement a guarantee system for the private sector to protect employees’ rights: an amount of KWD 250 (USD 813) will be set aside as a deposit, to be reimbursed when the employee leaves the country.

- A bill allowing up to 50% salary cuts in the private sector in Kuwait (while taking into account the actual work hours) was approved by the Educational, Cultural and Guidance Affairs Committee. Once approved by the Parliament, it will be implemented retroactively (from Mar 12th).

- Lebanon’s advisers are working on a compromise on the government’s financial rescue plan such that it is acceptable to the IMF and also the various Lebanese counterparts. The IMF had earlier in the week warned that attempts to present lower losses could only delay recovery.

- According to a memo, Lebanon’s central bank has set up a committee to restructure financially stricken commercial banks and study their performance. Currently, there are around 40 banks serving a population of around 6 million.

- Lebanon seeks to negotiate fuel imports with Kuwait, reported Kuwaiti newspaper Al Rai, citing the former’s internal security chief.

- Lebanon’s former director general of the finance ministry (who resigned this month) told FT that upto USD 6bn had been “smuggled” out of the country since Oct in spite of the controls introduced to curtail transfers abroad. (More in FT: https://www.ft.com/content/df234c78-a945-4199-befe-0272259dc755)

- Oman will allow its citizens to travel abroad, after they apply to the authorities and agree to quarantine on return; no specific dates were provided. Meanwhile, the two regions Dhofar and Masirah continue to be under lockdown.

- Inflation in Saudi Arabia inched up by 0.5% yoy in May, the smallest annual gain since Jan; food costs, which rose by 6.9% yoy, was the main component driving up inflation. Wholesale prices fell by 2.1% yoy in Jun, given lower prices of refined petroleum products (-16.8%).

- Saudi Arabia’s scaling back of the Citizen’s Account programme (to target more “deserving citizens”) has resulted in about 1.3 million Saudis losing benefits in Jul alone, reported Bloomberg.

- The second and final phase of the privatisation of the flour milling sector in Saudi Arabia begins: state grain buyer SAGO began receiving pre-qualification bids on Jul 16th.

- Saudi Arabia’s derivatives market will launch on 30th Aug, with the first exchange traded derivatives product an index futures contract based on the MSCI Tadawul 30 Index.

- Saudi Arabia’s new corporate law (if approved) will include more “flexible” companies: for example, simple joint-stock companies, which will have the characteristics of joint-stock companies but also feature flexibility in raising capital or issuing different types of shares.

- Saudi Arabia Ministry of Finance’s corporate sustainability program launched a SAR 670mn (USD 178mn) initiative to ease loan installments, supporting projects for 192 companies employing over 20k Saudis across different sectors.

- Oil exports from Saudi Arabia will remain unchanged in Aug as domestic demand increases during the summer months. An estimated 550,000 barrels per day (bpd) is burned during the hot summer months for power generation. Saudi Arabia consumed 1.57bn barrels of oil in 2019 (+0.25%), according to official data.

- Total oil exports from Saudi Arabia fell to 7.48mn barrels per day in May from Apr’s 11.34mn bpd, according to the Joint Organizations Data Initiative.

- Startups in Saudi Arabia raised USD 95mn from 45 deals in venture funding during H1 2020, up 102% yoy, according to a report from Magnitt and Saudi Venture Capital Company. Funding has already crossed that raised in 2019; e-commerce is the most active industry by both total funding (67%) and number of deals (22%).

- E-commerce transactions in Saudi Arabia posted a record 74% growth during Mar-Apr given the lockdown, with direct retail trade dropping by 30%, according to Saudi Payments. Retail sector growth has picked up by 38% mom in Jun, with easing of lockdown.

- Saudis holding key managerial positions account for 71.53% of total managerial positions in the private sector, reported Okaz/ Saudi Gazette citing government data.

- M&A transactions with any MENA involvement fell by 55% yoy to USD 50bn in H1 this year (though last year’s numbers included Aramco’s Sabic deal value) while the number of deals were down by 9% to a 3-year low.

- The UN e-government index ranks 5 GCC nations among the top 50, with UAE ranked the highest at 21st globally (unchanged from last year), followed by Bahrain (38, down 12 ranks), Saudi Arabia (43, +9), Kuwait (46, -5) and Oman (50, +13). Qatar slipped 15 ranks to 66.

- Saudi Arabia and Egypt are among the six nations participating in a multilateral fund for supporting infrastructure projects under the Belt and Road Initiative.

UAE Focus

- UAE banks’ investments recorded a 12.03% yoy increase to AED 414.9bn – the highest level since 2013 – by end-May 2020, according to the central bank. Separately, bank loans in the country were up by 6% yoy to AED 1.778trn in May, though loans to the private sector inched up by just 0.1% yoy.

- Inflation in Dubai declined by 3.44% in Jun (May: 3.49%), with transport costs and utilities prices dropped by 13.39% and 5.54% respectively. Meanwhile, food prices, education costs and tobacco prices increased by 3.49%, 1.87% and 15.96% respectively.

- Bilateral trade between Dubai and Italy touched AED 9.5bn (USD 2.6bn) in H1 this year, with imports from the latter at AED 8bn.

- UAE’s oil exports weakened by 14.3% yoy to USD 49.64bn in 2019, as per OPEC’s Annual Statistical Bulletin. Overall, UAE accounted for 8.8% of OPEC’s total value of oil exports.

- The Abu Dhabi Securities Exchange expects one IPO before the year end and listing of an ETF (potentially in Aug), according to its chief executive.

- DP World listed a USD 1.5bn perpetual sukuk in Nasdaq Dubai last week; the company the largest UAE debt issuer on the exchange. Value of sukuks listed on Nasdaq Dubai is up 80% yoy to USD 11.4bn so far this year, with the number of listing doubling to 14.

- The Abu Dhabi Fund for Development is suspending debt service repayments of some developing countries and private businesses for a year; it is applicable to the instalments and interests from Jan 1 to Dec 31 this year.

- The DIFC reported a 25% yoy increase in the number of firms operating from the free zone. Attracting 310 new firms in H1, of which 87 were FinTech firms (+74% yoy), the DIFC has a total of 820 financial firms.

- The Jebel Ali Freezone reported a growth of 10.6% yoy in the retail and e-commerce sector in the first 5 months of 2020.

- Hotel occupancy rates in Abu Dhabi have edged up by 3% yoy in the first week of Jul, as hotels reopen after the lockdown; government support for the sector includes up to 20% rental rebates for restaurants, tourism and entertainment facilities, as well as a suspension of tourism and municipality fees this year.

Media Review

IMF did not recommend Saudi Arabia VAT tripling, official says

https://www.reuters.com/article/us-saudi-economy-imf-taxation/imf-did-not-recommend-saudi-arabia-vat-tripling-official-says-idUSKCN24H28M

Five Charts That Illustrate Covid19’s Impact on the Middle East and Central Asia

https://www.imf.org/en/News/Articles/2020/07/14/na071420-five-charts-that-illustrate-covid19s-impact-on-the-middle-east-and-central-asia

Lebanon’s Hidden Gold Mine

https://carnegie-mec.org/2020/07/16/national-wealth-fund-would-alleviate-lebanon-s-multiple-crises-pub-82306

Uzbekistan is offering $3,000 to anyone who gets Covid19 during a visit to the country

https://www.insider.com/uzbekistan-travelers-3000-dollars-coronavirus-2020-6

Charting the Economy: China grows again, rest of world struggles

https://www.bloomberg.com/news/articles/2020-07-17/charting-the-economy-china-grows-again-rest-of-world-struggles

As Seasonal Rains Fall, Dispute Over Nile Dam Rushes Toward a Reckoning

https://www.nytimes.com/2020/07/18/world/middleeast/nile-dam-egypt-ethiopia.html

Market Snapshot as of 19th Jul 2020

Powered by: